1. Core Definition and Industry Background of Domain Controllers

-

Background of Technological Evolution

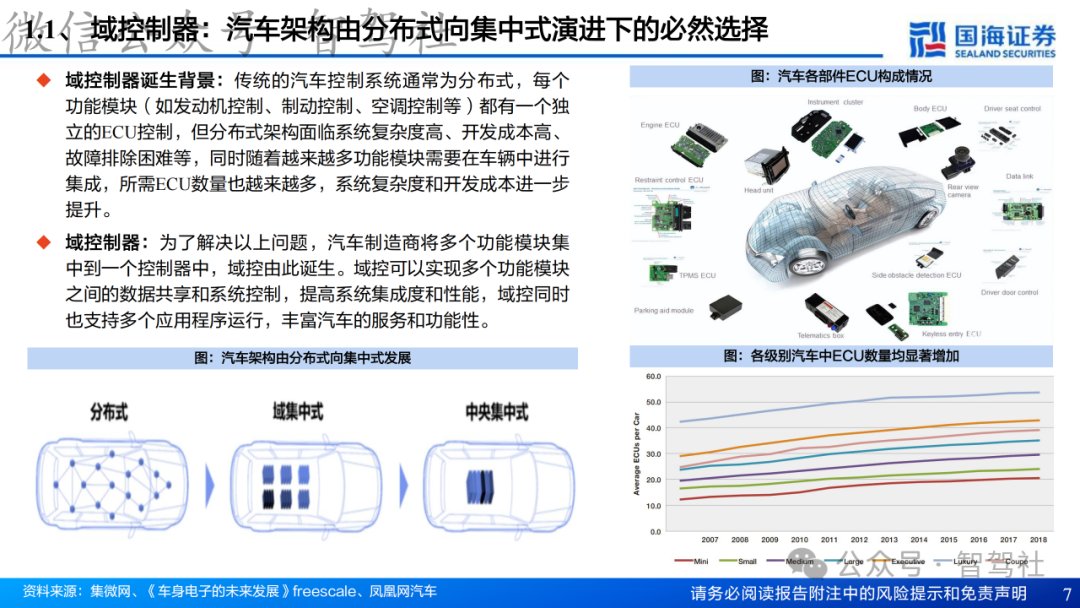

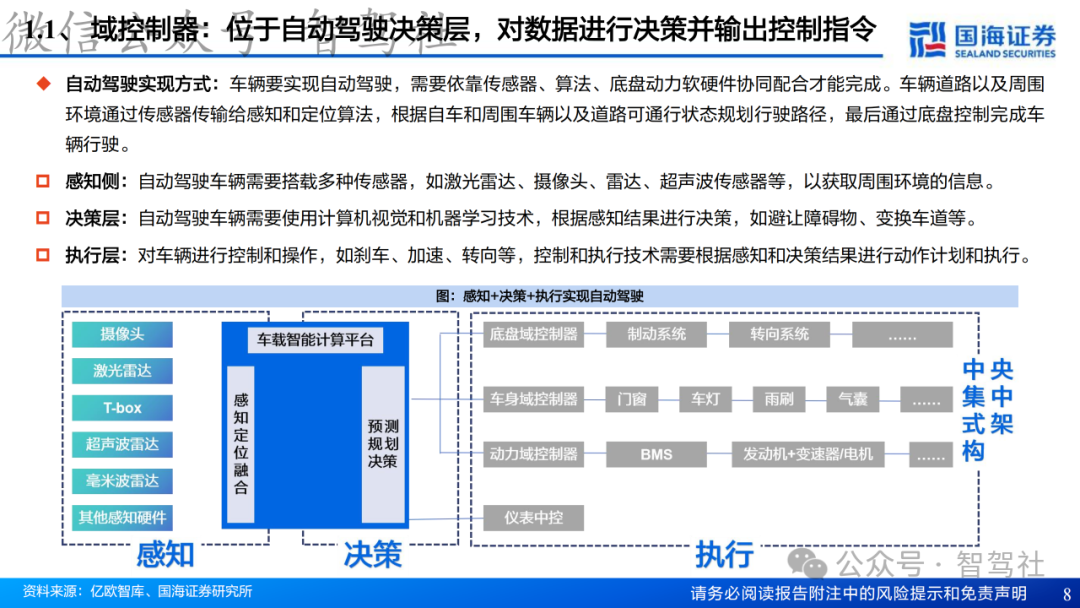

- Pain points of traditional distributed architecture: Each functional module is independently equipped with an ECU (such as engine control, brake control), leading to a surge in the number of ECUs (over 60 in luxury models in 2018), high system complexity, high development costs, and difficulties in fault diagnosis.

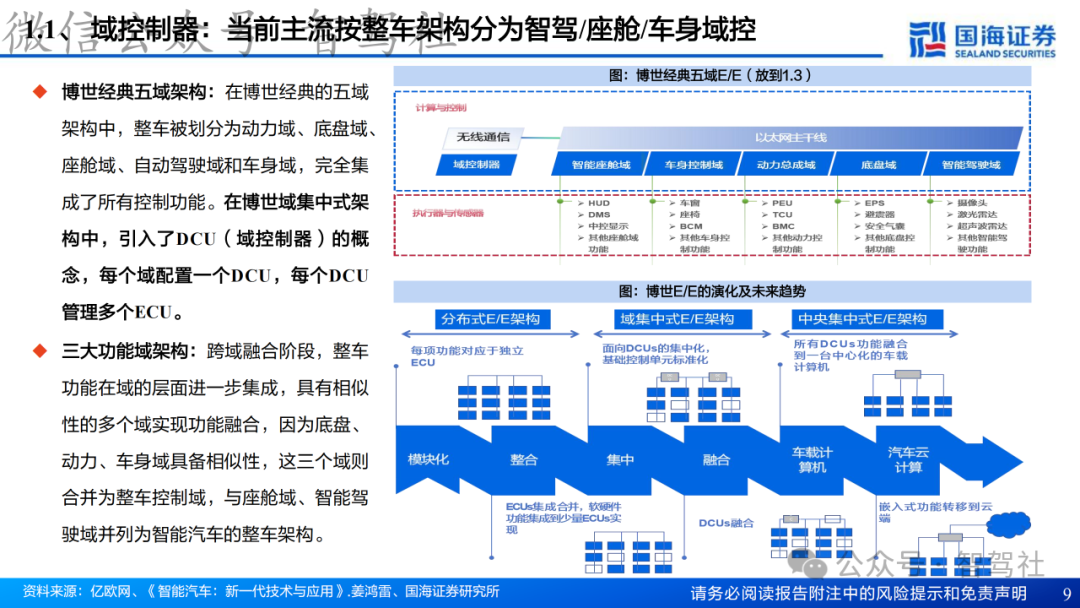

- Birth of the domain controller: Integrating multiple functional modules into a unified controller to achieve data sharing and system integration, enhancing computing power utilization. Currently, the mainstream is divided into three domains: intelligent driving, cockpit, and body, evolving towards a centralized architecture in the future.

