Recently, with the demand for DRAM exceeding supply and prices continuously rising, the prices of NOR Flash have also been affected. Even major manufacturers have no surplus inventory to release, causing many sourcing efforts to shift to Taiwan.

Macronix Chairman Wu Minqiu stated yesterday that the demand for NOR Flash remains substantial, and Macronix is doing very well in business. This week, he will continue to travel and meet with clients.

NOR Flash capacity is fully booked, resulting in significant shortages

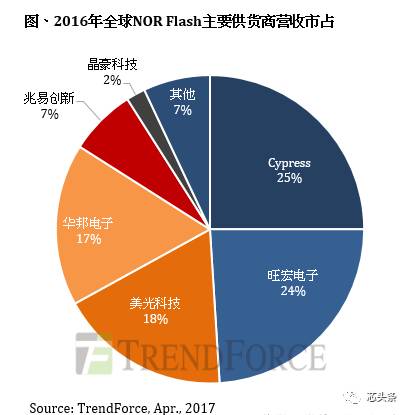

Chairman Wu Minqiu previously mentioned that the capacity for NOR Flash is fully booked, leading to significant shortages. Currently, Macronix’s capacity is at least booked by clients until the end of the year, and NOR Flash prices are expected to grow by at least 10% each quarter. If the capacity of Wuhan Xinxin is affected, orders will inevitably spread to manufacturers such as mainland Zhaoyi Innovation, Winbond, and Macronix, with prices likely to rise again, benefiting NOR Flash manufacturers’ profitability.

He candidly stated that many in the market still do not fully understand the current structural situation of the NOR industry. Macronix is seizing the current boom in NOR while continuing to invest in advanced memory layouts, adding four to five hundred new patents each year to expand its capabilities.

Currently, the capacity for NOR Flash in the market has not increased, while the demand for products such as smartphones using OLED panels, the Internet of Things, and microcontrollers continues to rise. These new applications are creating new demand for NOR Flash in the market. Therefore, Macronix hopes to capitalize on this wave to create more value and profits for the company and its shareholders.

NOR Flash shortage is significant, Wu Minqiu is actively engaging with clients

Regarding the global economic outlook for the second half of the year, Wu Minqiu said that Macronix’s business is currently very good, progressing along a positive trajectory, and the overall environment has little impact. After the Golden Silicon Award, he will continue to travel and meet with clients this week.

In response to strong client demand, Macronix has previously indicated plans to slightly expand capacity, including increasing the 12-inch process from 20,000 wafers per month to 20,400; the overall capacity for 8-inch will not increase, focusing mainly on structural adjustments, doubling the output of 75-nanometer wafers, expected to be completed in the second half of the year.

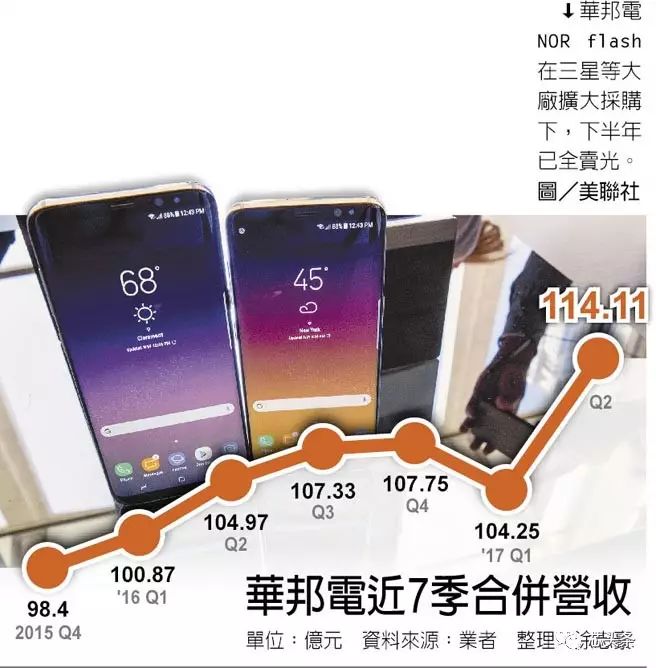

However, Winbond has sold out its entire capacity this year

Strategically, Winbond is fully pursuing orders from major manufacturers. In addition to being adopted by Apple’s MacBook, it is rumored that Apple’s new generation iPhone 8, which features a 5.8-inch AMOLED panel from Samsung, requires external NOR Flash to store states and compensate for the current and brightness of the AMOLED panel. Winbond is the exclusive supplier of NOR Flash.

Winbond currently holds a one-third market share in NOR Flash, with monthly shipments exceeding 200 million units. Although prices are low, it is like rice and meals; without rice, you cannot cook. NOR Flash is still in short supply, with clients queuing for capacity, and prices are showing an upward trend, expected to remain in short supply until mid-next year.

Strong demand directly impacts smartphone shipments

The demand for NOR Flash is so strong that major manufacturers are signing contracts with Winbond to secure capacity to avoid impacting smartphone shipments. It is understood that Winbond’s NOR Flash capacity for the second half of the year has already been fully booked, meaning that all output until the end of the year has been sold out, and the capacity for the first half of next year is also highly sought after.

In the coming quarters, the tight supply situation for NOR Flash will remain unchanged. From the demand side, the three emerging fields of AMOLED, TDDI, and the Internet of Things have a strong demand for NOR Flash products, coupled with the existing basic market not diminishing, making it difficult to resolve the short-term supply-demand imbalance, and prices will continue to rise.

▍Text: Chip Headlines整理, this article is for reference only

Recommended Follow: Chip Headlines (WeChat search “Chip Headlines” to follow, welcome to connect)

↓↓ Click 【Read Original】 for more advantageous part numbers