Word Count

5300

words

Reading Time

15

minutes

The strength of industrial software reflects a country’s industrial competitiveness. A strong manufacturing sector indicates strong software capabilities, and vice versa. The rise and fall of industrial software in Canada and the UK mirror the unique characteristics of industrial software.

Low-Key Industrial Software Powerhouse

Canada’s industrial software is similarly understated. In reality, with a population of only 37 million, Canada has developed many globally renowned industrial software products, comparable to those from the United States and France.

In 2019, Canada’s information and communications technology (ICT) industry generated a GDP of $94 billion, accounting for 4.8% of the national GDP. Over 90% of this contribution came from the software and computer services sector.

Commonly used image processing software CorelDraw and the special effects 3D software used in the sci-fi film “Avatar” both originate from Canada. In terms of scientific computing software, besides the American Mathematica and MATLAB, there is also Maple, developed by the University of Waterloo in Canada and released as early as 1980, forming a triad of leading software. The modeling and simulation system MapleSim, developed on the basis of Maple, excels in multidisciplinary modeling and high-performance simulation, particularly in robotics development. The magnetic levitation project in Shanghai, China, utilized this software for physical modeling and simulation.

Canada’s information technology sector is heavily influenced by the United States, with many sister products to American offerings. For example, the real-time microkernel operating system QNX was introduced in 1982 and is similar to Wind River’s VxWorks. It is widely used in nuclear reactors and rail transit equipment and holds a dominant position in the global automotive embedded platform market. The global display chip giant ATI, after being acquired by AMD, retained its R&D operations in Canada, continuing to compete with the global leader NVIDIA. In the chip design field, besides the three major American players Synopsys, Cadence, and Mentor (acquired by a German company but still headquartered in the U.S.), Canada’s EDA sector has its own territory, such as Solido Design. Crosslight (originally Beamtek), which focuses on memory, analog/RF, and standard cell variation-aware design software, was the first commercial company to launch quantum well laser diode simulation software globally.

In the popular field of artificial intelligence, Canada has also made remarkable achievements, with strong academic research and industrialization in AI. By 2020, Canada had over 60 AI laboratories, around 650 AI startups, and more than 40 accelerators and incubators. Renowned AI expert Richard Sutton, a pioneer in reinforcement learning, had students who later created “AlphaGo,” bringing AI into the limelight and marking a new era in AI. Geoffrey Hinton from the University of Toronto, a pioneer in deep learning, almost single-handedly brought neural networks from the fringes to the center stage of AI. With such a strong talent base, Canada has the potential to become the next global AI hub.

Transforming Industrial Advantages into Industrial Software

Canada is one of the wealthiest countries globally, with a per capita GDP of $46,000 in 2019, second only to the United States among the G7 developed nations. This is related to its abundant natural resources, with proven oil reserves of 173 billion barrels, ranking third in the world, and it is also the third-largest mining country.

With a small population but rich resources, Canada easily follows a trade-based national strategy, leading to a high dependence on foreign trade, especially with neighboring countries. Canada’s export regions are relatively singular, with the five largest export countries— the United States, China, Mexico, the UK, and Japan—accounting for over 85% of Canada’s total exports. In 2020, the trade value of exports to the United States reached $287 billion, accounting for over 73% of Canada’s total exports. Although China ranks second, it only accounts for 4.8% of Canada’s total export value. The U.S. population is about 330 million, nearly ten times that of Canada, and it is a large and mature market. This leaves ample room for Canada’s already vibrant technological innovation to flourish, supported by a solid domestic market.

Energy, manufacturing, and mining are important pillars of Canada’s national economy. Canada is the third-largest aircraft manufacturer in the world and the tenth-largest automobile manufacturer. Magna International is the largest automotive contract manufacturer globally, and in terms of the number of vehicles produced, it ranks as the third-largest automotive manufacturer worldwide. These industry advantages have been transformed into advantages in industrial software.

Canada ranks sixth in the world in electricity generation, with output only behind China, the United States, India, Russia, and Japan, and has significant expertise in power industry software. Power simulation software and power system software have historically been dominated by Canada. Canada offers comprehensive solutions, including distribution network simulation software CYME, grounding simulation software CDEGS, electromagnetic transient simulation software PSCAD, and large-scale power grid simulation software DSA-Tools. Canada’s HYPERSIM is a simulation testing software and hardware for ultra-large power systems, developed based on years of research by Hydro-Quebec.