Architecture and Industry Chain

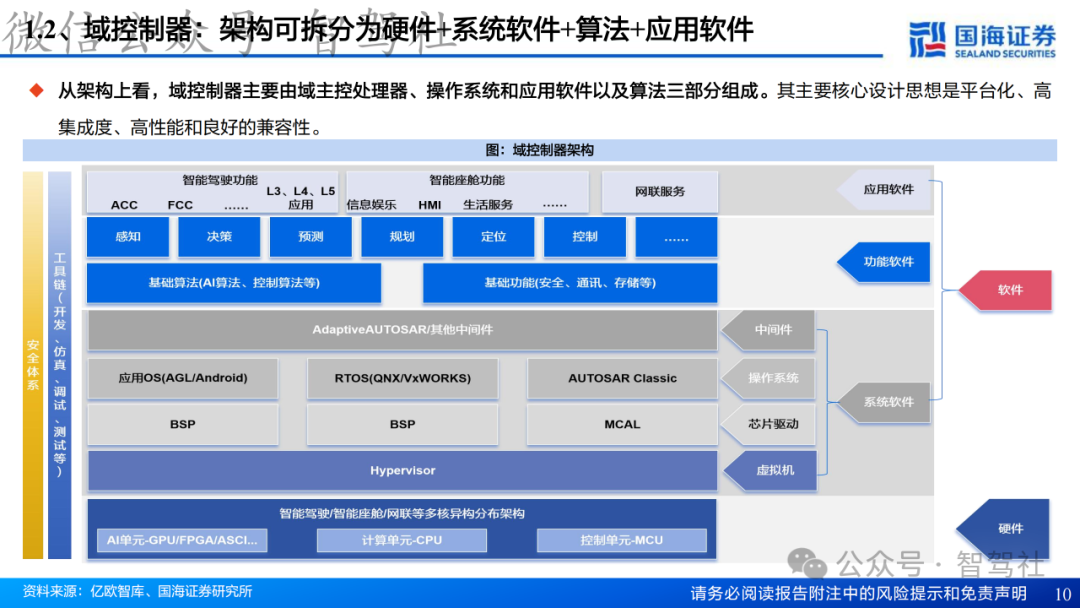

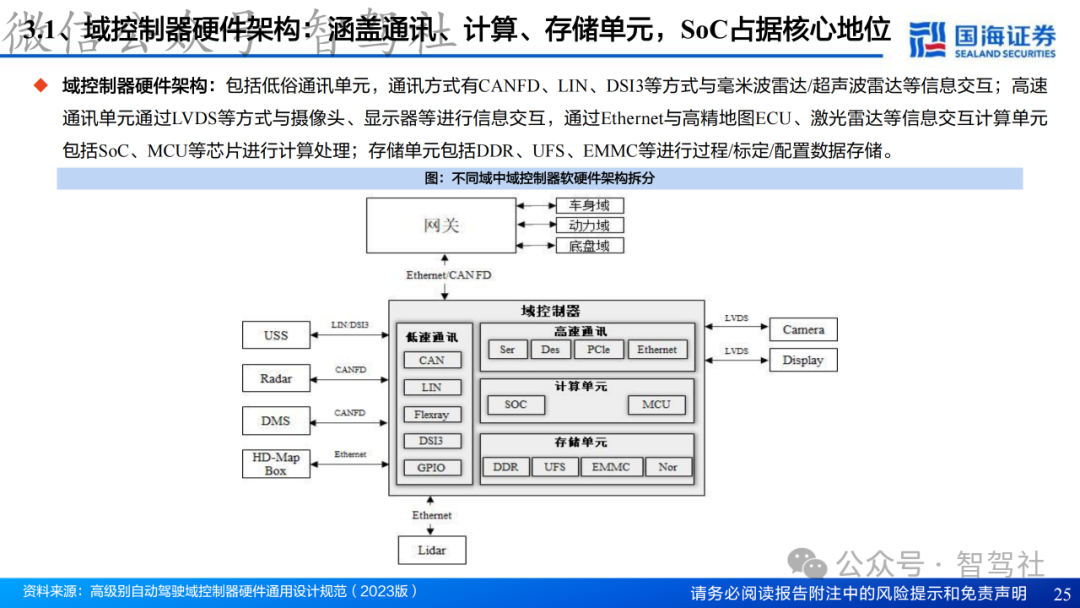

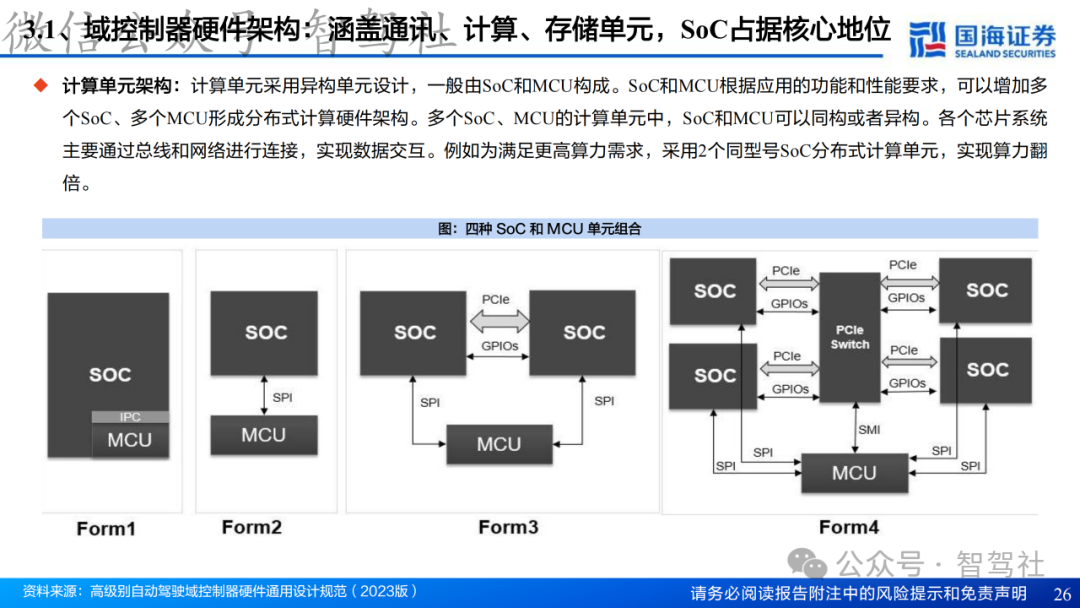

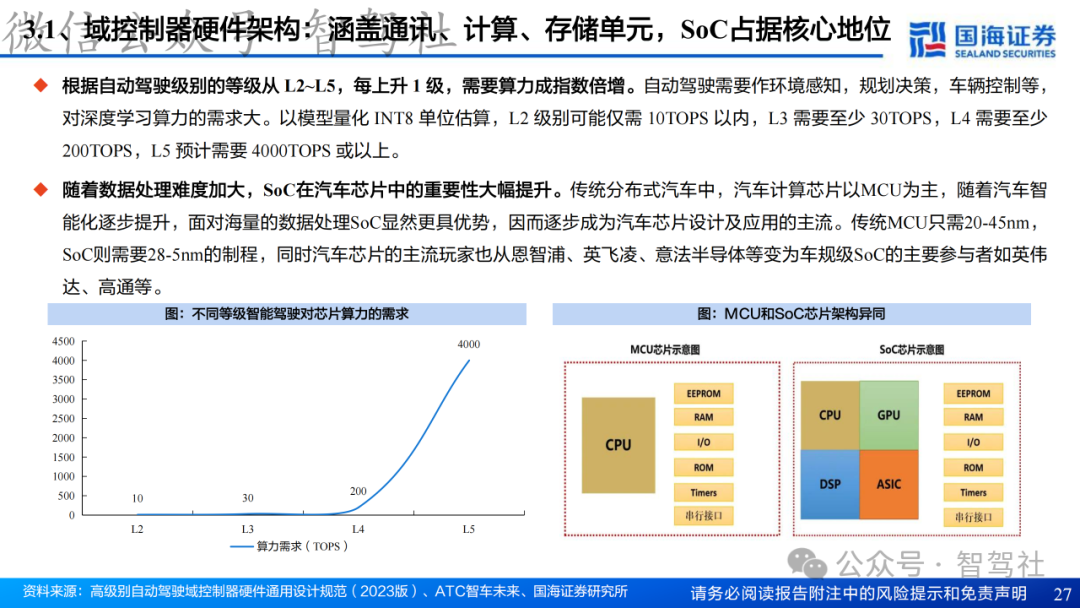

- Hardware LayerComposed of communication units (CANFD/LVDS/Ethernet), computing units (SoC+MCU heterogeneous design), and storage units (DDR/UFS). SoC has become the core due to high computing power requirements (e.g., L5 level requires 4000 TOPS computing power).

