Software Architecture Industry Chain

With the trend of automotive intelligence, “Software Defined Vehicles” has become an industry consensus. Software Defined Vehicles (SDVs) refer to the deep involvement of software in the definition, development, verification, sales, and service processes of vehicles, continuously changing and optimizing each process to achieve ongoing optimization of experience, processes, and value creation.

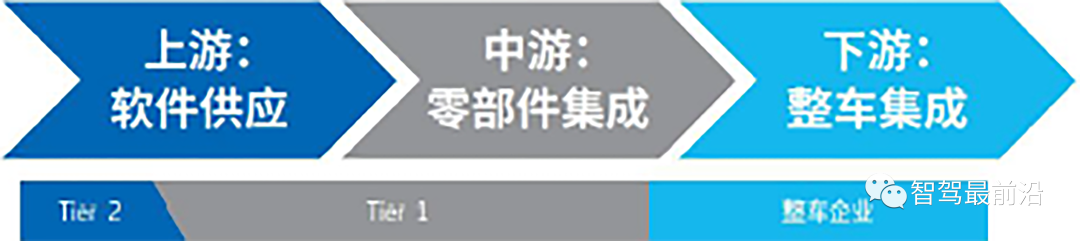

In the traditional automotive software industry, the industry chain is relatively short, and the industrial structure is simple (as shown in the figure). Software products mainly consist of basic software programs or simple embedded real-time OS, deeply coupled with ECU hardware. The upstream of the industry chain consists of software product suppliers, the midstream consists of parts integrators, and the downstream consists of vehicle integrators. Some mainstream Tier 1 manufacturers are involved in both upstream and midstream segments, building core technological barriers. Vehicle enterprises choose various ECUs based on the design requirements of a single model, with little correlation between components, making it difficult to accumulate design experience across models. Models lack continuous upgrade capabilities and cannot respond to the trends of intelligence and connectivity, nor can they track consumer upgrade demands for vehicles.

Traditional Automotive Software Industry Chain

Under the trends of intelligence and connectivity, in-vehicle software is designed, developed, managed, and operated from a software architecture perspective. Software systems and hardware systems will be fully decoupled at the component level, with software becoming the core commercial product in the form of service components. As automotive software becomes increasingly complex, the amount of code grows exponentially, and the difficulty of improving software quality increases. The traditional supply chain model is no longer suitable. The automotive software industry chain is undergoing reshaping, with internet and ICT (Information Communication Technology) companies that have advantages in software R&D continuously entering the market, becoming upstream Tier 1 suppliers alongside traditional automotive software Tier 2 manufacturers, and even new Tier 1.5 suppliers emerging. Vehicle manufacturers have become midstream players, while some automakers are moving upstream into software segments and extending downstream into application services. Internet companies, leveraging their deep connections with consumers, are digging into the value of subsequent application services for automotive software. As shown in the figure below.

Next-Generation Automotive Software Industry Chain

China’s automotive basic software architecture standards and overall industrial ecosystem have developed relatively late. Under the trend of automotive intelligence transformation and upgrading, domestic manufacturers are focusing on Adaptive AUTOSAR, launching corresponding middleware and toolchain products to seize market opportunities, achieving certain progress, but there remains a gap compared to foreign counterparts.

Domestic smart automotive software operating system technologies are mostly based on foreign technologies, with core layers still controlled by foreign companies. The macro kernel mainly adopts Linux and customized Linux macro kernels. The main organizations promoting Linux are the GENIVI Alliance and the Linux Foundation. Representative microkernel companies include Wind River (a subsidiary of TPG Capital) and Canada’s BlackBerry, while domestic independent companies such as Huawei, ZTE, and Zebra have also developed corresponding products and are expected to break free from foreign kernels.

