Recently, the consulting firm Yole released the report “Automotive Imaging 2025”.

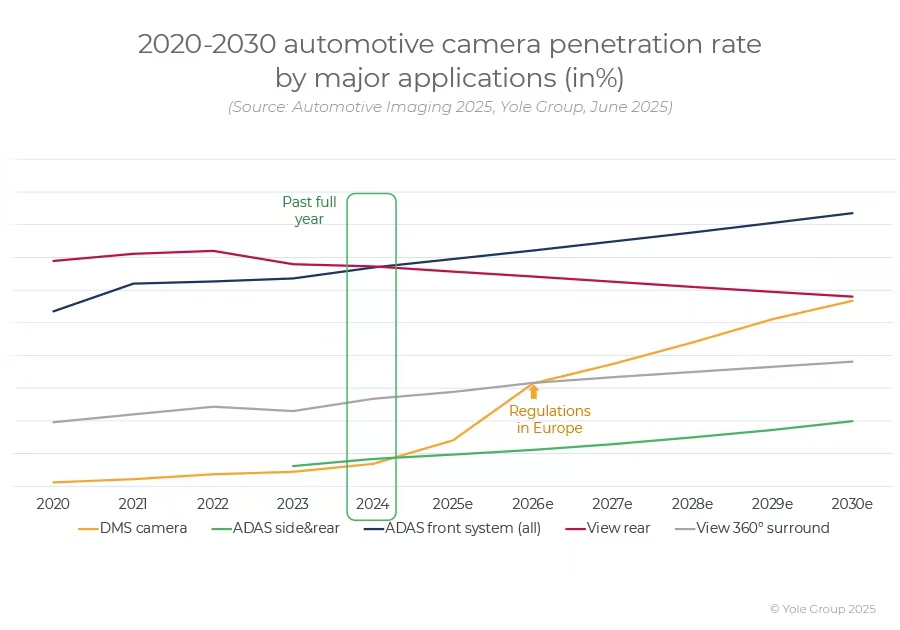

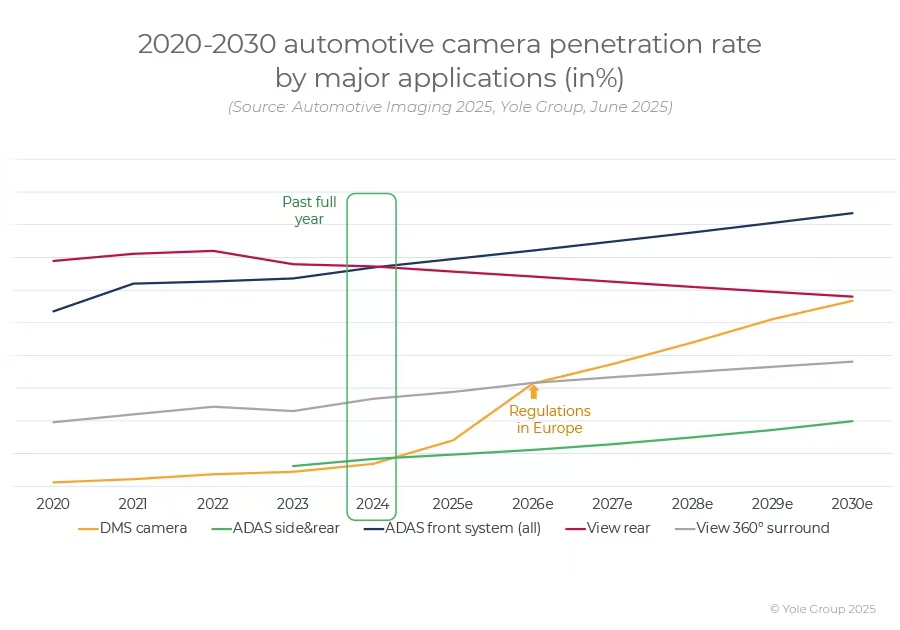

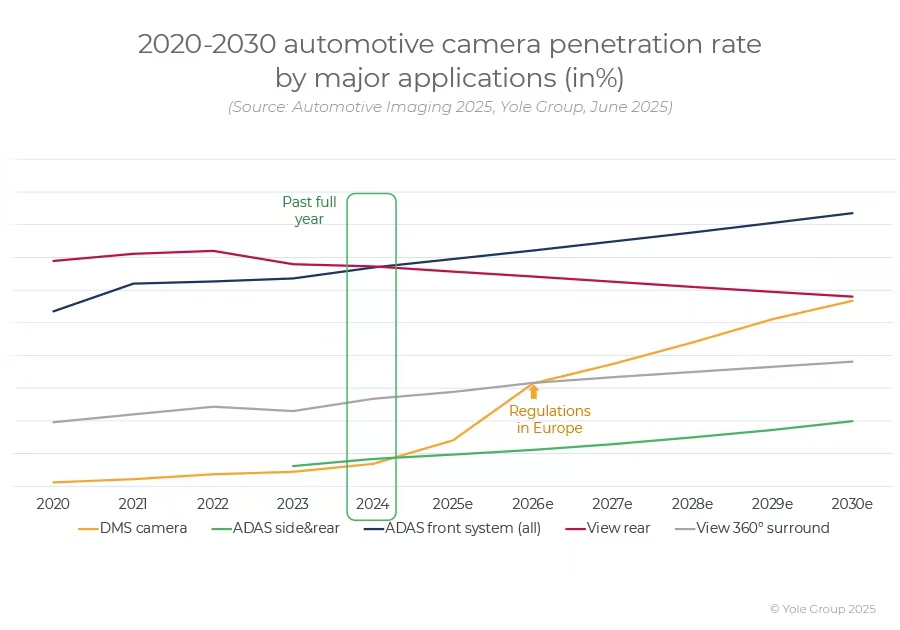

In 2024, the automotive imaging market is expected to reach $5.9 billion, with projections to grow to $8.9 billion by 2030 (a compound annual growth rate of 6.6%), driven by the increasing number of cameras and system complexity. By 2030, shipments are expected to rise to 400 million units, primarily in surround view, satellite ADAS, and cabin applications. The front ADAS camera remains the most valuable, but with the shift towards centralized computing, the growth rate of side view and satellite cameras is accelerating. Driven by EU regulations, DMS is the fastest-growing segment in cabin applications, while OMS is gaining favor with the emergence of new safety use cases. The market share of rearview cameras has slightly declined, replaced by surround view systems. Although revenue from image sensors has increased, lens groups and integrated components have shown stronger growth, highlighting the increasing value of optical components and full system design in automotive camera modules.

Omnivision Leads in the Growth Driven by China

In 2024, competition in the automotive CIS market intensifies, with Omnivision and Onsemi continuing to hold their positions as the largest suppliers. Omnivision has gained market share due to its strong performance in cost-sensitive surround view and ADAS camera applications, while Onsemi maintains a key position with its solid standing in high-volume projects. Sony continues to expand its market share, especially in the high-resolution camera sector. At the module level, Valeo leads the smart and viewing camera market, followed by Bosch, ZF, and Magna. Sunny Optical also leads the lens market, ahead of LCE and other companies like Sekonix and OptronTec. Camera manufacturers such as Sunny, LG Innotek, and Hikvision are currently providing complete modules, challenging tier-one suppliers in the context of a shift towards centralized computing architecture. China is building a fully integrated supply chain from sensors to modules, supporting OEM manufacturers like BYD. After the chip crisis, both OEMs and tier-one suppliers are now adopting multi-sourced CIS and seeking supply chain resilience. Asian suppliers are driving innovation in optics and lens groups.

Trends in Automotive Imaging Technology: Higher Resolution and Reliability

Automotive image sensors provide powerful object recognition capabilities. To achieve better perception and recognize more objects on the road, the resolution trend for ADAS is transitioning to 8 million pixels. High dynamic range, LED flicker suppression, and wide field of view are additional key requirements for sensors. The market is shifting towards centralized fusion architecture, with companies like Sony striving to directly integrate serializers into image sensors. DMS primarily relies on 2D RGB sensors and is gradually transitioning to RGB-IR sensors for better driver detection. Hybrid lens groups are common, combining glass and plastic to optimize cost, size, and thermal stability. Thermal imaging and SWIR cameras remain niche markets, mainly used for night vision and advanced ADAS in high-end vehicles, limited by cost and ecosystem maturity.

