-

Source/Author: Ping An Securities Research Institute

Abstract

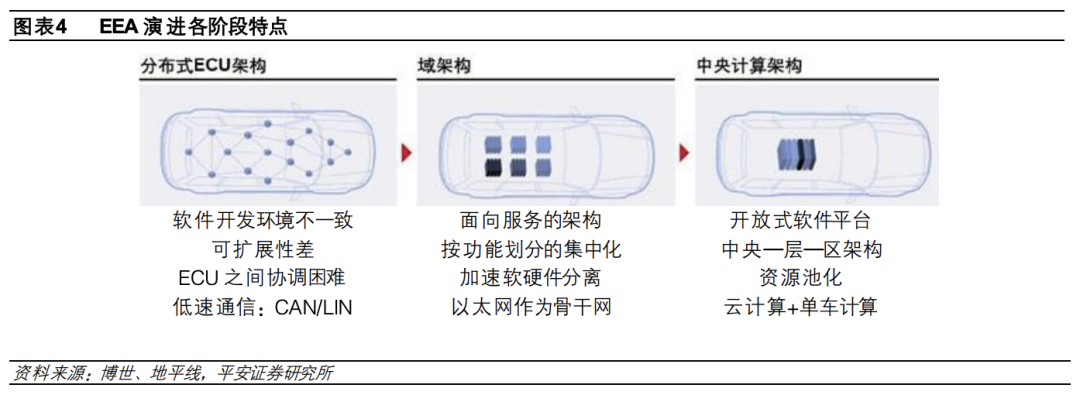

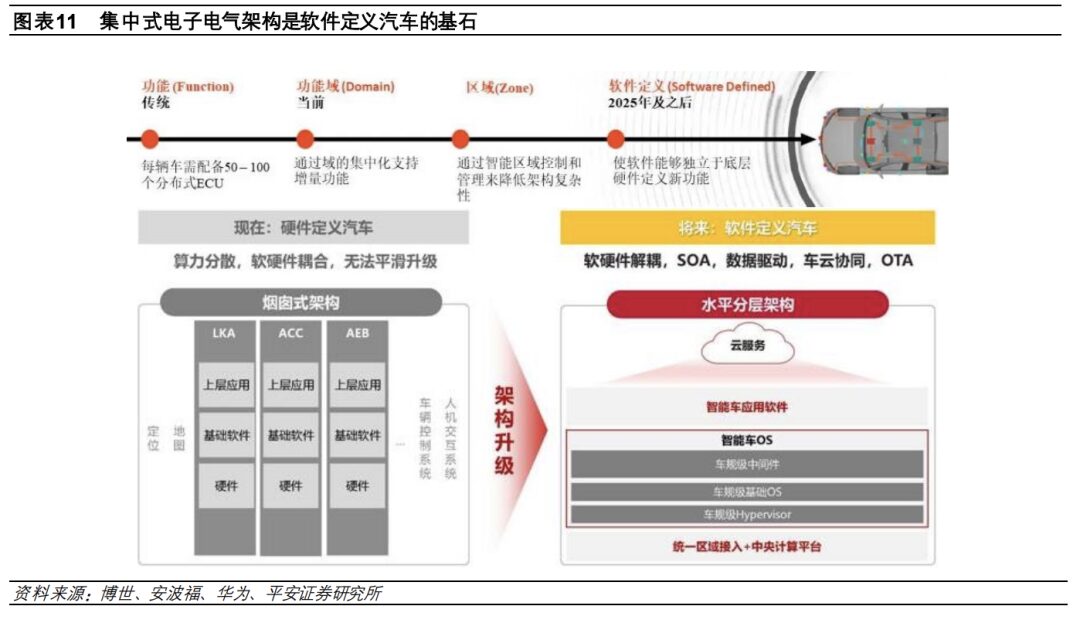

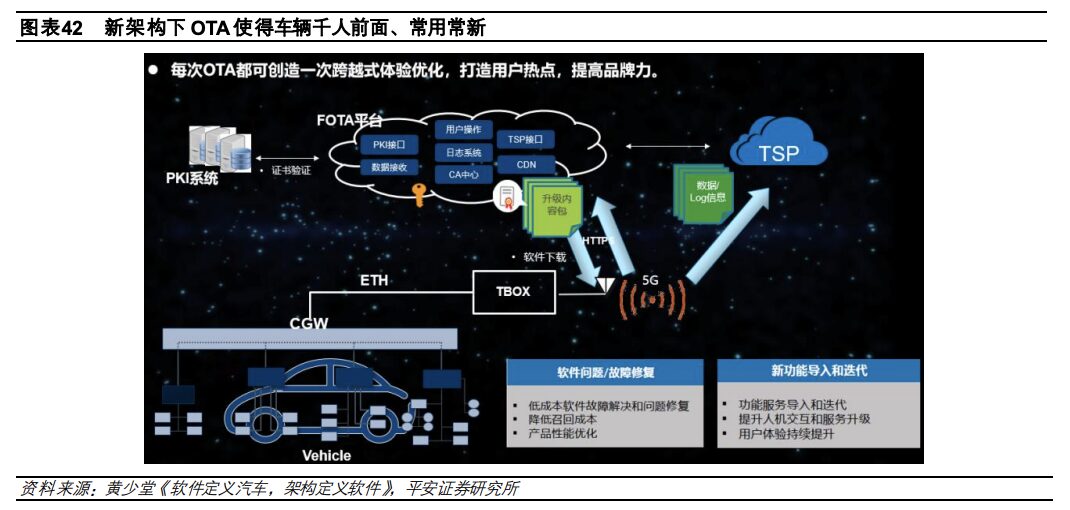

Centralized electronic and electrical architecture is the prerequisite for software-defined vehicles. With the increase in the application of electronic and electrical products in vehicles, the number of ECUs in a single vehicle has surged. Distributed electronic and electrical architectures, due to their dispersed computing power, complex wiring, deep coupling of hardware and software, and communication bandwidth bottlenecks, cannot adapt to the further development of automotive intelligence, and are moving towards centralized computing: vehicles will replace a large number of ECUs with a few high-performance computing units to provide the computing power foundation for increasingly complex automotive software; achieve hardware-software decoupling + software layer decoupling, allowing automotive software to be quickly iterated through OTA; and implement high-bandwidth communication architectures to accommodate the rapidly increasing data volume and low-latency requirements of vehicles.

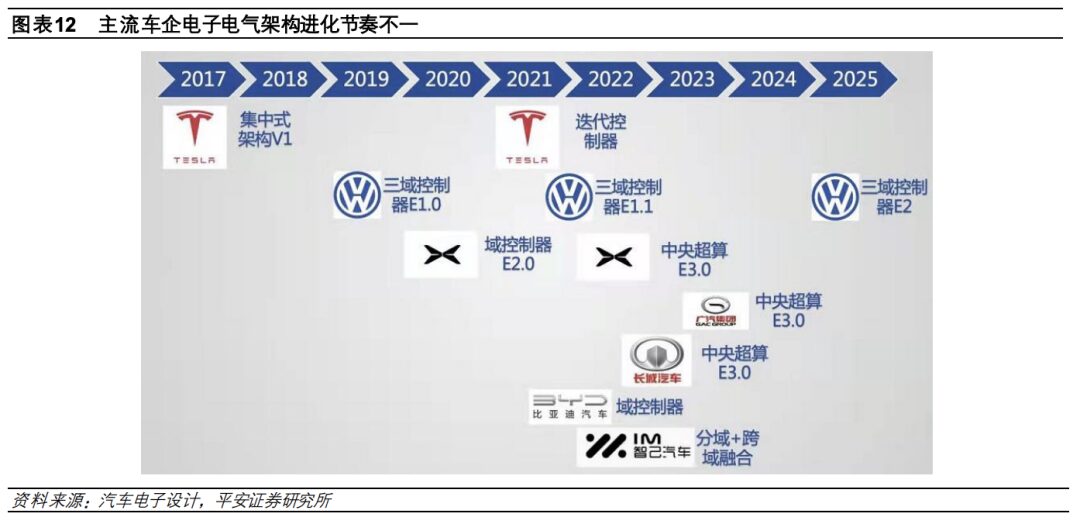

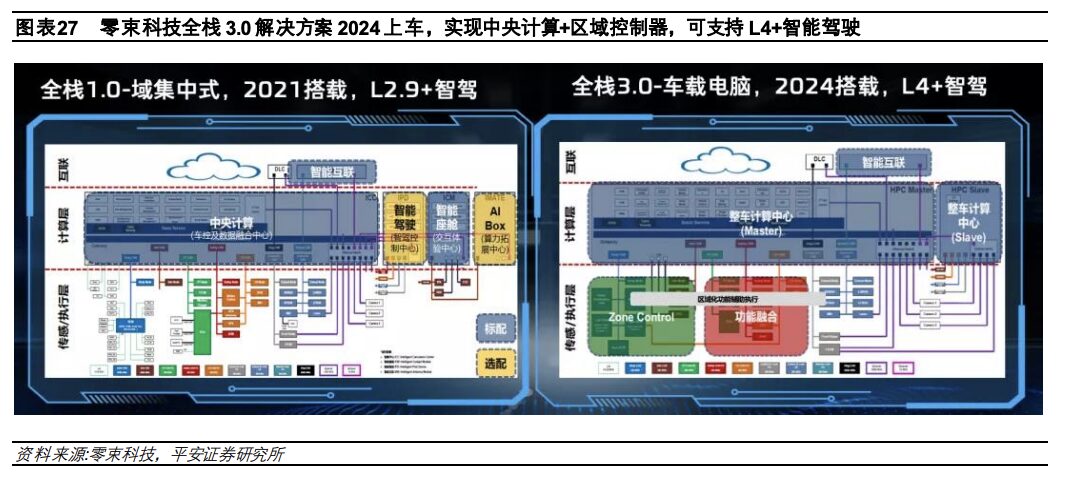

Leading electronic architecture is the premise for automakers to maintain a leading position in intelligence. The transition of electronic and electrical architecture from distributed to centralized computing is a new lesson for automakers, gradually integrating and centralizing the originally highly dispersed control functions based on existing R&D organizational structures and relationships. Tesla and new car manufacturers have relatively lighter historical burdens, but it also requires three generations of models to evolve into cross-domain integrated architectures. The Model 3 initiated a comprehensive transformation of electronic architecture, realizing the prototype of a centralized architecture, based on which Tesla achieved a high degree of vertical integration of hardware and software for assisted driving, and existing vehicles can also achieve regular updates and continuous leading capabilities. Traditional automakers’ electronic architectures still show early stages of functional domains, presenting a transitional form of “distributed ECU + domain controllers.” In 2022, Xiaopeng will launch the new generation architecture with G9, and Great Wall Motors will implement its fourth-generation architecture towards cross-domain integration. By 2024/2025, “centralized computing + regional controllers” will begin to be implemented.

