1. What is Mini LED Technology?

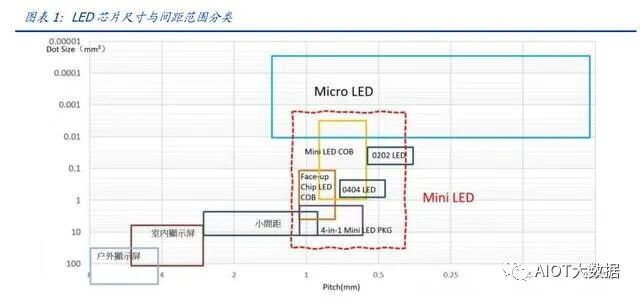

Generally speaking, Mini LED refers to LED chips that are 100 to 300 micrometers in size, with a chip pitch of 0.1 to 1mm, packaged in SMD, COB, or IMD forms. These miniature LED devices are often used in RGB displays or LCD backlighting.

Factors determining display quality include resolution (number of pixels), PPI (pixels per inch), and viewing distance. Typically, LCD and LED screens are used for distances greater than 3 meters, while OLED, Mini LED displays (2-3 meters), and Micro OLED (within 1 meter) are used for closer viewing. Mini LED technology can also enhance the display effect in LCD backlight modules. Therefore, Mini LED technology can be used directly for RGB displays or as backlight modules for LCDs.

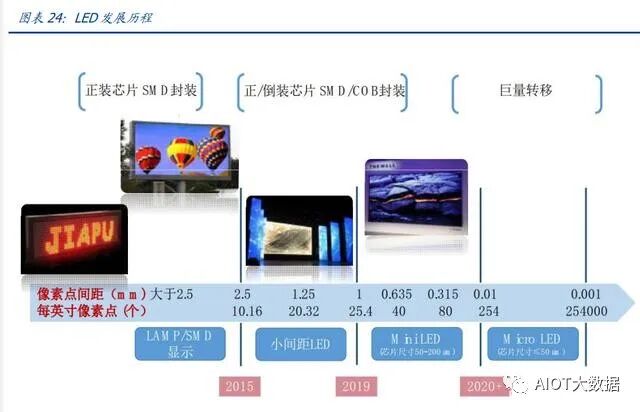

Generally, LED RGB displays include LED screens, small pitch, Mini LED, and Micro LED.

Small pitch: over 300 micrometers, with a chip pitch of 2.5 to 1mm, using traditional SMD packaging.

Mini LED: 100 to 300 micrometers, with a chip pitch of 0.1 to 1mm, using SMD, COB, or IMD packaging.

Micro LED: under 100 micrometers, with a chip pitch of 0.001 to 0.1mm, using mass transfer technology.

Mini LED backlighting + LCD and Mini LED displays drive innovation along two paths. From the perspective of original components, the application of Mini LED is mainly divided into two schemes: using Mini LED chips + LCD for backlighting and directly using Mini RGB displays for self-luminous solutions. Currently, the Mini LED backlight scheme has entered a period of explosive growth, with brands like Apple and Samsung already launching related products; Mini RGB direct displays focus on commercial display market demands, showing advantages in commercial displays, decorative lights for electronic products, tail lights, or ambient lights. Since both schemes share similarities in industrial rules and technical principles, they can share some equipment, and most companies choose to pursue both directions simultaneously to enjoy economies of scale.

2. Mini LED Backlight: An Innovative Direction for LCD Technology with Broad Market Potential

Mini LED backlighting is an important innovative direction for LCD display technology. Compared to LCD, OLED is a substitute innovation in display technology, while Mini LED is an upgrade innovation for LCD, aimed at competing with OLED products. Compared to the advantages of OLED, such as contrast and color, Mini LED backlight products perform comparably well, and they have advantages such as lower capital expenditure (cost), flexible specifications (broad applications), adaptability to the development needs of both panel and LED industries (supply-driven), and long lifespan (especially suitable for TV scenarios).

2.1. Mini LED Backlight Marks the Beginning of Commercialization, with Expected Market Growth

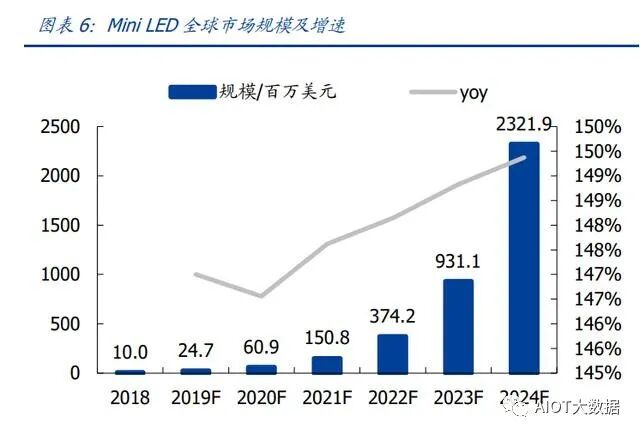

The Mini LED backlight market is officially starting to grow, with the commercialization of TV and IT applications expected to accelerate. According to Arizton, the global Mini LED market size is expected to grow from $150 million in 2021 to $2.32 billion by 2024, with an annual growth rate exceeding 140%. Based on our calculations and industry tracking, this data significantly underestimates the market’s growth potential. With mainstream brands like Samsung and Apple introducing Mini LED backlighting, a wave of innovation in the terminal market is expected. According to TrendForce, TVs and tablets are the first terminals to commercialize; smartphones, automobiles, and VR are expected to enter the commercialization phase in 2022-2023.

Apple launched the world’s first tablet product equipped with Mini LED backlighting, the iPad Pro. The pricing strategy for Apple’s first Mini LED backlight product is expected to drive high sales. The new 12.9-inch iPad Pro features 10,000 Mini LEDs, with 2,596 zones, achieving a contrast ratio of 1,000,000:1. The new 12.9-inch iPad Pro is equipped with the M1 chip, starting at a price of 8,499 yuan (the iPad Pro 2020 was priced at 7,899 yuan, lacking Mini LED backlighting and the M1 chip).