Automotive electronic software standards mainly include AUTOSAR, OSEK/VDX, etc. The AUTOSAR standard has been developed for over a decade, forming a complex technical system and a broad development ecosystem, becoming the mainstream operating system for vehicle control. Well-known global manufacturers applying AUTOSAR solutions include Vector, ETAS (under Bosch), EB (under Continental), Mentor Graphics (under Siemens), Wind River, and KPIT, while domestic companies mainly include Neusoft Ruichi, Huawei, Puhua Software, and Jingwei Hengrun. Adaptive AUTOSAR is still in its infancy, with EB collaborating with Volkswagen to apply Adaptive AUTOSAR and SOA platforms to Volkswagen’s MEB platform ID series pure electric vehicle models.

Functional software is a core common functional module of smart automotive software operating systems, supporting the efficient development of features like autonomous driving and intelligent cockpits. R&D of functional software is still in its infancy both domestically and internationally, with domestic and foreign companies running in parallel. Currently, companies like SAIC Motor and Huawei have released independently developed functional software layers. Functional software needs to break through technical barriers and achieve a unified understanding in architecture comprehension and product definition to facilitate the rapid establishment of industrial ecosystems and product implementation.

Next-Generation Automotive Software Industry Chain

China’s automotive basic software architecture standards and overall industrial ecosystem have developed relatively late. Under the trend of automotive intelligence transformation and upgrading, domestic manufacturers are focusing on Adaptive AUTOSAR, launching corresponding middleware and toolchain products to seize market opportunities, achieving certain progress, but there remains a gap compared to foreign counterparts.

Domestic smart automotive software operating system technologies are mostly based on foreign technologies, with core layers still controlled by foreign companies. The macro kernel mainly adopts Linux and customized Linux macro kernels. The main organizations promoting Linux are the GENIVI Alliance and the Linux Foundation. Representative microkernel companies include Wind River (a subsidiary of TPG Capital) and Canada’s BlackBerry, while domestic independent companies such as Huawei, ZTE, and Zebra have also developed corresponding products and are expected to break free from foreign kernels.

Automotive electronic software standards mainly include AUTOSAR, OSEK/VDX, etc. The AUTOSAR standard has been developed for over a decade, forming a complex technical system and a broad development ecosystem, becoming the mainstream operating system for vehicle control. Well-known global manufacturers applying AUTOSAR solutions include Vector, ETAS (under Bosch), EB (under Continental), Mentor Graphics (under Siemens), Wind River, and KPIT, while domestic companies mainly include Neusoft Ruichi, Huawei, Puhua Software, and Jingwei Hengrun. Adaptive AUTOSAR is still in its infancy, with EB collaborating with Volkswagen to apply Adaptive AUTOSAR and SOA platforms to Volkswagen’s MEB platform ID series pure electric vehicle models.

Functional software is a core common functional module of smart automotive software operating systems, supporting the efficient development of features like autonomous driving and intelligent cockpits. R&D of functional software is still in its infancy both domestically and internationally, with domestic and foreign companies running in parallel. Currently, companies like SAIC Motor and Huawei have released independently developed functional software layers. Functional software needs to break through technical barriers and achieve a unified understanding in architecture comprehension and product definition to facilitate the rapid establishment of industrial ecosystems and product implementation.

Hardware Architecture Industry Chain

With the increasing integration of chip computing power, controllers are evolving towards functional and computational integration. This reduces the overall vehicle harness length, lowers the number of ECUs, thus decreasing the total weight of electronic components in vehicles and manufacturing costs. The idea of classifying scattered controllers by functional domains or spatial regions and integrating them into more powerful domain controllers (Domain Control Unit, DCU) has emerged.

Functional domains and spatial domains are two current paths for the development of domain controllers. Depending on the classification method, domain controllers can be mainly divided into two types: those classified by the five major functional domains and those based on specific physical areas of the vehicle. Compared to purely function-oriented domain controllers, spatial domain classification has a higher degree of centralization and requires greater development capabilities from vehicle manufacturers:

(1) Functionally Divided Domain Controllers: Typical Representatives, Bosch, Continental, etc.

