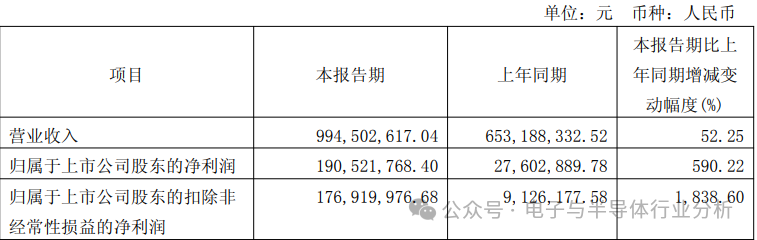

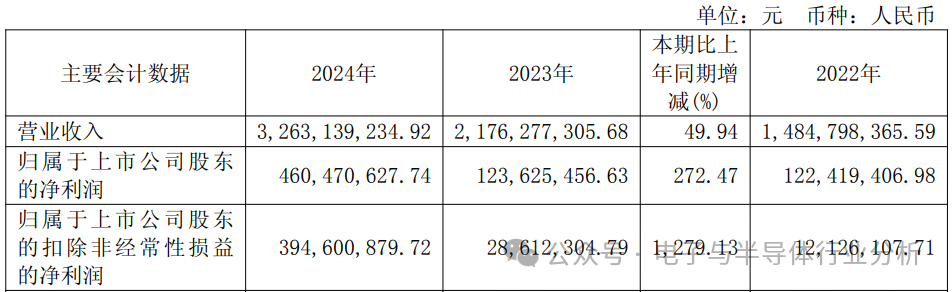

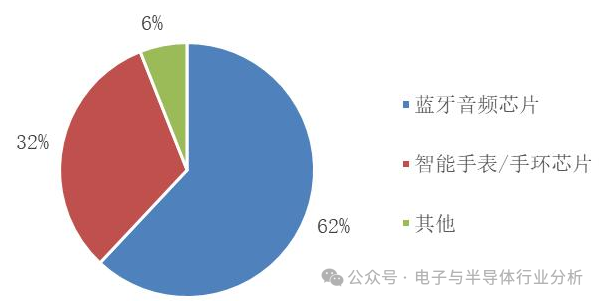

01. Hengxuan Technology (688608) Stock PriceOn April 30 last year, Hengxuan Technology (688608) saw its stock price drop to 122 yuan, but today, on April 30, the stock price reached 448 yuan during trading, marking an approximately fourfold increase over the year.As of the market close on June 30, 2025, Hengxuan Technology’s stock price was reported at 347.98 yuan, continuing to adjust since the peak in April.Despite fluctuations in the capital market, the competitiveness of its products remains evident. In the recently concluded quarter, Hengxuan Technology delivered an impressive performance:Revenue reached 995 million yuan, a year-on-year increase of 52.25%; net profit was 191 million yuan, a staggering year-on-year increase of 590.22%; and the non-recurring net profit grew by 1838% year-on-year. Of course, individual quarters can sometimes show significant fluctuations, but looking at the financial report for 2024, we find similarly impressive data: Revenue was 3.26 billion yuan, a year-on-year increase of 49.94%; net profit was 460 million yuan, a year-on-year increase of 272.47%; and non-recurring net profit was 390 million yuan, a year-on-year increase of 1279.13%.

Of course, individual quarters can sometimes show significant fluctuations, but looking at the financial report for 2024, we find similarly impressive data: Revenue was 3.26 billion yuan, a year-on-year increase of 49.94%; net profit was 460 million yuan, a year-on-year increase of 272.47%; and non-recurring net profit was 390 million yuan, a year-on-year increase of 1279.13%.  Since its IPO in 2020, the data shows that revenue has tripled and profits have increased by 2.3 times over the past four years.

Since its IPO in 2020, the data shows that revenue has tripled and profits have increased by 2.3 times over the past four years. 02. Main Business

