Report Producer/Author: Founder Securities, Chen Hang

NOR Flash Investment Logic Framework

NOR Flash Supply and Demand Outlook: Supply-Demand Imbalance, Continuous Price Increase

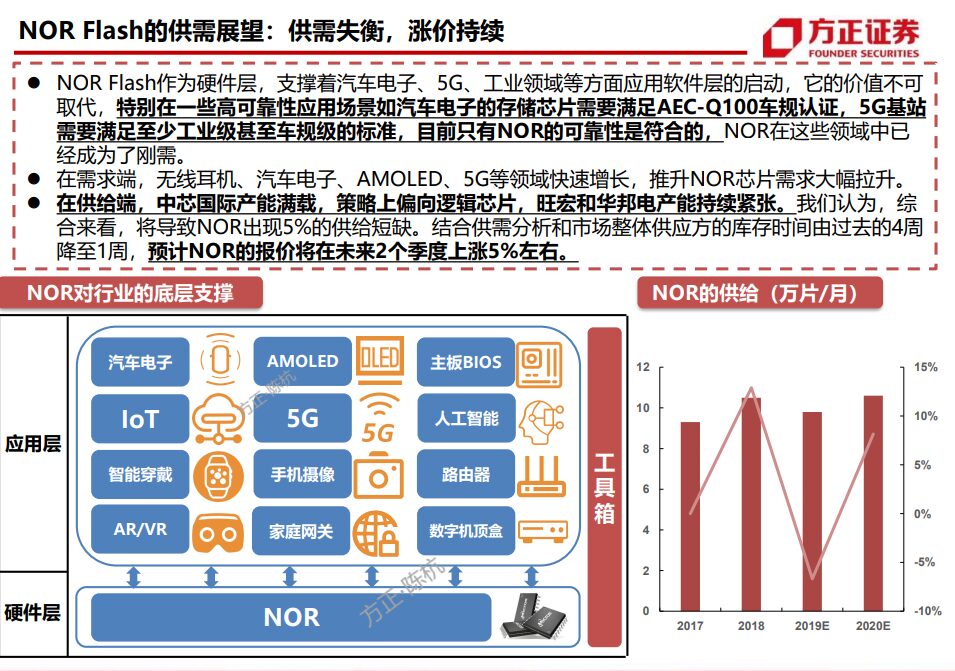

NOR Flash, as a hardware layer, supports the startup of application software layers in automotive electronics, 5G, and industrial fields. Its value is irreplaceable, especially in high-reliability application scenarios such as automotive electronics, where storage chips need to meet AEC-Q100 automotive certification, and 5G base stations need to meet at least industrial-grade or even automotive-grade standards. Currently, only NOR meets these reliability requirements, making it a necessity in these fields.

For the complete PPT report, please reply with the keyword “21422” in the dialogue box of the Lei Feng Network public account.

On the demand side, rapid growth in wireless earphones, automotive electronics, AMOLED, and 5G has significantly increased the demand for NOR chips.

On the supply side, SMIC is fully loaded, strategically leaning towards logic chips, while Winbond and Macronix continue to experience tight capacity. We believe that, overall, this will lead to a 5% supply shortage for NOR. Combined with supply-demand analysis and the overall inventory time for suppliers decreasing from 4 weeks to 1 week, it is expected that NOR prices will increase by about 5% in the next two quarters.

