Click the “blue text” above to follow for more exciting content.

This article contains a total of 952 words, and reading the full text will take about 2 minutes.

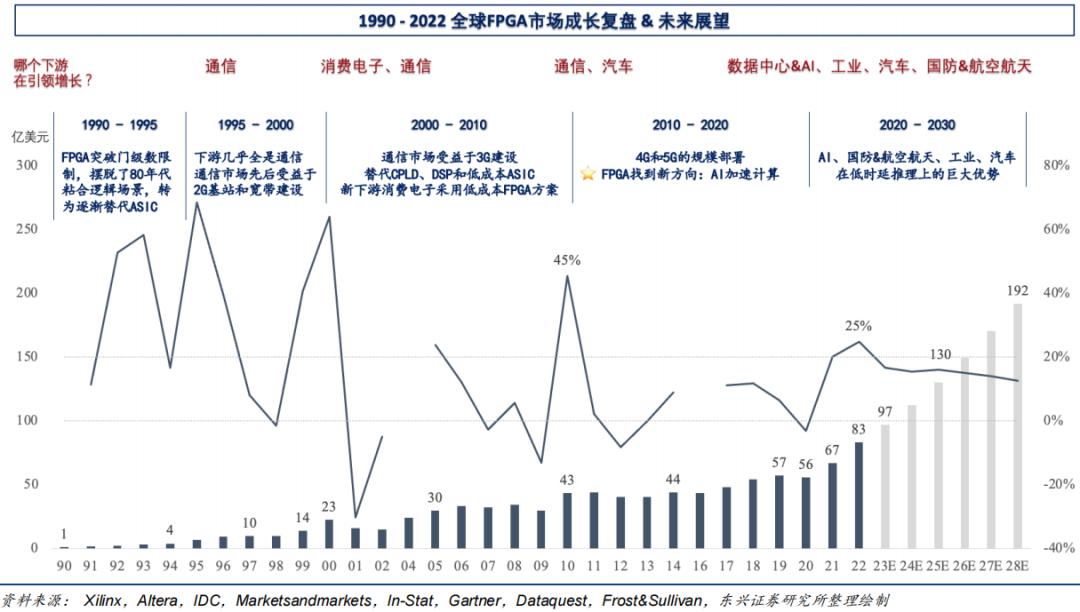

Currently, the global FPGA market size is approximately $8.3 billion, and it is expected to grow to nearly $20 billion by 2028. Since its invention in 1984, FPGAs have been widely used in communications, and after 2000, the dual drivers of consumer electronics and communications have led to development. After 2010, AI and automotive sectors have become new growth markets for FPGAs. In the future, the growth drivers for FPGAs will come from AI, defense & aerospace, industrial applications, and automotive sectors.

● Since 1984, although the original intention of FPGA invention was to replace ASICs, the wafer manufacturing technology of the 1980s limited the yield of larger FPGAs, making them expensive. Additionally, the EDA introduced by Xilinx was not yet mature and was less intuitive than the product term architecture of PAL. Therefore, before the 1990s, FPGAs were only used in glue logic applications, helping ASIC designers fill in those last-minute overlooked functions, resulting in an FPGA market space of only $100 million at that time, while the logic chip market size reached $15.6 billion in 1990, which was 156 times larger than the FPGA market (currently, the logic chip market is $176 billion, which is 20 times that of FPGAs).

● It was not until the breakthrough of gate count limitations that FPGAs began to move away from glue logic scenarios and gradually started to replace ASICs. The fabless model pioneered by Xilinx, along with the emergence of CMP technology, reduced wafer manufacturing costs, significantly lowering FPGA costs. After FPGAs surpassed the million-gate limit, they could implement complex large circuits that were previously only achievable by ASICs. Furthermore, FPGAs based on LUT architecture have higher scalability and capacity than product term architecture SPLDs and CPLDs. Thus, from 1990 to 1995, FPGA growth came from continuously acquiring orders from customers who originally used ASICs and replacing SPLDs. From 1995 to 2000, FPGAs expanded into downstream communications and networks, gaining widespread orders for wireless base stations and data communication network devices.

● After entering the 2000s, with the burst of the dot-com bubble, customers increasingly valued low-cost electronic system solutions. FPGAs transitioned from high-end communication downstream to low-cost consumer electronics downstream, especially small-capacity FPGAs began to encroach on the markets of CPLDs and low-cost ASICs, coupled with the demand from the 3G construction in the communications market and the replacement of DSPs, supporting FPGA market growth from 2000 to 2010.

● After 2010, with the emergence of neural network models represented by AlexNet, FPGAs found a new direction and growth logic for accelerated computing in artificial intelligence, making AI the fastest-growing downstream for FPGA leader Xilinx.

● In the future, the growth drivers for FPGAs will come from increasingly numerous low-latency processing and highly flexible changing scenarios, particularly evident in downstream sectors such as AI, defense & aerospace, industrial applications, and automotive.

Risk Warning:This content only represents the analysis, speculation, and judgment of the Breakthrough Research, and is published here solely for the purpose of conveying information, not as a basis for specific investment targets. Investment carries risks; please proceed with caution!Copyright Statement:This content is copyrighted by the original party or author. If reproduced, please indicate the source and author, retain the original title and ensure the integrity of the article content, and bear legal responsibilities for copyright, etc.

END