Against the backdrop of a structurally imbalanced global supply chain, issues such as inventory and output have led to a decline in the willingness of end customers, especially PC clients, to procure storage chips. In Q4 2021, both NAND Flash and DRAM ASPs from various manufacturers experienced varying degrees of sequential decline, resulting in a decrease in the global storage chip market sales scale for Q4 2021.

However, looking at the entire year, driven by continuous growth in the first three quarters, the global storage chip market sales scale reached $162.4 billion in 2021, a year-on-year increase of 31%.

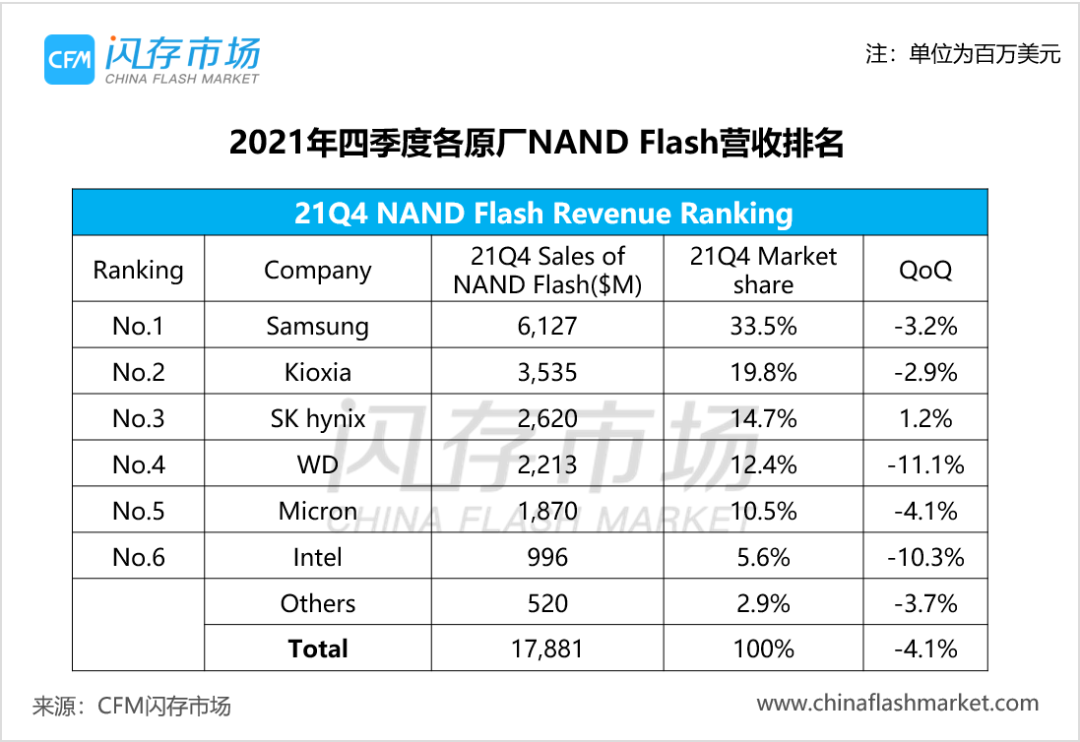

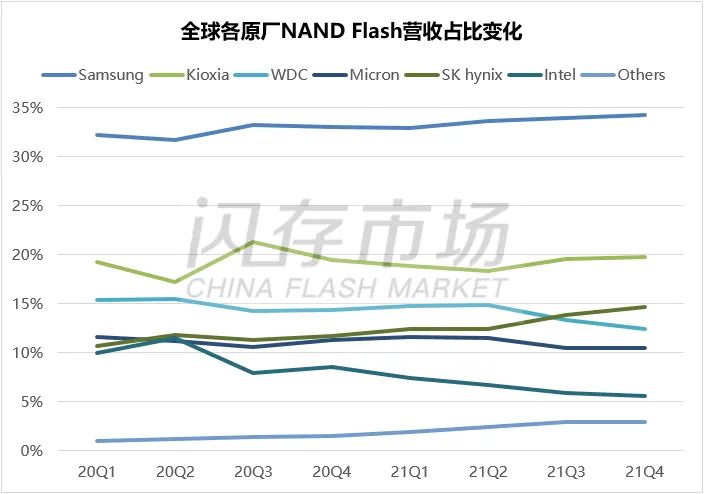

The global NAND Flash market scale reached $17.88 billion in Q4.