2

NOR Flash: Niche Memory Reviving

Overall Industry Position of NOR Flash: Niche Market Positioning

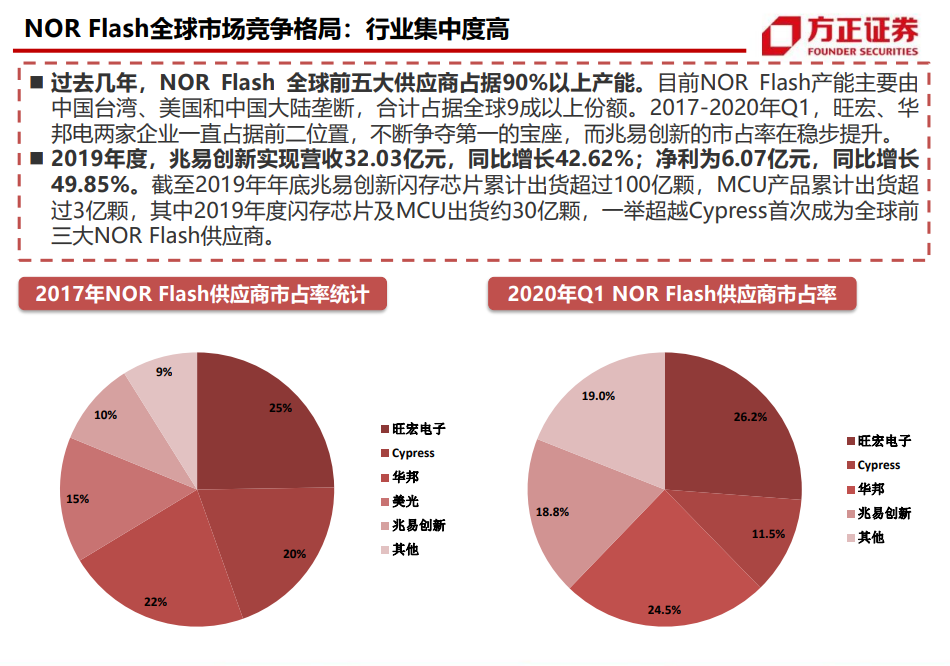

NOR and NAND both belong to Flash. However, due to NOR’s emphasis on performance and reliability, and its lack of cost advantages, NAND has become the mainstream large-capacity data storage solution, while NOR is mainly used for system boot code and specific read-only information storage, thus belonging to the niche memory market. In recent years, major international storage manufacturers Micron and Cypress have continuously reduced production in the NOR field, leading Taiwan’s Winbond and Macronix to become the leaders in the NOR market, with China’s Gigadevice following closely behind, ranking third. Together, these three account for nearly 70% of the market share.

NOR Flash’s Necessity and Industry Applications

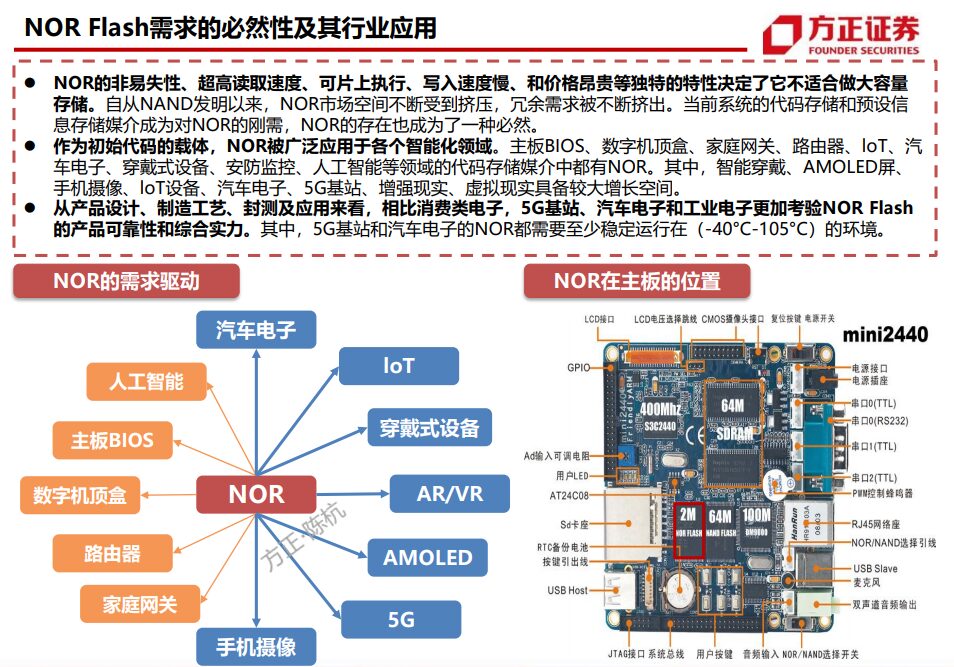

NOR’s non-volatility, ultra-high read speed, on-chip execution, slow write speed, and high price make it unsuitable for large-capacity storage. Since the invention of NAND, the NOR market space has been continually squeezed, with redundant demand being pushed out. Current systems require NOR for code storage and preset information storage, making NOR’s existence a necessity.

