01. Company Overview

01. Company Overview

Recently, I have been busy traveling for due diligence on chip design companies, and I would like to briefly discuss Allwinner Technology, one of the leading SoC chip manufacturers. The core founding team of Allwinner Technology originated from Zhuhai Jieli, and in September 2007, Zhang Jianhui and others jointly established Allwinner Technology Co., Ltd. In its early days, the company focused on high-definition video, analog chips, and network applications. In 2009, it launched its first power management chip, AXP186, followed by the F series chips for full-format decoding the next year, and in 2011, it released its first tablet chip, A10, which gained market recognition for its high cost-performance ratio and low power consumption. Since then, the company has continuously expanded its product line, involving smart power management chips, application processor chips, and more, with products widely used in industrial control, consumer electronics, smart home, automotive electronics, and robotics across many industries.

As of the end of 2024, the company’s revenue reached 2.288 billion yuan, a year-on-year increase of 36.76%, with a net profit of 166 million yuan, a year-on-year increase of 626.15%; by Q1 2025, the company reported revenue of 620 million yuan, a year-on-year increase of 51.36%, with a net profit of 56 million yuan, a year-on-year increase of 223.62%; the company’s revenue CAGR over the past five years is 11.04%, while the net profit CAGR is -5%. Overall, the company has recently achieved good performance growth; what are the reasons behind this? Let’s analyze them one by one.

02. Company Performance Closely Linked to Downstream Consumption and Economic Cycles, with Broad Application Scenarios and Validation from Major Clients, Indicating Future Growth Potential

02. Company Performance Closely Linked to Downstream Consumption and Economic Cycles, with Broad Application Scenarios and Validation from Major Clients, Indicating Future Growth Potential

The company’s main business is SoC chip design, and the prosperity of SoC chips is closely related to downstream products such as consumer electronics, smart homes, and automotive electronics. We can see the fluctuations in the company’s performance. In 2022, the company reported revenue of 1.514 billion yuan, a year-on-year decrease of 26.69%, with a net profit of 109 million yuan, a year-on-year decrease of 69.95%, mainly due to the impact of the pandemic in 2022, which led to weak downstream demand and a decline in both volume and price of SoC chips; in 2023, the company reported revenue of 1.673 billion yuan, a year-on-year increase of 10.49%, with a net profit of 23 million yuan, a year-on-year decrease of 89.12%. On one hand, market competition is fierce, with the company’s gross margin dropping from 38.31% to 32.40%; on the other hand, the company’s R&D expenses accounted for nearly 30%, reaching 488 million yuan, a year-on-year increase of 16.48%. As the pandemic subsided and downstream demand rebounded, the company has seen a performance rebound since 2024.

