Today, I am sharing an article explaining automotive-grade chips. The article is quite long, so you can save it for a slow read.

What is Automotive Grade (commonly referred to as automotive-grade)? It is consistent reliability.

The moment the car engine starts, it must work in the scorching heat of summer and the freezing cold of winter nights. The lifespan of a smartphone is 2 to 4 years, but your car is expected to last over ten years.

Moreover, all automotive components must withstand greater temperature fluctuations. If consumer electronics (like smartphones) exceed their limited tolerance range, they may send incorrect information or simply shut down.

This is intolerable in automotive-grade systems. Therefore, automotive engineers must ensure that all components—from the instrument cluster, navigation screens, to advanced driver-assistance systems and autonomous driving sensors, chips, etc.—meet stringent requirements.

This is why our automotive solutions (hardware) are rated to operate at temperatures from -40 to 105 degrees Celsius, and even up to 125 degrees Celsius.

Temperature resistance is just one of the key factors affecting the specifications and testing of automotive systems in our country. Compared to consumer-grade products, China has imposed stricter requirements on automotive system specifications and testing methods.

For instance, safety-critical components must have dedicated production lines certified to ISO 26262 ASIL (of course, they must also meet the foundation of IATF16949) to eliminate the possibility of human error during manufacturing. Using any product that does not meet the highest standards amplifies the dangers associated with driving safety.

The Tricks of “Automotive Grade”

Automotive Grade – There are Those Who Fish in Troubled Waters

In recent years, more and more new automotive electronic products such as sensors and chips have been introduced into the automotive industry, leading to chaos in the automotive-grade sector.

There are countless startups claiming to meet, comply with, or achieve automotive-grade standards, and naturally, there are also those adding dazzling adjectives before the term automotive-grade, as well as those adding “mass production” after it, which is another form of indescribable “naked” PR.

To comply means to conform to existing styles, formats, or standards. To meet means to feel that something is “sufficient,” which is a subjective judgment. To achieve implies reaching an abstract concept or degree, such as achieving or not achieving, which is also a subjective judgment.

In other words, compliance means “genuine product.” Those terms referred to as meeting or achieving are merely your “imagination.” There are also subtle terms, such as adhering to automotive-grade design. In fact, there is a lot of trickery involved.

Of course, no matter how you PR it, the product ultimately has to be sent to the “battlefield” for testing (for example, many suppliers often boast that “their products are fine for automotive-grade”).

Currently, the relevant quality standard for automotive-grade electronics is AEQ.

AEC-Q100 is a failure mechanism based on stress testing of packaged integrated circuits. The Automotive Electronics Council (AEC) is headquartered in the USA and was originally established by three major automotive manufacturers (Chrysler, Ford, and General Motors) to establish common component qualification and quality system standards.

The idea of establishing AEC emerged at a JEDEC meeting in the summer of 1992. The proposal for common qualification specifications was seen as a possible way to improve the situation. At subsequent JEDEC meetings, it was determined that the idea of establishing common qualification specifications was feasible, and work on Q100 (integrated circuit stress test qualification) soon began.

Currently, AEC-Q100 is primarily applied to discrete components AEC-Q101 and passive components AEC-Q200.

AEC-Q100 is divided into five levels based on temperature ranges as the fundamental classification criterion. Level 0 is the highest (-40°C to +150°C), Level 1 is -40°C to +125°C, Level 2 is -40°C to +105°C (which is quite common), and Level 4 is the lowest (0°C to +70°C). Level 0 is primarily for the worst environmental conditions under the hood, while Levels 1 and 2 are used in other parts of the car.

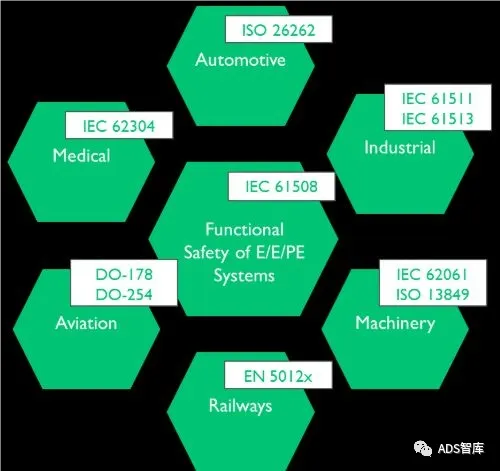

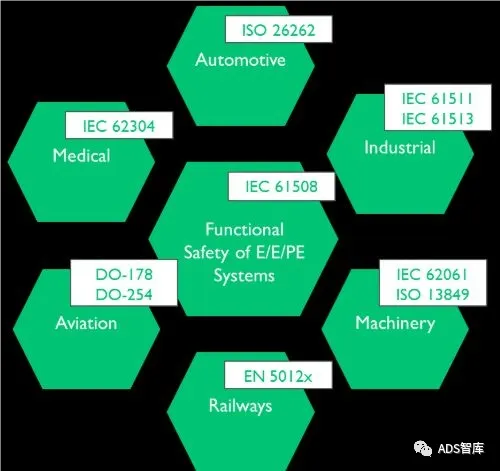

In addition to AEQ, another standard that needs to be followed is ISO 26262, established by the International Organization for Standardization (ISO) in 2011, which is mainly used for functional safety components, such as ADAS-related sensors and systems.

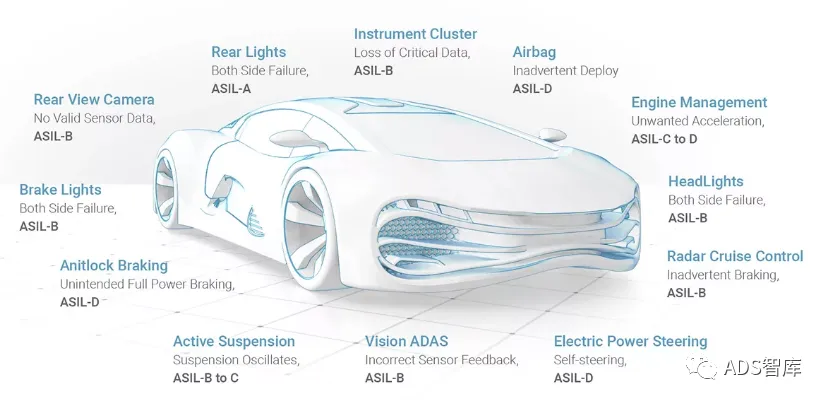

The Automotive Safety Integrity Level (ASIL) is a risk classification scheme defined by ISO 26262 – Road vehicles functional safety standard. This is an adjustment of the safety integrity levels used in the automotive industry from IEC 61508.

This classification helps define the safety requirements necessary to comply with ISO 26262 standards. ASIL is set based on potential hazards as the target of risk analysis, observing the severity, exposure, and controllability of driving scenarios. The safety goals associated with hazards also comply with ASIL regulations.

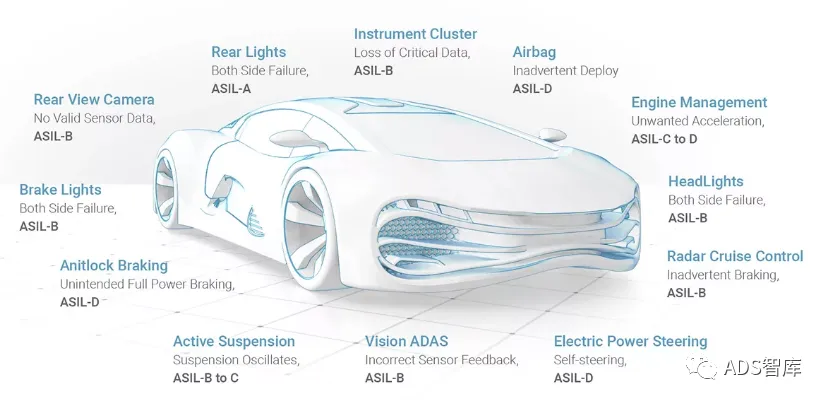

ASIL A, ASIL B, ASIL C, and ASIL D are the four levels, with ASIL D having the highest integrity requirements for products and ASIL A the lowest.

ASILs are established through hazard analysis and risk assessment. For every electronic component in a vehicle, engineers must measure three specific variables: severity (classification of driver and passenger injury), exposure (the frequency of the vehicle encountering hazards), and controllability (to what extent the driver can avoid injury). All these variables are broken down into subclasses.

Severity is categorized from “no injury” (S0) to “fatal/injury” (S3) across four types.

