Smartphones are the largest application market for NAND Flash. In 2015, the demand in the high-end market was primarily concentrated on capacities above 32GB, increasingly shifting towards 64GB, which is the main driver of NAND Flash consumption. However, due to the decline in demand for high-end smartphones, the sales of Samsung Galaxy S6/S6 Edge/Note 5 and Apple iPhone 6s fell below market expectations, leading to an oversupply in the NAND Flash market in the first half of 2015. The peak season in the second half of the year was not robust, compounded by a decline in tablet market demand and ongoing weakness in PC demand, resulting in overall sluggish growth in terminal demand for NAND Flash.

According to data from China Flash Market, the NAND Flash price index fell by as much as 35% in 2015, and DRAM prices also continued to decline due to weak PC market demand. The combination of falling prices and slowing growth in smartphone demand has impacted the revenues of most memory manufacturers.

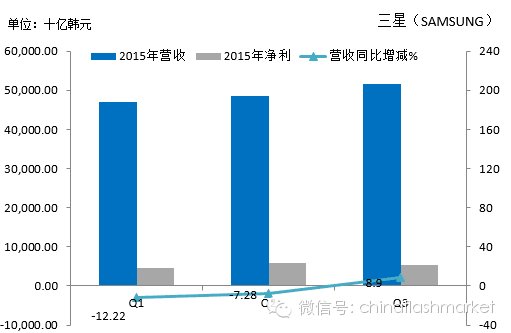

Among them, Samsung has faced a decline in profits from its smartphone business, resulting in eight consecutive quarters of poor performance. In Q3 2015, however, due to strong performance in its semiconductor business, revenue and net profit increased year-on-year, lifting it out of the shadow of poor performance. SanDisk, on the other hand, saw a decline in quarterly revenue throughout the year, while Micron also experienced three consecutive quarters of year-on-year revenue decline, facing similar challenges in revenue growth. Downstream memory module manufacturers such as Transcend and ADATA have seen continuous revenue declines, and packaging companies like SPIL and ASE are also unable to escape the downward trend. Conversely, the controller chip manufacturer Phison has benefited from demand in the eMMC and SSD markets, showing strong monthly revenue performance.

Data Source: China Flash MarketCompiled by ChinaFlashMarket

Data Source: China Flash MarketCompiled by ChinaFlashMarket

Recently, Daxin Securities lowered its forecast for Samsung’s Q4 semiconductor operating profit to 3.1 trillion Korean won, which is 600 billion won less than the original estimate. Although SK Hynix’s Q3 2015 revenue increased year-on-year, its profits significantly declined, with Q4 profit estimates at 1.1 trillion Korean won, indicating a continuous deterioration compared to 2014.

In 2016, original manufacturers will release 3D NAND technology, with 48-layer 3D technology allowing NAND Flash die capacity to increase to 256Gb, while 2D NAND continues to transition to 1znm, and DRAM will also move towards 1xnm. The lower costs will accelerate the continuous decline in prices. Coupled with the impact of the Q1 off-season, the NAND Flash market in the first half of 2016 will likely remain oversupplied, and storage manufacturers will once again face operational challenges.