As the carrier of initial code, NOR is widely used in various intelligent fields. NOR is present in code storage media for motherboard BIOS, digital set-top boxes, home gateways, routers, IoT, automotive electronics, wearable devices, security monitoring, artificial intelligence, etc. Among them, smart wearables, AMOLED screens, smartphone cameras, IoT devices, automotive electronics, 5G base stations, augmented reality, and virtual reality have significant growth potential.

From product design, manufacturing processes, packaging, and applications, compared to consumer electronics, 5G base stations, automotive electronics, and industrial electronics pose greater tests for the reliability and comprehensive strength of NOR Flash. Among them, NOR for 5G base stations and automotive electronics needs to operate stably in environments ranging from (-40°C to 105°C).

NOR Flash Supply Side Analysis: Major Manufacturers Continue to Cut Production, Supply Remains Tight

Global manufacturers continue to cut production or exit the NOR market, with limited new capacity on both sides of the Taiwan Strait, and the impact of the COVID-19 pandemic on the industry will lead to a 5% supply gap in NOR in 2021. Due to a significant reduction in overall inventory, driven strongly by demand in 5G and automotive electronics, NOR prices are expected to rise by about 5% in the next two quarters.

Samsung completely exited the NOR market in 2010, concentrating all storage capacity on the larger NAND and DRAM memory markets. Micron canceled its 8-inch production line in 2016, transferring all 8-inch and part of the 12-inch capacity to NAND. Cypress sold its NOR wafer factory in Bloomington, USA in 2017, while the NOR contract prices expired, leading Cypress to raise product prices again. Both Macronix and Winbond have actually cut production by 5%-10%. Winbond did not meet its planned production capacity of 30,000 wafers/month by 2019.

In mainland China, the production personnel return to work after the Spring Festival was restricted due to the COVID-19 virus in 2020, and Yangtze Memory and SMIC delayed their operations after the holiday. At the same time, SMIC faced restrictions due to the Entity List, along with recent tight capacity at wafer foundries, limiting supply.

NOR Demand Analysis: Seven Demand Breakdown

Currently, mainstream TWS chips are equipped with built-in or external NOR for storing earphone system code. Built-in NOR, or embedded Flash, integrates NOR with other modules on the same SoC; external NOR serves as a separate storage chip, existing in the IC circuit and not on the same SoC as the logic module.

The performance and functionality differences of smartwatches and smart bands determine the different configurations of NOR. Generally, high-end smartwatches have more powerful main control chips than smart bands. The area of the smartwatch SoC is also larger, sufficient to support built-in NOR, such as the S6 chip in the Apple Watch. Smart bands, due to weaker main control chip performance and smaller SoC area, are not able to support built-in NOR, and usually use external NOR.

