Overview of PCB Industry Development: Market Size, Technological Trends, and Industry Characteristics

1. Overview of the Printed Circuit Board MarketMarket

(1) Global PCB Market Space is Vast

The global printed circuit board (PCB) industry is the largest segment in the field of electronic components, with its output value showing significant correlation with the international economic environment and downstream application market demand. Industry data shows that in 2021, the total output value of the global PCB industry reached $80.92 billion, achieving a strong year-on-year growth of 24.1% driven by rising raw material prices and expanding terminal market demand. Notably, in 2022, due to weak demand for consumer electronics and prolonged inventory destocking cycles among downstream terminal customers, the total output value of the global PCB industry slightly increased to $81.74 billion, with a significant decline in year-on-year growth rate, narrowing to 1.0%.

Entering 2023, under the complex environment of geopolitical turmoil and macroeconomic downward pressure, the total output value of the global PCB industry fell to $69.52 billion, a year-on-year decrease of 15%. By 2024, benefiting from the initiation of server hardware upgrade cycles and accelerated communication infrastructure construction, the global PCB industry is expected to experience a structural recovery, with total output value rebounding to $73.57 billion, achieving a positive year-on-year growth of 5.8%. This cyclical fluctuation highlights the PCB industry as a foundational industry in electronics, with its development closely coupled with global technological innovation cycles and industrial upgrade demands.

In the future, downstream application fields of printed circuit boards (PCBs) such as new energy vehicles and cloud computing are expected to experience rapid growth, thereby driving continuous increases in PCB market demand.

(2) Global PCB Industry Shifting Towards Asia, Especially Mainland China

The PCB industry is widely distributed globally, with developed countries in North America, Europe, and Japan starting early. Before 2000, the three major regions of the Americas, Europe, and Japan accounted for over 70% of the global PCB output value. However, in the past two decades, due to advantages in labor, resources, policies, and industrial clustering, global electronic manufacturing capacity has shifted towards Asia, particularly Mainland China, Taiwan, and South Korea. As the global industrial center shifts to Asia, the PCB industry is presenting a new pattern with Asia, especially Mainland China, as the manufacturing center. Since 2006, Mainland China has surpassed Japan to become the world’s largest PCB production base, with both output and output value ranking first in the world.

The output value of PCBs in Mainland China has increased from 8.1% of the global total in 2000 to 55.74% in 2024.

(3) Global PCB Product Structure

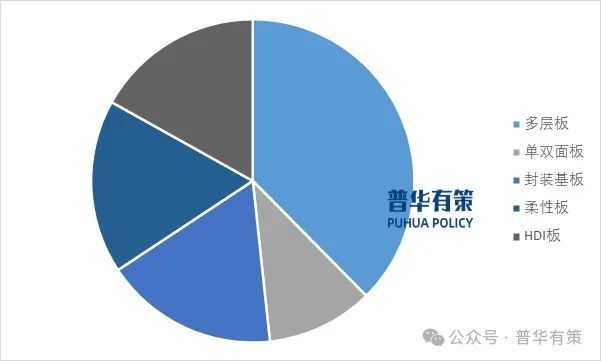

Global PCB Product Structure

Source: PwC Consulting

According to data, the market structure of global PCB segmented products in 2024 is as follows: in terms of product structure, rigid boards dominate, with multilayer boards accounting for 37.6% and single-sided and double-sided boards accounting for 10.7%; followed by packaging substrates and flexible boards, each accounting for 17.4%; and HDI boards accounting for 16.9%.

