Printed Circuit Boards (PCBs) are critical electronic interconnect components used in nearly all electronic products. They are indispensable electronic components in modern electronic information products, often referred to as the “mother of electronic products.” The global market size is expected to exceed $70 billion by 2024. Copper clad laminates (CCLs), one of the highest cost materials in PCB manufacturing, are projected to have a global market size of around $14 billion in 2024. Over the next five years, as AI applications accelerate, the demand growth in downstream industries such as high-speed networks, servers/data storage, automotive electronics, and satellite communications will drive the global PCB and CCL industry into a new growth cycle.

Product Types and Trends

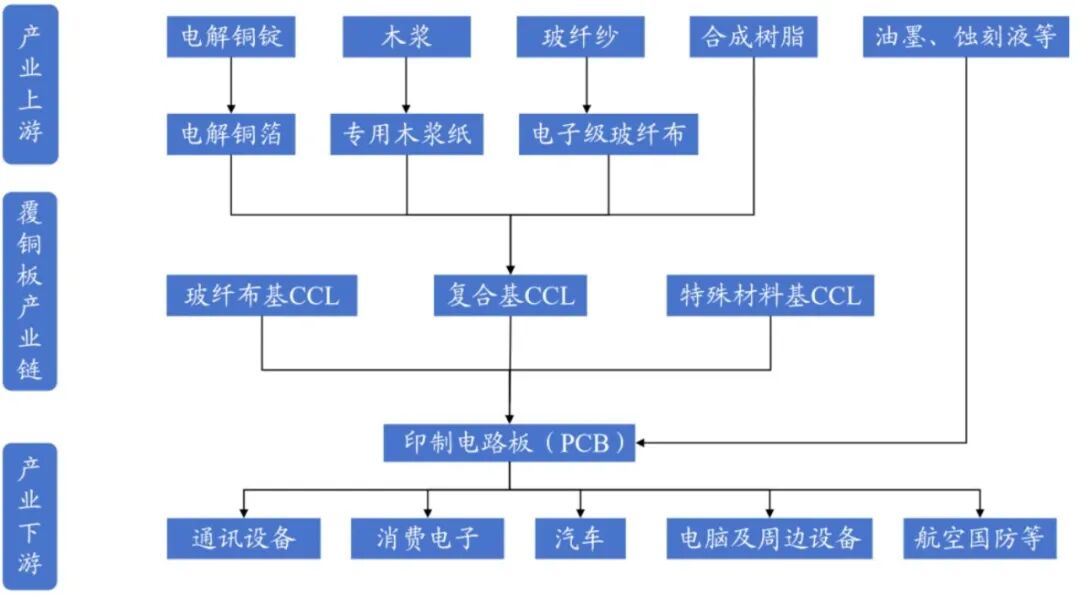

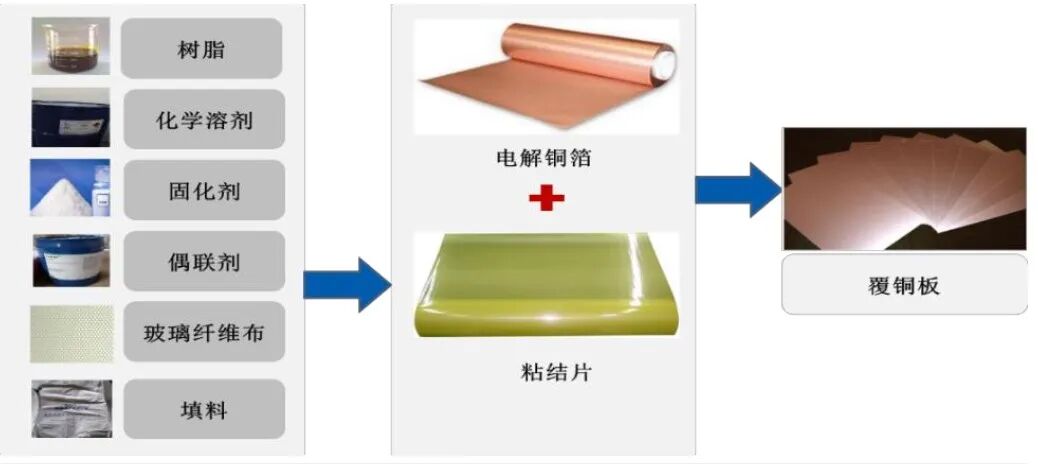

Copper clad laminates (CCLs) are substrate materials used in the manufacturing of printed circuit boards (PCBs), generally accounting for about 30% of PCB manufacturing costs, and even higher in certain types of PCBs (such as high-frequency high-speed PCBs used in AI servers). CCLs are made from reinforced materials like wood pulp paper or fiberglass cloth, impregnated with resin, and covered with copper foil through hot pressing. The upstream materials for CCLs include copper foil, resin, and fiberglass cloth, with their respective costs accounting for approximately 39%, 26%, and 18% of CCL costs.

Figure 1: CCL Industry Chain

Source: Shengyi Technology Convertible Bond Prospectus, Huachuang Securities.

CCLs can be categorized in various ways based on mechanical rigidity, insulation materials, and reinforcement materials. They can be roughly divided into rigid CCLs and flexible CCLs (FCCLs) based on material hardness. Rigid CCLs mainly include fiberglass cloth-based CCLs, paper-based CCLs, composite-based CCLs, and special material-based CCLs, with fiberglass cloth-based boards (FR-4) being the most widely used in PCB manufacturing.

Flexible CCLs are key materials for Flexible PCBs (FPCs) and are made by laminating copper foil onto polyimide film (PI). Unlike rigid PCBs, FPCs allow for product designs that can bend, fold, and slide. Flexible CCLs are divided into two main categories: traditional adhesive-containing three-layer flexible CCLs (3L-FCCL) and new adhesive-free two-layer flexible CCLs (2L-FCCL). The latter does not rely on epoxy or acrylic adhesives, using only flexible insulating films as the insulation layer. Currently, the insulating materials for producing two-layer FCCLs mainly include polyimide PI film, polyester PET film, and liquid crystal polymer LCP film. The application fields of different types of CCLs are shown in the table below.

