Click the “blue text” above to follow for more exciting content.

This article contains a total of 801 words, and reading the full text will take about 2 minutes.

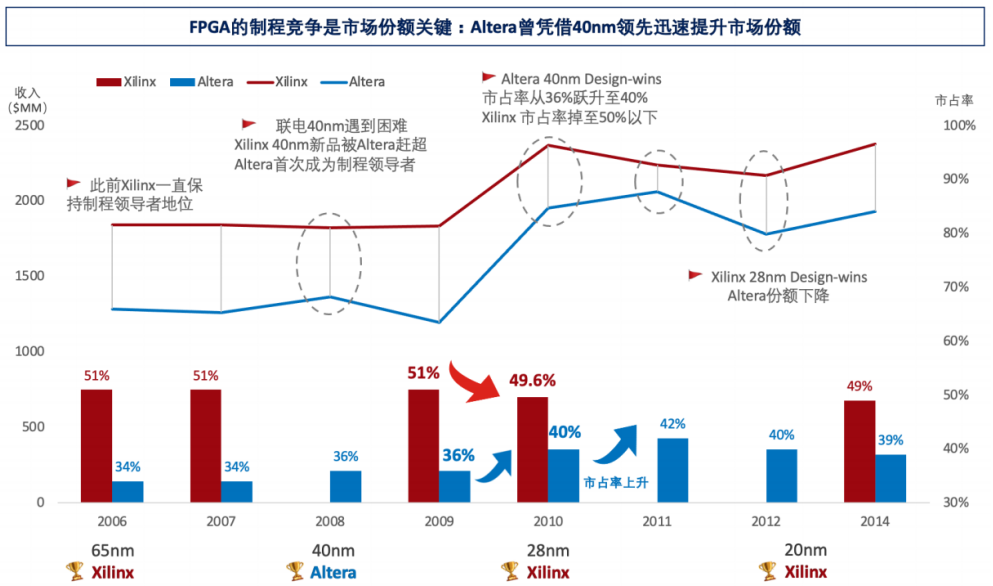

Technically, it is reflected in the necessity to keep up with the latest processes; leading processes are the most direct determining factor for FPGA market share.The versatility of FPGAs means that their routing and area are not optimal compared to ASICs. Therefore, FPGAs must be several generations ahead of ASICs or ASSPs in process technology to achieve more competitive performance, making the pursuit of advanced processes an inevitable choice for FPGAs. Additionally, there is a customer onboarding phase between the release of new products and mass production, during which customers evaluate newly launched FPGAs from different manufacturers before deciding on one for subsequent mass production and completing their circuit design on it, known as a Design-win. This process typically takes 9-12 months. Due to varying development environments and product architectures, once a decision is made, it is very difficult and time-consuming for users to switch to another FPGA manufacturer. This high level of binding creates a strong barrier for FPGAs, allowing the first players to launch products to often capture a large portion of the market share. Generally, design-wins with the latest processes can predict market share in the FPGA market 2-3 years later. FPGA leader Xilinx has historically been a process leader, maintaining a market share of around 50% since 2000, with only Altera able to keep pace with Xilinx, while other industry players lag behind by 2-3 generations.*The importance of process leadership for FPGAs can be seen from Altera’s catch-up at 40nm. In 2008, due to delivery issues at UMC at the 40nm node, Xilinx’s new product launch was hindered, while Altera, which had long collaborated with TSMC, was the first to launch 40nm products and historically became the process leader. Two years later, in 2010, Altera leveraged its advantage at 40nm to increase its market share from 36% to 40%, while Xilinx’s market share fell below 50% for the first time in years. Previously, the landscape was approximately 50% for Xilinx and 30% for Altera; this lead allowed Altera to rise from 36% in 2008 to 42% in 2011, an overall market share increase of about 6 percentage points. Xilinx subsequently switched its main wafer supplier to TSMC and was the first to launch 28nm products, regaining the share lost to Altera in 2012.

Risk Warning:This content only represents the analysis, speculation, and judgment of the Breaking Research team, and is published here solely for the purpose of conveying information, not as a basis for specific investment targets. Investment carries risks; please proceed with caution!Copyright Statement:This content is copyrighted by the original party or author. If reproduced, please indicate the source and author, retain the original title, and ensure the integrity of the article content, and bear legal responsibilities for copyright, etc.

END