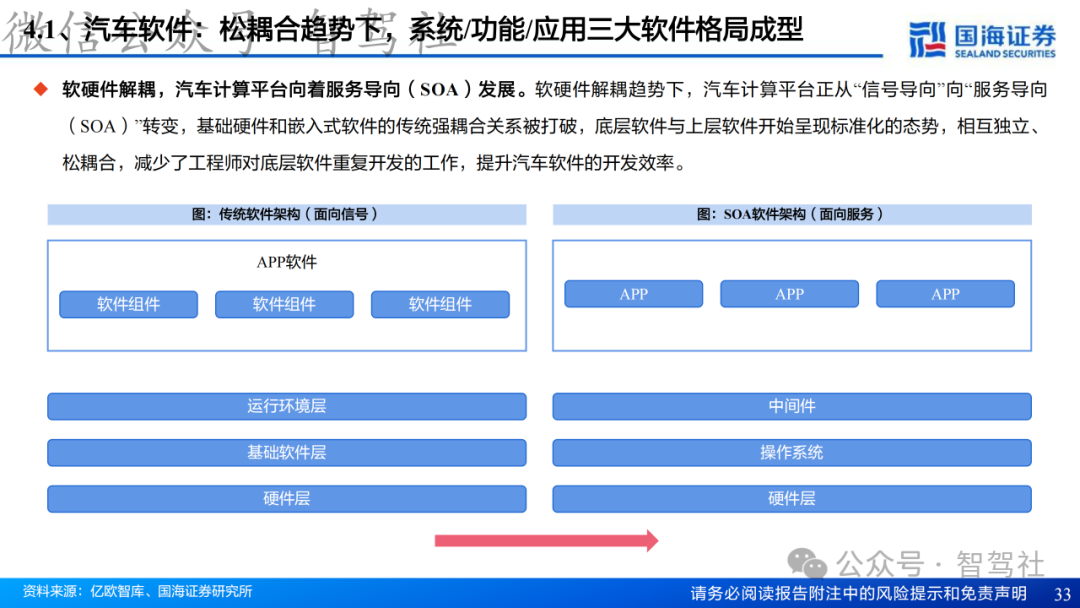

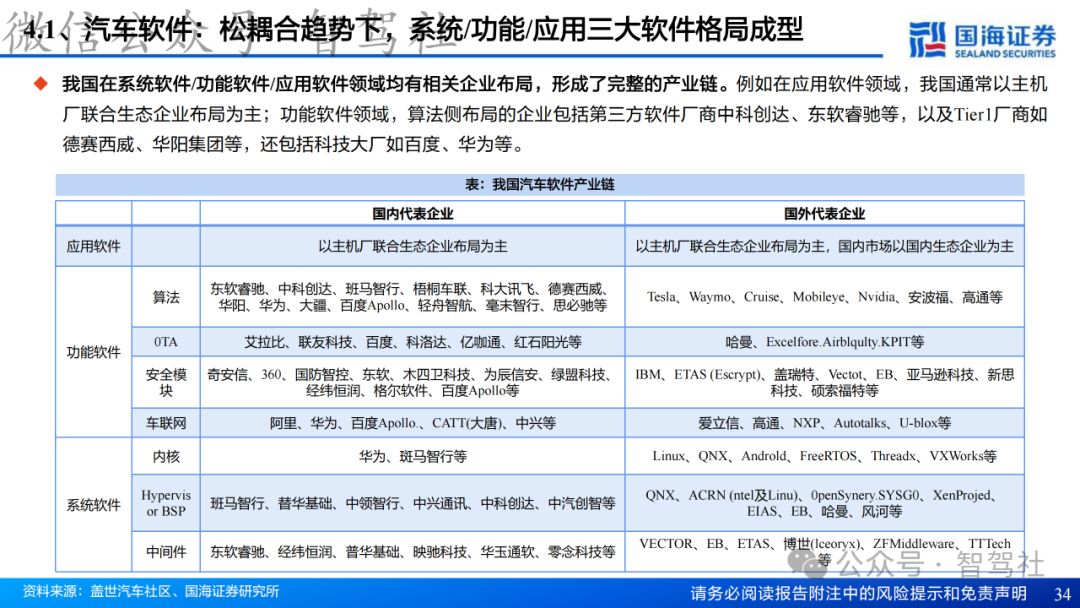

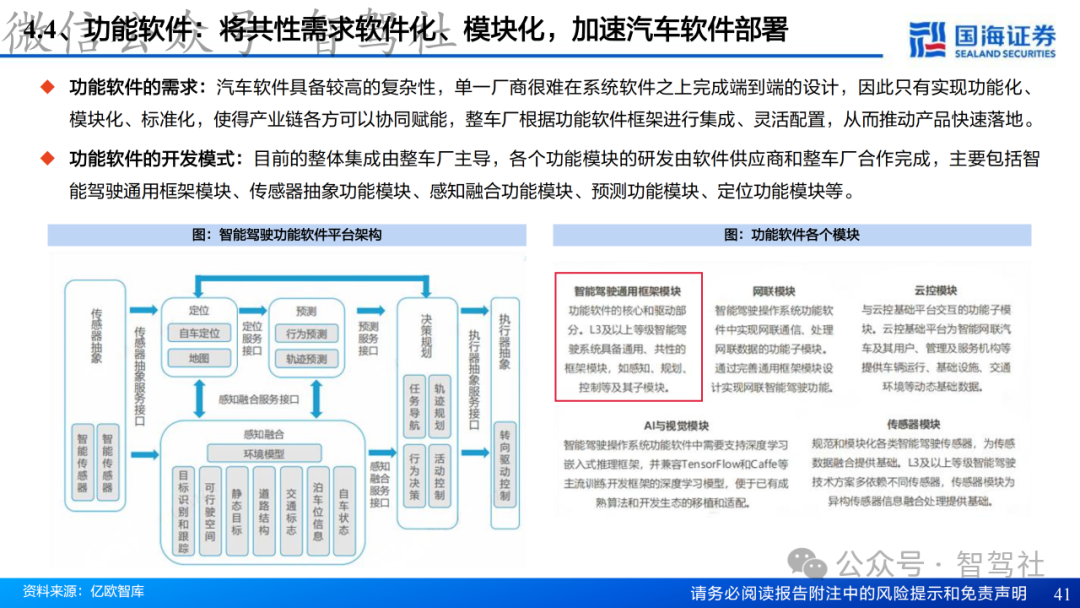

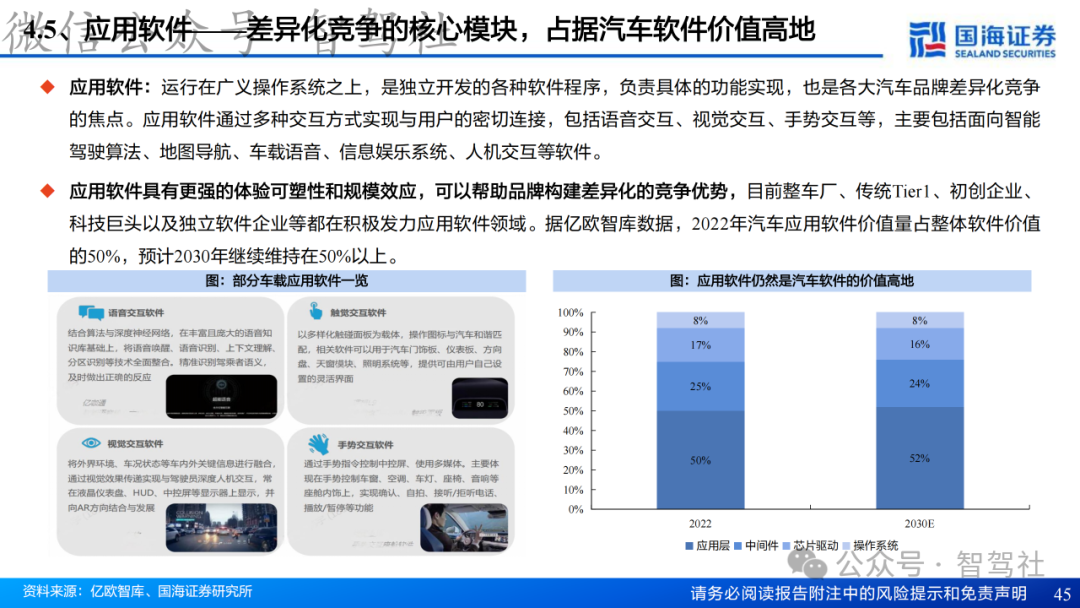

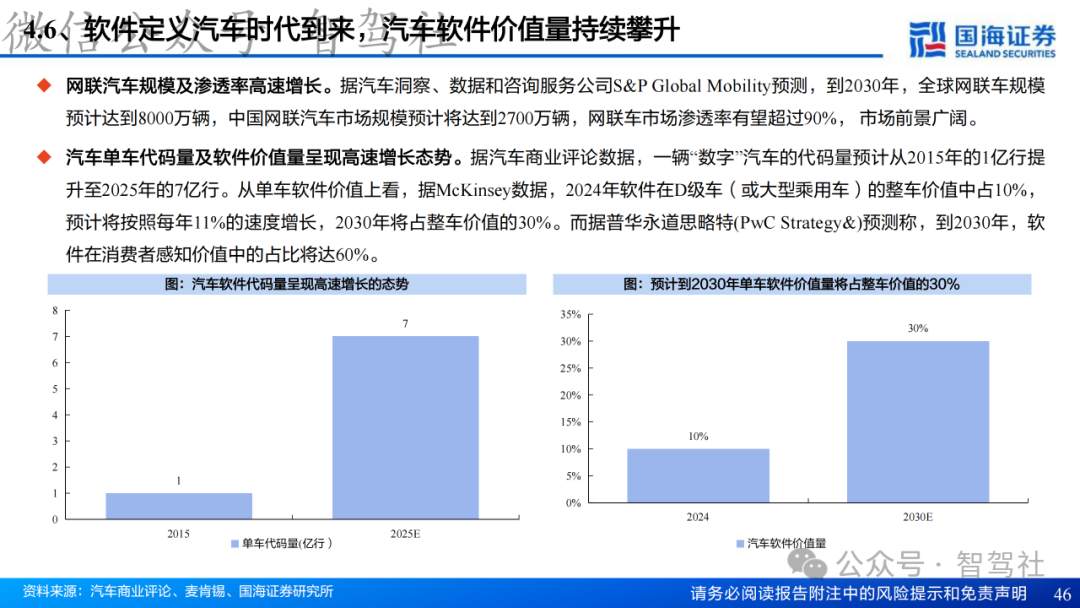

- Software LayerSystem software (kernel/virtual machine), middleware (AUTOSAR AP/CP), functional software (algorithms/OTA), application software (human-machine interaction/navigation) in a layered architecture, with the software value proportion expected to increase from 10% in 2024 to 30% in 2030.

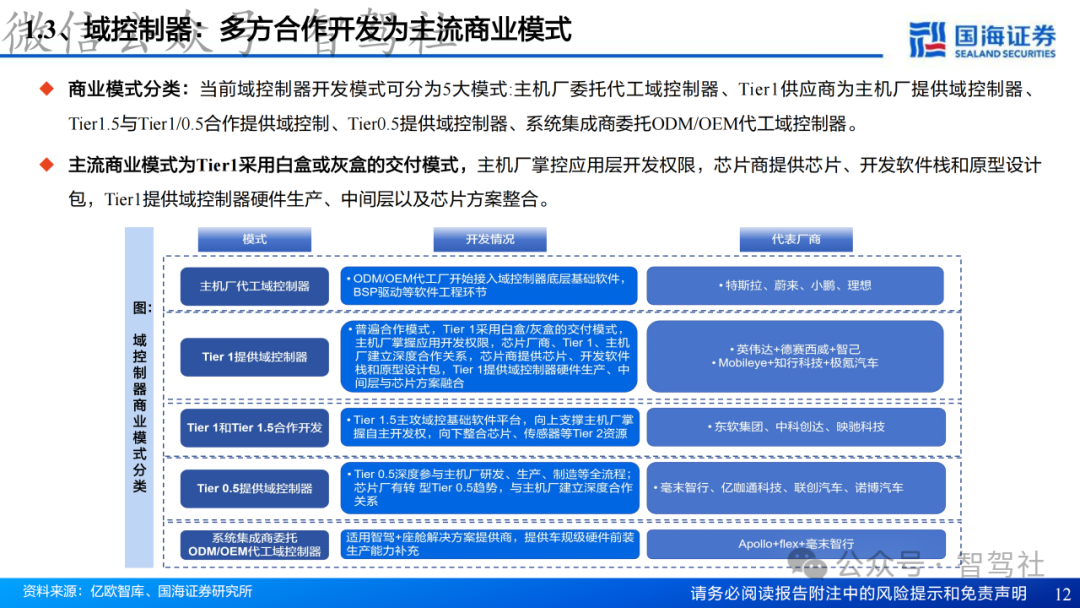

- Industry ChainUpstream chip manufacturers (NVIDIA, Qualcomm), midstream integrators (Desay SV, Jingwei Hirain), downstream OEMs (Tesla, BYD), with cooperation models mainly based on Tier 1 white box/gray box delivery.

2. Intelligent Driving Domain Controller: Core Engine for Advanced Autonomous Driving

-

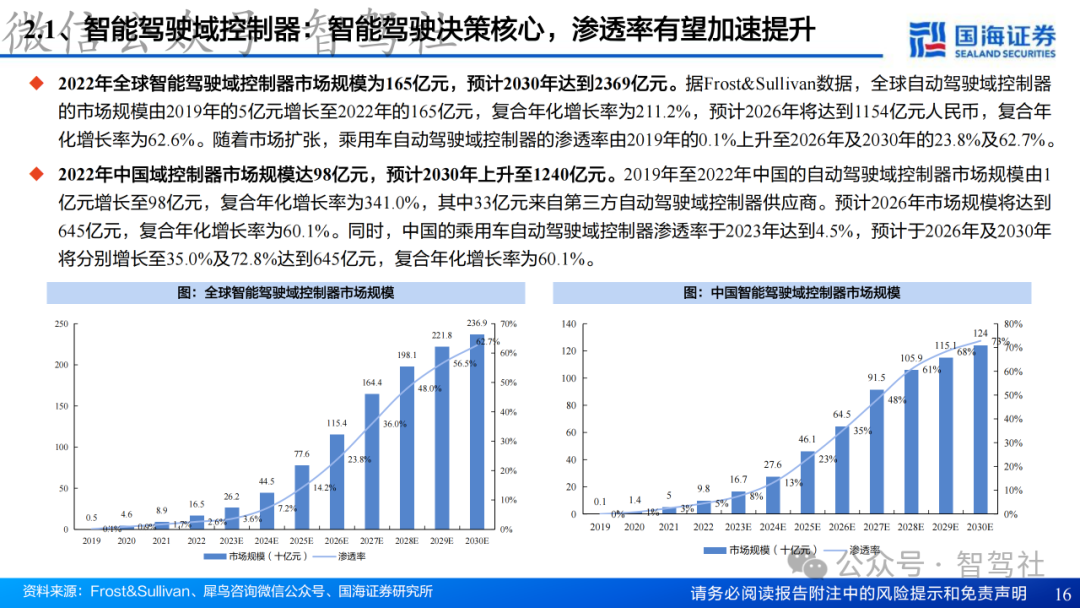

Market Size and Penetration Rate

- Global MarketIn 2022, the market size was 16.5 billion yuan, with a CAGR of 211.2% from 2019 to 2022, expected to reach 115.4 billion yuan by 2026, with a penetration rate of 62.7% by 2030.

- Chinese MarketIn 2022, the market size was 9.8 billion yuan, with a CAGR of 341% from 2019 to 2022, expected to reach 64.5 billion yuan by 2026, with a penetration rate of 72.8% by 2030.

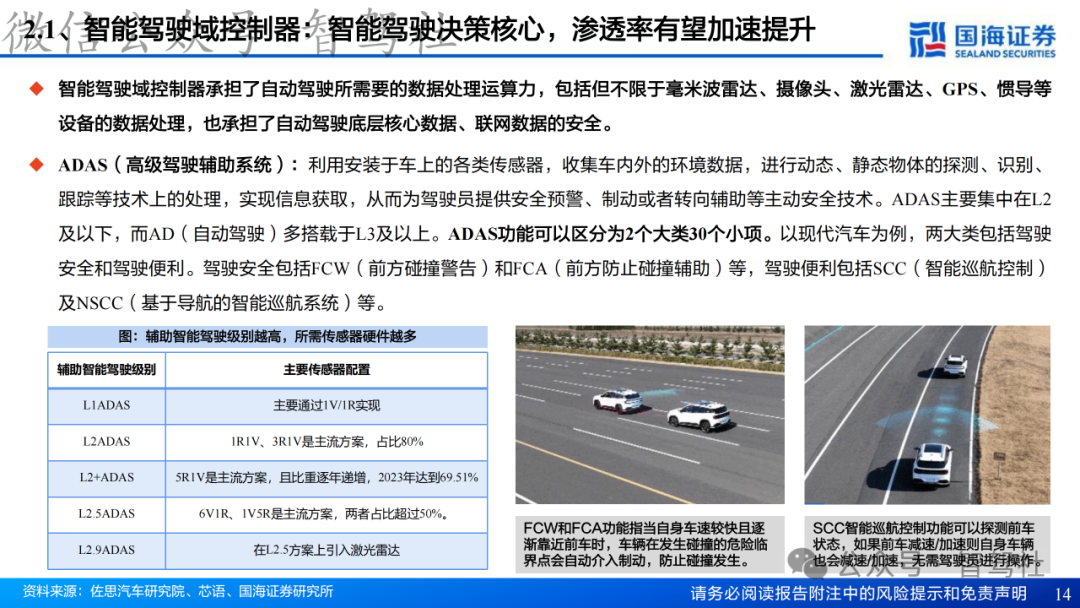

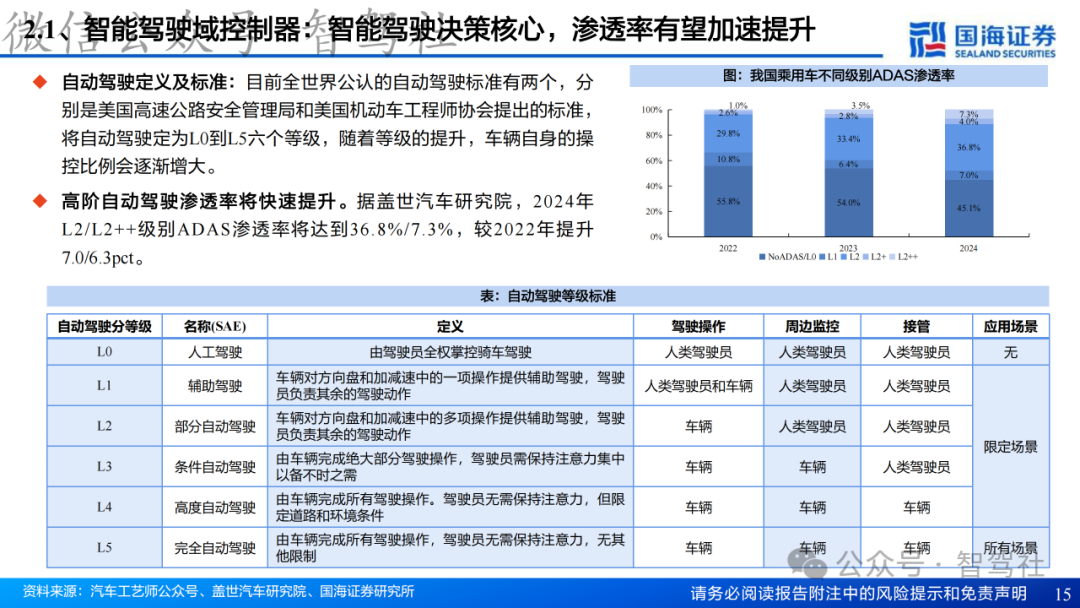

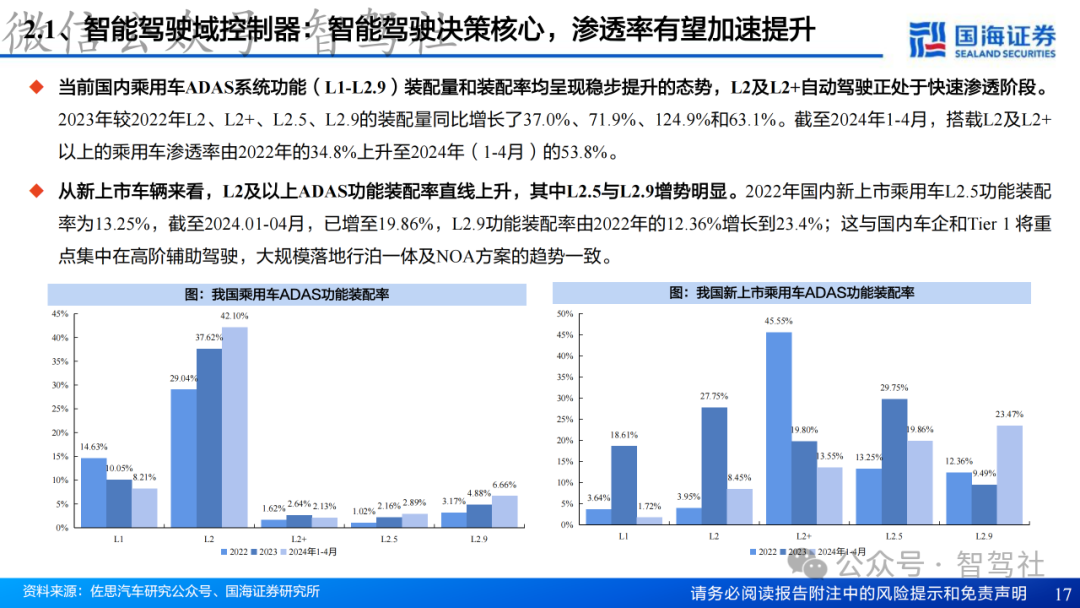

- ADAS Penetration RateIn 2024, the penetration rates for L2/L2++ are expected to be 36.8%/7.3%, with L2.5/L2.9 accelerating penetration due to the embedding of LiDAR, with a 23.4% installation rate for new L2.9 models launched in 2024.