Table 1: Main Types of CCLs and Their Application Fields

Source: Guohai Securities, Deep Industry Research Institute.

Prepreg (PP), also known as semi-cured sheets, is a precursor product in the production process of CCLs, determining the overall performance of the CCL. Additionally, prepregs have adhesive properties and can serve as bonding and insulating materials between layers in multilayer boards or HDI layers. Downstream multilayer board or HDI customers purchase CCLs from CCL manufacturers while also procuring prepreg products of the same specifications from the same manufacturers.

Figure 2: Relationship Between CCLs and Prepregs

Source: Nanya New Materials 2024 Annual Report.

CCLs are trending towards high-frequency and high-speed, with enhanced electrical performance as the main direction of material upgrades. As PCBs continue to evolve towards higher functionality and multilayer designs, and with increasing environmental standards, downstream applications are paying more attention to multiple performance indicators of CCLs. High-temperature resistance (high Tg), dielectric properties (low dielectric constant Dk, low dielectric loss Df), arc resistance (high CTI), and environmental friendliness (halogen-free, antimony-free) have become focal points, driving CCLs towards high-frequency, high-speed, lightweight, and lead-free/halogen-free developments. Among these, “lead-free/halogen-free” and “lightweight” have become mainstream, while the rapid development of 5G and AI technologies has significantly increased the communication frequency and transmission rates of communication stations, as well as the bus transmission rates of data centers represented by servers and the massive computing power demands of AI, continuously raising the electrical performance requirements for CCLs and driving the upgrade of high-frequency and high-speed CCLs. High-frequency and high-speed CCLs primarily pursue low dielectric constant Dk and low dielectric loss factor Df in terms of electrical performance, as a lower Dk can lead to smaller transmission losses and improved signal integrity, while a lower Df helps reduce transmission delays and further optimize characteristic impedance.

