Recently, Huawei’s competitors have been quite pleased. In terms of market share, they are currently in an offensive state. With Huawei’s global smartphone sales starting to decline in the fourth quarter of last year, its competitors have begun to enjoy their happy times. In the smartphone sector where Apple operates, over the past six or seven years, Chinese smartphone brands led by Huawei have risen, with Samsung undoubtedly being the biggest victim. 2013 was the peak year for Samsung’s global smartphone market share, exceeding 30%. According to IDC data, Samsung’s global smartphone market share reached 31.3% that year. The following chart shows the global smartphone market situation in 2013, where it can be seen that Samsung and Apple together accounted for nearly half of the global market.

However, since Xiaomi launched its first-generation smartphone, the Xiaomi 1, in 2011, pricing it at an astonishing 1999 yuan, domestic smartphones began to rapidly counterattack. In the past decade of China’s industrial sector, it can be said that the launch event of the Xiaomi 1 in August 2011, where Lei Jun displayed the retail price of 1999 yuan on the big screen, is an eternal classic moment. At that time, smartphones were still very expensive for Chinese consumers, and domestic smartphone brands had not yet emerged, with foreign brands dominating the market at prices often exceeding four or five thousand yuan. Just imagine what the salary levels of Chinese people were like back then; purchasing a four or five thousand yuan smartphone was a luxury. I remember when the Xiaomi 1 was launched, I was using a Nokia E63 with the Symbian system, and I couldn’t bear to spend 5000 yuan on an Android Samsung.

Due to the high prices of legitimate smartphones, there was a huge market for “parallel imports”. These are genuine devices smuggled in from overseas, especially from Hong Kong, through various channels, and because they do not require customs duties and VAT, they are significantly cheaper than legitimate devices. At the launch event of the Xiaomi 1 in Beijing, some fans in the audience were still holding feature phones, meaning that while Lei Jun was discussing the specifications of the Xiaomi 1 on stage, not everyone in the audience had a smartphone. Many people hoped that a domestic brand could lower the exorbitant prices.

Before announcing the retail price of the Xiaomi 1, Lei Jun first displayed a PPT showing the retail prices of several popular Android smartphones at the time. Two legitimate devices, the Samsung Galaxy S2 was priced at 4999 yuan, and Motorola’s Atrix ME860 smartphone was also priced at 4298 yuan. Even the parallel import of the HTC Sensation was still selling for 3575 yuan, while the parallel import of the LG Optimus 2X was priced at 2575 yuan. Although the two or three thousand yuan parallel imports were cheaper, they lacked after-sales service. The comprehensive configuration of the Xiaomi 1 was almost the best level compared to the four models mentioned above. Then Lei Jun asked the audience how much they thought the Xiaomi phone should sell for. The first answer was 5000 yuan, and then someone said 3000 yuan. At that time, it was already considered remarkable if the Xiaomi legitimate phone sold for below 3000 yuan, as legitimate phones were all above 4000 yuan. When the price of 1999 yuan appeared on the big screen, the audience erupted in applause and cheers lasting over twenty seconds. I counted this time while watching the video. Some even shouted Lei Jun’s name. At that moment, this number exceeded everyone’s expectations; no one thought Xiaomi could bring the price down so low. This launch event at 1999 yuan created a huge sensation, leading to massive expectations in the market, and during the subsequent pre-orders and sales of Xiaomi, a buying frenzy occurred. Xiaomi sold 270,000 units that year, and the following year, sales reached 7.19 million units. For many people, their first smartphone was a Xiaomi.

After Xiaomi, Huawei, OPPO, and VIVO also became stronger, resulting in the expensive and lower-quality Samsung being completely squeezed out of the market in China. Moreover, Chinese smartphone brands have also pursued aggressively overseas. In India, Xiaomi surpassed Samsung to rank first, while in Southeast Asia, OPPO and VIVO became Samsung’s two largest competitors. In the core European market, before the US sanctions in 2019, Huawei’s market share was rapidly catching up to Samsung. In the Middle East market, Samsung also faced continuous challenges from Huawei. After Huawei was hit by US sanctions, especially after its chips were cut off in 2020, the market initially expected Samsung to benefit, particularly in the core European market. However, unexpectedly, Xiaomi emerged as a strong competitor alongside Apple, becoming the largest alternative to Huawei smartphones in the European market. This clearly indicates the continuous decline in Samsung’s smartphone competitiveness; even with Huawei’s exit, it cannot compete with Xiaomi for market share. This fully demonstrates the ongoing decline in Samsung’s competitiveness.

