1. Industry Overview

The printed circuit board, abbreviated as “PCB”, also known as a printed wiring board, refers to a printed board that forms connections between points and prints components according to a predetermined design on a common substrate. Its main function is to connect various electronic components through circuits, serving as a key electronic interconnection component in electronic products. PCB products can be classified in various ways, generally divided into single-sided boards, double-sided boards, multi-layer boards, HDI boards, packaging substrates, flexible boards, etc.

Printed circuit boards are one of the important components of the electronics industry. Almost every electronic device that contains integrated circuits and other electronic components requires printed circuit boards to achieve electrical interconnection between the components. Almost every electronic device relies on printed circuit boards because they provide mechanical support for the fixed assembly of various electronic components, realize wiring and electrical connections or electrical insulation between them, and provide the required electrical characteristics. The quality of their manufacturing directly affects the stability and lifespan of electronic products and influences the overall competitiveness of system products, earning them the title of “mother of electronic products”. As an indispensable component of electronic terminal devices, the development level of the PCB industry reflects the speed and technological level of the electronic information industry in a country or region to a certain extent.

2. Industry Market Development

The PCB industry is widely distributed worldwide, with developed countries in North America, Europe, and Japan starting early, researching and fully utilizing advanced technology and equipment, leading to significant development in the PCB industry. Before 2000, the three major regions of the Americas, Europe, and Japan accounted for over 70% of the global PCB production value, making them the primary production bases. In the past two decades, due to the advantages of labor, resources, policies, and industrial clusters in Asia, especially mainland China, global electronic manufacturing capacity has shifted to Asian regions such as mainland China. With the global industrial center shifting to Asia, the PCB industry has formed a new pattern with Asia, particularly mainland China, as the manufacturing center. Since 2006, mainland China has surpassed Japan to become the world’s largest PCB production region, with both output and production value ranking first in the world.

Mainland China, as the largest PCB production region globally, has seen its share of the total global PCB production value rise from 8.1% in 2000 to 54.6% in 2021. In recent years, benefiting from the global PCB production capacity shift to mainland China and the booming development of downstream electronic terminal product manufacturing, the overall PCB industry in mainland China has shown a rapid development trend. In 2006, the production value of PCBs in mainland China exceeded that of Japan, making it the world’s largest PCB manufacturing base. Driven by the growing demand in downstream sectors such as communication electronics, computers, consumer electronics, automotive electronics, industrial control, medical devices, defense, and aerospace, the growth rate of the PCB industry in mainland China has outpaced that of the global PCB industry in recent years.

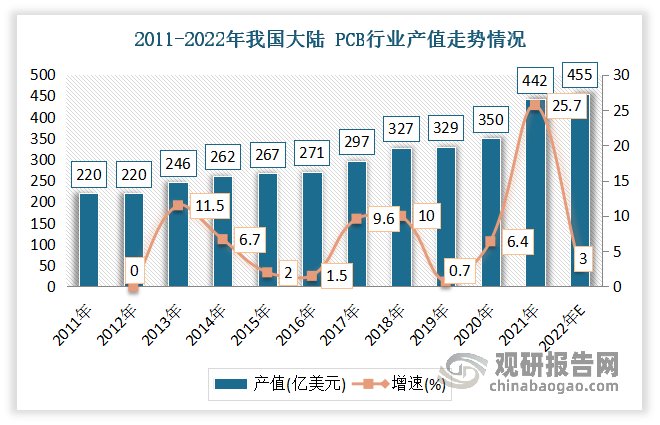

Data shows that in 2020, the PCB industry in mainland China reached a production value of $35.054 billion, a year-on-year increase of 6.4%. In 2021, the production value of the PCB industry in mainland China reached $44.150 billion, a year-on-year increase of 25.7%. It is estimated that in 2022, the production value of the PCB industry in mainland China will reach $45.5 billion, a year-on-year increase of 3%.