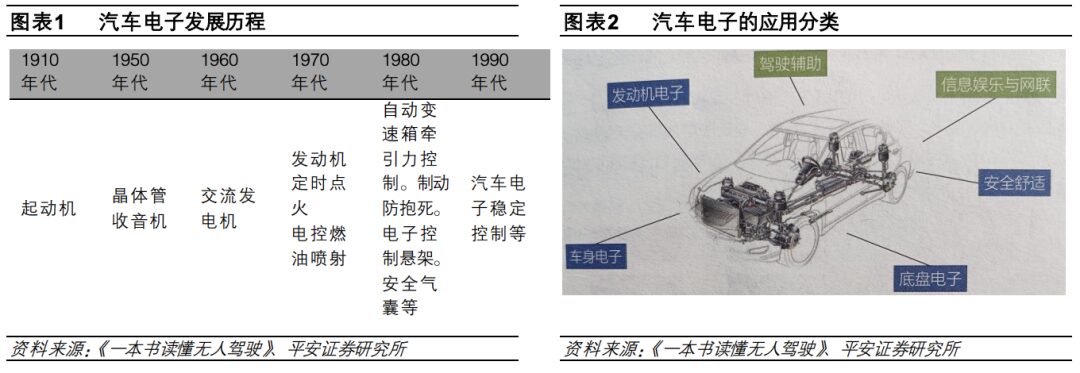

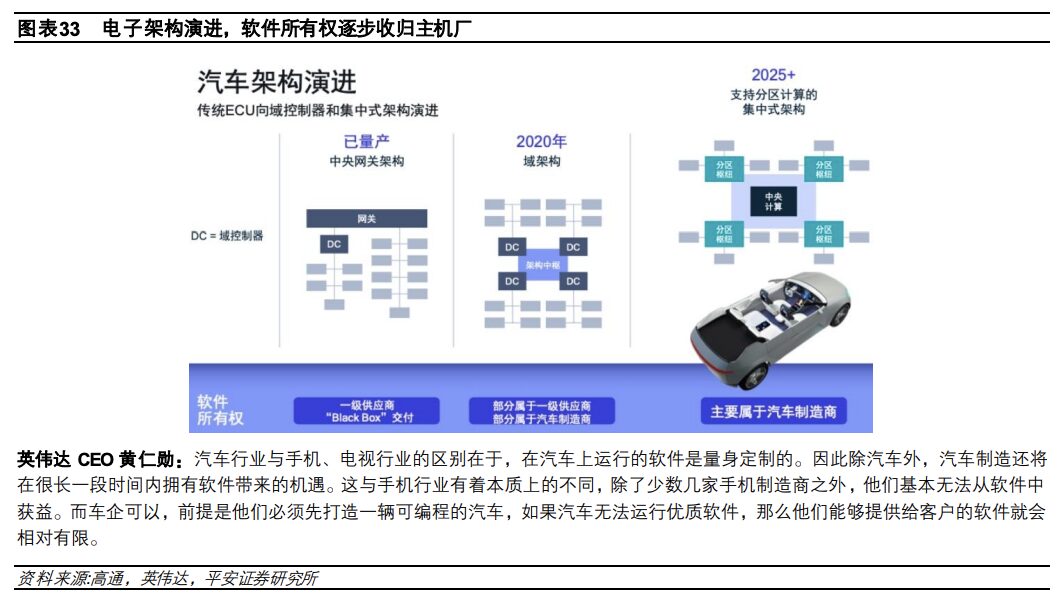

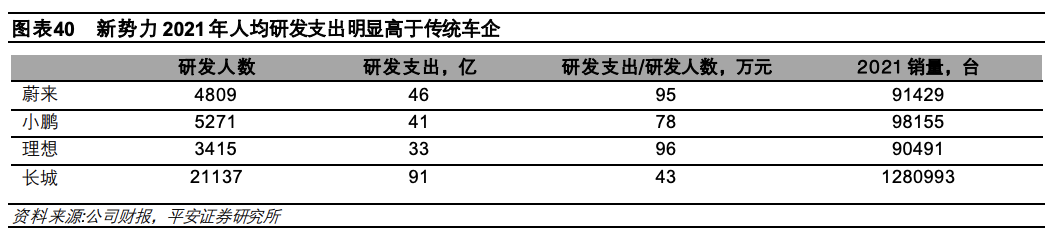

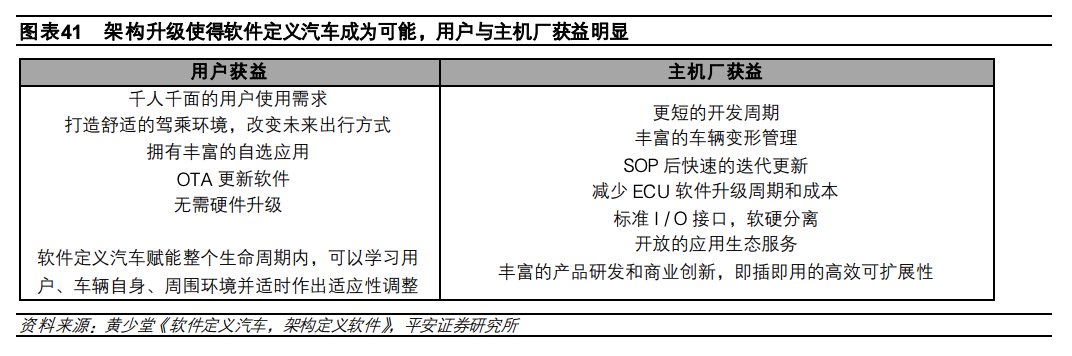

The evolution of architecture drives multiple changes in OEMs. Behind the evolution of architecture is the process of OEMs extracting and integrating control functions from components that originally belonged to suppliers’ integrated hardware and software. The proportion of self-developed software by OEMs will significantly increase, and the ownership of automotive software will gradually return to OEMs. In this process, OEMs will determine the number of high-value modules to be self-developed and the depth of involvement based on different brand positioning and their own strengths, such as Tesla’s core modules being fully self-developed while outsourcing hardware, or potentially existing as a vehicle brand with a high proportion of outsourcing for both software and hardware. The evolution of architecture changes the automotive development model, R&D talent structure, organizational forms, and relationships between manufacturers and suppliers. The profit pool for OEMs will be significantly widened, and they will enjoy long-term software dividends. Through hardware embedding and pluggable + user-paid unlocking services, OEMs can realize software and content monetization on existing vehicles, enhancing user stickiness to the brand.

Investment advice: Be optimistic about vehicle companies with a faster iteration speed of electronic architecture and a higher proportion of self-developed high-value modules. The demand for high-performance processors brought by hardware embedding will benefit chip companies like Qualcomm and NVIDIA; during the gradual advancement of electronic architecture, domain controller suppliers and software module suppliers will experience rapid growth in related businesses.

Intelligent driving and intelligent cockpits are experiences that consumers can perceive, supported by powerful sensors and chips, as well as advanced electronic and electrical architectures. The electronic and electrical architecture determines the upper limit of the realization of intelligent functions. Without advanced electronic and electrical architecture, no matter how many superficial intelligent functions are equipped, it cannot support the continuous updates and leading capabilities of vehicles, nor can it reduce vehicle costs and enhance the efficiency of production and R&D. Currently, automotive electronic and electrical architecture is transitioning from distributed to centralized computing, a process akin to moving from “feudal fragmentation” to “unification under one central authority.” Due to multiple historical burdens, control initially consolidates around several power centers while still retaining several local authorities, but eventually will move towards centralization, with local authorities only responsible for executing unified directives. Along with the integration of electronic architecture, there is also software layer decoupling, similar to a government organization with central, provincial, and county-level structures, where changes at one level do not affect others, allowing for layered iteration. At the same time, the vehicle’s communication architecture is also being upgraded, akin to constructing a nationwide highway network. Tesla initiated a comprehensive transformation of electronic and electrical architecture with the Model 3, and other automakers are also in a period of rapid architectural iteration. Overall, domestic brands are iterating faster, developing multiple generations of architectures simultaneously, a process accompanied by high R&D investment, expansion of software talent, organizational changes, and the reshaping of manufacturer-supplier relationships. Automakers are transitioning from hardware integrators to software integrators + hardware integrators, extracting software from the previously “black box” of suppliers and integrating it into themselves. This process is new and tortuous, and through several iterations, the shift of electronic and electrical architecture towards centralized computing is an inevitable trend. In the future, software ownership will return to OEMs, and the profit pool for automakers will be significantly widened.

01

Centralized Electronic and Electrical Architecture

Automotive electronic and electrical architecture (EEA) integrates various sensors, ECUs (Electronic Control Units), wiring topology, and electronic and electrical distribution systems in vehicles to complete calculations, power distribution, and energy allocation, thereby enabling all functions of the vehicle.

If we compare a car to a human body, the mechanical structure of the car is equivalent to the human skeleton, the power and steering correspond to the limbs, while the electronic and electrical architecture is akin to the nervous system and brain of a human, being the key to the vehicle’s information interaction and complex operations. The electronic and electrical architecture encompasses the hardware and software of the vehicle’s computing and control systems, sensors, communication networks, and electrical distribution systems; it orderly combines various subsystems through specific logic and standards, forming an organic whole that achieves complex functions. In the era of functional vehicles, once a car is manufactured, the user experience is basically fixed; in the era of intelligent vehicles, cars are frequently updated and personalized, making the transition to centralized electronic and electrical architecture a prerequisite for this transformation. With the development of chip and communication technologies, electronic and electrical architectures are undergoing significant changes from distributed to domain control and then to centralized systems.

1.1 Distributed Electronic and Electrical Architecture Overburdened

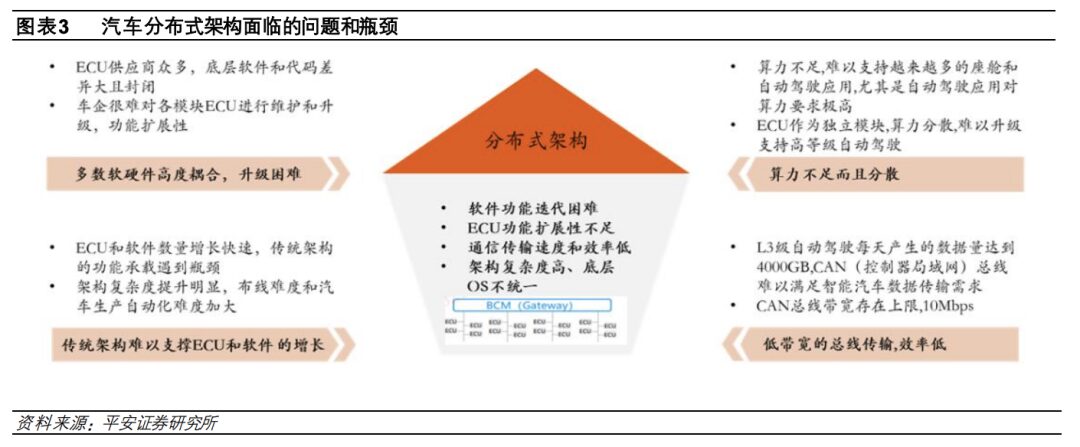

At the inception of the automobile, it was purely mechanical, with no batteries or electrical devices requiring power. The development of the lead-acid battery by Bosch in 1927 provided reliable power for electronic devices in vehicles. The advancement of large-scale integrated circuits has allowed automotive electronics to develop rapidly, with systems like engine ignition control, electronic fuel injection, automatic transmission control, traction control, electronic suspension, electronic seats, electronic windows, dashboards, electronic stability control, and more, gradually becoming indispensable components of vehicles. Automotive electronic control technology has progressively grown, providing consumers with higher performance, more comfort, and safer transportation tools.

Under the early distributed electronic and electrical architecture, each ECU typically only controlled a single functional unit, operating independently, controlling components like the engine, brakes, and doors. Common examples include engine control modules (ECM), transmission control modules (TCM), brake control modules (BCM), and battery management systems (BMS). Each ECU is connected via CAN (Controller Area Network) or LIN (Local Interconnect Network) buses, exchanging information through pre-defined communication protocols. As the application of electronic and electrical products in vehicles has increased, the number of ECUs has rapidly grown from dozens to over 100. The more ECUs there are, the longer the corresponding bus wiring must be, which also increases the weight of the wiring (for instance, the bus length of the 2007 Audi Q7 and Porsche Cayenne exceeds 6 km, with a total weight over 70 kg, making it the second heaviest component in the vehicle after the engine), leading to increased overall vehicle costs and lower levels of automation in vehicle assembly.

Distributed computing has led to information islands within the vehicle, wasted computing power, and deep coupling of hardware and software, with OEMs heavily reliant on suppliers.

In the traditional automotive supply chain, different ECUs come from different suppliers, with various hardware having different embedded software and underlying code. The overall vehicle software is essentially a mix of many independent and incompatible software systems, resulting in a lack of compatibility and scalability across the entire system. Any functional changes made by the vehicle manufacturer require negotiations with many different suppliers to coordinate hardware and software development issues. Every new feature requires adding a new set of ECUs and communication systems, which is time-consuming and cumbersome. Additionally, since each ECU is bound to a specific function, complex functions spanning multiple ECUs/sensors cannot be achieved, nor can the vehicle software be continuously updated via OTA (Over-the-Air).

The distributed electronic and electrical architecture leads to communication bandwidth bottlenecks.

As the functions of intelligent connected vehicles become increasingly complex, the number of sensors in vehicles increases, resulting in higher real-time requirements for data transmission and processing. The volume of communication data within the vehicle’s internal network is growing exponentially, and traditional FlexRay, LIN, and CAN low-speed buses can no longer provide high-bandwidth communication capabilities, nor can they meet the real-time requirements for data transmission and processing.

Let’s illustrate the drawbacks of the distributed electronic and electrical architecture with a specific example:

Suppose an automaker needs to modify the functionality of a wiper assembly. Due to predetermined nodes in the development process of each vehicle, the wiper assembly must be defined, calibrated, and validated. Subsequent modifications would be akin to secondary development, requiring the automaker to renegotiate contracts with the wiper supplier and redo calibration and validation at various levels. Clearly, this hardware-oriented engineering system and process cannot support the rapid iterative evolution of products in the increasingly complex future of vehicles.

The solution is to standardize hardware. The wiper assembly is a motor-driven mechanical component, and the sensors required for the wiper can utilize the cameras or other sensors equipped on the vehicle. Once the transparency of the windshield decreases, the vehicle can automatically start the appropriate working mode for the wiper through software control, achieving the goal of defining the wiper function through software. When various different assemblies and modules are standardized, higher levels of intelligence can be achieved through the software in the central controller, similar to how multiple apps run on a smartphone, significantly shortening the product development cycle and allowing for the widespread use of standardized components, helping companies control costs and quality. For instance, a parts company could develop and produce a standardized wiper, selling it cheaply to various automakers; simultaneously, the calibration and validation of standardized hardware could be simplified, further saving development time and costs.

1.2 Automotive Electronic and Electrical Architecture Moving Towards Centralized Computing

The distributed electronic and electrical architecture of vehicles can no longer adapt to the further evolution of automotive intelligence. High integration is the solution. By building the “brain” of the vehicle based on a small number of high-performance processors, a new type of electronic and electrical architecture is formed, creating a “nervous network” and “blood vessels” for rapid information transmission to control and drive all electronic components and sensors.

