At the beginning of 2024, the launch of “Beast Palu” marked the transition of SOC games from a “niche frenzy” to a “mainstream trend”. Entering 2025, SOC games are expected to experience explosive growth, with over 20 SOC games set to launch on the Steam platform alone, while mobile SOC games are also in a “fierce competition”: NetEase’s “Seven Days World”, Tencent’s “Wilderness Origin”, and Fengchi Network’s “Adversity Rebirth” are all scheduled to gradually go live in 2025. SOC may become another highly competitive popular track on mobile platforms.How are SOC games defined, and what are their distinct characteristics? What is the current data performance and market status of SOC games? What challenges and development trends do they face in the future? Point Data has compiled the “SOC Game Development Trend Insights“, interpreting the development direction and current status of SOC category games from a data perspective, unlocking future market opportunities and prospects.This report will comprehensively analyze and compare the development history and market status of SOC games, further dissecting the current development trends and gameplay pain points of SOC games, helping readers better grasp the future development trends and prospects of SOC games.

At the beginning of 2024, the launch of “Beast Palu” marked the transition of SOC games from a “niche frenzy” to a “mainstream trend”. Entering 2025, SOC games are expected to experience explosive growth, with over 20 SOC games set to launch on the Steam platform alone, while mobile SOC games are also in a “fierce competition”: NetEase’s “Seven Days World”, Tencent’s “Wilderness Origin”, and Fengchi Network’s “Adversity Rebirth” are all scheduled to gradually go live in 2025. SOC may become another highly competitive popular track on mobile platforms.How are SOC games defined, and what are their distinct characteristics? What is the current data performance and market status of SOC games? What challenges and development trends do they face in the future? Point Data has compiled the “SOC Game Development Trend Insights“, interpreting the development direction and current status of SOC category games from a data perspective, unlocking future market opportunities and prospects.This report will comprehensively analyze and compare the development history and market status of SOC games, further dissecting the current development trends and gameplay pain points of SOC games, helping readers better grasp the future development trends and prospects of SOC games. Here are some core contents of this report1.SOC Game Market StatusThe Development History of SOC Games: From Niche Frenzy to Mainstream TrendSOC games have been improving year by year in terms of graphics quality, thematic content, and gameplay richness, and basic gameplay elements such as resource gathering, item storage, and home building have formed certain common concepts. Notably, the official launch of NetEase’s “Tomorrow After” in 2018 opened the door to the SOC mobile game market, maintaining high popularity in the following years. However, from both the manufacturer and player perspectives, SOC games at this time still belonged to a niche track frenzy.

Here are some core contents of this report1.SOC Game Market StatusThe Development History of SOC Games: From Niche Frenzy to Mainstream TrendSOC games have been improving year by year in terms of graphics quality, thematic content, and gameplay richness, and basic gameplay elements such as resource gathering, item storage, and home building have formed certain common concepts. Notably, the official launch of NetEase’s “Tomorrow After” in 2018 opened the door to the SOC mobile game market, maintaining high popularity in the following years. However, from both the manufacturer and player perspectives, SOC games at this time still belonged to a niche track frenzy. At the beginning of 2024, “Beast Palu” achieved sales of over 15 million and over 25 million players within just a few days of its launch (debuting on XGP). More importantly, the development cost of “Beast Palu” compared to its revenue return is a typical case of “small pivot leveraging a large lever” in recent years. In fact, the overall cost of SOC games has always been low, with most products exhibiting a distinct “independent game” quality. This return rate has begun to attract many manufacturers to SOC games.According to incomplete statistics from Point Data, over 20 SOC games are set to be released on the Steam platform in 2025. On the other hand, mobile SOC games are also beginning to show their potential, including but not limited to NetEase’s “Seven Days World”, Tencent’s “Wilderness Origin”, Fengchi Network’s “Adversity Rebirth”, and also from Tencent, the Rust-officially licensed “Out of Control Evolution”, all scheduled to gradually launch in 2025. SOC may become another highly competitive popular track on mobile platforms.SOC is one of the few categories in a growth track