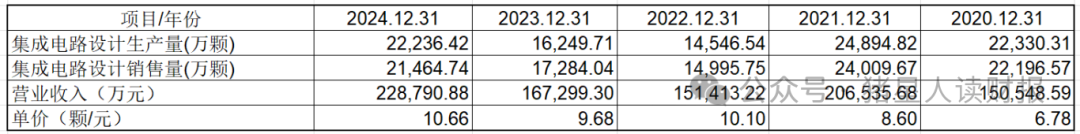

I believe one of the growth logic for Allwinner Technology is the broad application scenarios of its SoC chips and the overall large market size. Let’s first clarify what SoC is. In foreign academia, SoC is defined as a microprocessor, generally composed of a processor (CPU, GPU, DSP, etc.), memory, input/output interfaces, communication modules, and power management units. Simply put, it integrates various functions into a single chip, forming a processor that provides sufficient computing power to achieve various intelligent applications. SoCs are widely used in consumer electronics, automotive electronics, etc. For example, in smartphones, SoCs enable smooth operation of various applications. Allwinner has a variety of product models, and its rich series of products are suitable for different downstream application scenarios, with each scenario having a potential market space of hundreds of billions. The company’s V series chips are used in smart vision and security fields (such as Skyworth’s Xiaopai ultra-high-definition cameras, shared bicycle AI recognition cameras), T series chips are used in automotive electronics (such as Geely’s Lynk & Co panoramic system, Hongqi panoramic system, Wuling central control vehicle machines), R series chips are used for edge AI voice interaction (such as Xiaomi’s sweeping robot, Tmall’s smart speaker, and Midea’s smart air conditioner), H series chips are used for large-screen displays and smart projection (Philips, Skyworth, and other domestic and foreign brand projectors), and A series chips are used for high-performance general computing platforms (tablets, educational tablets, etc.).The company’s SoC products are mainly used in consumer-grade scenarios, hence the gross margin of the company’s products is around 32%, which is not particularly high; industrial-grade chips generally have higher gross margins. Notably, the company’s gross margins from 2021 to 2024 were 40.48%, 38.31%, 32.40%, and 31.21%, showing a downward trend. Let’s look at the gross margins of its competitor Rockchip, which also showed a downward trend from 2021 to 2023, but rebounded after 2024. Various mainstream opinions suggest thatthis is mainly due to the weak downstream demand and fierce market competition since 2021, with everyone competing fiercely on price, and the company’s product strength and process being slightly inferior to Rockchip, leading to a decline in gross margins. But is that really the case? Based on publicly available data, I roughly pulled the price of each chip from the company in recent years (Figure 1) and found that since 2020, the price of the company’s chips has shown an upward trend. I believe the decline in the company’s gross margin is due to the rise in raw material prices and the company’s insufficient cost control.In 2024, the cost of main business included raw material costs of 951 million yuan, while in 2023, raw material costs were 635 million yuan, a year-on-year increase of 49.74%, and the raw material costs in 2023 compared to 2022’s 508 million yuan increased by 24.89%. The growth rate of costs exceeds that of revenue, further confirming my viewpoint.

Figure 1: Price of Each Chip

Data Source: Company Annual Report

However, the company also has its advantages. First, the company supplies chips to well-known clients such as Xiaomi, Tencent, Alibaba, Baidu, Midea, Haier, Anker Innovations, Siemens, State Grid, Southern Grid, Changan, FAW, SAIC, Geely, Hongqi, and Bull, with validation from major clients proving that the company’s product strength is good and the prices are reasonable; second, the end-user consumer-grade products have a very good market space, with these consumer-grade products reaching hundreds of billions or even trillions, which is also why I am optimistic about the company’s future growth potential.

03. Accelerated Penetration of Edge AI, Booming Robotics Industry, and Domestic Substitution in Automotive Electronics May Become Potential Drivers of Future Company Performance

03. Accelerated Penetration of Edge AI, Booming Robotics Industry, and Domestic Substitution in Automotive Electronics May Become Potential Drivers of Future Company Performance

Although the overall product market space of the company is vast, the overall economy is sluggish, and consumption is relatively weak.

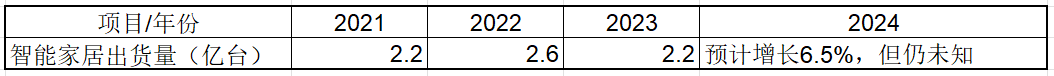

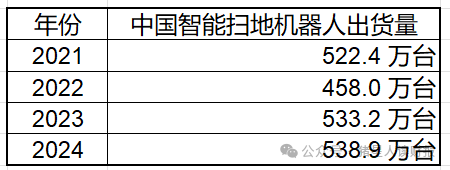

The company’s flagship product, the R series chips, will be used in sweeping robots, while the shipment volume of smart home products (Figure 2) has actually seen almost no growth since 2021; let’s also look at the shipment volume of smart sweeping robots (Figure 3), which actually saw a significant decline in 2022. Coincidentally, the company also experienced a performance decline in 2022, and the shipment volume of sweeping robots has seen almost no growth since 2021, indicating that the consumer-end smart home industry is temporarily sluggish.

Figure 2: Smart Home Shipment Volume

Data Source: IDC, etc.