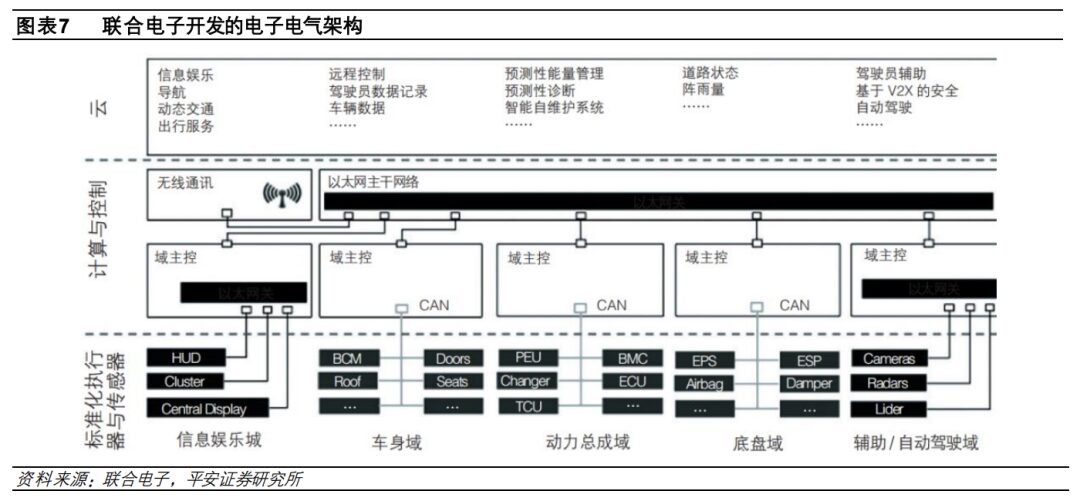

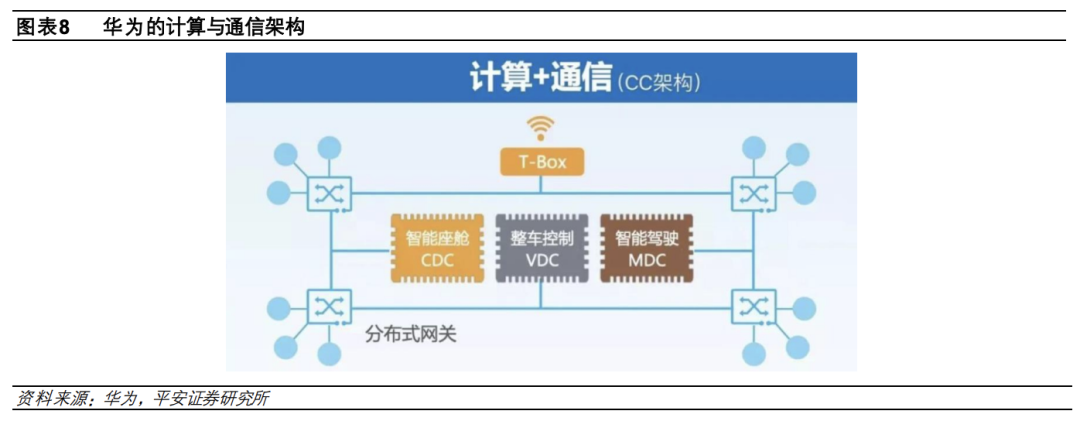

A small number of high-performance computing units replace the previously large number of distributed MCUs (Microcontroller Units), and multiple dispersed small sensors are integrated into a single more powerful sensor. The integration of functions in vehicles gradually centralizes, and the reduction of ECUs means that the dozens or hundreds of ECUs originally equipped in the vehicle are progressively stripped of their hardware and software, with functionalities mainly migrated to domain controllers (which refers to the entire system composed of domain master control hardware, operating systems, algorithms, and application software) such as autonomous driving, entertainment, and gateways. On the basis of the domain controller architecture, further integration of different functional domains leads to the cross-domain integration stage, and further to the centralized computing + location domain stage. Huawei predicts that by 2030, the electronic and electrical architecture will evolve into a computing and communication architecture of centralized computing platforms + regional access + high-bandwidth in-vehicle communication.

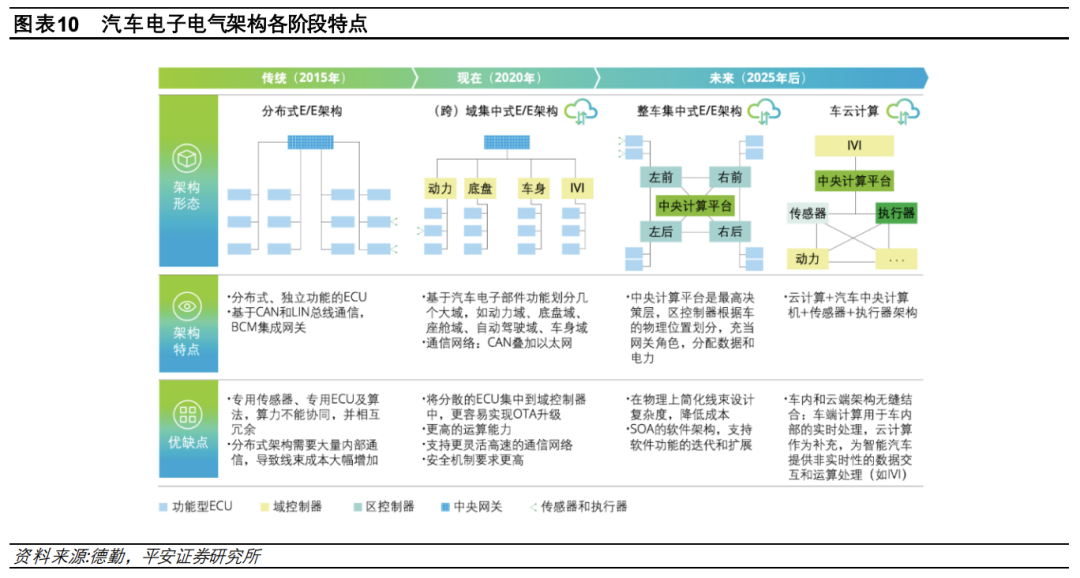

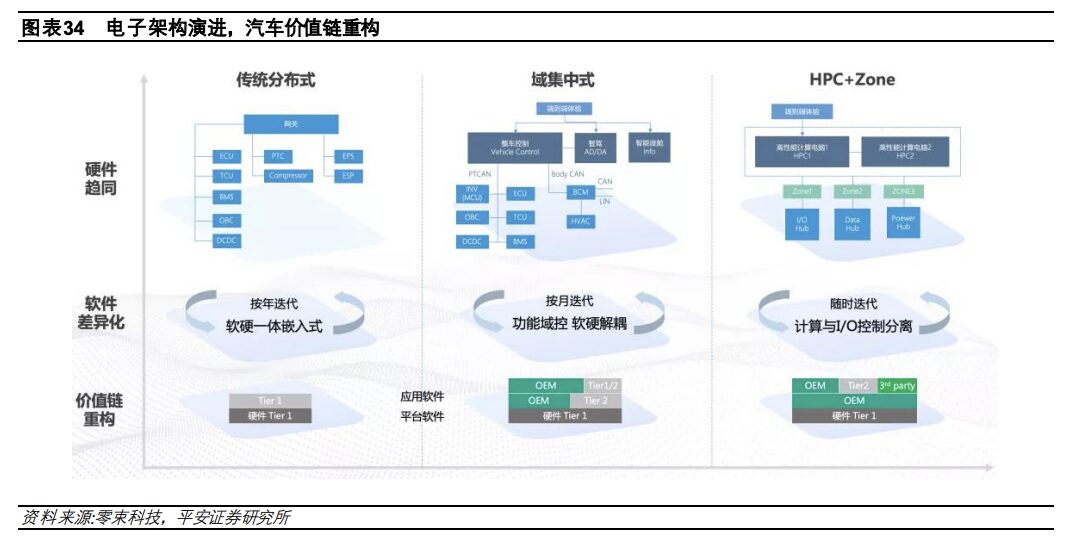

The upgrade of automotive electronic and electrical architecture mainly reflects in three aspects: hardware architecture is developing from distributed to domain control/centralized direction; software architecture is evolving from high coupling of hardware and software to layered decoupling; and communication architecture is transitioning from LIN/CAN buses to Ethernet.

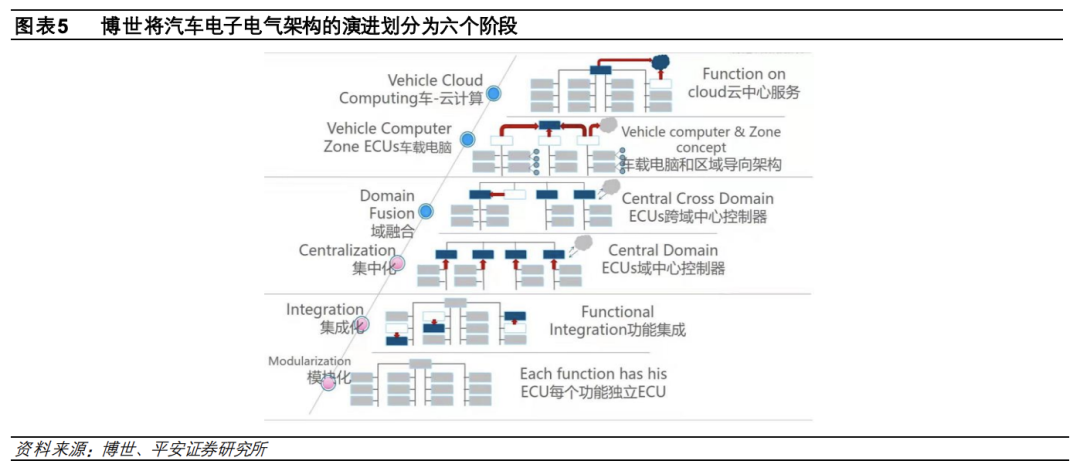

Bosch’s roadmap for electronic and electrical architecture is divided into six stages, which has become an industry consensus: distributed stage (including modularization and integration) – domain centralized (including centralization and domain fusion), centralized (including onboard computers and vehicle-cloud computing).

Modular stage. 1) One ECU is responsible for a specific function, such as a controller for the lights, a controller for the doors, and a controller for the keyless system. As the number of functions in vehicles increases, this architecture becomes increasingly complex and unsustainable. 2) Integration stage, where a single ECU is responsible for multiple functions, reducing the number of ECUs compared to the previous stage. In these two stages, the automotive electronic and electrical architecture remains in the distributed stage, with low integration of ECU functions.

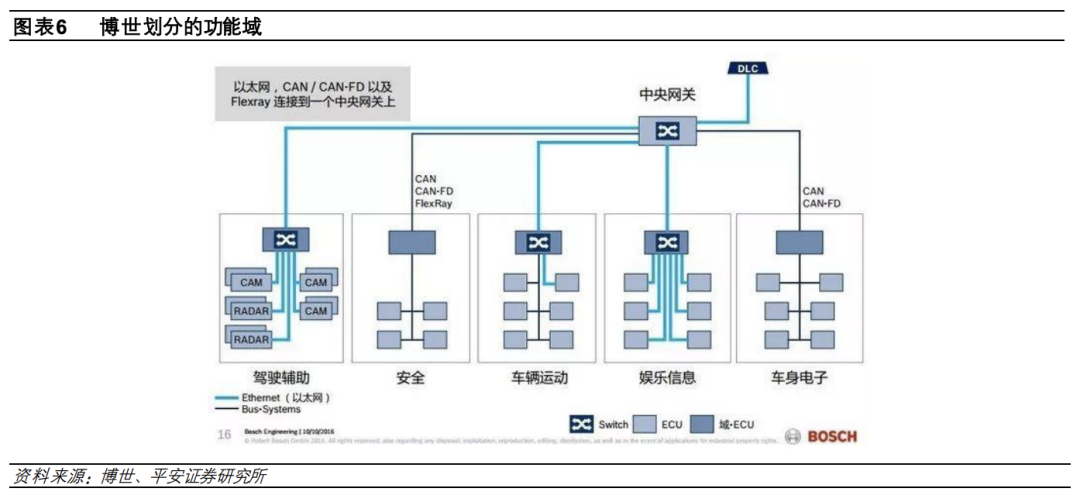

Functional domain control stage. Functional domains are domain controllers divided by function, the most common being the five functional domains defined by Bosch (power domain, chassis domain, body domain, cabin domain, autonomous driving domain). Domain controllers are connected via Ethernet and CANFD (CAN with Flexible Data-Rate), where the cabin domain and autonomous driving domain have gradually increased computational demands due to handling large amounts of data. The powertrain domain, chassis domain, and body domain mainly involve control instruction calculations and communication resources, with lower computational requirements.

Cross-domain fusion stage. Based on functional domains, cross-domain fusion has emerged to further reduce costs and enhance collaboration, merging multiple domains into one controlled by a cross-domain control unit. For example, merging the power, chassis, and body domains into an overall vehicle control domain, transitioning from five functional domains (autonomous driving, power, chassis, cabin, body) to three functional domains (autonomous driving, intelligent cabin, vehicle control).

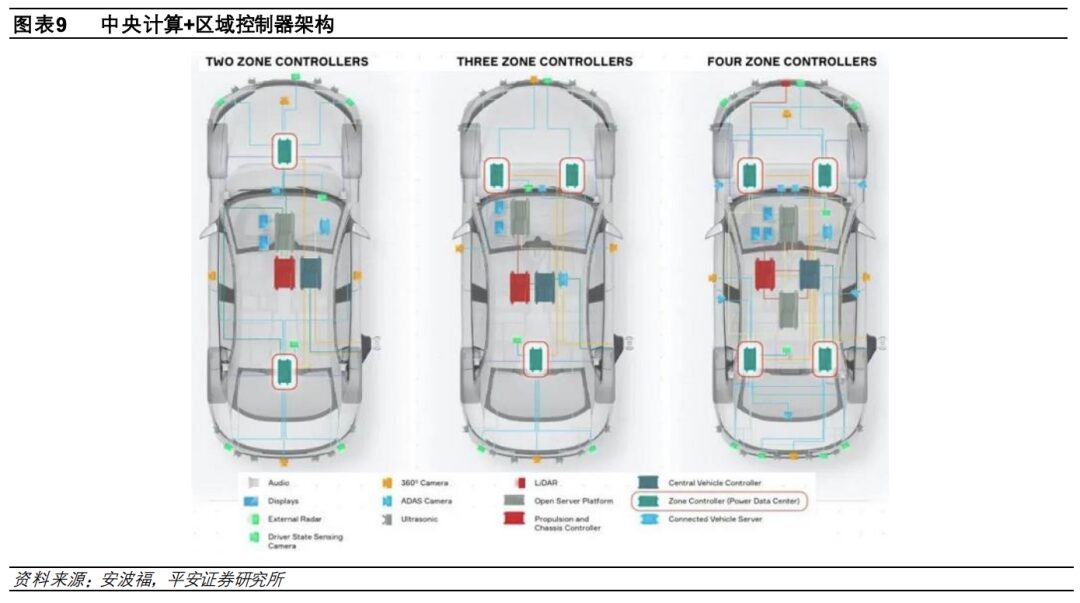

Centralized computing + location domain stage. With the deep integration of functional domains, functional domains gradually upgrade into more generic computing platforms, transitioning from functional domains to location domains (such as central, left, right). The zonal control unit (ZCU) is a perception, data processing, control, and execution unit for a specific area within the vehicle’s computing system. It connects sensors, actuators, and ECUs within a specific area of the vehicle and is responsible for the preliminary calculation and processing of sensor data within that location domain, as well as protocol conversion within that area. The location domain enables nearby wiring, reducing costs and communication interfaces, making it easier to achieve automated assembly of wiring harnesses, thus improving efficiency. Sensors, actuators, etc. are connected to nearby zonal controllers, allowing for better hardware expansion and easier structural management of zonal controllers. The regional access + centralized computing ensure the stability of the overall vehicle architecture and the extensibility of functions, allowing new external components to connect through regional gateways, and the pluggable hardware design supports continuous improvements in computing power, with sufficient computing power supporting the iterative upgrade of application software on the centralized computing platform.

