In the wave of display technology, LCD and OLED have long occupied the mainstream stage, defining our interaction with the digital world through high refresh rates, rich colors, and dynamic expressiveness. However, in recent years, a seemingly “low-key” technological force—e-paper—has quietly attracted the attention of global display panel giants, sparking a new wave of investment enthusiasm.

From AUO to Huike, these traditional panel manufacturers are increasingly investing in e-paper technology, raising the question: In an era where LCD/OLED technology is highly mature and even somewhat saturated, what unique charm does e-paper possess that compels display industry giants to invest? What future does this seemingly “countercurrent” layout suggest for the e-paper industry?

01E-Paper Race: AUO and Huike Increase Investment, Samsung and TCL Huaxing Showcase Strength

2025 may become a year of rapid development for e-paper, as panel companies have accelerated their business layout in e-paper technology this year, seizing more future market opportunities through further cooperation and investment.

In April, a series of investments and collaborations by Huike and AUO outlined the strong interest and strategic determination of major panel manufacturers in the e-paper field.

On April 2, AUO’s subsidiary, Daqin, signed an investment term sheet with E Ink Technology, planning to establish a joint venture with a capital of NT$390 million to jointly create a large-scale e-paper module production line at AUO’s Taoyuan Longke plant, expected to commence production in the fourth quarter of 2025.

On April 8, Huike also announced that it has officially signed a joint development agreement with e-paper manufacturer E Ink Technology, focusing on the joint research and development and large-scale production of large-size e-paper, initiating deep cooperation.

On May 7, Huike’s electronic production base in Guizhou officially commenced operations, with a total investment of 5.5 billion RMB, constructed in two phases, and an estimated annual output value of about 7 billion RMB upon full production. The first phase invested 3.333 billion RMB, mainly producing e-paper display modules and smart wearable product display modules, with an estimated output value of about 4 billion RMB at full capacity.

Image Source: Huike

Currently, Huike’s e-paper products have achieved full-size coverage from 1.54 inches to 75 inches, with capabilities for full-color display and independent production of TFT backplane modules.

Meanwhile, Longteng Optoelectronics recently stated in its performance briefing that it highly values the strategic value of e-paper and will actively promote the development and industrialization layout of e-paper products, leveraging its advantages in display technology research and development, system integration, and manufacturing processes. Currently, Longteng’s e-paper related products have completed key stages from technical validation to customer introduction, with some products achieving mass production and delivery to customers.

As giants in the panel industry, TCL Huaxing and Samsung are also showcasing their latest e-paper product combinations and technical solutions, indicating their determination to accelerate the layout of e-paper business.

At the Touch Taiwan 2025 exhibition, TCL Huaxing showcased a series of solutions in the e-paper field, including 13.3-inch color e-paper photo frames, 28.3-inch color e-paper signs, 9.7-inch smart office desk signs, 31.5-inch color e-paper signs, 4-inch e-paper phone cases, 42-inch color e-paper signs, and 25.3-inch color e-paper signs.

Samsung recently launched the new Color E-Paper (EM32DX) series, providing environmentally friendly and efficient digital signage solutions for industries such as dining, retail, and transportation…

To understand the logic behind panel companies increasing their investment in e-paper technology, one must analyze from multiple dimensions, including the technology itself, the current state of the industry, and the development trends in the display sector.

02What is E-Paper Technology?

E-paper, also known as electronic ink display, is a display technology that mimics the effect of ink printed on paper. As early as 1975, Nick Sheridon, a researcher at Xerox’s Palo Alto Research Center (PARC), first proposed the concept of e-paper and electronic ink, and in 1996, MIT’s Bell Labs successfully manufactured a prototype of e-paper.

