The Internet of Vehicles (IoV) technology can be considered a typical example of fluctuating technological development. At the recent CES Asia, the automotive industry occupied two entire venues, showcasing local IoV ecosystems by overseas manufacturers like Audi, Honda, and Ford, as well as the release of the “Connected Vehicle Specification” by local tech company Baidu Apollo. Looking back, we can also see Tencent releasing a fully voice-interactive in-car WeChat, and Huawei establishing a smart automotive business unit, with numerous IoV-related companies emerging rapidly in the Greater Bay Area.

The concept of IoV is not new, but it has become particularly hot in 2019. Many people may remember that just two or three years ago, this technology was often labeled as “concept hype” and “difficult to implement”.

“Every year is the inaugural year for China’s IoV”

In 2016, as companies like Didi, Baidu, Tencent, and Alibaba, which had previously made high-profile moves into IoV, failed to showcase sufficiently marketable products, many IoV startups represented by companies like Pateo began to shut down. The once highly praised IoV started to cool down. There was even a sarcastic saying that since the concept of IoV was proposed in 2010, every year has been the “inaugural year for China’s IoV”.

While this statement is somewhat exaggerated, it is not without basis. The series of products launched by BAT, such as Luba and Wedrive, have not been widely adopted, and user experience has not been satisfactory. There were even instances where the IoV system failed to boot up after the car had driven half a kilometer. Other startups, facing commercialization difficulties, began to shift downstream in the industry chain, abandoning technology development to sell in-car entertainment screens instead.

The reasons behind this can be analyzed from both technical and market perspectives.

From a technical standpoint, the maturation process of IoV technology has been slow and has had to overcome many obstacles.

For instance, in driving scenarios, it is difficult for drivers to divert their attention to handle other devices. If the interaction technology is not powerful enough, the application value of IoV remains difficult to realize. Additionally, the key term “network” in IoV means that if the data upload and download rates are not strong enough, the IoV’s role can only remain at in-car control and entertainment, making it hard to interact with broader scenarios.

Moreover, due to insufficient close ties between IoV manufacturers and automotive manufacturers, the development of IoV functionalities has not been sufficiently native, making it challenging to truly control certain functions of the vehicle through the IoV system.

From a market perspective, the lack of close ties with automotive manufacturers has also led to significant challenges in pushing IoV into the market.

Most importantly, when IoV is independently driven by tech companies, the costs can only be absorbed by the tech companies themselves or passed on to consumers. Data shows that installing a set of in-car entertainment, telephone communication, and partial fault detection IoV system in a vehicle can cost consumers several thousand to tens of thousands of yuan. While this price may not raise consumer sensitivity when purchasing a car, asking consumers to pay this price for an “equipment” after purchasing a car may encounter obstacles in terms of consumer tolerance and expectation management.

Furthermore, due to a small user base and unstable network connections, the application ecosystem of IoV is also quite barren, making it difficult to tap into service ports, and thus, monetization of the IoV ecosystem is challenging. Aside from the hardware itself, it is hard to find other profit channels.

As a result, it is not surprising that IoV has remained in its inaugural year.

Emerging Variables:

Who are the drivers of IoV in 2019?

So, what variables have emerged from the cooling in 2016 to the renewed heat in 2019?

In fact, the progress of IoV has been driven by overall technological advancements this year, as well as changes in the automotive subfields.

In recent years, the rapid development of AI technology and 5G technology has been closely related to IoV technology.