Market Size and Structure

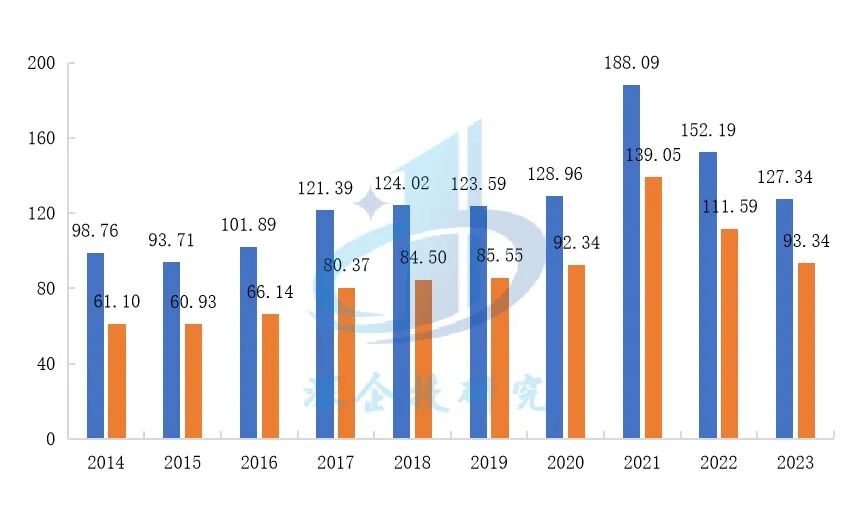

The global CCL market is dominated by rigid CCLs, with flexible CCLs accounting for less than 10% of production and value. According to Prismark data, global sales of rigid CCLs grew exceptionally by 45.8% in 2021, reaching $18.807 billion; however, they decreased consecutively in 2022 and 2023, with global sales of rigid CCLs in 2023 amounting to 655 million square meters, a year-on-year decrease of 1.1%, and sales revenue of $12.734 billion, a 16.3% decrease compared to 2022’s sales revenue of $15.219 billion. Although the demand for CCLs has slightly declined, significant price pressures have led to a larger decline in sales revenue. As the global PCB industry enters a new growth cycle, the CCL market is expected to regain growth momentum. According to a report from Goldman Sachs Global Investment Division in October 2024, the global CCL market is projected to have a CAGR of 9% from 2024 to 2026, while the high-end CCL (HDI and high-speed high-frequency) market is expected to have a CAGR of 26% during the same period.

Figure 3: Global and Mainland China CCL Sales Revenue from 2014 to 2023 (in millions USD)

Source: Prismark “LAMINATE Study Update-2023” and others, Deep Industry Research Institute.

Mainland China is the major production area and largest sales market for CCLs globally. According to Prismark statistics, in 2023, the sales revenue of rigid CCLs from enterprises in Mainland China (including foreign enterprises in Mainland China) was $9.334 billion, accounting for 73.3% of the global total sales revenue, ranking first globally. In terms of sales volume, the sales volume of rigid CCLs from enterprises in Mainland China in 2023 was 524.9 million square meters, accounting for 79.9% of the global total sales volume, an increase of 0.6 percentage points compared to 2022 (79.3%).

Figure 4: Global Sales Volume of Rigid CCLs by Region from 2019 to 2023 (in millions square meters)

Source: Prismark, Deep Industry Research Institute.

China’s CCL production capacity is enormous, with conventional products experiencing overcapacity. According to the China Electronic Materials Industry Association CCL Materials Branch (CCLA) survey data, the total production capacity of various CCLs nationwide in 2023 was 1.208 billion square meters, an increase of 3.5% compared to 2022. Among them, rigid CCLs (excluding commodity prepregs) accounted for 88.2%. The total production volume of various CCLs nationwide in 2023 was 795 million square meters, with a total capacity utilization rate of 65.8% (excluding commodity prepreg capacity utilization data), which is 0.9 percentage points higher than in 2022. Due to various market factors, the total capacity utilization rate of CCLs in China has not reached an ideal state, with significant overcapacity in conventional CCLs.