Bosch, Continental, and other traditional Tier 1 manufacturers divide the automotive EEA architecture into five functional domains: power domain (safety), chassis domain (vehicle motion), infotainment domain (cockpit domain), autonomous driving domain (assisted driving), and body domain (body electronics). Each functional domain corresponds to a respective domain controller, which is then connected to the backbone line or even hosted in the cloud via communication methods such as CAN/LIN, thus achieving information data interaction across the vehicle.

(2) Spatially Divided Domain Controllers: Typical Representative, Tesla

Spatially divided domain controllers integrate functions based on specific physical areas of the vehicle, offering a higher degree of centralization compared to purely function-oriented domain controllers. Tesla is a typical representative of this approach. In 2012, the Model S was primarily based on typical functional domain classifications, while the 2017 Model 3 directly entered the centralized computing + spatial domain architecture phase. Tesla’s EEA consists of only four major parts, including AICM (Intelligent Driving and Infotainment Domain Control Module), FBCM (Front Body Control Module)/Intelligent Distribution Module, LBCM (Left Body Control Module), and RBCM (Right Body Control Module).

Among them, the autonomous driving domain controller:

The autonomous driving domain controller enables the vehicle to have multi-sensor fusion, positioning, path planning, and decision control capabilities. It typically requires external data from multiple cameras, millimeter-wave radars, and LiDAR devices, completing functions such as image recognition and data processing.

Globally, Tier 1 manufacturers have basically laid out products for autonomous driving domain controllers, with typical products including Visteon DriveCore, Bosch DASy, Continental Group ADCU, ZF ProAI, Veoneer Zeus, and Magna MAX4. In China, products include Desay SV IPU series, Jingwei Hengrun ADC, Neusoft Ruichi CPDC, and Huawei MDC.

Among them, the intelligent cockpit domain controller:

The intelligent cockpit domain controller provides hardware support for the cockpit. The intelligence and automation of cockpit functions rely on the hardware proliferation and computing power support of the cockpit domain controller. Initially, the role of the intelligent cockpit domain controller was to manage the increasing number of displays and their information layout. From in-car touch screens to liquid crystal displays and touch screens, to the multiple different displays in high-end vehicles today. In the future, it will no longer be limited to achieving multi-screen interconnection but will gradually integrate air conditioning control, HUD (Head-Up Display), rearview mirrors, human-machine interaction, DMS (Driver Monitoring System), OMS (Occupant Monitoring System), as well as T-BOX (Telematics Box) and OBU (On-Board Unit), realizing cockpit electronic functions on a unified hardware and software platform.

Globally, Visteon, Continental, Bosch, Aptiv, Faurecia, and Harman dominate the market, while domestic companies such as Huawei, Desay SV, Hangsheng Electronics, Neusoft Ruichi, and Botai have also launched cockpit domain controller solutions.

Domestic independent Tier 1 manufacturers are rapidly penetrating the intelligent cockpit domain. Desay SV was the first to mass-produce cockpit domain controllers and has mature technologies in the cockpit AI scenario ecosystem. In the intelligent cockpit field, Desay SV has a complete product line layout, with hardware covering domain controllers, central gateways, sensors, displays, etc., and software covering infotainment systems, ADAS systems, IMS systems, health systems, etc. Desay SV and Qualcomm (Qualcomm) launched a multi-screen intelligent cockpit domain controller that uses 8155 and QNX Hypervisor, achieving dual systems in the cockpit, which has been applied to models such as Chery and GAC.

Nuobo Technology’s cockpit domain controller has also entered mass production. The intelligent cockpit domain controller IN9.0, based on Qualcomm 8155 chip and BlackBerry real-time operating system, has now entered mass production. The software uses virtualization technology, allowing a single chip to support multiple operating systems and integrate multiple electronic component modules such as instrument panels, central control entertainment, co-driver screens, head-up displays, seat air conditioning control, DMS, and 360-degree surround view, supporting up to six screens for display. IN9.0 has been applied to the Haval H6S, which was launched at the end of October.