Multi-Camera Architecture and Functional Integration Become the Focus

The trend of distributed camera architecture is reshaping the ADAS market. Traditional single front smart cameras are being replaced by multiple side, rear, and panoramic cameras, thanks to regional computing and sensor fusion.

360° surround view cameras are the main contributors to sales, especially as parking assistance and L2+ autonomous driving become standard. Meanwhile, DMS (Digital Image Management System) is gradually becoming a necessity in regulations and designs in Europe and other regions, with RGB-IR and global shutter sensors enhancing system value. In addition to sensors as the main semiconductor components of cameras, we are also tracking the development trends of lens groups, which are currently shifting towards hybrid solutions to reduce costs and improve performance. New camera functionalities such as electronic rearview mirrors and external access cameras are emerging on high-end electric vehicle platforms.

Source: Sensor Expert Network

The Shenzhen Intelligent Sensor Industry Association is a non-profit industry organization established under the guidance of the Shenzhen Municipal Bureau of Industry and Information Technology and approved by the Civil Affairs Bureau, aimed at implementing the spirit of relevant documents such as the “20+8” industrial cluster development plan and the “Shenzhen Action Plan for Cultivating and Developing the Intelligent Sensor Industry Cluster (2022-2025)”. The association currently has nearly 300 member companies, including 12 listed companies, 7 companies planning to go public, 70 specialized and innovative enterprises (including 17 small giants), 5 single champion enterprises, and 5 technology unicorns (including potential ones), covering the entire industry chain related to chips, materials, R&D, production, and applications. The association aligns with current industry development trends and policy calls, positioning itself as a government facilitator, a business helper, and an innovation promoter, playing a bridging role to build a diverse and efficient technology innovation service system and a comprehensive service platform for industrial innovation, accelerating technological innovation, achievement transformation, and industry application; gathering industry synergy, cultivating industrial ecology, and promoting the agglomeration and high-quality development of the intelligent sensor industry.

Guangming Phoenix Plaza

Guangming Phoenix Plaza is located in one of Shenzhen’s key areas, the Phoenix City portal, approximately 500 meters from the Phoenix City Station of Metro Line 6 and Line 13 (under construction). The project is positioned as a technology innovation platform, headquarters gathering platform, and industrial finance platform for Guangming District, being the only industrial complex in Guangming District that integrates R&D offices, project incubation, testing and inspection centers, and light industry and commerce. The total construction area of the project is about 170,000 square meters, including 20,000 square meters for R&D and light industry (Buildings 1 and 4), 88,000 square meters (Buildings 2 and 3), 10,000 square meters for commerce, and 974 underground parking spaces.

Click to read the original text and join the association!