Data Source: Organized by Guanyan Tianxia

Mainland China has a healthy and stable domestic demand market and significant manufacturing advantages, attracting a large number of foreign-funded enterprises to shift their production focus to mainland China. As a fundamental electronic component, the PCB industry is mainly concentrated around the supporting construction of downstream industries. PCB industry enterprises are mainly distributed in the Pearl River Delta, Yangtze River Delta, and Bohai Rim regions, which have strong economic, locational, and talent advantages. However, in recent years, due to the continuous rise in labor costs, some PCB enterprises have gradually shifted their production bases to inland areas such as Jiangxi, Hunan, Anhui, and Hubei to alleviate the operational pressure brought by rising labor costs.

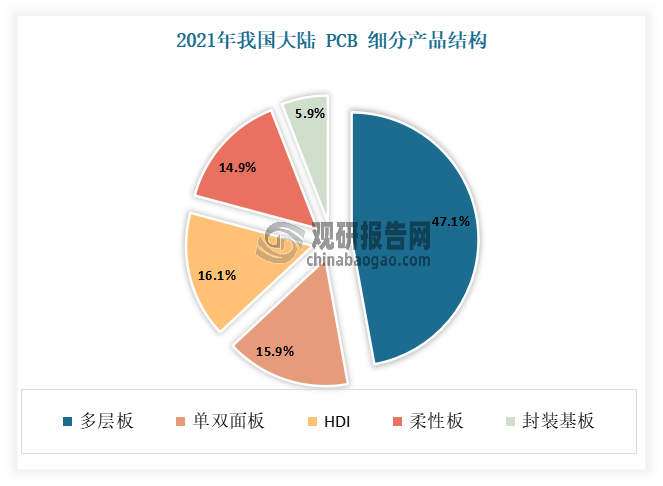

However, compared to advanced PCB manufacturing regions like Japan, the proportion of high-end printed circuit boards in mainland China remains relatively low, especially in areas such as packaging substrates, high-end HDI boards, and high-layer boards. According to data, in 2021, the market size of rigid boards in mainland China was the largest, with multi-layer boards accounting for 47.1%, and single-sided and double-sided boards accounting for 15.9%; followed by HDI boards, which accounted for 16.1%; and flexible boards accounted for 14.9%.

Data Source: Organized by Guanyan Tianxia

After years of development, the PCB industry in mainland China has shown a “hundred flowers blooming” situation, with sufficient market competition. Manufacturers from Taiwan, Japan still hold a leading position in the domestic market, while enterprises in mainland China are growing rapidly.

According to the report released by Guanyan Report Network titled “Research on the Development Trends and Future Prospects of China’s Printed Circuit Board Industry (2023-2030)”, the main enterprises in the PCB market in mainland China include: Unimicron Technology Corporation, Suzhou Dongshan Precision Manufacturing Co., Ltd., Kinwong Electronic Co., Ltd., Shenzhen Shennan Circuits Co., Ltd., Kingboard Chemical Holdings Ltd., and Shenzhen Jingwang Electronics Co., Ltd.

Competitive Advantages of Major Enterprises in China’s Printed Circuit Board Market

|

Company Name |

Competitive Advantage |

|

Unimicron Technology Corporation |

Product Line Advantage: Offers a diverse range of high-quality PCB products, including FPC, SMA, SLP, HDI, Mini LED, RPCB, Rigid Flex, and more, widely used in communication electronics, consumer electronics, high-performance computing products, as well as EVs and AI servers. |

|

Service Advantage: The company has strong capabilities to provide comprehensive PCB electronic interconnection products and services for different customers, creating a one-stop service platform for PCB products. |

|

|

R&D Advantage: The company places a high emphasis on research and development, with an R&D center in Shenzhen, continuously strengthening industry-university-research cooperation. To date, it has collaborated with several well-known universities in mainland China, including Tsinghua University Shenzhen Graduate School, Peking University Shenzhen Graduate School, Sun Yat-sen University, Harbin Institute of Technology (Shenzhen), Shenzhen University, as well as several renowned universities and research institutions in Taiwan. |