Mini LED has dynamic local dimming capabilities, enhancing the realism and vividness of images. The new 12.9-inch iPad Pro’s Liquid Retina XDR display utilizes Mini LED technology. Over 10,000 Mini LEDs are divided into more than 2,500 local dimming zones, allowing for precise adjustment of brightness in each dimming zone based on different screen content, achieving a contrast ratio of 1,000,000:1, fully showcasing rich details and HDR content.

The iPad Pro display features high contrast, high brightness, wide color gamut, and True Tone display advantages. Mini LED endows the Liquid Retina XDR display with an extreme dynamic range, achieving a contrast ratio of up to 1,000,000:1, significantly enhancing detail perception. Additionally, this iPad display performs impressively in brightness, with a full-screen brightness of 1,000 nits and peak brightness reaching 1,600 nits, and it incorporates advanced display technologies such as P3 wide color gamut, True Tone, and ProMotion adaptive refresh rate.

Apple is leading a new trend, accelerating the adoption of Mini LED in laptops and tablets. According to Digitimes, Apple will further release Mini LED-related products. Before Apple’s spring conference, only MSI and ASUS had released Mini LED laptops in 2020. Apple’s significant influence in terminal products is expected to create a demonstration effect, accelerating the adoption of Mini LED in laptops and tablets. Furthermore, Apple’s strict supply chain requirements are likely to cultivate stringent technical standards among supply chain companies, fostering mature processes and accelerating the development of the Mini LED industry.

Samsung’s QLED technology has reached a new level, refreshing the television experience. At CES 2021, Samsung launched the Neo QLED quantum television. This new product employs quantum Mini LED technology, eliminating lens scattering and packaging forms, with sizes only 1/40 of traditional LEDs. Additionally, the use of ultra-thin micro layers, combined with Samsung’s self-developed AI quantum computing technology, allows for precise control of tightly arranged LED chips, presenting fine images and avoiding halo effects.

Many well-known brands launched their first Mini LED televisions in 2021, and the leading demonstration effect is expected to accelerate Mini LED penetration. Brands like Samsung, LG, Skyworth, and TCL have all released their first Mini LED televisions, accelerating terminal applications. Under the demonstration effect of leading manufacturers, more companies are expected to launch Mini LED backlight products.

2021 is expected to be the year of significant volume for Mini LED TVs, with shipments expected to exceed 4 million units. According to AVC Revo, Mini LED TVs are expected to achieve the highest shipment volume among various new display technologies in 2021. In 2018-2019, Mini LED backlight TVs were only in the thousands, far less than the million-level shipments of OLED TVs; however, in 2021, they are expected to rapidly increase to about 60% of OLED shipments. TrendForce predicts that Mini LED backlight TVs will reach 4.4 million units in 2021, accounting for about 2% of the overall TV market. Omdia predicts that global Mini LED backlight TV product sales will increase to 52.8 million units by 2025, with a CAGR of 53.73% from 2019 to 2025.

The increasing penetration of smart vehicles will help Mini LED displays gain traction. As the coverage of smart connected vehicles gradually increases, the in-car display market is expected to grow significantly. Mini LED technology can meet automotive manufacturers’ demands for high contrast, high brightness, durability, and adaptability to complex lighting environments inside vehicles, indicating a broad future development prospect.

BOE’s automotive BD Cell display and automotive Mini LED displays are positioned for high-end automotive displays, applying flexible displays in automotive dashboards, in-car displays, tail lights, and other areas. In 2020, BOE’s automotive display shipment area has already ranked second globally, while its market share for automotive display panels over 8 inches has reached first place globally. The trend of large screens, personalization, and ultra-high definition in automotive displays is gradually becoming prominent, and BOE’s smart cockpit solutions integrate functions such as smart navigation, rearview imaging, in-car control, and entertainment information.

2.2. Mini LED Backlight Achieves Local Dimming, an Important Innovation Direction for LCD Upgrades

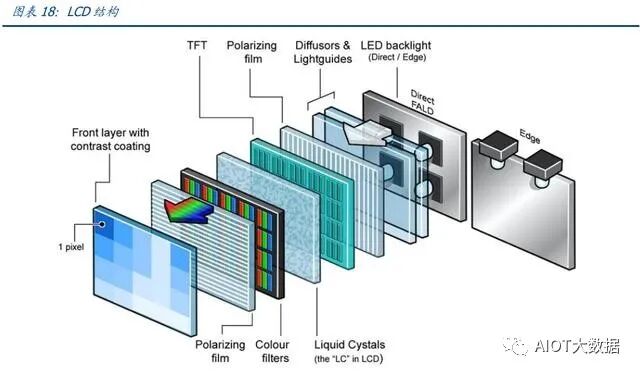

Mini LED backlighting is currently an important innovative direction for LCD upgrades, achieving local dimming capabilities through smaller backlight LED sizes and point spacing. The backlight source mainly consists of light sources, light guide plates, optical films, and plastic frames. Currently, there are three main types of backlight sources: EL, CCFL, and LED. Depending on the distribution position of the light source, they can be divided into edge-lit and direct-lit (bottom backlight). Mini LED is a new innovative backlight method. Mini LED backlighting has fine partitioning, and combined with local dimming technology, it can greatly improve LCD display quality, competing with OLED in terms of wide color gamut, ultra-high contrast, and high dynamic range display. Additionally, by integrating flip-chip packaging and other technologies, it can precisely control packaging thickness, achieving smaller OD, indicating broad application prospects in ultra-thin backlighting. Most importantly, Mini LED backlight LCD products have a longer lifespan than OLED, making them more suitable for TV scenarios.

