Flash memory chips have become a crucial part of the entire electronic semiconductor industry chain, among which NAND Flash has a vast market capacity. In fact, Flash is not limited to NAND; NOR Flash is also a branch, though its market capacity is relatively smaller. However, with the rapid development of various emerging applications in recent years, the market demand for NOR Flash and its importance have become increasingly prominent, leading to heightened industry attention.

01

01Introduction to NOR Flash

NOR Flash features chip-internal execution (XIP) and high reliability, but has a relatively short lifespan. It offers high cost-effectiveness for small capacity applications ranging from 1 to 16Mb.

Compared to NAND, NOR has a higher cost, smaller capacity, and slower write speed. Although NOR Flash’s erase and write speeds are relatively slow, its read speed is very fast, which is its core value in applications.

Traditionally, NOR Flash has been primarily used for small-capacity code storage in feature phones, televisions, set-top boxes, and USB keys. During the feature phone era, it dominated with the NOR+PSRAM architecture, where NOR Flash was used for code and data storage, while PSRAM served as data cache for MCU and DSP computations.

NOR Flash is mainly divided into serial and parallel types. Serial NOR Flash is characterized by a simple interface, lightweight design, lower power consumption, and overall system cost. Although its read speed is lower than that of parallel NOR Flash, its high cost-performance ratio has made it the preferred choice in the market and applications.

In terms of process technology, NOR Flash does not have high requirements for advanced nodes, typically using 55nm and 65nm, with the most cutting-edge processes reaching only 45nm, making further evolution challenging.

02

02Market Landscape

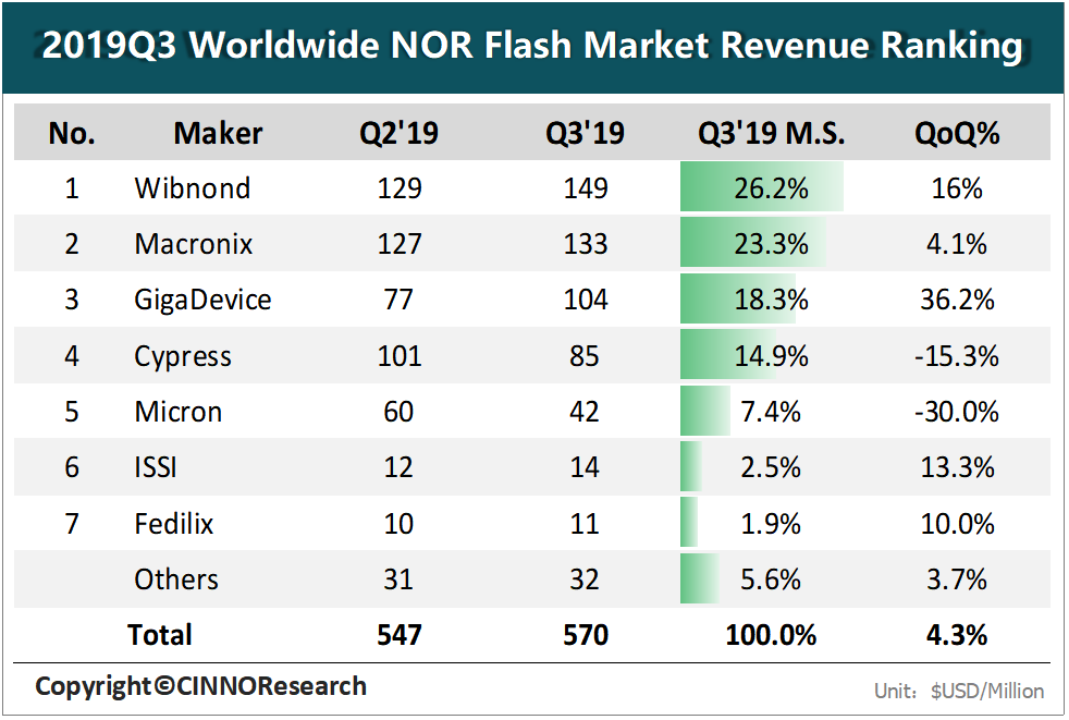

90% of the global NOR Flash market is dominated by five major manufacturers: Macronix, Winbond, Cypress (acquired by Infineon), Micron, and GigaDevice. The high-capacity NOR Flash market is mainly held by Cypress and Micron, targeting automotive, industrial control, and aerospace applications. Macronix and Winbond focus on producing medium-capacity NOR Flash, while GigaDevice, initially entering the market with low-capacity products, is now moving towards the high-end sector. Macronix, Winbond, and GigaDevice are more focused on the consumer electronics application market.

In recent years, driven by the demand for IoT and consumer electronics, especially various emerging applications, NOR Flash has seen a turnaround from its low point. Not only have mid-to-high capacity prices stabilized, but the price decline of low-capacity NOR Flash has also significantly narrowed, especially with the surge in shipments of TWS Bluetooth headsets, bringing enormous opportunities for NOR Flash. This has provided more opportunities for manufacturers focused on consumer electronics applications, particularly GigaDevice, which rose to the top three positions in the industry by 2019.

