This article is compiled by Semiconductor Industry Review (ID: ICVIEWS)In the face of the most severe oversupply situation in 2023, industry prices rose nearly 10% in the fourth quarter.

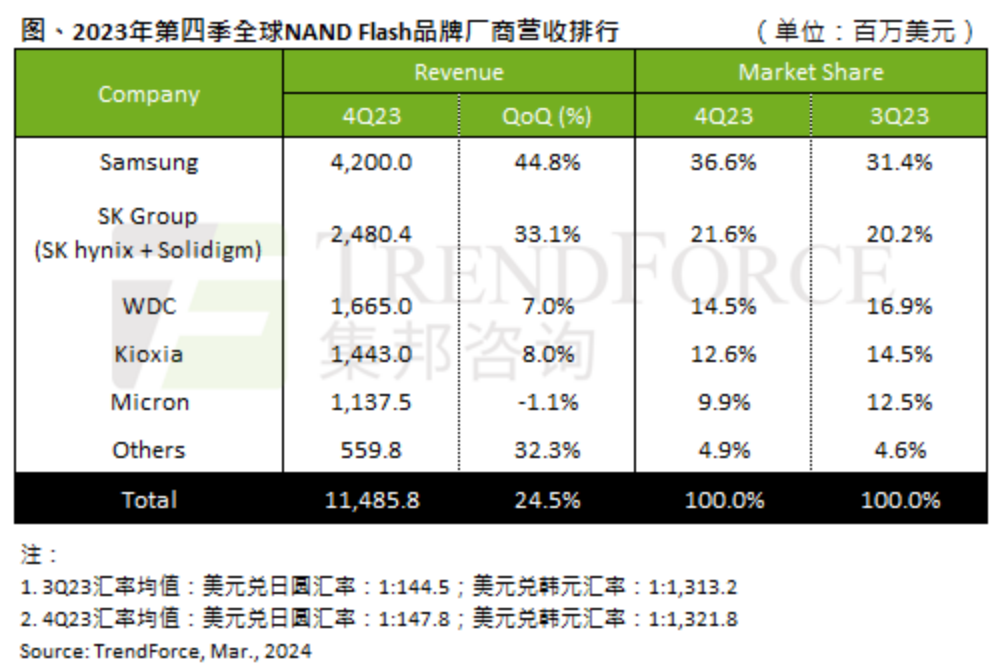

This article is compiled by Semiconductor Industry Review (ID: ICVIEWS)In the face of the most severe oversupply situation in 2023, industry prices rose nearly 10% in the fourth quarter. According to TrendForce, the NAND Flash industry revenue in the fourth quarter of 2023 grew significantly by 24.5% quarter-on-quarter, reaching $11.49 billion. This growth is attributed to stable end-user demand stimulated by year-end promotions, as well as an expansion of component market orders driven by price chasing, resulting in strong bit shipments compared to the same period last year. Additionally, the continued optimistic outlook for demand in 2024 from the enterprise sector and strategic inventory further fueled this growth.

According to TrendForce, the NAND Flash industry revenue in the fourth quarter of 2023 grew significantly by 24.5% quarter-on-quarter, reaching $11.49 billion. This growth is attributed to stable end-user demand stimulated by year-end promotions, as well as an expansion of component market orders driven by price chasing, resulting in strong bit shipments compared to the same period last year. Additionally, the continued optimistic outlook for demand in 2024 from the enterprise sector and strategic inventory further fueled this growth.