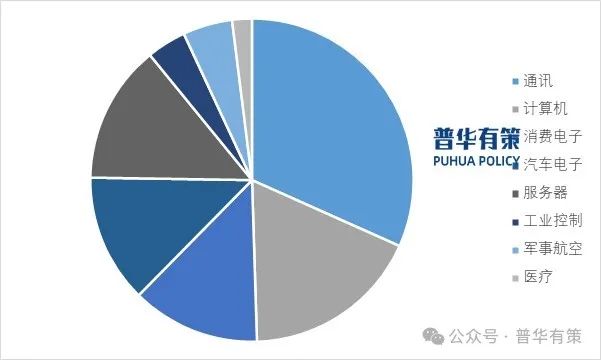

(4) Global PCB Downstream Application Fields

The global PCB downstream application fields are widely distributed, mainly including communications, computers, consumer electronics, automotive electronics, servers, industrial control, military aviation, and medical fields.

PCB Downstream Application Fields

Source: PwC Consulting

The growth of the PCB industry is closely related to the development of the downstream electronic information industry, with both mutually promoting each other. With the development of new generation information technologies such as big data, cloud computing, and 5G communication, the demand for data storage and computing power is showing high growth trends, and the server industry has vast development space. With the continuous popularization of new energy vehicles and the deepening of automotive electrification and intelligence, the automotive electronics industry is expected to experience high growth.

(5) Overview of the Chinese PCB Market

The Chinese PCB market presents a gradient development pattern, with coastal areas transitioning to high-end (high-precision HDI boards, IC substrates) while production capacity shifts to regions such as Jiangxi, Hubei, Hunan, Sichuan, and Chongqing. Currently, products are dominated by rigid boards (multilayer boards 49%, single-sided and double-sided boards 14%), with HDI boards accounting for 18%, highlighting technological upgrades. However, the localization rate of packaging substrates is less than 10%, and foreign capital monopolizes over 75% of high-end HDI and 20-layer+ high multilayer boards. In downstream applications, communications (31%) and computers (23%) serve as dual engines, while automotive electronics (CAGR over 15%) and consumer electronics form growth poles, with these four fields accounting for over 85%, while niche markets such as industrial control and medical electronics grow 3-5 percentage points faster than the industry average.

2. PCB Industry Technology Level and Industry Characteristics

(1) Industry Technology Level and Development Trends

As a core foundational component of the electronics industry, the technological evolution of the printed circuit board (PCB) industry has a significant synergistic development relationship with the market demand of downstream electronic terminal devices. This industrial interaction mechanism is mainly reflected in the improvement of PCB process precision, innovation of material systems, and optimization of structural design, all of which need to closely align with the continuous upgrade demands for high performance, miniaturization, and reliability from terminal application markets such as consumer electronics, communication devices, and automotive electronics. With the increasing demand for lightweight, thin, short, and high-frequency, high-speed electronic products, the PCB industry will develop towards high density and high performance. High density imposes higher requirements on the size of circuit board holes, wiring width, and the number of layers; high-density interconnect technology (HDI) reduces the number of through holes by precisely setting blind and buried holes, saving PCB wiring area and significantly increasing component density; high performance mainly refers to the requirements for PCB impedance and heat dissipation performance. Modern electronic products have a large amount of information transmission and require fast information transmission rates, and PCBs with good impedance are essential to ensure effective information transmission and maintain the stability of the final product’s performance. In addressing the technical challenges of continuously increasing power density and thermal flow density in electronic devices, the selection of innovative substrate materials has become a key aspect of thermal management solutions. Based on the aforementioned heat dissipation demand orientation, printed circuit boards with metal core substrate technology (MetalCorePCB) and high copper thickness copper-clad board structures have achieved industrial application breakthroughs in recent years in industrial power modules, new energy vehicle power systems, and high-power LED lighting components due to their significant thermal conductivity advantages and heat diffusion capabilities. This technological evolution trend not only validates the practical engineering value of high thermal conductivity substrates but also reflects the continuous innovation development direction in the thermal design field of power electronic devices.