Now, for Apple, this is a relatively happy situation. The two biggest competitors, Samsung, are facing a continuous decline in competitiveness, while the most aggressive Huawei is completely suppressed by US sanctions, with decreasing shipments. Additionally, Xiaomi, OPPO, VIVO, and the recently spun-off Honor from Huawei have not yet posed a significant challenge to Apple in the high-end market in a short time. In a previous article, I listed Apple’s Q4 2020 financial report, which showed a revenue growth of 21%, with the Greater China market even growing by 57%. However, this is not the end; Apple will continue to capture market share after Huawei’s flagship phones exit the market. Moreover, Apple is unlikely to face any significant challenges in the coming years. Apple’s self-developed chips + iOS ecosystem, along with strong technical and quality control capabilities over suppliers, form an insurmountable moat in the short term.

Originally, Huawei’s Kirin processor + HiSilicon chip set (WIFI, RF, power management, audio, etc.) + 5G communication technology + deep modifications to Android + camera technology, as long as they continue to upgrade, still have the potential to compete with Apple in the long term. For example, Huawei’s communication technology is not only leading in 5G; Huawei and Qualcomm are the two largest contributors to patents in communication technology, where Apple is not as strong as Huawei. Beyond Huawei, whether it is Xiaomi, Honor, OPPO, or VIVO, just having a self-developed processor is a daunting mountain to climb. Without unique technological and ecological advantages, they will generally fall into a relatively homogeneous competition. It is too difficult to catch up with Apple in all aspects. We will have to see if Honor can make technological advancements in the future.

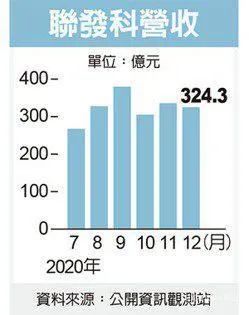

For Apple, Samsung’s decline and Huawei’s severe injury mean that the next few years will be a happy time to firmly hold the high-end market. Not only Apple benefits; since HiSilicon, a subsidiary of Huawei, is still one of the top ten chip manufacturers globally, its exit from the market has directly benefited Qualcomm and Taiwan’s MediaTek. MediaTek, as the leading Taiwanese chip design company, not only performed well in 2020 but is also expected to do well this year. They mainly supply the mid-to-low-end consumer electronics market. Not only do Xiaomi, OPPO, and VIVO need to purchase MediaTek’s 5G chips to seize the market with 5G smartphones, but the new Honor will also purchase a large number of MediaTek’s 5G chips. Sometimes when watching financial news, it is said that MediaTek’s revenue reached a historical high in September due to Huawei’s orders, but after losing Huawei’s orders in October, it fell by 20% month-on-month. This statement is indeed accurate, but it gives the impression that without Huawei’s orders, MediaTek’s performance would be dismal. In fact, looking at the chart below, it is clear that while October’s revenue was lower than August and September, it was still higher than July, and in November and December, it began to increase month-on-month again.

In 2020, MediaTek’s revenue increased by 30.84%, exceeding 10 billion USD. As HiSilicon’s chip smartphones gradually diminish, Honor will also purchase MediaTek chips, and MediaTek will have a good year. We often say to be frugal with Taiwan, but in fact, the industrial structure across the strait has, in a sense, become a strong competitive relationship. Whether it is the Sino-US trade war or Huawei being sanctioned by the US, Taiwan has been a significant beneficiary. The economic growth rate has noticeably accelerated in the past two years, with the annual economic growth rate reaching 2.98% in 2020. Driven by the significant development of electronic components centered around chips, as long as no special accidents occur, such as a major outbreak of the pandemic in Taiwan, Taiwan’s economy is expected to perform well in 2021.

