Executive Director of the Japan Enterprise (China) Research Institute

The importance of semiconductors, photovoltaics, batteries, and drones to a country’s economy is undeniable.

In the early stages of these technologies, Japanese companies played a crucial role in research and development, production, and market expansion, outperforming companies from other countries. However, after entering the 21st century, as Japan’s economic policy shifted from an industry-focused approach to a finance-led one, the dominance of financial theories in political and economic spheres led to a noticeable slowdown in product innovation and a severe lack of subsequent research and development. While the international market continued to expand, Japan’s domestic market gradually contracted.

Politically, during Junichiro Koizumi’s era, Japan’s attitude was only displayed through visits to the Yasukuni Shrine; during the Democratic Party’s governance, territorial disputes with neighboring countries intensified; under Shinzo Abe’s administration, relations with South Korea and North Korea became strained; and under Fumio Kishida, Japan-Russia relations reached a post-war low.

Economically, Japan entered a “lost decade” in the 1990s, which extended into a “lost twenty years” in the 21st century, and after 2010, under Abe’s leadership, this phenomenon evolved into a “lost thirty years.”

During this period, Japan’s semiconductor market share shrank from over 50% to less than 10%; the industrial promotion policies for photovoltaics have long since faded; lithium-ion battery technologies, originally invented by Japanese companies, saw Panasonic, once the world’s largest battery manufacturer, disappear from the list of the top five most influential battery companies; and although Japan began researching drones for agricultural spraying as early as the 1950s, drones have remained relatively stagnant in Japan and have yet to secure a place in the international market.

Today, Japan still holds significant influence in the global economy through its robotics industry. However, after thirty years of stagnation, Japan’s capabilities in artificial intelligence, industrial internet, and quantum computing have failed to achieve a mainstream position globally. Politically, since 2022, Japan has implemented the Economic Security Law, severing ties with major economic powers. Will Japan’s robotics industry be affected, transitioning from a leading role to a supporting one, and eventually into a background role? Is Japan more willing to accept a supporting role?

It can be said that the future of the robotics industry is a microcosm of Japan’s industrial economic development.

The Import Rate of Robots Begins to Decline Significantly

The Ministry of Economy, Trade and Industry of Japan has a dedicated organization responsible for robotics—the Robotics Policy Office.

The Robotics Policy Office is responsible for researching relevant industrial policies, formulating robotics policies, and regularly publishing industry reports. The latest report was released in July 2019.

According to the report from July 2019, several characteristics of Japan’s robotics industry have emerged:

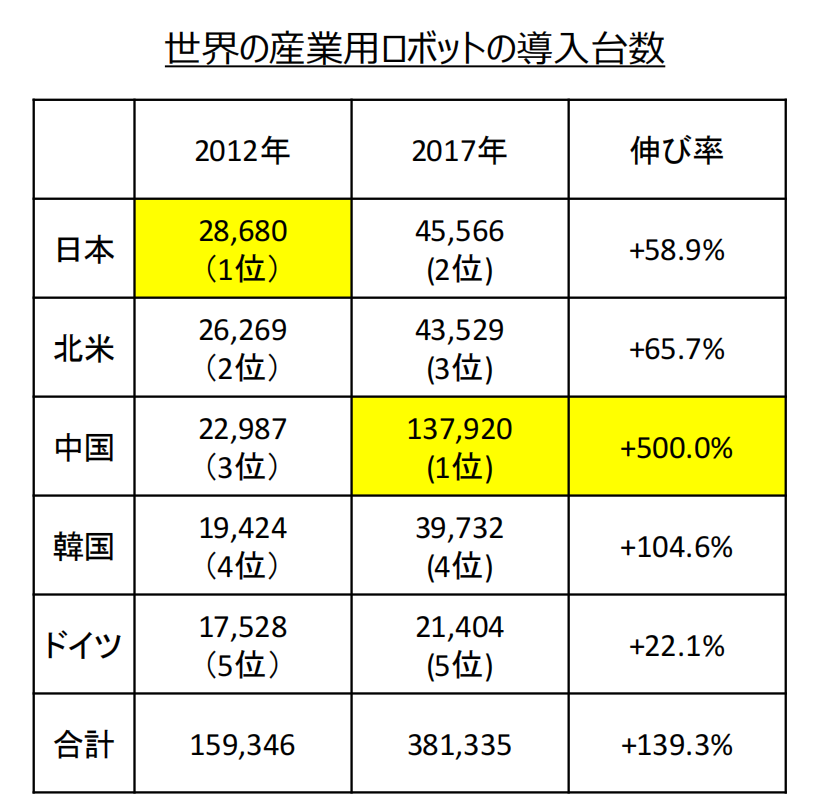

First, from the time Shinzo Abe was elected Prime Minister in 2012 to the data collection by the Ministry of Economy, Trade and Industry in 2017, Japan’s number of robot imports gradually fell from the top position in the world, with a significant gap in growth rates compared to China.

In 2012 alone, Japan imported 28,680 robots, ranking first in the world; while China imported 22,987 robots that year, ranking third. By 2017, Japan imported 45,566 robots in a year, an increase of 58.9% compared to 2012; whereas China imported 137,920 robots, nearly six times that of 2012.

In terms of both quantity and growth rate, China has completely surpassed Japan.

In terms of robot imports, Japan not only lags behind China but also falls behind other countries. In terms of growth rate, Japan significantly trails North America and South Korea, only slightly ahead of Germany, and is far from the world average (139.3%).

Source: Japan’s Conference on Promoting Social Change through Robotics, July 2019 report.

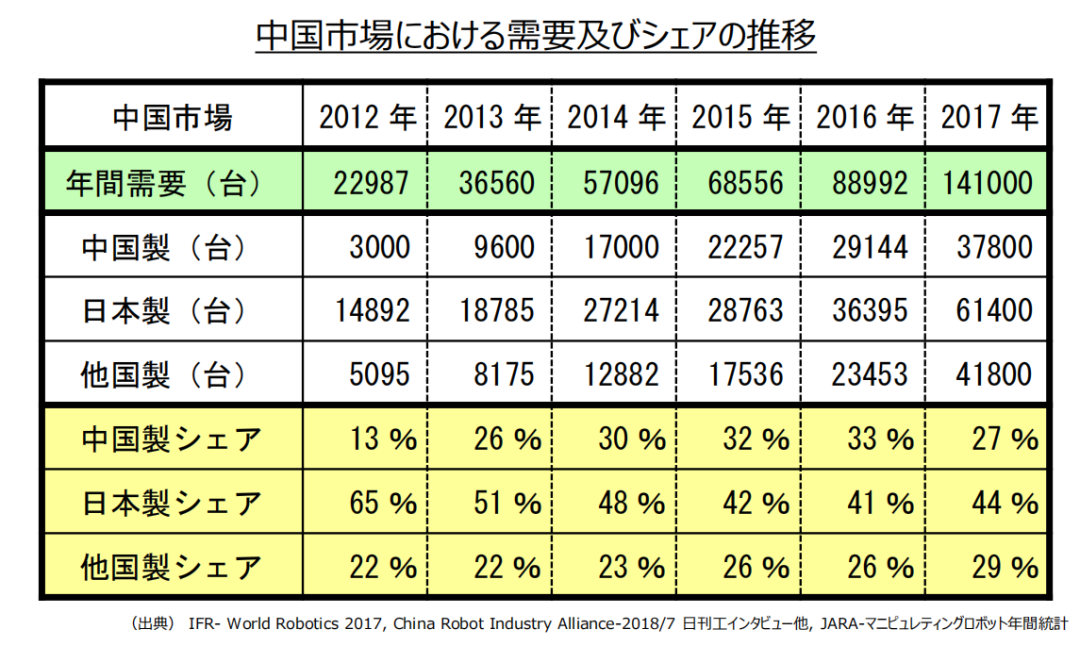

Second, Japan’s advantageous position in the robotics field is declining year by year. From the perspective of the Chinese market, Japanese-manufactured robots are no longer mainstream, as companies from various countries are catching up, making Japanese robots increasingly ordinary.

