Author: Ning Nanshan

Long press the QR code to join the storage technology and market group.

Currently, China only has a presence in the small market of NOR Flash, which is a type of flash memory chip primarily used for storing code and some data. It is widely used in PC motherboards, security monitoring products, smart home appliances, and automobiles.

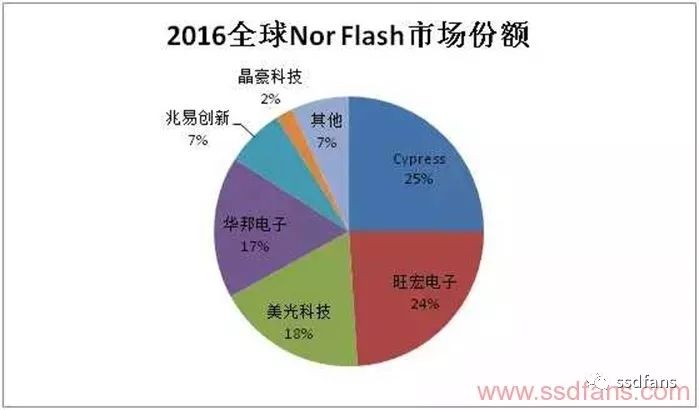

According to TrendForce data from June 2017, in 2016, the global market share was led by Cypress in the USA at 25%, followed by Winbond in Taiwan at 24%, Micron in the USA at 18%, and Nanya in Taiwan at 17%. Outside the top four, China’s Zhaoyi Innovation holds a market share of 7%, making it the only domestic memory manufacturer.

Of course, this 7% is just last year’s average; in fact, due to Zhaoyi Innovation’s rapid growth, its market share exceeded 7% in the fourth quarter of last year. Furthermore, as Cypress and Micron have gradually exited the mid-to-low-end market this year, Zhaoyi Innovation’s global market share has now surpassed 10%.

How does Zhaoyi Innovation’s technology level stack up? The highest-end NOR Flash products are mainly supplied by Micron and Cypress, with capacities of 64Mb and 128Mb. Winbond and Winbond mainly supply mid-range NOR Flash products with capacities of 16Mb, 32Mb, and 64Mb, while Zhaoyi Innovation primarily offers low-end products, mostly below 32Mb or 16Mb. In fact, Zhaoyi Innovation can provide a series of products ranging from 512Kb to 512Mb, covering most of the capacity types of NOR Flash, but there is still a gap in achieving high yield during mass production.

Currently, Zhaoyi Innovation’s NOR Flash process has been upgraded from 0.13μm to 65nm for mass production, with more advanced 45nm products expected to reach mass production in 2019. As we can see, NOR Flash does not require advanced processes, and SMIC can handle it completely. In fact, Zhaoyi Innovation primarily relies on SMIC for foundry services, with about 60% of its products being produced at SMIC, while some are produced at Wuhan Xinxin under Yangtze Memory Technologies.

Everyone knows that Zhaoyi Innovation has also made significant profits this year in NOR Flash products. To maintain high gross margins and expand into broader markets, global flash memory giants such as Cypress, Micron, and Samsung have shifted their focus to larger market segments like NAND Flash and DRAM chips, especially as Micron has expressed intentions to sell its NOR Flash business. As global flash memory giants gradually withdraw from the NOR Flash chip market, this presents a significant opportunity for Zhaoyi Innovation.

Zhaoyi Innovation is a technology-oriented company. Founder Zhu Yiming holds a master’s degree from Tsinghua University, is a Silicon Valley returnee, and a national Thousand Talents Plan expert. He leads Zhaoyi Innovation in pioneering the commercialization of China’s memory industry. Below is a picture of Zhu Yiming.

In addition to NOR Flash, Zhaoyi Innovation also produces low-capacity, especially SLC (Single Level Cell) NAND Flash products. SLC can be understood as a storage unit that can only store one bit of data, either 0 or 1, with product capacities ranging from 1Gb to 8Gb. These small-capacity products have a relatively small overall market scale and cannot leverage the advanced process nodes of major international manufacturers, which is suitable for Zhaoyi Innovation’s capabilities. In other words, they are targeting a small market that others overlook.

Currently, major international manufacturers such as Samsung, Toshiba, and Hynix primarily produce MLC (Multilevel Cell) and TLC (Trinary Level Cell) products, where a storage unit can hold two and three bits of data, respectively. For example, the 32GB, 64GB, 128GB, and 256GB in our phones are mostly MLC or TLC. The advantage of this is lower costs, as the same storage unit can hold more data, resulting in larger GB capacities.