Mini LED backlight schemes directly affect the imaging quality of LCD displays. LCD displays control each pixel by applying different voltages, causing liquid molecules to produce varying degrees of transparency under different current conditions, thus forming the desired image. The backlight source, located behind the LCD, directly influences the visual effect of the display module. LCDs do not emit light by themselves; the displayed graphics or characters are the result of their modulation of light.

Most mainstream LCD TVs or monitors use overall control of backlighting, which cannot achieve partitioned dimming, generally requiring only dozens of LED beads. The Mini LED backlight scheme achieves partitioned dimming through thousands of beads, representing an important innovation direction for LCD backlighting. The performance of the backlight source not only directly affects the quality of LCD imaging but also the typical backlight source mainly consists of light sources, light guide plates, optical films, and plastic frames. Currently, the three main types of backlight sources are EL, CCFL, and LED, which can be divided into edge-lit and direct-lit (bottom backlight) based on the distribution position of the light source. AIOT big data suggests that as LCD modules continue to develop towards brighter, lighter, and thinner directions, edge-lit CCFL backlight sources have become the mainstream in backlight source development, leading to the emergence of Mini LED backlight methods. The cost of Mini LED backlight modules includes LED, SMT assembly, driver ICs, backplanes, etc., with most currently using PCB backplanes and passive driving combinations.

Currently, AIOT big data indicates that the Mini LED backlight TV technology solutions on the market mainly include COB and POB; based on different substrates, they can be divided into PCB substrates and glass substrates. COB, or Chip on Board, directly mounts LED chips onto the substrate and then performs overall packaging; POB, or Package on Board, commonly referred to as the starry sky solution, first packages LED chips into individual SMD LED beads and then mounts the beads onto the substrate.

Mini LED backplanes mainly include three solutions: PCB, glass substrates, and FPC. Research shows that only about 60% of the light emitted from traditional backlight sources passes through the backlight module into the polarizing film after going through reflective films, diffusion films, and other optical films, leaving only 4% of the light after passing through the LC and surface. Therefore, the design of the backlight scheme structure is particularly important. The three mainstream solutions for Mini LED backplanes, PCB, glass substrates, and FPC, each have their own advantages and disadvantages, and the technical design of the backlight scheme will change accordingly. The choice of substrate material directly determines the effectiveness of the Mini LED backlight scheme.

The PCB basic backplane carries the functions of driving ICs and wiring. After the circuit board manufacturing process is completed, the required driving ICs are placed on the circuit board to complete the backplane driving process. Currently, there are two connection methods between PCB backplanes and driving ICs: the first is a passive driving method where each pixel is connected to the respective integrated driving IC behind the backplane; the second is an active driving method where each pixel has its own driving IC nearby.

The choice of PCB board material is related to the power of the LED. In the PCB backplane scheme, the heat generated by the LED needs to be dissipated with the help of the substrate material, so high thermal conductivity materials can effectively diffuse and cool over large areas, while low thermal conductivity materials cannot effectively dissipate heat, leading to excessive substrate temperatures.

PCB backplane sizes are limited, and currently, backlight technology is mainly achieved through splicing. During the PCB board manufacturing process, multiple reflow processes are required, and internal materials release internal stress, which can cause warping and bending of the board. This phenomenon becomes more severe as the PCB board size increases, leading to optical display differences. Therefore, the size of a single PCB board generally does not exceed 24 inches, and large backlights often require multiple PCB boards to be spliced together.

Glass backplanes are gradually replacing PCB backplanes, becoming a new solution for Mini LED backplanes. As the Mini LED manufacturing process gradually shrinks, the transfer process becomes more challenging. In comparison, glass backplanes have better flatness, do not require splicing, and possess better manufacturing precision, high thermal conductivity, and excellent heat dissipation performance, making them a trend to become the new solution for Mini LED backlighting.

3. Mini LED Display: Upgrading Technical Requirements for Chip Structure, Packaging, etc.

3.1. Mini LED Display Continues the Small Pitch Technology Route, Ongoing Miniaturization

Mini LED direct displays fill the gap between traditional LED displays and Micro LED technology. Since the 1990s, with significant breakthroughs in computer dynamic display systems and blue light-emitting diodes, LED displays have gradually upgraded from monochrome and dual-color to full-color screens.

After more than a decade of development, the size of LED chips has continuously shrunk, and the pixel pitch has also been reduced, resulting in increased PPI.

In 2010, Leyard launched the first 2.5mm small pitch LED TV, and small pitch LED displays have rapidly developed since 2013. From 2015 to 2016, they penetrated rapidly in specialized display fields such as government and public services.

As the pixel pitch further decreases to below 1mm, LED displays are referred to as Mini LED displays. Mini LED sizes are smaller than small pitch LEDs, with tighter arrangements of LED beads and higher PPI, making production, testing, and maintenance more challenging.

Mini LED technology is similar to Micro LED, which will achieve better display effects. Compared to small pitch LEDs, Mini LED manufacturing is miniaturized, and the depackaging process has similarities with Micro LED technology, facilitating the development of related production and testing technologies and accelerating the landing process of Micro LED. Theoretically, Micro LED can achieve better RGB primary colors, but there are currently technical challenges in mass transfer, driving ICs, epitaxial wafers, and maintenance, and the costs are high, remaining in the technical accumulation stage.

LED displays have high brightness and can achieve ultra-large sizes, while currently, other display technologies struggle to achieve ultra-large size displays. Traditional LED displays are mainly used in outdoor large-screen display fields. AIOT big data believes that small pitch LED displays have advantages such as seamlessness, good display effects, and long lifespan, and their costs have decreased rapidly in recent years, forming a trend to replace LCD and DLP, with their application range expanding from public information displays to commercial displays. As the demand for small pitch and ultra-small pitch displays continues to grow in rental markets, HDR market applications, retail, and conference room markets, the potential for Mini LED TVs is enormous.