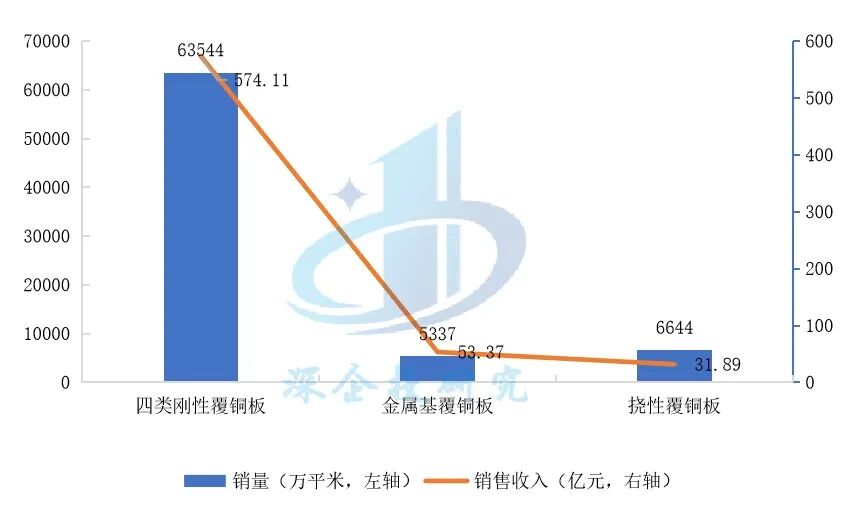

In 2023, the sales volume of various CCLs in China was 755 million square meters, a decrease of 1.7% compared to 2022, with sales revenue of 65.937 billion yuan, a decrease of 9.7% compared to 2022; the sales volume of commodity prepregs was 736 million square meters, a decrease of 3.0% compared to 2022, with sales revenue of 12.513 billion yuan, a decrease of 13.2% compared to 2022; the total sales revenue of CCLs and commodity prepregs nationwide was 78.450 billion yuan, a decrease of 10.3% compared to 2022. From the perspective of CCL sub-products, in 2023, the sales volume of the four major categories of rigid CCLs (fiberglass cloth-based, paper-based, CEM-3, CEM-1) was 63.544 million square meters, a year-on-year decrease of 2.4%, with sales revenue of 57.411 billion yuan, a year-on-year decrease of 10.3%; the sales volume of metal-based CCLs was 5.337 million square meters, a year-on-year increase of 7.0%, with sales revenue of 5.337 billion yuan, a year-on-year increase of 5.9%; the sales volume of flexible CCLs and related products was 6.644 million square meters, a year-on-year decrease of 1.0%, with sales revenue of 3.189 billion yuan, a year-on-year decrease of 19.4%. The sales volume and revenue of various CCLs in 2023 are shown in the figure below.

Figure 5: Sales Volume and Revenue of Various CCLs in China in 2023

Source: CCLA, Deep Industry Research Institute.

China’s high-end CCLs still rely on imports. China exports more CCLs than it imports, with exports in 2024 expected to be 97,900 tons, with an export value of $626 million, while imports are expected to be 40,700 tons, with an import value of $1.122 billion. In terms of value, this results in a trade deficit, mainly due to the significantly higher unit price of imported CCL products compared to exported products, with imported products primarily being high-frequency, high-speed CCLs, IC packaging substrates, and other high-performance CCL products.

Competitive Landscape

CCL technology has high barriers to entry. The resin formulation technology is the core technology of CCL enterprises, determining the key performance of CCLs. The formulation system for CCLs is quite complex, covering various compound components such as resins, curing agents, fillers, accelerators, coupling agents, and flame retardants, with varying proportions. Enterprises need to select suitable raw materials from thousands of polymer compounds and find the best reaction ratios among numerous combinations to achieve optimal CCL performance. A well-developed new formulation for CCLs generally requires a development cycle of 2-5 years, creating a high technical barrier.