Qualcomm has also benefited from Huawei’s sanctions. As the shipment of smartphones equipped with HiSilicon chips gradually decreases, Qualcomm’s latest financial report shows that for the first fiscal quarter of 2021 ending December 27, 2020, their revenue under US GAAP was 8.235 billion USD, an increase of 3.158 billion USD compared to the same period last fiscal year, representing a year-on-year growth of 62%. At the same time, the financial report shows that their net profit for this fiscal quarter under US GAAP was 2.455 billion USD, compared to 925 million USD in the same period last fiscal year, a year-on-year growth of 165%. Under non-US GAAP, Qualcomm’s revenue for the first fiscal quarter was 8.226 billion USD, a year-on-year growth of 63%, and net profit was 2.51 billion USD, a year-on-year growth of 118%. Without the competition from HiSilicon, Qualcomm and MediaTek’s chips have jointly divided the Android smartphone market. Not only has Huawei been sanctioned, but this has also brought benefits to Apple, Qualcomm, and MediaTek. China’s largest local chip manufacturer, SMIC, has also been placed on the US entity list, facing restrictions on equipment supply. Equipment for 10nm and below processes is completely restricted, while equipment for above processes is in a limited supply state. Recently, SMIC released its financial report, which, although showed record highs in multiple financial indicators in 2020, with annual revenue of 3.907 billion USD, a growth of 25.4%, and gross profit of 921 million USD, a growth of 43.3%, the sales in the fourth quarter were 981.1 million USD, a year-on-year growth of only 10.3%, and a month-on-month decline of 9.16% compared to the third quarter. At the same time, the expected revenue growth for 2021 is only in single digits. It is worth noting that the revenue share of SMIC’s 14/28nm processes in the fourth quarter dropped to 5%, down from 14.6% in the previous quarter. As is well known, Huawei is the largest customer of SMIC’s 14nm process, indicating that the inability to supply Huawei in the fourth quarter has had a significant impact on advanced processes. Correspondingly, semiconductor manufacturers across the strait in Taiwan are quite pleased. Although SMIC is far behind TSMC, it achieved a revenue growth of at least 30.2% in the first three quarters of 2020, calculated in RMB. However, as its largest customer, Huawei, could no longer ship, and equipment supply faced restrictions from the US, the revenue growth rate in the fourth quarter rapidly declined to 10.3%. The portions of growth that were lost will undoubtedly flow to Taiwanese manufacturers, meaning that Taiwanese semiconductor manufacturers, led by TSMC and UMC, will face significantly reduced competitive pressure from mainland China for a long time.

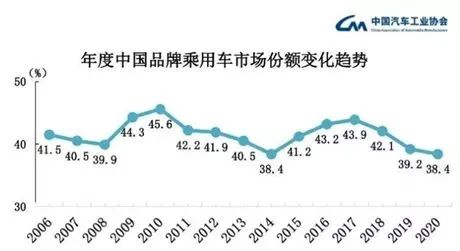

For mainland China, the current focus is on when the domestic production lines or the de-Americanization of production lines will be completed. Until this is accomplished, both Huawei and SMIC will not have good data. I know that upon reaching this point, some may feel anxious. If this is the darkest moment before domestic production, such moments have occurred multiple times in history. Industrial upgrades have never been smooth sailing. Take the smartphone and automotive industries as examples. In the early 2000s, due to the significant loosening brought by China’s accession to the WTO in 2001, domestic automotive brands experienced tremendous development. Before that, the most famous was the Xiali car. Then, domestic brands exploded, leading to several breakout models. Notable breakout models include the Haval H6, Chery QQ, and BYD F3, which can be said to have created three rising domestic brands. When the Chery QQ was launched in 2003, it immediately caused a sensation in the Chinese market, positioning itself as the first car for young people, and brought the price of cars down to below 50,000 yuan, accounting for 70% of Chery’s sales at one point, attracting competitors to follow suit. The first domestic brand sedan launched by Changan in 2006, the Changan Benben, was priced around 40,000 yuan, directly competing with the Chery QQ. To this day, the Chery QQ remains the highest-selling model series for Chery. The F3, launched in 2005, was similar for BYD. After its launch, it immediately became a hit, accounting for the vast majority of BYD’s sales, with average sales growth exceeding 100% from 2005 to 2009. When I bought a car back then, I was once torn about whether to buy the F3, as it was so popular. In 2006, the F3 sold 46,000 units, accounting for 83.6% of BYD’s total car sales; in 2007, it sold 84,000 units, accounting for 97.7% of total sales; in 2008, it sold about 140,000 units, still accounting for 82.4% of total sales. Even in 2009, when BYD had launched models like the F0 and F6, the F3’s sales reached 290,000 units, still accounting for 65% of total sales. The Haval H6, launched in 2011, has sold over 3 million units, becoming the king of domestic brand models. Another example is the Emgrand, launched by Geely in 2009, which has long been a pillar of Chinese domestic brand sedans. However, after the H6, although some popular domestic models emerged, such as the Changan CS75, Yidong, Baojun 730, and Roewe RX5, their overall sales and historical status are still inferior to the aforementioned four models. In fact, the market share of domestic passenger car brands (including sedans, SUVs, and MPVs, according to data from the China Association of Automobile Manufacturers) was 45.6% in 2010, 42.23% in 2011, 41.9% in 2012, 40.3% in 2013, 38.4% in 2014, 41.3% in 2015, 43.2% in 2016, 43.9% in 2017, 42.1% in 2018, 39.2% in 2019, and dropped to 38.4% in 2020, reaching the lowest point in 14 years for domestic brand passenger cars.

