Industry weatherman

The rapid development of artificial intelligence technology is profoundly reshaping the landscape of the consumer electronics industry. Smart glasses, as one of the most promising carriers of AI large models, are gradually transitioning from concept to large-scale commercial applications. With the gradual enhancement of AI large model capabilities, human-computer interaction methods are undergoing revolutionary changes, creating conditions for the birth of new AI terminal carriers. Among various AI terminal forms, smart glasses, with their unique form advantages and functional expansion potential, have become a key focus of innovation in the industry.

Smart glasses differ from previous wearable devices, with their core value lying in the seamless integration of AI capabilities with the most important human sensory systems. The glasses’ form is close to the three most important sensory organs: the ear, eye, and mouth, and the AR display capability provides AI with text and image output capabilities, allowing users to receive more graphic and textual information, thus providing an effective way to fully explore the application potential of AI large models. This form advantage makes smart glasses an ideal interface for connecting the virtual world with the real world, representing an important development direction for future human-computer interaction.

The launch of RayBanMeta in 2023 marks a consensus in the market regarding the product form of AI glasses, which includes glasses hardware + AI functionality + photography + voice. At the same time, RayBanMeta achieved annual sales of over 1.4 million pairs in 2024, strongly validating the feasibility of the simplified AI glasses product business model. As user acceptance of AI glasses gradually increases, the development trend of glasses products, due to their proximity to users’ visual characteristics, is to gradually add optical display modules in form, evolving into AI + AR glasses.

01Market Development Trends

01Market Development Trends

The breakthroughs of AI large models in voice and image recognition provide strong support for the practicality and cost-effectiveness of smart glasses, and the AI glasses market is on the brink of explosion. Major global market research institutions have made positive predictions regarding the market size and shipment volume for 2025 and the following years, indicating that the global smart glasses market is on a rapid growth trajectory. All major institutions expect that by 2025, global smart glasses shipments will exceed 12 million units, and the market size will soar to nearly $7 billion to $9 billion, with an average annual compound growth rate exceeding 25%.

In the long term, the market growth potential is even more promising. Data shows that in the traditional eyewear industry, the sales of prescription glasses and sunglasses are both over 700 million pairs. Moreover, as most tech giants have not found a better portable smart terminal product form, they have anchored the next generation of smart hardware products on brain-computer interfaces and smart glasses.

Therefore, the industry is optimistic that by 2030, at least 100 million prescription glasses users and 100 million sunglasses users will upgrade to smart glasses users, meaning that in just five years, this market is expected to grow nearly 20 times. Currently, the factory-side revenue of the traditional eyewear market is about $60 billion, while the store-side revenue is about $120 billion. Thus, even if the number of eyewear users remains unchanged, the smart glasses market on the store side in 2030 is expected to add $60 billion in market revenue growth. Due to the smaller price difference between the factory and store sides for smart glasses, it is estimated that the factory-side revenue growth for smart glasses will reach $40 billion.

From the product form perspective, AI glasses and AR glasses each have their focus. AI glasses concentrate on capturing voice and image information, focusing on intelligent processing and human-computer interaction, providing users with intelligent auxiliary services; AR glasses focus more on providing immersive augmented reality experiences. In terms of hardware composition, the core hardware requirements for AI glasses focus on SoC processors, which require low power consumption and high performance; AR glasses rely not only on SoC processors and various sensors but also on optical modules to generate virtual images.

In terms of functionality, smart glasses are transforming from simple auxiliary tools to multifunctional intelligent terminals. The world’s first payable smart glasses, RokidGlasses, have officially launched, featuring the built-in Alipay “Look to Pay” function, allowing users to complete payments with just a voice command. This innovation marks a significant leap from “seeing” to “using” for smart glasses. The AR glasses, Thunderbird X3 Pro, equipped with the RayNeoOS 2.0 system, integrates various functions such as AI translation, spatial navigation, AI recording, call-to-text, and first-person perspective photography and videography, with a built-in multimodal large model customized by Tongyi.