|

|

Patent Advantage: To date, the company has obtained nearly 1099 authorized patents domestically and internationally. |

|

|

Market Position Advantage: According to the global PCB company rankings based on revenue from Prismark from 2018 to 2023, the company has ranked as the largest PCB manufacturer in the world for six consecutive years from 2017 to 2022. |

|

|

Suzhou Dongshan Precision Manufacturing Co., Ltd. |

Product Line Advantage: The company has formed a horizontal product line covering three major sectors: electronic circuits, optoelectronic displays, and precision manufacturing, providing various core components for intelligent interconnectivity. |

|

Integration Advantage: The company actively leverages the synergy of its various business sectors in R&D, technology, supply chain, products, and markets, gradually building a vertically integrated industrial chain collaborative advantage. |

|

|

Customer Advantage: The company has a rich customer base across multiple industries, including consumer electronics, communication equipment, industrial equipment, and automotive, which helps the company withstand seasonal and cyclical impacts from different industries while maintaining stable business development. |

|

|

R&D Advantage: Through continuous investment in R&D, the company currently holds hundreds of authorized patents and has established a complete open R&D system and efficient R&D mechanism. |

|

|

Technology Advantage: Through continuous R&D investment in new materials, technologies, and processes, the company explores cutting-edge manufacturing processes for core components in the intelligent and interconnected fields. |

|

|

Kinwong Electronic Co., Ltd. |

Market Position Advantage: The company is the number one printed circuit manufacturer globally, the number one in memory modules, and the number one in LCD display PCBs, with the highest revenue in mainland China PCB industry, growing at over 30% annually, making it a renowned PCB manufacturer capable of providing world-class processes and technologies to global customers. |

|

Shenzhen Shennan Circuits Co., Ltd. |

Business Layout Advantage: The company focuses on the electronic interconnection field, deeply cultivating the printed circuit board industry, and has formed a “3-In-One” business layout after 38 years of development. |

|

Comprehensive Manufacturing Advantage: The company has the capability to provide comprehensive manufacturing from “samples to small and medium batches to mass production”, offering professional and efficient one-stop comprehensive solutions. |

|

|

Technology Advantage: The company has established a three-tier R&D system, with R&D departments at the headquarters, business units, and production plants, effectively promoting the enhancement of the company’s technological capabilities. |

|

|

Brand Advantage: The company has been deeply involved in the electronic circuit industry for over 30 years, becoming a key supplier for many leading global enterprises, and has established a good reputation for technological leadership and stable quality. |

|

|

Kingboard Chemical Holdings Ltd. |

Brand Advantage: Kingboard Chemical Holdings Ltd. was listed in the Forbes 2022 Global 2000 list in May 2022, ranking 1663. |

|

Shenzhen Jingwang Electronics Co., Ltd. |

Product Strategy Advantage: The company has established specialized independent factories for each sub-product category, achieving good performance contributions in communication equipment, consumer electronics, automotive electronics, industrial control, medical, computer and network equipment, and new energy applications. |

|

Quality Advantage: The company is committed to establishing a strict quality management system and has obtained and implemented ISO 9001-2015 quality management system certification, IATF16949-2016 automotive industry quality system certification, and ISO13485-2016 medical device quality management system certification. |

|

|

Management Advantage: The company continuously develops and improves its information system, having implemented the “Oracle” ERP system, and introduced internationally renowned MES manufacturing execution systems and EAP equipment automation systems. |

|

|

Customer Resource Advantage: The company has accumulated a number of high-quality customers, including Huawei, Hella, Tianma, OPPO, Vivo, Foxconn, Hikvision, ZTE, Bosch, Jabil, Delphi, Siemens, Valeo, and other well-known domestic and international enterprises. |

Data Source: Organized by Guanyan Tianxia (WW)

Reprint with note: “Beidou Star Photovoltaic Research Society”