Figure 3: Shipment Volume of Smart Sweeping Robots in China

Data Source: Pig Star整理

Another of the company’s V series chips is used in the smart security field. According to data from Huajing Industry Research Institute, the global smart video surveillance market has been continuously growing, from $14.8 billion in 2015 to $22.6 billion in 2020, and it is predicted that by 2025, the market sales scale is expected to grow to $31.8 billion (which is over 200 billion yuan). This is based on predictions from 2020; looking at actual data, according to the China Report Hall, the smart video surveillance market in China reached 127.15 billion yuan in 2023, and is expected to be 112.94 billion yuan in 2024. Smart security has already become quite popular in recent years, thus experiencing rapid growth. From a practical perspective, we cannot replace smart security devices every year, so a slowdown in growth or even negative growth is normal. I believe the market scale or revenue of the company in the smart home and smart security fields will maintain a slow and steady growth trend.

Traditional fields may see growth moderate, but the future will certainly be an era of AI computing power sinking down, which will further boost the company’s performance, such as the implementation of edge AI applications. I would like to mention a few areas I am optimistic about. First, the recently popular AI glasses, which can achieve voice interaction, photography, and payment functions, are expected to sell 1.52 million units globally in 2024, a year-on-year increase of 533%, and are expected to reach 3.5 million units in 2025. Major domestic manufacturers like Xiaomi and Baidu, as well as overseas companies like Samsung, are expected to release new AI glasses products in 2025, while other domestic manufacturers such as Thunderbird, Mojie, Meizu, and Rokid are also making layouts and have completed multiple rounds of financing. The entry of many tech giants will further promote technological innovation and market expansion for AI glasses, which are expected to become a breakout point in the coming years. Second, the current robotics industry chain is booming, and Allwinner has become the core functional chip supplier for Xiaomi’s bionic quadruped robot, supplying the main control chip MR813 for the CyberDog series bionic quadruped robots. The global humanoid robot industry is expected to reach $3.4 billion in 2024, a year-on-year increase of 57.41%, and the China Business Industry Research Institute predicts that the global humanoid robot industry will reach $20.6 billion by 2028. Well-known automotive manufacturers such as Tesla, Xiaopeng, and GAC are successively laying out robotics projects. However, humanoid robots currently do not meet the requirements in terms of motion accuracy, flexibility, decision-making ability, and endurance, and their high costs restrict commercialization. Non-humanoid robots, however, have already found widespread application scenarios. I believe this track of robotics will also be a driving force for the company’s performance growth in the future. Third, in the automotive electronics field, according to the latest data released by the China Association of Automobile Manufacturers, the cumulative production and sales of automobiles in China in 2024 are expected to reach 31.282 million and 31.436 million units, respectively, with year-on-year growth of 3.7% and 4.5%, setting new records. Currently, overseas intelligent driving SoCs are still the market mainstream. In the ranking of installed intelligent driving domain control chips in the Chinese market in 2023, the top five are Tesla’s FSD chip (37%), NVIDIA’s Orin-X chip (33.8%), Horizon’s Journey 5 chip (6.1%), and Mobileye’s EyeQ4H and EyeQ5H chips (the two chips together account for 11.5%). The company’s T507 and T517 series adopt a 4-core Arm architecture, supporting up to 4K@30fps decoding and 4K@25fps encoding, with rich audio and video interfaces, widely used in Geely’s Lynk & Co, Hongqi panoramic systems, and Wuling central control vehicle machines. However, the introduction of automotive-grade chips is a very lengthy process, and domestic substitution has just begun. Some vehicles are still hesitant to apply domestic chips in large quantities, as this involves personal safety issues, and foreign chips are more mature. However, currently, complete machine manufacturers are also looking for backups, so Allwinner has certain opportunities for domestic substitution in the automotive electronics field.

04. Compared to Peers, Allwinner Does Not Show Competitive Advantages, and Industry Competition is Fierce

04. Compared to Peers, Allwinner Does Not Show Competitive Advantages, and Industry Competition is Fierce

The competition in the SoC chip design track is fierce. I selected three companies with business similarities to Allwinner for comparison: Espressif Technology, which mainly provides AIoT SoCs and their software, with its chips and modules widely used in smart homes, consumer electronics, industrial control, smart agriculture, healthcare, and smart dashboards; Amlogic, whose main business is the R&D, design, and sales of system-level SoC chips and peripheral chips, with current main products including multimedia smart terminal SoC chips, wireless connection chips, and automotive electronics chips, providing SoC main control chips and system-level solutions for many consumer electronics fields; and Rockchip, a leader in high-end SoC chips for the smart IoT, with business types similar to Allwinner, whose products are mainly applied in smart IoT and consumer electronics fields, covering smart home appliances and smart hardware products such as tablets, TV boxes, dictionary pens, smart speakers, and sweeping robots.