Exposure is divided into five categories, covering “very unlikely” (E0) to “very likely” (E4).

Controllability has four types, transitioning from “generally controllable” (C0) to “uncontrollable” (C3).

All variables and subclasses are analyzed and combined to determine the expected ASIL.

Systems such as airbags, anti-lock braking systems, and power steering systems require ASIL-D level—safety assurance employs the most stringent systems—because the risks associated with failures are the highest. On the other hand, components like tail lights only require ASIL-A level. Headlights and brake lights are generally ASIL-B, while cruise control is typically ASIL-C.

Considering the speculative work involved in determining ASIL hazard levels, the Society of Automotive Engineers (SAE) drafted J2980 in 2015, which provides guidelines for evaluating specific hazard exposure, severity, controllability, etc.

ISO 26262 has become the guiding standard for functional safety in automotive development processes. However, in recent years, with the rapid introduction of ADAS and autonomous driving technologies, the bottleneck of this standard has begun to emerge.

J2980 is still evolving—SAE released a revised version in 2018. With the development of autonomous vehicles, ISO 26262 will need to redefine “controllability,” which currently pertains to human drivers.

According to the current standards, the absence of human driving means controllability will always be at C3, which is the extreme of “uncontrollable.” “Other variables’ severity (injury) and exposure (likelihood) will undoubtedly also need to be re-examined.

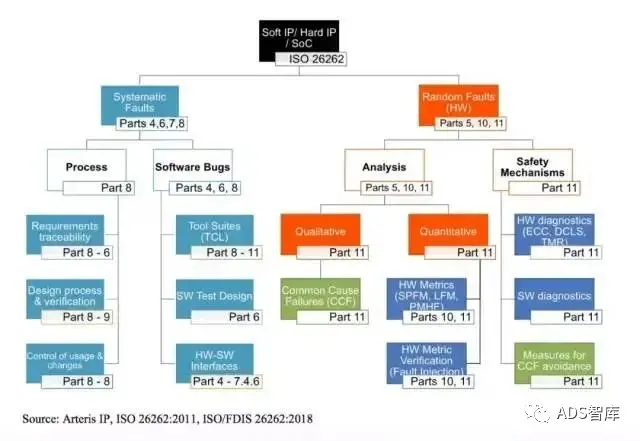

The International Organization for Standardization has also updated ISO26262:2018. This version adds guidance for semiconductor design and use in the context of automotive functional safety.

Chips (microcontrollers) were first used in automobiles to control engine operation. It is called ECU or Engine Control Unit. The first ECU appeared in Volkswagen in 1968, achieving a specific function: EFI (Electronic Fuel Injection).

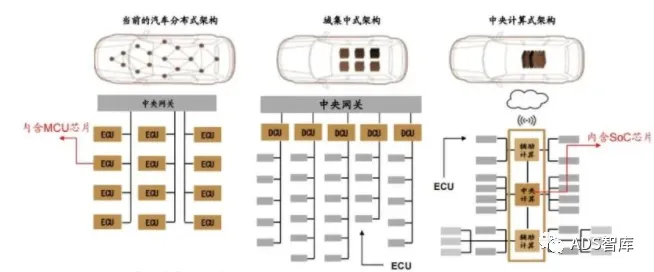

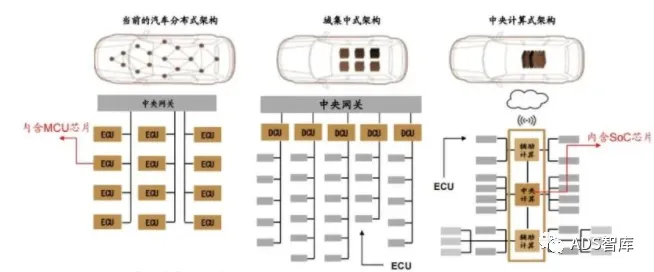

As of today, there are over 50 ECUs in cars dedicated to monitoring various aspects such as power systems, in-vehicle entertainment systems, active safety systems, and communication systems. In the future, in addition to distributed networks and centralized domain control architectures, more chips (more complex than past ECUs) will appear in new vehicles.

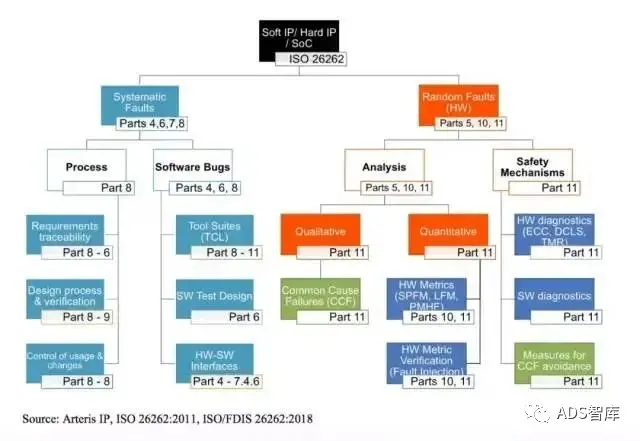

ISO26262:2018 Part 11 provides a comprehensive overview of R&D projects related to functional safety semiconductor products. These issues include a general description of semiconductor components and their development and possible classifications. This includes relevant hardware failures, errors, and failure modes. This invention also involves intellectual property (IP), particularly with one or more safety requirements related to ISO 26262.

Safety and Reliability Should Be Consistent

However, nowadays, the reliability of automotive electronic products is facing more and more new issues, causing chaos throughout the supply chain, alongside a series of problems such as insufficient data, unclear definitions, and varying levels of expertise.

For example, most automotive chips are not developed based on advanced nodes. However, technologies that require significant computational power to make safety-critical decisions instantly, such as artificial intelligence, will require the highest available density.

The resulting reliability issues are largely overlooked at advanced nodes because many chips developed using the aforementioned technologies were previously targeted at consumer electronics or controlled environments.

At the same time, newer manufacturing processes typically produce components with more defects than existing mature and older process technologies. This high defect density means that achieving the same quality level in post-manufacturing testing requires even higher defect coverage rates.

The traditional method of generating test sequences for defect detection using abstract logic fault models is no longer completely applicable. To achieve automated quality levels using complex integrated circuits at advanced process nodes, it is necessary to understand how and where defects are physically revealed and to know the behavior of these defects in a simulated sense, not just in a digital sense.

For example, defects within the pre-logic units and interconnects using finFET technology are prevalent. When finFET was introduced, the complexity of the manufacturing process for transistors and related logic units increased proportionally compared to the interconnect layers. As more transistor technologies are introduced, this difference is expected to continue into 5nm, 3nm, and lower.

However, all automotive electronic products, especially safety-critical components and systems, must undergo rigorous testing during and after production.

Reliability also has a cost-related issue. In the design of safety-critical automotive components and systems, every supplier in the supply chain must complete more steps, which increases testing time and subsequently raises costs.

It is well known that testing automotive components is the most complex and expensive testing. Nowadays, everyone is trying to cut costs, but the automotive industry is very cautious and methodical.

There are two completely different ideas to solve this problem. One is to adopt system-level testing, which is more expensive but allows testing in the context of actual systems. However, whether system-level testing can truly increase overall costs is still unclear, as temperature usually requires three different insertion points while system-level testing may only need one.

The other approach is to focus on costs first, then identify which tests are necessary and which tests are unnecessary.

Moreover, not all errors are the same, nor are all errors predictable. ISO 26262 identifies systematic faults, which are faults we can discover, predict, and repair, while random faults belong to “things that happen.”

To make automotive systems reliable and safe, the entire automotive supply chain must integrate a culture of safety, with reliability as the foundation, even though 100% reliability is not achievable.

At the same time, the relationships within the automotive supply chain are becoming increasingly complex.

For instance, on one hand, traditional semiconductor suppliers need to start in-depth communication with OEM manufacturers, whereas in the past, this communication was limited to the Tier 1 level;

On the other hand, traditional semiconductor suppliers may also need to compete with Tier 1 or OEMs, as the latter may produce chips themselves or make explicit demands of semiconductor supplier partners.

Additionally, there are thousands of startups entering the automotive industry, many of which lack experience. ISO 26262 requires high levels of collaboration and information sharing throughout the value chain, which may be unfamiliar to new entrants.

In the past, the supply chain adopted a waterfall model, where OEMs would provide specifications to Tier 1 suppliers, who would then decide which Tier 2 suppliers to involve, and so on, down to Tier 3 and Tier 4.

