China Flash Market Network | Analysis Report

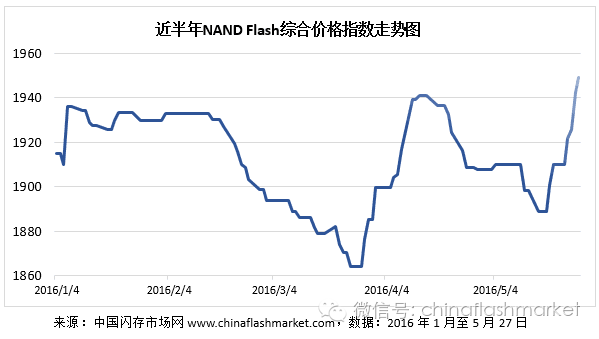

In the first half of 2016, the upstream Flash manufacturers faced challenges with the mass production of 3D technology and production line transitions, resulting in limited output of 3D NAND and reduced capacity supply of 2D NAND. In late March, driven by the stockpiling of Apple’s iPhone SE and strong demand for SSDs, the NAND Flash market experienced its first wave of price increases, with the comprehensive price index for NAND Flash rising by 4% in a short period, breaking the traditional off-season norms.

As the peak season approaches, to meet the growing demand for SSDs and the need for high-capacity embedded solutions in mid-to-high-end smartphones, Flash manufacturers have reduced the number of wafers supplied to the market and increased prices by 15%. In late May, NAND Flash prices rose again. Among them, the prices of memory cards increased first, and the prices of eMMC/eMCP have also clearly stopped falling. There are reports in the market of price increases for low-capacity products such as 4GB-16GB eMMC and 4+4/8+4/8+8 eMCP, indicating that the NAND Flash market has entered a state of tight supply ahead of schedule.

Upstream Flash Manufacturers Report Poor Q1 Revenues; Profitability is the Core Task for FY 2016

In the past two years, Flash manufacturers have been continuously reducing NAND Flash costs. Coupled with the slowdown in global smartphone growth, declining tablet shipments, and persistent weakness in PC demand, the NAND Flash price index has dropped by more than 60%, putting pressure on the operations and profitability of Flash manufacturers and the entire supply chain.

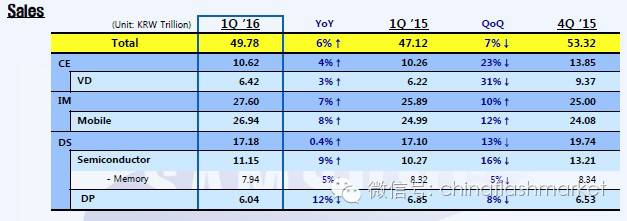

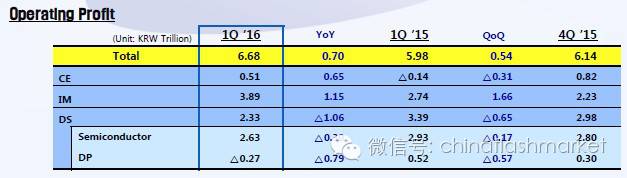

In Q1 2016, although Samsung’s revenue and operating profit increased by 5.6% and 12% respectively, Memory revenue fell by 4.6% year-on-year, and semiconductor operating profit dropped by 10.2% year-on-year, primarily due to falling prices in the DRAM and NAND Flash markets, which reduced product profitability. Samsung stated in its financial report that it will expand sales of V-NAND server SSDs and other high-density products while increasing shipments of 14nm process technology products to improve profitability.

Samsung Q1 2016 Revenue Table

Toshiba fell into financial crisis in 2015, with a net loss of 710 billion yen as of March 2016, which also led to a significant drop in its stock price, falling by more than 40%. To improve its financial situation in 2016, Toshiba sold its white goods and medical businesses, and in NAND Flash, it is not aiming for market share but focusing on product profitability. It has notified key customers that it will no longer supply low-capacity NAND Flash product lines and will raise prices on some products to achieve its plan of turning losses into profits, targeting a net profit of 40 billion yen for FY 2016 and 100 billion yen for FY 2018.

Micron’s Stock Performance Over the Past Year

SanDisk, Micron, and SK Hynix are also facing challenges in improving operational profits. SanDisk’s Q1 revenue was $1.366 billion, only a 3% year-on-year increase, and an 11% quarter-on-quarter decline. After being acquired by Western Digital, it may face a series of structural adjustments. Micron’s Q1 financial report showed a 30% year-on-year decrease in revenue, with a loss of $97 million, and its stock price has dropped by more than 60% over the past year; SK Hynix’s Q1 revenue fell by 24% year-on-year, with net profit down 65% year-on-year, primarily due to the cost advantages of 21nm Mobile DRAM contributing to the SK Hynix Group, while NAND Flash is at a loss.