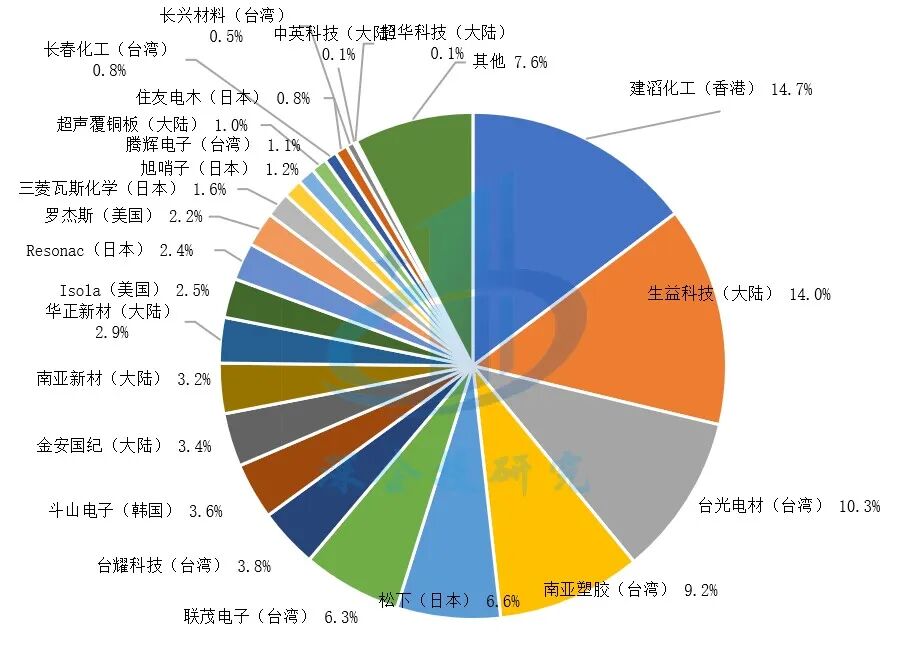

The global CCL market is highly concentrated, with major enterprises based in Mainland China. After decades of market competition, the global CCL industry has formed a relatively concentrated and stable supply structure. In 2023, the top ten enterprises in the global rigid CCL market accounted for approximately 75.10% of the market share. Among them, Kingboard Chemical (Kingboard Laminates, Hong Kong), Shengyi Technology (A-shares), and Taiflex Scientific (Taiwan) are the top three enterprises, with market shares of 14.7%, 14.0%, and 10.3%, respectively, totaling about 39%, with their main bases located in Mainland China. Among the top 23 enterprises by global sales revenue, there are seven domestic enterprises, including Shengyi Technology (A-shares), Jinan Guojin (A-shares), Nanya New Materials (A-shares), Huazheng New Materials (A-shares), Ultrasonic Copper Clad (A-shares Ultrasonic Electronics), Zhongying Technology (A-shares), and Super Hua Technology, with a total sales revenue of $3.144 billion, accounting for 24.7% of the global total. Most other major enterprises also have their main production bases in Mainland China.

Figure 6: Market Share of Global Rigid CCL Industry Enterprises in 2023

Source: Prismark, Deep Industry Research Institute.

