Click the “blue text” above to follow for more exciting content.

This article contains a total of 667 words, and it takes about 2 minutes to read.

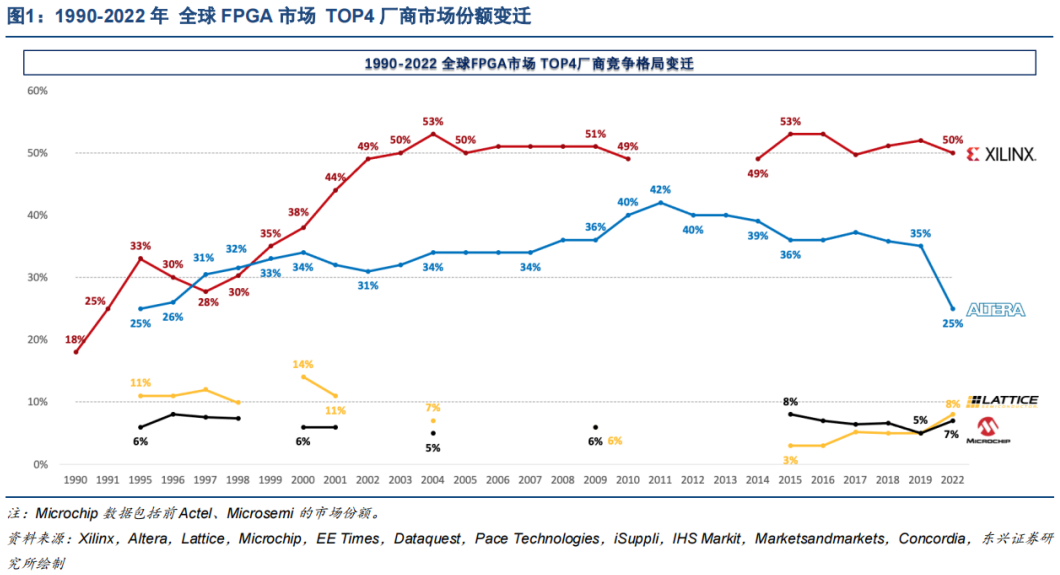

FPGA is a highly concentrated market, with the leading company Xilinx holding over half of the market share, and the top four players accounting for over 90% of the total market. According to data and estimates from Marketsandmarket, in 2022, Xilinx held a global market share of 50%, creating a significant gap with the second-place Intel (which acquired Altera) at 25%. The third and fourth players, Lattice and Microchip (which acquired Microsemi), have market shares close to each other, both not exceeding 10%. The industry shows a highly concentrated trend, with a CR4 exceeding 90%, and all are American companies. Notably, Xilinx has maintained a market share of over 50% since 2003.

Xilinx has maintained a market share of over 50% for nearly 20 years, along with a high level of ROIC, which demonstrates its strong competitive advantage. Since Xilinx invented the FPGA in 1984, its market share has climbed from 18% in 1990 to 50% in 2003, and it has largely remained around 50% over the following 20 years. During the nearly 30 years from 1990 to 2019, the FPGA market has seen a compound annual growth rate of 14%, maintaining a high growth rate. Xilinx’s ROIC has consistently remained around 15% since 2003, climbing to over 20% in 2018-2019. In a rapidly growing industry, the ability of the leader to maintain a market share of 50% with a ROIC level of over 15% for nearly 20 years indicates a very strong competitive advantage for the FPGA leader.

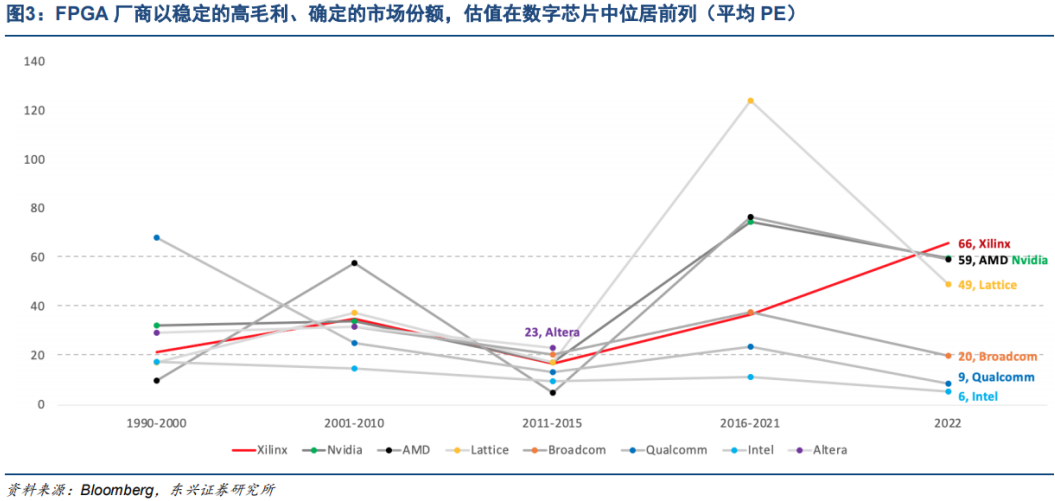

What are the reasons for the high valuations of FPGA companies in the US stock market? High entry barriers and a clear and defined competitive landscape. Although the FPGA market is neither too large nor too small (with a global value of $8.3 billion in 2022), the high entry barriers and a clear and defined competitive landscape have led to the high valuations of US FPGA manufacturers compared to other digital chip companies.

Risk Warning:This content only represents the analysis, speculation, and judgment of the Breaking Research team, and is published here solely for the purpose of conveying information, not as a basis for specific investment targets. Investment carries risks, and one should proceed with caution when entering the market!Copyright Statement:This content is copyrighted by the original party or author. If reproduced, please indicate the source and author, retain the original title, and ensure the integrity of the article content, and bear legal responsibilities for copyright and other issues.

END