Overall, the AI glasses market is in a rapid development stage, with the resonance of technology maturity, policy friendliness, and scene richness driving the domestic consumer-grade AI/AR glasses market from “novelty” to “necessity.” With more tech giants entering the market and continuous innovation in product forms, AI glasses are expected to become the next generation of mobile computing platforms after smartphones, bringing enormous business opportunities to upstream and downstream enterprises in the industry chain.

02Analysis of Key Links in the Industry Chain

The AI glasses industry chain involves multiple key links, each with its unique technical challenges and business opportunities.

Optical Display Module

The optical display module is a core component of AI glasses, directly determining the product’s display effect and user experience. Currently, the main challenges facing optical display technology are how to provide high-quality display effects while maintaining lightweight and portability, and how to solve the rainbow pattern and dispersion issues in traditional optical solutions.

In terms of technical routes, there are currently three main solutions: Surface Relief Grating Waveguide (SRG), Holographic Waveguide, and MicroLED. With breakthroughs in the surface relief grating waveguide technology and silicon carbide (SiC) material processes, AR glasses have made significant progress in optical performance, lightweight design, and cost control, accelerating penetration into the consumer market.

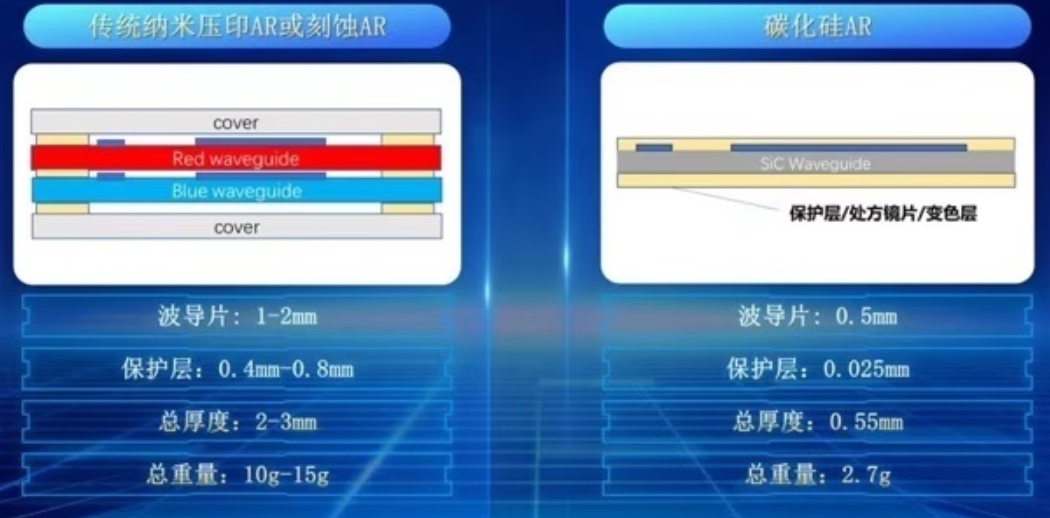

Silicon carbide materials, due to their high refractive index and high thermal conductivity, are becoming important materials for diffraction waveguide technology in AR glasses. The refractive index of silicon carbide can reach 2.6-2.7, while the highest refractive index of glass is only 2.0. This means that silicon carbide can more effectively confine light, reduce light energy loss, and provide a wider field of view (FOV). At the same time, its high thermal conductivity allows silicon carbide materials to effectively solve heat dissipation issues, while high hardness and thermal stability support the introduction of etching processes, effectively improving production capacity and yield.

Traditional AR optical materials are mainly glass and resin, but in the face of higher field of view (FOV), lighter and thinner bodies, and higher heat dissipation requirements, these materials are clearly becoming inadequate. Silicon carbide, with its extremely high refractive index and thermal conductivity, provides a new technical path for the entire industry. A single-layer silicon carbide waveguide lens can achieve a FOV of over 80°, compressing thickness and weight compared to a three-layer glass structure. Moreover, the unique optical properties of silicon carbide can effectively reduce rainbow patterns and solve the serious dispersion issues in previous waveguide structures, directly enhancing the clarity and stability of AR displays.