Today, this process has become too slow for automotive manufacturers, with insufficient communication of information. Many automotive manufacturers have begun to break this traditional value chain. They are starting to directly engage original technology suppliers (who may have previously been Tier 2 or even Tier 3), as they want to understand what this technology can truly do, especially in cutting-edge technology fields.

They also want to know what these previously indirect suppliers are experimenting with to ensure that the product lifecycle can last over 10 years.

Tier 2 and even Tier 3 suppliers are very interested in these products as they want to understand what the end-user OEM is doing with these products and under what application conditions they should operate.

Throughout the automotive industry, technology is constantly evolving, and the standards for safety and reliability are becoming increasingly stringent. For those startups shouting “automotive-grade” everywhere, deception and trickery do not apply to the automotive industry; rather, it reflects the high entry barriers of the automotive sector.

Automotive Chips vs. Consumer Electronics Chips

The design considerations for consumer electronics chips and automotive chips differ significantly, leading to substantial differences in process technology. It is challenging to compare them, akin to discussing who is stronger between Qiao Feng from “Demi-Gods and Semi-Devils” and Zhang Wuji from “The Heaven Sword and Dragon Saber.” Below, I will attempt to analyze it for readers.

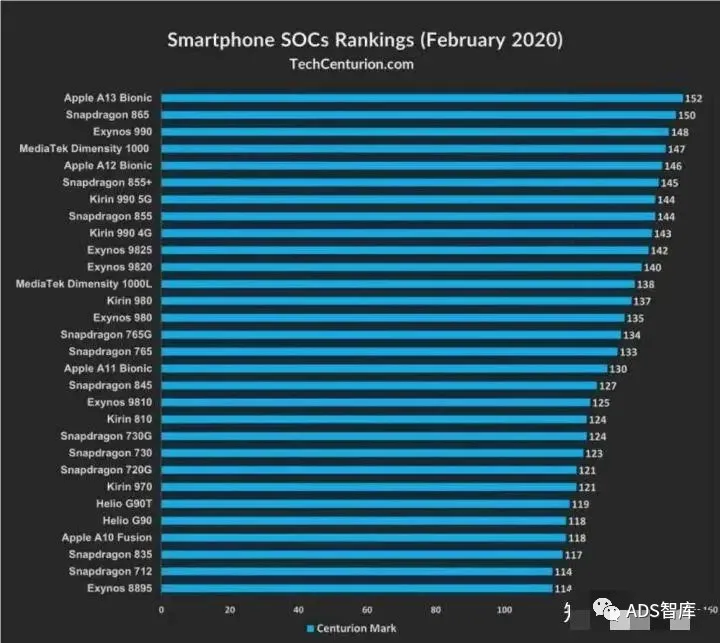

Smartphone Chips: Speed is King

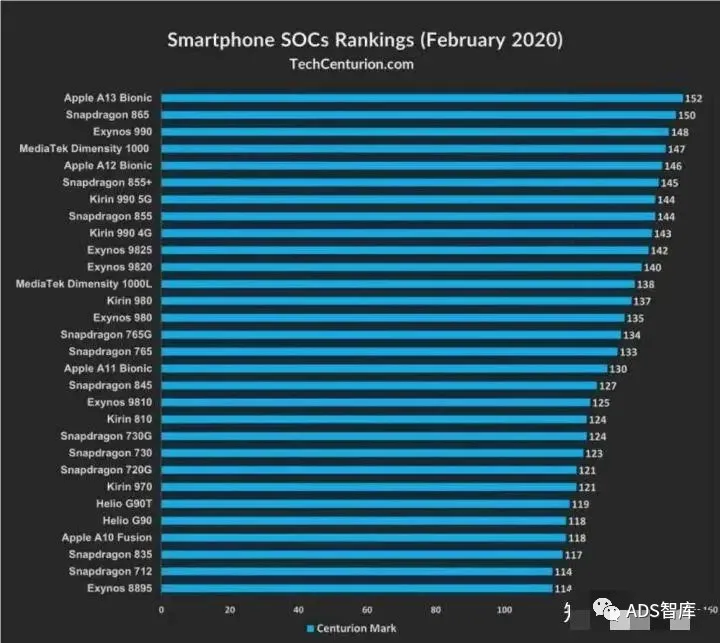

Whether it is smartphones, tablets, set-top boxes, or smart wearable devices, consumer electronics chips consider performance, power consumption, and cost during the R&D phase.

In the era of smart devices, chip performance has become a crucial standard for evaluating a model’s quality. Whether playing “Honor of Kings” or “PUBG Mobile,” a stronger CPU chip can provide an ultimate gaming experience. Taking the Qualcomm Snapdragon 865 chip as an example, it uses a 1*Cortex-A77 (2.84GHz) + 3*Cortex A77 (2.42GHz) + 4*Cortex-A55 (1.8GHz) architecture, with an NPU capable of 15 trillion operations per second: the ISP speed reaches 2 billion pixels per second, supporting 200 million pixel cameras.

A chip with dozens of billions of transistors running at high frequencies generates a significant amount of dynamic power consumption, short-circuit power consumption, and leakage power consumption. If not controlled, it can result in computational errors or even cause certain circuits to fuse, rendering the chip irreparable. Therefore, consumer electronics must balance performance with power consumption; otherwise, it may lead to overheating, reduced standby time, and a decline in user experience.

As chip performance continues to improve, chip prices are rising, accounting for an increasing share of the total cost of smartphones. For instance, the cost of the Qualcomm Snapdragon 865 is around 700 yuan, accounting for 14% of the cost of the Xiaomi 10 Pro, 23% of the Redmi K30 Pro, 10% of the OPPO Find X2 Pro, and 7% of the Samsung S20 Ultra; the cost of the Kirin 990 is about 500 yuan, accounting for 16% of the price of Huawei Nova 6, 10% of the P40, 7% of the P40 Pro, and 5% of the P40 Pro Plus; the price of MediaTek Dimensity 1000 is 280 yuan, accounting for 9.8% of the price of OPPO Reno3. Therefore, from both the perspective of enhancing product competitiveness and improving corporate profits, controlling chip costs is essential.

Automotive Chips: Reliability Above All

Due to the unique nature of vehicles as transportation tools, automotive chips place a significant emphasis on reliability, safety, and longevity! Why prioritize reliability? Because of the characteristics of automotive-grade chips:

1. Harsh Operating Environment

The temperature range in the engine compartment is -40°C to 150°C, so vehicle chips must meet this wide temperature operating range, while consumer chips only need to meet a range of 0°C to 70°C. Additionally, vehicles encounter more vibrations and shocks during operation, and the internal environment is subject to high humidity, dust, and corrosion, far exceeding the requirements for consumer chips.

2. Longer Product Lifespan

The lifespan of smartphones is typically 3 years, at most 5 years, while automotive designs usually last around 15 years or 200,000 kilometers, significantly exceeding the lifespan requirements of consumer electronics. Therefore, automotive chips must have a product lifecycle requirement of over 15 years, with supply cycles possibly extending to 30 years.

In such cases, maintaining consistency and reliability in chips is the primary consideration for automotive-grade chips.

3. Safety is Especially Important in Automotive Chips

The safety of automotive chips primarily consists of functional safety and information security.

While a smartphone chip can reboot if it fails, a failure of an automotive chip could lead to severe safety incidents, which is unacceptable for consumers. Therefore, in the design of automotive chips, functional safety must be prioritized from the architecture design stage, incorporating independent safety islands, with data verification such as ECC and CRC in key modules, computing modules, buses, and memory, including the entire production process using automotive-grade chip processes to ensure functional safety.

With the promotion of vehicle networking technology, information security is becoming increasingly important. As real-time online devices, vehicles must encrypt data in their communications with networks and internal vehicle networks; otherwise, they could be vulnerable to hacking. Thus, it is necessary to embed high-performance encryption verification modules within the chips.

Regarding functional safety, the international organization IEC has released the IEC 61508 standard, which has spawned a series of functional safety standards applicable to different industries, as shown in the following image:

4. Automotive Chip Design Must Also Consider Longevity

Smartphone chips generally follow Moore’s Law, with new generations of chips released every year and new flagship models launched annually. Essentially, a chip can meet software system performance requirements for two to three years. However, the development cycle for automotive products is longer, with new models requiring at least two years from R&D to market validation, meaning that automotive chip designs must be forward-looking, capable of meeting customer needs for the next 3 to 5 years. Furthermore, as the number of software in vehicles continues to increase, from a chip development perspective, it is necessary to support multiple operating systems and the continuously evolving requirements of software.