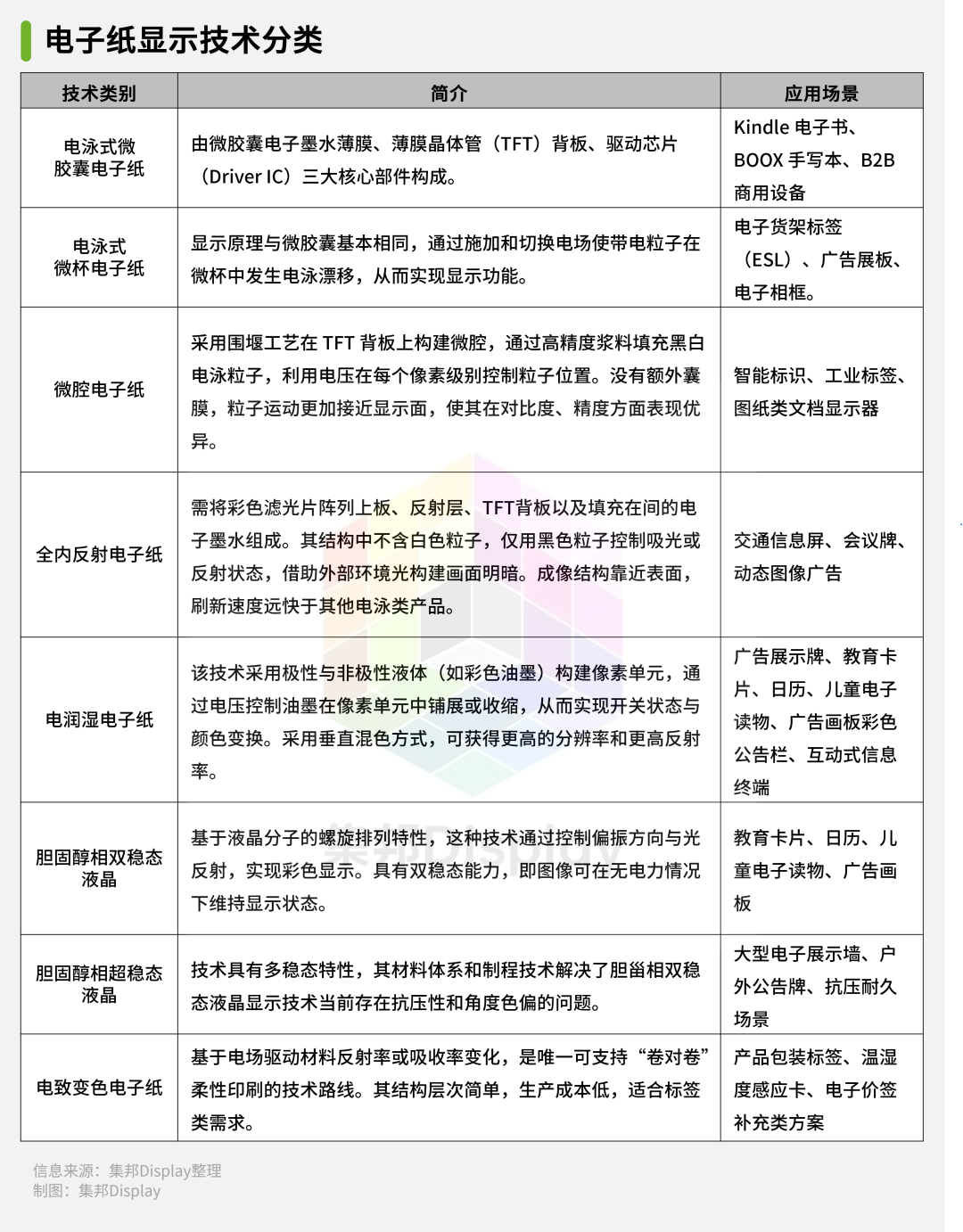

Today, e-paper is a general term for a type of display technology, among which electrophoretic display (EPD) is currently the most mainstream e-paper technology. Its display principle is mainly based on the control of particles by an electric field to achieve image display. The establishment of E Ink Technology in 1997 further promoted the mass production application of electrophoretic e-paper display technology. Over time, the display industry has continued to improve the performance of e-paper technology and has developed various e-paper technology routes.

Among them, electrophoretic microcapsule e-paper, electrophoretic microcup e-paper, and electrochromic e-paper technology routes have been mass-produced, while other technologies are still in experimental and pilot stages.

Regardless of the route, the core characteristics of e-paper compared to other display technologies are bistability and reflectivity. In simple terms, e-paper can maintain the display of images even after the power is cut off, and it can display content by reflecting ambient light.

These two characteristics provide e-paper with advantages distinct from conventional display technologies, including ultra-low power consumption, paper-like comfortable reading experience, readability in bright light, wide viewing angles, light weight, and flexibility. Compared to LCD and OLED technologies, e-paper has unique advantages.

03Under the Background of Low Carbon and Environmental Protection, E-Paper Applications Continue to Expand

Despite its uniqueness, the development of e-paper applications has not been smooth sailing. Although e-paper has been developing for some time, its widespread recognition can be attributed to the launch of Amazon’s Kindle e-reader in 2007. This product adopted E Ink’s electrophoretic e-paper technology, and with its low power consumption, high contrast, and paper-like display effect, it once gained market popularity, driving up the demand for e-paper technology applications.

Image Source: Amazon

However, the popularity of the Kindle e-reader was short-lived. With the rapid development of smartphones and tablet devices, the Kindle gradually faded from public memory and was jokingly referred to as the “instant noodle press,” leading to its decline. The limitations of traditional electrophoretic e-paper in color and refresh rate performance contributed to this outcome, resulting in a less-than-expected user experience and raising doubts in the terminal market about e-paper technology.

Fortunately, over time, the defects of e-paper are gradually being improved, showing significant technological advancements compared to the past. Meanwhile, global society is increasingly focused on energy conservation and carbon reduction, leading to a growing demand for green and environmentally friendly technology products, creating new opportunities for e-paper applications.

With earlier applications and the continuous improvement of technology, the demand for e-paper in the e-book application market has stabilized, becoming one of the pillars of e-paper applications. Relevant research institutions indicate that the shipment volume of e-paper modules is expected to grow by 34.8% year-on-year in 2024.