Source: CINNO

In 2021, GigaDevice further consolidated its industry position.

03

03Driving Forces

Due to the small capacity and high cost of NOR Flash, it was once marginalized by major manufacturers. However, with the rapid development of emerging markets such as 5G, AMOLED, and autonomous vehicles, NOR Flash has regained market attention.

TWS Bluetooth Headsets

Since 2018, TWS Bluetooth headsets have become popular in the consumer electronics market, with statistics indicating that by 2022, the global TWS Bluetooth headset market is expected to exceed 200 billion yuan.

TWS Bluetooth headsets must be equipped with NOR Flash due to their numerous functions, requiring external serial NOR Flash to store more firmware and code programs.

As the functions of TWS Bluetooth headsets continue to increase, more storage capacity is needed. For example, TWS Bluetooth headsets used with Android phones typically use 8Mb or 16Mb of NOR Flash, but as features increase, they may require 32Mb, 64Mb, or even 128Mb.

Statistics show that in 2020, the NOR Flash capacity of the new AirPods increased to 256Mb, while the average NOR Flash capacities in the Android market from 2019 to 2021 were 16Mb, 32Mb, and 64Mb, with corresponding market sizes of 6.75 million, 20.62 million, and 50.99 million USD. Considering the market size of AirPods, the market size for NOR Flash used in TWS Bluetooth headsets exceeded 200 million USD in 2021.

AMOLED

Due to process reasons, AMOLED displays face two major challenges: brightness uniformity and ghosting, which require compensation. Compensation methods are divided into internal and external compensation. Internal compensation is ineffective and struggles to solve ghosting issues; external compensation, however, has advantages such as simple pixel structure, fast driving speed, and a wide compensation range, making it the preferred choice in practical applications.

When using external compensation, an external NOR Flash is required to avoid the issue of blue light from AMOLED panels fading over time. In Full HD scenarios, 8Mb of NOR Flash is needed, while QHD requires 16Mb of NOR Flash.

AMOLED’s increasing prevalence in smartphones has driven the growth in demand for mid-range NOR Flash, achieving a compound annual growth rate of 24%.

TDDI

TDDI stands for Touch and Display Driver Integration, which integrates the previously separate touch IC and display IC into a SoC. As technology continues to optimize, the cost of TDDI chips is decreasing.

Due to the large capacity required for TDDI touch function coding, it cannot be fully integrated into the TDDI chip and requires an external NOR Flash of 4 to 16Mb for storage, assisting TDDI in parameter adjustments.

5G

5G is also a significant driving force for NOR Flash. Currently, the NOR Flash used in 5G base stations is about 1 to 2G, and there are not many manufacturers globally capable of producing such specifications. Currently, over 80% of manufacturers producing 5G base stations place orders for NOR Flash from Macronix.

Automotive Electronics

Due to the better reliability of NOR Flash, mid-to-high capacity NOR Flash is widely used in automotive electronics. It has evolved from the initial need for 1Mb low-end NOR for vehicle broadcasting to 128Mb to 256Mb for central control systems.

According to IHS statistics, the global automotive electronics market reached 160.2 billion USD in 2022, with the fastest growth occurring in ADAS, reaching 21.447 billion USD in 2022, with a compound annual growth rate of 20.27%. Functions such as navigation, driving recording, image processing, and lane departure warning in ADAS systems require 512Mb or higher capacity NOR Flash. The scale and rapid growth of the automotive electronics market will significantly drive the demand for NOR Flash and other memory products.

04

04Market Trends

Overall, before 2018, the demand for NOR Flash was relatively weak, while suppliers’ production capacity was increasing, leading to a downward price cycle for NOR Flash starting in 2018. According to TrendForce data, NOR Flash prices began to rebound in the third quarter of 2019. The revenue growth rates of Macronix, Winbond, and GigaDevice also reflect this trend, with all three companies seeing improved revenue growth rates starting from the second quarter of 2019, and the growth rate in the third quarter continuing to rise, indicating that the NOR Flash market has entered an upward cycle.

It is expected that mid-to-high-end NOR Flash will maintain high price levels in the future, while low-end NOR Flash will see price declines due to the introduction of cost-down series low-priced products and the gradual launch of new production capacities.

05

053D Stacking

In recent years, 3D chips have become the preferred solution in the industry to address the contradiction between increased transistor density and the high costs of advanced process miniaturization, whether in chip manufacturing or packaging, and regardless of whether it is logic chips or memory, there is a shift towards 3D in high-end applications.

Especially in memory, 3D NAND Flash has been widely adopted, with major memory manufacturers investing their primary energy and resources into research and production in this area. In this trend, NOR Flash, which has smaller market capacity than NAND Flash but possesses unique characteristics, is also beginning to develop towards 3D. However, compared to 3D NAND Flash, 3D NOR Flash is still in its infancy, with only leading industry players like Macronix and Winbond making significant investments in R&D, while other manufacturers tend to be more cautious.

Macronix Chairman Wu Minqiu stated that it is becoming increasingly difficult to shrink NOR Flash processes down to 45nm due to substantial cost increases. However, the demand from emerging applications such as automotive electronics and artificial intelligence will drive continuous growth in the NOR Flash market. Macronix has invested in 3D NOR Flash R&D to overcome the challenges of further node miniaturization.