Mini LED is a further extension of small pitch LEDs. In direct display fields, Mini LED serves as an upgraded product of small pitch displays, enhancing reliability and pixel density, with corresponding LED chip sizes ranging from 0.08 to 0.20mm, suitable for RGB displays. In backlighting fields, LCD displays using Mini LED backlight technology far outperform ordinary LED backlit LCD displays in brightness, contrast, and color reproduction, directly competing with OLED. Micro LED (micro light-emitting diode) miniaturizes traditional LED arrays, forming a high-density integrated LED array with pixel sizes below 50um.

Mini/Micro LED is seen as the mainstream and development trend of future LED display technology, representing a new product upgrade in LED display technology following indoor and outdoor LED displays and small pitch LED displays, with advantages of “thin film, miniaturization, and arraying,” gradually being introduced into industrial applications.

The pitch of small pitch LED beads has continuously upgraded from the initial 2.5mm, with 1.5-1.6mm becoming the mainstream shipping pitch since 2017. In 2019, the shipment proportion of 1.2-1.6mm reached 41.5%, and in the coming years, pitches below 1.1mm will become the main driving force for small pitch LEDs.

3.2. Rapid Growth in Demand for Mini LED Displays in Commercial Fields

Mini RGB self-luminous solutions are increasingly applied in commercial display markets, with significant application potential in scenarios such as cinema displays, traffic advertising, rental displays, and sports displays. In the public display field, spliced video walls were originally one of the main applications, with technologies including LCD, DLP, and small pitch LEDs. DLP has low color saturation and high power consumption, while LCD video walls have seams, making small pitch LED displays, which are seamless and can be flexibly sized, show a rapidly growing trend.

Displays are one of the important application fields for LEDs. According to data from the National Semiconductor Lighting Engineering R&D and Industry Alliance, in 2018, the market size for downstream applications of LEDs in China was 608 billion yuan, with LED general lighting, LED landscape lighting, LED displays, and LED backlighting applications accounting for 48%, 14%, 13%, and 12%, respectively. AIOT big data believes that as LED packaging technology continues to mature, LED displays have basically achieved high clarity, high resolution, and stable long-term performance. The application scenarios for LED displays are becoming increasingly diverse, widely used in advertising media, cultural performances, sports venues, high-end conference rooms, traffic control, high-end auto shows, security, and night economy fields, with outdoor advertising and stage rental markets already being relatively mature. According to data from the China LED Display Application Industry Association, from 2015 to 2019, China’s LED display sales increased from 31 billion yuan to 62.6 billion yuan, with an average annual compound growth rate of 19.21%.

Small pitch LEDs show a clear replacement effect for DLP and LCD in the large screen splicing market. Small pitch LED displays generally refer to LED displays with a resolution of P2.5 or lower (inclusive). As SMD LED technology matures, small pitch LED displays are gradually showing a trend of replacing traditional displays such as DLP and LCD. Compared to DLP and LCD, small pitch LEDs have advantages such as seamless splicing, wide color gamut, low power consumption, and long lifespan; as well as continuously decreasing prices, leading to increasing market penetration in large screen splicing fields. In 2020, small pitch LEDs accounted for 61.2% of China’s large screen splicing market, an increase of 4.8% compared to 56.4% in 2019. Small pitch LEDs continue to penetrate the indoor large screen splicing market, accelerating the replacement of DLP and LCD.

Cinema displays: Mini LED movie screens provide a high-quality visual experience. A typical movie screen 10 meters wide (diagonal 445 inches) can accommodate 150-240 viewers, while a 14-meter wide screen can accommodate 273 seats. Because the audience is at a distance from the screen, P2.5 is sufficient to meet the scene’s needs. Mini LED screens can achieve HDR and high-brightness 3D experiences. With the unique advantages of Mini LED displays, despite currently being more expensive than traditional laser projection, Mini LED movie screens have the opportunity to secure a place in high-end cinemas.

Large transportation advertising: Excellent characteristics better match different scene requirements. Currently, major airports and stations both domestically and internationally have extensively deployed LED displays, from information display to advertising placement, LED displays have penetrated. There are many outstanding cases of LED displays in large global airports. Mini LED displays have smaller LED crystal particles, more robust overall screen sturdiness, better sealing, and optical design characteristics, overcoming issues such as the fragility of small pitch LED screens and the inability to repair COB products on-site, excellently matching corresponding scene requirements.

Rental displays: Ultra-high-definition displays provide audiences with a stunning visual experience and artistic effects. Currently, rental displays are mainly focused on high-end demands, such as stage performances, large exhibitions, and industrial design. With the development of the cultural and entertainment industry, the demand for high-quality LED displays is also rapidly increasing. More 4K/8K displays will be presented at high-end concerts and exhibitions, and the rental display field often comes with personalized customization demands, so companies that can provide a complete set of hardware facilities and control solutions for LED displays are expected to gain strong market competitiveness.

Sports displays: Strong demand for LEDs in large international events. LED displays have a long history of use in sports events. Large sports events often require clear, timely, and accurate responses to real-time game situations, so Mini LED display solutions are expected to penetrate further. In the future, from international events to national and regional events, they will become important factors driving sports displays.

4. Demand: Terminal Applications Drive Exceeding Expectations, Establishing the Commercial Year for Mini LED

Mini LED has broad application prospects in backlighting and displays. TVs, monitors, laptops, tablets, and automotive displays are potential fields where Mini LED backlighting is expected to penetrate. Mini LED RGB displays are also gradually replacing traditional small pitch and ultra-large size display solutions in commercial fields, continuously improving display effects. According to our calculations, the chip market driven by Mini LED backlighting exceeds 10 billion yuan, and the future space for Mini/Micro LED displays is very large, with market potential far exceeding that of backlighting, and there is still significant room for improvement in technical maturity.

Assumptions for TV Mini backlight shipments: Assuming global TV shipments remain unchanged, the penetration rate for 55 inches and above continues to rise, with some high-end products equipped with Mini LED backlight solutions, the mid-term penetration rate is expected to be 10-15%.