In a study on a certain vehicle manufacturer, Aptiv found that using zonal controllers can integrate nine ECUs and reduce the use of hundreds of individual wires, thereby reducing the vehicle’s weight by 8.5 kg. Weight reduction helps save energy and extend the range of electric vehicles. Furthermore, because zonal controllers divide the vehicle’s basic electrical structure into more manageable components, it is easier to achieve automated wiring assembly.

Automotive cloud computing stage. Some functions of the vehicle are transferred to the cloud, further simplifying the in-vehicle architecture. Various sensors and actuators in the vehicle can be software-defined and controlled, and the vehicle’s components gradually become standardized parts, completely achieving software-defined automotive functions.

The evolution of automotive electronic and electrical architecture provides strong support for hardware-software decoupling, while highly centralized electronic and electrical architecture brings about centralized computing, hardware-software decoupling, platform standardization, and function customization. 1) Computing power tends to be centralized, with numerous ECUs concentrated into a few powerful computing platforms, providing the computing power foundation for software operation; 2) The underlying software and code begin to be interconnected, establishing a software ecosystem centered around the operating system, allowing for continuous iteration of software, accelerating the development of OTA; 3) Domain controllers + time-sensitive Ethernet can achieve high-speed processing and transmission of data, creating conditions for the development of software applications.

02

Comparison of Electronic and Electrical Architecture Progress Among Major OEMs

The core technology of future automotive products is electronic and electrical architecture, which is gradually evolving from decentralized, embedded systems to centralized, integrated systems. The ultimate ideal state should form a centralized brain for the vehicle (one brain), uniformly managing various functions. The electronic and electrical architecture is similar to a “central government,” which can coordinate the various functions of the vehicle, avoiding “feudal fragmentation and inconsistent directives.” At the beginning, this “central government” may have less control, with “local lords” still retaining some control, but eventually, the “central government” will certainly take on more authority, and local administrative bodies will only receive directives from the “central government” and execute them efficiently to ensure optimal overall vehicle performance.

Because in the past, the controllers on vehicles were independent of each other, and software was embedded, the final hardware integration of the entire vehicle was sufficient. In the future, as the burden of ECUs decreases, the originally highly dispersed functions will be integrated into domain controllers. OEMs must master the central control system themselves, or they will lose control over automotive products. Gradually integrating the originally highly dispersed control functions into a unified system is a new compulsory course for traditional automakers, so their mastery of electronic and electrical architecture is a step-by-step, progressive process.

Tesla’s Model 3 initiated a major transformation of electronic and electrical architecture, presenting a prototype of centralized computing + location domain, reducing the overall vehicle wiring by 50%, with future goals to reduce overall vehicle wiring to 100 meters. In terms of electronic architecture, Tesla is over 6 years ahead of traditional automakers. Aside from Tesla, most automakers’ electronic and electrical architectures are still in the early functional domain controller stage, where some functions are centralized into domain controllers while retaining many distributed modules, a transitional scheme of “distributed ECUs + domain controllers” to avoid excessive risks and costs due to the magnitude of the transformation.

Most companies plan to mass-produce the next generation of cross-domain integrated electronic and electrical architectures in 2022, achieving high centralization of software within domain controllers and gradually reducing distributed ECUs. By 2025, some automakers will implement centralized computing + regional controller electronic and electrical architectures, further integrating hardware and software, with software ownership gradually returning to OEMs. The process of evolving towards “centralized computing + regional control” may take 5 to 10 years.

2.1 Audi A8’s Initial Experiment

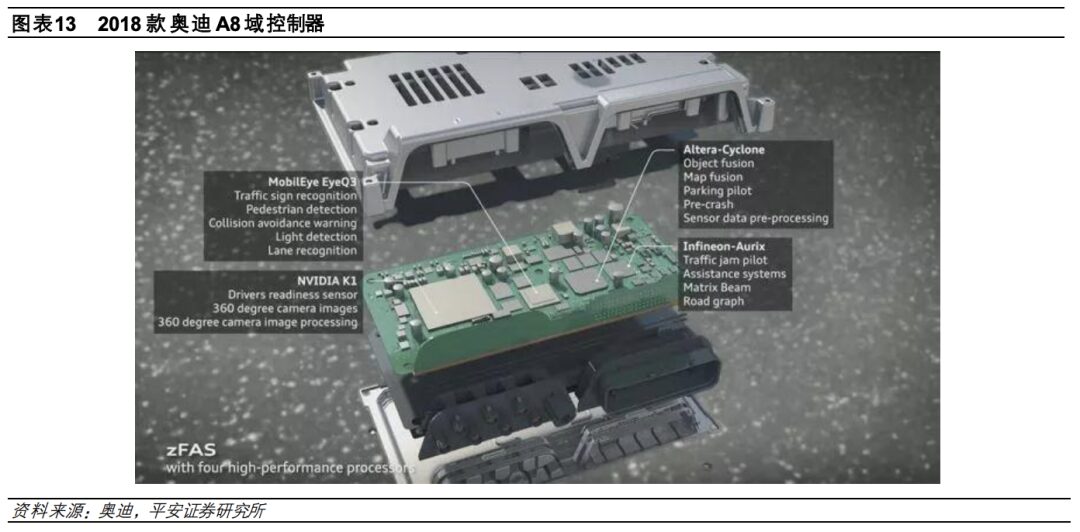

The Audi A8, launched in 2018, was the first to achieve integrated control of assisted driving functions, replacing the distributed assisted driving system with separated ECUs. Aside from the integration of the autonomous driving domain, the other four domains—chassis + safety, power, body, and entertainment—still adopt a distributed architecture.

The autonomous driving domain controller consists of four chips, with Mobileye EyeQ3 responsible for visual perception calculations, such as traffic signal recognition, pedestrian monitoring, collision alarms, lane line recognition, and light detection. NVIDIA K1 is responsible for image fusion calculations, such as driver monitoring and processing images from 360-degree cameras. Intel Cyclone V handles target fusion, map fusion, parking assistance, and pre-brake light functions. Infineon’s Aurix TC297 is responsible for communication processing. The software development for this autonomous driving domain controller was completed by the Austrian software company TTTech, while Delphi provided hardware integration.

2.2 Tesla Model 3 Initiates Comprehensive Changes in Electronic and Electrical Architecture

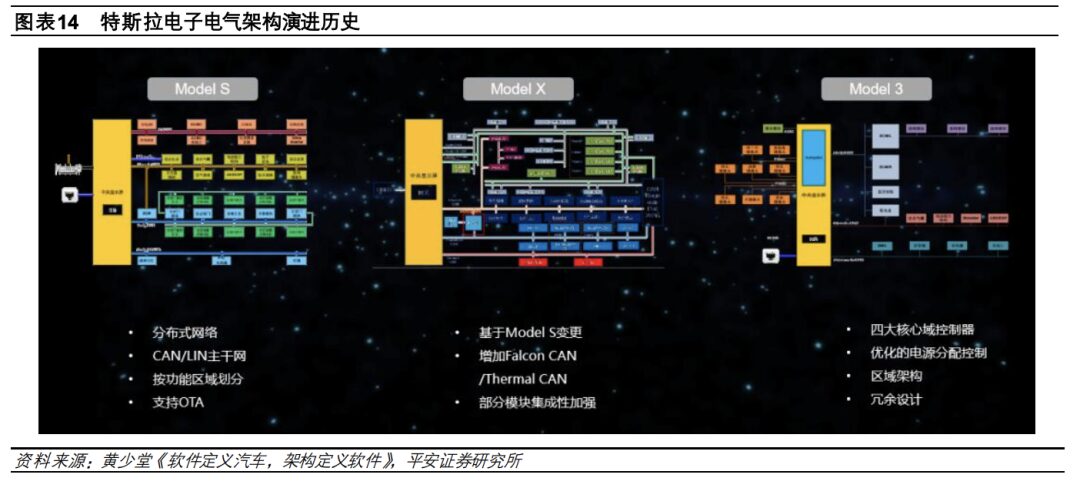

Tesla is a comprehensive transformer of automotive electronic and electrical architecture. The Model S, launched in 2012, had a clear division of functional domains, including power domain, chassis domain, and body domain, with the ADAS module spanning the power and chassis domains. As traditional domain architectures could not meet the development of autonomous driving technology and the needs of software-defined vehicles, it was necessary to decouple hardware and software, and to equip it with a more powerful master control chip. Therefore, the Model 3, launched in 2017, broke through the framework of functional domains, realizing a centralized computing + regional controller framework. By establishing a cross-domain integration architecture + a self-developed software platform, it not only achieved software-defined vehicles but also effectively reduced overall vehicle costs and improved efficiency: 1) The Model 3 has three controllers, effectively lowering material costs; 2) Hardware is integrated into software, providing a foundation for deep control and maintenance of the vehicle; 3) The self-developed software platform supports modular expansion and reuse.

The Model 3 essentially realized the prototype of a centralized architecture, but it is still quite a distance from a truly centralized architecture: the communication architecture is primarily based on CAN bus, and the centralized computing module merely integrates the multimedia MCU, autonomous driving FSD, and vehicle-to-vehicle communication modules onto one board, with each module running its own operating system independently. Nevertheless, the Model 3 has already implemented the concept framework of centralized computing + regional control in electronic and electrical architecture, leading traditional automakers by about six years.

The evolution of Tesla’s electronic and electrical architecture across three generations of vehicles is fundamentally about reclaiming vehicle functions from suppliers for self-development. The autonomous driving module, entertainment control module, other regional controllers, and thermal management of the Model 3 are all self-designed and developed, achieving autonomy over the main modules of the vehicle without relying on Tier 1 suppliers. Even for modules that have not achieved autonomy, Tesla has engaged in joint development with suppliers, such as incorporating its software into the ibooster provided by Bosch, thereby shortening braking distances through software updates.

Through the evolution of three models, Tesla’s new electronic and electrical architecture not only significantly reduces the number of ECUs and wiring harnesses (the wiring harness of the Model S is 3000 meters, while the Model 3 reduces it by more than half) but also breaks the traditional automotive component supply system (where hardware and software are deeply coupled and sold to OEMs, leaving them with little bargaining power and difficulty in subsequent functional adjustments), truly realizing software-defined vehicles. Tesla’s OTA can change braking distances, enable seat heating, and provide personalized user experiences. By breaking through functional domains, Tesla’s domain controllers span the body, cabin, chassis, and power domains, allowing for more flexible iteration of vehicle functions. Users can experience vehicles that are frequently updated, contrasting sharply with most traditional automakers whose OTA capabilities are limited to infotainment functions.

To better leverage the role of software, Tesla has independently developed its core intelligent hardware, the autonomous driving master control chip (Tesla believes that specialized chip design allows its software to run more efficiently). This means that future upgrades and functional deployments of Tesla vehicles will no longer depend on external SOC chip suppliers, truly putting the soul of the vehicle in its own hands.

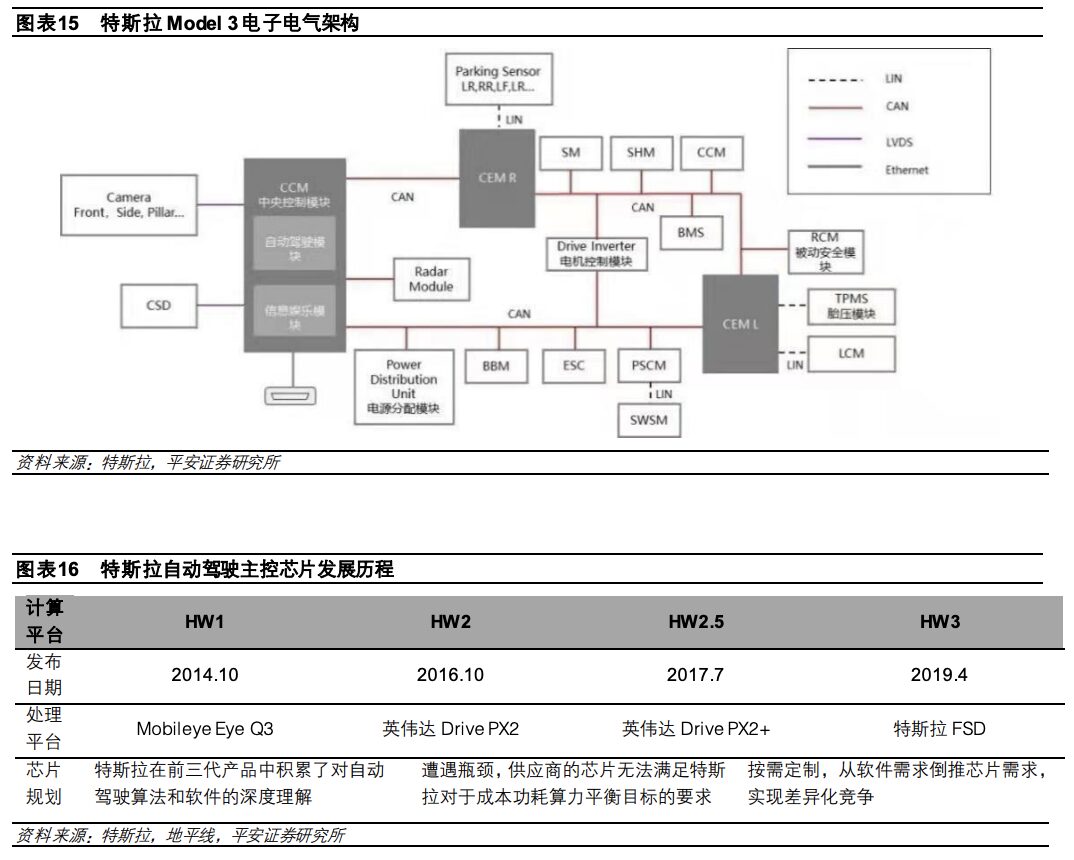

The Model 3 features four controllers including the Central Computing Module (CCM), left body control module (BCM LH), right body control module (BCM RH), and front body control module (BCM FH).