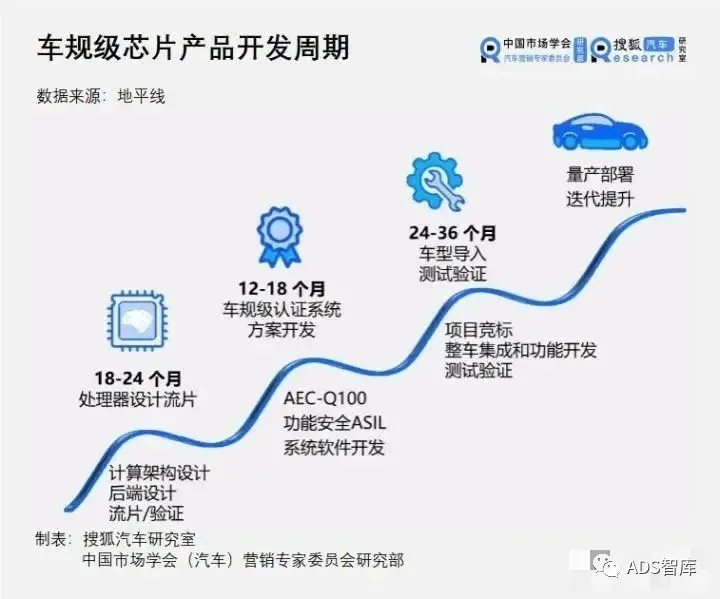

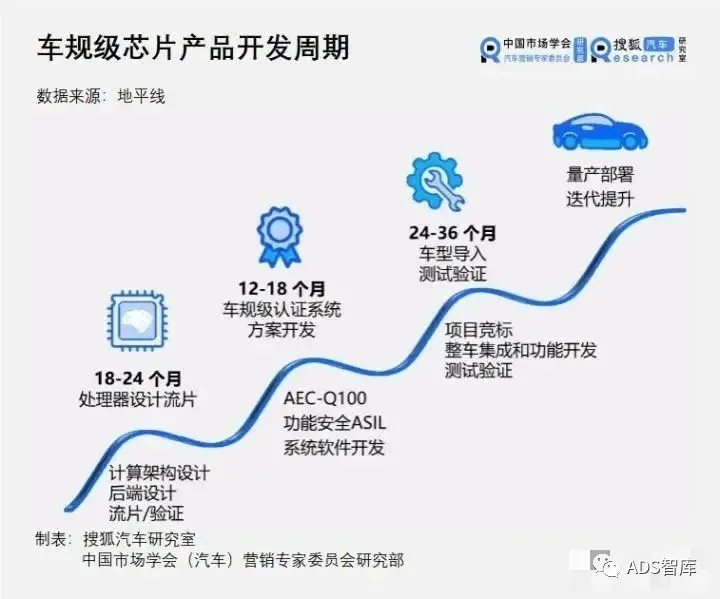

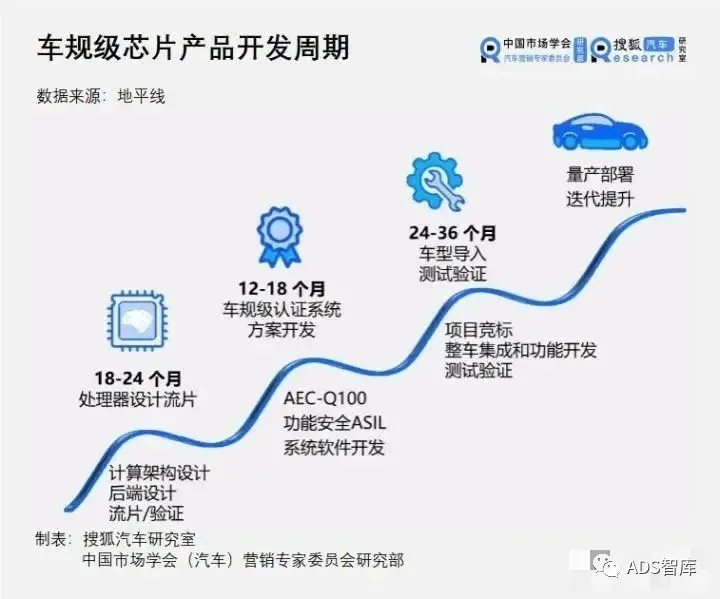

Thus, automotive-grade chips exhibit characteristics such as long industrialization cycles and high supply chain thresholds. To enter the mainstream automotive electronic supply chain, several basic requirements must be met: compliance with the reliability standards AEC-Q100 (IC), 101 (discrete components), and 200 (passive components) issued by the North American automotive industry; adherence to international standards for automotive electronics and software functional safety ISO 26262; compliance with ISO 21448 for expected functional safety, covering safety hazards arising from non-system failures; compliance with ISO 21434 for network security, ensuring reasonable vehicle and system network safety; and adherence to the zero-failure supply chain quality management standard IATF 16949. Generally, the certification of a chip to automotive-grade standards typically requires 3 to 5 years, posing significant technical, production, and time cost challenges for chip manufacturers. Mobileye took a full 8 years to secure its first automotive order, while NVIDIA’s main chip Xavier incurred a development cost of 2 billion dollars.

Different Process Technologies Used

In chip manufacturing, reducing the distance between internal circuits allows more transistors to be packed onto a smaller chip, enhancing computational performance while also reducing power consumption. Thus, from early micrometer to later nanometer chips, significant emphasis has been placed on process technology size. However, the process cannot shrink indefinitely; when transistors shrink to about 20 nanometers, they encounter quantum physical issues, leading to leakage currents that negate the benefits of reduced gate lengths. To address this, Professor Hu Zhengming from the University of California, Berkeley, invented FinFET, significantly improving circuit control and reducing leakage currents.

Currently, smartphone chip process technologies have evolved from earlier 90 nanometers to later 65 nanometers, 45 nanometers, 32 nanometers, 28 nanometers, 16 nanometers, 12 nanometers, 7 nanometers, and now to the latest 5 nanometers. The process size of smartphone chips is heading towards 1 nanometer.

Different Process Technologies Used

In chip manufacturing, reducing the distance between internal circuits allows more transistors to be packed onto a smaller chip, enhancing computational performance while also reducing power consumption. Thus, from early micrometer to later nanometer chips, significant emphasis has been placed on process technology size. However, the process cannot shrink indefinitely; when transistors shrink to about 20 nanometers, they encounter quantum physical issues, leading to leakage currents that negate the benefits of reduced gate lengths. To address this, Professor Hu Zhengming from the University of California, Berkeley, invented FinFET, significantly improving circuit control and reducing leakage currents.

Currently, smartphone chip process technologies have evolved from earlier 90 nanometers to later 65 nanometers, 45 nanometers, 32 nanometers, 28 nanometers, 16 nanometers, 12 nanometers, 7 nanometers, and now to the latest 5 nanometers. The process size of smartphone chips is heading towards 1 nanometer.

In contrast, traditional automotive chips do not pursue advanced process technology as aggressively due to the larger space in vehicles and lower integration requirements compared to consumer electronics. Moreover, automotive chips focus on low-power areas such as generators, chassis, safety, and lighting control, leading to a preference for mature process technologies over advanced ones. However, with the development of automotive intelligence, the urgent demand for high computing power in advanced driving will drive automotive computing platform processes to extend to 7 nanometers and below. NXP plans to launch its next-generation high-performance automotive computing platform based on 5nm technology in 2021.

In contrast, traditional automotive chips do not pursue advanced process technology as aggressively due to the larger space in vehicles and lower integration requirements compared to consumer electronics. Moreover, automotive chips focus on low-power areas such as generators, chassis, safety, and lighting control, leading to a preference for mature process technologies over advanced ones. However, with the development of automotive intelligence, the urgent demand for high computing power in advanced driving will drive automotive computing platform processes to extend to 7 nanometers and below. NXP plans to launch its next-generation high-performance automotive computing platform based on 5nm technology in 2021.