Looking ahead to the first quarter of 2024, although it is traditionally a low season, the NAND Flash industry revenue is expected to grow another 20%. This expectation is based on significantly improved supply chain inventory levels and continued price increases, as customers increase orders to avoid potential supply shortages and rising costs. The continued expansion of order sizes is expected to drive average contract prices for NAND Flash up by 25%.Samsung became the focus in the fourth quarter, primarily due to a sharp increase in demand for servers, laptops, and smartphones driving significant growth for Samsung. Although unable to fully meet customer orders, Samsung’s bit shipments increased by 35% quarter-on-quarter, coupled with a 12% increase in average selling price, resulting in revenue of $4.2 billion, a substantial quarter-on-quarter increase of 44.8%. SK Group lagged behind Samsung, with revenue growth of 33.1% to $2.48 billion due to a significant rebound in prices.Western Digital experienced a slight decline in shipments of 2%, but a 10% increase in average selling price led to a 7% increase in NAND revenue, reaching $1.67 billion. Due to the price rebound, retail SSD market shipments increased significantly, with inventory levels dropping to a four-year low. Driven by orders from PC and smartphone customers, Kioxia reported a slight increase in shipments in the fourth quarter, with revenue growing 8% to $1.44 billion. In the face of the most severe oversupply situation in 2023, industry prices rose nearly 10% in the fourth quarter. However, Micron significantly reduced supply to improve profitability, resulting in a more than 10% quarter-on-quarter decline in bit shipments and a revenue decrease of 1.1% to $1.14 billion. Additionally, Micron expects NAND Flash demand growth to reach 15-20% this year, emphasizing the need for continuous capacity adjustments to achieve supply-demand balance and realize the industry’s potential profitability.

Kioxia Increases NAND Flash Capacity Utilization

Kioxia Increases NAND Flash Capacity Utilization

According to Taiwan’s Economic Daily, after the news of Kioxia increasing NAND capacity was released, executives from two downstream manufacturers, Phison and ADATA, expressed their views on this matter.According to previous reports, Kioxia stated that it would reassess its NAND Flash production reduction strategy and will increase its operating rate to 90% within this month.Phison CEO Pan Jiancheng stated that Phison is currently still in a state of shortage, and if NAND Flash manufacturers can provide stable supply at reasonable prices, it would be beneficial for Phison.Additionally, the expansion of production capacity by manufacturers can help restore order in the NAND market: if flash memory prices continue to rise, it will affect downstream manufacturers’ demand, while increased production capacity can stabilize prices.For downstream manufacturers, the existing low-priced NAND inventory will eventually run out, and if prices continue to rise, it will put pressure on procurement costs.ADATA Chairman Chen Libai analyzed that Kioxia may still be in a loss state, so it is necessary to increase capacity utilization. However, even if production capacity is adjusted this month, the increase in NAND shipments will not be seen until June, by which time flash memory shipment prices will have risen to the profit line.Chen Libai stated that ADATA still holds over NT$20 billion (approximately RMB 4.56 billion) of low-priced NAND Flash inventory.

Weak Demand Limits NAND Price Increases

Weak Demand Limits NAND Price Increases

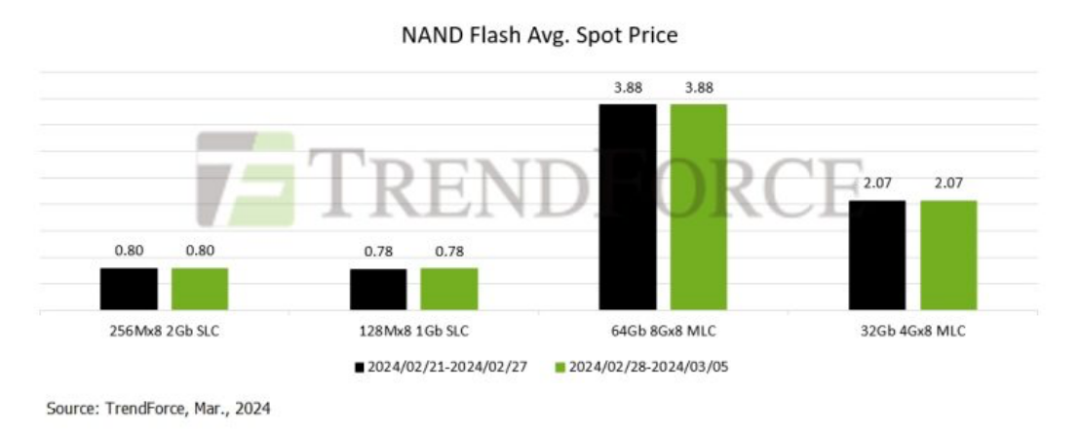

According to the latest spot price report from TrendForce, weak demand limits NAND price increases. Details are as follows:

