Connection is a movement of entropy reduction; the more connections there are, the more interactions occur, leading to more innovation, richer value, and enhanced experiences. This is a fundamental development trend of demand and an inevitable law of ecosystem formation.

Big Connectivity: From Voice and Data to IoT

Over the past 30 years, communication connection technology has evolved from analog to digital, gradually reaching its conclusion. The 3G construction that began in 2000 and the 4G upgrades that started in 2010 have gradually transitioned communication from a voice-centric model to a new model primarily based on data traffic, where voice and messaging services are increasingly replaced by IP-based innovative applications from the internet OTT.

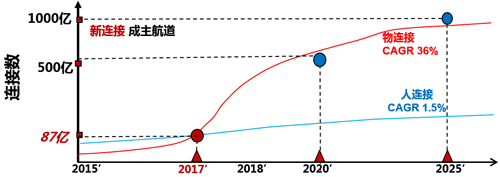

Figure 1: IoT Industry 2017 “Turning Point” – Connections of Things Surpassing Human Connections

When human connections exceed a penetration rate of 70%, the connections of things begin to sprout and develop. In 2017, the number of M2M connections of things will surpass human connections for the first time, becoming a new form of connectivity that will reshape the forms of communication networks, operations, businesses, and services.

Masayoshi Son of SoftBank predicted at the 2017 Mobile World Congress that in the next 30 years, each person will connect to more than 100 nodes of things. In the next five years, connections of things will exceed 50 billion, and in the next ten years, they will surpass 100 billion. By 2035, there will be 1 trillion IoT chips globally, bringing massive opportunities for terminal devices (data generation), cloud (data analysis), and artificial intelligence. The era of big connectivity has begun.

In June 2016, the NB-IoT standard was officially released globally. At the same time, $1 IoT chips began to emerge in the United States; 4G networks represented by LTE became widely popular, with a penetration rate exceeding 20%. The conditions for large-scale deployment and application of IoT have gradually accumulated to a critical point. The year 2017 will be a breakthrough year for IoT.

Business & Network Reconstruction: Horizontal Diversification + Vertical Specialization

The diversification of IoT application scenarios drives the reconstruction of business, network, operations, and business models. Diversification is reflected in horizontal coverage across various industries and vertical satisfaction of different specialized needs. The business scenarios of IoT are elastic, instantaneously changing, and infinitely extendable, requiring networks and platforms to possess capabilities that include breadth, depth, speed, latency, cost-effectiveness, and security.

In addition to human connection scenarios, connections of things encompass even more scenarios. For example, in the case of autonomous driving, the latency requirement is at the millisecond level, and the transmission speed must reach 10Gbps to ensure that self-driving cars do not have accidents. Therefore, 5G is currently the main network choice, and the network needs to allocate resources based on business priorities; SDN/NFV is an inevitable trend. To ensure transmission and latency pressure under continuously growing capacity, the network must build a CDN from the “top down,” achieving a transformation from cloud computing to fog computing, and integrating cloud management is also an important trend.

Diverse access terminals and near-field access technologies pose new challenges for network normalization and intelligent services. New integrated gateways gather various access technologies and terminals, becoming a key focus for edge reconstruction. Furthermore, the enthusiastic discussions on security issues at the 2017 Mobile World Congress have once again raised new requirements for IoT security strategy management.

Operations & Business Reconstruction: Beyond Connectivity, Monetizing Platforms and Applications

The complexity of IoT networks and businesses is growing exponentially, requiring a new type of operational platform and model driven by data insights and intelligent algorithms. This is similar to the cloud/big data platforms of internet companies, referred to as “intelligent middle platforms.” In business, the core of IoT is the application innovation that generates new value, while operators’ strengths lie in connectivity. Initially, they need to monetize connectivity and data by bundling applications. In the long run, platforms will control user flows, data flows, and the ecosystem of data platforms and application innovations will bring in capital flows, which is the goal of future business model evolution.

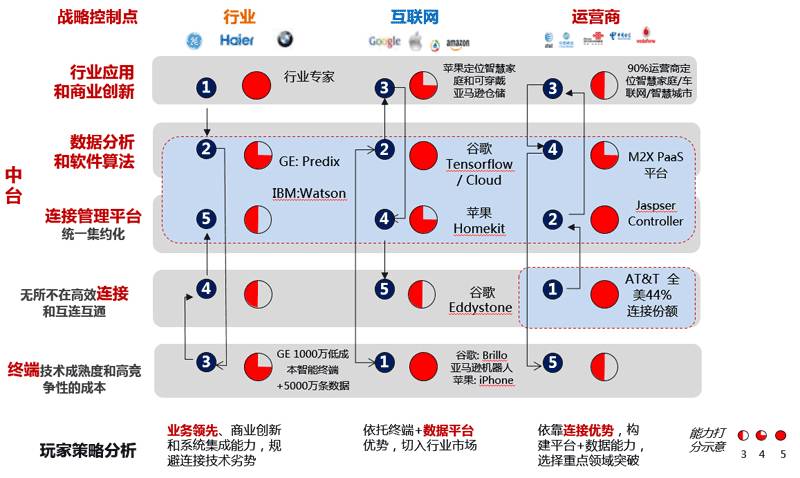

IoT Strategic Path and Competitiveness: Business, Enablement, Connectivity

The development focus of IoT lies in three areas: vertical industries, with leaders including GE, BMW, and Haier; internet OTT, with leaders including Google, Amazon, and Alibaba; and the telecom sector, with leaders including AT&T, China Mobile, and Vodafone. The strategic positioning and evolution paths of each field differ, but they all follow the same rule: “long board synergy, distant engagement with close attacks.”

