This article is compiled by Semiconductor Industry Insights (ID: ICVIEWS).By 2025, 3nm will become the dominant node for all new flagship SoCs.

This article is compiled by Semiconductor Industry Insights (ID: ICVIEWS).By 2025, 3nm will become the dominant node for all new flagship SoCs.

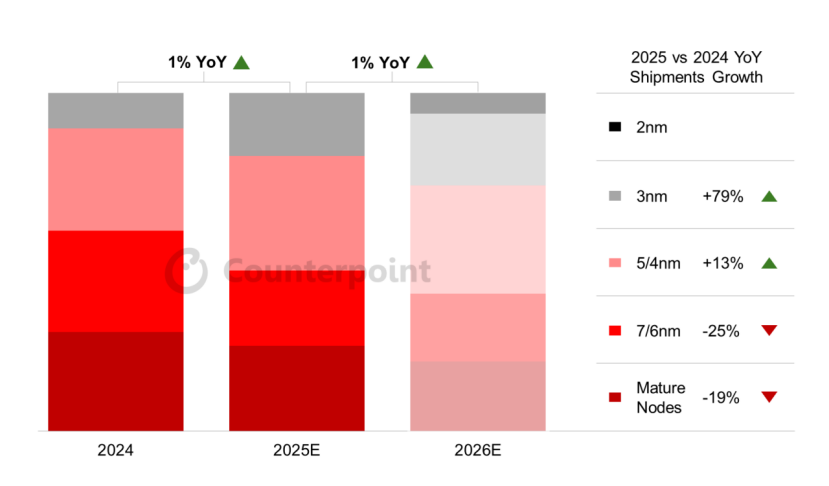

According to Counterpoint’s latest “Global AP-SoC Long-term Forecast,” leading nodes (3nm and 2nm) will account for about one-third of smartphone SoC shipments in 2026.

Apple is the first smartphone OEM to adopt TSMC’s 3nm process, which was used to manufacture the A17 Pro SoC in the 2023 iPhone 15 Pro series. The following year, Qualcomm and MediaTek will launch flagship SoCs based on the 3nm process.By 2025, 3nm will become the dominant node for all new flagship SoCs.

Accelerated Adoption of 2nm and 3nm in Flagship SoCs

Accelerated Adoption of 2nm and 3nm in Flagship SoCs

The adoption rates of 3nm and 2nm are continuously increasing as they provide stronger performance and higher efficiency, which are essential for AI on devices, immersive gaming, and high-resolution content on smartphones. 3nm and 2nm offer higher transistor density and faster clock speeds, which are necessary for the growing computational power.

Senior analyst Parv Sharma commented on the adoption of cutting-edge technology in smartphone SoCs, stating: “The current demand for complex AI capabilities in devices is a significant accelerator towards smaller, more powerful, and more efficient nodes. The rising wafer prices and the increasing semiconductor content in smartphone SoCs have also led to an overall increase in SoC costs.3nm and 2nm nodes will reach a critical milestone, with one-third of smartphone SoCs expected to adopt these nodes by 2026.“

TSMC will begin tape-out of the 2nm node in the second half of 2025 and achieve mass production in 2026. Apple, Qualcomm, and MediaTek are expected to launch their first flagship SoCs by the end of 2026.

In the initial two to three years, the adoption of 2nm will be limited to flagship and high-end SoCs. Meanwhile, most mid-range smartphone SoCs will migrate to 5/4nm process nodes to meet the computational demands of devices and transition to 3nm in the coming years.

The 5/4nm nodes will account for more than one-third of smartphone SoC shipments in 2026, becoming the most widely adopted nodes in smartphones. Entry-level 5G SoCs will migrate from 7/6nm nodes to 5/4nm, while LTE SoCs will transition from mature nodes to 7/6nm nodes.

Source: Counterpoint Research Global AP-SoC Long-term Forecast

Source: Counterpoint Research Global AP-SoC Long-term Forecast

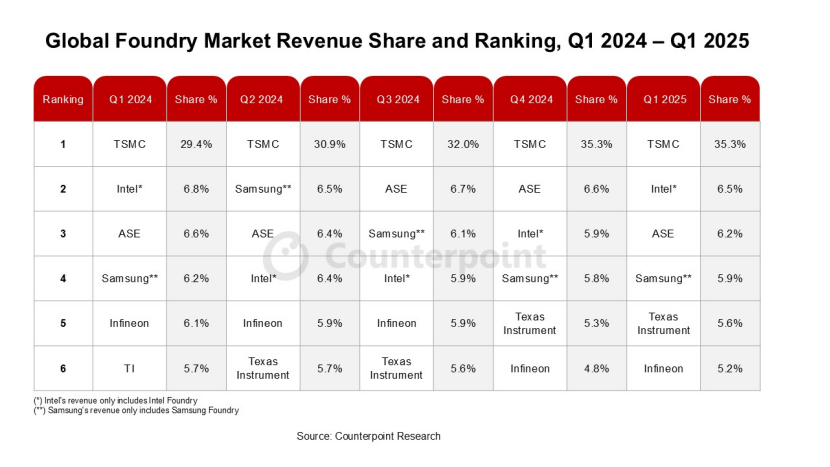

Counterpoint believes that TSMC is the undisputed leader in chip manufacturing. By 2025, TSMC is likely to lead the total smartphone SoC shipment volume, with a market share of 87% in nodes of 5nm and below (3nm and 2nm), expected to grow to 89% by the end of 2028.