In the silicon carbide optical display module industry chain, a number of technically advanced companies have emerged. Companies like Lante Optics and Medicae have a comprehensive reserve in the waveguide processing link, focusing on providing upstream raw materials for the waveguide industry, along with high-precision glass wafer processing technology; Crystal Optoelectronics has a full industry chain layout in the waveguide link, capable of providing one-stop optical solutions for various waveguide technologies.

Among them, Crystal Optoelectronics has focused on the optical industry for over twenty years, rooted in imaging perception and display projection. Through self-research and acquisitions, it has expanded its product range from infrared cutoff filters and other optical components to new fields such as thin-film optical panels, semiconductor optics, automotive electronics, and reflective materials. The company places great importance on technological investment in the AR/VR field, reserving a third growth curve. The company has a comprehensive layout across multiple technical paths and collaborates closely with global leading waveguide and specialty glass material manufacturers. Its forward-looking technological layout is expected to help the company fully benefit from the rising tide of the AR/VR industry.

West Lake University and its incubated company, Mude Micro-Nano, have led the research on the “extremely lightweight, no rainbow pattern silicon carbide AR diffraction waveguide” technology, which has been globally unveiled, showcasing the world’s first silicon carbide AR glasses lens. It looks no different from regular sunglasses, but compared to traditional AR glasses lenses, it is lighter and thinner, with a single lens weighing only 2.7 grams and a thickness of just 0.55 millimeters, achieving breakthroughs in multiple technical dimensions such as no rainbow patterns and full-color display.

With mass-produced silicon carbide waveguide AR glasses like the Thunderbird X3 Pro set to launch in Q2 2025, the industry is officially entering a turning point from the concept verification stage to large-scale production. Silicon carbide is no longer the patent of a few laboratory players but is becoming the inevitable direction for the entire AR supply chain’s collective upgrade.

SoC Processors

The SoC (System on Chip) processor is the “brain” of AI glasses, responsible for processing various AI algorithms and user interaction tasks. With the rapid development of AI large models, higher performance and energy efficiency requirements are being placed on SoC processors.

Currently, the SoC solutions used in AI smart glasses are quite diverse. SoC chips from Qualcomm, Hengxuan Technology, Rockchip, Espressif, Unisoc, Zhongke Blue News, Juchip Technology, and Allwinner Technology are all applied in the AI glasses field.

Taking Qualcomm’s AR1 (4nm process) as an example, the SoC chip integrates CPU, GPU, NPU, and ISP modules, with computing power increased by five times compared to the previous generation while power consumption is reduced by 40%. This allows AI glasses to run large models with billions of parameters, such as Tongyi Qianwen, smoothly, achieving real-time translation and object recognition. The domestic Shenju SoC chip, with its extremely high cost-performance advantage, provides voice interaction and basic AR rendering capabilities for entry-level products, pushing the price of AI glasses down to the thousand-yuan range.

Qualcomm’s Snapdragon AR1 Gen1 platform adopts advanced 4nm process technology, supporting 12 million pixel photo capture and 1080P 60fps video recording. Meta’s Ray-Ban glasses, Thunderbird V3, and the upcoming glasses from Samsung all use its chips. Hengxuan Technology’s BES2800 chip adopts a system-level SoC solution, a 6nm process chip, integrating multi-core CPU/GPU, NPU, etc., and has been introduced into multiple customers’ smart glasses projects.