Assumptions for IT Mini backlight shipments: Assuming global IT total shipments remain unchanged, due to Apple’s push (Apple iPad shipments of 50 million units, Mac shipments of 15-20 million units), the penetration rate is expected to rise rapidly. In 2021, the new 12.9-inch iPad Pro is standard equipped, with annual sales of 5-6 million units, and MacBook optional (with M1 and other Arm CPU costs offset). It is assumed that the initial penetration is mainly driven by Apple, with a higher unit price; later, Android will be introduced, leading to a decrease in average price.

Estimation of demand for Mini LED direct displays: Assuming 10% of display devices use Mini/Micro RGB display forms, this means an annual demand of 500 million units, approximately 2.5 times the current global production capacity. Among them, TVs are the largest consumers, with 4K TVs corresponding to 25 million chips. The future space for Mini/Micro LED displays is very large, with market potential far exceeding that of backlighting, and there is still significant room for improvement in technical maturity.

The demand for high-end film materials for Mini LED is expected to drive a market space of over 10 billion yuan. Mini LED backlight TVs require the use of high-end new composite films and quantum dot films to enhance display effects and achieve color light-emitting solutions. Based on the above shipment assumptions, we estimate that the high-end film market driven by Mini LED is expected to reach a scale of over 10 billion yuan by 2024. As technology matures, quantum dot films may also be integrated into composite films, thereby increasing the value of composite films.

Transfer equipment will benefit from the rapid growth of Mini LED backlighting and direct displays, showing significant elasticity. From the perspective of transfer equipment, due to the significant differences in efficiency and price of different specifications of equipment in the industry, taking the industry center position as a reference, calculations show that Mini LED transfer solid crystal equipment has benefited from the rapid growth of Mini LED backlighting in the past two years; in the future, it will benefit from the commercialization and growth of Mini/Micro LED direct display TV products, which will have greater elasticity.

5. Technology: Various Links in the Industry Chain Actively Layout to Support the Rapid Rise of Mini LED

Mini/Micro LED technology continues to upgrade, with many participants in the industry chain. In comparison, Mini LED display technology is relatively mature, gradually beginning to penetrate the market in 2020/2021; Micro LED, due to its higher technical specifications, is still in the technical introduction phase, with key technical challenges such as micro LEDs and mass transfer. For a micro LED display product, the basic components include substrates, micro LED chips, driver ICs, and other materials, with the industry chain links including LED chip manufacturers, panel manufacturers, IC manufacturers, material manufacturers, LED packaging manufacturers, and LED application manufacturers.

The yield and consistency requirements for chips are high. The consistency of Mini LED chips includes high and low position consistency, color consistency, etc., while the maintenance difficulty of Mini LED displays poses significant technical challenges. Among them, red flip-chip LED chips generally require substrate transfer and solid crystal welding, thus facing higher yield challenges.

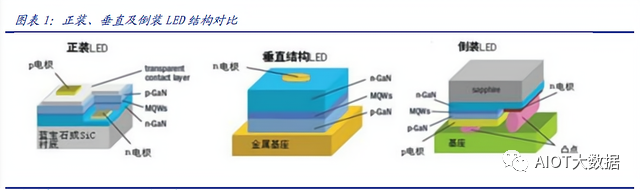

The rapid miniaturization of Mini LED pixel pitch significantly increases the design difficulty at the chip end, directly leading to low yield issues for Mini LED chips. Unlike the positive mounting technology and vertical technology for LED chips, flip-chip technology has advantages such as low voltage, high brightness, high reliability, and high saturation. Additionally, it can integrate protection circuits on the substrate for the chip’s reliability. At the same time, flip-chip technology saves costs by eliminating the need for gold wires on electrodes, making it very suitable for applications with densely packed small spaces. Flip-chip chips have high saturation current, especially under high current, showcasing advantages. Currently, the industry has adopted flip-chip structures for Mini LED chip designs. Among them, blue and green flip-chip technologies are relatively mature with higher yields, while red flip-chip chips generally require substrate transfer and solid crystal welding, making them susceptible to process environment and uncontrollable factors, posing challenges in yield and reliability.

Mass transfer mainly refers to transferring large quantities of micro LED chips to substrates through methods such as adhesion and bonding, focusing on transfer efficiency and yield. There are many transfer technology solutions available in the market. Currently, the mainstream method is stress adhesion and transfer, which can achieve more precise and smaller LED chip transfers, but the number of chips transferred in each operation is relatively small. Other methods include static transfer used by Longda and low-temperature bonding technology used by Mikro Mesa. The bottlenecks that mass transfer must overcome include equipment precision, transfer yield, transfer time, process technology, detection methods, reworkability, and processing costs.

Rohinni significantly improves transfer yield and efficiency, continuously increasing the cost competitiveness of large-scale production. Rohinni’s new composite transfer head can achieve over 99.999% placement yield, with a transfer rate of over 100 chips per second (i.e., over 100 times per second). This technology can be combined in multi-head systems, offering significant speed advantages compared to existing pick-and-place technologies, making it a cost-effective solution for large-scale production of consumer electronic displays. Rohinni and its joint venture company BOE Pixey are entering the stage of large-scale production of Mini LED displays.

Mini LED packaging mainly includes two solutions: COB (Chip on Board) technology and IMD (Integrated Mounted Devices) technology. COB technology directly packages LED chips onto the module substrate, performing overall packaging for each unit. IMD technology integrates multiple groups (two, four, or six) of RGB beads into a small unit.

COB packaging has advantages such as low power consumption, good heat dissipation, high saturation, high resolution, and no restrictions on screen size. However, the challenges of Mini COB packaging technology mainly lie in optical consistency and PCB ink color consistency. IMD can be seen as a small COB, facing challenges similar to COB packaging technology, but with reduced difficulty. Compared to COB technology, IMD technology improves the mounting efficiency at the application end and enhances the packaging reliability of chip RGB.