Technical Requirements and Competitive Landscape

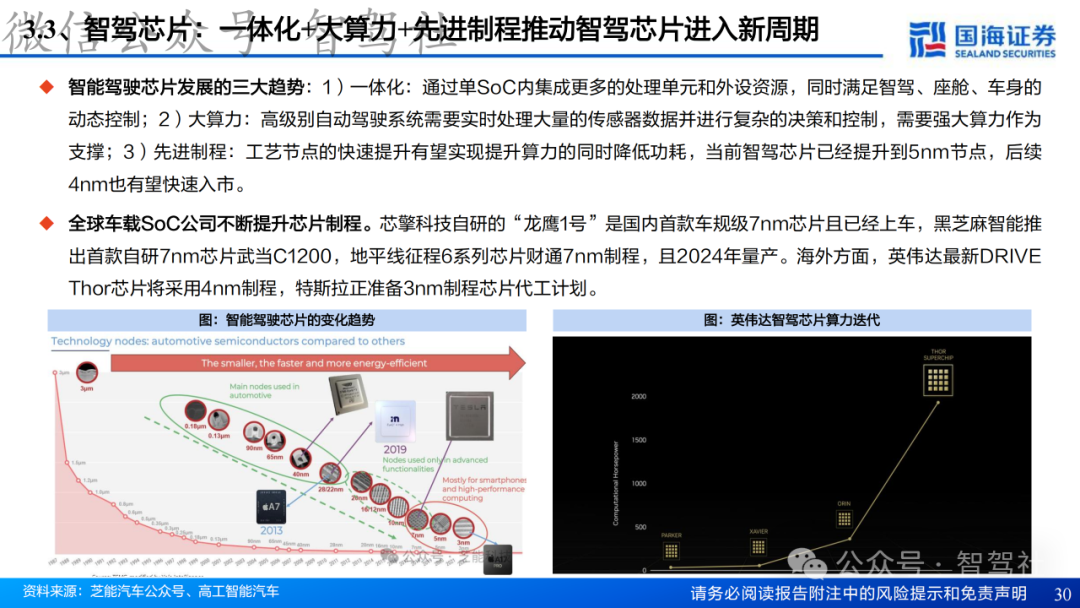

- Computing Power RequirementsL2 requires less than 10 TOPS, while L4 requires more than 200 TOPS, driving SoC towards high computing power (e.g., NVIDIA Orin-X 254 TOPS) and advanced processes (5nm/4nm).

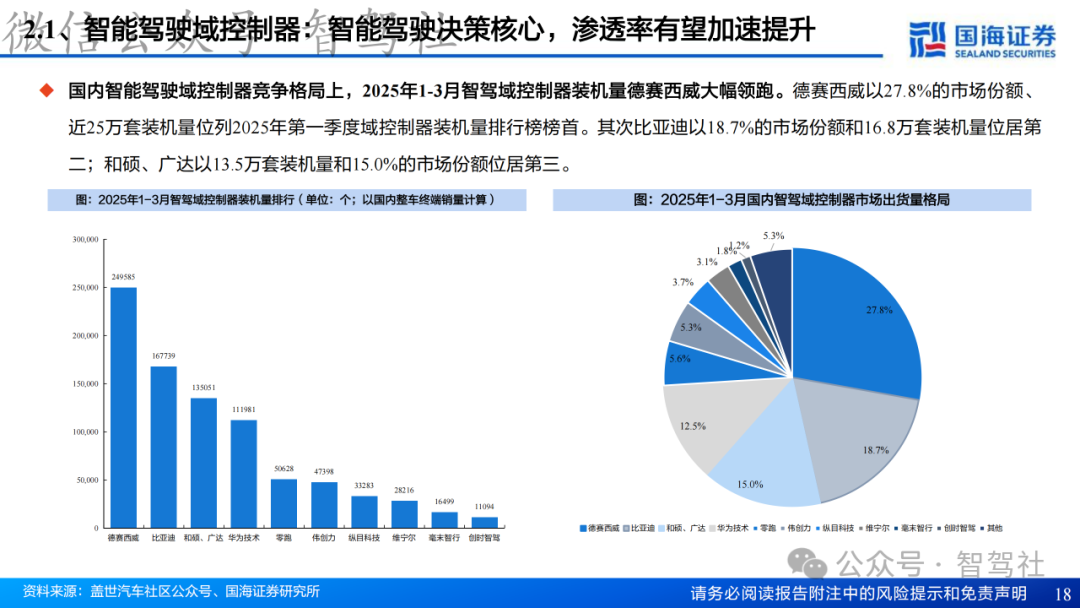

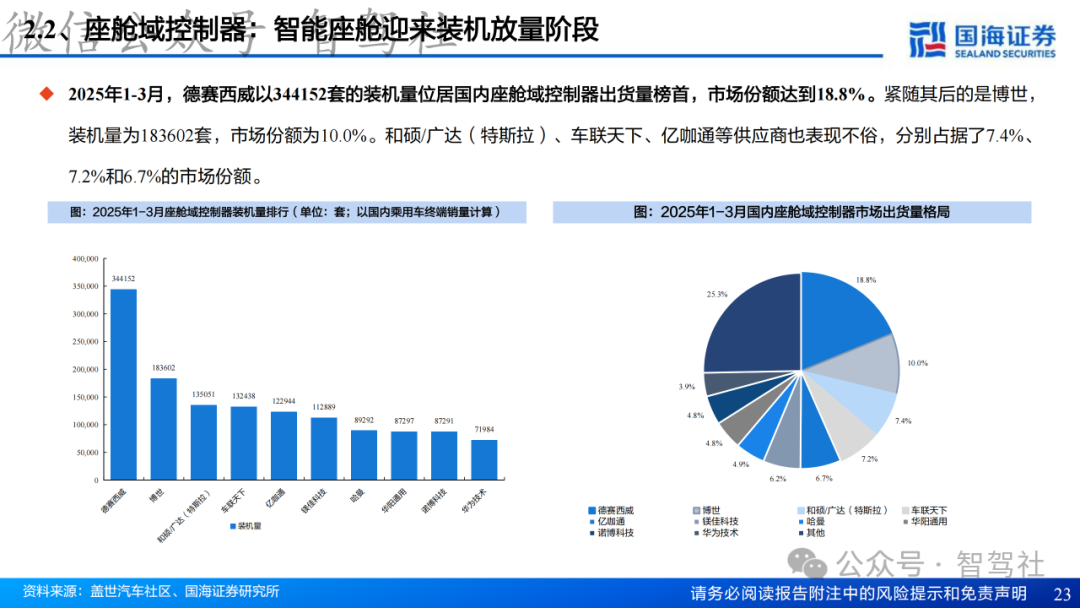

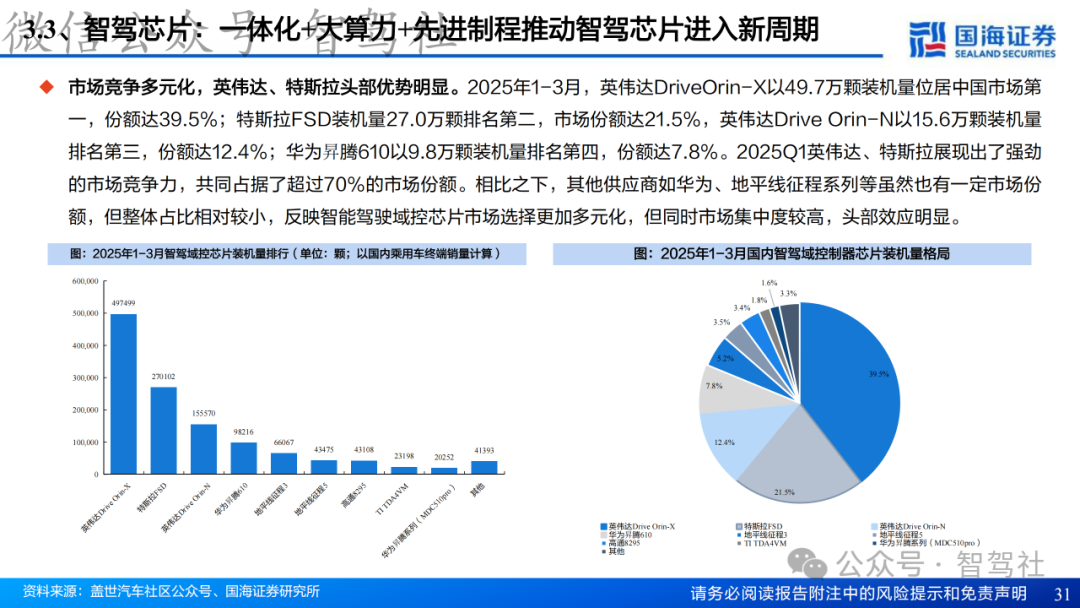

- Market ShareIn Q1 2025, the installation volumes are expected to be led by Desay SV (27.8%), BYD (18.7%), and Pegatron/Quanta (15.0%), with NVIDIA (39.5%) and Tesla (21.5%) dominating the chip side.

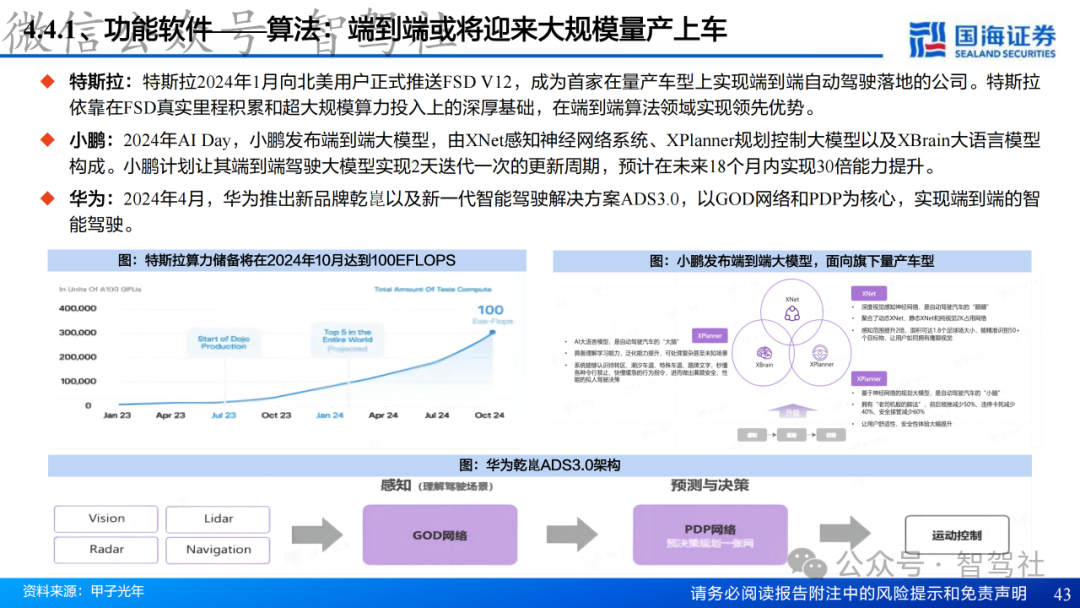

- Typical SolutionsTesla FSD V12 achieves end-to-end autonomous driving, Xiaopeng XNet perception model supports integrated driving and parking, Huawei ADS 3.0 optimizes environmental perception with GOD network.

