Click the “blue words” above to follow for more exciting content.

This article contains a total of 1557 words, and it takes about 4 minutes to read.

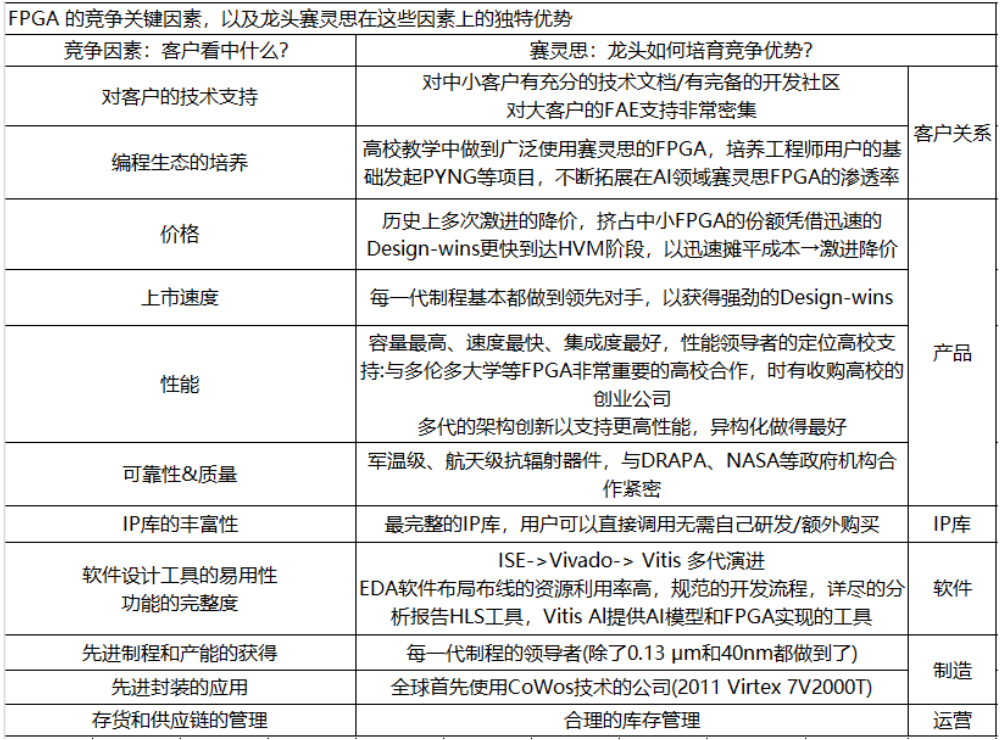

From the customer’s perspective, the key competitive factors of FPGA can be summarized into the following six points: customer relationships, products, IP libraries, software, manufacturing, and operational capabilities. The article describes how Xilinx uniquely excels in these six factors, illustrating how it cultivates its competitive advantages.

The reasons for Xilinx becoming a leader are: 1) Process leadership. As previously analyzed, the process is the most direct competitive factor in the FPGA market. Apart from 0.13μm and 40nm, Xilinx has consistently played the role of process leader in the industry, continuously initiating a positive cycle of “technological leadership – orders – cost advantages – customer stickiness – next-generation R&D investment”;