In the field of electromagnetic transient analysis of power systems, Canada’s PSCAD software is well-known. As the power grid develops, relying solely on software simulation is no longer sufficient, leading to the emergence of real-time digital simulation and hardware-in-the-loop simulation, with RTDS being a representative product. As the first product of its kind, the RTDS simulator is the global benchmark for real-time power system simulation.

Bombardier, once the third-largest aircraft manufacturer in the world, behind Boeing and Airbus, exemplifies Canada’s industrial software characteristics, which actively align with the extension of the industrial chain. With Bombardier, there is also CAE, the world’s largest flight simulator manufacturer. CAE’s aviation flight simulation platform Presagis provides training for pilots worldwide, with many military and industrial giants like Boeing, Airbus, and Lockheed Martin as its users. It also offers solutions in automotive modeling, simulation, and embedded graphical displays. Many command and control systems and simulation software also originate from Canada. Canada’s FlightSim is a high-precision standard flight simulation platform capable of simulating various dynamic characteristics of fixed-wing aircraft.

Canada’s oil resources are abundant, with proven global oil reserves of 1.672 trillion barrels as of the end of 2018, ranking third in the world and accounting for 10% of the global total. Despite this, Canada’s energy sector has taken a completely different route from Middle Eastern oil countries. The latter is resource-intensive, while Canada follows a “high-tech intensive energy development” path. While exporting oil and gas to other parts of the world, Canada strongly advocates clean energy, with the proportion of renewable energy generation reaching 66%. The “high-tech intensive energy development” is supported by rich software.

Canada’s oil and gas modeling and simulation software CMG Suite is the world’s largest reservoir numerical simulation software, capable of analyzing geochemistry, geomechanics, and is widely used by companies like PetroChina, Sinopec, and CNOOC. In the field of process simulation in petrochemicals, mainstream software includes the American PRO/II, Aspen Plus, and the British gPROMS, while Canada’s HYSYS has also established its position early in the petrochemical industry, integrating process and equipment for simulation in oil and gas processing and petrochemicals.

The development and application of process simulation software have now evolved to the fourth generation, with the American Aspen Plus mainly used in chemicals, the French PRO/II mainly in refining, and Canada’s HYSYS mainly in oilfield and natural gas processing. The Canadian software VMGSim, launched in the early 21st century, is a rising star developed by core technical personnel from HYSYS, and it can now compete with American Aspen Plus and French PRO/II.

Latecomer enterprises need to better integrate knowledge. VMGSim has established extensive technical alliances globally, including with the National Institute of Standards and Technology’s Thermodynamics Research Center (NIST/TRC), the Gas Processing Association (GPSA), and the Sulfur Engineering Association (SRE), giving it unique advantages in specialized divisions, such as competitive desulfurization technology.

In fact, this is also a characteristic of Canadian software companies, which are willing to band together. Most Canadian software companies are micro-enterprises, typically with fewer than 10 employees, often relying on larger companies for design and development. Recognizing the importance of the software ecosystem, Canadian software strategic alliances are quite common. For example, two software companies may sign agreements to collaborate on development while independently implementing sales and product development. This is a strategy of companionship.

Educational and Research Advantages

There are many reasons for the success of software development in Canada. First, the strong industrial foundation provides fertile ground for the development of industrial software; second, the proximity to the key U.S. market provides significant support for the development of industrial software in terms of talent and product application. It is also noteworthy that Canada’s basic education and social environment form a good interaction, creating a holistic innovation system.

Software engineering is one of the fastest-growing branches in the field of computer science, and Canada places great importance on the development of the software industry, offering very favorable policies for cultivating software talent. Significant efforts are made to train high-level talents who master the basic theoretical knowledge of computer software, are familiar with software development and management techniques, and can engage in software design, development, and management. The top-ranked university for software development in Canada is the University of Waterloo, where the real-time microkernel operating system QNX originated.

Canada’s public and commercial sectors emphasize the continuously developing entrepreneurial community and connect them with business and academic institutions. Currently, Toronto, Vancouver, and Montreal are growing into centers for startups in Canada.