Looking at the relevant figures released by the Ministry of Economy, Trade and Industry:

In 2012, among the robots needed in the Chinese market, only 13% were produced in China, while Japanese products accounted for 65%, and imports from other countries made up 22%;

However, by 2017, the proportion of robots made in China doubled to 27%, with the number increasing from 3,000 in 2012 to 37,800, while Japan’s share dropped to 44%. Although Japan remains the most important country exporting robots to China, its significance has diminished;

Moreover, the proportion of robots exported to China from other countries increased from 22% in 2012 to 29%, indicating that not only has China’s robotics industry undergone significant changes in five years, but other countries are also striving to catch up with Japan.

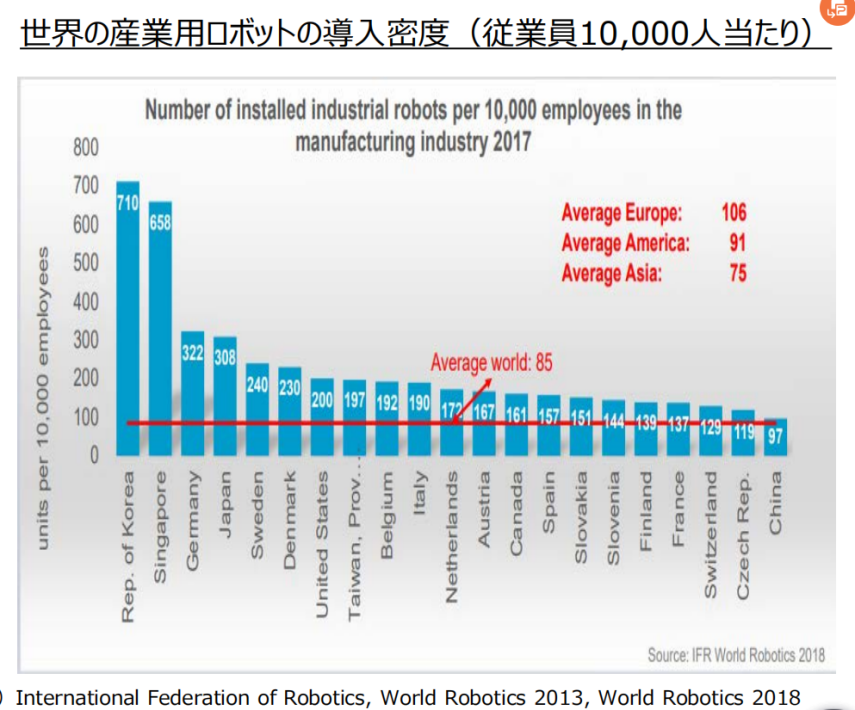

Third, in terms of robot usage, Japan lags behind South Korea and Germany. Although it still surpasses other countries and regions, there is limited room for further robot imports in the future.

According to data released by the Ministry of Economy, Trade and Industry: the density of robots per 10,000 people is 710 in South Korea, 658 in Germany, and less than half of that in Japan, which stands at only 308. Of course, Japan is much higher than the United States (230) and China (97), but China is catching up rapidly.

Assets and Self-Rescue

After losing its advantages in semiconductors, batteries, photovoltaics, and drones, Japanese companies have temporarily retained their world-leading positions in semiconductor packaging, battery anodes and cathodes, membranes, single-crystal and multi-crystalline silicon production, and motors for drones.

Therefore, Japan is now more willing to retreat from finished products to key raw materials and components, aiming to ensure profits without losses—Japanese finished products lack advantages in cost and market expansion; however, retaining uniqueness in key products allows companies to enjoy benefits from market development without bearing risks from competition among finished products or failures in new product development.

In the robotics industry, the microcosm of the smile curve is at both ends: one is materials, and the other is system integration. Japanese companies have certain advantages in subfields such as composite materials, resins, smart materials, control, communication, and sensors; in system integration, Japanese companies have accumulated experience in processing machines, robotic systems, and information processing machines, ensuring the profitability of Japanese robotics companies.

