Focusing on research in popular industries and companies. Disclaimer: The content of this account does not constitute any investment advice, guidance, or commitment, and is for academic discussion only. The market carries risks, and investment decisions should be based on rational independent thinking.

Welcome to join the in-depth community (click) to not miss any short updates.

The surge in AI computing power ignites the PCB sector, with a single server circuit board valued over 200,000!

This week, the PCB concept has collectively exploded. Behind this wave of market activity is the strong drive for high-end circuit boards due to the explosive demand for AI computing power!

🔥 Core Logic: Hardware upgrades in computing power drive simultaneous increases in PCB “volume and price”.

Single machine value leap: The Nvidia GB300 server will ship in Q3, and its use of advanced HDI solutions has pushed the value of a single NVL72 server PCB to over 200,000, doubling compared to traditional models.

Market scale surge: Benefiting from a 71% annual compound growth rate in AI server shipments, the global AI server PCB market is expected to reach 49 billion yuan by 2026, nearly doubling in three years.

Technical barriers highlighted: AI servers require PCBs to upgrade to high multilayer designs of over 16 layers and 5-6 stage HDI, with a continuous expansion of the high-end capacity gap. TSMC’s CoWoS packaging is still in high demand, and the mass production of Broadcom’s 102.4Tbps switch chip further exacerbates supply-demand tension.

🌐 New industry trends: Edge computing opens a second growth curve

With lightweight models like DeepSeek being implemented, AI smartphones and wearable devices are accelerating penetration. Apple’s supply chain companies have taken on PCB orders for robotics, leading to a 17% increase in the average price of mainboards, injecting new volume into consumer electronics PCBs.

Copper-clad laminates (CCL) benefit simultaneously: High-speed materials are iterating from M6 to M9 and PTFE, with Toray’s fiberglass price increase of 20% validating the prosperity of upstream materials.

⚠️ Risk warning: Accelerated technological iteration (such as advanced packaging potentially replacing some PCB functions), geopolitical policy fluctuations, and raw material price risks still need to be monitored.

Industry voices

“The global AI computing power race has just entered the mid-stage,” said an analyst from CITIC Securities, “Companies that are bound to Nvidia/ASIC leaders and have high-end HDI mass production capabilities will be the biggest winners.” With the release of production capacity in Thailand and the rising demand for automotive electronics, the PCB industry’s high prosperity is expected to continue at least until 2026.

