1.Printed Circuit Board (PCB)

Industry Basic Situation

1.1 Definition of Printed Circuit Board

Printed Circuit Board (PCB), also known as printed wiring board or printed circuit board, is a board made of insulating and heat-resistant materials that serves to fix various components in a circuit and provide the connecting circuits between these components. Broadly speaking, it refers to a finished product that carries LSI, IC, transistors, resistors, capacitors, and other electronic components on the printed circuit board and is electrically connected through soldering. In a narrow sense, it refers to a semi-finished board that has not yet installed components and only has the wiring circuit pattern.

PCB products are diverse and can be classified based on the flexibility of the substrate into rigid boards (R-PCB), flexible boards (FPC), and rigid-flex boards; based on the number of conductive layers, they can be divided into single-sided boards, double-sided boards, and multi-layer boards; additionally, there are special product classifications such as high-speed high-frequency boards, high-density interconnect boards (HDI), and packaging substrates.

1.2 Industry Chain Structure

The printed circuit board (PCB) manufacturing industry has a complete industrial chain with closely related links. The upstream includes key raw material fields such as copper foil, copper foil substrates, electronic-grade fiberglass cloth, and resin, whose quality and supply stability directly affect the midstream manufacturing process; the midstream focuses on PCB manufacturing, transforming copper-clad laminates (CCL) into PCB products with specific circuit functions through precision processes such as etching and electroplating; the downstream is widely applied in fields such as communication, optoelectronics, consumer electronics, automotive, aerospace, military, and industrial precision instruments, with changes in terminal market demand driving technological iterations and capacity layout adjustments across the industrial chain.

From the perspective of representative enterprises in each link of the industrial chain, the upstream raw material segment mainly includes copper foil suppliers such as Nordson Corporation and Jiayuan Technology, fiberglass cloth companies like China Jushi and Changhai Co., Ltd., epoxy resin companies such as Sinopec, Sanmu Group, and Dongcai Technology, as well as copper-clad laminate companies like Jintao Laminates, Shengyi Technology, and Nanya New Materials. The midstream of the industrial chain mainly consists of PCB manufacturers such as Pegatron, Dongshan Precision, Shenzhen Sannuo Circuit, Huadian Technology, and Jingwang Electronics. The downstream applications are extensive, including communication, computers, automotive electronics, and consumer electronics.

2. Current Development Status of the Printed Circuit Board (PCB)

2.1 Market Size

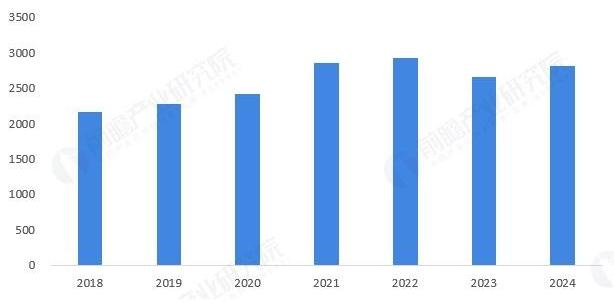

1..Market Size of the PCB Industry in Mainland China

In recent years, with the acceleration of China’s industrialization process and the surge in demand from emerging industries such as 5G communication, new energy vehicles, and artificial intelligence, the PCB industry has entered an important period of development opportunities. According to industry statistics, from 2018 to 2023, the market size of China’s PCB industry steadily increased from 216.39 billion yuan to 266.29 billion yuan, with a compound annual growth rate of 4.2%. Based on historical data trends and market dynamics, the market size of China’s PCB industry is expected to reach approximately 280.6 billion yuan in 2024, with a year-on-year growth of 5.4%, demonstrating a continuous positive development trend.