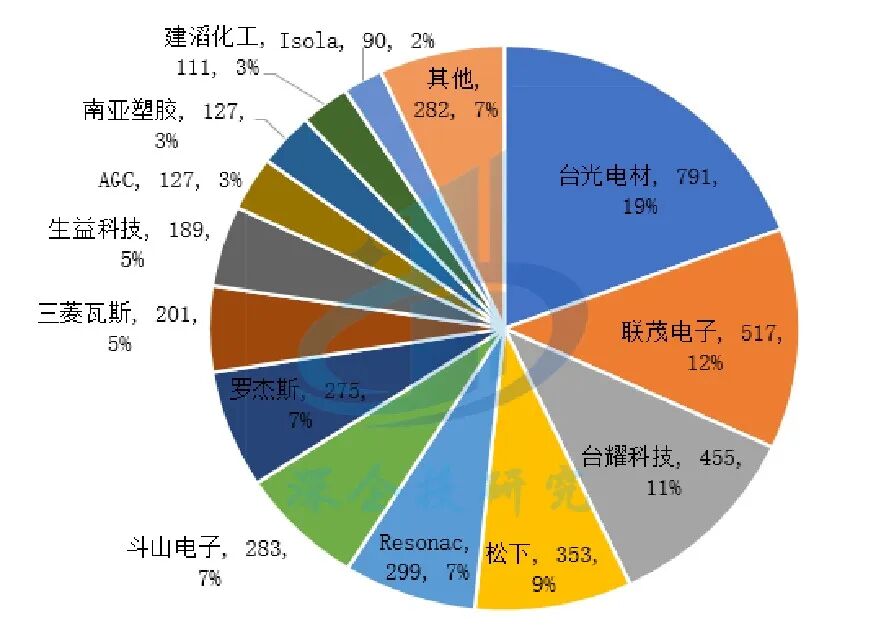

High-end CCLs are dominated by Taiwanese and Japanese enterprises, with a low market share for domestic enterprises. High-end CCLs mainly consist of special base CCLs suitable for semiconductors, artificial intelligence, 5G communication base stations, intelligent driving, servers, switches, and other fields. According to Prismark data, in 2023, the global sales revenue of three major categories of rigid special CCLs (including CCLs for IC packaging substrates, high-frequency CCLs, and high-speed CCLs) was $4.1 billion, mainly dominated by Taiwanese and Japanese enterprises. The top 13 enterprises include Taiflex Scientific (Taiwan), Unimicron Technology (Taiwan), Taimag (Taiwan), Panasonic (Japan), Resonac (formerly Hitachi Chemical, Japan), Doosan Electronics (South Korea), Rogers (USA), Mitsubishi Gas Chemical (Japan), Shengyi Technology (A-shares), AGC (formerly Taiyo Yuden, Japan), Nanya Plastics (Taiwan), and Kingboard Chemical (Hong Kong), with a total sales revenue of $3.818 billion, accounting for 93%, and a total sales volume of about 100 million square meters, accounting for 87%. Only Shengyi Technology, a domestic enterprise, accounts for 4.6% of the sales revenue. Other domestic enterprises in the high-frequency and high-speed CCL sector include Nanya New Materials (A-shares), Huazheng New Materials (A-shares), Zhongying Technology (A-shares), Hangyu New Materials, and Zhongshan New High Electronics.

Figure 7: Sales Revenue of Major Enterprises in the Three Categories of Rigid Special Base CCLs in 2023 (in millions USD)

Source: Prismark, Deep Industry Research Institute.