Currently, Zhaoyi Innovation’s NAND Flash has achieved successful mass production of 38nm process technology products, and the R&D verification of 24nm products is progressing steadily, accelerating mass production and launching larger products up to 32Gb. The gap between this and international mainstream technology is vast; Samsung has already advanced to 16nm.

In addition to the continuous advancement of process technology, there will always be limits encountered on the planar level. Due to the physical characteristics of flash memory itself, the improvement of physical performance is not linear as the technology advances, and the insulating oxide layer becomes too thin and prone to wear.

Therefore, development must also move towards stacking, which does not require as high process technology standards.

Zhaoyi Innovation also needs to develop 3D NAND Flash with similar stacking capabilities as Samsung’s 32-layer and 64-layer products to meet high capacity and advanced process requirements. However, do not expect Zhaoyi Innovation to achieve this in the short term, as they have not yet mass-produced 24nm 2D NAND Flash. Major international manufacturers have gradually transitioned to 3D technology seeking higher performance and capacity due to reaching limits with 2D technology as they have advanced to 16nm.

Additionally, Zhaoyi Innovation is also developing MCU products. Currently, major international manufacturers such as Renesas, NXP, TI, and ST dominate the market, but the company has made good progress in certain niche areas. Zhaoyi Innovation’s MCU products are mainly applied in the Internet of Things and vehicle networking fields.

In fact, looking at the fundraising when Zhaoyi Innovation went public last year, 160 million yuan was allocated for NOR Flash R&D and product transformation, 200 million yuan for NAND Flash R&D and industrialization, and 120 million yuan for MCU product R&D and industrialization, in addition to 32.8 million yuan for establishing a research and development center. This company is a typical technology-oriented company.

In the first three quarters of 2017, Zhaoyi Innovation achieved operating revenue of 1.517 billion yuan, a year-on-year increase of 44.69%; the net profit attributable to shareholders of the listed company was 339 million yuan, a year-on-year increase of 134.74%.

It is expected to break through 2 billion yuan this year for the first time, but it is still a small company with only 300 million dollars.

Due to Zhaoyi Innovation’s good development momentum, it has caught the attention of Hefei Changxin, an independent integrated circuit project in Hefei.

Hefei Changxin is a state-owned company controlled by the Anhui Hefei government, established in June 2016, and yes, this company has only been established for a little over a year.

At the end of 2016, they invested 49.4 billion yuan to start building a DRAM memory base (actual news was officially announced in May 2017), with mass production expected to start by the end of 2018, a rapid leap in two years.

In August 2017, a Hefei Daily article titled “317 ‘Big New Special’ Projects Started in the First Seven Months” stated: “Currently, in the Hefei Economic Development Zone, the Hefei Changxin high-end general storage wafer manufacturing project is under construction. This project aims to establish a 12-inch storage wafer R&D project with industry-leading process technology, with plans for factory completion in 2017 and equipment installation and debugging to be completed in the first half of the following year, with successful product R&D expected in the second half.”

Where does its technology come from? Hefei Changxin’s core operating partner is Hefei Ruili Integrated Company, whose legal representative, Wang Ningguo, is the former global executive vice president of the world’s largest semiconductor equipment company, Applied Materials. Another Chinese individual, Yin Zhiyao, also served as vice president and later returned to establish the best semiconductor equipment manufacturing company in China, Zhongwei Semiconductor. Wang Ningguo was also the former CEO of SMIC and left during the control battle for SMIC in 2011.

Therefore, the Hefei government relies on Wang Ningguo’s Ruili Integrated Company to establish an integrated circuit development platform, aggressively poaching employees from Hynix, Elpida, and Hua Ya Ke to form a research and development team, with former senior vice president Liu Dawei joining Hefei Changxin.

In addition to Wang Ningguo leading the company’s operations and development, the Hefei government has also partnered with Zhaoyi Innovation. In fact, when Hefei Changxin was just established in 2016, Zhaoyi Innovation began a series of recruitment activities at various universities across the country, including Southeast University, Nanjing University of Science and Technology, Xi’an Jiaotong University, Wuhan University of Technology, and the University of Electronic Science and Technology of China in Chengdu.

In the recruitment notice, it revealed Zhaoyi Innovation’s joint project with Hefei, aiming to create a chip company integrating design, manufacturing, and processing. The project is planned in three phases, with the first phase planning to build a 12-inch wafer factory in the Hefei Airport Economic Demonstration Zone, estimated to start construction in July 2017. The current team has over 50 employees, and by 2017, it is expected to reach a scale of 1,000 employees, and by 2018, possibly 2,000 employees. This project is essentially the Hefei Changxin DRAM project.