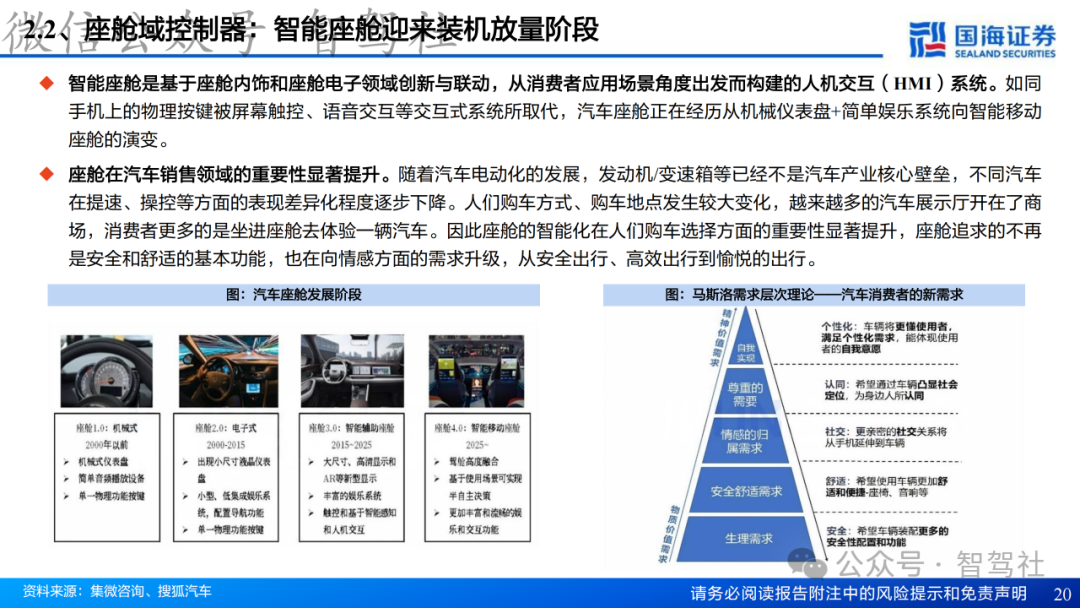

3. Intelligent Cockpit Domain Controller: Core Carrier for Human-Machine Interaction Upgrade

-

Market Growth and Penetration Rate

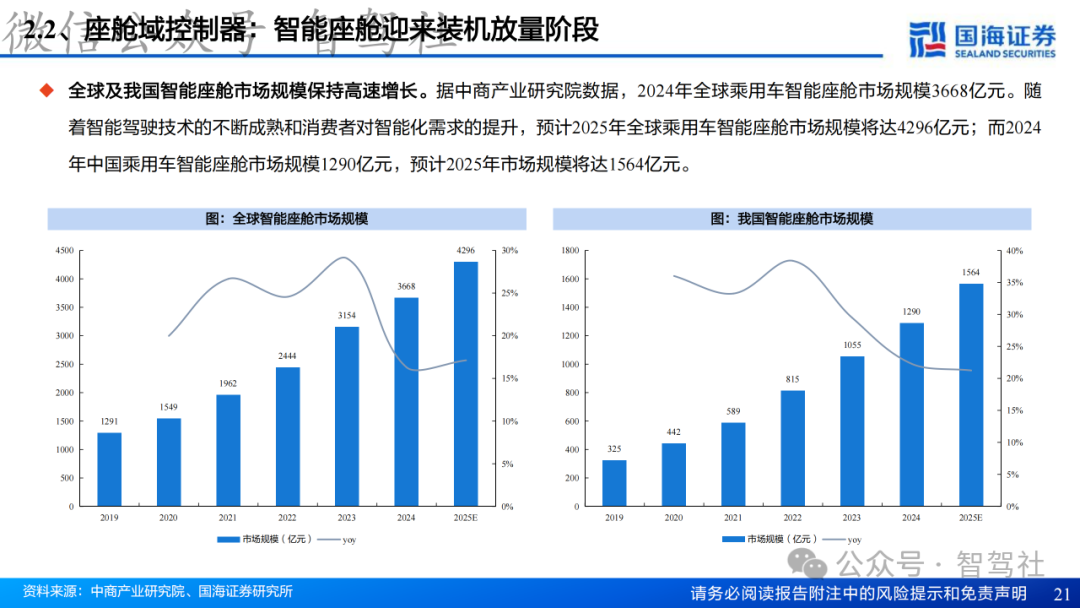

- Global MarketIn 2024, the market size is expected to reach 366.8 billion yuan, with an expected 429.6 billion yuan in 2025, and a CAGR of 18.7% from 2019 to 2025.

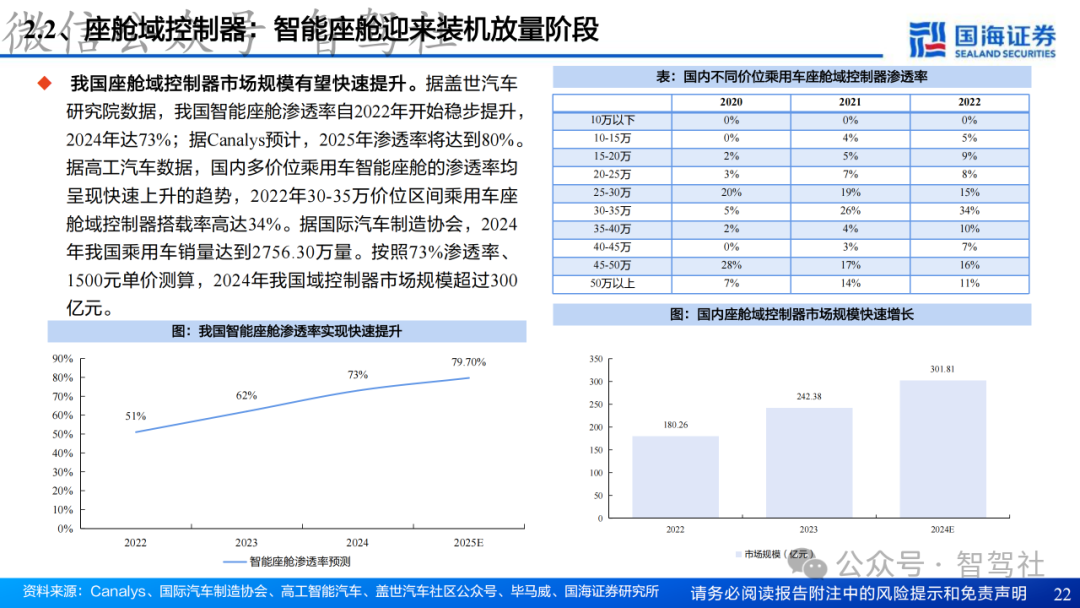

- Chinese MarketIn 2024, the market size is expected to reach 129 billion yuan, with an expected 156.4 billion yuan in 2025, and a penetration rate increasing from 51% in 2022 to 73% in 2024, with an expected 80% in 2025.

- Segmented ScenariosIn 2022, the cockpit domain controller installation rate for vehicles priced at 300,000-350,000 yuan reached 34%, with lower-cost models (150,000-200,000 yuan) accelerating penetration due to cost reductions.

Technical Trends and Competitive Landscape

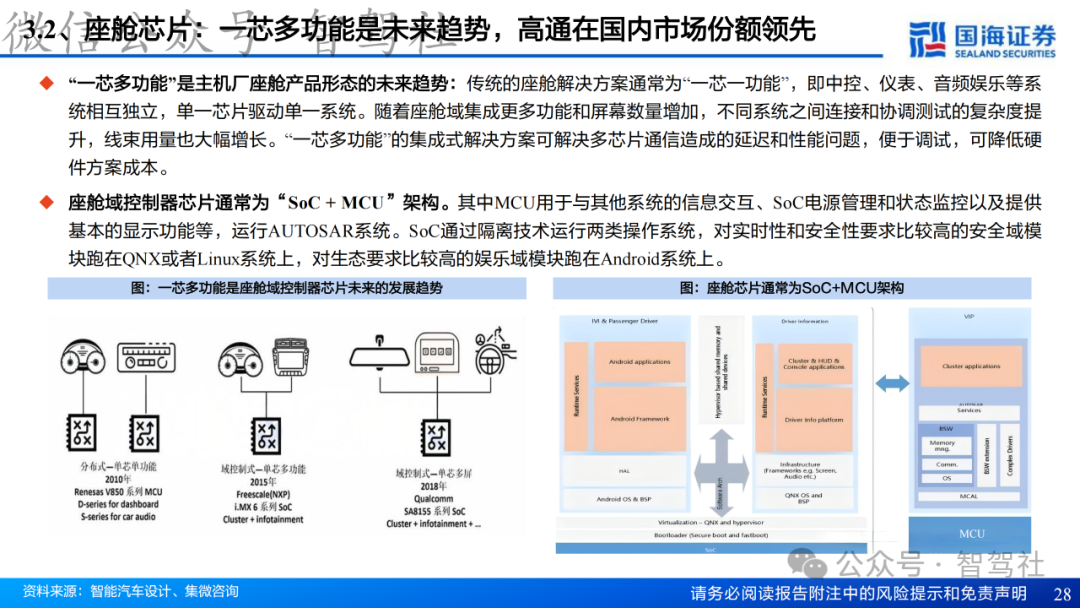

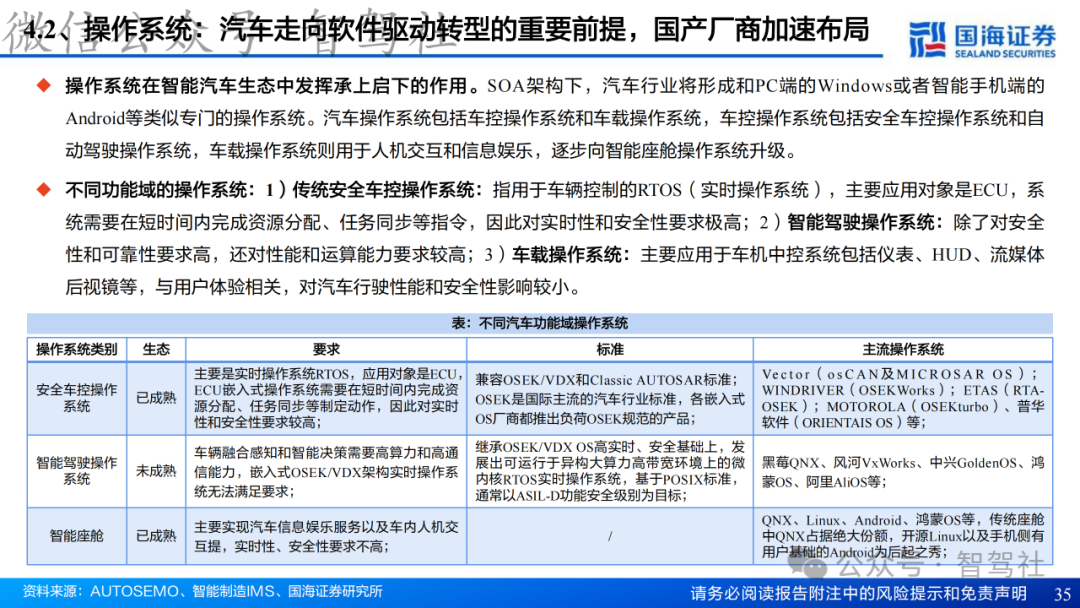

- Architecture UpgradeTransitioning from “one chip one function” to “one chip multiple screens,” supporting dual-system isolation of QNX (safety domain) + Android (entertainment domain), such as Qualcomm SA8155 supporting multi-screen interaction.