(2) Industry Operating Models

1) Procurement Model

PCB manufacturing enterprises generally adopt an order-oriented procurement model for raw material management while establishing a dynamic inventory management mechanism to respond to market fluctuations. Specifically, enterprises mainly implement precise procurement based on customer order demands, and for common basic materials (such as copper-clad boards), strategic stocking strategies are implemented. This mechanism effectively balances the dual impacts of order delivery timeliness requirements and raw material price cycle fluctuations. Given that PCB production involves over a hundred types of raw materials, the industry common practice is to build a strategic supplier management system, utilizing multi-source supply strategies and a qualified supplier directory system to ensure supply chain stability and effectively avoid risks associated with reliance on a single supplier.

It is particularly noteworthy that in the procurement of key materials such as copper-clad boards, downstream customers in the industry chain often intervene in the procurement process through supply chain collaboration mechanisms. Specifically, terminal customers may provide a verified list of copper-clad board suppliers to their certified PCB manufacturers or determine supplier admission standards through bilateral technical negotiations, thereby forming a supply chain cooperation model with significant directional procurement characteristics. This deep customer involvement in the supplier admission mechanism reflects the special attributes of supply chain management in the high-end electronic manufacturing field.

2) Production Model

Due to the customized nature of products, the PCB industry generally adopts an order-oriented production model, with production organization strictly following customer demand for scheduling planning. In specific execution, enterprises always adhere to the principle of prioritizing self-production capacity, dynamically optimizing the allocation of production line resources through intelligent scheduling systems. When facing order peaks that exceed baseline production capacity thresholds or encountering capacity bottlenecks in specific process links, enterprises will initiate strategic outsourcing production plans, relying on a network of qualified collaborative manufacturers to build a capacity elasticity adjustment mechanism, ensuring the dual achievement of order delivery cycles and product quality standards.

3) Sales Model

PCB companies generally adopt a sales model primarily based on direct sales, supplemented by traders and PCB companies, to quickly respond to downstream customer demands and provide better and faster services. Some enterprises may assist in sales through agents.

(3) Industry Characteristics

1) Cyclical Characteristics

The PCB industry has historically been significantly influenced by the demand for computers and consumer electronics, but as downstream distribution becomes increasingly widespread and product coverage expands, the risk of industry fluctuations has decreased. The printed circuit board industry is mainly affected by macroeconomic cycle fluctuations.

2) Seasonal Characteristics

The production and sales of printed circuit boards are less affected by seasons, and the industry’s seasonal characteristics are not obvious. However, due to factors such as holiday consumption of downstream electronic terminal products, PCB production enterprises generally see higher production and sales scales in the second half of the year compared to the first half.

3) Regional Characteristics

The PCB industry overall exhibits certain regional characteristics. The global PCB industry’s output value is mainly distributed in Mainland China, Taiwan, Japan, South Korea, the United States, and Europe; the PCB industry in Mainland China is mainly concentrated in the South and East China regions, with the South China region being the most concentrated area for PCB manufacturers. As labor costs in coastal areas rise, some PCB enterprises are gradually shifting the production capacity of mid-to-low-end products to inland areas.

The “Market Research and Development Trend Forecast Report for the Printed Circuit Board Industry (2025-2031)” covers the global and Chinese development overview of the industry, supply and demand data, market size, industrial policies/plans, related technologies/patents, competitive landscape, upstream raw material conditions, downstream major application market demand scale and prospects, regional structure, market concentration, key enterprises/players, market share, industry characteristics, driving factors, market outlook forecasts, investment strategies, major barrier compositions, related risks, and more. At the same time, PwC Consulting also provides market-specific research projects, industry research reports, industry chain consulting, project feasibility study reports, specialized small giant certification, market share reports, the 14th Five-Year Plan, project post-evaluation reports, BP business plans, industry maps, industry planning, blue and white papers, national-level manufacturing single champion enterprise certification, IPO fundraising feasibility studies, IPO working paper consulting, and other services. (PHPOLICY:GYF)