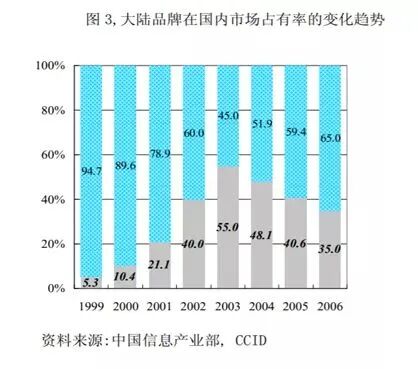

However, on the other hand, starting from the second half of 2020, the explosive growth in the market value of domestic electric vehicle brands, including NIO and BYD, has propelled their market values into the global top ten, along with a surge in domestic electric vehicle sales. At the same time, domestic ICT technology giants are also entering the fray. In November 2020, Changan Automobile, Huawei, and CATL announced a joint venture to create a new smart car brand. In December 2020, SAIC, Alibaba, and Zhangjiang Hi-Tech raised 10 billion yuan in the first round of financing to jointly establish “ZhiMi Automotive Technology”. On January 11, 2021, Baidu also announced the establishment of an electric vehicle company, with Geely as its strategic partner. This essentially means that after long-term cultivation, China’s automotive industry is finally about to usher in a market explosion. The situation in the smartphone era is similar; during the feature phone era, domestic brands once rose, with many brands like Bird, TCL, Tianyu, Gionee, KTC, Konka, and Amoi emerging, but they were quickly overwhelmed by Nokia, Motorola, and Samsung, leading to a rapid decline in domestic smartphone brand shares. As shown in the chart below, in 2003, domestic feature phones reached a 55% market share, but were soon counterattacked by foreign brands, dropping to 35% by 2006, a decline of 20 percentage points in just three years.

However, in the smartphone era, domestic brands ultimately launched a major counterattack. Whether in the automotive industry or the smartphone industry, during such large-scale industrial upgrades, there will always be a situation of foreign brands counterattacking. In recent years, the share of domestic products has experienced a low point. Taking the automotive industry as an example, this low point lasted for more than ten years. In the smartphone industry, if we consider the counterattack of foreign brands starting around 2003 until domestic smartphones began to counterattack around 2011, it took about 8-10 years. During this period, foreign brands and enterprises will experience a relatively happy time. In 2021, the US is using semiconductor manufacturing to choke China, which is actually similar to these historical situations, except this time the US is using administrative power rather than relying solely on foreign enterprises’ technological and management advantages to counterattack through market forces. Note the difference; in fact, the Americans are also aware of the problem. If they do not use administrative power, they cannot suppress Chinese enterprises through market competition alone. The development and surpassing of domestic products is not something that can be completed in five or ten years. Based on the history of the automotive and smartphone industries, they have experienced a first round of rapid rise, occupying a considerable market share, and then faced a counterattack from foreign brands, entering a low point due to insufficient technological reserves. This low point lasted for about ten years, and after overcoming it, with accumulated technology and management capabilities, they experienced a rapid counterattack and resurgence. China’s semiconductor industry chain, due to the special interference of US sanctions, will have a different trajectory from the automotive and smartphone industries. After the US sanctioned ZTE in 2018 and the arrest of Meng Wanzhou, domestic capital investment in this industry surged, especially with Huawei’s significant investment in de-Americanization alternatives, greatly promoting the development of this industry. Then, in 2020, marked by the sanctions against Huawei’s chips, China’s largest chip design company, HiSilicon, and SMIC were also sanctioned, entering a low point, with the only way out being to achieve domestic production. Fortunately, China’s semiconductor manufacturing industry chain had already undergone considerable accumulation before 2020, so we do not need another ten years to achieve domestic production. In the past five years, Yangtze Memory Technologies and Hefei Changxin have begun mass production and shipment. Although they have not disclosed their sales figures for 2020, I estimate that both companies’ sales may exceed 1 billion yuan this year. SMIC and Huahong’s Huali Microelectronics have been continuously expanding production and tackling advanced processes in recent years. Domestic semiconductor equipment manufacturers have also been growing. Five years ago, it was a problem for domestic semiconductor equipment manufacturers to achieve profitability, with very few companies able to operate profitably and at a small scale. Now, they have generally achieved profitability. This year (2021), we will see the first domestic semiconductor equipment manufacturer with annual sales exceeding 1 billion USD. Several semiconductor material manufacturers have also gone public, and some semiconductor materials that we could not manufacture five years ago, including integrated circuit silicon wafers and CMP polishing pads, have successively achieved mass production. By the end of 2020, ArF photoresist also passed verification. This means that we have initially accumulated a group of technical talents and seed enterprises, and the situation in 2020 is already a level better than in 2015.