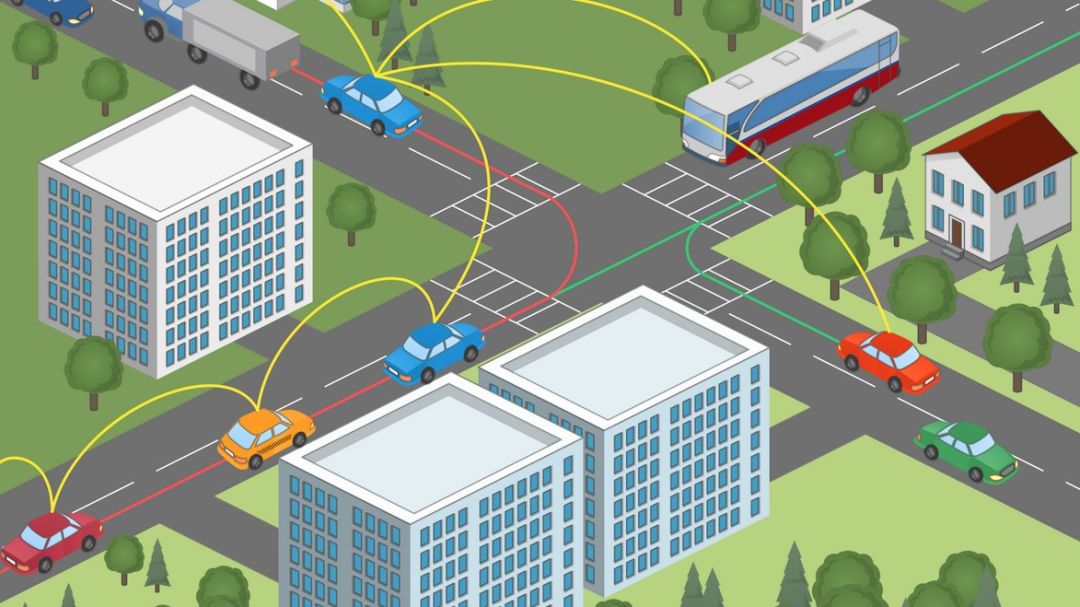

AI technology has brought about a comprehensive evolution of interaction technology. The clear understanding of voice, gestures, and even expressions can change the previous situation where drivers could not attend to in-car interaction issues. At the same time, the popularization of AI technology has led to a continuous decrease in the costs of algorithm applications and computing chips, allowing more devices to become intelligent. This includes adding more sensors inside vehicles, expanding the control range of IoV systems, and connecting various devices and products such as traffic lights, parking lots, and charging stations through intelligence and IoV systems.

As for the powerful momentum of 5G technology, its strong data carrying capacity and transmission speed meet the massive data demands generated during the digitalization of travel. The increase in network speed also ensures the timeliness of information flow between people and vehicles, vehicles and vehicles, and vehicles and roads, allowing IoV technology to not only meet entertainment needs but also participate more in the driving process itself.

Moreover, changes within the automotive sector have also led resources to tilt towards the IoV field.

Firstly, the automotive market itself has shown a more pronounced downturn in recent years. For automotive manufacturers, quickly demonstrating changes to consumers is an important task, which naturally leads to more active participation in the IoV field. Additionally, due to the difficulties in exploring autonomous driving, the technological investments in the automotive sector are also shifting towards the more easily implementable IoV field. For example, Audi’s connect system can control a series of functions from volume adjustment to vehicle settings. Besides self-research, more automotive manufacturers are choosing to collaborate with tech companies, such as Honda partnering with Alibaba and Keda Xunfei to jointly develop the third-generation HONDA CONNECT; Ford collaborating with Baidu to develop a new SYNC system with AI technology; and Alibaba’s Zebra Smart Travel being a partner of SAIC Roewe.

The deep involvement of automotive manufacturers will greatly enhance the experience of IoV. Planning for IoV can begin at the assembly and production stages of the vehicle, such as adding a microphone array in the steering wheel to improve the accuracy of sound capture, thereby enhancing voice recognition capabilities.

Under the influence of technological and market variables, we are witnessing another wave in the IoV field in 2019.

Old players re-entering a new environment,

IoV is stepping out of its inaugural year

In the new wave era of IoV, we can clearly identify three future development models for IoV.

The first model is the application ecosystem model represented by Tencent’s in-car services.

Although Tencent previously released in-car QQ, due to various limitations, this product has remained relatively ineffective, only allowing for the practical use of sharing locations between vehicles. However, now, with the enhancement of voice interaction and the addition of dedicated steering wheel buttons for in-car WeChat and navigation functions, the presence of in-car WeChat can evidently play a more significant role.

Using WeChat, a national-level app, as a platform, seamless integration of services between cars and mobile terminals can be achieved. For example, WeChat friends can recommend restaurants, shopping malls, and other location information through chat, and users can directly navigate via voice interaction in the car. Additionally, the existence of Tencent’s cross-OS development platform allows developers to port mobile products to the car terminal, enabling users to connect more closely with services such as parking lots, charging stations, and vehicle maintenance through IoV interaction.

In this way, IoV has the potential for traffic monetization.

The second model is the underlying technology service model represented by Huawei.

Compared to many tech internet companies that are more closely integrated with software ecosystems, companies like Huawei, which originated from ICT, still have advantages in software and hardware technology. For instance, many of Huawei’s proposed in-car computing platforms, intelligent driving subsystems, 4G/5G in-car mobile communication modules, T-BOX, and in-car networks serve as more foundational technologies for IoV.

In other words, concepts such as IoV, smart vehicles, autonomous driving, and vehicle-road collaboration can all apply these technologies. It can be said that as technology continues to upgrade, the automotive and overall travel sectors will require enhancements in ICT, hardware systems, and software platforms. In the future, manufacturers will need to supplement services for these foundational demands.

The third model is the driving collaboration model represented by Audi.

Compared to the aforementioned models, there are still automotive manufacturers and tech companies working hard on collaborative driving in IoV. For example, Audi has been researching the C-V2X model of IoV, which allows drivers to see the status and countdown of the next traffic light on the dashboard through intelligent signalization and vehicle interconnectivity, enabling them to adjust their driving speed accordingly.

Objectively speaking, the construction costs of C-V2X IoV are very high. In addition to the vehicle itself, it also requires signal-level interconnectivity with other terminals. However, once the cost limitations of terminal device modifications are overcome, it can greatly enhance the driving experience.

Currently, it seems that these three models do not overlap; one calls for developers to create “in-car mini-programs,” another accompanies automotive manufacturers in transforming vehicles, and the last is dedicated to adding sensors to various traffic lights, charging stations, and parking lots.

In fact, many of these players are already “old players” in the IoV field. Perhaps under the maturity of the technological and market environment, these old players can leverage their skills and experience to advance IoV further after stepping out of its inaugural year.