Huayang Group has already pinpointed multiple cockpit domain controller projects. At the 2021 Shanghai Auto Show, Huayang Group launched the “One Chip Multi-Screen” cockpit domain controller, which integrates functions of different operating systems and security levels onto one platform through virtualization technology, enabling multi-screen interconnection and cross-screen display for instrument panels, infotainment, co-driver screens, AR-HUD, etc. The company has announced that it has pinpointed multiple cockpit domain controller projects for various vehicle manufacturers.

Botai and Neusoft Ruichi will launch cockpit domain controllers based on Qualcomm chips. In 2021, Botai’s intelligent cockpit solution based on NXP chips was mass-produced and equipped on the Dongfeng Lantu FREE, featuring a three-screen setup (instrument panel, central control, co-driver) supporting multi-screen interaction and multi-modal interaction (gesture + voice) among various ecological closed-loop services. Botai is also developing an intelligent cockpit domain controller solution based on Qualcomm 8155 chips. In 2019, Neusoft Ruichi achieved a dual-system multi-screen function configuration based on Intel’s in-vehicle computing solutions and Hypervisor virtualization technology. Currently, Neusoft is promoting a platform-based product line for intelligent cockpits, with high-end platforms based on Qualcomm 8155/6155 high-performance chip cockpit domain controllers, which are about to enter mass production.

ThunderSoft has launched cockpit domain solutions compatible with multiple chip suppliers. In 2021, the company launched the E-Cockpit 4.5 cockpit domain controller, which is compatible with three mainstream chip platforms: Qualcomm, Renesas Electronics, and NXP, supporting one chip with multiple screens (instrument panel, central control, co-driver, air conditioning seat screen) and multiple systems (Android, Linux, QNX, INTEGRITY). ThunderSoft can also provide customized overall intelligent cockpit software solutions that include automotive entertainment systems, smart dashboards, integrated cockpits, ADAS, and audio products.

Yanfeng Electronics has partnered with Huawei’s ecosystem. The company’s YL Intelligent Mobility has reached a cooperation with Huawei in the intelligent cockpit field, with Huawei providing core modules for cockpit chips, HarmonyOS, and application ecosystems, while Yanfeng Intelligent Mobility is mainly responsible for algorithms, hardware and software architecture design, and system integration development related to the operating system in the intelligent cockpit.

2. Domain Controller Chips

In terms of hardware, compared to MCU (Microcontroller Unit) chips, SoC (System on Chip) chips have higher computing power and integration and can be applied in intelligent cockpits, autonomous driving, and other fields. In the ECU (Electronic Control Unit) era, MCU chips were the main control chips; entering the DCU (Domain Control Unit) era, the intelligence level of vehicles has significantly increased, and the complexity of computational processing has increased exponentially. For example, the computing power required for L4 and above autonomous driving may exceed 700 TOPS, and vehicle manufacturers often pre-install high-performance hardware during the development of intelligent functions, using algorithm software to achieve functional updates, necessitating DCU main control chips with stronger multicore and larger computing capabilities. Unlike MCU chips, which are primarily CPU-based, SoC chips integrate multiple modules such as CPU, AI chips (GPU, FPGA, ASIC), and deep learning acceleration units (NPU). Compared to MCU chips, SoC chips have higher computing power and integration, with the main computing power coming from AI chips, particularly with the GPU, which has significant advantages over CPU operations in image computing, helping SoC chips achieve a noticeable computing power advantage over MCU. Therefore, the use of SoC chips in DCUs has become a mainstream trend.