Another pillar is the application of electronic shelf labels (ESL), which is widely used in large supermarkets, convenience stores, pharmacies, specialty stores, and warehouses as a modern retail management technology. It updates product information through network data transmission, efficiently manages goods, and reduces the labor and material costs of replacing paper labels. Relevant research institutions indicate that in 2024, thanks to orders from well-known Walmart projects, the shipment volume of electronic paper labels is expected to grow by 39.3% year-on-year.

Image Source: Realtek Semiconductor

E-books and electronic shelf labels have become the two major applications driving the growth of e-paper demand. In addition, other e-paper applications are also emerging, providing more room for market development.

As e-paper technology continues to upgrade towards larger sizes, higher refresh rates, richer colors, and wider operating temperature ranges, e-paper applications are expanding beyond e-books and electronic shelf labels to include electronic notebooks, billboards, flashcards, desk signs, name tags, wearable devices, and even higher-demand display fields.

For example, companies like Dazhang Technology and BIGME have launched 25.3-inch color e-paper displays, with product prices around 10,000 RMB. The selling points of these displays mainly focus on eye protection and energy saving, but their refresh rates and color performance still lag behind conventional displays.

Although e-paper has not yet gained a competitive advantage in the display field, looking ahead, as the global industry continues to transition towards low-carbon and environmentally friendly practices, e-paper technology will find its place in more application scenarios.

04E-Paper Supply Chain, Panel Companies Frequently Appear

In the face of the promising development prospects of e-paper technology, panel companies have already deployed their advantages and occupy an important position in the e-paper supply chain. An analysis of the e-paper supply chain shows that the e-paper industry system mainly consists of upstream core components, midstream modules and system integration, and downstream complete machine manufacturers. Currently, each link in the industry chain exhibits a high degree of market concentration.

In the upstream segment, the materials and process technology barriers are high, covering key raw materials such as electronic ink films, TFT substrates, and driver chips. Among them, electronic ink films are the most critical part, mainly used in electrophoretic display technology, with over 90% of the global electronic ink film market share held by Taiwan’s E Ink Technology. Additionally, the markets for other raw materials such as TFT substrates and driver chips also show high concentration.

In the TFT substrate segment, well-known panel companies such as TCL Huaxing, Tianma, BOE, Innolux, AUO, and Huike dominate. Since the core drive of e-paper displays relies on TFT backplane technology, which is precisely the core competitiveness of LCD panel companies, these manufacturers can utilize their existing TFT production lines to quickly enter e-paper module production through transformation or optimization, effectively reusing and extending their technological assets.

In the midstream segment, the core of e-paper module manufacturing is to coat electronic ink onto plastic films, then bond it with TFT circuits, and control image display through driver ICs. Relevant data shows that domestic companies occupy a major production position in the e-paper module segment, including Dongfang Kema, Xingtai Yingke, Qingyue Technology, Hanshuo Technology, Yashiguangdian, and panel company BOE.

05Conclusion

The increased investment by panel companies in e-paper is not a fleeting trend but is based on profound insights into technological trends, market demands, and their own advantages. E-paper, with its unique ultra-low power consumption, paper-like reading experience, and readability in sunlight, has found an irreplaceable value positioning in the wave of the Internet of Things and decarbonization. Although there is still room for improvement in refresh speed and color performance, continuous technological advancements, especially breakthroughs in colorization and large-size applications, are constantly broadening its application boundaries.

The entry of panel giants not only brings strong capital and technical support but, more importantly, their expertise in large-scale production and cost control is expected to resolve the long-standing cost bottleneck that has hindered the widespread adoption of e-paper, particularly in large-size and color fields.

It is foreseeable that as technology matures, costs decrease, and applications deepen, e-paper will no longer be a “niche” technology but will shine in more corners of smart retail, smart education, smart transportation, smart office, and daily life. The year 2025 may be a key year for e-paper to open a new chapter. This investment boom led by panel giants suggests that the “golden age” of the e-paper industry may have quietly arrived. What exciting stories will unfold in this captivating world of e-paper in the future is worth our continued attention.

(Source: Display Supply Chain Consultants. This article is produced by the Qingdao West Coast International Investment Promotion Center, reprinted for sharing and learning purposes only, not for commercial use. If there is any infringement, please contact for deletion.)

NEXT

NEXT

Qingdao West Coast New Area International Investment Promotion Center

Responsible for the investment promotion work of the four major industrial chains of new displays, integrated circuits, software information technology, and technology services in the West Coast New Area, as well as the investment promotion work in the direction of the new generation of information technology and future industries in Qingdao’s “10+1” innovative industrial system.

Investment Hotline:

0086-532-86989002

Recommended Reading

Fortune Global 500! Shandong High-Speed Group’s High-Tech Project Signed and Settled in West Coast New Area

New Landmark for Technology Service Industry, Tianbao Medical Technology Industrial Park Commences Construction

Policy Express | 50 Articles! Shandong Supports High-Quality Development of Private Economy with a Package of Financial Policies