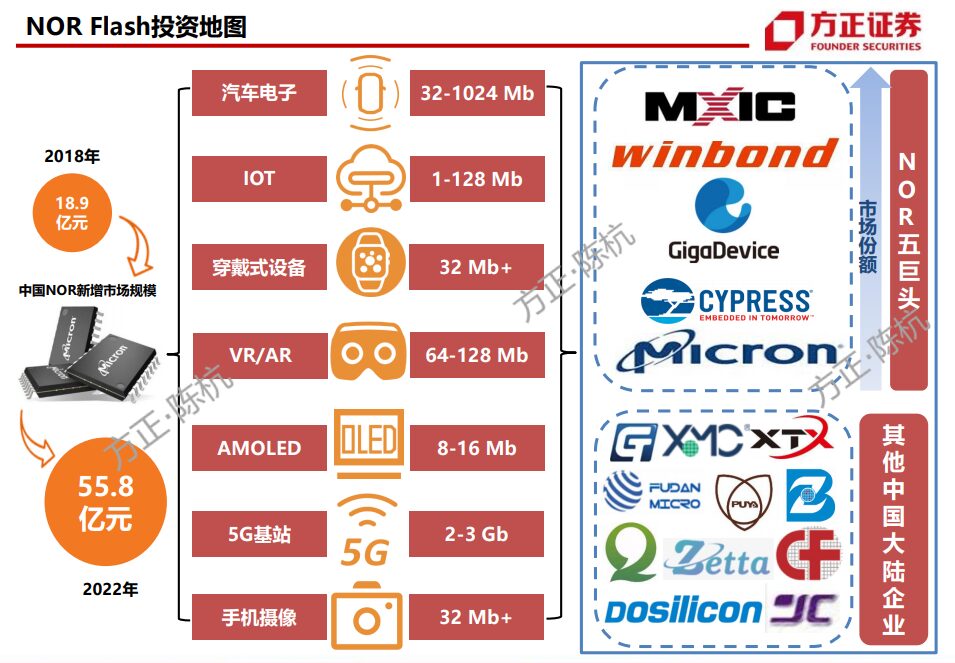

AR/VR, as the next generation of mobile terminal computing platforms, has high computational requirements, equivalent to a standalone PC. High-performance AR/VR devices typically configure a 64-128Mb NOR. The related code for the AR/VR boot system needs to be stored in NOR.

AMOLED panel production consistency issues require later external calibration, recording the row and column positions of problematic pixels and brightness difference values, calculating the required compensation voltage/current values, and writing this information into the external NOR of the panel module. The module IC will use the compensation information in NOR to achieve consistent display effects. External optical compensation is the most commonly used Demura. NOR demand increases in tandem with display screen resolution. FHD resolution AMOLED screens typically configure 8Mb of NOR, while 2K resolution AMOLEDs usually configure 16Mb of NOR.

IoT devices do not require complex computing functions; the core is connection speed. Typically, small-capacity NOR is widely used in IoT for storing boot and operational system codes. Smart speakers, in addition to basic music playback functions, have multiple features based on voice recognition, often serving as entry points for smart homes and IoT, providing integrated OEM voice services. The fast read speed of NOR helps reduce latency and speed up the startup of smart speakers. The 16Mb NOR in the Amazon Echo Show is mainly used to store boot programs and operating system kernel files. Wireless routers, as hardware devices connecting two or more networks, occupy a central position in IoT. The 8 MB NOR in the TP-Link N300 Nano router is mainly used to store the boot program and run code.

Automotive systems differ from mobile phones, as the main control electronic system shuts down immediately after parking, while each startup requires a quick launch of the ADAS system interface. The quick startup of in-vehicle systems requires fast code reading, and NOR has a natural advantage in this regard. Automotive applications require NOR to operate within a temperature range of at least “-40°C to 105°C”, meeting AEC-Q100 automotive certification. Automotive-grade NOR must achieve a reliability requirement of 0dppm, far exceeding the 100-200dppm of consumer applications. A single vehicle may also configure multiple independent ADAS systems, forming a more complex and reliable autonomous driving system. Each ADAS system requires one or more NORs to achieve more complex functions, with an average NOR capacity ranging from 32-128Mb, and high-end ADAS systems may configure NORs with a capacity of 1Gb.

The 5G base station system requires configuration by FPGA/SoC, and the FPGA and SoC need to be configured each time the system starts. Unlike NAND and SD cards, NOR can provide higher reliability and lower latency support for initial responses and startup configurations in 5G devices. At the same time, industrial-grade or automotive-grade NOR can operate in harsh environments ranging from (-40°C to 105°C) and survive in the market for 10 years or longer, meeting the requirements of 5G base stations for products to possess “high capacity + high performance + high reliability” characteristics. Currently, the MirrorBit technology used in 5G devices supports greater density scaling compared to floating gate technology. Higher density enables NOR products with single-chip capacities of 1Gb and higher, required for 5G wireless infrastructure. Each 5G base station needs to be equipped with at least five NOR memory modules with capacities above 1Gb.