Currently, among SoC chips, GPUs are the main force, and ASICs are expected to become mainstream after software algorithms mature and stabilize. GPUs have significant operational advantages and have been applied in consumer electronics for many years, making them highly versatile and relatively easy to develop, thus maintaining a leading position in the current and foreseeable future. To compensate for the high cost and power consumption of GPUs, customized FPGA chips and ASIC chips have been introduced. FPGAs are semi-custom chips that have significant performance and energy consumption advantages over GPUs but have high mass production costs; ASICs are customized chips that require tailored research and development, with long design and development cycles and substantial funding requirements. Given the current unclear technological route, the cost-effectiveness of large-scale wafer production is not high. Therefore, both play a complementary role in AI chips. In the future, once software algorithm technology routes are mostly standardized, high-performance, low-power, and low-cost mass-produced ASICs will likely replace GPUs and become mainstream AI chips. FPGAs will maintain a certain market share by complementing the energy consumption and functionality that can be modified, providing a long-term supplement to GPUs and ASICs.

(1) Autonomous Driving AI Chips

Currently, the main manufacturers capable of large-scale production in the autonomous driving AI chip market include NVIDIA, Mobileye, and Tesla (self-developed FSD), with Qualcomm accelerating its efforts. Domestic companies like Huawei, Horizon Robotics, and Black Sesame are still in the early stages.

NVIDIA has a first-mover advantage and is currently the main chip supplier for vehicle manufacturers. NVIDIA entered the autonomous driving market early and has an aggressive technological path. The Xavier chip and Orin chip are among the highest computing power mass-produced chips on the market during the same period. In April 2021, NVIDIA released the next-generation Atlan chip, which has a computing power of 1000 TOPS per chip, expected to provide samples to developers in 2023 and be widely adopted in vehicles by 2025. High computing power gives NVIDIA a significant advantage in L3 and above autonomous driving. Previously, NVIDIA’s low energy efficiency ratio was considered a drawback, but the DRIVE AGX Orin solution, which is expected to be mass-produced in 2022, has achieved an energy efficiency ratio of 2.7. It is anticipated that the launch of the Orin chip and the collaboration with the Drive, AGX, and Orin software platforms will solidify NVIDIA’s first-mover advantage in the L3 and above market.

Qualcomm launched the autonomous driving platform “Snapdragon Ride” at the 2020 CES, entering the smart automotive field. The Snapdragon Ride SoC features the sixth-generation Qualcomm Kryo CPU and the sixth-generation Adreno GPU, with computing power reaching 700-760 TOPS, supporting L1/L2 level ADAS and L2+ functions such as highway assistance/autonomous driving, assisted/automated parking, etc.; L4/L5 fully autonomous driving is intended for urban autonomous driving, taxis, and robotic logistics.

Mobileye’s closed solution has shown its drawbacks, leading to a shift towards openness. Mobileye provides an integrated solution of cameras + chips + basic software + application algorithms, often in a black box mode, which can reduce costs and accelerate vehicle modeling for newly started or technically challenged vehicle manufacturers. However, software algorithms are the core capability of vehicle manufacturers in autonomous driving, and mainstream manufacturers need to master software development capabilities. The black box mode is no longer preferred; thus, Mobileye has provided an open version of the EyeQ5 chip since 2020, which can execute third-party program codes and support manufacturers in compiling their programs. Meanwhile, Intel is fully supporting the development of the toolchain for the new EyeQ5 chip.

Huawei has integrated software and hardware capabilities, becoming an important player in autonomous driving domain control. Huawei has the MDC computing platform + AOS intelligent driving operating system, with the MDC computing platform covering all software and hardware for vehicle intelligence. The Huawei MDC is the industry’s first mass-produced automotive-grade intelligent driving computing platform, with computing power ranging from 48 to 400 TOPS, supporting smooth evolution for L2+ to L5 level autonomous driving and compatible with AUTOSAR architecture.