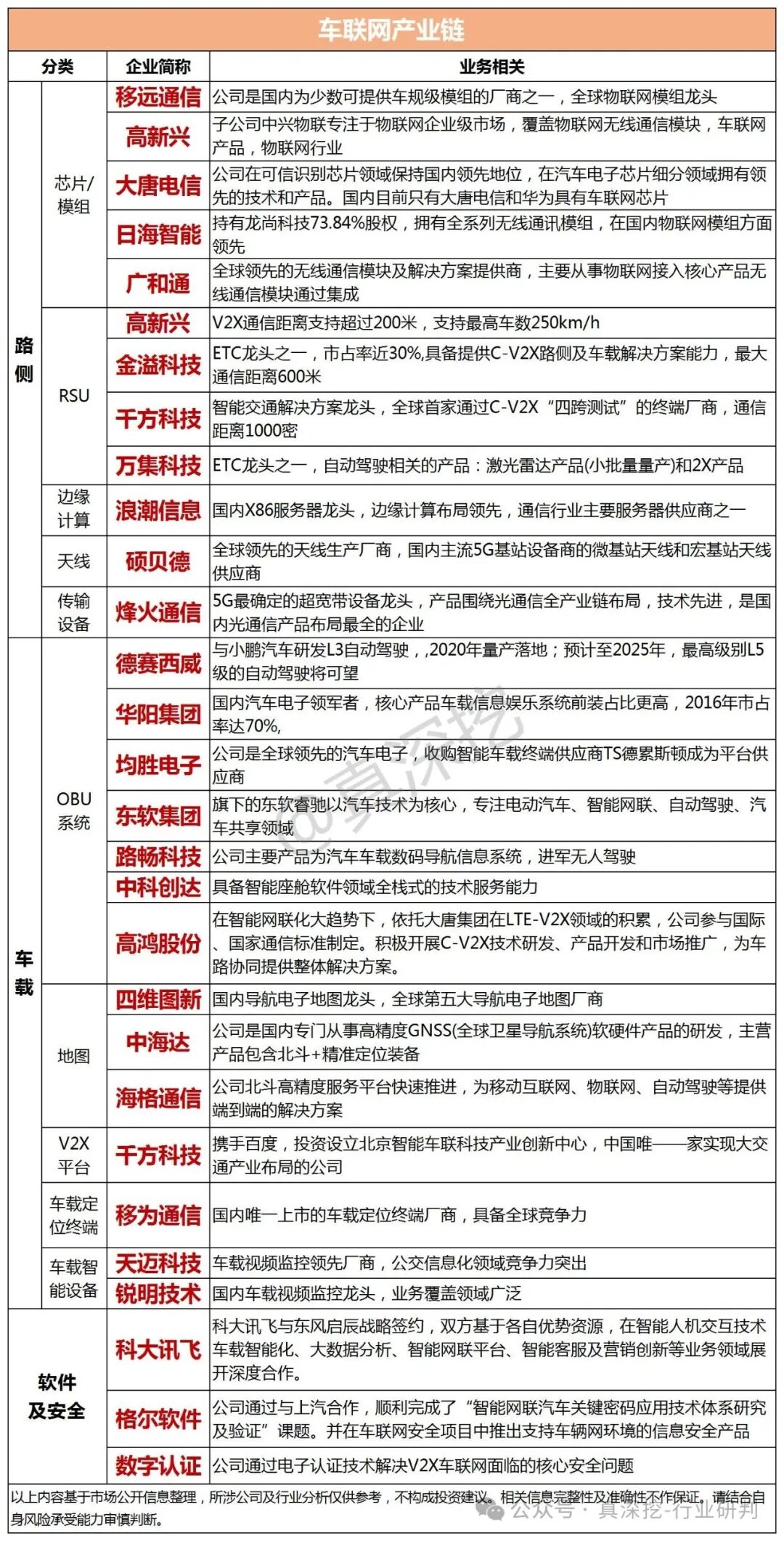

The new era of the Internet of Vehicles has begun! The industry chain is undergoing national-level restructuring and technological revolution.

⚡️ Latest updates

Shanghai Unicom has built the largest 5G-A Internet of Vehicles demonstration area in the country

Breaking through two major technical indicators: all-time, all-domain unidirectional end-to-end latency ≤ 20ms, single-user uplink rate ≥ 20Mbps, providing millisecond-level response capability for vehicle-road-cloud collaboration. The integrated sensing base station achieves lane-level recognition and a perception distance of 400 meters, with a traffic element recognition accuracy rate of 90%.

A new automotive central enterprise is born

The State Council approved the separation of the automotive business of the Weapon Equipment Group into an independent central enterprise, with Changan Automobile and other major shareholders changing to focus on the new energy and intelligent track.

🔧 Core of industry chain transformation

Technological breakthroughs: The 5G-A network supports V2X (vehicle-road collaboration) full-domain interconnection, and RedCap lightweight technology reduces terminal costs, accelerating the commercialization of intelligent driving.

Ecological competition and cooperation: Huawei and SAIC jointly build the “SAIC Shangjie” ecosystem, integrating HarmonyOS intelligent travel, precision manufacturing, and industrial resources to promote the value migration of “hardware + software + services”.

Policy-driven: The national-level Internet of Vehicles pilot area is expanding, and from 2026, new cars will be required to be equipped with L2-level autonomous driving and V2X functions, driving an 80 billion hardware upgrade demand.

🌐 Future trends

Market scale: By 2025, the penetration rate of the Internet of Vehicles in China will reach 80%, with a trillion-level market attracting technology giants and automotive companies to deepen their ties (such as Baidu Apollo × Geely, Tencent × Changan).

Security upgrades: Blockchain technology will cover 60% of vehicle authentication, and the automotive-grade security chip market will reach 12 billion yuan.

Global competition: China’s CV2X standards are expanding into Southeast Asia and the Middle East, with communication modules accounting for 30% of the global market.

Save for future reference, stay ahead

Check out the pinned information on the public account homepage. Join the in-depth community to not miss any short updates.

👇👇👇

Welcome to join the in-depth community

Previous concept selections

Stablecoins/RWA, Tesla FSD, comprehensive overview of cargo drones (save for future reference, stay ahead)

Nvidia-related, chip design EDA, consumer branch anti-hair loss, comprehensive overview of leading companies in autonomous vehicles (save for future reference, stay ahead)

Cross-border payment crypto assets, autonomous taxis, autonomous sanitation vehicles, Dragon Boat Festival-related concepts, smart nail art comprehensive overview (save for future reference, stay ahead)

New consumer beverages, unmanned logistics, autonomous taxis (carrot fast run), Doubao ISP vision (save for future reference, stay ahead)