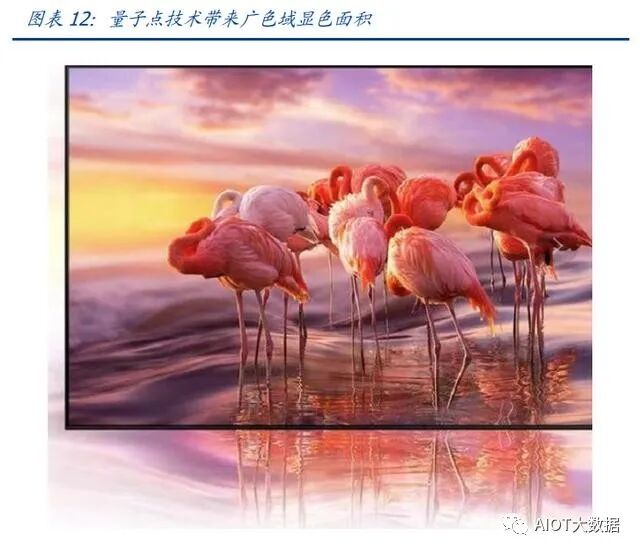

UV/blue LED + luminescent medium method is currently an important way to achieve full-color light sources. Traditional luminescent media use phosphors, which have low conversion efficiency and larger granularity, while quantum dot (nanocrystal) technology is gradually showing superiority. Quantum dots exhibit both electroluminescence and photoluminescence effects, emitting fluorescence when stimulated, with the emitted light color determined by the material and size, allowing for wavelength adjustments by controlling the quantum dot particle size. Quantum dots have diverse chemical compositions, covering the entire visible range from blue to red light; they possess high light-absorbing and emitting efficiency, narrow half-width, and broad absorption spectrum characteristics, resulting in high color purity and saturation; and quantum dot technology has a simple structure, is thin, and can be flexible.

The Mini LED industry chain can be roughly divided into five links: chips, packaging/mass transfer and assembly, panels, systems (assembly), and brands.

Chips: The chip manufacturing link involves a series of semiconductor processes to prepare epitaxial wafers into light-emitting particles, followed by key indicator testing, grinding, cutting, sorting, and packaging. Currently, the challenges for Mini LED chips include: 1) Red flip-chip chips face issues of process consistency and low optical efficiency in small size cutting. 2) The miniaturization of chip sizes increases the precision requirements for equipment etching/lithography. 3) The consistency and reliability of LED chips, as well as maintenance requirements, are increasing.

Packaging/mass transfer: Packaging mainly includes two solutions: COB, which directly packages LED chips onto the module substrate, and IMD, which integrates multiple groups of RGB beads into a small unit. The mass transfer technology link involves chip sorting and transferring, with challenges in equipment sorting algorithms, transfer efficiency, and yield control.

Panels: Panel manufacturers extending into glass substrate backlight solutions are expected to gain a stronger competitive position in the industry chain.

Systems (assembly): This refers to the assembly supply and final testing of Mini LED terminal applications.

Brands: Including various terminal brands such as Apple, Samsung, TCL, etc.

Supply Chain Expands Mini LED Layout, Industry Chain Gradually Matures.

Chips: In the direct display chip sector, many LED chip manufacturers have begun to enter, with Sanan Optoelectronics, HC Semitek, and Qianzhao Optoelectronics all having batch shipments. In the backlight chip sector, there are relatively few companies capable of mass production and large-scale shipments of Mini LED backlight chips, with companies possessing corresponding customers, yield, and mass production capabilities being even scarcer, mainly concentrated in leading companies with competitive advantages in technical support, reasonable capacity layout, and large-scale production, including Jingdian, Sanan Optoelectronics, Osram, Nichia, and HC Semitek.

Packaging/mass transfer: Companies are actively increasing production capacity, with most LED packaging companies laying out Mini LED packaging technology. Mulinsen has advantages in CSP and COB technology; Nationstar is simultaneously laying out COB and IMD; Ruifeng Optoelectronics is ramping up its COB production line; and Zhaochi has a more comprehensive vertical industry chain layout.

Panels: 2021 is a key year for mass production. Panel manufacturers play a more important role in the Mini LED industry chain. Among them, BOE’s Mini LED glass direct display products are expected to be launched in the market within 2021.

Systems (assembly): Industry chain companies are continuously making progress in product introduction, R&D, and shipments. Foxconn is assembling the new Mini LED backlit iPad for international major clients. Unilumin’s P0.7 products have been shipped in bulk. Leyard’s LCD module (LCM) with a thickness of 2.2mm backlight module is now mass-producible, and 2.0mm and below backlight modules have been sampled to international and domestic clients.

Mini LED Industry Chain Overview

The industry chain includes upstream chip manufacturing, midstream packaging, and downstream modules. In the upstream chip manufacturing, GaN-based/GaAs-based epitaxial wafers are manufactured on substrates such as sapphire, SiC, or silicon wafers, followed by etching, cleaning, and other steps to obtain different types of LED chips. LED chip suppliers include mainland manufacturers such as Sanan Optoelectronics, HC Semitek, and Qianzhao Optoelectronics, as well as Taiwanese manufacturers like Jingyuan Optoelectronics and foreign manufacturers like Osram and Nichia. The midstream packaging end involves solid crystal, wire bonding, glue application, and encapsulation steps to form granular finished products, mainly serving to provide mechanical protection, enhance heat dissipation, improve LED performance and light output efficiency, and optimize light beam distribution. Major LED packaging manufacturers include mainland companies like Nationstar, Mulinsen, and Hongli Zhihui, as well as Taiwanese manufacturers like Longda Electronics.

