Unisplendour’s Tongfang Guoxin has proposed a private placement of 80 billion RMB for capital increase aimed at the Flash industry. This capital increase is nearly 60% of the scale of the National Integrated Circuit Industry Investment Fund, indicating a high concentration of capital in promoting the Flash industry. A report from TrendForce’s Tsinghua Unigroup will examine the current status of China’s Flash industry, particularly focusing on the development and opportunities in the Flash chip manufacturing sector. Here, I will share the current status of major Flash wafer manufacturers in China.

(1) Wuhan Xinxin

1. Capacity Status

Wuhan Xinxin is a professional foundry manufacturer, primarily producing NOR Flash and BSI CIS technologies, with a monthly production capacity of 22,000 12-inch wafers. In 2014, the planned capacities for NOR Flash and BSI were 10,000 and 12,000 wafers per month, respectively. Currently, the monthly capacity remains at 22,000 wafers, with a focus on Low Power Logic and NAND Flash products.

2. Human Resources and R&D Support

The innovation and execution capabilities of Wuhan Xinxin’s R&D team benefit from long-term close cooperation with the Institute of Microelectronics of the Chinese Academy of Sciences. In the 3D NAND project, both parties adopted an innovative cooperation model, integrating their experts in R&D projects and human resource management through a corporate platform. This model combines the Institute’s profound theoretical background with Wuhan Xinxin’s rich manufacturing and R&D experience.

3. International Cooperation and Progress

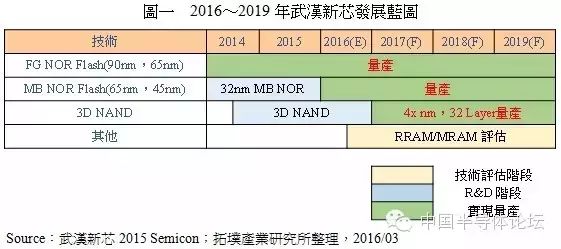

In mid-2014, Wuhan Xinxin successfully advanced NAND technology from 55nm to 32nm in collaboration with Spansion. By the end of 2014, Wuhan Xinxin formed a joint R&D team with Spansion (now part of Cypress) in the memory field to begin R&D work on the 3D NAND project. On May 11, 2015, Wuhan Xinxin announced a breakthrough in its 3D NAND project, with the first storage test chip passing electrical verification of memory functionality. Although no details have been released yet, the goal of this collaboration is to achieve mass production of 32-layer stacked 4x nm 3D NAND by 2017.

(2) SMIC

SMIC is the fifth largest wafer manufacturer globally and the largest in China, primarily focusing on logic IC foundry services. Although it exited the management of Wuhan Xinxin in 2013, it has not been absent from the Flash business.

Before 2014, SMIC had developed a series of special NOR Flash memory production platforms ranging from 130nm to 65nm. On September 10, 2014, it announced that the 38nm NAND Flash memory process was ready.

Although the revenue information publicly disclosed by SMIC shows that the 38nm NAND Flash has not yet made a significant impact on revenue since its launch, SMIC stated that this technological breakthrough indicates important progress in technology diversification, laying a solid foundation for the subsequent development and mass production of more advanced 2x/1x nm and 3D NAND Flash memory. While not as focused on NAND Flash results as Wuhan Xinxin, SMIC’s recent efforts to break through the memory self-sufficiency gap in China may further strengthen its manufacturing capabilities in NAND Flash memory.

(3) Unisplendour Group: Tongfang Guoxin’s Capital Increase

As mentioned above, Tongfang Guoxin’s large-scale capital increase will be invested in Flash R&D and manufacturing.

In this planned project, Unisplendour does not have as complete a technical accumulation as Wuhan Xinxin or SMIC, so it mainly operates through capital and supply chain collaboration.

From the perspective of internal resources and funding in China, there is an opportunity to gain a lead (the investment plan is approximately $18 billion, which is significantly larger compared to SMIC’s 2015 Capex of about $1.5 billion and an estimated $2.1 billion in 2016). This is a major advantage for Unisplendour, but the risk lies in how to ensure that technology and mass production capabilities can align with funding without technical support.

Compared to leading international companies like Samsung (with a 2015 Capex of about $13.5 billion and an estimated $11.5 billion in 2016), this $18 billion investment over two years still lags behind Samsung’s two-year investment. Ensuring that Unisplendour’s investments achieve the same effects as those of leading manufacturers will be the biggest challenge for successful investment. Without existing operational support, if production capacity cannot be smoothly established, how to maintain the factory’s monthly production capacity of 120,000 wafers will be a problem. How Unisplendour can overcome the acquisition and licensing of production technology will be the most critical aspect of the entire investment.

(4) Foreign Wafer Manufacturing Enterprises in China: Samsung and Intel

1. Samsung’s Xi’an Flash Factory Increases Capacity to 100,000 Wafers per Month

Currently, Samsung’s investment in China is the most advanced. By the end of 2015, Samsung’s total investment in the Xi’an factory exceeded $5 billion, with a production capacity reaching 80,000 wafers per month. Samsung is deploying the most advanced 3D NAND Flash process in Xi’an, with plans to further increase capacity to 100,000 wafers per month by the end of 2016.

2. Intel’s Dalian Factory Transitioning to 3D NAND Flash Production

Intel announced an investment of $5.5 billion to convert its original 65nm production line in Dalian into a 3D NAND Flash factory with a monthly capacity of 30,000 wafers. It is expected to invest $1.5 billion in 2016, with production starting in the fourth quarter of 2016, estimating a monthly capacity of 10,000 wafers.

With Samsung and Intel’s capacity building in China’s NAND Flash sector, it is estimated that by the fourth quarter of 2016, the total capacity will reach 110,000 wafers per month, accounting for approximately 7.6% of global NAND Flash wafer shipments. Considering the higher bit output of 3D NAND, along with the progress of Chinese manufacturers, the share of NAND bits produced in China may reach 10% globally by 2017.

(5) TRI’s Perspective

Wuhan Xinxin successfully advanced NAND technology to 32nm in collaboration with Spansion in 2014. In May 2015, Wuhan Xinxin announced a breakthrough in its 3D NAND project in collaboration with Spansion, making it the fastest progressing manufacturer in China’s NAND Flash industry.

SMIC announced in September 2014 that the 38nm NAND Flash memory process was ready. Although it is not as focused on NAND Flash results as Wuhan Xinxin, this technology still lays the foundation for the subsequent development and mass production of more advanced 2x/1x nm and 3D NAND Flash memory.

Unisplendour Group’s financial resources are a major advantage in the competition related to Flash, but without existing operational support, how to overcome the acquisition and licensing of production technology will be the most critical aspect of the entire investment.

In terms of international investment, Samsung and Intel’s capacity building in China’s NAND Flash sector is estimated to reach 110,000 wafers per month by the fourth quarter of 2016, accounting for approximately 7.6% of global NAND Flash wafer shipments.

The characteristics of NAND Flash products, the demand for 3D NAND, the growth potential of emerging markets, and the investments of international semiconductor giants in China provide opportunities for the development of China’s NAND Flash manufacturing industry.

Article Recommendations, Business Cooperation: WeChat ID iccountry