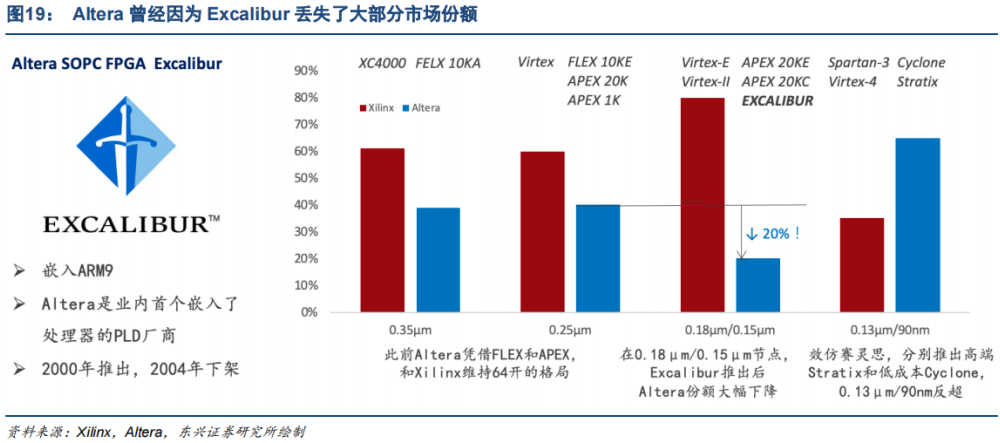

2) The best grasp of customer needs, along with excellent competitive strategy formulation and execution capabilities. Embedding hardened units in FPGA often results in lower power consumption and area compared to using LUTs, registers, and other universal resources. However, designers must weigh which hardened units to embed, as FPGA developers purchase the entire chip and may end up paying for features they do not need or use. On the other hand, if the FPGA has too few hardened functions, its competitiveness in the market significantly decreases, as customers must use too many valuable programmable logic resources to implement functions that should have been hardened, greatly increasing power consumption and latency. This requires FPGA companies to have excellent communication with customers. As early as 1998, Xilinx differentiated between high-end and low-capacity markets, launching the low-cost Spartan for the low-capacity market, targeting those who need the flexibility and high parallelism of FPGAs but do not require high-performance hard cores like transceivers in the communication market. In contrast, in 2000, Altera focused on launching the highest performance Excalibur without paying attention to the low-capacity market. It was not until Excalibur failed that, in 2002, Altera emulated Xilinx by launching the high-end Stratix and low-cost Cyclone. In addition to products, Xilinx was the first to implement remote upgrade functionality on Virtex in 1998, allowing programming files to be sent to connected devices to comply with changing communication standards without requiring engineers to upgrade software at each base station individually, which many ASICs at the time could not achieve. This remote reconfiguration feature saved customers a significant amount of time and money, making Virtex very popular in the communication market, boosting Xilinx’s market share from 30% in 1998 to 50% in 2003.

*Altera’s historical failure with Excalibur illustrates the importance of product definition and demand matching. The attempt to embed processor hard cores in FPGA dates back to 2000. At the 0.18/0.15μm node, Altera embedded ARM9 into its latest SOPC FPGA Excalibur to compete with Xilinx on performance, becoming the first company in the industry to embed a processor into an FPGA. However, customers, having just experienced the dot-com bubble, prioritized power consumption as equally important as performance and were unwilling to pay for overly high-performance FPGAs. The demand for FPGAs remained focused on flexibility, causing Altera’s market share in the 0.18/0.15μm FPGA market to plummet to only 20%, while Xilinx and Altera had previously maintained a 60-40 split. Altera learned from this lesson and became very cautious when embedding hardened units, no longer emphasizing product performance alone but focusing on understanding customer needs. In 2002, they launched the high-end Stratix and mid-to-low capacity Cyclone, surpassing Xilinx in market share at 0.13μm/90nm. However, Xilinx had already established a significant gap in overall FPGA market share. In 1999, Xilinx and Altera had market shares of 35% and 33%, respectively, quite close; from 2000 to 2002, Xilinx established itself as a technological leader in the industry with the high-performance Virtex and rapidly expanded its customer base and shipment volume with the low-cost Spartan, quickly increasing its market share to 49% by 2002, while Altera’s market share dropped to 31%, essentially missing the best opportunity to catch up.

3) The best ecosystem cultivation.Xilinx has the most comprehensive documentation among all FPGA manufacturers, which is very attractive to small and medium-sized customers who typically do not have the FAE support that large customers enjoy. In user community cultivation, FPGA education in universities almost always uses Xilinx as an example, providing engineers with a solid foundation. In the IP library, Xilinx has the most complete IP library, with 910 IPs, nearly 60% of which are self-developed IPs that users can directly call without needing to redevelop, while Altera has about 278 IPs, offering a much smaller selection than Xilinx. Additionally, Xilinx demonstrates strong overall performance across multiple dimensions, including EDA iteration speed and ease of use.

Risk Warning:This content only represents the analysis, speculation, and judgment of the Breaking Research team. It is published here solely for the purpose of conveying information and should not be used as a basis for specific investment targets. Investment carries risks; please proceed with caution!Copyright Statement:This content is copyrighted by the original party or author. If reproduced, please indicate the source and author, retain the original title, and maintain the integrity of the article content, and bear legal responsibilities for copyright, etc.

END