The left body control module is responsible for controlling left body convenience functions as well as steering, braking, and assistance. The right body control module is responsible for controlling right body convenience functions, chassis safety systems, power systems, thermal management, etc. The central computing module includes the autonomous driving module, infotainment module, and vehicle-to-vehicle communication connections, sharing a liquid cooling system. The autonomous driving and entertainment control modules manage sensors related to assisted driving—cameras and millimeter-wave radars—placing the computationally intensive intelligent driving and infotainment together, facilitating continuous upgrades of intelligent hardware. In 2019, Tesla launched its self-developed FSD chip, replacing the NVIDIA Drive PX2 chip set, achieving a 21-fold increase in AI computing performance. As Tesla has realized self-development of the most critical computing hardware for autonomous driving, it has significantly enhanced its competitive advantage over rivals. The operating system is customized based on open-source Linux, and middleware is self-developed, achieving autonomy and control over both software and hardware, accelerating the speed of model function iteration and reducing overall vehicle development costs.

2.3 Volkswagen ID Series Electronic and Electrical Architecture

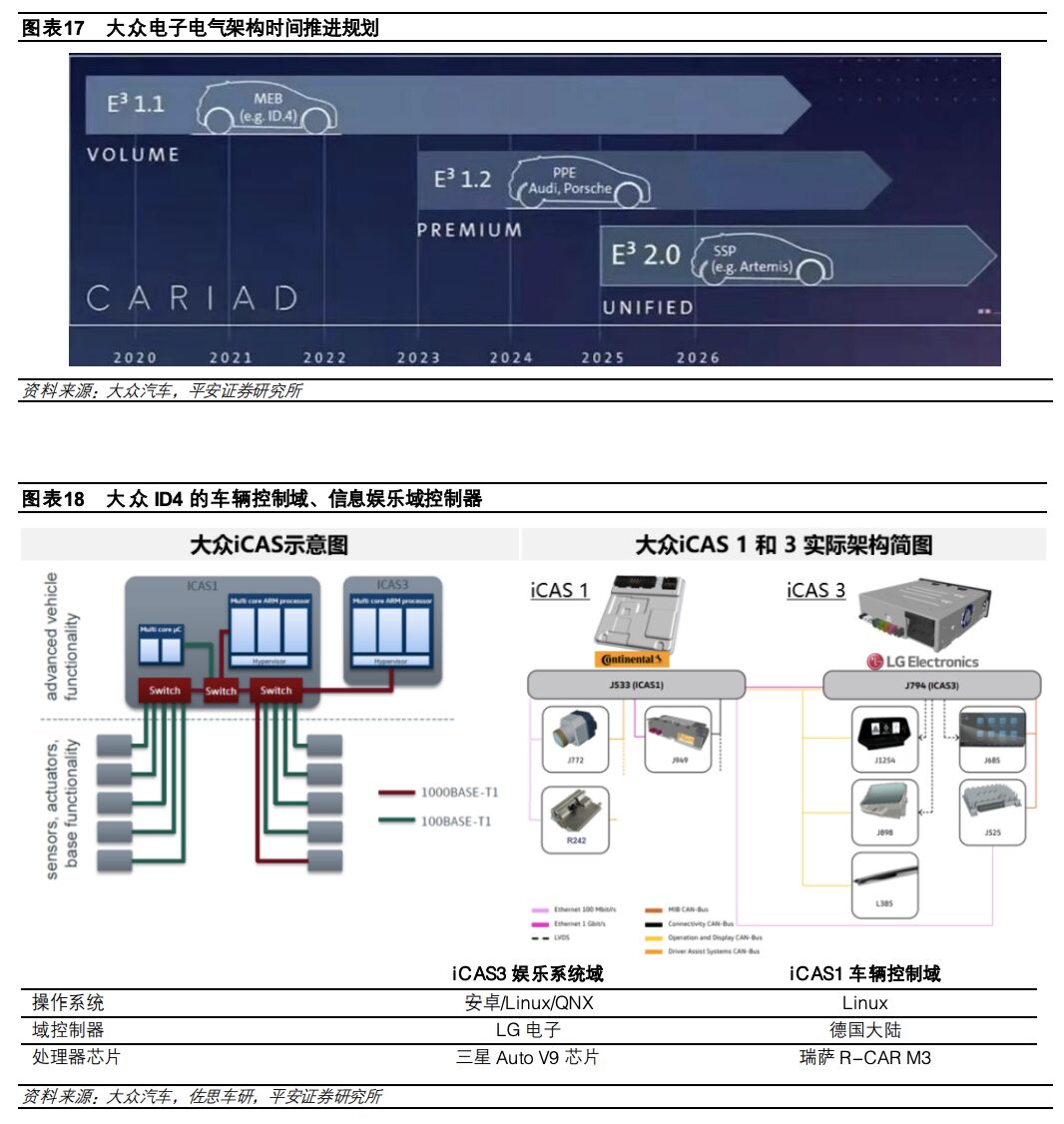

Volkswagen has upgraded from the distributed electronic and electrical architecture of MQB platform vehicles to the three functional domain electronic and electrical architecture used in the MEB platform ID series vehicles. According to plans, the ID series electronic and electrical architecture based on Volkswagen’s MEB platform is E³ version 1.1, with E³ version 1.2 set to launch on the PPE platform in 2023, and the evolution to E³ version 2.0 expected after 2025.

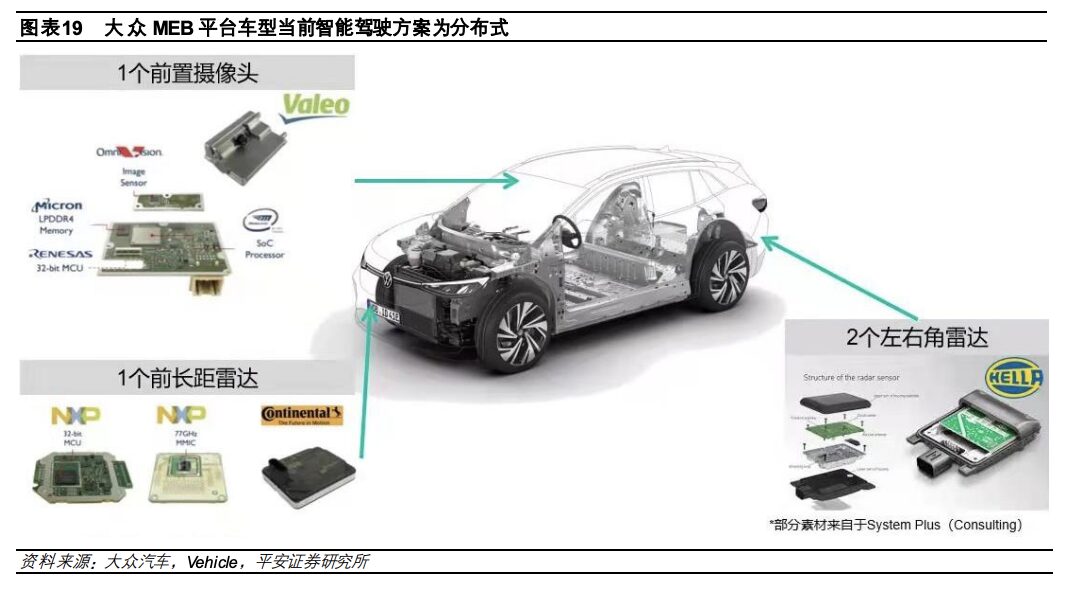

Volkswagen’s E3 architecture mainly consists of vehicle control domain (ICAS1), intelligent driving domain (ICAS2), and intelligent cabin domain (ICAS3), with the intelligent driving domain ICAS2 still under development, and the mass-produced models still adopting the distributed architecture scheme. Although the electronic and electrical architecture of the Volkswagen ID series claims to replace over 70 distributed ECUs with three domain controllers, it still retains a significant number of distributed modules. The domestic ID4’s assisted driving function is realized through a Mobileye monocular camera + front long-range radar + two rear corner radars, and as an affordable electric vehicle, it has not yet chosen to compete with Tesla and new players in the autonomous driving domain controller area.

The Volkswagen ID series vehicles completed a delivery volume of 70,000 units in 2021, lower than the earlier plan. As the most important single market for Volkswagen, intelligentization is also accelerating. In 2022, Volkswagen’s software company CARIAD established a subsidiary in China, with its CEO stating that the core business focuses on software R&D for the MEB platform, launching OTA functions in the second half of 2022, and also developing localized, digital products for high-end platforms (the first vehicle on the PPE platform is set to be produced in 2024), including advanced driver assistance systems, and integrating its intelligent networking system with China’s infrastructure development. Thirdly, it will conduct software R&D around the SSP platform after 2025. According to Volkswagen’s 2030 NEW AUTO plan, the proportion of self-developed software is expected to rise to 60%, and the benefits of maintaining autonomous software development include agility (including development and maintenance) and differentiation in products, with localization being a necessary and key aspect for foreign investment in China to enhance intelligentization, ultimately aiming to create competitive products that attract Chinese users.

Let’s compare the electronic and electrical architectures of three electric vehicles launched around the same time. Although the Volkswagen ID series claims to replace over 70 distributed ECUs with three domain controllers, it still retains a significant number of ECUs. The ID3 was delayed in delivery due to widespread software bugs, reflecting that even if traditional automakers choose to undergo major transformations in electronic and electrical architecture, if their talent structure and software capabilities are insufficient, they will still heavily rely on external suppliers, leading to additional risks due to overly ambitious steps. Therefore, most OEMs choose a gradual approach, gradually reclaiming software leadership as their software capabilities improve.

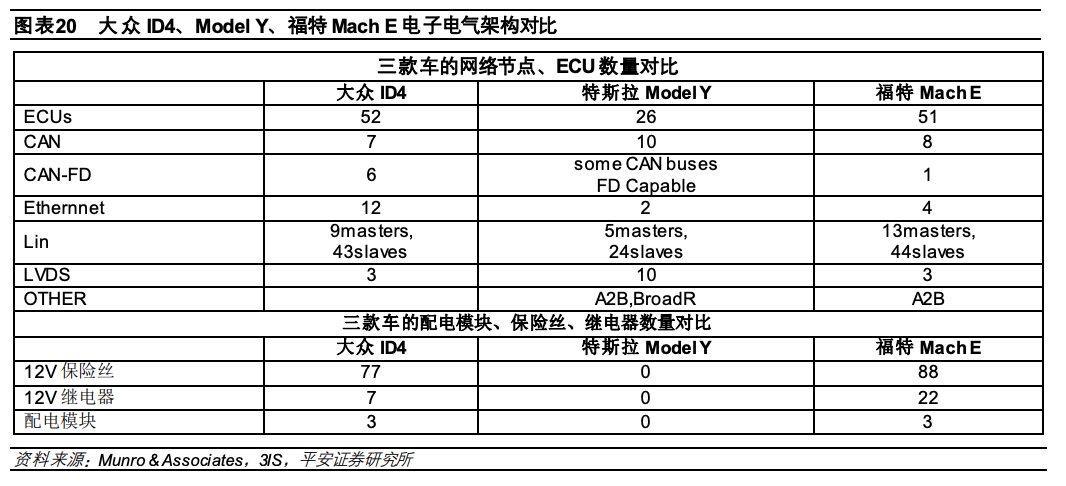

In 2021, Munro & Associates engineering company compared the differences in electronic architecture between Tesla Model Y, Ford Mach-E, and Volkswagen ID.4. The comparison involved the number of ECUs in the three electric vehicles, the number of CAN buses, the use of Ethernet, LIN buses, the use of LVDS (Low-Voltage Differential Signaling), audio, fuses, and relays. The integration level of Tesla Model Y is significantly higher, with its number of ECUs being half that of ID4, while Ford and Volkswagen retain a larger number of existing distributed ECUs. The number of LIN (Local Interconnect Network) in Tesla is also only half that of Volkswagen ID4 and Ford Mach-E. The number of CAN (Controller Area Network) buses is higher in Tesla, and due to the increased number of cameras, Tesla’s usage of low-voltage differential signaling (LVDS) is more than three times that of Ford and Volkswagen, while Volkswagen’s use of Ethernet is more prevalent. Since the Model 3, Tesla has not used any fuse boxes or relays in the low-voltage electrical parts of its vehicles.