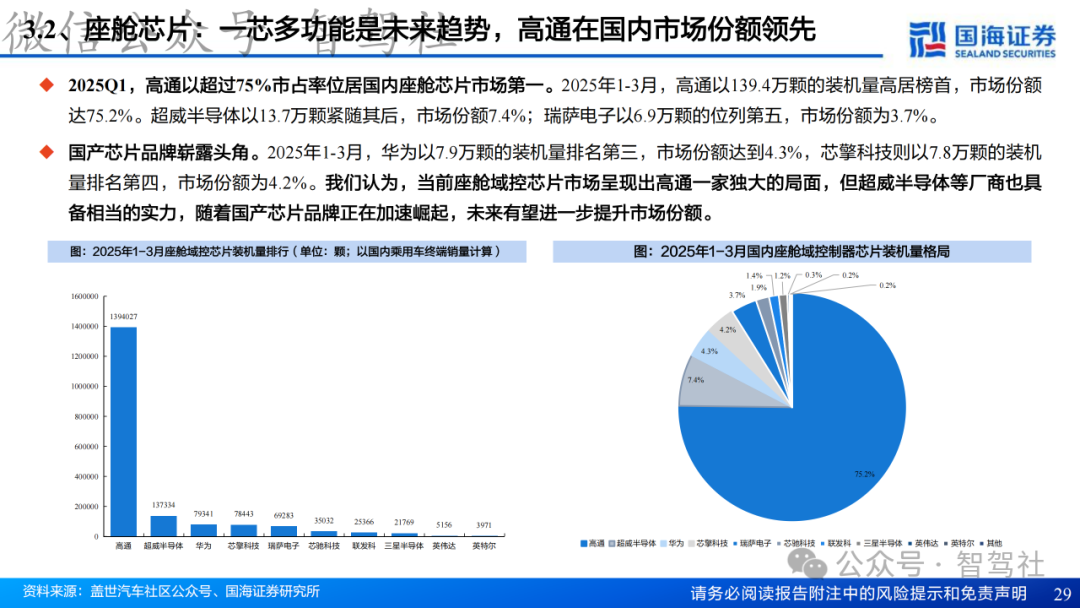

- Chip CompetitionIn Q1 2025, Qualcomm is expected to dominate with a 75.2% share, while Huawei (4.3%) and Chipone Technology (4.2%) accelerate domestic substitution, with the embedded cost of cockpit chips accounting for about 1,500 yuan per vehicle.

- Interaction InnovationIntegrating voice recognition (iFlytek), gesture control, AR-HUD (HuaYang Group), with cockpit software value proportion expected to exceed 50% by 2025.

4. Domain Controller Hardware Architecture: In-Depth Analysis of SoC and Heterogeneous Computing

-

Subdivision of Hardware Units

- Communication UnitLow-speed communication (CANFD/LIN for radar), high-speed communication (Ethernet for LiDAR/high-precision maps), supporting transmission rates above 10 Gbps.

- Computing UnitSoC (GPU/AI unit processing perception algorithms) + MCU (real-time control of chassis/brakes), such as NVIDIA Orin-X containing 12 ARM Cortex-A78AE cores.

- Storage UnitDDR4/DDR5 (operating memory) + UFS (data storage), with L4 level requiring TB-level storage bandwidth.

Chip Technology Iteration

- Cockpit ChipsQualcomm 8295 (7nm) supports 6-screen linkage, while domestic chip manufacturer Chipone X9H (8nm) enters models priced below 150,000 yuan.

- Intelligent Driving ChipsNVIDIA Thor (4nm, 2000 TOPS), Tesla’s self-developed 3nm chip, and Horizon Robotics’ Journey 6 (7nm, 200 TOPS) expected to be mass-produced in 2024.

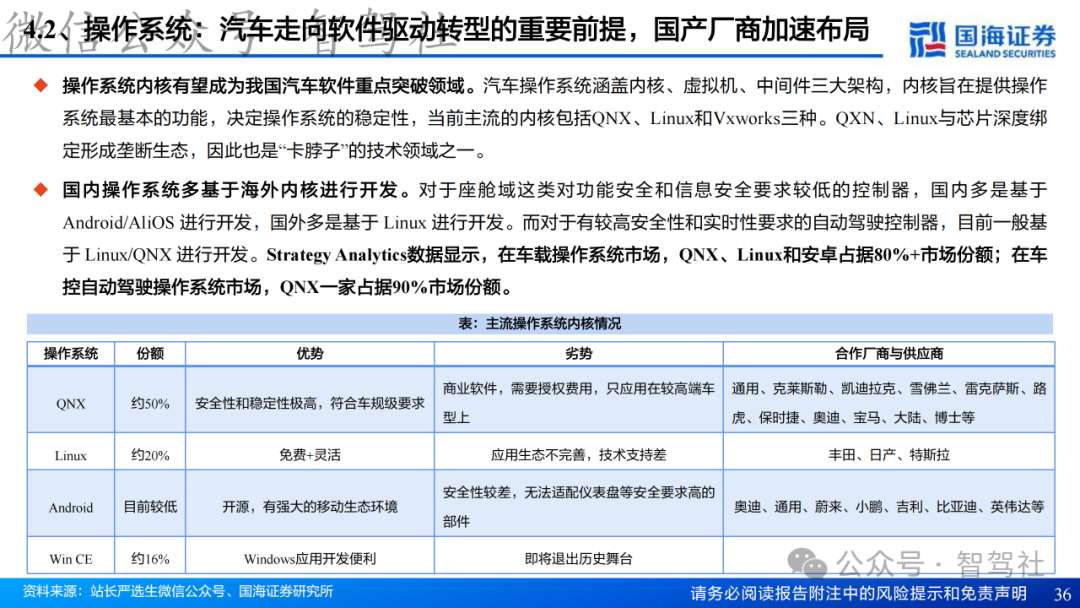

5. Domain Controller Software Architecture: Loose Coupling and Value Layering

-

System Software Layer

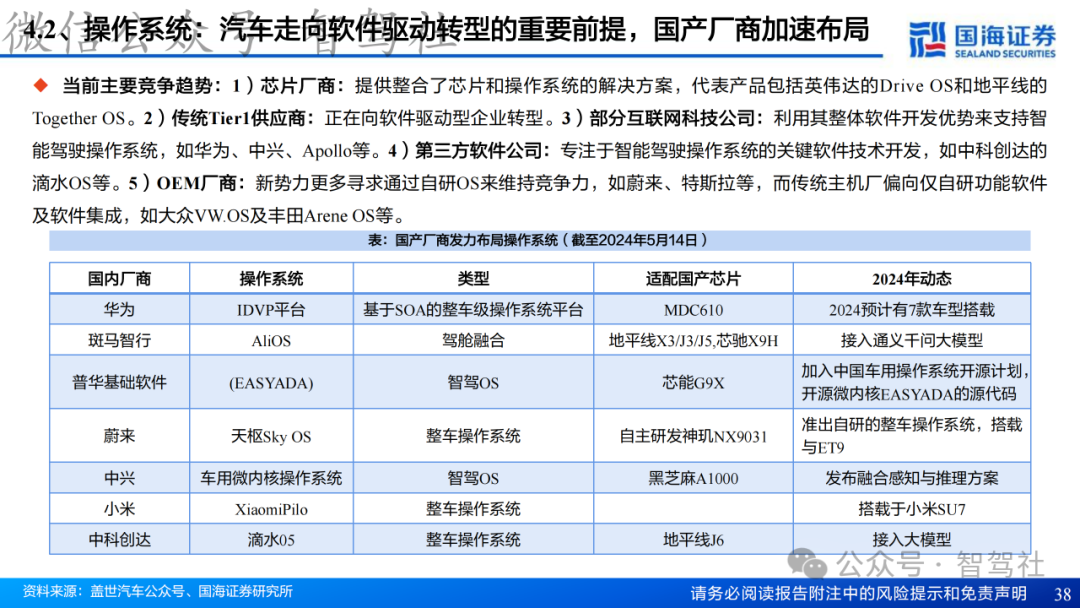

- Kernel Monopoly PatternQNX occupies 90% of the vehicle control OS market share, while Linux/Android dominate the cockpit OS, with domestic Huawei Harmony and Zhongke Chuangda’s Drip Water OS accelerating adaptation.

- Virtual Machine TechnologyHypervisor achieves isolation between safety and non-safety domains, such as QNX Hypervisor supporting parallel multi-system in the cockpit.

Middleware and Functional Software

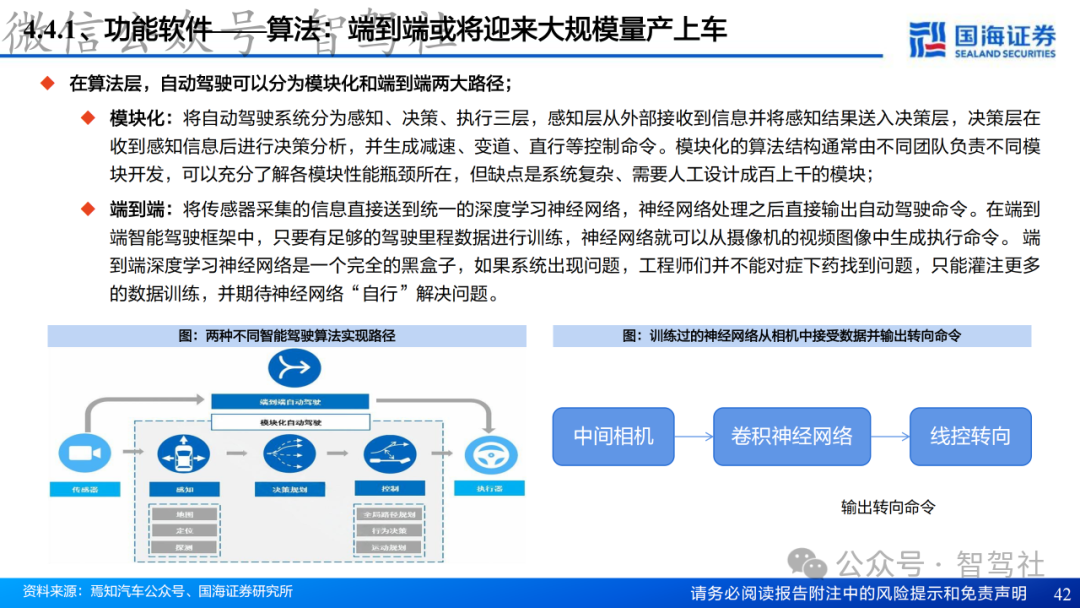

- AlgorithmsEnd-to-end neural networks replace traditional modular architecture, with Tesla FSD achieving “camera → steering” direct control through 100 EFLOPS computing power training.

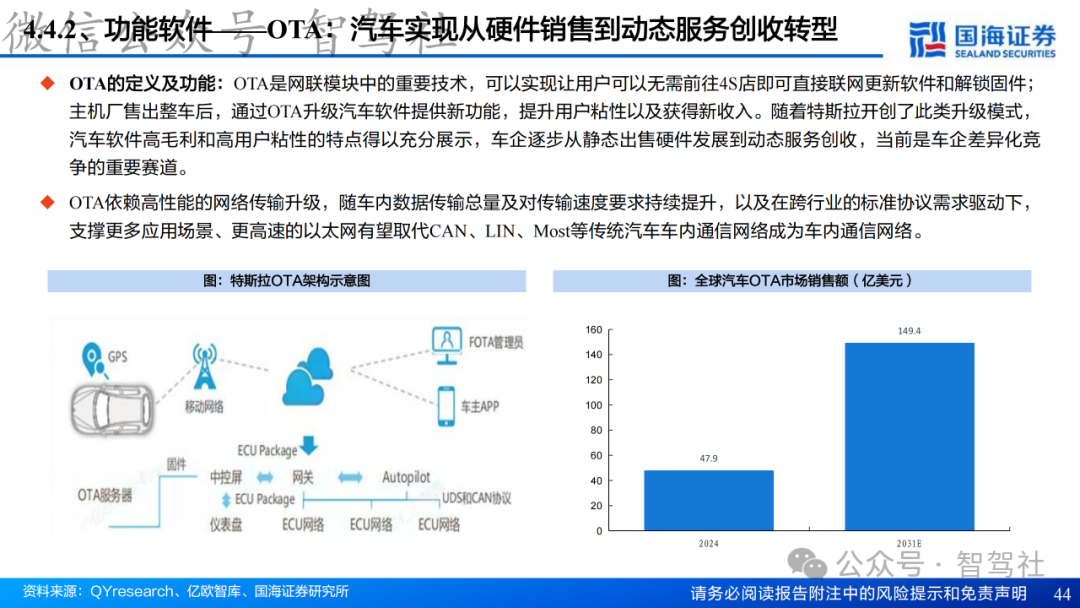

- OTATesla achieves software subscription revenue through FOTA, with global OTA sales expected to reach 14.94 billion USD by 2031, while domestic Xiaopeng and NIO iterate more than 12 times annually.