Samsung’s 48-Layer 3D NAND Certified by Apple, Accelerating Mass Production

With poor financial performance in Q1, upstream Flash manufacturers are seeking better production efficiency and cost competitiveness. Samsung is not only gradually switching its 2D NAND process from 16nm to 14nm for mass production but is also transforming its 16nm 2D NAND production line at the Hwaseong Fab16 in Korea into a 20nm 48-layer 3D V-NAND line, expected to be completed in Q2.

Based on the performance and capacity advantages of 3D NAND, Samsung’s 3D V-NAND capacity will primarily be used for rapidly growing and high-profit SSDs, as well as for producing 256GB high-capacity UFS 2.0 and memory card products. Moreover, Samsung’s 48-layer 3D V-NAND has been certified by Apple, with the 256GB capacity in the new iPhone exclusively supplied by Samsung, expected to start shipping in Q3. Consequently, Samsung plans to reduce wafer market supply by 35% to ensure sufficient NAND Flash capacity to meet Apple’s demand.

At the same time, due to the transition of Samsung’s Hwaseong Fab16 to 48-layer 3D V-NAND, the capacity of 2D NAND has decreased. Additionally, the mainstream demand for smartphones is shifting from 16GB to over 32GB, and flagship smartphones are expected to feature 256GB UFS 2.0. The Samsung Galaxy Note 6 is also likely to be equipped with 256GB capacity, indicating that Samsung will not only have limited supply for low-capacity embedded products below 16GB but also for the entire NAND Flash market.

Toshiba Plans to Reduce Supply of Low-Capacity eMMC/eMCP to Ensure Product Profitability

Due to the 48-layer stacked 3D technology, which can increase the capacity of a single NAND Flash die to 256Gb, offering greater capacity and cost advantages compared to 32-layer 3D NAND, Toshiba is also accelerating the mass production of 48-layer 3D NAND to lower production costs and improve product profitability. At the same time, Toshiba/SanDisk is also a NAND Flash supplier for Apple, and it is expected that their NAND Flash supply will be quite limited.

To further ensure a certain level of product profitability, Toshiba has begun to adjust its production and market supply strategy, planning to reduce the production and supply of low-profit products. There are rumors in the market that Toshiba has clearly notified key customers that it will reduce the supply of mid-to-low capacity eMMC/eMCP, affecting some traditional industry customers who have seen production impacted due to Toshiba’s reduction or cessation of low-capacity eMMC/eMCP supply, primarily in low-end smartphones/tablets, OTT boxes, TVs, and wearable devices.

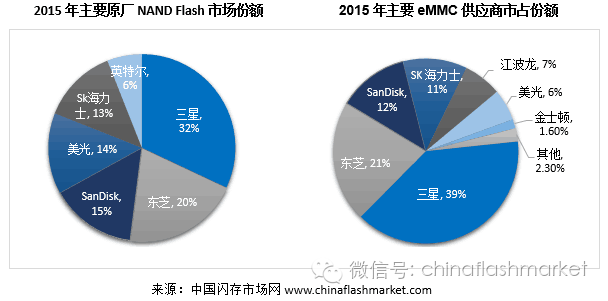

According to research data from China Flash Market Network, in 2015, Samsung and Toshiba/SanDisk together held approximately 65% of the NAND Flash market share, with the eMMC market accounting for about 75%. Currently, Samsung’s NAND Flash capacity primarily meets the high-capacity demands of Apple and high-end smartphones, while Toshiba/SanDisk also supplies Apple. With Toshiba reducing the supply of low-capacity products, it is expected that the NAND Flash supply will be tight in the Q3 peak season, and there may be a trend of price increases for low-capacity eMMC/eMCP.

2D NAND Lacks Cost Advantage, Manufacturers Raise Market Prices and Increase Wafer Prices

Due to the continuous decline in NAND Flash prices, the sales price of consumer-grade NAND Flash per GB fell to a low of $0.115 in mid-March 2016, breaking below the cost price of Flash manufacturers.

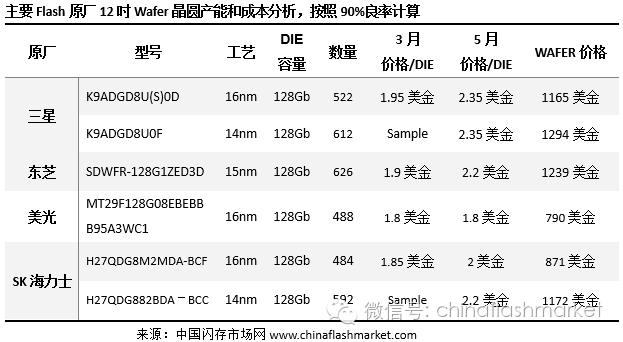

At that time, the market price of a single 128Gb die for Samsung’s 16nm and 14nm process wafers was only $1.95, estimating the wafer sales price to be around $1000, which is in a loss state compared to the cost of $1500 including profit. Micron and SK Hynix, using 16nm processes, had wafer sales prices even below $1000, resulting in more severe losses.

Due to the lack of market competitiveness in 2D NAND costs, the transition to mass production of 48-layer 3D NAND will also take more than two months, prompting some upstream manufacturers to communicate to key customers that prices for certain capacity products will remain unchanged or may increase, thus stimulating market price increases.