Major fabless smartphone SoC suppliers like Apple, Qualcomm, and MediaTek rely on TSMC for their competitive edge. However, Google’s Tensor and Samsung’s Exynos currently use Samsung’s foundry. Samsung’s foundry has faced some yield issues in the past, delaying the application of 3nm in smartphones.Samsung’s foundry is expected to focus on3nm and 2nm process nodes, with mass production of the 2nm process expected in 2026.

Q1 Global Semiconductor Foundry 2.0 Revenue Grows 12%

Q1 Global Semiconductor Foundry 2.0 Revenue Grows 12%

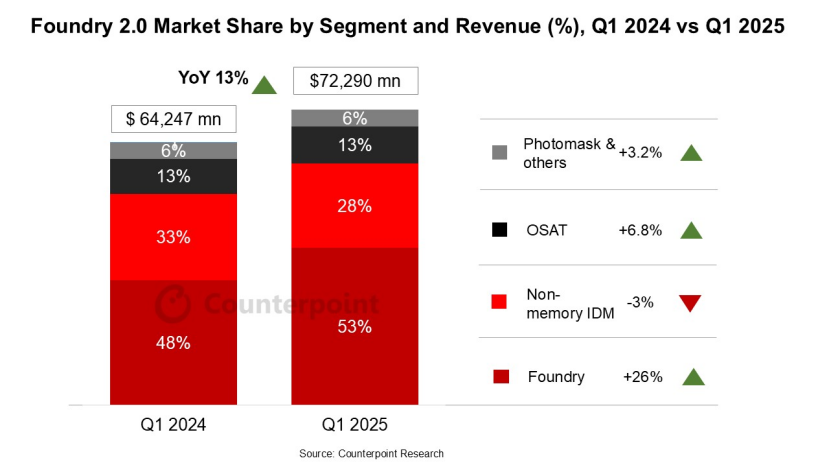

According to Counterpoint Research’s “Q1 2025 Wafer Foundry Revenue and UTR by Node Tracker,” global semiconductor wafer foundry 2.0 market revenue grew by 13% year-on-year to $72.29 billion in Q1 2025, primarily driven by a surge in demand for AI and high-performance computing (HPC) chips, which stimulated demand for advanced nodes (3nm, 4/5nm) and advanced packaging (e.g., CoWoS).

Traditional semiconductor foundry (Foundry 1.0) primarily focused on chip manufacturing, which is no longer sufficient to highlight industry dynamics; today, industry dynamics are driven by AI trends and related system-level optimizations. Companies are transitioning from being part of the production line to becoming technology integration platforms. This will ensure tighter vertical coordination, faster innovation, and deeper value creation. Therefore, we cover pure foundries, non-memory IDMs, OSAT, and photomask manufacturing suppliers in Foundry 2.0, while our Foundry 1.0 definition only covers pure foundry companies.

Speaking about the foundry market share, Deputy Director Brady Wang stated: “TSMC is in the lead, with its market share growing to 35%, achieving around 30% year-on-year growth, thanks to its strong position in advanced processes and a large number of AI chip orders. Intel and Samsung foundries lag behind, with Intel developing with 18A/Foveros, while Samsung, despite developing 3nm GAA, still faces yield challenges.”

OSAT suppliers represent the next key link in the Foundry 2.0 supply chain following pure foundries, especially in the context of surging demand for advanced packaging.The OSAT industry shows signs of recovery, with ASE, SPIL, and Amkor increasing advanced packaging capacity, growing nearly 7% year-on-year in Q1 2025.These suppliers benefit from TSMC’s excess demand for AI-related CoWoS but are still constrained by yield and scale.

However, non-memory IDMs such as NXP, Infineon, and Renesas continue to experience weakness in the automotive and industrial sectors, with Q1 2025 revenues expected to decline by 3%. Although inventory is returning to normal, a sustained recovery may be delayed until the second half of 2025. On the other hand, photomask suppliers are boosted by the adoption of 2nm EUV and the increasing complexity of AI/Chiplet designs.

Senior analyst William Li commented on the quarterly revenue performance, stating: “The application of AI remains at the core of semiconductor growth, reshaping the priorities of the entire wafer foundry supply chain and solidifying TSMC and packaging manufacturers as the core beneficiaries of this new wave.”

Looking ahead, the Foundry 2.0 ecosystem is expected to evolve from a linear manufacturing model to a seamlessly integrated value chain. This transformation will deepen the synergies between design, manufacturing, and advanced packaging, ushering in a new era of innovation, especially as AI, chip integration, and system-level collaborative optimization continue to redefine the competitiveness of the semiconductor industry.

*Disclaimer: This article is the original work of the author. The content reflects their personal views, and our reposting is solely for sharing and discussion purposes, not representing our endorsement or agreement. If there are any objections, please contact us.