-

In the fourth quarter of 2019, demand from data centers was strong, and supplier inventory decreased.

-

In the first quarter of 2020, revenue performance remained flat compared to the previous quarter amidst a situation of reduced volume and increased prices.

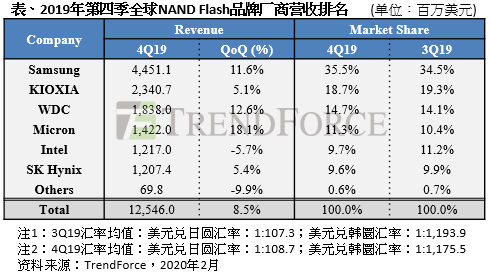

According to a survey by TrendForce’s Semiconductor Research Center (DRAMeXchange), benefiting from the growth in data center demand, the overall bit shipment volume of NAND Flash increased by nearly 10% quarter-on-quarter in the fourth quarter of 2019. On the supply side, the power outage at Kioxia’s Yokkaichi plant in June affected supply, leading to a supply-demand imbalance that caused contract prices to stop falling and rebound. Overall, the industry’s revenue in the fourth quarter grew by 8.5% compared to the third quarter, reaching $12.5 billion.

Due to better-than-expected demand performance in the fourth quarter, supplier inventory levels have returned to normal, leading to a reduction in the supply of wafers to the channel market, with a focus on higher-margin product shipments.

Looking ahead to the first quarter of 2020, considering the potential impact of the pandemic on the supply chain of consumer electronics such as smartphones and laptops, there may be a slight decline or flat performance in NAND Flash bit shipments. However, given the increase in contract prices, industry revenue is expected to remain flat compared to the previous quarter.

Samsung Electronics

Due to the rapid growth in data center demand in the fourth quarter of 2019, the supply-demand imbalance for SSDs intensified, driving Samsung’s bit shipments to increase by nearly 10% quarter-on-quarter. The average selling price also grew, primarily due to contract price increases and a significant reduction in supply to the channel market. With both price and volume increasing, fourth-quarter NAND Flash revenue reached $4.451 billion, an 11.6% increase from the previous quarter.

On the capacity side, Samsung will continue to reduce the capacity of its Line 12 planar process in 2020, with the main expansion coming from the second phase of its Xi’an factory. Although there are concerns about the expansion schedule due to the pandemic, it is still proceeding as originally planned.

SK Hynix

Benefiting from the growth in demand from smartphones and data centers, SK Hynix’s bit shipments increased by 10% quarter-on-quarter in the fourth quarter of 2019. However, due to the higher capacity of the shipped products, despite the increase in contract prices, the average selling price remained flat, resulting in overall revenue of $1.207 billion, a 5.4% quarter-on-quarter increase.

On the capacity side, due to the reduction of planar process capacity in favor of 3D NAND, it is expected that capacity by the end of 2020 will decline compared to the beginning of the year. In terms of architecture, it is expected that 128-layer products will officially enter mass production in the first quarter of 2020, and QLC product planning will be seen for the first time this year. However, due to the focus on mobile device product mix, it is expected to take longer to introduce QLC SSD applications to relevant customers.

Kioxia

With capacity recovering from the power outage incident and the growth in demand for data center and PC SSDs, Kioxia’s bit shipments grew by nearly 10%. The tightening supply-demand situation led to an increase in contract prices for various products, driving the average selling price up by about 5%. Financially, the power outage only affected operations in the third quarter, with no related adjustments in the fourth quarter, resulting in overall revenue of $2.341 billion, a 5.1% increase from the previous quarter.

In terms of capacity expansion, the K1 plant in Iwate Prefecture will start contributing output in the first half of 2020 for the production of 96/112-layer products. However, the new capacity is mainly used to compensate for the capacity loss due to the layer increase at the Yokkaichi plant, so the overall wafer input scale remains unchanged.

Western Digital

With a surge in demand for data center SSDs and the stocking of new Apple devices, Western Digital’s bit shipments increased by 24% quarter-on-quarter in the fourth quarter of 2019. However, the average selling price decreased by about 8% due to product mix issues, resulting in fourth-quarter NAND Flash revenue of $1.838 billion, a 12.6% increase from the previous quarter.

On the capacity side, Western Digital continues to invest in the K1 plant in Iwate Prefecture, but the new capacity at the K1 plant is mainly to compensate for the capacity loss due to process or generation transitions at the Yokkaichi plant, so the total capacity plan has not increased.

Micron

Continuing the momentum from the third quarter of 2019 in mobile devices, Micron’s MCP product shipments continued to rise, benefiting from strong demand from SSDs, with bit shipments increasing by nearly 15% quarter-on-quarter in the fourth quarter of 2019. Due to rising market prices and improved product mix, the average selling price also increased slightly, resulting in overall revenue growing by 18.1% compared to the previous quarter, reaching $1.422 billion.

On the capacity side, Micron’s capacity planning for 2020 is conservative, with the cleanroom space in the new factory in Singapore mainly used to maintain existing capacity levels. Micron will focus on new processes and architectures this year, with 128-layer products expected to enter mass production in the second half of the year.

Intel

Intel also benefited from strong demand from data centers. Due to customers pulling orders early, Intel’s bit shipments increased by over 50% in the third quarter, but in the fourth quarter of 2019, they could only respond with production line capacity, leading to a decline of over 10% in bit shipments. The average selling price increased by over 10% due to shortages, with quarterly revenue of $1.217 billion, a 5.7% decline from the previous quarter.

In terms of capacity and processes, Intel’s Dalian plant maintains its existing capacity, and is currently less affected by the pandemic; in terms of processes, it will continue to invest in the development of 144-layer products, with mass production expected in the second half of 2020.

About TrendForceTrendForce is a global high-tech industry research organization spanning storage, integrated circuits and semiconductors, optoelectronic displays, LEDs, new energy, smart terminals, 5G and communication networks, automotive electronics, and artificial intelligence. The company has accumulated years of rich experience in industry research, government industry development planning, project evaluation and feasibility analysis, corporate consulting and strategic planning, and brand marketing, making it a quality partner for government and enterprise clients in high-tech industry analysis, planning evaluation, consulting, and brand promotion.Research report inquiries: 0755-82838930-2101For business cooperation, please add WeChat:18128855903 (Linna)To join the TrendForce Semiconductor Group, please add WeChat:DRAMeXchange2019

Note:The above content is original from TrendForce and is prohibited from being reproduced, excerpted, copied, or mirrored. For reprints, please leave a message in the background to obtain authorization.

Cover image source:Photo Credit