Table of Contents

Chapter 1 Overview of the Printed Circuit Board Industry

Section 1 Definition and Classification of the Printed Circuit Board Industry

1. Industry Definition

2. Industry Characteristics and Its Position and Impact in the National Economy

Section 2 Characteristics and Models of the Printed Circuit Board Industry

1. Development Characteristics of the Printed Circuit Board Industry

2. Operating Models of the Printed Circuit Board Industry

Section 3 Analysis of the Printed Circuit Board Industry Chain

1. Industry Chain Structure

2. Analysis of the Supply Scale of Major Upstream in the Printed Circuit Board Industry (2020-2024)

3. Analysis of the Price of Major Upstream in the Printed Circuit Board Industry (2020-2024)

4. Analysis of Development Trends of Major Upstream in the Printed Circuit Board Industry (2025-2031)

5. Analysis of Development Overview of Major Downstream in the Printed Circuit Board Industry (2020-2024)

6. Analysis of Development Trends of Major Downstream in the Printed Circuit Board Industry (2025-2031)

Chapter 2 Global Development Analysis of the Printed Circuit Board Industry

Section 1 Overall Situation Analysis of the Global Printed Circuit Board Market

1. Development Characteristics of the Global Printed Circuit Board Industry

2. Structure of the Global Printed Circuit Board Market

3. Analysis of the Market Size of the Global Printed Circuit Board Industry

4. Competitive Landscape of the Global Printed Circuit Board Industry

5. Regional Distribution of the Global Printed Circuit Board Market

6. Market Size Forecast of the Global Printed Circuit Board Industry

Section 2 Market Analysis of Major Countries (Regions)

1. Europe

1. Market Size of the Printed Circuit Board Industry in Europe

2. Structure of the Printed Circuit Board Market in Europe

3. Development Prospects of the Printed Circuit Board Industry in Europe (2025-2031)

2. North America

1. Market Size of the Printed Circuit Board Industry in North America

2. Structure of the Printed Circuit Board Market in North America

3. Development Prospects of the Printed Circuit Board Industry in North America (2025-2031)

3. Japan and South Korea

1. Market Size of the Printed Circuit Board Industry in Japan and South Korea

2. Structure of the Printed Circuit Board Market in Japan and South Korea

3. Development Prospects of the Printed Circuit Board Industry in Japan and South Korea (2025-2031)

4. Others

Chapter 3 Overview of the Printed Circuit Board Industry Classification and Code in the National Economic Industry Classification

Section 1 Review of the Development of the Industry (2020-2024)

1. Operation of the Industry (2020-2024)

2. Development Characteristics of the Industry (2020-2024)

3. Achievements of the Industry (2020-2024)

Section 2 Interpretation of the Industry Planning (2025-2031)

1. Overall Strategic Layout of the Planning (2025-2031)

2. Impact of the Planning on Economic Development (2025-2031)

3. Main Goals of the Planning (2025-2031)

Chapter 4 Analysis of the Industry Development Environment (2025-2031)

Section 1 World Economic Development Trends (2025-2031)

Section 2 Economic Situation Facing China (2025-2031)

Section 3 Forecast of China’s Foreign Economic Trade (2025-2031)

Section 4 Analysis of the Industry Technology Environment (2025-2031)

1. Relevant Technologies in the Industry

2. Patent Situation in the Industry

1. Patent Applications for Printed Circuit Boards in China

2. Patent Disclosures for Printed Circuit Boards in China

3. Popular Applicants for Printed Circuit Board Patents in China

4. Popular Technologies for Printed Circuit Boards in China

Section 5 Analysis of the Social Environment of the Industry (2025-2031)

Chapter 5 PwC Consulting’s Overall Development Status of the Printed Circuit Board Industry

Section 1 Analysis of the Characteristics of the Printed Circuit Board Industry

Section 2 Characteristics of the Printed Circuit Board Industry and Its Importance

Section 3 Development Analysis of the Printed Circuit Board Industry (2020-2024)