Rockchip’s RK3588 and RK3576 are equipped with NPU with 6 TOPs computing power, supporting the deployment of large language models with 0.5B to 3B parameters on the edge, and have been applied in Xrany Space 1 AR glasses. Espressif’s ESP32-S3 and ESP32-P4 chips are its main products in the AI glasses field, with ByteDance’s AI toy “Eye-catching Bag” using this chip. Unisoc’s W517 chip is designed specifically for smart wearable devices, using a 12nm process, with a quad-core CPU architecture and a clock speed of up to 2.0GHz, adopted by the X series AI glasses from Yingmu Technology and the Flash AI “Snap Mirror”.

SoC chips, through heterogeneous computing architecture, synchronously process multi-dimensional data from cameras, microphones, and IMU sensors, providing underlying support for multimodal interaction. The development trend of SoC chips is evolving towards higher computing power and lower power consumption while supporting more AI models and algorithms.

In the SoC processor industry chain, in addition to the companies mentioned above, MediaTek is also an important participant. SoC + MCU will become the ideal choice for future AI glasses, ensuring performance while considering battery life needs. In addition to Xiaomi’s AI glasses, domestic Niumiao Technology’s new products and Alibaba’s AI glasses may also choose this route in the future.

Apple also plans to officially launch its first AI smart glasses by the end of 2026. To ensure product stability and reliability, Apple will produce prototypes for testing by the end of this year. According to insiders, Apple’s smart glasses will be equipped with key components such as cameras, microphones, and speakers, giving them powerful functionality. They will be able to analyze the external world and receive user requests through the Siri voice assistant. Additionally, these glasses will handle various tasks such as phone calls, music playback, real-time translation, and directional navigation, providing users with a more convenient and intelligent experience.

Sensor Systems

The sensor system is key for AI glasses to perceive the external world, including image sensors, microphones, IMU (Inertial Measurement Unit), and various other types. These sensors need to maintain high precision while being miniaturized and low power to meet the special form requirements of smart glasses.

SmartSens has made breakthroughs in the field of CMOS image sensors, launching the AI glasses-specific CMOS sensor SC1200IOT, which features 12 million pixels and is based on the SmartClarity-3 platform. This innovative product represents the latest deep integration of micro-camera technology and low-power design in the industry. The SC1200IOT adopts SmartSens’ self-developed SFCPixel patented technology, achieving a pixel size of 1μm and equipped with a 1/3.57-inch target surface design. This allows the sensor to maintain high sensitivity while significantly reducing noise levels, enhancing the stability of image quality.

In terms of power consumption control, SmartSens has introduced precise control designs for internal circuit modules, effectively optimizing energy consumption performance and reducing heating issues during prolonged use, thus significantly enhancing the battery life of AI glasses. This technological breakthrough has profound implications for the user experience of wearable devices and sets a new performance benchmark for the industry.

The Thunderbird V3 smart glasses are equipped with multiple types of sensors: a 12 million pixel camera for image capture, capacitive sensors for touch interaction monitoring, Hall sensors for open/close state detection, light sensors for camera obstruction detection, and an IMU (Inertial Measurement Unit) built into the camera module that supports electronic image stabilization. The Rokid Max AR smart glasses’ sensor system includes proximity sensors, gyroscopes, accelerometers, magnetometers, distance sensors, and MEMS sensor modules. Among them, the MEMS sensor module uses STMicroelectronics’ LSM6DSR chip, while the proximity sensor uses Taiwan’s TXC’s miniaturized four-in-one light sensor PA22C.

As AI technology continues to evolve, visual perception, as a core aspect of AI applications, requires significant improvements in its hardware foundation. In 2025, SmartSens will again break through in the field of CMOS image sensors, launching the AI glasses-specific CMOS sensor SC1200IOT. This innovative product represents the latest deep integration of micro-camera technology and low-power design in the industry, showcasing SmartSens’ leading advantages in deep learning and AI innovation. It not only meets the multiple demands of AI glasses for high image quality, portability, and long battery life but also sets a new benchmark for the visual perception capabilities of future smart wearable devices.

