Click the “blue words” above to follow for more exciting content

This article has a total of 816 words, reading it will take about 2 minutes

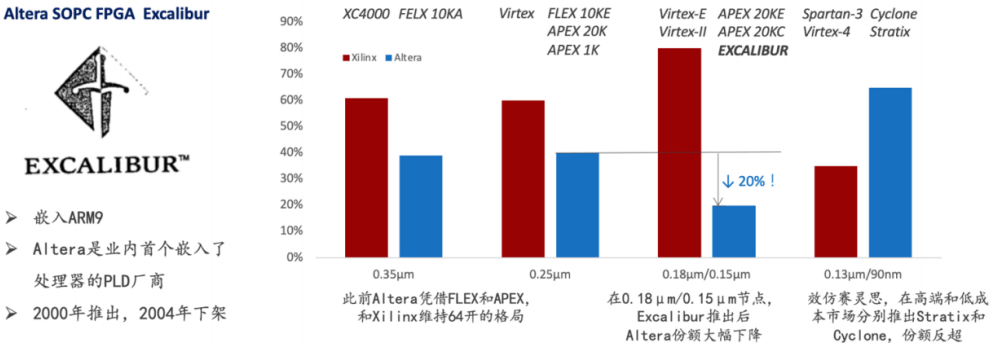

In product definition, it is essential to balance various market demands, and the challenge lies in how to balance programmable functions with fixed functions. Embedding fixed units in FPGA often results in lower power consumption and area compared to using universal resources like LUTs and registers. For example, the RFSoC FPGA, which integrates AD/DA and ARM cores, reduces area by 50%, power consumption by 30%-40%, and cost by 40%-60% compared to a discrete “ARM + AD/DA + FPGA” solution. However, designers must weigh which fixed units to embed because FPGA developers purchase the entire chip and may end up paying for features they do not need or use; on the other hand, if the FPGA has too few fixed functions, its competitiveness in the market significantly decreases, as customers are forced to use too many valuable programmable logic resources to implement functions that should be fixed, leading to increased power consumption and latency. This requires FPGA companies to have excellent communication with their customers.*Altera’s historical failure with Excalibur illustrates the importance of product definition and demand matching. The attempt to embed processor hard cores in FPGA dates back to 2000. At the 0.18/0.15μm node, Altera embedded ARM9 into its latest SOPC FPGA Excalibur to compete with Xilinx in performance, becoming the first company in the industry to embed a processor into an FPGA. However, customers, having just experienced the dot-com bubble, prioritized power consumption to be as important as performance and were unwilling to pay for high-performance FPGAs, maintaining a demand for flexibility in FPGAs, which caused Altera’s market share in the 0.18/0.15μm FPGA market to plummet to 20%, while Xilinx and Altera had previously maintained a 60-40 split. Altera learned from this lesson and took great care in considering which fixed units to embed, no longer emphasizing product performance alone but focusing on understanding customer needs. Subsequently, they launched the high-end Stratix and mid-to-low capacity Cyclone at the 0.13μm/90nm node, regaining market share over Xilinx at 90nm.

Risk Warning:This content only represents the analysis, speculation, and judgment of the Breaking Research team, and is published here solely for the purpose of conveying information, not as a basis for specific investment targets. Investment carries risks; please proceed with caution!Copyright Statement:This content is copyrighted by the original party or author. If reproduced, please indicate the source and author, retain the original title, and ensure the integrity of the article content, and bear legal responsibilities for copyright, etc.

END