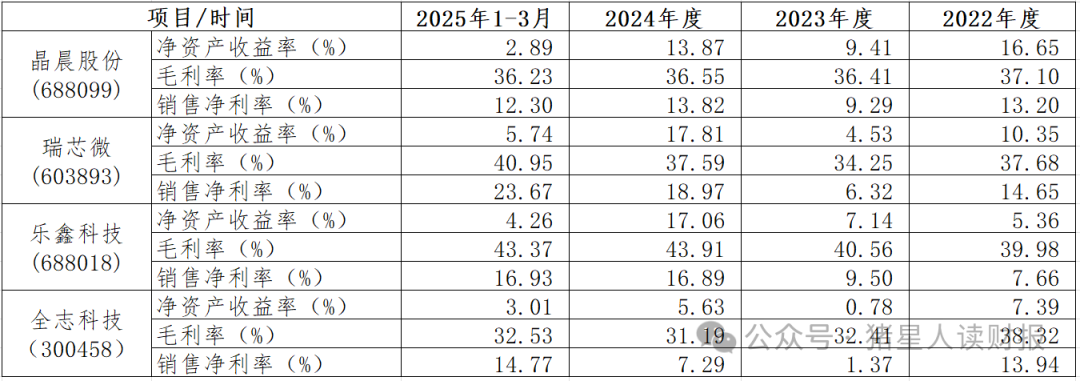

The profitability of several competitors (see Figure 4) is as follows. In terms of profitability, Allwinner’s gross margin, net margin, and return on equity in 2024 are all lower than those of the other three companies. Why is this? Amlogic derives over 90% of its revenue from overseas, with gross margins exceeding 37% in 2024 due to its overseas advantages, resulting in higher profitability; Rockchip has superior chip processes and technology, currently using TSMC’s 8nm process, while Allwinner is still mainly based on 22nm, with 12nm not yet in mass production, so Rockchip’s products have higher gross margins; Espressif Technology mainly focuses on wireless communication SoCs, maintaining gross margins above 40%, and with many new clients, the gross margins will be higher when the initial volume is low. Readers may wonder if Allwinner’s products are slightly inferior. In fact, different companies have different product positioning, and Allwinner’s product categories are relatively rich, and existing major clients are more concerned about price; performance-wise, everyone is competing and iterating, and they can all use it, so lower prices have an advantage. Sacrificing gross margins to gain volume is also a strategy. Of course, Amlogic and Rockchip indeed have better chip processes and technologies, and higher gross margins are understandable.