1. Analysis of the Development Trend of the Printed Circuit Board Industry (2020-2024)

2. Analysis of the Development Characteristics of the Printed Circuit Board Industry (2020-2024)

3. Regional Industrial Layout and Industrial Transfer (2025-2031)

Section 4 Analysis of the Scale of the Printed Circuit Board Industry (2020-2024)

1. Analysis of the Scale of the Industry Units

2. Analysis of the Scale of Personnel in the Industry

3. Analysis of the Scale of Assets in the Industry

4. Analysis of the Market Scale of the Industry

Section 5 Analysis of the Financial Capability of the Printed Circuit Board Industry (2020-2024) and Forecast (2025-2031)

1. Analysis and Forecast of the Profitability of the Industry

2. Analysis and Forecast of the Solvency of the Industry

3. Analysis and Forecast of the Operating Capability of the Industry

4. Analysis and Forecast of the Development Capability of the Industry

Chapter 6 Analysis of Supply and Demand Situation in China’s Printed Circuit Board Market (2025-2031)

Section 1 Supply and Demand Analysis of China’s Printed Circuit Board Market

1. Supply Situation of China’s Printed Circuit Board Industry (2020-2024)

2. Demand Situation of China’s Printed Circuit Board Industry (2020-2024)

1. Demand Market of the Printed Circuit Board Industry

2. Customer Structure of the Printed Circuit Board Industry

3. Regional Demand Structure of the Printed Circuit Board Industry

3. Analysis of Supply and Demand Balance of China’s Printed Circuit Board Industry (2020-2024)

Section 2 Application and Demand Forecast of Printed Circuit Board Products

1. Overall Demand Analysis of the Application Market for Printed Circuit Board Products

1. Demand Characteristics of the Application Market for Printed Circuit Board Products

2. Total Demand Scale of the Application Market for Printed Circuit Board Products

2. Demand Forecast for Printed Circuit Board Industry Fields (2025-2031)

1. Forecast of Product Functions in the Printed Circuit Board Industry Fields (2025-2031)

2. Forecast of Market Structure in the Printed Circuit Board Industry Fields (2025-2031)

Chapter 7 Operation Analysis of China’s Printed Circuit Board Industry

Section 1 Development Status Analysis of China’s Printed Circuit Board Industry

1. Development Stage of China’s Printed Circuit Board Industry

2. Overall Overview of China’s Printed Circuit Board Industry

Section 2 Current Situation of China’s Printed Circuit Board Industry (2020-2024)

1. Market Size (Growth Rate) of China’s Printed Circuit Board Industry (2020-2024)

2. Development Analysis of China’s Printed Circuit Board Industry (2020-2024)

3. Development Analysis of China’s Printed Circuit Board Enterprises (2020-2024)

Section 3 Market Situation Analysis of China’s Printed Circuit Board Industry (2020-2024)

1. Overall Overview of China’s Printed Circuit Board Market (2020-2024)

2. Development Analysis of China’s Printed Circuit Board Market (2020-2024)

Section 4 Price Trend Analysis of China’s Printed Circuit Board Market

1. Composition of the Pricing Mechanism of the Printed Circuit Board Market

2. Factors Affecting the Price of the Printed Circuit Board Market

3. Price Trend Analysis of Printed Circuit Boards (2020-2024)

4. Price Trend Forecast of Printed Circuit Boards (2025-2031)

Chapter 8 Analysis of China’s Printed Circuit Board Market Size (2020-2024)

Section 1 Analysis of China’s Printed Circuit Board Market Size (2020-2024)

Section 2 Analysis of Regional Structure of China’s Printed Circuit Board Market (2020-2024)

Section 3 Regional Market Size of China’s Printed Circuit Board (2020-2024)

1. Market Size Analysis of Northeast Region (2020-2024)

2. Market Size Analysis of North China Region (2020-2024)

3. Market Size Analysis of East China Region (2020-2024)

4. Market Size Analysis of Central China Region (2020-2024)

5. Market Size Analysis of South China Region (2020-2024)

6. Market Size Analysis of Western Region (2020-2024)

Section 4 Forecast of Regional Market Prospects of China’s Printed Circuit Board (2025-2031)

