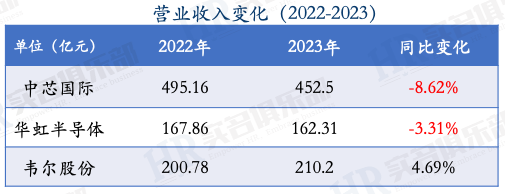

According to the 2023 company financial reports, we summarize the revenue and employee compensation of three major semiconductor companies.

1. Revenue

Due to the overall impact on the industry, in 2023, SMIC and Huahong Semiconductor saw their revenues decline by 8.6% and 3.3%, respectively.

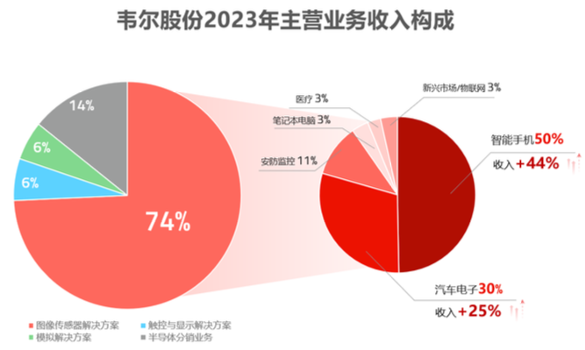

Weir Shares experienced growth against the trend, with revenue increasing from 20 billion to 21 billion, a growth of 4.69%.

In terms of revenue structure, the main drivers for Weir Shares were: smartphone growth of 44% and automotive electronics growth of 25%.

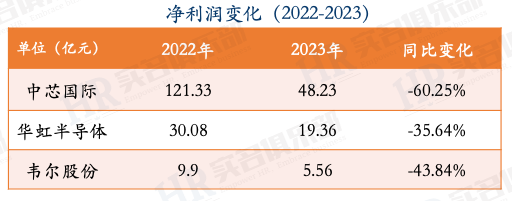

However, in terms of net profit, all three companies experienced significant declines.

The largest drop was for SMIC, with net profit falling from 12 billion to 4.8 billion.

3. Employee Changes

In 2023, SMIC reduced its workforce by 1,396 people, while Weir Shares reduced its workforce by 180 people.

Huahong Semiconductor increased its workforce by 103 people.

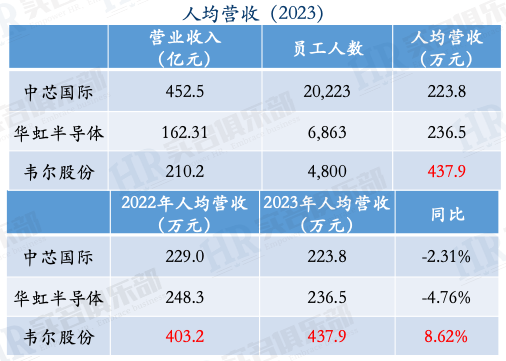

4. Employee Efficiency

Based on April’s exchange rate, TSMC, as a global leader, has a revenue per employee of 666,000 yuan.

SMIC and Huahong Semiconductor have revenue per employee between 220,000 and 240,000 yuan.

Comparing with Weir Shares.

In 2022, Weir Shares had a revenue per employee of 4.03 million, which increased to 4.38 million in 2023, showing excellent performance.

Now looking at profit per employee.

Due to industry impacts, the profit per employee for all three companies has significantly decreased.

SMIC’s profit per employee fell from 560,000 to 230,000, while Huahong Semiconductor’s fell from 450,000 to 280,000.

Weir Shares’ profit per employee decreased from 200,000 to 120,000.

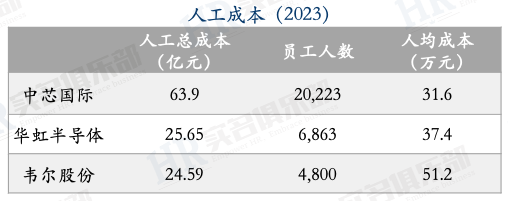

5. Labor Costs

The “labor costs” discussed here refer to the total costs that the company must bear for employee salaries, social security, housing funds, pensions, etc.

Based on total labor costs and total number of employees, in 2023, SMIC’s average cost per employee was 316,000 yuan, Huahong Semiconductor’s was 374,000 yuan, and Weir Shares’ was 512,000 yuan.

From the company’s perspective, Weir Shares’ individual labor cost is slightly “expensive”.

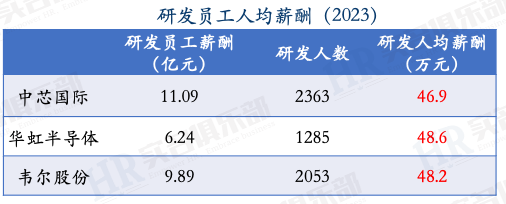

6. Employee Compensation

First, let’s look at the compensation for R&D personnel.

In 2023, the average compensation for R&D personnel at the three major companies was between 460,000 and 480,000 yuan, which is quite close.

