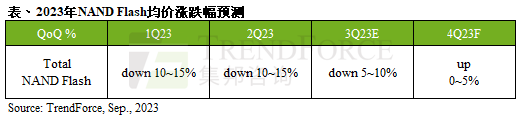

Recently, Samsung announced that in response to the continued weakening of demand, it will expand its production cuts to 50% starting in September, primarily focusing on processes below 128 layers. According to TrendForce, other suppliers are also expected to follow suit and increase their production cuts in Q4, aiming to accelerate inventory reduction. It is estimated that the average price of NAND Flash in Q4 may stabilize or slightly increase, with an expected rise of about 0-5%.

In terms of pricing, as predicted by TrendForce at the beginning of the year, the rebound in NAND Flash prices will occur earlier than that of DRAM. Due to the continuous expansion of losses among NAND Flash suppliers, sales prices have approached production costs. Suppliers have chosen to expand production cuts to maintain operations, hoping to drive prices up. Among them, the contract price of NAND Flash wafers rebounded in August, and as the production cuts expand, customer stocking is expected to increase, further supporting the rise in the contract price of NAND Flash wafers in September. However, for the price increase of NAND Flash to continue into 2024, it still relies on sustained production cuts and the observation of whether Enterprise SSD procurement orders will significantly rebound.

Supplier Losses Expected to Narrow, Module Manufacturers to Benefit

From the supplier’s perspective, even though NAND Flash has a more flexible price advantage compared to DRAM, this year’s demand has not seen an increase. Additionally, the shipment scale of general-purpose servers continues to be squeezed by AI servers, leading to a poor overall NAND Flash market trend this year, with average prices continuing to decline through Q3, and supplier losses continuing to expand.

According to TrendForce’s survey of supplier inventory levels, for Samsung, if it wants to effectively reduce inventory before the end of the year, it relies on end-application customers to increase stocking efforts, which is actually a slow remedy. Only rigorous capacity control can bring supply and demand back to a reasonable state. Samsung’s significant production cuts are expected to lead to a rebound in prices for some products primarily supplied by Samsung, which may drive the overall shipment volume of NAND Flash in Q4 and gradually narrow the supplier loss gap, while also helping module manufacturers improve future profitability.

▶ About Us

TrendForce is a global high-tech industry research organization spanning storage, integrated circuits and semiconductors, wafer foundry, optoelectronics, LED, new energy, smart terminals, 5G and communication networks, automotive electronics, and artificial intelligence. The company has accumulated years of rich experience in industry research, government industrial development planning, project evaluation and feasibility analysis, corporate consulting and strategic planning, and brand marketing, making it a quality partner for government and enterprise clients in high-tech industry analysis, planning evaluation, consulting, and brand promotion.

Scroll up and down to view

Share

Collect

Like

In View