The development trend of sensor systems is evolving towards higher precision, lower power consumption, and smaller sizes, while supporting more AI algorithms and functions. In AI glasses, multimodal sensor fusion will become an important trend, providing more comprehensive and accurate environmental perception capabilities by integrating data from various sensors.

Structure and Assembly

Structure and assembly are key links in integrating various components of AI glasses into a complete product. With the enrichment of AI glasses’ functionalities and the complexity of their forms, higher requirements are placed on structural design and assembly processes.

Goertek, as a global core supplier of smart wearable devices, has built a full-chain capability in the AI glasses field, covering optics, acoustics, sensors, and complete machine assembly. Its self-developed holographic waveguide lenses and Micro-LED optical technology can achieve dual-eye full-color display and ultra-thin design. In the acoustic field, its unique DPS speaker technology enables private calls and immersive sound effects, already applied in leading brands like Huawei and Apple; its six-axis sensors and spatial algorithms support natural interactions such as nodding to answer and shaking head to reject calls, with technical parameters reaching industry-leading levels.

Yidao Information collaborates with several companies like Rokid, possessing ODM/OEM capabilities for smart glasses. Tianjian Co., Ltd. is deeply engaged in the smart wearable products and health acoustics field, with AI glasses products currently in the R&D and trial production stages, mainly providing audio components for AI glasses. Xingchen Technology’s SoC chips can meet the requirements of AI glasses for small area, low power consumption, visual effects, and intelligence, with terminal products expected to launch in the second half of 2025.

Luxshare Precision, HC SemiTek, Doctor Glasses, Xiechuang Data, and Anker Innovation are also important participants in the AI glasses industry chain.

The technical challenges in the structure and assembly link mainly focus on how to provide sufficient structural strength and heat dissipation capabilities while ensuring product lightweight; how to achieve precise integration of components, ensuring that the performance of optics, acoustics, electronics, and other parts is not affected; and how to improve production efficiency and yield while reducing manufacturing costs.

As the AI glasses market rapidly develops, the importance of the complete machine assembly link is becoming increasingly prominent. Enterprises with complete industry chains and rich manufacturing experience will have significant competitive advantages.

Materials and Processes

Materials and processes are the foundational guarantees for the performance and experience of AI glasses, especially in optical displays, structural components, and electronic components, where the application of new materials plays a key role in enhancing product performance.

Silicon carbide materials, due to their excellent optical and thermal properties, are becoming important materials for diffraction waveguide technology in AR glasses. The high refractive index and high thermal conductivity of silicon carbide make it an ideal substrate material for AR glasses lenses. The higher the refractive index of the substrate material, the larger the FOV of the AR lens. A single-layer SiC lens can achieve a FOV of over 80 degrees, providing thinner dimensions and larger, clearer visual effects. The high refractive index can also effectively solve rainbow patterns and dispersion issues in waveguide structures. High thermal conductivity significantly enhances the heat dissipation capabilities and performance of AR glasses. At the same time, the high hardness and thermal stability of SiC also support the introduction of etching processes, effectively improving production capacity and yield.

The combination of silicon carbide + SRG waveguide + etching processes is the technical foundation for significant progress in AR glasses. The high refractive index and high thermal conductivity of silicon carbide materials and surface relief grating waveguides effectively enhance the FOV of AR glasses, solving the previous issues of rainbow patterns, dispersion, and light loss, while achieving lightweight design and good passive heat dissipation capabilities. The development of silicon carbide substrates, surface relief grating waveguides, and breakthroughs in etching processes are the technical foundations for accelerating the improvement and mass shipment of AR glasses in the consumer market.

In the field of silicon carbide materials, Tianyue Advanced is a leading company in the global wide bandgap semiconductor materials industry, focusing on the R&D and industrialization of high-quality silicon carbide substrates since its establishment. According to Frost & Sullivan data, based on sales revenue from silicon carbide substrates in 2023, the company ranks among the top three silicon carbide substrate manufacturers globally. The company’s silicon carbide substrates can be widely applied in electric vehicles, AI data centers, photovoltaic systems, AI glasses, rail transit, power grids, home appliances, and advanced communication base stations.