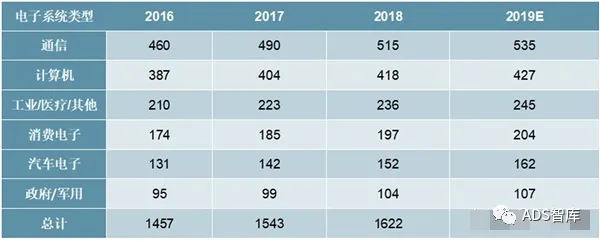

The Future of Domestic Automotive Chips

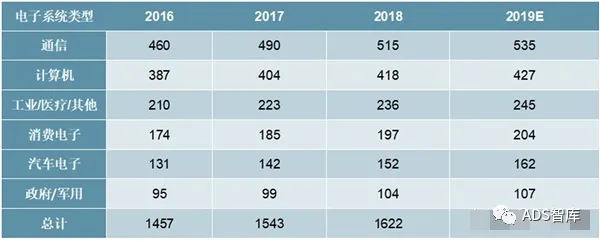

Once upon a time, the automotive chip market was limited in size, making it a niche sector, thus deterring many external entrants. For decades, it has been monopolized by automotive chip giants such as NXP, Texas Instruments, and Renesas Semiconductor. With the continuous improvement of automotive electronics and intelligence levels, the market scale of automotive electronic systems is increasing year by year, and top chip companies like Samsung, Intel, Qualcomm, NVIDIA, and Xilinx have successively entered the automotive chip field, creating an environment of ‘seeking opportunities amidst change’ for domestic companies.

In the functional chip sector, listed companies such as NXP Electronics, GigaDevice, and Neusoft Zhaibo are involved in automotive electronics but hold a very small market share. Jiefa Technology received automotive-grade MCU chip orders in 2018, marking the official mass production of the first domestic automotive-grade MCU through AEC-100 Grade 1, breaking the foreign technology monopoly.

In the main control chip sector, Huawei has fully laid out automotive intelligent computing platforms with its Ascend and Kirin series chips, while Horizon has taken the lead in mass-producing AI chips for vehicles.

In the automotive storage chip sector, GigaDevice and Hefei Changxin have closely collaborated, launching the GD25 series of SPI NOR FLASH in 2019, which meets AEC-Q100 standards, making it the only fully domesticated automotive-grade storage solution; Hongwang Semiconductor has introduced embedded storage, mobile storage like eMMC/DDR/LPDDR/SSD/DIMM, expanding applications in automotive electronics.

In the automotive communication chip sector, Huawei has provided 4G communication modules for millions of vehicles worldwide, and 5G modules have also been mass-produced for vehicles; in the C-V2X field, a large number of C-V2X chip/module enterprises represented by Huawei, Datang, High-Technology, and Quectel have emerged. Huawei’s baseband chips Balong 765 and Balong 5000 have been successively applied to onboard units and roadside units, while Datang has successfully achieved mass production of C-V2X automotive-grade module DMD3A. The extensive cooperation between foreign companies like Qualcomm and domestic module manufacturers like High-Technology and Quectel promotes the promotion and application of C-V2X chipsets, and Autotalks is also actively conducting interoperability experiments for C-V2X chips with Datang and other domestic manufacturers.

In the power chip sector, in terms of MOSFETs, Wingtech Technology holds 4% of the global market share, while China Resources Microelectronics accounts for 8.7% of the domestic MOSFET market; for IGBTs, domestic companies include CRRC Zhuzhou Electric, BYD, Star Power, and Shanghai Advanced.

In the functional chip sector, listed companies such as NXP Electronics, GigaDevice, and Neusoft Zhaibo are involved in automotive electronics but hold a very small market share. Jiefa Technology received automotive-grade MCU chip orders in 2018, marking the official mass production of the first domestic automotive-grade MCU through AEC-100 Grade 1, breaking the foreign technology monopoly.

In the main control chip sector, Huawei has fully laid out automotive intelligent computing platforms with its Ascend and Kirin series chips, while Horizon has taken the lead in mass-producing AI chips for vehicles.

In the automotive storage chip sector, GigaDevice and Hefei Changxin have closely collaborated, launching the GD25 series of SPI NOR FLASH in 2019, which meets AEC-Q100 standards, making it the only fully domesticated automotive-grade storage solution; Hongwang Semiconductor has introduced embedded storage, mobile storage like eMMC/DDR/LPDDR/SSD/DIMM, expanding applications in automotive electronics.

In the automotive communication chip sector, Huawei has provided 4G communication modules for millions of vehicles worldwide, and 5G modules have also been mass-produced for vehicles; in the C-V2X field, a large number of C-V2X chip/module enterprises represented by Huawei, Datang, High-Technology, and Quectel have emerged. Huawei’s baseband chips Balong 765 and Balong 5000 have been successively applied to onboard units and roadside units, while Datang has successfully achieved mass production of C-V2X automotive-grade module DMD3A. The extensive cooperation between foreign companies like Qualcomm and domestic module manufacturers like High-Technology and Quectel promotes the promotion and application of C-V2X chipsets, and Autotalks is also actively conducting interoperability experiments for C-V2X chips with Datang and other domestic manufacturers.

In the power chip sector, in terms of MOSFETs, Wingtech Technology holds 4% of the global market share, while China Resources Microelectronics accounts for 8.7% of the domestic MOSFET market; for IGBTs, domestic companies include CRRC Zhuzhou Electric, BYD, Star Power, and Shanghai Advanced.

Overall, China’s chip industry has a late start and a weak foundation, facing many limitations in the R&D and mass production applications of automotive-grade chips. Foreign chip giants still dominate the domestic automotive semiconductor chip market, and domestic companies’ technical accumulation, funding, and talent cannot compete with international giants. For China’s automotive chip industry to achieve breakthroughs and grow strong, it is not an overnight process. It must be based on the present, following the objective laws of industry development, avoiding speculative thinking of hitting it big in one go, and preventing issues such as overheated investment and blind low-level repetitive construction. Seizing the opportunities presented by intelligent networking and new energy is essential for the transition from single-point breakthroughs to ecological breakthroughs.

In the context of the booming smart automotive market and national support for domestic chip enterprises, we firmly believe: the “core” will ignite the fire!