Direct display and backlight module manufacturing are the downstream application ends of the Mini LED industry chain. Direct display manufacturers include Leyard, Unilumin, and Lehman Optoelectronics, while backlight module manufacturers include Zhaochi and Ruifeng Optoelectronics. Additionally, panel manufacturers have also ventured into Mini LED product manufacturing, with TCL Technology and BOE both making layouts. TCL launched the world’s first Mini LED starry screen in 2019, using a glass substrate integrated LED solution, which has better performance advantages than existing PCB integrated solutions, and began mass production in 2020. BOE established a joint venture with American Rohinni in 2019 to jointly develop Mini/Micro LED solutions, and after overcoming technical challenges, BOE’s glass-based Mini LED backlight products achieved mass production and shipment in 4Q20, recently delivering to clients, initially focusing on 65-inch and 75-inch TV products, with plans to expand product varieties based on client demand and capacity conditions.

Mainland Manufacturers Continue to Increase Investment, Taiwanese Manufacturers Begin to Collaborate

Currently, mainland LED industry chains are actively laying out Mini LED-related technologies and products. Leading LED chip manufacturer Sanan Optoelectronics has already begun batch shipments of Mini LED chips to domestic and international downstream clients such as TCL Huaxing and Samsung Electronics in 2020. Additionally, Sanan Optoelectronics’ wholly-owned subsidiary Quanzhou Sanan Semiconductor has jointly invested 300 million yuan with Huaxing Optoelectronics to establish a joint laboratory, focusing on overcoming key technical challenges in Micro-LED display engineering, including Micro-LED chip technology, transfer, bonding, colorization, detection, and repair. In the packaging and testing sector, mainland manufacturers such as Nationstar, Hongli Zhihui, and Ruifeng Optoelectronics have all achieved mature product shipments. Among them, Nationstar has deep collaborations with many domestic and international display companies, with multiple large-size TV backlight products achieving mass production. Ruifeng Optoelectronics has closely collaborated with well-known domestic and international electronics companies to develop various Mini LED backlight and display product solutions for displays such as tablets, laptops, and TVs, and has led the market in launching multiple Mini LED products. Meanwhile, downstream application manufacturers are also taking frequent actions. In 2020, Leyard and Jingyuan Optoelectronics established the world’s first Mini/Micro LED mass production base in Wuxi, mainly focusing on the development of mass transfer technology for Mini/Micro LEDs, while integrating the entire industry chain to produce self-luminous and backlight modules. Additionally, other manufacturers are actively promoting the industrialization of Mini LED. Unilumin has established a standard product line for Mini LED displays and achieved bulk production of P0.9 Mini LED products, and the company announced plans to add several Mini LED intelligent production lines at its Huizhou base in 2020 to expand production capacity. Zhaochi’s Mini RGB products have completed product definition and achieved 4K displays under 110 inches, 135 inches, and 162 inches, with Mini LED chips entering small batch trial production.

As Mini LED requires higher precision transfer, assembly, and sorting equipment, related equipment companies such as ASM Pacific are also actively laying out relevant technologies and solutions. ASM Pacific has launched a fully automated mass soldering production line, Ocean Line, which can transfer up to 10,000 LEDs at a time through its unique mass soldering technology, and with excellent flatness control, achieving better grayscale effects without color difference issues even from different angles. Additionally, in the PCB sector, global leader Pengding is one of the few manufacturers mastering Mini LED backlight circuit board technology, and the company has laid out relevant production capacity in its Huai’an park, with the first phase of the project having been put into production by the end of 2020, and the second phase expected to be put into production in the second half of 2021.

Under the capacity suppression of mainland manufacturers, Taiwanese manufacturers have begun to collaborate: Jingdian and Longda jointly established Fucai Holdings to seize Apple orders. In recent years, as mainland LED industries have risen, the bargaining power of Taiwanese manufacturers has decreased, and most manufacturers have been unable to expand capacity on a large scale to cooperate with brand manufacturers. Additionally, in recent years, mainland LED manufacturers have allied with panel manufacturers, increasing capital expenditures, leading to heightened crisis awareness among Taiwanese manufacturers, prompting them to actively seek collaboration opportunities. In January 2020, leading Taiwanese chip manufacturer Jingyuan Optoelectronics and packaging manufacturer Longda Electronics jointly established Fucai Holdings Group, where Jingyuan focuses on LED chip epitaxy and chips, while Longda focuses on packaging technology. The collaborative strategy of Taiwanese manufacturers has proven effective, as Fucai Holdings has since secured Apple orders. According to industry insiders cited by the Electronic Times, Fucai Holdings will begin producing Mini LED screens for the upcoming 12.9-inch iPad Pro in the first half of this year. Additionally, Taiwanese manufacturer Ruifeng Optoelectronics will serve as a foundry for Apple’s Mini LED backlight modules. Besides Taiwanese manufacturers, European and American manufacturers are also actively vying for Apple orders. Osram plans to continue expanding equipment investments to produce Mini LED chips and is expected to ship Mini LED backlight boards for MacBooks to Apple in the second half of this year, having preliminarily established a factory in Malaysia with a monthly capacity of 100 million chips.

From a Technical Perspective, Exploring the Development Trends of the Mini LED Industry

As the upstream and downstream of the industry chain continue to increase investment, Mini LED technology is at a critical point of landing. Therefore, in terms of technology, new technologies and variables have emerged in chip, packaging, and substrate selection. In this chapter, we will sort out the latest processes and technologies for Mini LED, exploring the most suitable technological direction for the development rules of the Mini LED industry chain, thus providing guidance for investment in the Mini LED industry chain.