2.4 Xpeng Motors G9 Electronic and Electrical Architecture is Leading

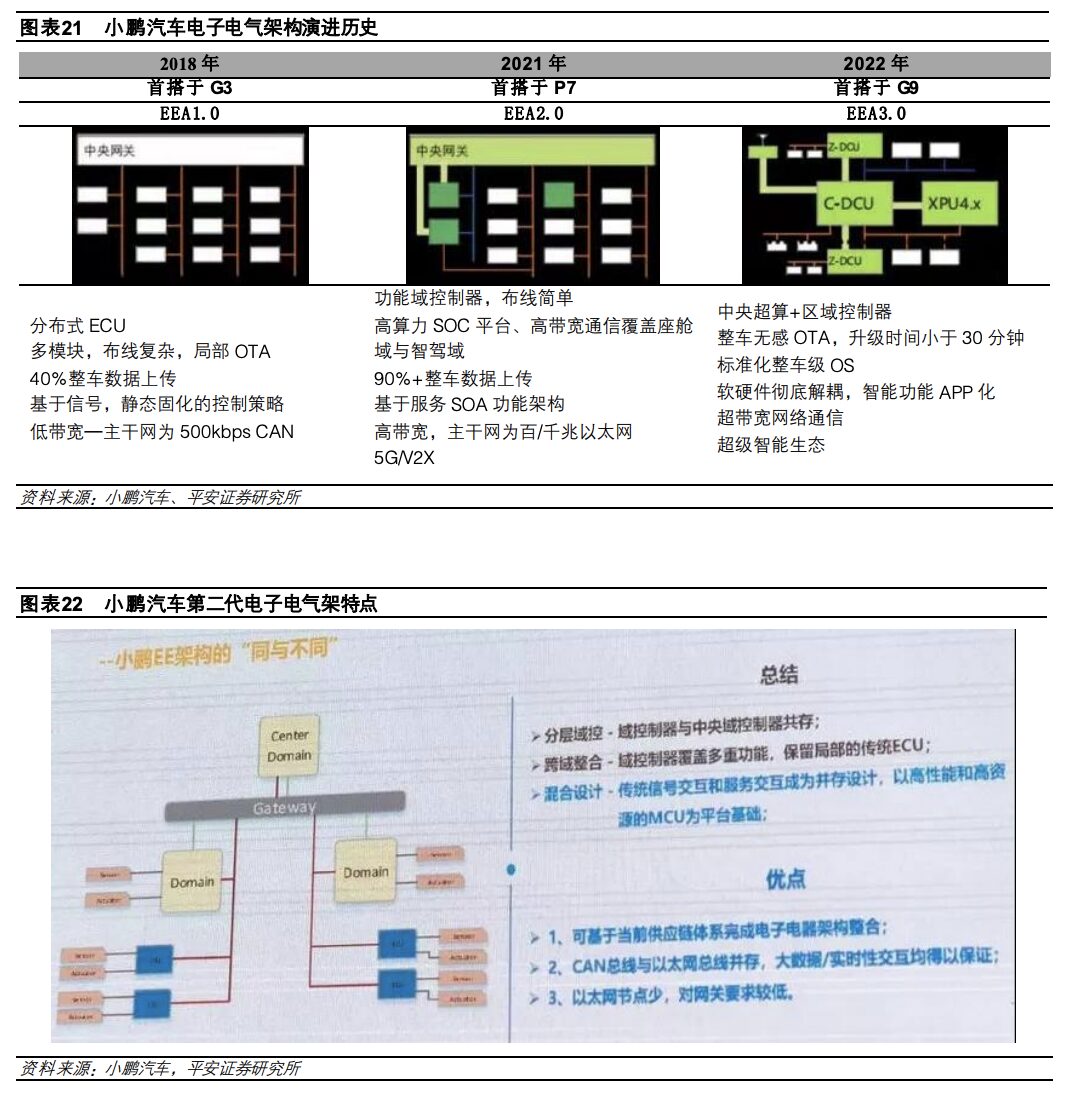

Among the three new forces, Xpeng Motors has taken a leading position in electronic and electrical architecture. With the iteration of models from G3, P7, and P5 to G9, this set of X-EEA3.0 electronic and electrical architecture has already entered the stage of centralized electronic and electrical architecture. With the leading generation architecture, equipped with higher computing power SOC chips and higher computing power utilization rates, the Xpeng G9 may become the first mass-produced vehicle to support the XPILOT 4.0 intelligent driving assistance system.

The Xpeng P7 is equipped with Xpeng’s second-generation electronic and electrical architecture, featuring a hybrid design:

1) Layered domain control. Functional domain controllers (intelligent driving domain controller, body domain controller, power domain controller, etc.) coexist with the central domain controller;

2) Cross-domain integration—domain controllers cover multiple functions while retaining some traditional ECUs;

3) Hybrid design—traditional signal interaction and service interaction coexist.

Thus, CAN buses and Ethernet buses coexist, ensuring big data/real-time interaction; the number of Ethernet nodes is low, and the requirements for gateways are minimal.

The second-generation electronic and electrical architecture of Xpeng reduces the number of traditional ECUs by approximately 60%, achieving high integration of hardware resources. Most body functions have migrated to domain controllers, and the central processor can support most functions related to instrumentation, infotainment systems, and intelligent body control, while also integrating a central gateway that is compatible with V2X protocols, supporting communication within the vehicle’s local area network, and facilitating cloud connectivity and connections to remote digital terminals. Xpeng’s intelligent driving domain controller integrates high-speed NGP, urban GNP, and parking functionalities. Xpeng’s assisted driving uses a lidar-vision fusion solution, differing from Tesla’s pure vision solution, leading to different hardware architectures and varying requirements for communication bandwidth and computing power.

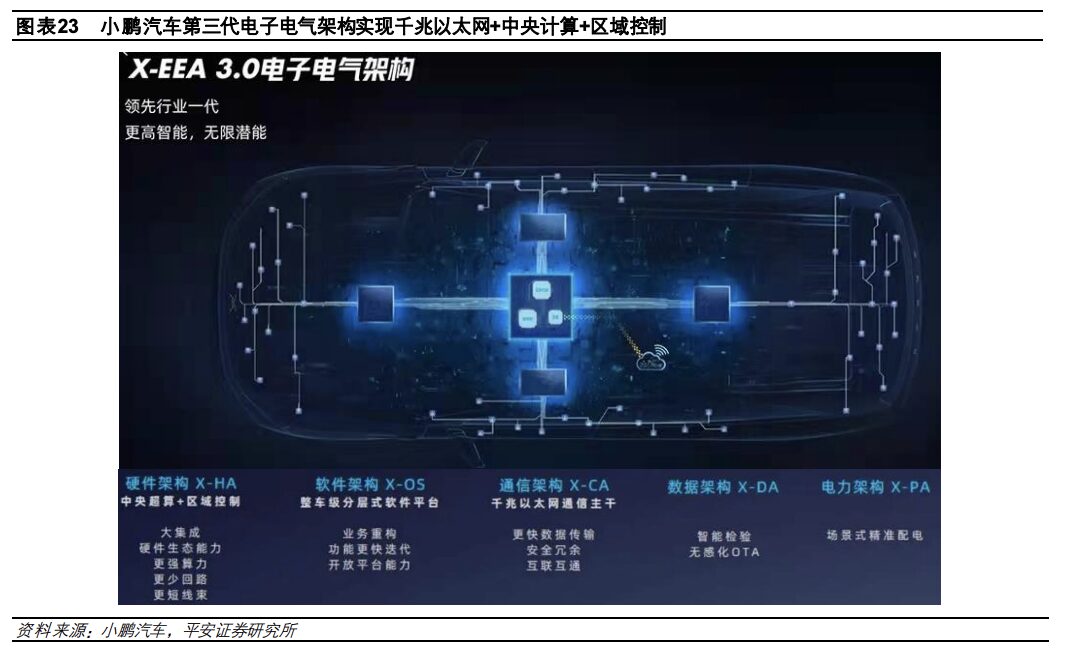

Xpeng Motors refers to its X-EEA3.0 electronic and electrical architecture as the “secret to keeping intelligent vehicles up to date in the future.” According to information disclosed by the company, the electronic and electrical architecture first equipped on the G9 has great potential for upgrades and optimizations in the future.

The X-EEA 3.0 hardware architecture adopts a Central Supercomputer (C-DCU) + Regional Control (Z-DCU) hardware architecture, with the Central Supercomputer containing three domain controllers for vehicle control, intelligent driving, and cabin functions, while the regional controllers manage functions based on proximity, significantly reducing wiring harnesses.

Thanks to Xpeng Motors’ full-stack self-development capabilities, the new architecture achieves deep integration of hardware and software, not only realizing hardware-software decoupling but also software layer decoupling, allowing for layered iteration of system software platforms, foundational software platforms, and intelligent application platforms, separating the vehicle’s underlying software and foundational software from applications related to intelligence, technology, and performance. When developing new functions, only the top layer of application software needs to be researched and iterated, shortening the R&D cycle and technical barriers, allowing users to enjoy rapid iterations of their vehicles.

System Software Platform: Partially customized development based on purchased code, frozen along with the foundational software platform of the entire vehicle, reusable across different models;

Foundational Software Platform: Multiple foundational function software for the entire vehicle form standard service interfaces, frozen before mass production, reusable across different models;

Intelligent Application Platform: Functions such as autonomous driving, intelligent voice control, and intelligent scenarios can be developed and iterated quickly.

The X-EEA 3.0 data architecture sets memory partitions for domain controllers, allowing upgrades to run independently without interference, enabling on-vehicle upgrades that can be completed in 30 minutes.

In terms of communication architecture, X-EEA3.0 has achieved a communication architecture based on gigabit Ethernet for the first time in the country, while supporting multiple communication protocols, allowing for faster data transmission in vehicles. The new generation electronic and electrical architecture equipped on the G9 shows that Xpeng has started early in building backbone networks and moving towards SOA.

The X-EEA 3.0 power architecture can achieve scenario-based precise power distribution, supplying power according to different usage scenarios such as driving and third spaces. For example, when waiting by the roadside, it can supply power only to functions like air conditioning, seat adjustments, and music, while cutting power to other parts, thus achieving energy savings and extending range. Vehicles conduct regular self-diagnosis, proactively identifying issues and guiding maintenance, empowering after-sales service through technology.

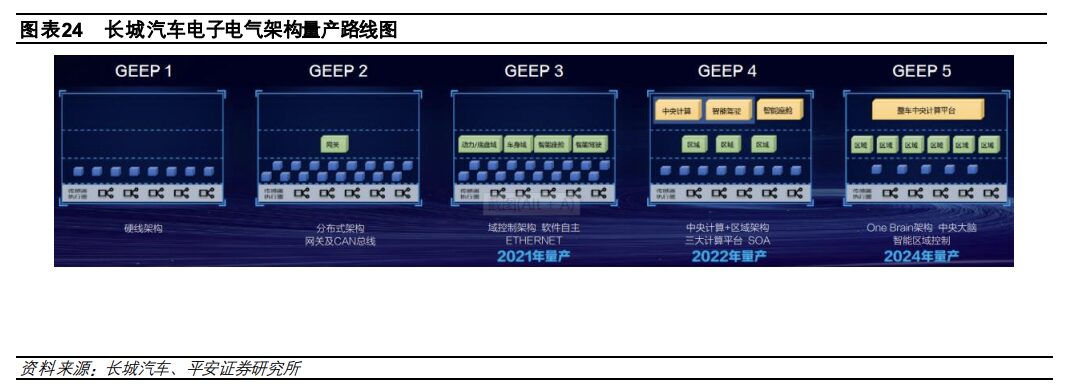

2.5 Great Wall Motors Electronic and Electrical Architecture Development Roadmap

Great Wall Motors developed its third-generation electronic and electrical architecture in 2020, which includes four functional domain controllers—body control, power chassis, intelligent cabin, and intelligent driving. The application software is developed in-house and has been mass-produced and applied to the entire range of Great Wall Motors vehicles, optimizing material costs for models like the new Haval H6, which optimized its wiring harness by 300 meters, totaling 1.6 kilometers, nearly matching that of the Tesla Model 3, reducing weight by over 2 kilograms.

Starting from GEEP3.0, Great Wall Motors has achieved the capability for all application layer software to be developed in-house, with upper application software for the four domain controllers, and even some integration software at the lower levels being developed by Great Wall Motors.

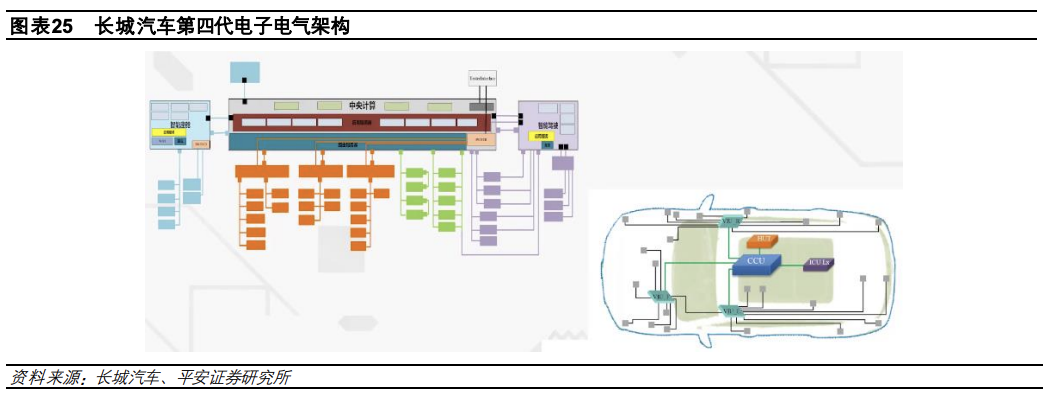

In 2022, the fourth-generation electronic and electrical architecture will further centralize the vehicle control software, achieving efficient integrated management, high safety and reliability, and faster response to demands. The fourth-generation architecture will have three computing platforms: centralized computing, intelligent cabin, and advanced autonomous driving, in addition to three regional controllers (left, right, front). The fourth-generation architecture will first be equipped on Great Wall Motors’ new electric and hybrid platforms and will gradually expand to the entire range of models.

The central computing unit of the fourth-generation electronic and electrical architecture integrates the body, gateway, air conditioning, power/chassis control, and ADAS functions across domains. Its main control chip has a computing power of up to 30KDMIPS, ensuring efficient system control and response. The GEEP 4.0 architecture features mature visual processing chip solutions, 18 CAN FD channels, 4 LIN channels, 11 in-vehicle Ethernet connections, as well as 64GB storage and 1GB memory, preparing for future demands in computing power and communication due to functional integration. The three regional controllers serve as standardized control units, responsible for integrating surrounding MCUs, and most of the software algorithms for the three regional controllers have already been migrated to the central computing unit, developed by Great Wall’s software team.

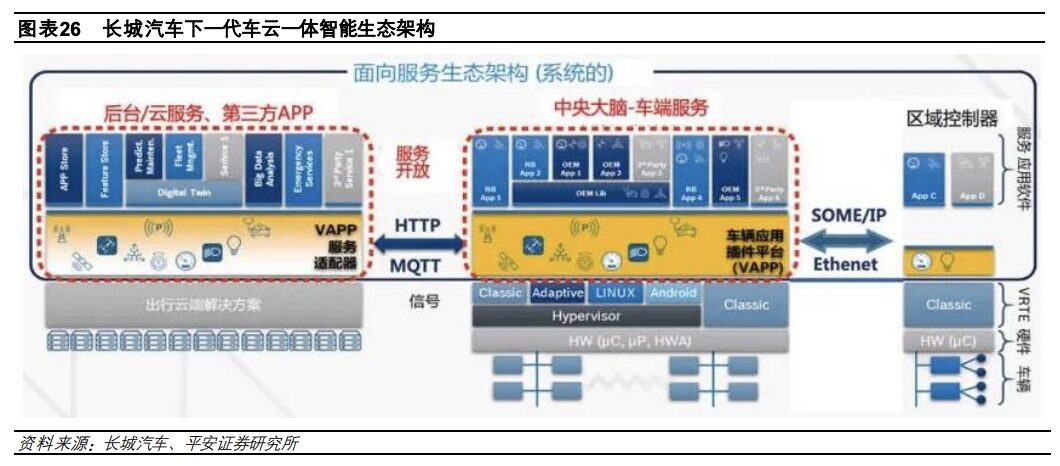

This architecture introduces SOA design concepts and principles, creating a foundational infrastructure platform for software layering, providing modular standard service interfaces. The advantage is that it can offer modular assembly and disassembly, decoupling hardware and software platforms, enhancing software reusability, allowing vehicles to achieve functional iteration and upgrades throughout their lifecycle, enabling users to dynamically subscribe to upgraded vehicle service functions without waiting for software upgrade batches. Additionally, SOA can flexibly deploy intelligent scenarios, with standardized interfaces allowing for open services, building a collaborative ecosystem for Great Wall Motors, working with developers to provide comprehensive smart mobility services for users.