Here, I must once again thank those who promoted and passed the “National Integrated Circuit Industry Development Promotion Outline” through the State Council in June 2014, and those who initiated the first phase of the integrated circuit big fund in September 2014. They may have inadvertently changed history. If we consider the time from the first investment of the big fund at the end of 2014 to May 2019 when the US first began to strike Huawei’s computing, they secured an additional four and a half years of development time for China’s semiconductor industry. This precious time allowed Huawei to avoid facing a desperate situation today. Otherwise, if Huawei faced a complete cut-off of chips in 2020, and China’s semiconductor industry chain was still at the level of 2015, Huawei’s main business in communication equipment would have no possibility of continuing, and it could only survive by relying on patent fees and other businesses.

In previous articles, I have mentioned that the domestic production line’s localization is a major project that requires strong organization to lead. I believe that both the state and Huawei are aware of this. On January 28, the Ministry of Industry and Information Technology announced the establishment of a national integrated circuit standardization technical committee to coordinate the promotion of integrated circuit standardization work and strengthen the construction of the standardization team. The committee includes 90 member units covering companies, research institutes, universities, and users across the integrated circuit industry chain, including HiSilicon, Unisoc, SMIC, JCET, Yangtze Memory Technologies, Huahong, Nanda Optoelectronics, Jiangfeng Electronics, Zhonghuan Semiconductor, Zhongwei Semiconductor, Beifang Huachuang, Shanghai Microelectronics, and others, as well as Tsinghua University, Peking University, Fudan University, Tianjin University, the Institute of Microelectronics of the Chinese Academy of Sciences, the Institute of Semiconductor Research of the Chinese Academy of Sciences, the National Integrated Circuit Innovation Center, and three research institutes under China Electronics Technology Group Corporation, and many other research institutes. The national team is already quite complete. Additionally, Huawei has been making continuous organizational adjustments in recent months, with an unprecedented frequency, including Lei Jun taking over Huawei’s car BU business in November 2020, Huawei’s rapid divestiture of Honor in December 2020, and Lei Jun taking over Huawei’s cloud business in January 2021. Adjustments are made almost every month. Will this be the end of the adjustments? Of course not. The localization of chip production lines is a tough battle. Before a battle, organizational formations must be adjusted, fully considering all aspects. From the adjustments of the national team and Huawei, we can sense that it will not simply be a matter of saying, “Shanghai Microelectronics and SMIC, you charge forward and must take it down.” After all, there is a large amount of technical strength in Huawei, the Chinese Academy of Sciences, China Electronics Technology Group, and universities. How could it be just SMIC and Shanghai Microelectronics fighting to the death? In 2021, we will definitely complete the organizational adjustments for the localization of chip production lines. We will see new messages coming out soon. This time will not be too long. As long as the organizational formation is set, and the right people are doing the right things, we can basically say that half the problem is solved. Let us wait and see.

Source | Ning Nanshan

Recommended Hot Videos📹

👇