Mature Manufacturing Processes, Continuous Innovation in Transfer Technology

The LED chip manufacturing process mainly includes front-end epitaxial wafer manufacturing, mid-stage epitaxy, and back-end chip cutting, involving dozens of specific processes, making manufacturing difficult. However, due to the years of development in the LED industry, traditional LED chip manufacturing equipment and processes have become relatively mature, and the requirements for cutting precision and transfer equipment for Mini LED are not as stringent as those for Micro LED, making the manufacturing difficulty of Mini LED chips relatively lower. Chip manufacturers only need to optimize processes to improve yield and production capacity to achieve the transition from conventional sizes to Mini sizes. In terms of transfer technology, compared to Micro LED, Mini LED has larger sizes and more rigid substrates, allowing for higher precision tolerances and more flexibility in the transfer process. Currently, mainstream manufacturers are developing Mini LED-related transfer technologies, mainly including the following three: 1) The first solution is to improve existing gripping equipment by setting multiple arms to increase picking and placing efficiency. This solution has a lower technical difficulty, making it easier to achieve mass production, but it has capacity limitations and cannot achieve large-scale increases. 2) The second solution involves placing the chip and substrate relative to each other, then using pins to push the chip out for placement on the substrate. Compared to the first solution, this method reduces the repeated movement of the arms, thus improving transfer efficiency. Moreover, if the chip’s placement on the blue film aligns with the control electrode position of the final substrate, combined with multiple pins, it can achieve mass transfer, significantly enhancing transfer efficiency. 3) The third solution is similar to the second, where the chip is placed on a UV film, and UV light is used to selectively transfer the LED chip to the substrate. This solution can achieve true mass transfer, but it requires high precision in chip sorting and placement on the UV film.

Full Flip-Chip + COB, Forming a New Trend in Packaging Technology

LED packaging technology is transitioning from traditional bracket-type packaging (such as SMD technology) to new unbracketed integrated packaging (such as COB technology). Traditional LED packaging technology mainly uses SMD (Surface Mounted Devices) technology, which involves surface mounting devices. SMD technology uses flat brackets + glue forming and is assembled using surface mount technology, employing alloy copper flat pins that can be assembled on aluminum substrates or PCBs. Its process flow includes solid crystal, wire bonding, forming, cutting, sorting, and warehousing. SMD technology can achieve stable pixel pitches in the range of 1.2-1.5mm, with advantages such as mature and stable technology, low manufacturing costs, good heat dissipation, and ease of maintenance, making it a very mature LED packaging technology.

However, as LEDs develop towards Mini/Micro directions, the application of SMD technology has begun to face limitations. Its low protection level and short lifespan defects have become apparent, especially when manufacturing display products with pixel pitches below P1.2, where SMD packaging technology encounters many insurmountable technical bottlenecks. For example, SMD technology cannot meet the panel-level pixel failure rate requirements of Mini LED display products. COB (Chip On Board) packaging technology is a type of unbracketed integrated packaging technology that directly mounts LED chips onto PCBs, creating high-integrated pixel panel-level packaging on one side of the PCB, while placing driver IC devices on the other side without requiring any brackets or solder joints.

Compared to traditional SMD technology, COB technology can significantly reduce pixel failure issues in LED display panels while achieving smaller dot pitches and higher arrangement densities. Therefore, COB technology can significantly enhance the pixel density and overall reliability of LED display systems, providing the underlying high-end panel manufacturing technology for 4K, 8K ultra-high-definition display products and Mini LED displays, making it an inevitable choice for the current LED display moving towards million-level displays. Additionally, there are various limited integrated packaging technologies between SMD and COB, mainly including 2in1, 4in1, and Nin1 packaging technologies. This technology essentially represents a hybrid packaging technology of SMD and COB, reducing the number of bracket pins, reflecting the idea of COB packaging integration, but it cannot truly eliminate the pixel failure rate at the panel level, encountering the same technical bottlenecks as SMD packaging technology in the pixel range of Mini LED from 1.2-0.9mm.

In addition to COB technology, the packaging end has innovatively introduced flip-chip processes to achieve higher luminous efficiency, arrangement density, and reliability. Traditional positive mounting technology has drawbacks such as electrode shielding affecting luminous efficiency and complex processes with many solder wires. Flip-chip technology, by inverting the chip, allows the light emitted from the light-emitting layer to be emitted directly from the other side of the electrode, achieving no electrode shielding and no solder wires in the packaging process, thus maximizing the light-emitting area and heat dissipation area, while avoiding issues caused by metal false soldering and poor contact. At the same time, the absence of solder wires can enhance chip arrangement density, helping LEDs further improve display pixel density.

Currently, in the pixel pitch range above 1.2mm, positive mounting chips can still be used; in the range of 1.2-0.7mm, there are solutions for red positive mounting and blue-green flip-chip; in the pixel range of 0.7-0.3mm, RGB must use flip-chip. In the future, as LEDs accelerate their evolution towards Mini/Micro directions, flip-chip technology will see rapid penetration.

In summary, for the Mini LED industry, SMD packaging technology is currently the most mature and cost-effective packaging combination, which will be used in the promotion of mid-to-low-end Mini LED products. Looking ahead, as Mini LED demand increases, glass substrates are expected to achieve large-scale shipments, and their costs will be amortized. At that time, the competitive advantages of glass substrates will be fully demonstrated, and they are expected to replace PCB substrates.

Source: Grid Public Data, AIOT Big Data, Display Exchange

–

END

–

Deep Display Association Elite Gathering

“Innovation, Harmony, Win-Win,” covering global display industry upstream, midstream, and downstream enterprises, as well as representative institutions, higher education institutions, and research institutions, building a bridge for communication and cooperation among members of the entire display industry chain.

Welcome to scan and join!

About SDIA

The Shenzhen Flat Panel Display Industry Association was established in January 2005

by more than 30 leading enterprises in the industry,

and established a touch screen branch in 2009,

making it one of the earliest optoelectronic display industry associations in China, with members covering both domestic and international,

and currently one of the largest, most influential, and most active optoelectronic display industry organizations in China.

Secretary’s hotline: Secretary Liu 13027903795

Yearbook/Brief Advertising: He Shan 18617177787

Submission/Complaint Email: [email protected]

Click to read the original text to learn more about the association’s activities!!