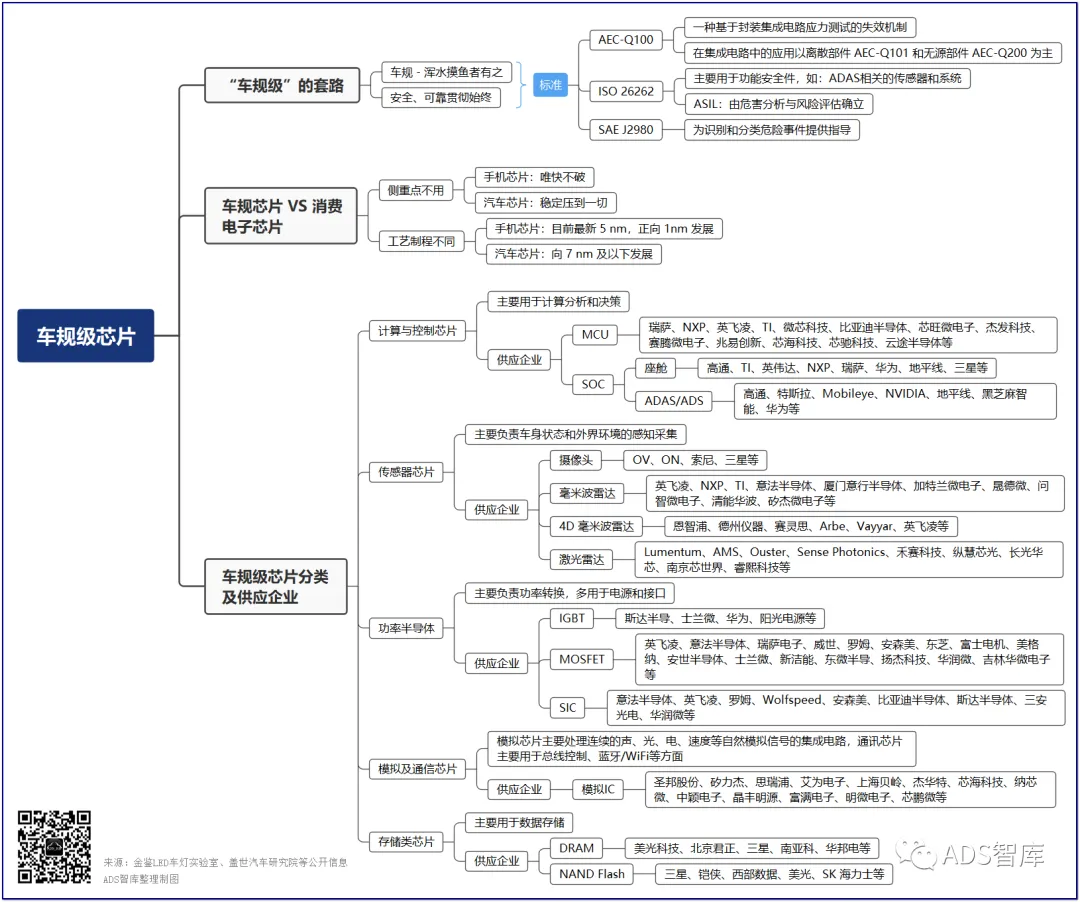

Classification of Automotive Grade Chips

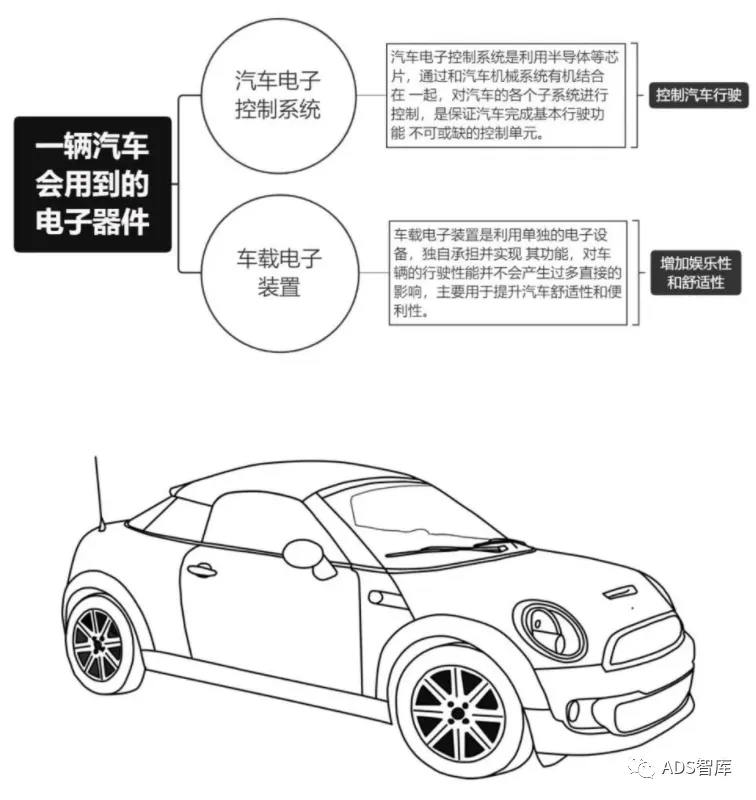

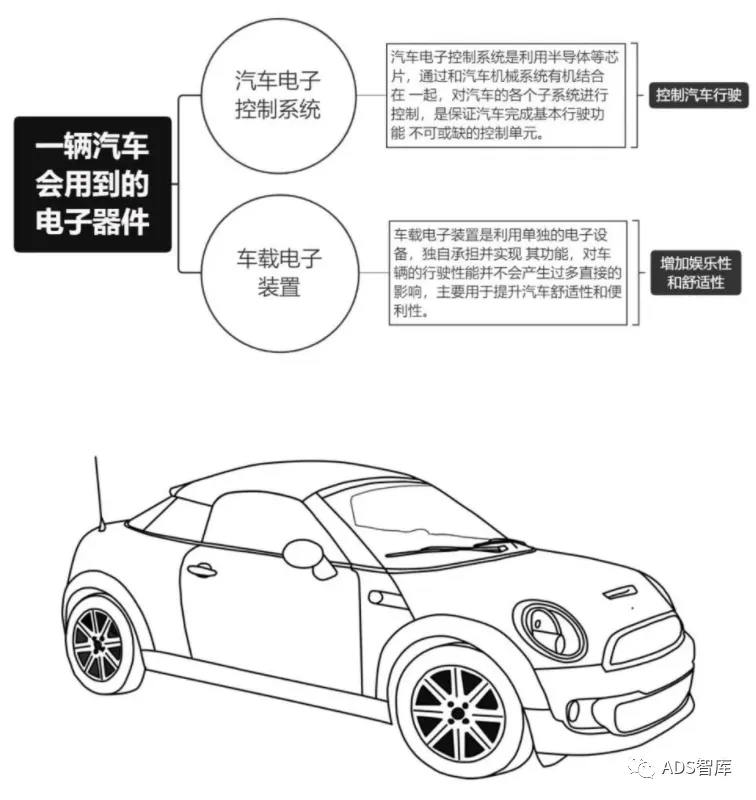

What semiconductor devices does a car need?

What if only considering the chips required for vehicle operation?