Strong demand from data center customers has driven the growth in server SSD shipments. However, due to inventory adjustments by some customers and global supply chain issues, the demand for cSSD has faced some stagnation. Additionally, supply disruptions in AP have led to a slight decline in NAND demand.According to CFM flash market data, the global NAND Flash market scale reached $17.88 billion in Q4 2021, a sequential decline of 4.1%. The total NAND Flash market scale for 2021 reached $67.5 billion, a year-on-year increase of 19%.

Among them,

-

Samsung’s NAND Flash sales revenue in Q4 reached $6.127 billion, a sequential decrease of 3.2%, with a market share of 33.5%;

-

Kioxia’s NAND Flash sales revenue in Q4 reached $3.535 billion, a sequential decrease of 2.9%, with a market share of 19.8%;

-

SK Hynix’s NAND Flash sales revenue in Q4 reached $2.620 billion, a sequential increase of 1.2%, ranking third and being the only manufacturer with a sequential sales increase for the quarter;

-

Western Digital’s NAND Flash sales revenue in Q4 was $2.213 billion, a sequential decrease of 11.1%, with a market share of 12.4%;

-

Micron’s NAND Flash sales revenue in Q4 was $1.870 billion, a sequential decrease of 4.1%, with a market share of 10.5%, ranking fifth;

-

Intel’s NAND Flash sales revenue in Q4 was $0.996 billion, with a market share of 5.6%, ranking sixth.

Note: Due to different fiscal quarter timings, CFM has smoothed Micron’s quarterly revenue.

From the perspective of market share, another significant change is that other manufacturers represented by Yangtze Memory Technologies are gradually increasing their share, having grown from less than 1% in 2020 and 2021 to over 2%.