Canada’s innovation system is relatively complete and actively encourages the development of the software industry. Canada has established a variety of R&D tax credit policies. Small businesses in Canada have many opportunities to obtain venture capital and public funding, creating an environment conducive to the growth of startups. With its rich industrial software, Canada has also become a favorable location for multinational software giants to engage in mergers and acquisitions. Infolytica, as the first commercial finite element analysis software for electromagnetic fields, has a good reputation among low-frequency electromagnetic design engineers in aerospace, automotive, electrical, power, medical devices, and electronic products. After fifty years of establishment, Infolytica was acquired by Siemens in 2017 and integrated into its EDA software Mentor series.

The Canadian federal government has a complex array of R&D projects and funding. Small and medium-sized enterprises enjoy relatively low taxes, and if a company invests in R&D, about half of the investment is directly covered by the government. Many small and medium-sized enterprises benefit from the government’s multiple supports. In 2019, there were 43,000 companies in Canada’s ICT sector. Among them, over 86% of the enterprises had fewer than 10 employees; even counting the branches of international companies, there are only about 100 companies with more than 500 employees. A mature business environment has become the most scarce resource for industrial software. Of course, Canada also faces disadvantages in the development of industrial software, namely the shrinking market size. The best choice for Canadian technology is to land in the U.S., but Canada is also seeking more alternative markets.

The Power of National Manufacturing

A strong foundation in basic education and mathematics in a country’s universities can lead to the development of many software products, as seen in France, Canada, and the UK. However, the UK presents a different trend.

The UK software industry has a long-standing tradition and foundation, particularly in areas such as databases, support software packages, virtual reality, financial software, and entertainment software. In fact, the UK has always been a center for unicorns in Europe, closely following the U.S. and China in creating rapidly growing global companies. According to data from EEO, in 2019, eight UK companies entered the unicorn club, meaning the UK has produced 77 companies valued at over $1 billion, double that of Germany (34) and triple that of Israel (20).

In the field of industrial software, there are also prominent British founders. Currently, the mainstream geometric engines for commercial CAD software globally are Parasolid and ACIS, developed by the same professor from the University of Cambridge, regarded as first and second-generation products. The UK also has a long-standing tradition in computer-aided design and manufacturing (CAM). For example, the CAM software PowerMILL from the UK company Delcam has received widespread acclaim. According to a 2012 report by the American research firm CIMdata, its sales have maintained a global leading position for 13 consecutive years. In 2013, Autodesk acquired the UK company Delcam, which was considered a surprising event in the CAM software field. Since then, many CAM software from the UK have been widely acquired. The following year, the UK CAM software company Vero, with a turnover of approximately 80 million euros, was fully acquired by Hexagon, becoming part of its measurement and quality management division. After years of acquisitions, Vero now owns many well-known brand software, such as Edgecam, SurfCAM, and WorkNC.

The trend of foreign companies acquiring UK firms has been a recurring theme in the UK industrial software sector. In 2020, Hexagon again acquired the UK gear design technology company Romax, which holds a unique position in simulation technology for rotating machinery such as wind turbine gearboxes and electric vehicle transmissions. Romax’s software was used to complement Hexagon’s simulation software MSC product line, enhancing Hexagon’s development in low-carbon new energy and electrification.

Founded in 1988, the UK company Flomerics saw its FloTHERM software become the standard analysis program for airflow and heat transfer in the electronics and engineering industries. In 2008, Flomerics was acquired by the American company Mentor. In the same year, the UK’s largest industrial software company, AVEVA, was acquired by Schneider Electric. The UK industrial software sector lost another shining gem.

One of the few exceptions is the fluid and heat transfer simulation software Phoenics. Its first version, Phoenics-81, released in 1981, was the world’s earliest commercial software for fluid and heat transfer simulation. It is a classic work by Professor D.B. Spalding, a major founder of international computational fluid dynamics and heat transfer, and, along with Star CD and Fluent, became one of the three leading software in fluid dynamics simulation.

