In 2016, the transition from 2D to 3D technology by flash manufacturers led to a tight supply of NAND Flash throughout the year. By the end of the year, the price of NAND Flash per GB had risen back to the levels seen at the end of 2014. It is expected that the market will continue to experience shortages of NAND Flash in 2017 until manufacturers can release 3D NAND resources.

Intel issued a memorandum titled “Intel SSD Supply Health Information” to its partners, stating that “the supply of SSDs is expected to remain very tight throughout 2017, forcing Intel to prioritize the production of SSDs for the rapidly growing data center applications over low-cost consumer SSDs. It also noted that the SSD and NAND Flash industry is experiencing supply tightness across all markets.“

Some custom system manufacturers and solution providers have reported feeling the pressure from the tight SSD supply. To avoid shortages, they are not only purchasing Intel SSDs but also considering enterprise SSDs from Micron and Samsung. The tight supply of SSDs has already affected shipments to major customers, and delays are not limited to just one or two manufacturers; this has become a widespread issue across the industry.

After a year of transition, the 3D NAND technology from flash manufacturers has improved to 64 layers, with Samsung’s Fab 18, Toshiba’s Fab 2, Micron’s Fab 10x, and SK Hynix’s M14 all set to begin 3D NAND production. Intel SSDs are actively transitioning to 3D NAND or 3D Xpoint, and Intel’s memorandum also stated, “We encourage customers to certify and update to 3D NAND products immediately and to forecast your needs with Intel.”

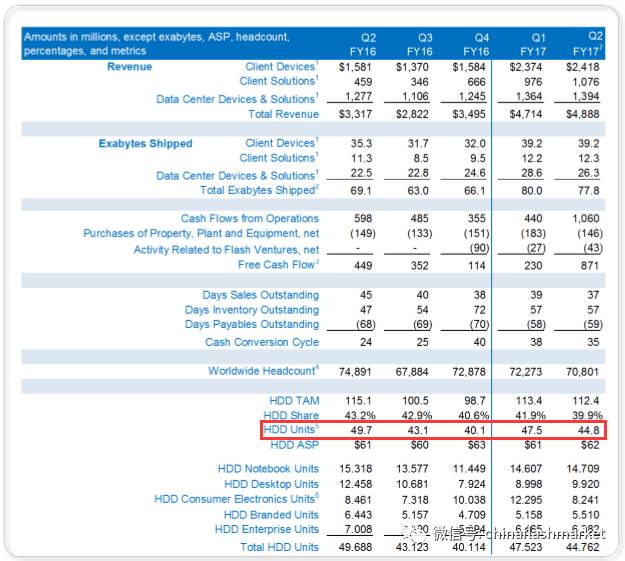

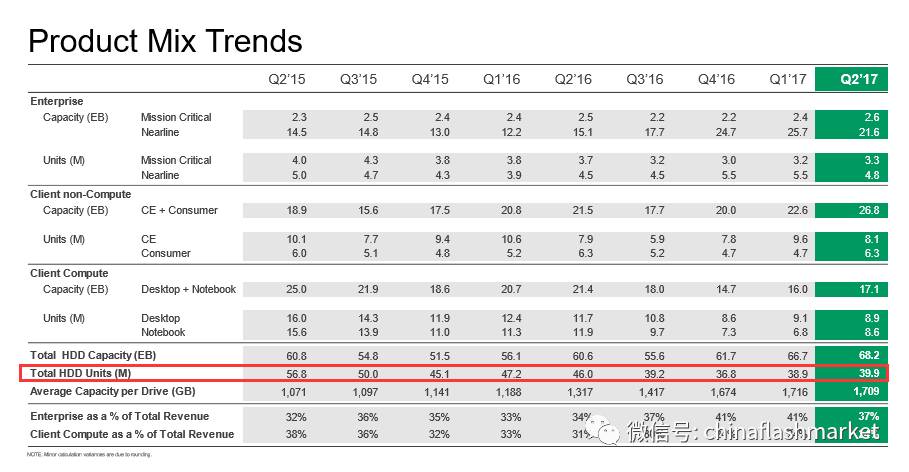

Further analysis from China Flash Market indicates that global shipments of consumer SSDs exceeded 110 million units in 2016, with expectations to surpass 130 million units in 2017. In contrast, the HDD market saw the largest hard drive manufacturer, Western Digital, ship 176 million HDDs in 2016, a 14% decline from 2015, while Seagate shipped 155 million HDDs, an 18% decline from 2015. SSDs are gradually capturing market share from HDDs.