It is reported that the market price of a single 128Gb die for Samsung’s 16nm and 14nm process wafers has risen to $2.35, a 20% increase compared to the wafer sales price in March, while Toshiba’s 15nm process wafer price has also increased by 16%. SK Hynix, due to its switch to the more advanced 14nm process, has a market price for a single 128Gb die reaching $2.20, with wafer sales prices exceeding $1000, significantly increasing product profitability.

NAND Flash Market Size Continues to Expand, Peak Season Demand May Continue to Ferment

Based on the more advanced 1znm/3D NAND technology from upstream Flash manufacturers, China Flash Market Network estimates that the NAND Flash market supply will reach 120 billion GB equivalents in 2016, a 40% growth compared to 2015, and will exceed 160 billion GB equivalents in 2017.

On the demand side, in the first half of 2016, models such as the Galaxy S7, Huawei Mate 8, Xiaomi 5, Vivo Xplay 5, and OPPO R9 Plus have all increased their 128GB capacity options, driving 32GB, 64GB, and 128GB to become standard capacities for mid-to-high-end smartphones. In the second half of the year, Apple’s new iPhone will increase to a 256GB capacity, with the minimum capacity starting from 32GB, expected to be distributed as 256GB (10%), 128GB (50%), 64GB (30%), and 32GB (10%), with the first batch of 15 million units scheduled for stock in July, thus leading to an early start of stockpiling demand for the Q3 peak season.

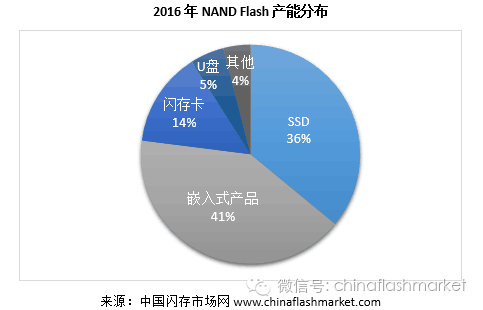

China Flash Market Network estimates that the average built-in storage capacity in the smartphone market will be 26GB in 2016, increasing to 34.5GB in 2017. Coupled with applications in tablets, OTT boxes, and TVs, it is estimated that embedded products will consume about 41% of the capacity in 2016, remaining the largest application for NAND Flash.

SSDs are showing strong demand in both consumer and data center markets, especially as hard drive manufacturers Western Digital and Seagate have both reported dismal Q1 2016 financial results, with HDD shipments plummeting by 20%, reaching historical lows of 43.1 million and 39.2 million units. In addition to the decline in PC market demand, a more significant factor is that SSD prices have cumulatively dropped by 20% in 2016, with explosive demand growth continuing to eat into the market share of hard drives. The proportion of laptops equipped with SSDs has increased from 15% in 2015 to 25% now, with retail prices for 240GB SSDs and 500GB HDDs being the same, leading to a significant increase in users replacing HDDs with SSDs. At the same time, users of small-capacity 64GB SSDs are upgrading to 120GB and 240GB capacities. In Q1 2016, global SSD shipments reached 30 million units, a year-on-year increase of 30%, and it is expected that global SSD shipments will increase to 135 million units in 2016, consuming 36% of NAND Flash capacity, and by 2017, it may exceed embedded products to become the largest application.

Retail Prices for 240GB SSDs and 500GB HDDs are Now the Same

It is worth noting that in 2016, only Samsung has mass-produced 3D NAND TLC SSD products and does not sell 3D NAND chips and wafers externally. Market SSD brand manufacturers can only choose 2D TLC Flash and some 3D MLC for SSD production. However, the cost advantage of 3D MLC Flash is not as good as that of 15nm process 2D TLC Flash. By the end of May, even in the traditional off-season, some manufacturers had the confidence to raise the price of 2D TLC wafers by about 15%, which poses a challenge for SSD manufacturers. They cannot resist the price increases from upstream Flash manufacturers while waiting for the large-scale production of 3D TLC NAND in 2017, which will truly test the wisdom and strength of the SSD industry players.

China Flash Market Network reminds that although the current market situation suggests that there may be supply shortages and demand exceeding supply in the Q3 peak season, industry insiders should still pay close attention to subsequent market demand to respond flexibly to any changes!

Copyright Statement

1. The copyright of this report belongs to Shenzhen Flash Market Information Co., Ltd.

2. Without permission, no one may reproduce, transmit, reproduce, publish, or broadcast in any form.

3. If you wish to reproduce or quote this article, please indicate the source as China Flash Market Network.

4. This report is the result of statistical analysis by China Flash Market Network and is provided for customer reference only.

5. Shenzhen Flash Market Information Co., Ltd. will not be liable for any losses, injuries, or disputes caused by this report.

6. If you have any objections to the content of this report, please contact us in a timely manner.

Shenzhen Flash Market Information Co., Ltd.

Customer Service Phone: 0755-86133027

Email: [email protected]