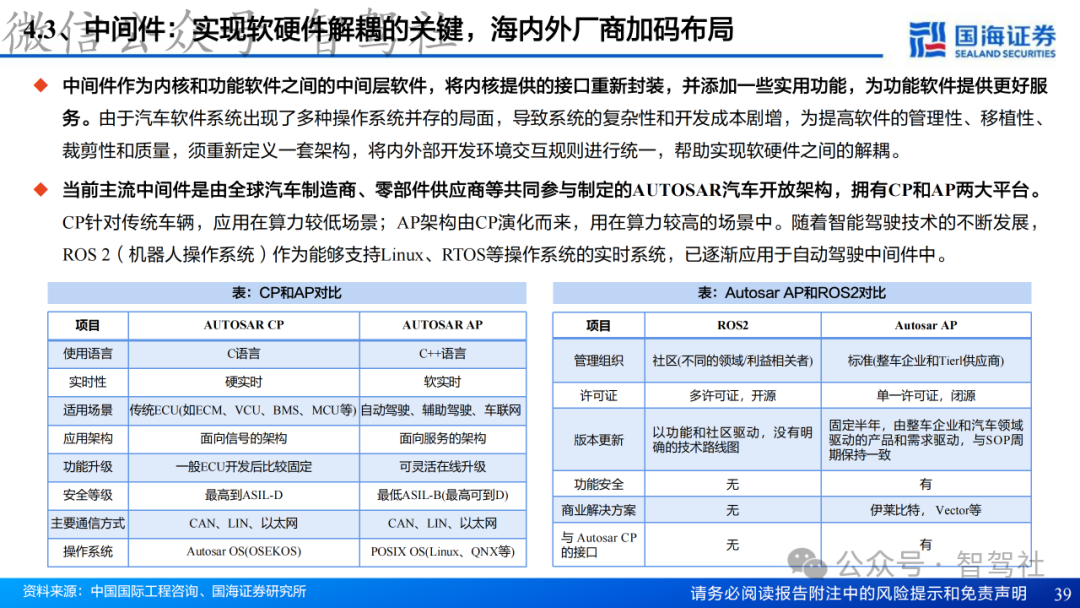

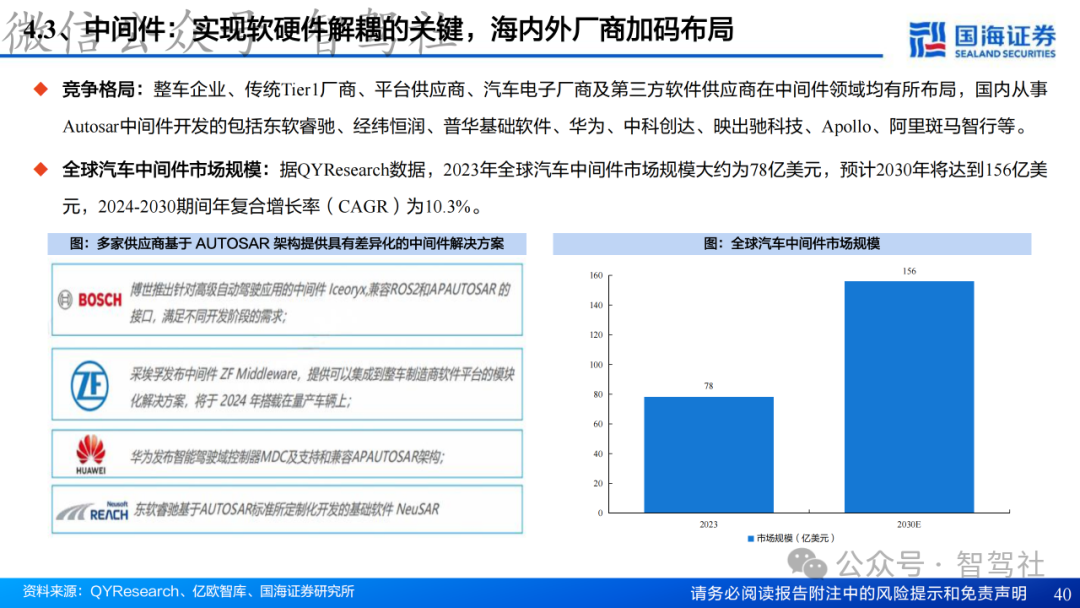

- Middleware StandardsAUTOSAR CP (for traditional ECUs) and AP (for autonomous driving) differentiation, with AP supporting C++ language and SOA architecture, with a global market size expected to reach 15.6 billion USD by 2030.

6. Core Targets and Business Layout of the Industry Chain

-

Domain Controller Integrators

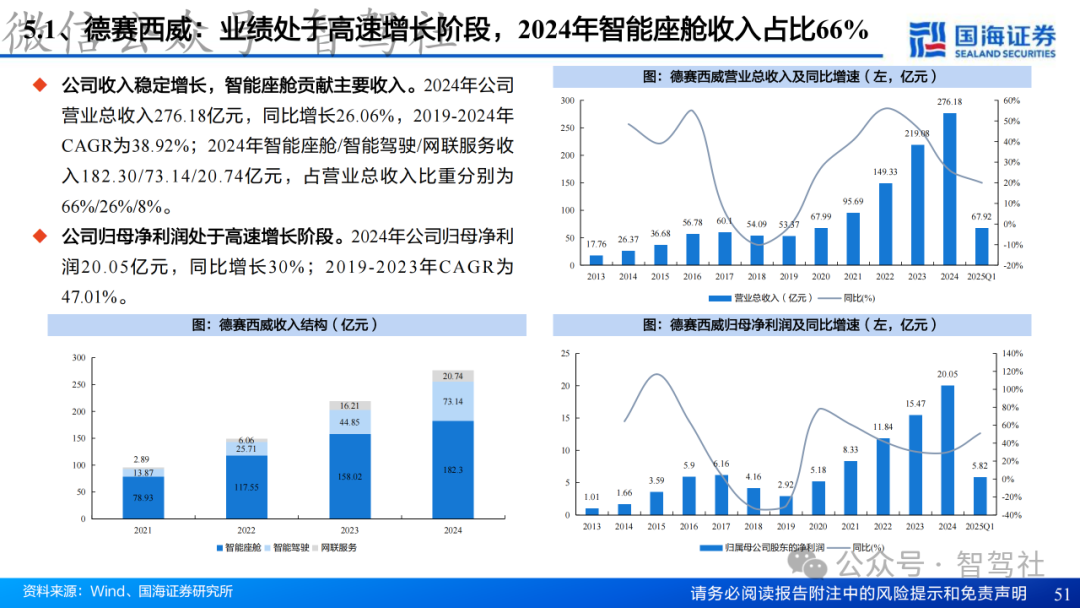

- Desay SVIn 2024, intelligent cockpit revenue is expected to reach 18.23 billion yuan (66% share), with intelligent driving domain control supporting Li Auto and BYD, and Orin-X installation volume expected to rank first in Q1 2025.

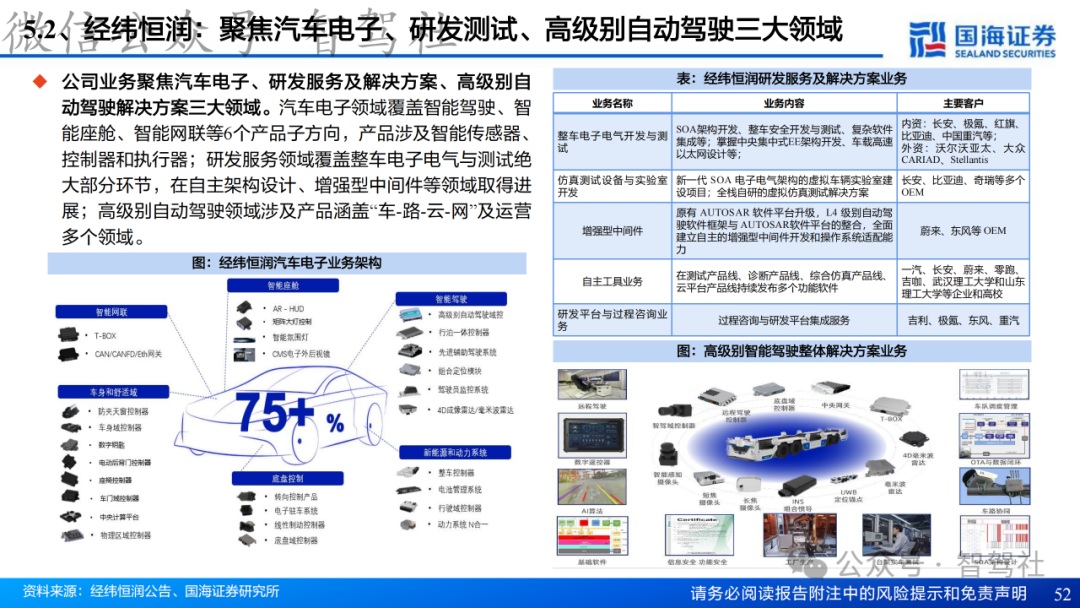

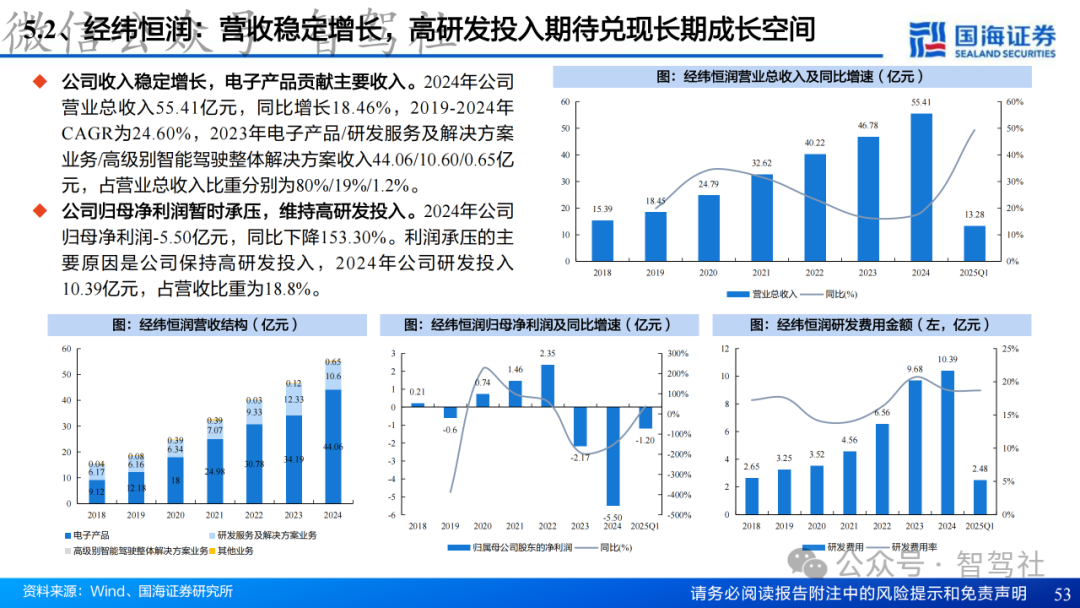

- Jingwei HirainAutomotive-grade middleware (AUTOSAR AP) adapted for NIO and Dongfeng, with R&D investment of 1.039 billion yuan in 2024 (18.8% of revenue).