The GEEP 4.0 supports firmware over-the-air upgrades, software over-the-air upgrades, and remote diagnostics; it also supports OTA functions for all ECUs in the vehicle, including power chassis systems, infotainment systems, body systems, and intelligent driving systems. The new architecture’s cloud diagnostic approach brings convenience to after-sales service, enabling remote diagnosis of vehicle fault information based on vehicle-side and cloud-side function deployments, allowing for remote vehicle maintenance. While ensuring the timeliness of diagnosis and maintenance, the diagnostic knowledge base can intelligently identify, analyze, and match the optimal maintenance solutions, effectively addressing the shortcomings of insufficient personnel and technical limitations at 4S stores, truly providing quick solutions for user concerns.

The fifth-generation electronic and electrical architecture of Great Wall Motors is being developed in parallel with the fourth generation, aiming to highly centralize all vehicle software into a single central brain (one brain), scheduled for release in 2024. It will achieve 100% SOA, completing the establishment of a standardized software platform for the entire vehicle. Currently, the central computing modules for Tesla’s vehicles separate the cabin chip and intelligent driving chip, and do not yet employ the one-brain solution. From the trends among the leading global smart chip manufacturers, the integration of intelligent driving chips and cabin chips into one is the trend, but the one-brain solution demands high software capabilities from OEMs.

Great Wall Motors’ rapid iteration of electronic and electrical architecture will provide a “foundation” for the implementation of self-developed intelligent core technologies. The rapid iteration of electronic and electrical architecture is also closely related to the company’s goal of maintaining a leading position in intelligentization.

In terms of intelligentization, Great Wall’s typical winning strategies include: 1) The fully self-developed automatic driving technology from Haomo Zhixing. 2) Line control steering technology set to be commercially applied in 2023.

Regarding the full-stack self-development of autonomous driving solutions, Haomo Zhixing under Great Wall Motors is set to realize urban navigation assistance driving functions by 2022, potentially competing with Xpeng Motors in the pace of urban navigation function deployment. In terms of hardware, HPilot 3.0 boasts powerful computing capabilities of 360 TOPS, with the vehicle equipped with 12 cameras, 2 lidar units, 5 millimeter-wave radars, and 12 ultrasonic radars. One reason for the early realization of the urban navigation function is the adoption of a perception-heavy solution rather than a map-heavy one, making it less reliant on high-definition maps in cities. The urban navigation plan is set for SOP in June 2022, with effective deployment in over 100 cities nationwide, providing a significant geographical advantage. Haomo Zhixing’s overall deployment range is broad, with multiple models and quantities, allowing for high-speed continuous iteration based on more data. In 2022, it undertook the development tasks for high-level driving assistance of 34 models awaiting launch, accounting for nearly 80% of Great Wall Motors’ models scheduled for release this year, with 30% being standard configurations and the rest being high-end models.

On the autonomous driving execution side, the upgrade of automotive intelligence and the centralization of electronic and electrical architecture also require upgrading traditional automotive chassis to adapt to development. The chassis control system is closely related to the execution of autonomous driving. The line-controlled chassis mainly includes line-controlled steering, line-controlled braking, line-controlled shifting, line-controlled throttle, and line-controlled suspension, with line-controlled steering and line-controlled braking being the core products for autonomous driving execution. Currently, the main line-controlled braking manufacturers globally are traditional Tier 1 suppliers like Bosch, Continental, and ZF, with high entry barriers. In mid-2021, Great Wall Motors first announced the smart line-controlled chassis, with all core hardware, including electronic mechanical line-controlled braking, steering gears, motors, simulators, and controllers, designed and completed by Great Wall Motors itself. This is the first line-controlled steering technology in the country to support L4+ autonomous driving, set to be officially applied in 2023.

2.7 GAC Starlink Electronic and Electrical Architecture

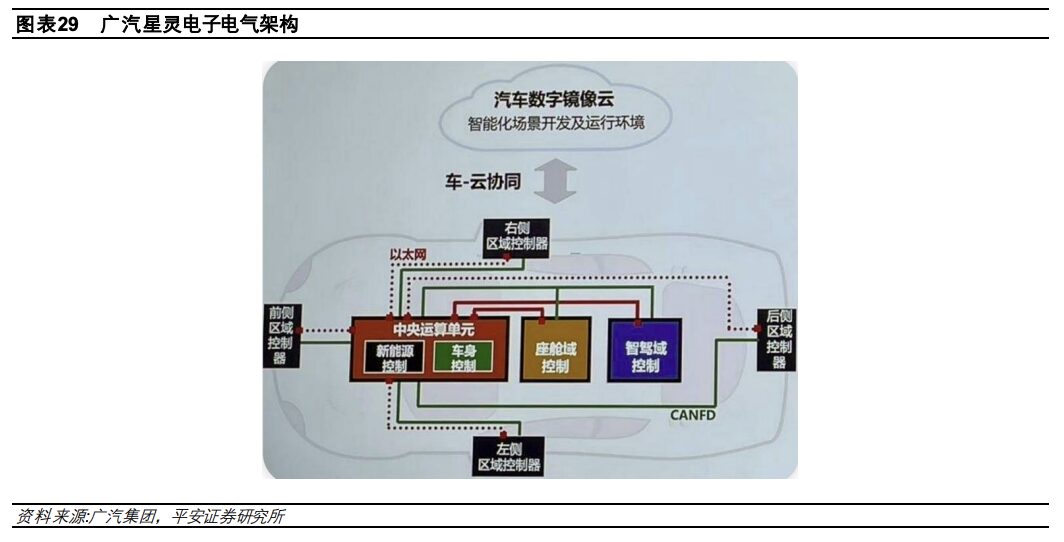

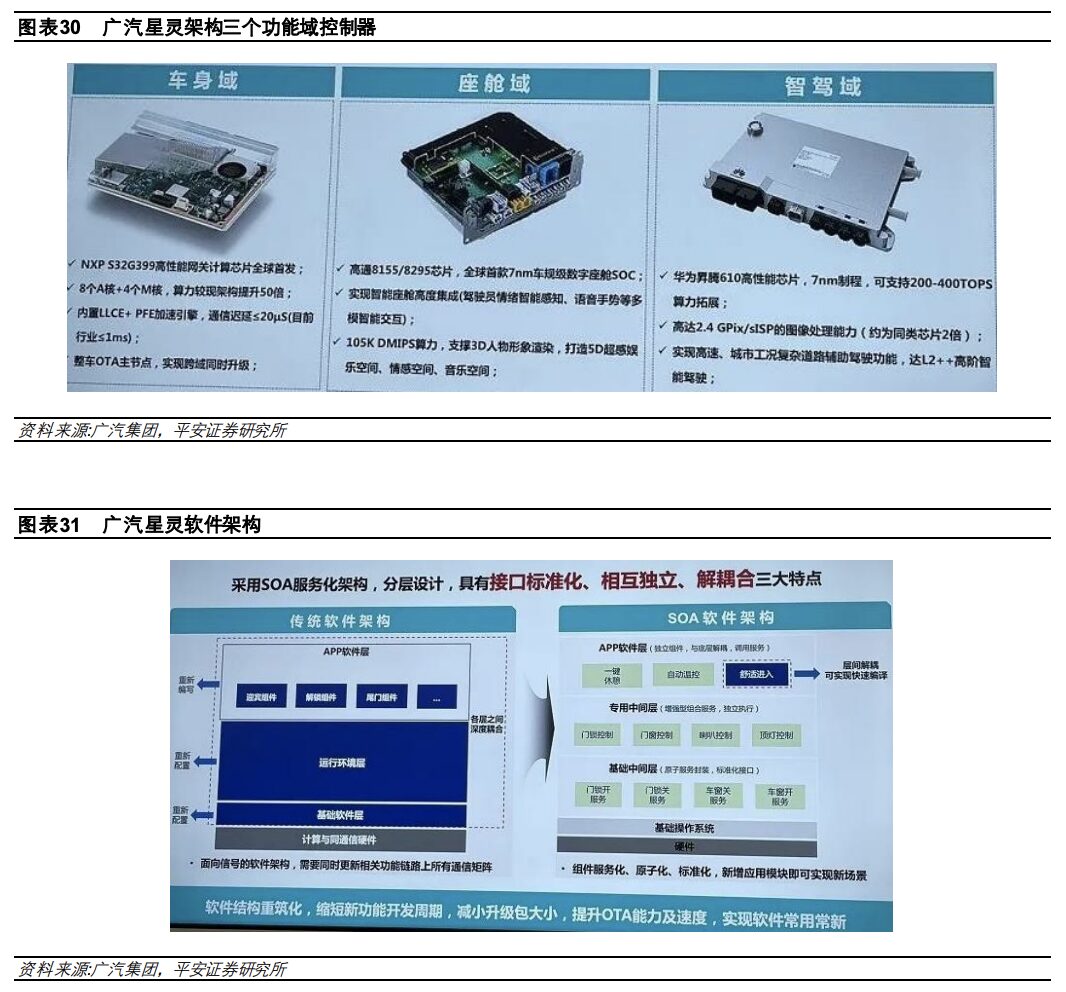

The GAC Starlink electronic and electrical architecture is planned to be equipped on GAC Aian’s new models in 2023. It consists of three core computing groups: automotive digital mirror cloud, central computer, intelligent driving computer, and infotainment computer, along with four regional controllers, integrating gigabit Ethernet, 5G, information security, and functional safety technologies. Compared to GAC’s previous generation electronic and electrical architecture, the new architecture’s computing power has increased by 50 times, data transmission rates have improved by 10 times, wiring harness loops have been reduced by about 40%, and the number of controllers has decreased by about 20.

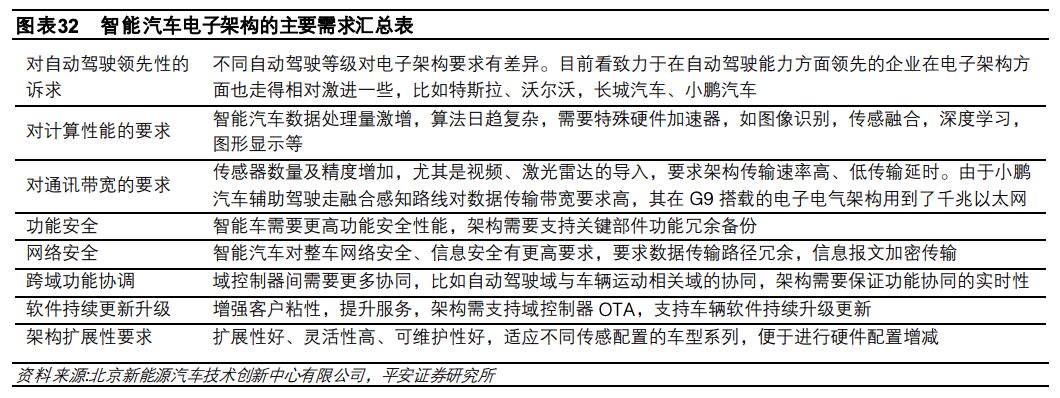

In terms of hardware architecture, the three functional domain controllers + four regional controllers at the front, rear, left, and right are similar to Great Wall Motors’ fourth-generation electronic and electrical architecture. The central computing unit (body control + new energy control) is equipped with the high-performance NXP S32G399 gateway computing chip; the cabin domain is equipped with Qualcomm 8155/8295 chips; and the intelligent driving domain is equipped with Huawei Ascend 610 high-performance chips, with a computing power of 400 TOPS. The four regional controllers distributed around the vehicle’s body are mainly responsible for power supply and executing commands from the central computing unit, and the central computing unit is connected to the four regional controllers via Ethernet. In terms of software structure, the “Starlink” architecture adopts the SOA software architecture to replace the traditional software architecture, achieving component service, atomization, and standardization, allowing new application modules to realize new scenarios.

A good electronic and electrical architecture can save costs, including manufacturing and operational costs. The production side can save materials, simplify assembly, and enhance development and manufacturing efficiency. Under similar surface functions, consumers using vehicles with higher integration of electronic architecture may have lower energy consumption. Secondly, it can quickly provide a rich variety of functions. OEMs can develop various functions for different scenarios, such as Tesla’s seat heating and holiday modes, and the function updates should be controllable by OEMs without the need for complex supply chain organization like in the past.

If there is no upgrade to the underlying architecture, no matter how many intelligent functions are superficially present, it cannot be considered a truly intelligent vehicle. For example, a distributed electronic and electrical architecture can also achieve automatic parking and L2 intelligent driving functions, but due to architectural limitations, it cannot connect sensors to a single intelligent driving domain controller, instead having to equip two independent control units—parking controller and driving controller—unable to share computing power and sensing hardware, leading to resource wastage and constraints in subsequent functional upgrades. Product definition is a prerequisite for architecture development, and automakers will make trade-offs based on their brand image, product positioning, target customers, and internal resources. For instance, automakers may prioritize integration in the intelligent cabin area, while adopting low-cost distributed solutions for the assisted driving section. They may also prioritize high integration in chassis and body control. Different automakers have varying brand matrices and vehicle structures, and architecture must consider platform universality and continuity.