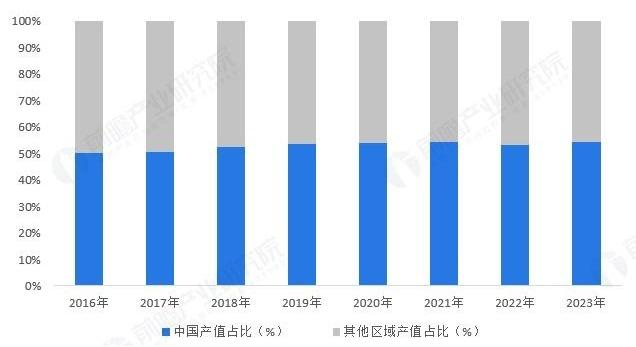

2..Proportion of PCB Output Value in Mainland China

According to Prismark statistics, from 2016 to 2023, Mainland China has dominated the global printed circuit board (PCB) industry, with its output value proportion remaining stable at around 50%, marking that Mainland China has firmly established itself as the world’s largest PCB manufacturing base, leading the industry’s capacity and technological development trends.

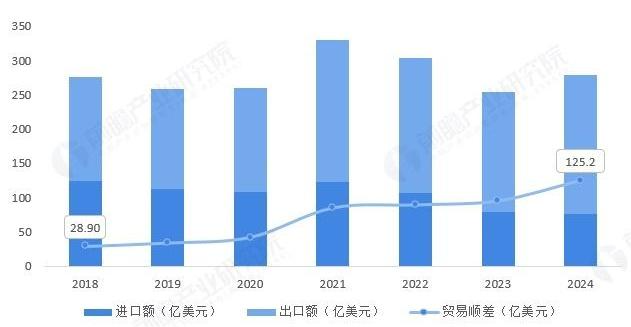

3..Overall Import and Export Situation of PCB in Mainland China

According to statistics from the General Administration of Customs, China’s printed circuit board (PCB) industry has long maintained a trade surplus. From 2018 to 2024, the trade surplus of the industry has continued to expand, with a trade surplus of 12.52 billion USD expected in 2024, a year-on-year increase of 31.2%, fully demonstrating the competitive advantage and market vitality of China’s PCB industry in the global trade landscape.

2.2 Competitive Landscape

1..Enterprise Competitive Landscape

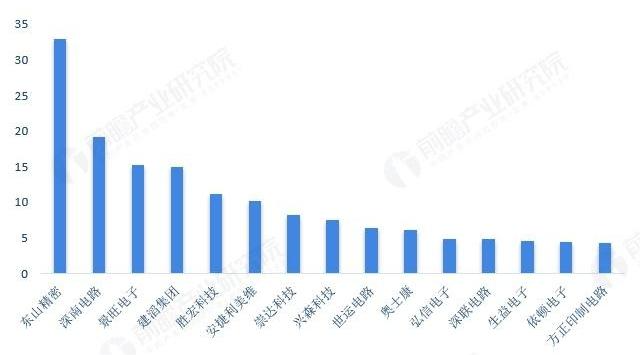

In October 2024, the professional consulting agency N.T. Information released the 2023 list of “World’s Top Printed Circuit Board Manufacturers” (NTI-100, the world’s top 100 PCB list). The data shows that in 2023, among the top 50 global printed circuit board (PCB) companies by sales, Chinese companies occupied 15 seats. Among them, Dongshan Precision ranked third globally with a sales revenue of 3.289 billion USD, and Shenzhen Sannuo Circuit ranked eighth globally with a sales revenue of 1.913 billion USD, both demonstrating strong strength in global market competition as leading enterprises in the industry.

(Note: Pegatron is a subsidiary of Zhen Ding in Mainland China, and N.T. Information has included Pegatron’s sales in Zhen Ding, so it is not listed in the above image; according to N.T. Information’s statistics, Zhen Ding’s sales in 2023 were 4.918 billion USD, ranking first globally)

2..Regional Competitive Landscape

From the perspective of the regional layout of PCB industry chain enterprises, China’s PCB companies show significant agglomeration characteristics, highly concentrated in the economically developed eastern coastal areas. Among them, Guangdong Province, with its first-mover advantage, complete industrial support system, and abundant human resources, has become the most densely populated area for PCB companies in China, gathering leading enterprises such as Pegatron and Shenzhen Sannuo Circuit, ranking first in both output value scale and number of enterprises nationwide; Fujian Province also has a certain scale in the PCB industry, especially in Longyan and other places, forming a specialized industrial cluster; Jiangsu Province, relying on its strong manufacturing base and strong technological innovation capabilities, has attracted many PCB companies, with companies such as Jieding (Wuxi) Electronics and Suzhou Dongshan Precision performing outstandingly in the manufacturing of mid-to-high-end PCB products.