Additionally, Japanese companies are well-capitalized but invest little in robotics research and development, with limited robot imports. Therefore, Japanese companies are striving to expand the usage of robots—only by succeeding in new fields can Japan’s robotics industry continue to develop.

In simpler terms, robots are beginning to enter various fields of Japanese society, and the paths for development are continuously broadening.

If you see a beautiful woman or handsome man on the street, staring intently and reaching out to touch their face or hand, the immediate result is self-evident. However, in Tokyo’s Shibuya, there is a beautiful woman standing there 24 hours a day, surrounded by a crowd of admirers, with hands reaching out, but no one gets slapped; instead, a polite warning comes from a nearby speaker: “Please do not touch!”—this “beauty” is a robot.

One of the “beautiful” robots developed in Japan

Such robots that can speak and communicate with people using affectionate gazes are still not very common in Japanese society, while robotic animals are much more prevalent.

For example, Sony’s robotic dog AIBO was quite popular in Japan. This dog can walk and perform actions similar to a real dog, albeit with a cartoonish and exaggerated flair, making it very appealing to elderly apartment dwellers who cannot keep dogs. Walking around the house with such a robotic dog and conversing with it can significantly alleviate feelings of loneliness for elderly individuals.

In Japanese nursing homes, in addition to robotic pets like AIBO, there are also robots that assist the elderly with bowel movements or help bedridden patients bathe. Due to low wages for caregivers and a significant shortage of staff, there is a strong desire to introduce robots in Japanese nursing homes; however, the extent to which current robots can meet the needs of nursing homes and whether they can be produced at a low cost remains a significant issue.

In recent years, a notable change in Japan is that many government offices have replaced front desks with robots capable of answering visitors’ questions in Japanese, Chinese, and English, guiding them to relevant departments or meeting rooms. Some office buildings have also begun using robots for patrolling; in emergencies, while robots cannot directly control personnel, they can record video and provide preparation time for backend personnel, which can play a significant role in problem-solving.

In fact, Japan primarily manufactures robots used in production processes. In addition to the robots we commonly see in television broadcasts during automotive welding processes, many fixed operations benefit from using robots over human workers to ensure stable quality.

For instance, after the Fukushima nuclear accident, companies like Hitachi and Toshiba have been developing corresponding robots to investigate the conditions of the nuclear power plant accident and to some extent address the incident. However, information on the situation remains scarce, and related work is ongoing, likely facing numerous challenges.

When discussing robots with personnel from Japan’s diplomatic and military sectors, their focus is more on military robots, such as unmanned submarines and drones equipped with explosive devices, which will significantly expand their use in future warfare. A major producer of robots is naturally also a major producer of military robots; beyond long-range weapons like missiles, the use of these robots will greatly alter the course of warfare, making it more destructive and capable of rapidly regressing human history.

Conclusion

Due to the competition from countries and regions like China in the finished robotics market, Japan’s share in the international finished robotics market is expected to decline further. However, decades of research and production in robotics mean that Japanese companies will not be completely cornered and will still have the ability to respond.

What will ultimately lead to the downfall of Japan’s robotics industry is still Japan’s industrial policy.

After the passage of the Economic Security Law in 2022, even with advanced material and system integration capabilities, Japan cannot collaborate with the world’s most important countries (such as China) or can only cooperate with other countries using relatively outdated technologies. This may provide some protection for Japan’s domestic robotics industry, but the Japanese market is too narrow to allow companies to become giants in the robotics industry; external markets are not pursued but prohibited, leading to the inevitable decline of the robotics industry, following the same path as semiconductors and batteries.

The Kishida administration is also striving for the revival of industries like semiconductors and batteries, for instance, by investing heavily to attract TSMC and other companies’ semiconductor technologies and encouraging investments in battery companies, attempting to build a complete industrial supply chain. However, in the global economy, once an industry loses its position, there are very few precedents for recovery through economic policy. Semiconductors and batteries are no exception, and the declining Japanese robotics industry is no different.

Source | Observer Network