The “average compensation” here includes stock compensation, employee benefits, social security, housing funds, etc.

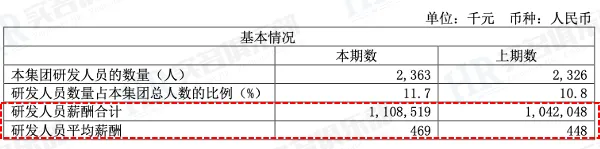

Where does the compensation data come from?

Many tech giants actively disclose this information. For example, SMIC disclosed in its financial report that in 2023, the average compensation for R&D personnel was 469,000 yuan, compared to 448,000 yuan in 2022.

Is employee compensation in the semiconductor industry that high?

Not necessarily.

For example, sales personnel at Huahong Semiconductor have had an average compensation of around 370,000 yuan in the past two years.

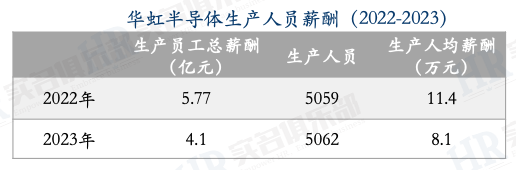

For production personnel at Huahong Semiconductor, the average compensation has been between 80,000 and 110,000 yuan over the past two years.

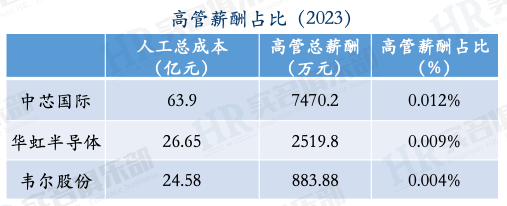

Do executive salaries lower the average employee compensation?

Executive salaries are indeed not low, but the overall proportion of executive compensation is generally below 0.1%, which has a limited impact on overall employee compensation.

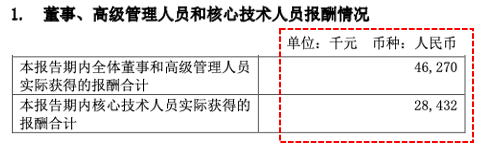

The following image shows the total executive compensation disclosed by SMIC.

In 2023, SMIC’s total executive compensation was 74.7002 million yuan, accounting for 0.012% of total employee compensation.

Weir Shares’ total executive compensation is 8.83 million yuan, with the lowest package accounting for 0.004%.

Note: The term “average compensation” in this article refers to a financial concept calculated based on the number of employees and labor costs disclosed in the financial report, and does not represent the actual income of individual employees.

[2023 Major Companies Compensation and Efficiency Compilation]

Semiconductors: SMIC, Huahong Semiconductor

Hotels: Huazhu Group, Jinjiang Hotels, Shoulu Hotels

Medical Devices: Mindray Medical, United Imaging

In Vitro Diagnostics: Dian Diagnostics, BGI, New Industry, Antu Bio

Old Car Manufacturers: SAIC, FAW, GAC, BAIC, Dongfeng

New Car Manufacturers: BYD, Geely, Great Wall, Changan

New Forces: Li Auto, NIO, Xpeng, Zeekr, Leap Motor

Photovoltaics: Jinko Solar, Sungrow Power, Trina Solar, TCL Zhonghuan

Lithium Batteries: CATL, Yiwei Lithium Energy, Sunwoda, Tianneng, Desay, Guanyu

Electronics Manufacturing Services:: Luxshare Precision, BYD Electronics, Lens Technology

Industrial Control: Inovance Technology, Zhongkong Technology

Network Security: Sangfor, 360, Qihoo 360, Tianrongxin

Security: Hikvision, Dahua, Qianfang Technology

Consumer Electronics: Ezviz, Anker Innovation, iFLYTEK

Cosmetics: Proya, Shanghai Jahwa

Internet: ByteDance, Tencent Baidu, Kuaishou, Meituan

Entertainment: NetEase, Bilibili iQIYI, Himalaya

E-commerce: Alibaba JD.com, Pinduoduo

Software: Yonyou, Kingdee, Inspur, Kingsoft Office

Drinks: China Resources Beverage, Dongpeng Special Drink, Nongfu Spring

Beer: China Resources Beer, Tsingtao, Yanjing Beer, Chongqing, Zhujiang Beer

Food: KFC, Haidilao, Mengniu, Yili

Tea Drinks: Nayuki, Cha Bai Dao, Gu Ming, Mixue Ice City

Two-Wheeled Vehicles: Yadea, Aima Technology

Sports: Anta, Li Ning, 361 Keep

Communications: Huawei ZTE, Xiaomi, Transsion Holdings

Technology: Foxconn Industrial Internet BOE, GoerTek

Optics: Sunny Optical, OFILM

Home Appliances: Midea, Haier, TCL, Hisense

Express Delivery: JD Logistics, SF Express, Jitu, Cainiao

– If you want to discuss the compensation and efficiency of major companies in depth, there will be an offline exchange meeting in May in Hangzhou and Beijing, welcome to participate.