Source: CFM Flash Market

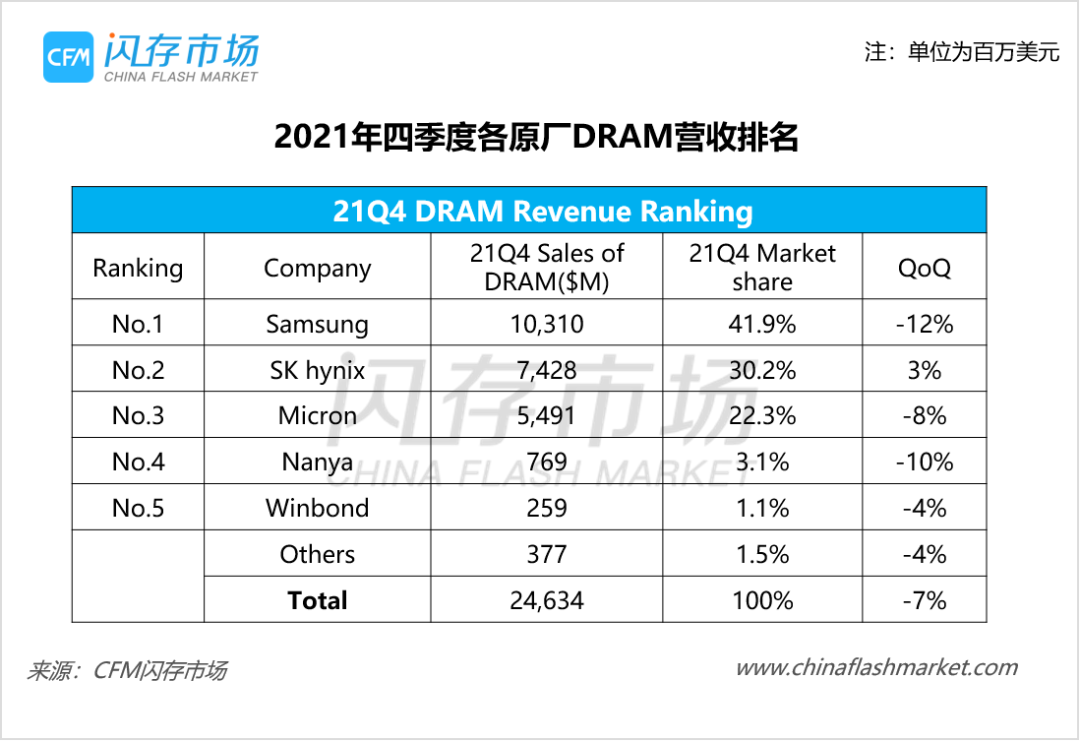

The global DRAM market scale reached $24.63 billion in Q4.

In Q4, server DRAM demand was strong, while PC and mobile were more severely affected by supply chain issues, with PC clients continuously adjusting their inventory. Meanwhile, under the ongoing pandemic, mobile demand for DRAM has been somewhat impacted.According to CFM flash market data, the global DRAM market scale reached $24.63 billion in Q4 2021, a sequential decline of 7%. The total DRAM market scale for 2021 reached $94.9 billion, a year-on-year increase of 41%.

Among them,

-

Due to DRAM bit shipments remaining flat, DRAM ASP declined by 5% sequentially. In dollar terms, Samsung’s DRAM sales revenue in Q4 reached $10.310 billion, a sequential decrease of 12%, with a market share of 41.9%;

-

SK Hynix’s DRAM sales revenue in Q4 reached $7.428 billion, accounting for 30.2%, with a sequential increase of 3%, also being the only manufacturer with a sequential sales increase in Q4;

-

Micron’s DRAM revenue in Q4 reached $5.491 billion, accounting for 22.3%, with a sequential decrease of 8%;

-

Nanya Technology’s DRAM sales revenue in Q4 reached $0.769 billion, accounting for 3.1%, with a sequential decrease of 10%;

-

Winbond Electronics’ DRAM sales revenue in Q4 reached $0.259 billion, accounting for 1.5%, with a sequential decrease of 4%.

Note: Due to different fiscal quarter timings, CFM has smoothed Micron’s quarterly revenue.

Future Outlook: The market should rationally view the price increase signals, with manufacturers focusing their 2022 strategies on servers.

Due to seasonal weakness, most manufacturers hold a neutral attitude towards Q1, expecting a certain degree of sequential decrease in both NAND Flash and DRAM bit shipments, with only SK Hynix being relatively optimistic about NAND Flash bit shipments, mainly due to strong demand from data centers.

Although the recent contamination incident at Kioxia/Western Digital has sounded the alarm for price increases, the market should be more rational and return to fundamentals.

Currently, there are signs of improvement in PC demand, and with the expansion of investments by cloud computing companies, as well as the delayed demand from last year due to supply issues, server demand is supported. However, inventory issues remain a concern. In the mobile sector, due to slowing demand, manufacturers are expected to make some adjustments.In response to the complex changes, manufacturers are expected to focus their 2022 strategies on strengthening server demand.

Latest Recommended Readings:

-

Kioxia’s Q4 revenue hits a new high, and the raw material contamination incident may trigger a new round of NAND Flash price increases.

-

Micron’s inert gas supply statement.

-

Upstream resource supply faces “variables,” with this week’s flash memory prices generally rising, while memory trends are relatively mixed.

-

SMIC: 40nm is the most in short supply this year, and 55nm demand is very high; Toshiba’s Kyushu plant is expected to return to pre-earthquake production levels by mid-March; ASE Investment Holding states that packaging and testing product prices are expected to stabilize…