02. Main Business

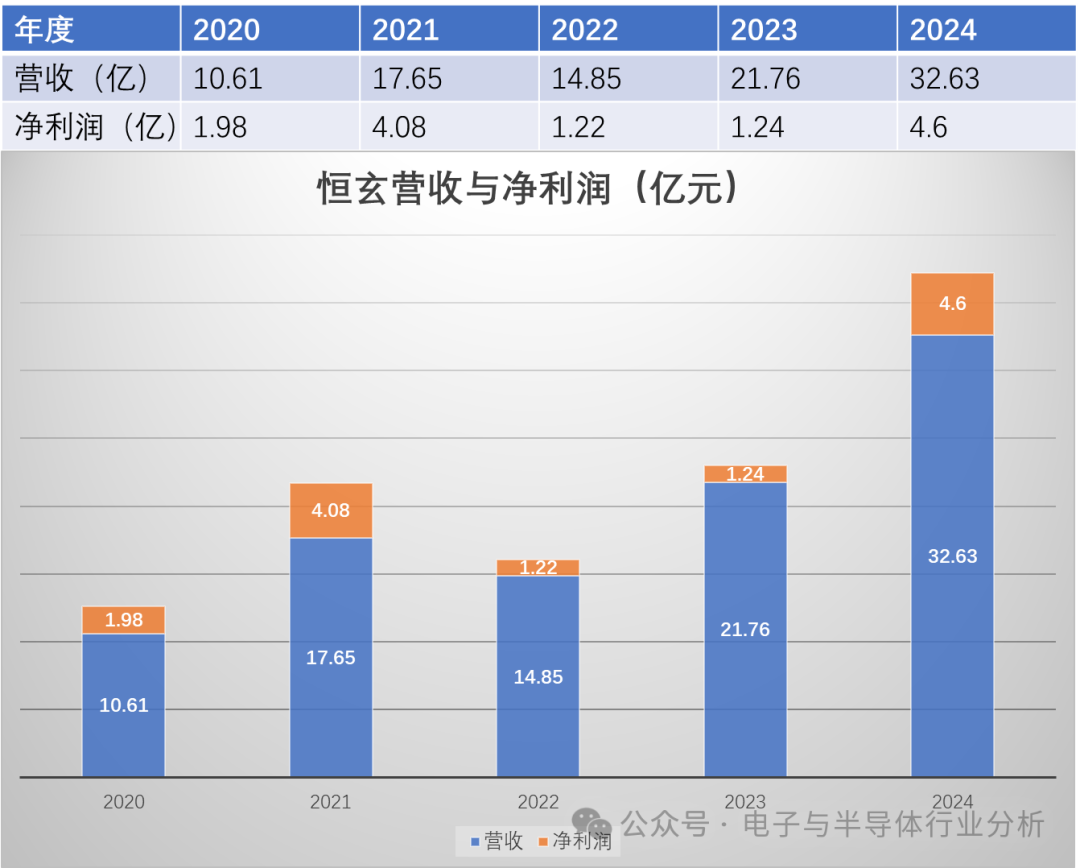

- TWS headphones and Bluetooth audio business are stable, accounting for 62% of revenue,with a market share of approximately 22% in TWS headphone chips, firmly positioned in the leading tier of the industry.

- The market share of smartwatches has further increased, accounting for 32% of revenue. In 2024, the company continuously introduced new customers for its smartwatch/band chips, achieving revenue of 1.045 billion yuan during the reporting period, a year-on-year increase of 116%, with total shipments exceeding 40 million units, becoming the largest driver of revenue growth for the company.

- The revenue structure is becoming more diversified, gradually moving towards a platform-based chip company.The main customers include: mainstream Android phone brands such as Samsung, OPPO, Xiaomi, Honor, Vivo; professional audio manufacturers such as Harman, Anker Innovations, Edifier, and Aiyin; and internet companies such as Alibaba, Baidu, ByteDance, and Google; as well as home appliance manufacturers like Haier, Hisense, and Gree.Applications have expanded from TWS headphones, speakers, and watches to the AR/AI glasses market and wireless connectivity market; wireless connectivity has expanded from Bluetooth to Wi-Fi 6/Star Flash; Bluetooth has evolved from 6.0+ to the future 7.0 HDT protocol, and MCUs have expanded from M4 to multi-core M55+NPU+DSP.