Figure 4: Comparison of Competitor Profitability

Data Source: iFinD

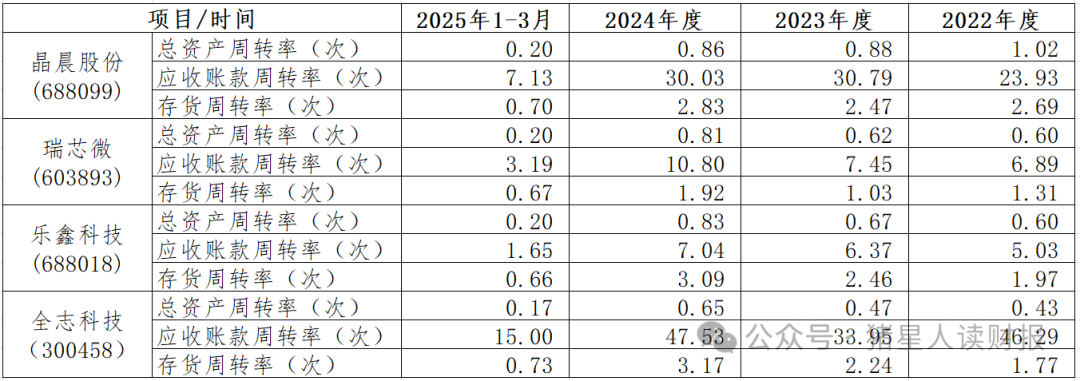

Looking at operational capabilities (see Figure 5), Allwinner Technology has the highest accounts receivable turnover and inventory turnover in 2024, especially with an accounts receivable turnover rate of 47 times, which is astonishing in terms of cash collection ability, thus Allwinner’s operating cash flow is almost entirely positive, indicating a very stable operation, which is a point I appreciate.

Figure 5: Comparison of Competitor Operational Capabilities

Data Source: iFinD

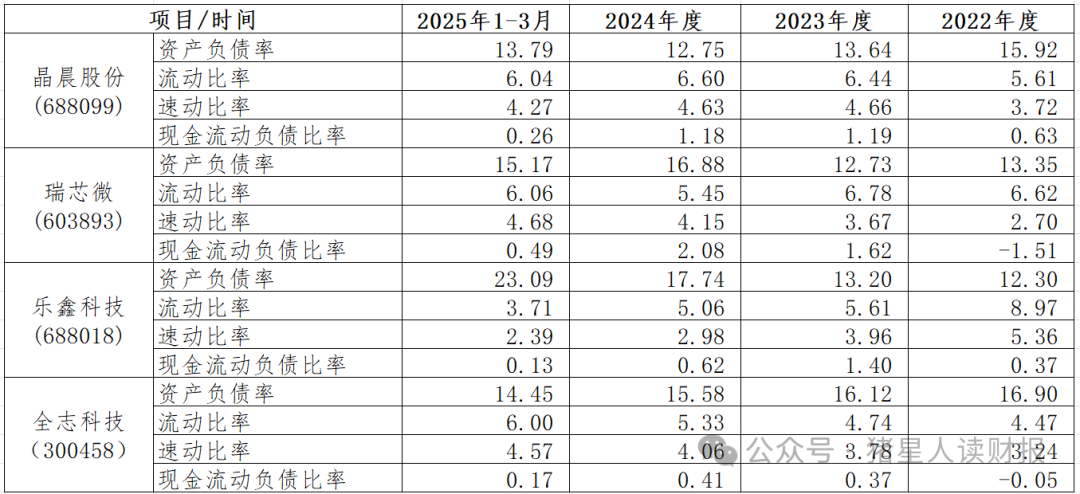

In terms of solvency (see Figure 6), these SoC chip design manufacturers all have good solvency, with low debt-to-asset ratios and ample cash flow, indicating very stable finances.