The UK still maintains a high level of innovative vitality. However, the growth of the industrial software industry requires the soil of industrial sectors. Deindustrialization has been a national policy in the UK, leading to a continuous decline in the manufacturing sector. The value added by the UK manufacturing industry has dropped from a peak of 16.4% of GDP in 1994 to only 8.6% in 2019. The once-leading automotive and machine tool industries are gradually declining. With the decline of manufacturing, many brands in the UK machine tool industry have fallen, such as the British Bridgeport machine tools, which became popular in China during the early reform and opening period, were acquired by the American company Hardinge in 2004. All of these factors have profound impacts on the development of CAM software. Overall, the irreversible deindustrialization has also caused damage to the development of industrial software in the UK.

Only a strong manufacturing sector can better support the development of industrial software. France and Canada are positive examples, while the UK shows us another side. This reaffirms the supportive role of a country’s manufacturing sector in industrial software.

Perhaps it is worth reiterating: only a strong manufacturing sector can better support the development of industrial software. France and Canada are positive examples, while the UK shows us another side. This reaffirms the supportive role of a country’s manufacturing sector in industrial software.

(Click the image to enter the book purchase webpage)

Related Reading:

Industrial Software: A Foggy Landscape

The Lighthouse Workshop of Digital Operations

Author Profile

Lin Xueping:General Manager of Beijing Lianxun Power Consulting Company, Visiting Researcher at Shanghai Jiao Tong University Quality Research Institute

|

Previous Series Recommendations |

||

|

Industrial Internet |

Intelligent Manufacturing |

Industry 4.0 |

|

Global Manufacturing Strategy |

U.S. Manufacturing Innovation |

Industrial Software |

|

New Concepts in Industry |

Corporate Strategy |

Advanced Manufacturing |

|

Digital Factory Transformation |

Textiles |

Gray Innovation |

|

Automation |

Digital Talent Education |

International Exhibitions |

Like this article? Please follow and share

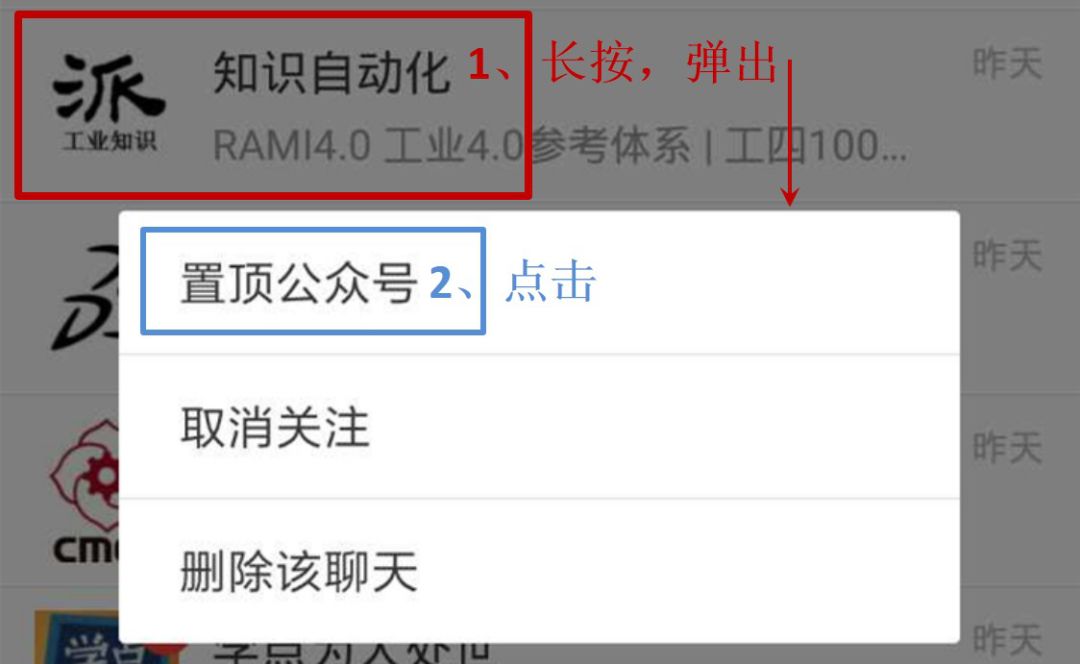

For easy viewing, you can use the pin feature of the public account