▲ Western Digital HDD Shipments

▲ Seagate HDD Shipments

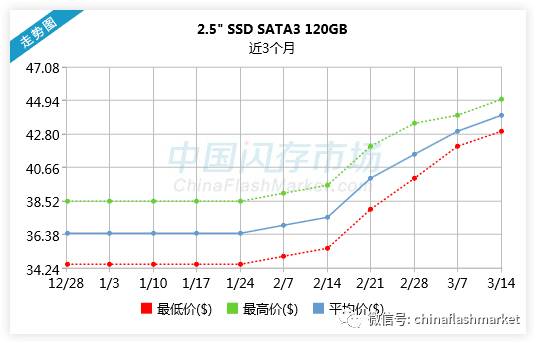

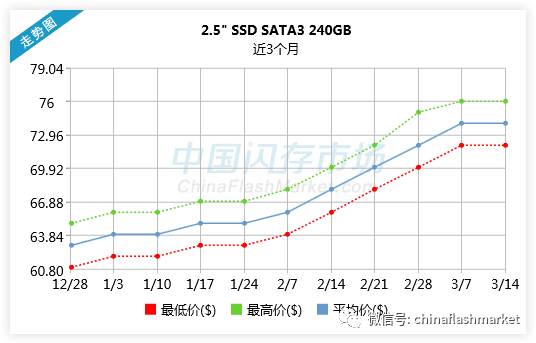

However, due to the ongoing tight supply of NAND Flash, prices for related NAND Flash products, including SSDs and eMMCs, continue to rise. According to China Flash Market, since the price increase in Q2 2016, the price of a 120GB SSD has risen to $45, an increase of 80%, while the price of a 240GB SSD has risen to $75, an increase of 71%.

Due to the significant and prolonged price increases of SSDs, the SSD market experienced a phenomenon of price inversion in the first quarter of 2017 (where procurement prices exceed sales prices). Demand for 240GB capacity has noticeably weakened, with some customers even shifting to 64GB smaller capacities combined with HDDs, leading to a recent downturn in the consumer market.

In contrast, in the SSD data center sector, the demand for SSDs in the server market has increased, and with higher profit margins compared to the consumer market, manufacturers like Samsung and Intel are prioritizing NAND Flash production to meet enterprise SSD demand.

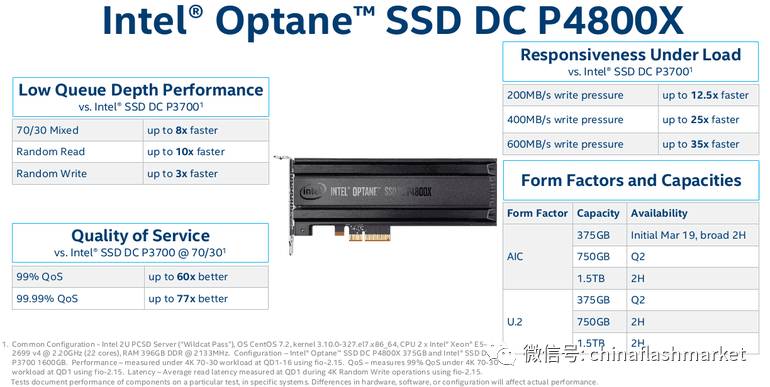

Recently, Intel launched the Optane P4800X series SSD based on 3D Xpoint technology, primarily targeting high-performance, high-capacity storage requirements in data centers and enterprise servers. The 375GB capacity has already been shipped, with a 750GB capacity set to launch in the second quarter and plans to increase to 1.5TB in the second half of the year. To optimize their data storage systems, Tencent and Alibaba have also announced that they will deploy Intel’s latest 3D Xpoint technology in their cloud services, SSD cloud disks, and databases.