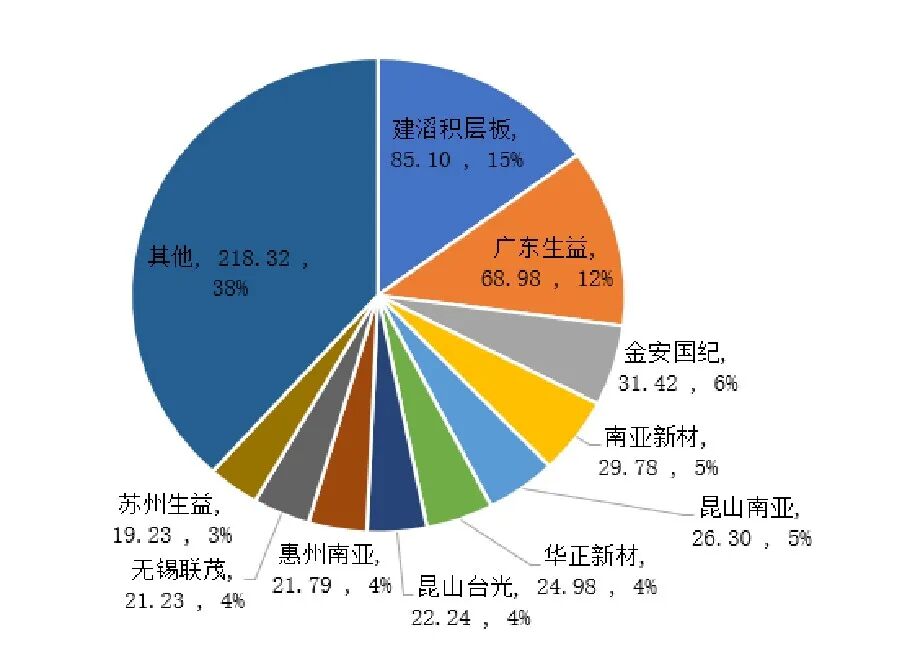

From the domestic market perspective, according to CCLA data, in 2022, the main enterprises in the fiberglass cloth-based CCL (including CEM-3 type) industry were Shengyi Technology (Guangdong Shengyi, Suzhou Shengyi), Kingboard Laminates (Hong Kong), Jinan Guojin (A-shares), Nanya New Materials (A-shares), Nanya Plastics (Kunshan Nanya, Huizhou Nanya), Huazheng New Materials (A-shares), Taiflex Scientific (Kunshan Taiflex), and Wuxi Unimicron (Taiwan), with the top ten enterprises’ total sales revenue amounting to 35.105 billion yuan, accounting for 61.7% of the total sales revenue of fiberglass cloth-based CCLs (including CEM-3), as shown in the figure below.

Figure 8: Sales Revenue of Major Enterprises in China’s Fiberglass Cloth-Based CCL Industry (in millions yuan)

Source: CCLA, Deep Industry Research Institute.

In 2022, the main enterprises in the paper-based CCL industry (including CEM-1, CPFCP (G)-22F boards) were Kingboard Laminates (Hong Kong), Fujian Lihao Electronics (Quanzhou), Shandong Jinbao Electronics (A-shares Baoding Technology subsidiary, Yantai), Shengyi Technology (Shaanxi Shengyi), Changchun Chemical (Taiwan), Meizhou Weilibang Electronics, Jiangyin Mingkang Electronics, Laizhou Pengzhou, and Guangdong Super Hua Technology (Meizhou), with the top nine enterprises’ total sales revenue amounting to 6.948 billion yuan, accounting for 98.1% of the total sales revenue of the paper-based CCL industry.

Figure 9: Sales Revenue of Major Enterprises in China’s Paper-Based CCL Industry (in millions yuan)

Source: CCLA, Deep Industry Research Institute.

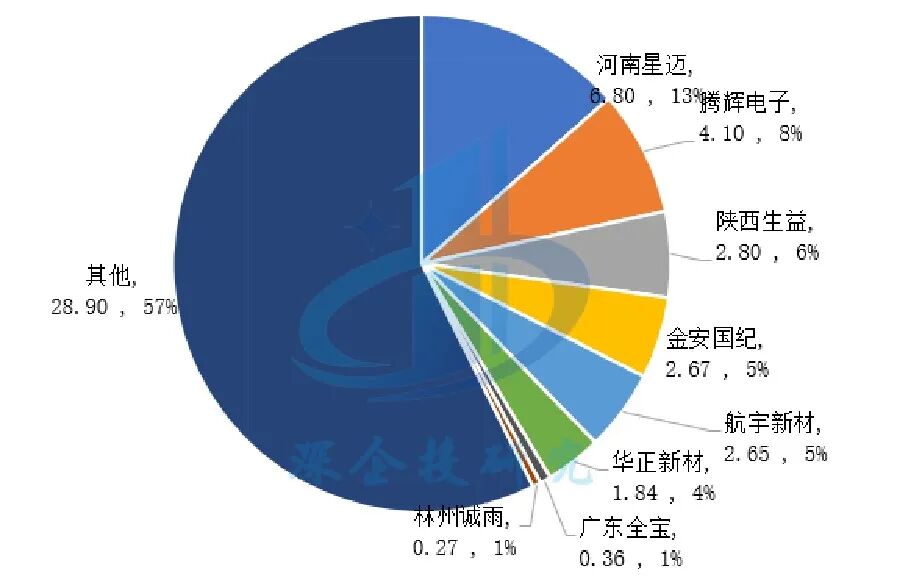

In 2022, the main enterprises in the metal-based CCL industry were Henan Xingmai, Tenghui Electronics, Shengyi Technology (Shaanxi Shengyi), Jinan Guojin, Hangyu New Materials, Huazheng New Materials, Guangdong Quanjin, Linzhou Chengyu, etc., with the top eight enterprises’ total sales revenue amounting to 2.150 billion yuan, accounting for 42.7% of the total sales revenue of the metal-based CCL industry, as shown in the figure below.