03

Architecture Evolution Drives Multiple Changes in OEMs

3.1 Architecture Evolution, Gradual Reclamation of Automotive Software Ownership by OEMs

The shift of automotive electronic architecture towards centralized computing, with a reduction in the number of ECUs, means that the original integrated modules are disassembled, and domain controllers are centralized. This is not merely physical integration; increasingly, OEMs are consolidating more authority, hoping to achieve full-stack coverage from application layer software to middleware to underlying software, even to core hardware. This process involves OEMs extracting the software portions of previously integrated hardware and software from suppliers and gathering them internally. Given the constraints of existing supply chains and their own software capabilities, this will be a gradual process. Once the electronic and electrical architecture enters the centralized computing + regional control stage, the ownership of automotive software will mainly belong to OEMs, who will enjoy long-term software dividends, possessing stronger bargaining power in the industrial chain than in the traditional vehicle era, and holding the lifeline for continuous product updates in their own hands.

Under the distributed architecture, OEMs are essentially hardware integrators, with Tier 1 bundling upstream Tier 2 (embedded software suppliers, chip suppliers) to provide to OEMs. To enhance product control, OEMs in the functional vehicle era generally choose to self-develop high-value modules, which are the differentiated parts that consumers can perceive, namely the powertrain components.

In the second phase of functional domains, similar functions are merged into domains, and software gradually separates from the previous black box; OEMs, considering their existing supply chains and software capabilities, choose to cooperate directly with the original Tier 1/2 suppliers. At the application software level, they may choose a cooperative model or a self-developed model. For example, Xpeng and Great Wall’s autonomous driving algorithms are self-developed, while some other OEMs choose to collaborate with Baidu, Momenta, Xiaoma Zhixing, and Huawei. At this stage, OEMs vary in their involvement in the software and hardware aspects of domain controllers, leading to different service levels from domain controller suppliers. For OEMs with deep self-development, domain controller suppliers act as pure contract manufacturers, while for OEMs with shallow self-development, domain controller suppliers take on a comprehensive “nanny” role.

In the third phase, stepping out of the functional domain framework and entering the centralized computing + regional control stage, most ECUs disappear, with various sensors/actuators governed by the central computing unit. Most policy-level software that originally belonged to Tier 1 is led by OEMs, and the degree of OEM involvement in high-value modules within software gradually deepens. Therefore, OEMs must have specialized software teams to integrate self-developed and outsourced software, with software ownership primarily belonging to automotive manufacturers. Volkswagen plans to increase its self-developed software ratio to 60% by 2030 (focusing on artificial intelligence, big data, confidentiality, and security). While the self-developed ratio will significantly increase, the overall scale of outsourced software will also grow, but Volkswagen will define the standards and roadmaps for in-vehicle software. CARIAD’s business planning mainly covers four areas: 1) Electronic and electrical architecture E³ architecture; 2) VW.OS (Volkswagen Operating System); 3) VW.AC (Volkswagen Cloud); 4) Key applications.

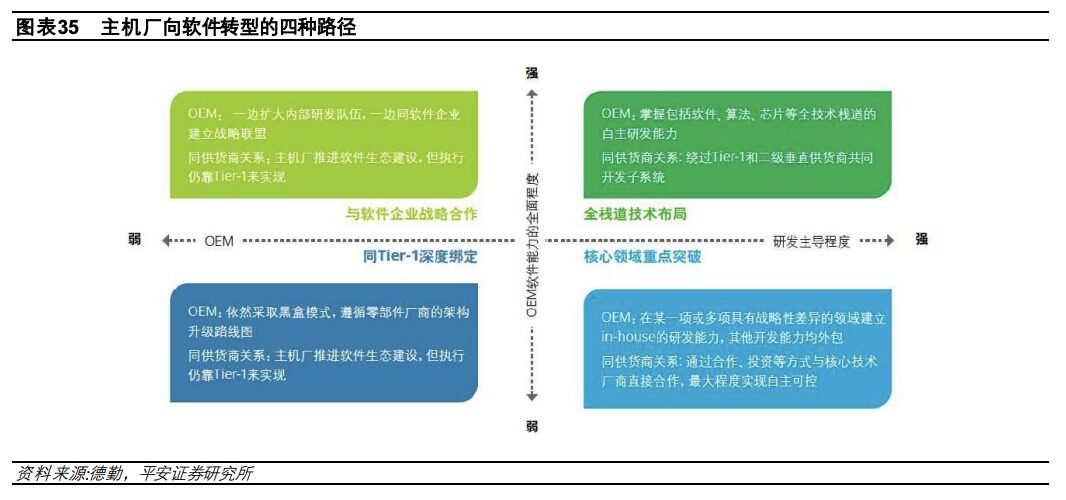

The number of high-value modules that are self-developed will largely determine the profitability of different OEMs, similar to the significant profitability differences among consumer electronics brands (Apple’s net profit margin has been around 20-26% in the past three years, while Xiaomi’s has been 5-8%). OEMs will assess suitable paths based on their business size, R&D capabilities, cash flow situations, and historical burdens. Affordable and luxury, fuel and electric will make starkly different transformation choices.

1) The first tier, such as Tesla, achieves full self-development in core areas like chips, operating systems, middleware, and domain controller system integration, while outsourcing hardware.

2) Focus on breakthroughs in one or two core technologies. For instance, whether to self-develop autonomous driving perception algorithms. Based on the pace of self-development of autonomous driving algorithms, Xpeng, Great Wall, and Huawei are relatively ahead. Some OEMs also choose to self-develop cabin chips, like Geely’s Yika Tong.

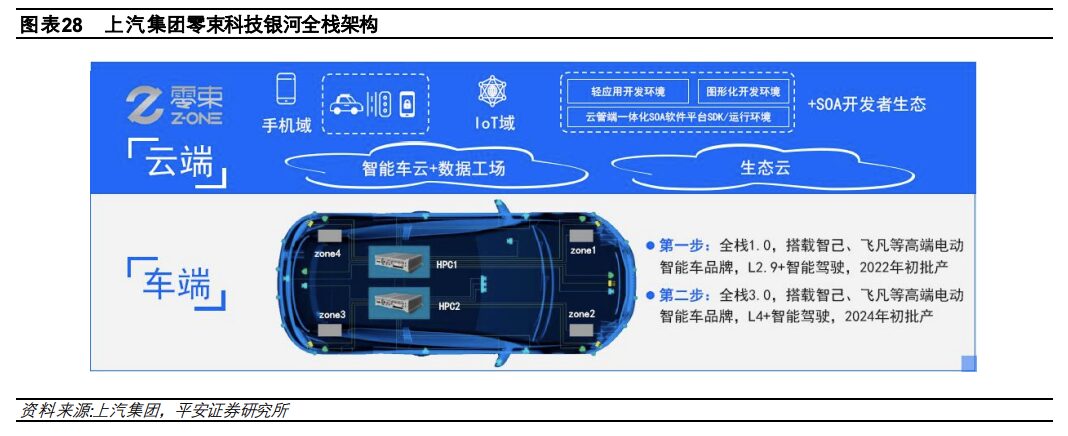

3) Multiple preparations. OEMs are forming their software teams while actively establishing cooperative alliances with technology firms/internet companies, relying on Tier 1 or emerging software companies for foundational software and hardware architecture solutions until they have mature software development capabilities. For example, SAIC’s Zero Bund is currently collaborating with various external companies, covering SOC chip companies, algorithm companies, and domain controller suppliers (Qualcomm, Horizon, United Electronics, Momenta).

4) Automakers only focus on brand operations, while software development is mainly outsourced, with components packaged as a whole system to large suppliers or internet companies.

With the evolution of electronic and electrical architecture, OEMs’ positions are changing from three dimensions: safety, data, and users:

1) The development of electronic architecture towards vehicle-cloud integration will make smart vehicles a more open intelligent touchpoint, significantly increasing safety requirements, with OEMs being the primary responsible entities.

2) OEMs that choose to self-develop assisted driving will find that the assisted driving functions will improve over time. As assisted driving evolves gradually, more companies that previously focused on L4 algorithms are beginning to collaborate with OEMs, indicating that the data generated from effective mileage will be the key to leading the capabilities of assisted driving in the next phase.

3) OEMs will have real-time direct links to users throughout the vehicle’s lifecycle, significantly enhancing stickiness with end consumers, with user operations, remote diagnostics, and services becoming triggers for OEMs’ business based on existing vehicles.

The traditional OEM V-shaped R&D model (including mechanical hardware testing, supply chain collaboration, styling design, etc.) requires a 5-7 year R&D cycle, which cannot adapt to the rapid iteration of mobile services and the operation of existing users. In the future, the separation of hardware and software development will transform into a closed-loop development model for software, allowing for rapid iterations while hardware can be pre-embedded and remain unchanged for a considerable time.

Electronic architecture evolution enables diverse profit models for OEMs.

Based on the shift towards centralized computing in electronic and electrical architecture, OEMs’ original profit models will be significantly broadened. As automakers possess numerous mobile terminals, they will have a massive amount of data in the future (involving body data, environmental data, driving data, and various data about vehicle occupants), which can directly reach users throughout the vehicle’s lifecycle. This will allow for the derivation of various business models, such as software algorithms, virtual drivers, mobility services, operation platforms, after-sales services, and diagnostics; looking further ahead, with the advent of autonomous driving, the software ecosystem of vehicles will have even broader imaginative space. Currently, some vehicle brands are innovating the cabin while the vehicle is stationary to stimulate and meet the increasing entertainment and relaxation demands, making vehicles transcend mere physical transportation, similar to how smartphones have long surpassed mere communication purposes.

Tesla has already integrated 22 types of games into its vehicles, and its technical department is working to integrate the game library from Steam into its vehicles, with the Tesla vehicle system expected to support smooth operation of Steam in the future. In terms of hardware, all Tesla vehicles in 2022 will be equipped with AMD Ryzen chipsets, with performance comparable to the latest Sony gaming console, the PlayStation 5. As the content ecosystem becomes increasingly rich, future vehicles may participate in content sharing, which could become a significant source of revenue.

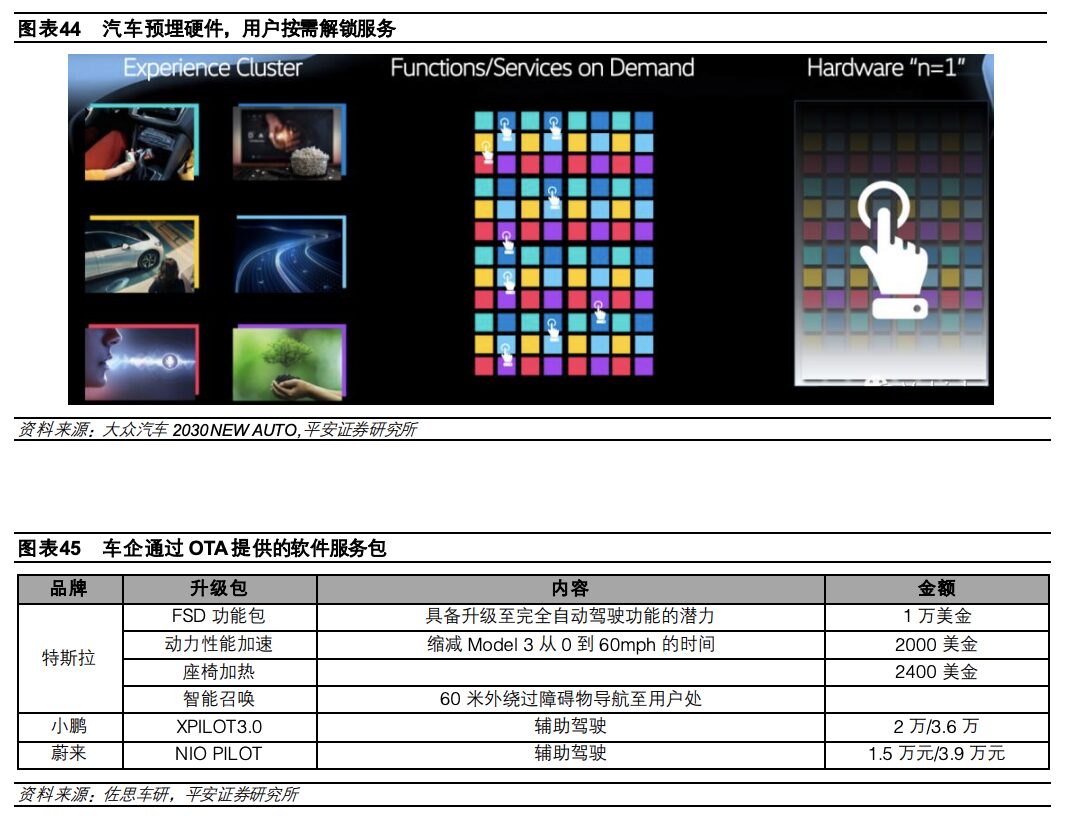

In Volkswagen’s 2030 NEW AUTO strategy, the company describes the future of automobiles and their application scenarios: future vehicles will evolve into sanctuaries, mobile offices, home travel salons, or resting places. Due to technological advancements, cars will gradually shed negative attributes (accidents, pollution, etc.) and become a more popular mode of personal transportation than now.

Volkswagen estimates that the automotive market will reach a scale of 5 trillion euros by 2030, ten times the current smartphone market scale, mainly benefiting from improvements in software and autonomous driving service capabilities. Volkswagen aims to create new business models in the automotive industry’s new future, with profit pools comprising vehicle hardware, software, batteries and charging, and mobility solutions. Volkswagen believes that future vehicles will still be personalized products (as customers still need differentiated vehicle shapes, brands, and services), but compared to the traditional automotive era, brand differentiation will increasingly come from software and services.

Volkswagen plans that future profit pools will include not only vehicle sales and vehicle platform sales, but also software sales, battery and refueling services, and mobility solutions (algorithm sales, mobile services). In front of consumers, services can be activated on-demand, and before that, Volkswagen will complete the unification of hardware platforms (i.e., the SSP platform) and the unification of software architecture (electrical architecture E3 version 2.0 + VW.OS).