Currently, mainstream smartphone camera modules have certain shortcomings in focusing speed and low-light imaging quality. Future consumer electronics camera upgrades will follow three major trends: 1) multi-camera collaboration; 2) phase focus or full-pixel focus technology improvement; 3) pixel enhancement. The upgrade of camera quantity and imaging quality imposes higher requirements on enterprises’ image integration processing capabilities and precision algorithms. NOR, as dedicated image memory, will become a standard in the future, representing a significant incremental demand for NOR in consumer electronics.

3

NOR Flash: Market Space and Competitive Landscape Analysis

NOR Flash Industry: Niche Market of the Storage Industry

According to data released by SIA in April 2020, in terms of sales, the largest area of the global semiconductor market in 2019 was memory and logic chips, with each category reaching sales of $106.4 billion, accounting for 26% each; followed by analog and microprocessors, accounting for 13% and 11% of the global semiconductor industry sales, respectively. Among memory products, mainstream universal memory NAND Flash and DRAM account for a combined 98% of the memory market share.NOR Flash and other product categories account for about 2% of the memory market, collectively referred to as niche memory.

Currently, China’s semiconductor market has a relatively low global market share in mainstream universal memory DRAM and NAND Flash. In recent years, a number of excellent companies focusing on the niche memory field of NOR Flash have emerged in China, including Gigadevice, Dongxin Semiconductor, and SMIC, which has NOR manufacturing capabilities, as well as Wuhan Xinxin and other companies. Companies deeply engaged in NOR in China are expected to become the backbone of domestic memory development.

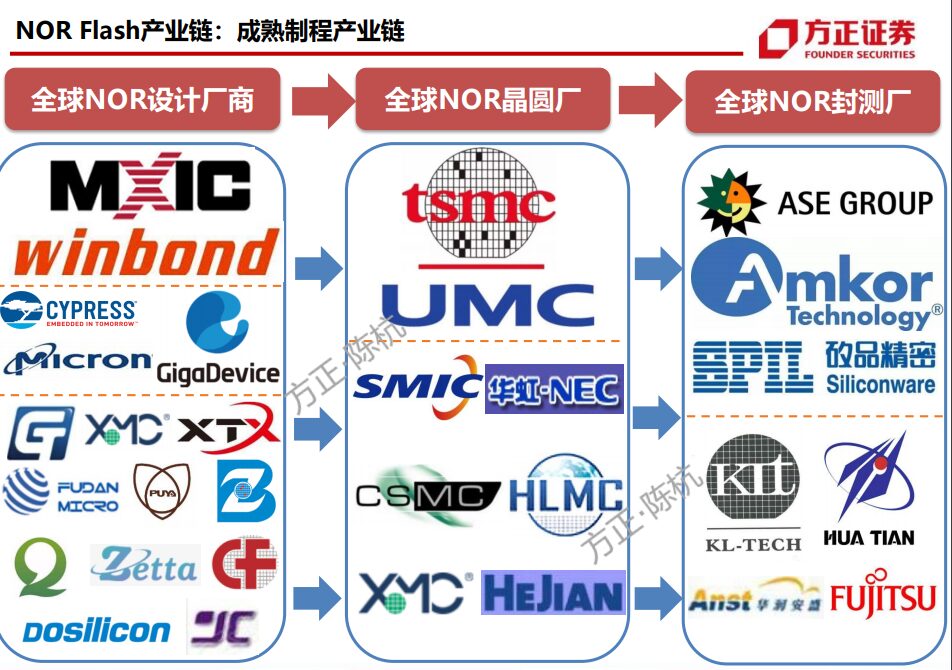

NOR Flash Global Market Competitive Landscape: Continuous Exit of American Capacity

Since 2010, the NOR Flash market has undergone several reshuffles. In 2017, both Cypress and Micron announced their exit from the low-end NOR Flash market, leading to a competitive landscape dominated by five major players that has persisted to this day. However, this landscape has begun to change rapidly this year. In Q2 2019, Gigadevice’s market share first surpassed Micron, becoming the fourth largest NOR Flash supplier globally, and in Q3 2019, it surpassed Cypress to become the third largest, maintaining its third position in Q1 2020.