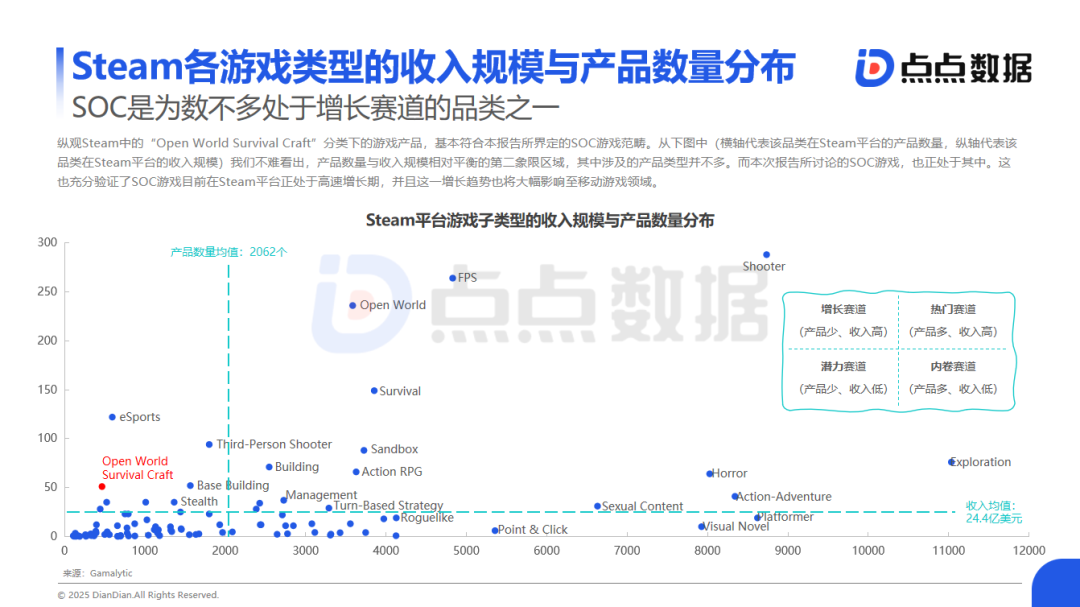

At the beginning of 2024, “Beast Palu” achieved sales of over 15 million and over 25 million players within just a few days of its launch (debuting on XGP). More importantly, the development cost of “Beast Palu” compared to its revenue return is a typical case of “small pivot leveraging a large lever” in recent years. In fact, the overall cost of SOC games has always been low, with most products exhibiting a distinct “independent game” quality. This return rate has begun to attract many manufacturers to SOC games.According to incomplete statistics from Point Data, over 20 SOC games are set to be released on the Steam platform in 2025. On the other hand, mobile SOC games are also beginning to show their potential, including but not limited to NetEase’s “Seven Days World”, Tencent’s “Wilderness Origin”, Fengchi Network’s “Adversity Rebirth”, and also from Tencent, the Rust-officially licensed “Out of Control Evolution”, all scheduled to gradually launch in 2025. SOC may become another highly competitive popular track on mobile platforms.SOC is one of the few categories in a growth track Looking at the game products under the “Open World Survival Craft” category on Steam, they generally fit the definition of SOC games as outlined in this report. Based on the revenue scale and product quantity distribution of various game types on Steam, it is evident that the second quadrant area, where product quantity and revenue scale are relatively balanced, involves few product types. The SOC games discussed in this report are also situated within this area. This fully validates that SOC games are currently in a period of rapid growth on the Steam platform, and this growth trend will significantly impact the mobile gaming sector.2025 May Mark the ‘Year of SOC Mobile Games’According to Point Data’s observations of the gaming market, it can be inferred that with the global SOC game craze triggered by the early 2024 launch of “Beast Palu”, mobile game manufacturers represented by Chinese companies are also rapidly entering this track, with the first wave of market validation expected to be released in 2025.

Looking at the game products under the “Open World Survival Craft” category on Steam, they generally fit the definition of SOC games as outlined in this report. Based on the revenue scale and product quantity distribution of various game types on Steam, it is evident that the second quadrant area, where product quantity and revenue scale are relatively balanced, involves few product types. The SOC games discussed in this report are also situated within this area. This fully validates that SOC games are currently in a period of rapid growth on the Steam platform, and this growth trend will significantly impact the mobile gaming sector.2025 May Mark the ‘Year of SOC Mobile Games’According to Point Data’s observations of the gaming market, it can be inferred that with the global SOC game craze triggered by the early 2024 launch of “Beast Palu”, mobile game manufacturers represented by Chinese companies are also rapidly entering this track, with the first wave of market validation expected to be released in 2025. The mobile adaptation of SOC games faces challenges on one hand with the “single-player online game transformation”, and on the other hand with the “long-term content supply”. The former aims to differentiate players with different preferences by distinguishing between “PVE servers” and “PVP servers”; feedback from testing several SOC products indicates acceptable results; however, the latter currently lacks effective solutions, mostly relying on relatively crude “seasonal settlements” to maintain player activity, which significantly undermines the sense of purpose and achievement in “Craft” within SOC games. The ability to effectively maintain long-term product activity and revenue volume will also determine whether SOC games can become another major track in the mobile gaming market.2.SOC Game Development Trends and Pain PointsSOC games are not merely a pure gameplay innovation but a catalyst under market demand and technological development

The mobile adaptation of SOC games faces challenges on one hand with the “single-player online game transformation”, and on the other hand with the “long-term content supply”. The former aims to differentiate players with different preferences by distinguishing between “PVE servers” and “PVP servers”; feedback from testing several SOC products indicates acceptable results; however, the latter currently lacks effective solutions, mostly relying on relatively crude “seasonal settlements” to maintain player activity, which significantly undermines the sense of purpose and achievement in “Craft” within SOC games. The ability to effectively maintain long-term product activity and revenue volume will also determine whether SOC games can become another major track in the mobile gaming market.2.SOC Game Development Trends and Pain PointsSOC games are not merely a pure gameplay innovation but a catalyst under market demand and technological development SOC games are not merely a pure gameplay innovation but a catalyst under market demand and technological development. Currently, several major trends have emerged: Diversification of partner functions, convenience of item access, significant simplification of late-stage construction, optimization of basic resource acquisition methods, and multi-platform, mobile adaptation, and large-scale production.

SOC games are not merely a pure gameplay innovation but a catalyst under market demand and technological development. Currently, several major trends have emerged: Diversification of partner functions, convenience of item access, significant simplification of late-stage construction, optimization of basic resource acquisition methods, and multi-platform, mobile adaptation, and large-scale production.

Under the premise of SOC games developing towards mobile and service-oriented models, there are still two major pain points that urgently need to be addressed:

Under the premise of SOC games developing towards mobile and service-oriented models, there are still two major pain points that urgently need to be addressed:

- The new player guidance issue, how to balance the game experience driven by “negative feedback” in service-oriented games;

- The late-game experience issue, where the experience of product-based SOC games often comes from encountering pressure and solving problems, while service-based SOC games need to set new goals for the late-game experience.