Horizon Robotics collaborates with multiple vehicle manufacturers on its Journey chip. In 2021, Horizon released the Journey 5 chip aimed at L3 and above autonomous driving, adopting a 16nm process with a maximum computing power of 128 TOPS and a power consumption of only 30W, with a latency of only 60ms, supporting 16-channel camera video input.

Black Sesame has also achieved breakthroughs in chips. The most advanced chip from Black Sesame is the Huashan No. 2 A1000 Pro, adopting a 16nm process and built on a 16-core Arm v8 CPU with a heterogeneous multi-core architecture, supporting input from 20 high-definition cameras and consuming only 25W.

(2) Intelligent Cockpit Domain Controller Chips

Chips for cockpit entertainment screens and other devices can reduce the number of ECUs and avoid communication transmission issues between multiple chips, while also lowering costs. The challenge in achieving one chip with multiple screens lies in the need for the chip to have strong processing capabilities and complex software operating systems. Currently, chip manufacturers are accelerating technological iterations, such as Qualcomm’s 8155/8195 chips, which can support up to 8 sensor inputs and 5 display screens; in 2021, Xinchip Technology released the latest intelligent cockpit chip X9U, capable of supporting 10 independent high-definition display screens. Currently, the main manufacturers capable of large-scale production in the intelligent cockpit chip market include Qualcomm, NVIDIA, while domestic companies like Huawei, Horizon Robotics, and Xinchip Technology are still in the early stages.

Qualcomm is the leader in cockpit domain chips, being the first to adopt 5nm automotive chips. Qualcomm’s third-generation digital cockpit platform features the world’s first 7nm 8155 chip, which is currently the most powerful cockpit chip available for mass-produced vehicles, leading to over a dozen brands announcing their adoption. The fourth-generation Snapdragon automotive digital cockpit platform was announced in January 2021, set to use the world’s first 5nm automotive chip along with the sixth-generation Qualcomm Kryo CPU, Qualcomm Hexagon processor, multi-core Qualcomm AI engine, sixth-generation Qualcomm Adreno GPU, and Qualcomm Spectra ISP, with performance comparable to flagship smartphone chips like Snapdragon 888, expected to achieve mass production in 2022, with cooperation intentions established with 20 mainstream vehicle manufacturers, solidifying Qualcomm’s position in the cockpit domain.

NVIDIA has emerged strongly thanks to its experience in autonomous driving development. NVIDIA previously only sold chips but now offers a complete protocol stack for autonomous driving (DRIVE AV) and a complete protocol stack for cockpits (DRIVE IX), supporting functions in instrument display, cockpit entertainment, passenger interaction, and monitoring. NVIDIA’s one chip with multiple screens product has been implemented in the Hyundai GV60 model, achieving one set of computing hardware driving the instrument panel, central control, HUD, and two electronic rearview mirrors. NVIDIA is also collaborating with Mercedes-Benz and Audi to develop cockpit domains.

Horizon has proposed cockpit solutions based on the Journey series chips. At the 2021 Shanghai Auto Show, Horizon proposed an in-vehicle intelligent interaction solution based on the Journey 5 chip. On the basis of a unified chip architecture, it can actively intervene based on external road conditions and the driver’s status, such as fatigue reminders, highway ramp warnings, smoking mode, etc., achieving in-vehicle scene perception and dynamically adjusting driving strategies.

Huawei promotes the Kirin chip and HarmonyOS. Huawei’s cockpit solution mainly consists of three parts: HarmonyOS, Harmony vehicle domain ecosystem, and the CDC intelligent hardware platform based on Huawei’s Kirin chip platform. Currently, Huawei’s cockpit business focus is on promoting the Kirin chip and developing the HarmonyOS ecosystem, with Tier 1 responsible for algorithms, hardware and software architecture design, and system integration development related to the operating system in the intelligent cockpit.