1. Forecast of Northeast Region Market Prospects (2025-2031)

2. Forecast of North China Region Market Prospects (2025-2031)

3. Forecast of East China Region Market Prospects (2025-2031)

4. Forecast of Central China Region Market Prospects (2025-2031)

5. Forecast of South China Region Market Prospects (2025-2031)

6. Forecast of Western Region Market Prospects (2025-2031)

Chapter 9 PwC Consulting’s Analysis of the Structural Adjustment of the Printed Circuit Board Industry (2025-2031)

Section 1 Analysis of the Structure of the Printed Circuit Board Industry

1. Analysis of the Degree of Market Segmentation

2. Demand Structure Proportion of Downstream Application Fields

3. Structural Analysis of Leading Application Fields (Ownership Structure)

Section 2 Analysis of the Structure of the Industry Value Chain and Overall Competitive Advantages of the Industry Chain

1. Composition of the Industry Value Chain

2. Analysis of Competitive Advantages and Disadvantages of the Industry Chain

Chapter 10 Analysis of Competitive Advantages in the Printed Circuit Board Industry

Section 1 Analysis of Competitive Advantages in the Printed Circuit Board Industry

1. Overall Competitiveness Evaluation of the Industry

2. Analysis of the Results of the Industry Competitiveness Evaluation

3. Evaluation of Competitive Advantages and Suggestions for Construction

Section 2 Analysis of Competitiveness in China’s Printed Circuit Board Industry

Section 3 SWOT Analysis of the Printed Circuit Board Industry

1. Analysis of Advantages in the Printed Circuit Board Industry

2. Analysis of Disadvantages in the Printed Circuit Board Industry

3. Analysis of Opportunities in the Printed Circuit Board Industry

4. Analysis of Threats in the Printed Circuit Board Industry

Chapter 11 Analysis of Market Competition Strategies in the Printed Circuit Board Industry (2025-2031)

Section 1 Analysis of Overall Market Competition Status

1. Analysis of the Competitive Structure of the Printed Circuit Board Industry

1. Competition Among Existing Enterprises

2. Analysis of Potential Entrants

3. Analysis of Threats from Substitutes

4. Bargaining Power of Suppliers

5. Bargaining Power of Customers

6. Summary of Competitive Structure Characteristics

2. Analysis of the Competitive Landscape Among Enterprises in the Printed Circuit Board Industry

1. Competitive Landscape of Enterprises of Different Scales

2. Competitive Landscape of Enterprises of Different Ownerships

3. Competitive Landscape of Enterprises in Different Regions

3. Analysis of the Concentration of the Printed Circuit Board Industry

1. Analysis of Market Concentration

2. Analysis of Enterprise Concentration

3. Analysis of Regional Concentration

Section 2 Overview of the Competitive Landscape of China’s Printed Circuit Board Industry

1. Overview of Competition in the Printed Circuit Board Industry

2. Analysis of Market Share of Key Enterprises

3. Analysis of Competitiveness of Major Enterprises in the Printed Circuit Board Industry

1. Comparative Analysis of Total Assets of Key Enterprises

2. Comparative Analysis of Employees of Key Enterprises

3. Comparative Analysis of Revenue of Key Enterprises

4. Comparative Analysis of Total Profits of Key Enterprises

5. Comparative Analysis of Total Liabilities of Key Enterprises

Section 3 Analysis of the Competitive Landscape of the Printed Circuit Board Industry (2020-2024)

1. Trends of Major Domestic Printed Circuit Board Enterprises

2. Analysis of Planned Projects of Domestic Printed Circuit Board Enterprises

3. Analysis of Market Concentration of China’s Printed Circuit Board Industry

Section 4 Analysis of Competitive Strategies of Printed Circuit Board Enterprises