It is reported that Macronix’s innovations in 3D NOR Flash include the investment in vertical 2T architecture and low-power process technology research, achieving higher storage density through 3D stacking, and employing micro heater technology to enhance product durability. The company plans to launch 3D NOR Flash within two years, expected to use 45nm process technology.

Additionally, Macronix has gained a head start in advanced NOR Flash technology for 2Gb and 4Gb, with related samples already released and mass production products expected to follow.

In terms of process technology, Macronix has introduced the AND architecture, an early flash memory circuit technology that provides bit-level access, similar technologies have been applied in the stacking process of Gate-All-Around (GAA) 3D NAND structures.

Like typical 3D NAND flash memory, this 3D NOR stacked cell is formed by drilling holes in multi-layer interlayers of oxide and nitride layers, then filling deep holes. However, Macronix’s experimental architecture is not made of homogeneous cylindrical polysilicon but consists of several different heterojunctions, two of which are N+ doped, serving as the source and drain of multiple stacked transistors, separated by a silicon nitride insulator pillar.

Figure: 3D AND Flash Structure

In the AND structure, each transistor has paired source lines and orthogonal drain connection bit lines. The sources are individually decoded rather than having a common source. Polysilicon “plugs” connect the sources and drains of transistors in each stack.

Initially, Macronix developed this on an 8-layer structure and has completed work on a 34-layer stack, which seems feasible. Macronix believes that beyond 70 layers, their proposed 3D NOR Flash will challenge the 20nm half-pitch two-layer cross-point phase-change memory. Further improvements may come from ferroelectric memory transistors, allowing for lower voltage operations and faster write speeds.

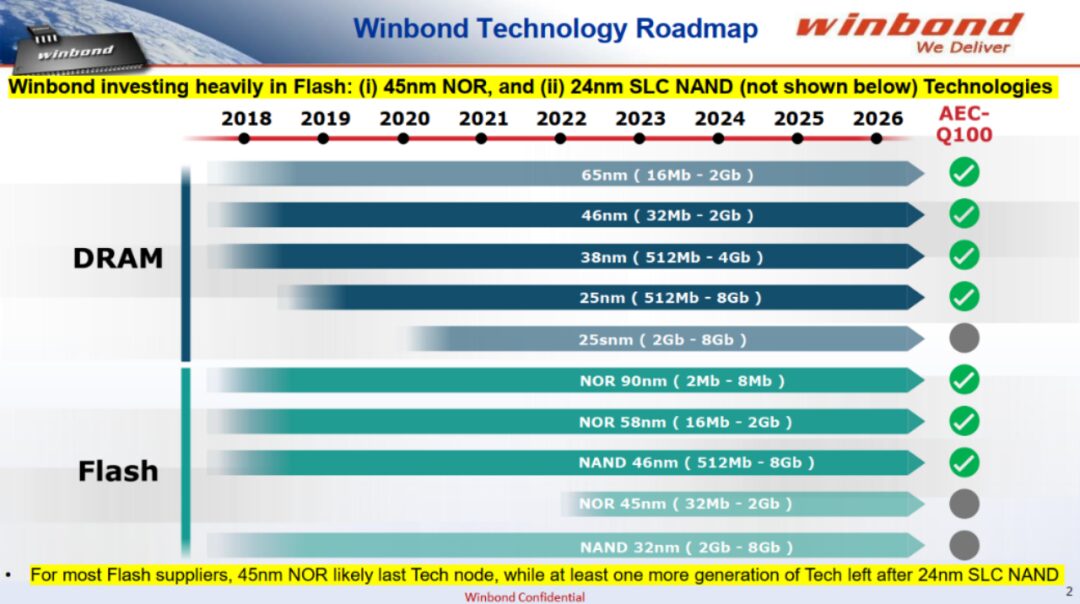

Winbond has also invested heavily in 45nm process NOR Flash, with capacities ranging from 32Mb to 2Gb.

Winbond believes that 45nm is likely the last technology node for NOR Flash, while SLC NAND Flash still has room for process miniaturization, being able to further shrink process technology after 24nm.

Compared to Macronix, Winbond is also investing in advanced NOR Flash but seems to be less aggressive, focusing more on the R&D of advanced process NAND Flash. Since the emergence of 45nm process NOR Flash in 2008, no more advanced process products have appeared, making further process miniaturization very challenging.

06

06Conclusion

Compared to NAND Flash, the advantages of “small but beautiful” NOR Flash are becoming increasingly prominent, and its market demand is growing with the development of various applications.

The increase in market attention and demand has motivated major NOR Flash manufacturers to further increase their R&D investment, making related products and new technology evolution more dynamic.

Market demand is driving the continuous evolution of NOR Flash process technology, with leading companies exploring 3D stacking architecture technology similar to NAND Flash. This holds stronger symbolic significance for NOR Flash, which has a relatively small market capacity. As applications continue to develop, will the market scale of NOR Flash see a significant increase? We shall wait and see.