Tianyue Advanced has made a series of breakthrough advancements in core areas such as material crystal growth, defect control, and processing technology, not only overcoming world-class challenges such as large-size production but also achieving internationally leading levels in material performance, becoming an innovative benchmark in the global semiconductor materials field. Tianyue Advanced is one of the few companies capable of mass-producing 8-inch silicon carbide substrates, the first to commercialize silicon carbide substrates from 2 inches to 8 inches, and also one of the first companies to produce P-type silicon carbide substrates using liquid phase methods.

The high bandgap width, high breakdown electric field strength, high electron saturation drift rate, and high thermal conductivity of silicon carbide play a crucial role in applications such as power electronic devices, giving silicon carbide significant advantages in high-performance applications such as electric vehicles and photovoltaics. Currently, Tianyue Advanced’s silicon carbide substrates can be widely applied in electric vehicles, AI data centers, photovoltaic systems, AI glasses, rail transit, power grids, home appliances, and advanced communication base stations.

In addition to silicon carbide materials, other new materials such as lightweight high-strength composite materials and flexible electronic materials are also being applied in AI glasses, providing more possibilities for enhancing product performance and user experience.

03Analysis of Opportunities in the Industry Chain

Based on an in-depth analysis of various links in the AI glasses industry chain, we can identify multiple commercially valuable opportunity areas. These opportunities include not only market breakthroughs brought about by technological innovation but also value enhancement through business model innovation and industry chain integration.

Breakthroughs and Investment Opportunities in Optical Display Modules

The optical display module is a core technical bottleneck of AI glasses and one of the most valuable investment areas. With the maturity of silicon carbide materials and surface relief grating waveguide technology, AR glasses have made significant progress in optical performance, lightweight design, and cost control, accelerating penetration into the consumer market.

Silicon carbide materials, due to their high refractive index and high thermal conductivity, are becoming important materials for diffraction waveguide technology in AR glasses. A single-layer silicon carbide waveguide lens can achieve a FOV of over 80°, compressing thickness and weight compared to a three-layer glass structure. Moreover, the unique optical properties of silicon carbide can effectively reduce rainbow patterns and solve the serious dispersion issues in previous waveguide structures, directly enhancing the clarity and stability of AR displays.

In the silicon carbide optical display module industry chain, a number of technically advanced companies have emerged. Companies like Lante Optics and Medicae have a comprehensive reserve in the waveguide processing link, focusing on providing upstream raw materials for the waveguide industry, along with high-precision glass wafer processing technology; Crystal Optoelectronics has a full industry chain layout in the waveguide link, capable of providing one-stop optical solutions for various waveguide technologies.

Innovation and Investment Opportunities in SoC Processors

The SoC processor is the “brain” of AI glasses, responsible for processing various AI algorithms and user interaction tasks. With the rapid development of AI large models, higher performance and energy efficiency requirements are being placed on SoC processors, creating vast market space for related enterprises.

Companies like Qualcomm, Hengxuan Technology, Rockchip, Espressif, Unisoc, Zhongke Blue News, Juchip Technology, and Allwinner Technology have all applied their SoC chips in the AI glasses field. These companies continuously innovate to provide dedicated SoC solutions for AI glasses, meeting the demands for low power consumption and high performance.

Upgrades and Investment Opportunities in Sensor Technology

Sensors are key for AI glasses to perceive the external world. With the continuous evolution of AI technology, higher requirements for sensor precision, power consumption, and integration are being placed, creating market opportunities for related enterprises.

SmartSens’ AI glasses-specific CMOS sensor SC1200IOT represents the latest breakthrough in micro-camera technology and low-power design in the industry. This sensor adopts SmartSens’ self-developed SFCPixel patented technology, achieving a pixel size of 1μm and equipped with a 1/3.57-inch target surface design. The packaging size is only 5.1mm x 3.7mm, making it highly compact and suitable for application in the visual module micro-camera of mainstream AI glasses.