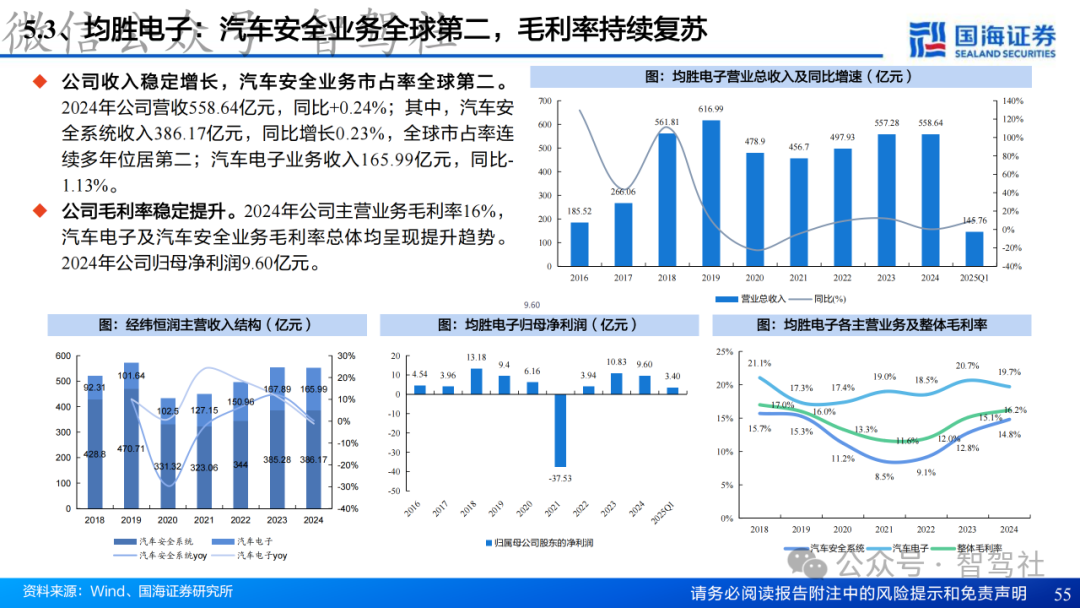

- Joyson ElectronicsIntelligent driving domain control supporting Volkswagen and BMW, with automotive electronics revenue expected to reach 16.599 billion yuan in 2024, with a gross margin of 16%.

Software and Algorithm Vendors

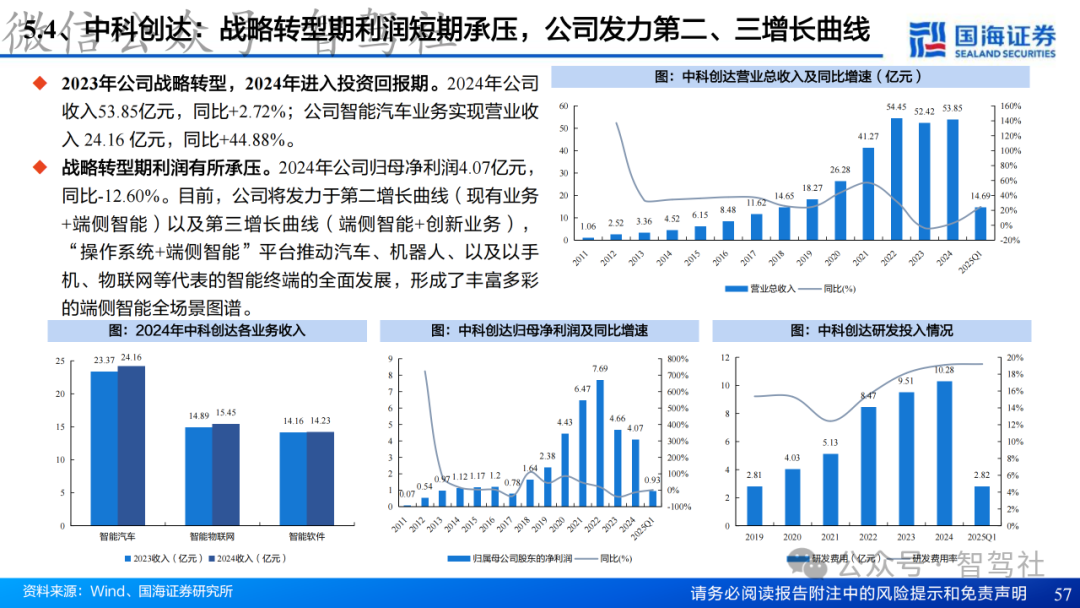

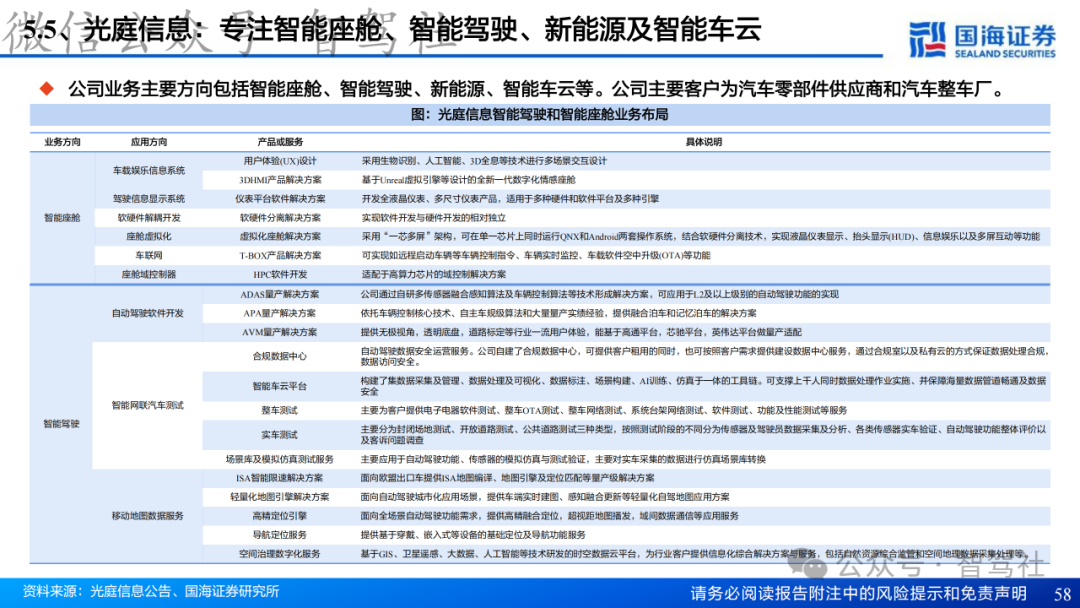

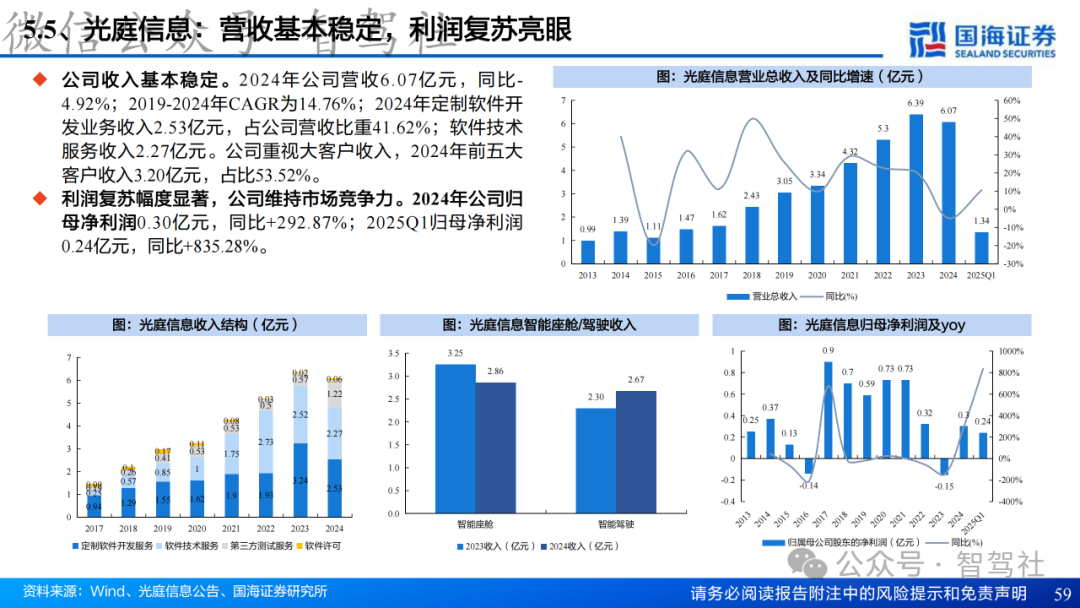

- Guangting InformationADAS algorithms adapted for Qualcomm/Horizon platforms, with a net profit of 30 million yuan in 2024 (year-on-year +292.87%).

Chip and Hardware Suppliers

- HuaweiAscend 610 chip (200 TOPS) supporting Arcfox and Wenjie, with a market share of 7.8% in intelligent driving chips in Q1 2025.

- Wanjie TechnologyLiDAR (VT60 series) supporting Yutong and Xiaopeng, with roadside equipment revenue expected to exceed 30% in 2024.

7. Summary of Future Trends

- Hardware IntegrationIntelligent driving/cockpit domain control is evolving towards a central computing platform, with a single SoC expected to integrate vehicle control/cockpit/network functions by 2028.

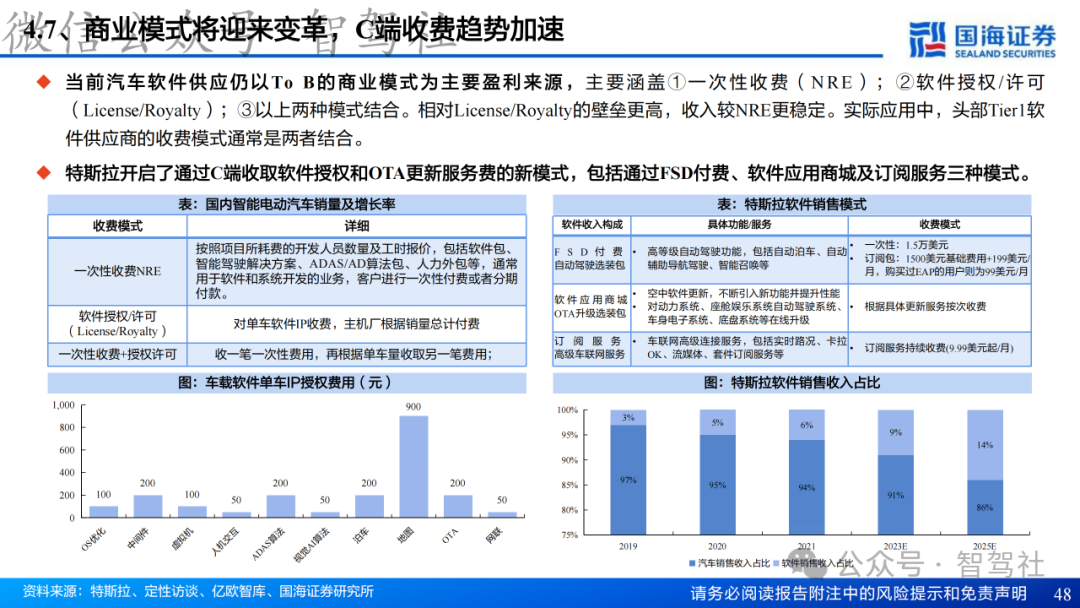

- Software-Defined ValueAutomakers are achieving secondary revenue through OTA subscriptions (e.g., Tesla FSD monthly fee of 199 USD), with software revenue potentially accounting for 30% of the entire vehicle by 2030.

- Domestic Substitution PathSoC (Horizon, Huawei), OS (Harmony), and middleware (Neusoft Ruichi) are gradually breaking through from cockpit to intelligent driving.