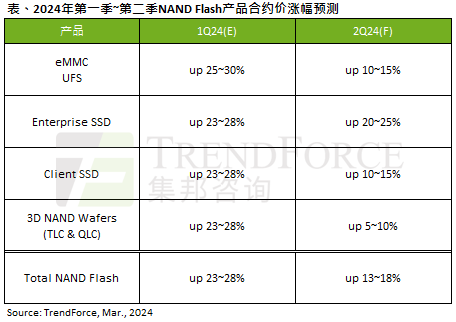

TrendForce indicates that, apart from Kioxia and Western Digital (WDC) increasing their capacity utilization rates since the first quarter of this year, other suppliers have generally maintained a low production strategy. Although NAND Flash procurement volume in the second quarter has slightly decreased compared to the first quarter, the overall market atmosphere continues to be influenced by reduced supplier inventory and production cuts. It is estimated that NAND Flash contract prices will strongly rise by approximately 13-18% in the second quarter.

Regarding eMMC, Chinese smartphone brands are the largest demand source for this wave of eMMC. Due to some suppliers reducing the supply of this category of products, Chinese module manufacturers have significantly increased their shipments. Buyers have begun to expand their adoption of module manufacturer solutions to meet production needs, aiding the further upgrade of technology in Chinese module manufacturers and extending their reach to first-tier customers. In the future, Chinese module manufacturers will be able to continuously increase their eMMC penetration rate among smartphone customers. In light of the sharp rebound in NAND Flash wafer prices, it is estimated that eMMC contract prices will increase by 10-15% in the second quarter.

Regarding UFS, recent demand for smartphones in India and Southeast Asia has shown significant growth, supporting the momentum for UFS orders in the second quarter. Chinese smartphone brands have also increased orders in advance to establish a safe inventory level, thus supporting demand. On the supply side, suppliers are eager to quickly achieve their profit and loss balance goals, so it is estimated that UFS contract prices will increase by 10-15% in the second quarter.

Regarding Enterprise SSDs, benefiting from the rising demand from cloud service providers (CSPs) in North America and China, it is expected that the procurement volume of Enterprise SSDs will grow quarter by quarter in the first half of this year. Due to the low order fill rate (OFR) for large-capacity SSD orders, suppliers still dominate price trends, forcing buyers to accept the possibility of higher supplier prices. At the same time, some buyers are still trying to increase their inventory levels before the peak season in the second half of the year. Therefore, it is estimated that Enterprise SSD contract prices will increase by 20-25% in the second quarter, the highest increase across all product lines.

Regarding Client SSDs, as end sales remain in the off-season, buyers’ stocking strategies have become more conservative, with some PC OEMs even beginning to revise down their 2Q24 stocking orders. Additionally, due to PC brands being unable to reflect the increase in NAND Flash prices on finished products, they have further reduced their order volumes for the second quarter. This rapid price rebound will further suppress the growth of order momentum in the second half of the year. It is estimated that the contract price increase for PC client SSDs in the second quarter will be less than that of Enterprise SSDs, with a quarterly increase of 10-15%.

Regarding NAND Flash wafers, after the Lunar New Year holiday, product sales have continued to weaken, and downstream customers have no stocking demand. However, this wave of price increases has led suppliers to be unable to meet orders from Chinese smartphone brands, resulting in orders being transferred to module manufacturers. Therefore, Chinese module manufacturers are currently maintaining high stocking demand to expand cooperation with smartphone brands. As original manufacturers aim to quickly achieve profit targets, NAND Flash wafer contract prices are expected to continue to rise, but due to weak retail market demand, the increase is significantly lower than in the first quarter, estimated at 5-10% quarterly.

▶ About Us

TrendForce is a global high-tech industry research organization spanning storage, integrated circuits and semiconductors, wafer foundry, optoelectronic displays, LEDs, new energy, smart terminals, 5G and communication networks, automotive electronics, and artificial intelligence. The company has accumulated years of rich experience in industry research, government industrial development planning, project evaluation and feasibility analysis, corporate consulting and strategic planning, and brand marketing, making it a quality partner for government and enterprise clients in high-tech industry analysis, planning evaluation, consulting, and brand promotion.

Scroll up and down to view

Did you find the “Share” and “Like”? Click to see!