Figure 6: Comparison of Competitor Solvency

Data Source: iFinD

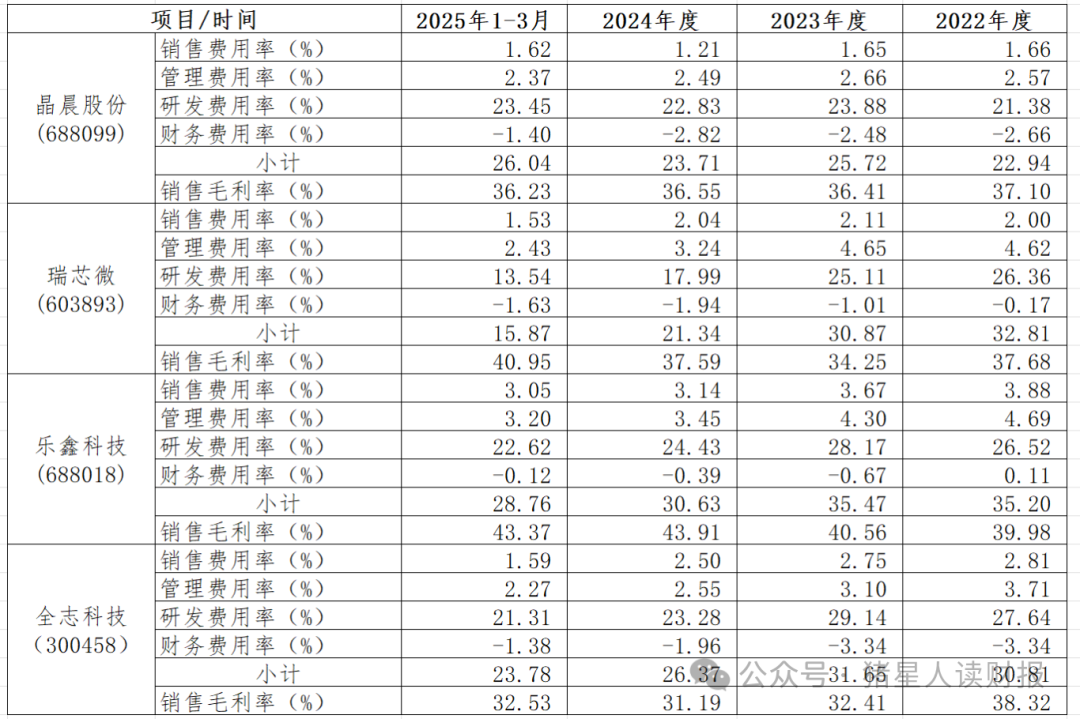

Finally, let’s look at the expense structure of each company (see Figure 7). Each company has controlled its expense rates well, with Allwinner’s expense rate reaching 26.37% in 2024, mainly due to a high R&D expense rate of 23.28%. The high proportion of R&D expenses is reasonable as the company aims to develop new products to increase market share. For chip design companies, a high R&D expense rate is a good thing.

Figure 7: Comparison of Competitor Expense Rates

Data Source: iFinD

In summary, Allwinner has low profitability due to sacrificing gross margins to expand scale, but its stable operations, ample cash flow, and high operational efficiency are also rare advantages.

05. Is the Company’s Valuation Overstated?

05. Is the Company’s Valuation Overstated?

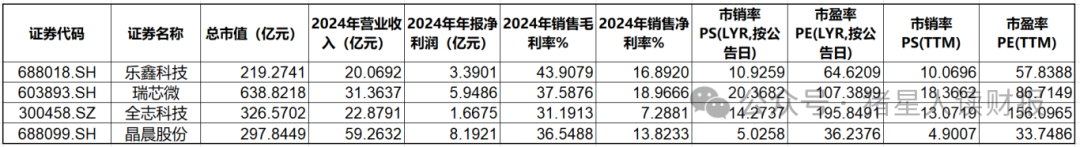

I believe Allwinner has its advantages in terms of products, technology, and potential, but the biggest issue lies in its valuation. The company’s revenue and valuation situation (as of June 27, 2025) is shown in Figure 8. The company’s gross margin and net margin are at lower levels compared to comparable companies, but its PE (LYR) and PE (TTM) are approximately 196 times and 156 times, which is a very high valuation level, while Espressif, Rockchip, and Amlogic have rolling PEs of only 58, 87, and 34 times.

Figure 8: Valuation Situation of Comparable Companies

Data Source: Choice

Let’s make a rough profit forecast. Assuming the company’s revenue growth rate reaches 30%, 40%, and 50% in 2025, and the net margin is calculated at the near five-year average of about 12%, the net profits for 2025 would be 357 million, 384 million, and 412 million yuan, respectively. Based on the market value of 32.6 billion as of June 27, the rolling PEs would be 91.32, 84.90, and 79.13, for a chip design company with a gross margin just above 30% and a growth rate of about 30%, I believe the valuation is slightly overstated, as a good company does not necessarily equate to a good valuation. It may take time to resolve the high valuation before embracing the company.

Disclaimer: This article is written by an individual, and all cited information comes from publicly available sources. No guarantees are made regarding the accuracy and completeness of this information, and the information or opinions in the report do not constitute any investment advice. Any investment decisions made based on this are not related to the author.

Creating is not easy, please click “Like” and “See”. Those who click “Like” and “See” will surely have good fortune! Follow the author to avoid getting lost in investments.