3 Product Competitiveness: 6nm Chip Constructs Technical Barriers

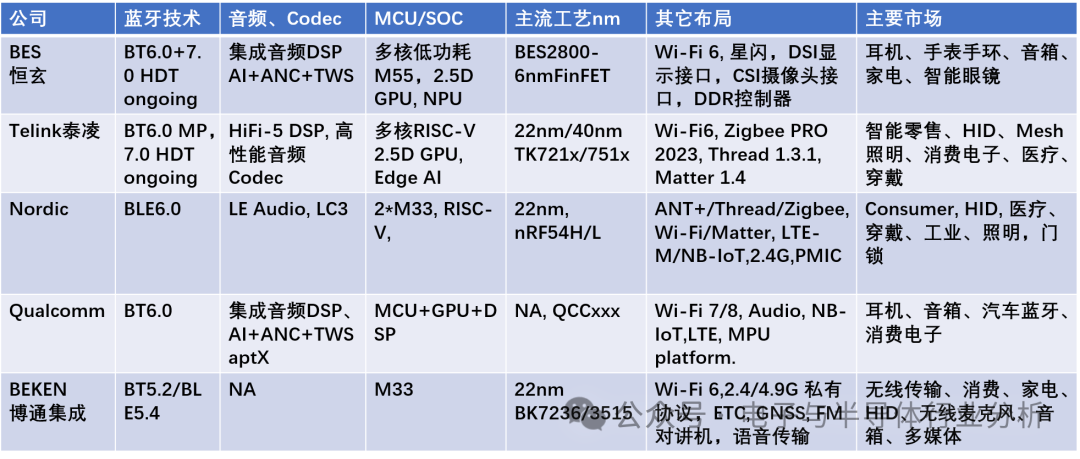

The core competitiveness of Hengxuan Technology is fully demonstrated in the BES2800 chip. This flagship product, utilizing 6nm FinFET technology, is redefining the performance boundaries of smart audio chips. The 6nm process Bluetooth SoC chip showcases aggressive process iteration (compared to competitors’ Bluetooth SoC chips, which are generally at 22nm) and confidence in technical strength (the costs of tape-out for 6nm process and the requirements for memory IP in 6nm process).

Technological Breakthroughs

- Single-chip integration of multi-core systems: CPU, NPU, and GPU work together, supporting dynamic power allocation

- Ultra-low power design: Local AI computing power consumption for AR glasses reduced by over 30%

- Comprehensive connectivity capabilities: Supports Wi-Fi 6, Bluetooth 5.4, and LE Audio standards

04 Industry Competitive Landscape

In the TWS headphone sector, the main competitors include Qualcomm, while in the low-power Bluetooth sector, Nordic and Telink are also significant references. In the wireless domain, Broadcom Integration can be referenced. Hengxuan holds certain advantages in audio integration, process, MCU integration, and recognition by major customers.

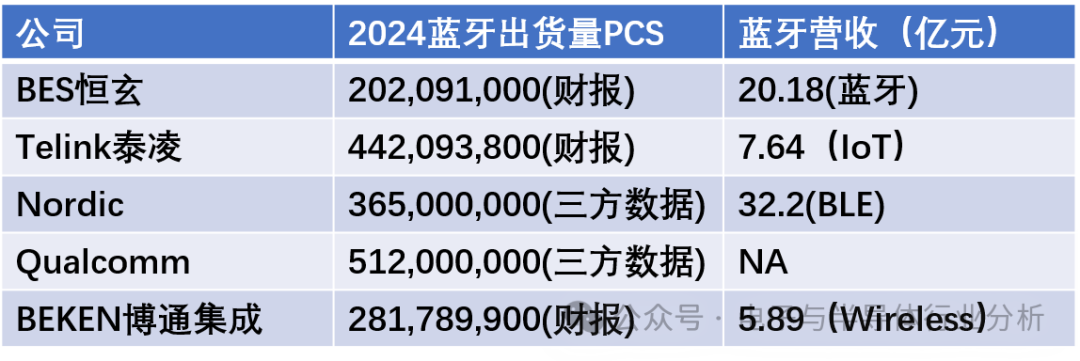

The comparison of annual shipment volume and revenue is as follows, where the Bluetooth unit price of BES is approximately 10 yuan, Telink’s IoT chip unit price is approximately 1.8 yuan, Nordic’s BLE chip unit price is approximately 8.8 yuan, Qualcomm’s Bluetooth revenue data is not available, and Beken’s wireless chip unit price is approximately 2.1 yuan. Hengxuan, Qualcomm, and Nordic hold advantages in chip pricing.

Conclusion

Technological iteration never stops. Just as the stock price is undergoing fluctuations, there are reports that Hengxuan Technology has quietly initiated the research and development of 3nm technology, with market news indicating that the company’s next-generation SoC chip supporting visual processing will be launched in 2026, aiming for a position as a core supplier of edge AI hardware.

Hengxuan is one of the few domestic semiconductor manufacturers occupying a leading position in the industry, maintaining significant advancements in technological iteration and process. With the gradual realization of smart glasses orders in the second quarter, analysts expect Hengxuan Technology’s annual revenue to exceed 4 billion yuan.

The competitive edge built by technological moats and diversified product lines is accumulating energy for the revaluation of this chip newcomer. However, with a current price-to-earnings ratio of over 60, the future trend remains a matter of opinion.

After analyzing so much, I really can’t afford to buy even one share!!!