Figure 10: Sales Revenue of Major Enterprises in China’s Metal-Based CCL Industry (in millions yuan)

Source: CCLA, Deep Industry Research Institute.

In 2022, the main enterprises in the flexible CCL industry were Shengyi Technology (A-shares), Changchun Chemical (Taiwan), Shandong Jinding Electronic Materials (Jinan), Zhaoyuan Chunpeng (Yantai), Jiujiang Flex (Anjieli subsidiary), Huashuo Electronic Materials (Wuhan), etc., with the top six enterprises’ total sales revenue amounting to 1.471 billion yuan, accounting for 37.1% of the total sales revenue of flexible CCLs and related products, as shown in the figure below.

Figure 11: Sales Revenue of Major Enterprises in China’s Flexible CCL Industry (in millions yuan)

Source: CCLA, Deep Industry Research Institute.

High-end flexible CCLs are primarily dominated by foreign enterprises. Currently, there are many manufacturers of adhesive-free two-layer flexible CCLs globally, but production and value are concentrated in a few leading enterprises, resulting in a high market concentration, with Japanese enterprises being predominant. Major manufacturers include Nippon Steel Chemical, Sumitomo Metal Mining SMM, Nitto Denko, and Arisawa Manufacturing, while the leading domestic enterprise is Shengyi Technology (A-shares), with other companies such as Foster (A-shares) and Guangzhou Fangbang Co., Ltd. (A-shares) also involved.

Based on revenue scale, domestic CCL enterprises can be roughly divided into four tiers. The first tier includes Shengyi Technology, with CCL business revenue nearing 15 billion yuan, significantly ahead of other domestic enterprises. The second tier includes Jinan Guojin, Huazheng New Materials, Nanya New Materials, Shandong Jinbao Electronics, etc., with revenue scales between 2-5 billion yuan. The third tier includes enterprises such as Jiangxi Hongruixing, Hangyu New Materials, Guangdong Longyu New Materials, Linzhou Zhiyuan, Ultrasonic Electronics, Hongchang Electronics, Chongqing Dekai, etc., with revenue between 500 million to 1.5 billion yuan. The fourth tier includes enterprises with revenue below 500 million yuan.

In 2024, the revenue situation of major enterprises in China’s CCL industry (including both domestic and foreign enterprises) is shown in the table below.

Table 2: Key Enterprises in China’s CCL Industry Revenue in 2024

Source: CPCA China Electronic Circuit Industry Association “2024 China CCL Enterprise Ranking”, various listed company annual reports, Deep Industry Research Institute. Taiwanese and foreign enterprises only account for their revenue from their Mainland China bases. Listed company revenue includes prepregs (semi-cured sheets).

Deep Industry Research Institute Introduction

The Deep Industry Research Institute is a high-end think tank under the Deep Industry Investment Group, focusing on industrial development, serving regional economies, and dedicated to providing industrial development implementation plans for local governments and parks. Its main business includes the 14th Five-Year Plan, industrial planning, industrial chain investment strategies, project planning and packaging, project evaluation, etc. The research institute has a team of industry research experts with economic backgrounds from Peking University, Renmin University, Nankai University, and Sun Yat-sen University, and has completed hundreds of planning consultations and industrial research projects for various regions including the Pearl River Delta, Yangtze River Delta, Haixi, Southwest, and Northwest.

Follow Us to Get More Industry Content

Business Cooperation|Ms. Wang: 13168781866 (WeChat same number)Address|7B1 Benyuan Building, Shennan Avenue, Futian District, Shenzhen

We Look Forward to Your Comments Below to Interact with Us!

Your “likes” and “views” are important motivation for our creation, thank you for your support! If you like the article, remember to “share”!