Comparison of Core Components in Traditional Cars vs. Smart Electric Vehicles

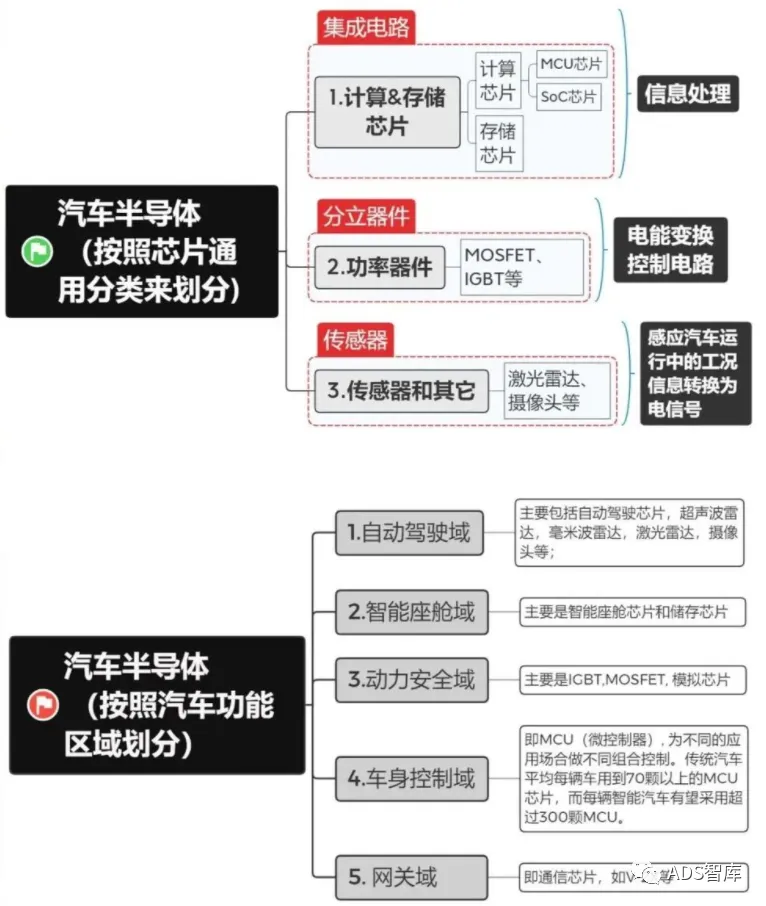

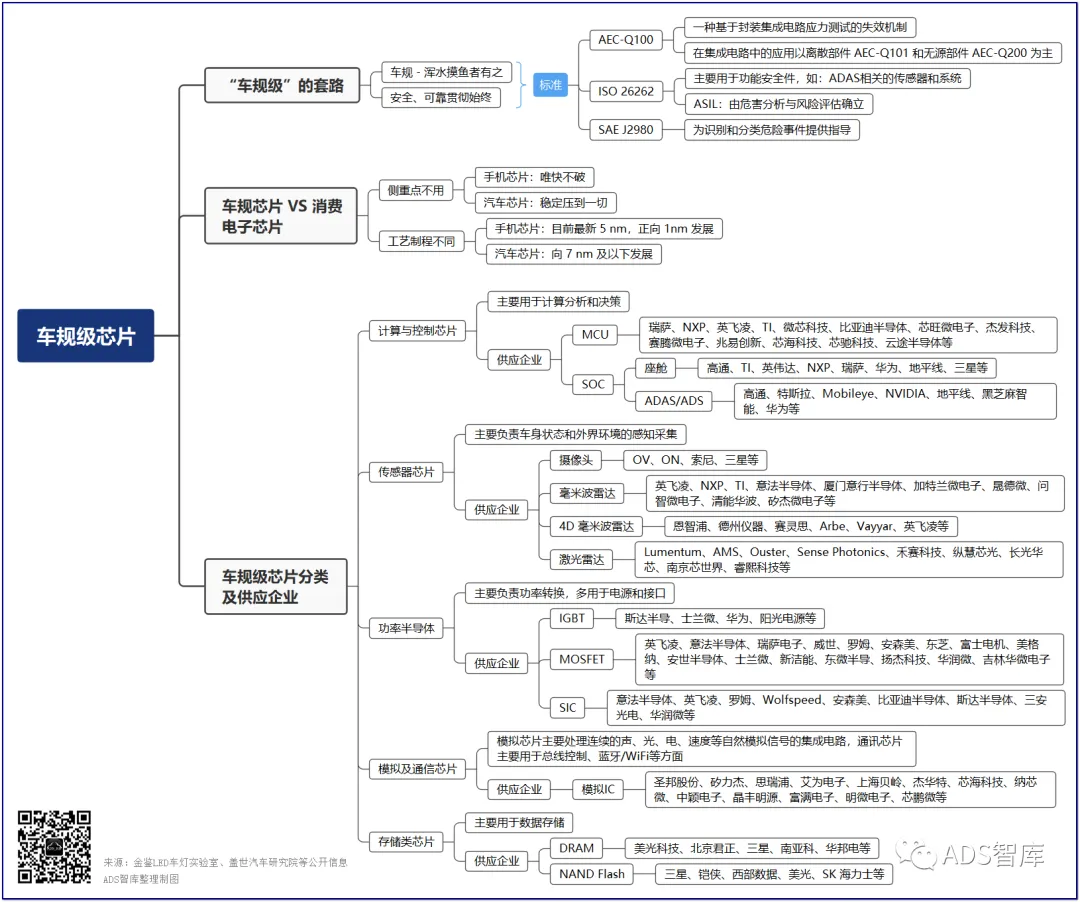

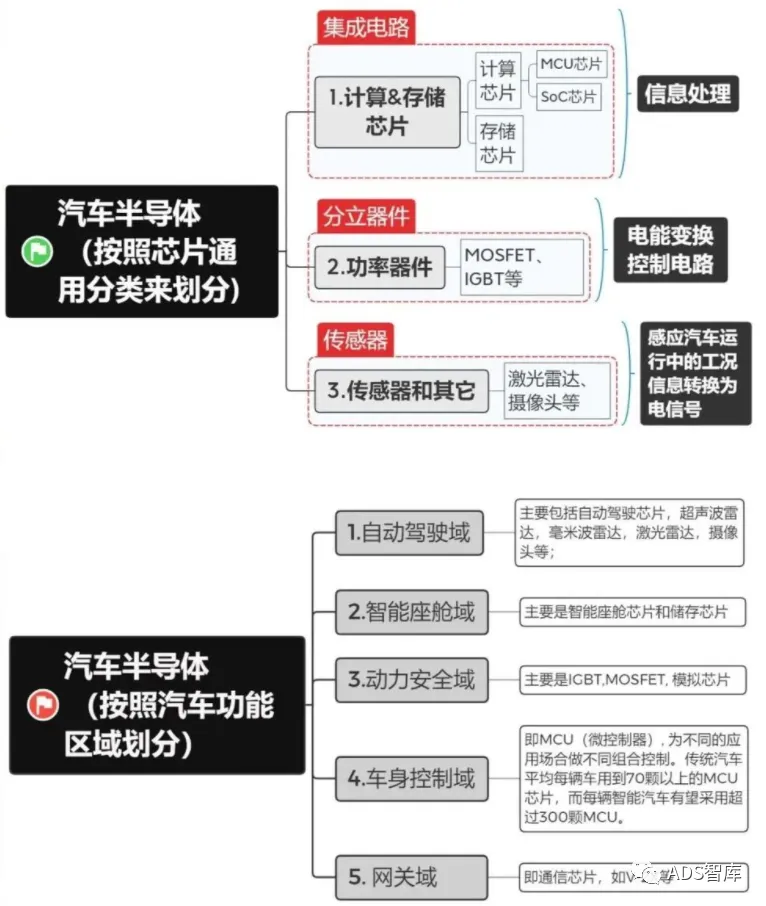

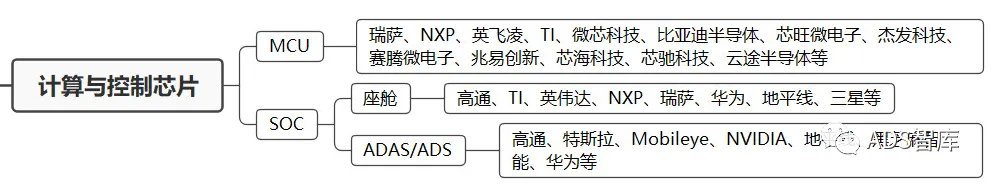

Automotive chips are mainly categorized by function into computing and control chips, sensor chips, power semiconductors, analog and communication chips, and memory chips.

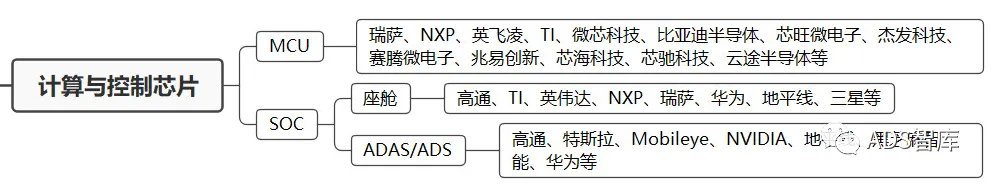

Computing and Control Chips

Primarily used for computational analysis and decision-making. In traditional automotive distributed E/E architecture, an ECU controls a single function, which can be met with an MCU chip, while domain controllers (DCUs) in centralized architecture require SOC chips.

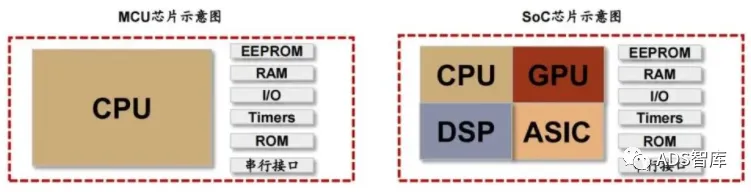

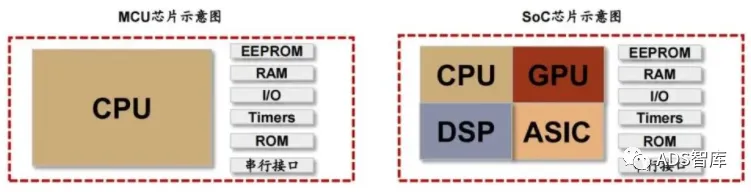

MCU/SOC computing cores are divided into CPU, GPU, DSP, ASIC, and FPGA.

MCU, also known as microcontroller, typically contains only one processing unit, with MCU = CPU + memory + interface unit;

SOC is a system-on-chip, generally containing multiple processing units, for example: SOC can be CPU + GPU + DSP + NPU + memory + interface unit.

CPU, GPU, and DSP are general-purpose processing chips:

> CPU is the central processing unit, skilled in logical control;

> GPU is adept at processing image signals;

> DSP excels at processing digital signals.

ASIC is a dedicated processor chip, while FPGA is a “semi-dedicated” processor chip.

Major companies involved in MCU and SOC include:

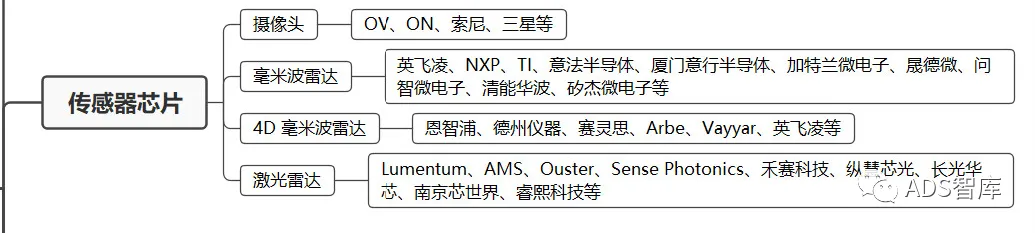

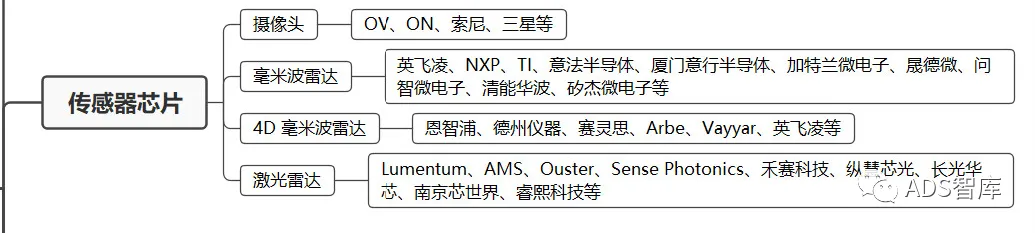

Primarily responsible for perceiving and collecting the vehicle’s status and external environment. Traditional automotive sensors mainly include 8 types: pressure sensors, position sensors, temperature sensors, acceleration sensors, angle sensors, flow sensors, gas sensors, and liquid level sensors, while smart electric vehicles also include CIS, LiDAR, millimeter-wave radar, MEMS, and other semiconductor products.