Vertical Industries: Leading Specialized Businesses

Industry leaders build and consolidate their professional leadership by deeply and modularly absorbing IoT, cloud, big data, and internet technologies based on scenario demands, achieving automation and intelligence in connectivity, business, and operations, thus becoming industry leaders. For example, the practices of BMW and Bosch have pioneered the European Industry 4.0 industry standard and secured a leading position; GE monitors and analyzes 50 million data points from 10 million sensors across trillions of devices daily through the Predix platform, realizing new IoT applications. These cases indicate that the core competitiveness of IoT in the future will be precisely the specialization of business.

Internet OTT: Leading in Data/Intelligence

Internet companies’ leading position and capability accumulation in big data, cloud, and internet enabling technologies have allowed them to demonstrate strong disruptive and substitutive capabilities when entering general business areas, such as logistics, retail, and access control IoT service innovations. Companies like Google and Amazon are also elevating their enabling capabilities from simple data analysis to specialized intelligence, combining professional capabilities to innovate intelligent applications that transform traditional industries. Alibaba’s prominent “5 New” is a concentrated embodiment of this strategy. Specialization is both the direction of internet companies’ IoT business and service innovation and their Achilles’ heel.

Telecom Operators: Leading in Connectivity

Globally leading operators have a long board in IoT, which is their connectivity network. China Mobile, AT&T, and Verizon have made NB-IoT and 5G the core of their big connectivity strategies. In 2013, AT&T launched the Digital Life smart home service centered on intelligent security, transitioning from home IoT to vehicle networking, operating on the M2X capability open platform, aiming to have one-third of the vehicle networking in the U.S. based on AT&T’s network platform. China Mobile has launched a 2020 strategy centered on big connectivity, relying on its strong connectivity advantages and the OneNet IoT platform (which has connected over 5.6 million devices, with more than 27,000 developers and over 10,000 applications), taking the lead in laying out the ecosystem of the Internet of Everything. Vodafone has transformed from selling SIM cards to selling services, achieving regional expansion and value extension.

These practices demonstrate a universal truth: operators cannot form a profitable model solely based on connectivity. They must build a data-driven platform on top of connectivity to support and accelerate operational innovation. Platform monetization and application monetization are the directions for operators to explore successful business models in IoT.

Figure 2: Strategic Benchmarking – Three Types of Strategic Paths

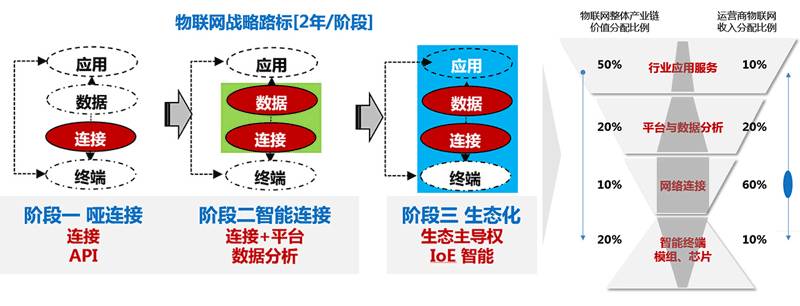

IoT Strategic Evolution Roadmap: From Connectivity to Data and Applications

IoT is a very complex ecosystem that horizontally covers all industry fields and vertically spans all links from endpoints, networks, data, to cloud applications. The IoT strategy first involves horizontally selecting and determining the main attack scenarios, followed by vertically building capabilities, competitiveness, market patterns, and realizing profit models. Overall, the evolution of telecom operators’ IoT strategy can be divided into at least three stages, described as follows.

Operators have advantageous long boards and comprehensive competitive capabilities in horizontal industry scenarios, mainly including digital homes, smart cities (security), and vehicle networking, which can combine operators’ connectivity advantages with telecom-grade security, reliability, localization, and end-to-end service advantages. Vertically, operators need to follow the principle of building long boards based on advantages, focusing on constructing connectivity networks first, and gradually building data capabilities and developing application innovation platforms to promote ecological application innovation.

Figure 3: IoT Three-Step Strategy – “Diamond” Assault

Stage One: Connectivity is King

In the early stages, the strategic focus of operators is undoubtedly to build a strong IoT connectivity network, primarily creating a network with full coverage based on NB-IoT, expanding LTE connectivity to connections of things, piloting 5G applications in IoT, and simultaneously attempting to integrate near-field IoT networks supported by Bluetooth, WiFi, Zigbee, and other connection technologies. The focus of strategic cooperation is to achieve collaboration with leading IoT application innovation service providers through APIs to open up network capabilities, support operational innovation, and quickly achieve breakthroughs.

Stage Two: Data is King

As the leading position of the network is gradually established, operators will face new bottlenecks and business innovation opportunities based on the complexity and diversity of IoT scenarios. In this stage, operators should build an integrated network based on intelligent middle platforms, achieving a transformation of the connectivity network from “dumb to smart,” creating a data platform for intelligent operations based on network development to support business innovation and precise, efficient customer service.

Stage Three: Applications are King

The strength and scalability of the data platform will enable operators to build an application aggregation platform. Similar to the APP Store in the mobile internet field, operators will support and trigger business and service innovations across various industries based on the IoT Store. Ecological innovation will become a new strategic control point for operators.

The ultimate strategic vision for operators is to achieve a “diamond” positioning on the “inverted trapezoid” value view of IoT, ensuring control points for data platforms and business innovations, and realizing long-term premium monetization of network connectivity.

The IoT will reach a turning point in 2017. Operators need to rely on their advantages, identify strategic control points, gradually build long boards and strategic control points in the new ecological field, and achieve innovation and successful transformation in the IoT field, welcoming another wave of new blue oceans following the consumer internet, family internet, and industrial internet.