1. Strategies to Enhance Competitiveness of Printed Circuit Board Enterprises

2. Factors Affecting the Core Competitiveness of Printed Circuit Board Enterprises and Ways to Improve

Chapter 12 Analysis of the Development Situation of Key Enterprises in the Industry by PwC Consulting

Section 1 Enterprise One

1. Overview of the Enterprise and Introduction to Printed Circuit Board Products

2. Analysis of Core Competitiveness of the Enterprise

3. Analysis of Major Profit Indicators of the Enterprise

4. Key Operating Data Indicators (2020-2024)

5. Development Strategic Planning of the Enterprise

Section 2 Enterprise Two

1. Overview of the Enterprise and Introduction to Printed Circuit Board Products

2. Analysis of Core Competitiveness of the Enterprise

3. Analysis of Major Profit Indicators of the Enterprise

4. Key Operating Data Indicators (2020-2024)

5. Development Strategic Planning of the Enterprise

Section 3 Enterprise Three

1. Overview of the Enterprise and Introduction to Printed Circuit Board Products

2. Analysis of Core Competitiveness of the Enterprise

3. Analysis of Major Profit Indicators of the Enterprise

4. Key Operating Data Indicators (2020-2024)

5. Development Strategic Planning of the Enterprise

Section 4 Enterprise Four

1. Overview of the Enterprise and Introduction to Printed Circuit Board Products

2. Analysis of Core Competitiveness of the Enterprise

3. Analysis of Major Profit Indicators of the Enterprise

4. Key Operating Data Indicators (2020-2024)

5. Development Strategic Planning of the Enterprise

Section 5 Enterprise Five

1. Overview of the Enterprise and Introduction to Printed Circuit Board Products

2. Analysis of Core Competitiveness of the Enterprise

3. Analysis of Major Profit Indicators of the Enterprise

4. Key Operating Data Indicators (2020-2024)

5. Development Strategic Planning of the Enterprise

Chapter 13 Investment Outlook for the Printed Circuit Board Industry (2025-2031) by PwC Consulting

Section 1 Analysis of Investment Opportunities in the Printed Circuit Board Industry (2025-2031)

1. Analysis of Typical Projects in the Printed Circuit Board Industry

2. Investment Models in the Printed Circuit Board Industry

3. Investment Opportunities in the Printed Circuit Board Industry (2025-2031)

Section 2 Forecast Analysis of the Development of the Printed Circuit Board Industry (2025-2031)

1. Analysis of Trends in Industry Concentration

2. Development Trends of the Industry (2025-2031)

3. Directions for Technological Development in the Printed Circuit Board Industry (2025-2031)

4. Overall Planning and Forecast for the Printed Circuit Board Industry (2025-2031)

Section 3 The Planning Will Find New Growth Points for the Printed Circuit Board Industry (2025-2031)

Chapter 14 Analysis of Development Trends and Investment Risks in the Printed Circuit Board Industry (2025-2031) by PwC Consulting

Section 1 Problems in the Printed Circuit Board Industry (2020-2024)

Section 2 Forecast Analysis of Development Trends (2025-2031)

1. Analysis of Development Directions in the Printed Circuit Board Industry (2025-2031)

2. Forecast of Development Scale in the Printed Circuit Board Industry (2025-2031)

3. Forecast of Development Trends in the Printed Circuit Board Industry (2025-2031)

4. Key Focus Areas in the Printed Circuit Board Industry (2025-2031)

Section 3 Analysis of Entry Barriers in the Printed Circuit Board Industry (2025-2031)

1. Analysis of Technological Barriers

2. Analysis of Financial Barriers

3. Analysis of Policy Barriers

4. Analysis of Other Barriers

Section 4 Analysis of Investment Risks in the Printed Circuit Board Industry (2025-2031)

1. Analysis of Competitive Risks

2. Analysis of Raw Material Risks

3. Analysis of Talent Risks

4. Analysis of Technological Risks

5. Analysis of Other Risks