Major companies involved in smart sensors include:

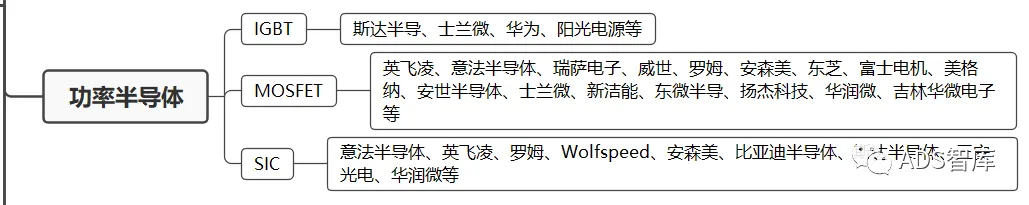

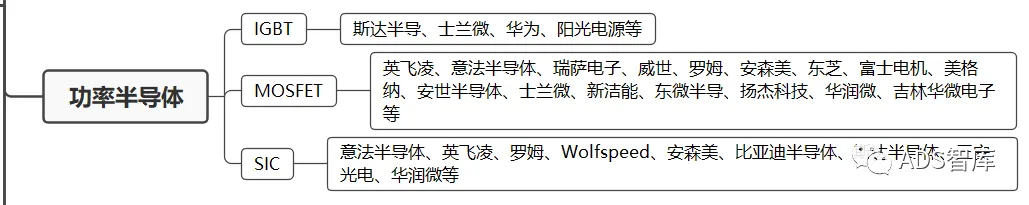

Primarily responsible for power conversion, commonly used in power supplies and interfaces. For example: IGBT power chips, MOSFETs, etc. Currently, in the electric vehicle (excluding 48V MHEV) system architecture, components involving power devices include the main inverter in motor drive systems, on-board charging systems (OBC), power conversion systems (DC-DC), and non-vehicle charging piles.

IGBT (Insulated Gate Bipolar Transistor) is a composite power semiconductor device composed of BJT and MOSFET, possessing the advantages of high switching speed, high input impedance, low control power, simple driving circuits, and low switching losses.

MOSFET (Metal Oxide Semiconductor Field Effect Transistor) is a semiconductor device widely used for switching purposes and amplifying electronic signals in electronic devices.

SiC is a compound semiconductor material composed of silicon (Si) and carbon (C) and is currently one of the fastest-growing power semiconductor devices in the power electronics field.

Major companies involved in power semiconductors include:

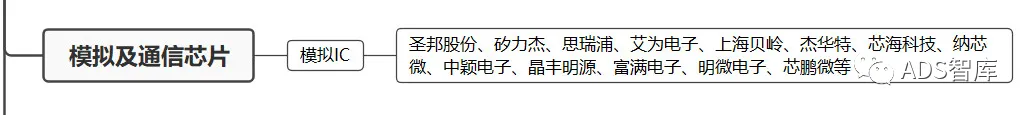

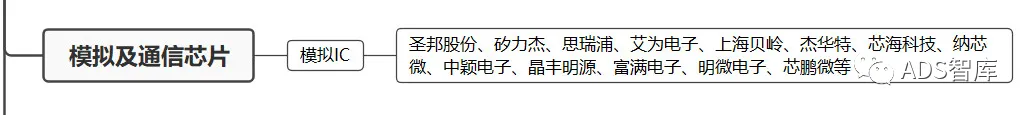

Analog and Communication Chips

Analog chips primarily process continuous natural analog signals such as sound, light, electricity, and speed, while communication chips are mainly used for bus control, Bluetooth/WiFi, etc.

Major companies involved in analog ICs include:

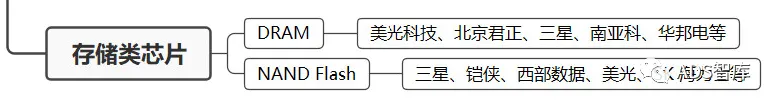

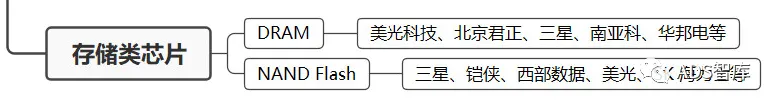

Primarily used for data storage. DRAM and NAND Flash are the mainstream products for automotive storage chips.

Major companies involved in storage chips include:

Overall, China’s chip industry has a late start and a weak foundation, facing many limitations in the R&D and mass production applications of automotive-grade chips. Foreign chip giants still dominate the domestic automotive semiconductor chip market, and domestic companies’ technical accumulation, funding, and talent cannot compete with international giants. For China’s automotive chip industry to achieve breakthroughs and grow strong, it is not an overnight process. It must be based on the present, following the objective laws of industry development, avoiding speculative thinking of hitting it big in one go, and preventing issues such as overheated investment and blind low-level repetitive construction. Seizing the opportunities presented by intelligent networking and new energy is essential for the transition from single-point breakthroughs to ecological breakthroughs.

In the context of the booming smart automotive market and national support for domestic chip enterprises, we firmly believe: the “core” will ignite the fire!

Classification of Automotive Grade Chips

What semiconductor devices does a car need?

What if only considering the chips required for vehicle operation?

Comparison of Core Components in Traditional Cars vs. Smart Electric Vehicles

Automotive chips are mainly categorized by function into computing and control chips, sensor chips, power semiconductors, analog and communication chips, and memory chips.

Computing and Control Chips

Primarily used for computational analysis and decision-making. In traditional automotive distributed E/E architecture, an ECU controls a single function, which can be met with an MCU chip, while domain controllers (DCUs) in centralized architecture require SOC chips.

MCU/SOC computing cores are divided into CPU, GPU, DSP, ASIC, and FPGA.

MCU, also known as microcontroller, typically contains only one processing unit, with MCU = CPU + memory + interface unit;

SOC is a system-on-chip, generally containing multiple processing units, for example: SOC can be CPU + GPU + DSP + NPU + memory + interface unit.

CPU, GPU, and DSP are general-purpose processing chips:

> CPU is the central processing unit, skilled in logical control;

> GPU is adept at processing image signals;

> DSP excels at processing digital signals.

ASIC is a dedicated processor chip, while FPGA is a “semi-dedicated” processor chip.

Major companies involved in MCU and SOC include:

Primarily responsible for perceiving and collecting the vehicle’s status and external environment. Traditional automotive sensors mainly include 8 types: pressure sensors, position sensors, temperature sensors, acceleration sensors, angle sensors, flow sensors, gas sensors, and liquid level sensors, while smart electric vehicles also include CIS, LiDAR, millimeter-wave radar, MEMS, and other semiconductor products.

Major companies involved in smart sensors include:

Primarily responsible for power conversion, commonly used in power supplies and interfaces. For example: IGBT power chips, MOSFETs, etc. Currently, in the electric vehicle (excluding 48V MHEV) system architecture, components involving power devices include the main inverter in motor drive systems, on-board charging systems (OBC), power conversion systems (DC-DC), and non-vehicle charging piles.

IGBT (Insulated Gate Bipolar Transistor) is a composite power semiconductor device composed of BJT and MOSFET, possessing the advantages of high switching speed, high input impedance, low control power, simple driving circuits, and low switching losses.

MOSFET (Metal Oxide Semiconductor Field Effect Transistor) is a semiconductor device widely used for switching purposes and amplifying electronic signals in electronic devices.

SiC is a compound semiconductor material composed of silicon (Si) and carbon (C) and is currently one of the fastest-growing power semiconductor devices in the power electronics field.

Major companies involved in power semiconductors include:

Analog and Communication Chips

Analog chips primarily process continuous natural analog signals such as sound, light, electricity, and speed, while communication chips are mainly used for bus control, Bluetooth/WiFi, etc.

Major companies involved in analog ICs include:

Primarily used for data storage. DRAM and NAND Flash are the mainstream products for automotive storage chips.

Major companies involved in storage chips include:

Source: Automotive Electronics Academy