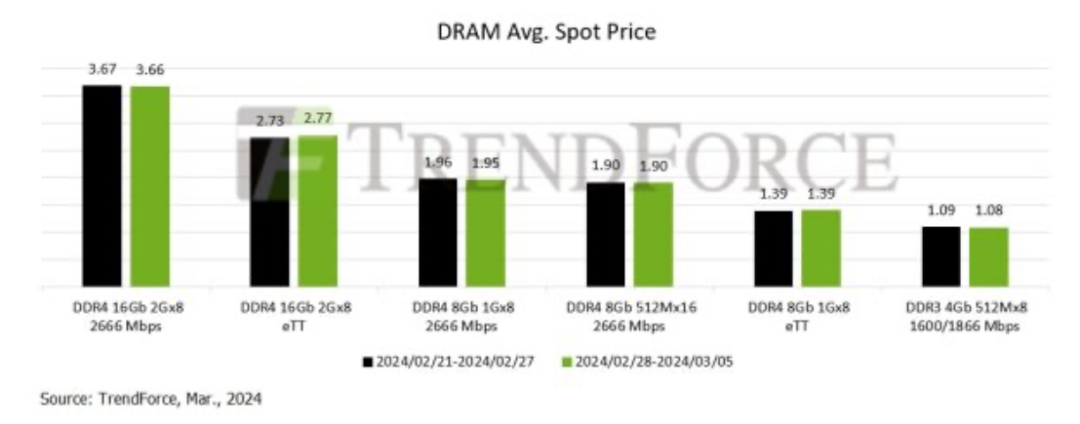

DRAM Spot Market:In the spot market, since the end of the Spring Festival holiday, demand momentum has not been sufficient to further push up prices. Therefore, overall trading volume remains low. Due to the low season, buyers are relatively passive, and component demand is tepid. As for chips, their prices are supported by sporadic transactions. The average spot price of mainstream chips (i.e., DDR4 1Gx8 2666MT/s) fell by 0.41% from last week’s $1.950 to this week’s $1.942. NAND Flash Spot Market:This week, the NAND Flash spot market remains sluggish. Considering the extended sales days, sellers have been actively quoting and providing bargaining space to complete transactions, while buyers are reluctant to act due to dissipating urgent orders and sufficient inventory to meet corresponding demand. Overall, the increase in NAND Flash spot is limited, remaining sluggish. The spot price of 512Gb TLC wafers increased by 4.28% this week, reaching $3.585.

NAND Flash Spot Market:This week, the NAND Flash spot market remains sluggish. Considering the extended sales days, sellers have been actively quoting and providing bargaining space to complete transactions, while buyers are reluctant to act due to dissipating urgent orders and sufficient inventory to meet corresponding demand. Overall, the increase in NAND Flash spot is limited, remaining sluggish. The spot price of 512Gb TLC wafers increased by 4.28% this week, reaching $3.585.

Storage Market Warms Up, HBM Becomes New Favorite

Storage Market Warms Up, HBM Becomes New Favorite

Manufacturers are not only committed to production cuts and price increases but are also competing in the HBM (High Bandwidth Memory) field. HBM is a new type of CPU/GPU memory chip that stacks multiple DDR chips together and packages them with the GPU to achieve a large-capacity, high-bandwidth DDR combination array. HBM can meet the high computing power and large storage needs of the big model era. Therefore, HBM is gradually becoming a key force for storage industry giants to achieve performance reversal during market downturns.Recently, SK Hynix Vice President Kim Ki-tae stated that the company’s HBM is already sold out this year and has begun preparations for 2025. Micron Technology CEO Sanjay Mehrotra also revealed that Micron’s HBM capacity for 2024 is expected to be fully sold out.*Disclaimer:This article is the original author’s creation.The content of the article represents their personal views, and our reprint is only for sharing and discussion, not representing our endorsement or agreement. If there are any objections, please contact the backend.