Upgrades and Investment Opportunities in Structure and Assembly

Structure and assembly are key links in integrating various components of AI glasses into a complete product. With the enrichment of AI glasses’ functionalities and the complexity of their forms, higher requirements are placed on structural design and assembly processes, creating market opportunities for related enterprises.

Goertek has built a full-chain capability in the AI glasses field, covering optics, acoustics, sensors, and complete machine assembly, and is expected to occupy an important position in the hardware manufacturing segment of AI glasses due to its technological and production capacity advantages.

04Future Development Trends

The AI glasses industry is in a rapid development stage, and the next few years will witness a qualitative change from “novelty” to “necessity.” With the resonance of technology maturity, policy friendliness, and scene richness, the AI glasses market is expected to experience explosive growth.

The application scenarios for AI glasses will expand from initial basic functions such as navigation, translation, and photography to more complex scenarios such as payment, office work, and entertainment. The world’s first payable smart glasses, RokidGlasses, have officially launched, featuring the built-in Alipay “Look to Pay” function, allowing users to complete payments with just a voice command. This innovation marks a significant leap from “seeing” to “using” for smart glasses.

As market competition intensifies, the AI glasses market will form a market structure dominated by tech giants like Meta, Apple, Huawei, and Xiaomi, with professional manufacturers as supplements. The AI glasses industry will also build a complete ecosystem that includes hardware, software, content, and services, providing users with a comprehensive intelligent experience.

Companies with leading advantages in core technology fields such as optical displays, AI chips, and sensors will hold the keys to the industry. These companies possess core technologies that can provide critical components for the industry chain, with high technical barriers and market value.

Meanwhile, companies that can integrate industry chain resources and provide full-chain services from design to manufacturing will have stronger market competitiveness and risk resistance, allowing them to occupy advantageous positions in fierce market competition.

Additionally, there are investment opportunities in various segments of the AI glasses industry chain. For example, in the optical display field, attention can be paid to silicon carbide material production and waveguide design; in the AI chip field, attention can be paid to dedicated chip design and IP licensing.

Moreover, companies with continuous innovation capabilities, especially those that maintain close cooperation with universities and research institutions and participate in the formulation of international technical standards, will be able to continuously launch innovative products and maintain market leadership.

As the AI glasses market rapidly grows, those companies that can quickly scale production to meet market demand will gain larger market shares and economic benefits. Therefore, companies with strong production capabilities and market expansion abilities will become major participants in the industry.

The AI glasses industry is at a critical stage of transitioning from concept to commercialization, containing enormous investment opportunities. As one of the most promising carriers of AI large models, it is undergoing a transformation from concept to large-scale commercialization. With the gradual enhancement of AI large model capabilities, human-computer interaction methods are experiencing revolutionary changes, creating conditions for the birth of new AI terminal carriers. The glasses form is close to the three most important sensory organs of humans: the ear, eye, and mouth, and the AR display capability provides AI with text and image output capabilities, offering an effective way to fully explore the application potential of AI large models.

Thus, the key links in the AI glasses industry chain, including optical display modules, SoC processors, sensor systems, structure and assembly, and materials and processes, all contain significant business opportunities due to their technical challenges.

In the future, the AI glasses industry will exhibit trends such as accelerated technological breakthroughs, rapid market growth, expanded application scenarios, formation of brand patterns, and construction of ecosystems. Core technology companies, enterprises integrating industry chain resources, companies with opportunities in niche fields, those valuing innovation capabilities, and those focusing on market scale expansion will all grow into quality enterprises in the industry track.

With continuous technological advancements and the expansion of application scenarios, AI glasses are most likely to become the next generation of mobile computing platforms after smartphones, bringing users a more intelligent and convenient life experience, while also creating substantial commercial returns for enterprises across the industry chain.