After more than a year of preparation, Zhaoyi Innovation and Hefei Industrial Investment (Hefei Industrial Investment Holding Group Co., Ltd., the sole shareholder and actual controller is the State-owned Assets Supervision and Administration Commission of Hefei Municipal People’s Government) signed a cooperation agreement on October 26, 2017, regarding the storage research and development project, agreeing to collaborate on the 19nm 12-inch wafer storage (including DRAM, etc.) R&D project, with an estimated budget of about 18 billion yuan. The project’s goal is to achieve successful R&D and a product yield of no less than 10% by December 31, 2018.

Note that December 31, 2018, is just a little over a year from now; if successful, Hefei Changxin will become China’s first large-scale DRAM factory, surpassing Yangtze Memory Technologies. Although the yield may only be 10% at that time, it will still represent a breakthrough.

Why is it a breakthrough? Because it will be the fourth company in the world to achieve DRAM production technology below 20nm. Based on the currently planned capacity (monthly production of 125,000 wafers), if everything goes smoothly, although it will still not match Samsung and Hynix, it could be compared to Micron, ranking fourth globally.

Our current question is that although Zhaoyi Innovation has been engaged in independent R&D for many years, it only has mass production experience in NOR Flash, SLC NAND Flash, and MCU, lacking mass production technology in the DRAM field.

Additionally, while Wang Ningguo is an industry giant, he has poached technical personnel from multiple manufacturers; who will be the core technology leader remains unknown. However, Hefei Changxin is conducting DRAM trial production technology breakthroughs in the form of Zhaoyi Innovation + Ruili Integrated, and we will wait to see the results.

I am optimistic about technology-oriented companies like Zhaoyi Innovation. China already has many such cases, such as iFlytek, Baidu, BYD, Xiaomi, and Cambrian, all founded by technical experts.

Talent is the core factor in a company’s development. Zhaoyi Innovation’s development over the years has not been easy, largely due to the constraints of company size, as R&D requires investment. In 2016, the company’s total revenue was only 1.489 billion yuan, and one can imagine that the funds available for R&D were only at the level of one or two hundred million yuan. Even with the 2016 IPO, the funds raised for R&D and industrialization were only 600 million yuan.

Zhaoyi Innovation has completed its alignment with the national team this year, as the National Big Fund invested 1.45 billion yuan in August 2017 to acquire 11% of Zhaoyi Innovation’s shares, becoming the second-largest shareholder, second only to founder Zhu Yiming.

This 18 billion DRAM cooperative R&D project requires Zhaoyi Innovation to raise 3.6 billion yuan, while Hefei Industrial Investment will raise 14.4 billion yuan, with a funding scale far exceeding all of Zhaoyi Innovation’s previous large projects, marking the biggest historical opportunity for Zhaoyi Innovation since its establishment.

What does the future hold? We will know the answer by the end of 2018 or in 2019.

Upcoming: Yangtze Memory Technologies

Reposted from WeChat public account “Ning Nanshan”

Check SSD, NAND purchasing demand and sources, recruitment and job listings at www.ssdfans.com!

Don’t want to miss out on exciting follow-up articles? Just long press or scan the QR code below to follow ssdfans!

Introduction to the SSD Fans WeChat Group

| Technical Discussion Group | Covering over 5,000 Chinese and global SSD and storage technology elites |

| Firmware, Software, Testing Group | Firmware, software, and testing technology discussions |

| Heterogeneous Computing Group | Discussions on artificial intelligence and GPU, FPGA, CPU heterogeneous computing |

| ASIC-FPGA Group | Chip and FPGA hardware technology discussion group |

| Flash Memory Device Group | DRAM, NAND, 3D XPoint and other solid-state storage medium technology discussions |

| Enterprise Level | Enterprise-level SSD and storage |

| Sales Group | All national DRAM and SSD suppliers are here; negotiate prices that are 20% cheaper than certain e-commerce platforms! |

| Job Seeking Group | Job changes in the storage industry, posting recruitment information, and keeping an eye on major companies’ recruitment news. |

| Executive Group | Executives and founders of major SSD-related storage companies, investors |

| Regional Groups | Jiangsu, Zhejiang, Shanghai, Beijing, Guangdong, Sichuan, Shaanxi, Hubei, Taiwan, Shandong, USA |

If you want to join these groups, please add nanoarch as a WeChat friend, introduce your name – company – position, and specify the group name to be added.