3. Development Trends of the Printed Circuit Board (PCB) Industry

3.1 Market Size Steadily Expanding, Emerging Fields Driving Growth

With the explosive development of global artificial intelligence technology, coupled with the comprehensive coverage of 5G communication networks, the continuous increase in the penetration rate of new energy vehicles, and the rapid popularization of IoT terminal devices, the printed circuit board (PCB) market is showing strong growth. According to data from the China Business Industry Research Institute, the PCB market in China is expected to fully recover by 2025, with a scale expected to reach 433.321 billion yuan; from 2025 to 2030, the market size will steadily expand at a compound annual growth rate of 6.5%, expected to exceed 400 billion yuan by 2030. On a global scale, the PCB market is expected to reach 96.8 billion USD by 2025, demonstrating broad growth potential.

3.2. Technological Innovation Deepening, Product Performance Iteration and Upgrade

In the field of high-frequency and high-speed PCBs, with the deepening application of 5G communication technology, the market demand for high-performance materials such as polytetrafluoroethylene (PTFE), ceramic substrates, and polyimide has significantly increased. Multi-layer board structure design has become mainstream, and the widespread application of embedded passive device technology effectively shortens signal transmission paths, significantly reducing signal loss and providing reliable assurance for high-speed signal transmission. High-density interconnect (HDI) technology continues to break through, with its application scenarios extending from traditional consumer electronics to automotive electronics, high-end servers, and precision medical devices. The diameter of through holes continues to shrink, and micro-hole processing technology is maturing, with PCB layers breaking through 20 layers, and high-precision laser drilling equipment and processes continuously optimizing, driving HDI technology towards higher precision and higher integration.

3.3. Environmental Standards Continuously Upgrading, Green Manufacturing Becoming Industry Consensus

In the context of tightening global environmental policies and the popularization of sustainable development concepts, environmental protection and sustainability have become the core themes of PCB industry development. The application of lead-free soldering technology and halogen-free environmentally friendly substrates is gradually becoming standard configurations in the industry. Enterprises are accelerating the layout of efficient wastewater treatment systems and waste liquid recycling systems, achieving full-process environmental control from production sources to end treatment. At the same time, product design emphasizes ease of disassembly, optimizing material selection and structural design to enhance the recycling rate throughout the product lifecycle, practicing the concept of green manufacturing.

3.4. Application Structure Deeply Adjusted, Emerging Fields Releasing Potential

The consumer electronics field remains the main demand support for the PCB market, but as the market gradually saturates, the growth trend is becoming flat. The automotive electronics field, driven by the explosive sales of electric vehicles and iterations of autonomous driving technology, has seen explosive growth in the demand for core components such as battery management systems (BMS), advanced driver assistance systems (ADAS), and in-vehicle entertainment systems, becoming an important growth engine for the industry. The demand for high reliability and high-performance PCBs in industrial automation equipment and high-end medical instruments continues to rise, driving steady expansion in niche markets.

3.5. Regional Pattern Dynamically Evolving, Industrial Layout Accelerating Reconstruction

The Asia-Pacific region, with its complete industrial chain support, strong manufacturing capabilities, and huge market demand, continues to consolidate its dominant position in the global PCB manufacturing field, with China occupying a core position with over 50% of global production share. Southeast Asian countries, with their labor cost advantages and policy incentives, are attracting global PCB industry transfers, gradually becoming new industrial clusters. The European and American markets focus on high-tech, high-value-added PCB application fields such as aerospace, defense, and high-end medical, strengthening their competitive advantages in high-end markets. At the same time, affected by global supply chain fluctuations, countries are promoting PCB production localization strategies to reduce supply risks and ensure industrial safety.

Source: Information Management Department of the Investment Company

Reviewed by: Sun Rong

Published by: Xu Zijun