The reasons for the continuous exit of American capacities are threefold: first, the demand for NOR Flash in automotive electronics and industrial markets is relatively average, while the demand for Micron and Cypress’s NOR Flash products is primarily in these two markets, while the consumer electronics market shows significant demand increases; second, Macronix, Winbond, and Gigadevice are also continuously penetrating the automotive and industrial control markets, leading American manufacturers to consider completely exiting the NOR Flash market under competitive pressure, with production capacities declining rather than increasing; third, to maintain high gross margins and explore broader markets, global flash memory giants such as Samsung Electronics and Micron Technology have shifted their product focus to the larger NAND Flash chip market.

Three Core Competencies of NOR Flash Industry Leaders

As a core product in the niche market, the industry barriers for NOR Flash are relatively low compared to DRAM, making it easier for domestic manufacturers to enter and occupy market share. Currently, we believe that the core competencies of industry leaders primarily include the following three points, which are also the directions for domestic NOR Flash manufacturers to strive for in the future.

-

Focus on niche markets, achieve market focus, and obtain local advantages in segmented industries.

-

Have a complete and comprehensive upstream and downstream ecosystem, establishing a global distribution network.

-

Develop stable customer resources to achieve economies of scale under mass production.

Currently, in the global NOR Flash market, although a tripartite structure has formed among Gigadevice, Macronix (Taiwan), and Winbond (Taiwan), Macronix, Micron, and Cypress’s large-capacity NOR Flash processes have reached around 45nm, while Gigadevice’s mass production of 55nm NOR Flash has begun, but its main process still concentrates on 65nm.

Among them, Taiwan’s Winbond, a global market giant in NOR Flash, has consistently adopted a niche market focus strategy, always concentrating on NOR Flash. Currently, Winbond’s NOR Flash has a universal SPI interface, with capacities ranging from 512Kb to 512Mb, featuring small capacity erasable blocks and the industry’s highest operational efficiency. In the future, Winbond will continue to advance NOR Flash’s advanced processes, increase storage density, and continuously explore niche market potential to consolidate its global leadership position.

Currently, the mainstream process node for NOR Flash products is 65nm, with Cypress and Micron having relatively advanced technology nodes reaching 45nm, while Macronix’s most advanced process is 48nm, Winbond’s is 58nm, and domestic Gigadevice has products with a small number of 55nm process nodes.

Currently, multiple domestic manufacturers have launched new 50nm NOR Flash products, with Wuhan Xinxin announcing the full production of its 50nm XM25QWxxC series products, and Dongxin Semiconductor’s 48nm NOR Flash products have begun customer sampling tests, expected to start mass production in the second half of the year. Hengshuo Semiconductor’s 50nm 128Mb NOR Flash chip has passed customer verification and will see large shipments in many application markets in Q4 2020. The core competitive advantage in the NOR Flash market also reflects whether manufacturers can achieve economies of scale in mass production, which determines whether manufacturers can reduce unit production costs, R&D costs, and fixed costs such as factory and production equipment.

From the current global market trend, international memory leaders are continuously exiting the NOR Flash and SLC NAND mid- to low-end markets, leaving market gaps in competition. Gigadevice is rapidly seizing the market with its Fabless model. Macronix and Winbond, adopting an IDM model that covers integrated circuit design, manufacturing, packaging, and testing, are limited in their capacity expansion due to the IDM model. This also indicates that there is still significant participation space for domestic manufacturers in the market, which can achieve mass production to meet market demand and reduce total costs to gain this advantage.

For the complete PPT report, please reply with the keyword “21422” in the dialogue box of the Lei Feng Network public account.

Industrial Manufacturing “Carbon Neutrality”, Is It Possible?