Xinchip Technology’s chip can support 10 screens. At the 2021 Shanghai Auto Show, Xinchip Technology launched the intelligent cockpit chip X9U, with a CPU computing power of 100K DMIPS and AI computing power of 1.2 TOPS. It can support functions such as voice, navigation, entertainment, surround view, DMS, OMS, etc., and supports up to 10 independent full HD display screens.

Thanks to the rapid advancement of innovative technologies, foreign LiDAR Tier 1 manufacturers have developed rapidly, with major LiDAR companies including Velodyne, Ibeo, Quanergy, Innoviz, and LeddarTech;

In contrast, the domestic LiDAR market is still in its infancy, with autonomous driving companies yet to adopt them on a large scale, but a certain competitive landscape has already formed. The main domestic LiDAR companies include Hesai Technology, Suton Ju Chuang, Huawei, Lei Shen Intelligent, and DJI’s subsidiary Livox. Domestic companies are actively laying out in the solid-state LiDAR field, having developed many products, with some technical performances at the international leading level. As LiDAR continues to develop towards solid-state technology, domestic LiDAR companies have significant growth opportunities.

In terms of upstream components for LiDAR, there is still a gap until complete independent supply is achieved. However, the performance of domestic manufacturers’ laser devices, sensors, and control chips is continuously improving, gradually catching up with the world’s advanced level. In terms of development, domestic LiDAR manufacturers have made significant breakthroughs, with multi-beam high-performance vehicle-mounted LiDAR achieving international leading levels in terms of detection range and resolution.

(2) Millimeter-Wave Radar

In terms of chip technology, the number of domestic millimeter-wave radar chip startups is increasing, with some manufacturers having matured technologies that meet certain indicators comparable to international mainstream products. However, further support is needed from millimeter-wave radar system manufacturers to detect mass production quality and accelerate the mass production process.

In terms of productization, through years of technological exploration and experience accumulation, domestic millimeter-wave radars have achieved breakthroughs in many key technologies. Self-owned brand companies like Sensory Technology have achieved mass production in corner radars and gained a certain market share; however, in terms of front radars, they still need to accelerate productization and mass production processes.

In terms of millimeter-wave imaging radar (4D millimeter-wave radar), domestic millimeter-wave radar manufacturers are on the same starting line as international mainstream companies. Imaging radar involves a large amount of data processing and advanced processing algorithms, requiring further exploration in data processing levels both domestically and internationally.

In terms of market applications, local manufacturers have shown an increasing ability to drive out foreign manufacturers in the field of millimeter-wave radar, and in the coming years, local manufacturers’ market share is likely to completely surpass that of international manufacturers.

The current major millimeter-wave radar manufacturers include Furitek, Sensory Technology, Bosch, Continental, etc.

From the perspective of the industry chain, lenses, CMOS chips, DSP (Digital Signal Processors), and modules are the most important components of on-board cameras, with the CMOS chip being the core component, accounting for about one-third of the entire camera’s value.

In terms of optical lenses, the industry is relatively mature, basically meeting expected goals, with domestic companies like Sunny Optical, Lianchuang Electronics, and OmniVision Technology having established a foothold in the industry. In the future, the local industrial chain will continue to develop.

In terms of photosensitive chips, significant breakthroughs have been made in technologies such as high resolution, low power consumption, high dynamics, and high/low light conditions, but market share remains insufficient, with international manufacturers like Sony, ON Semiconductor, and OmniVision still dominating the mainstream market, leaving domestic manufacturers with a long way to go.

In terms of visual computing chips, local players like Horizon have already achieved initial success in the domestic market, but still need to break into the international market. In terms of visual perception algorithms and products, warning products have already achieved large-scale applications, and vehicle control products based on visual perception have high penetration rates. However, the comprehensive recognition and integration technology required for highly autonomous driving is still in the early stages.

In terms of market applications, the growth in the equipping of visual systems on vehicles will drive overall industry demand growth, and local manufacturers are expected to enter a period of rapid development in the next five years.

Welcome all angel round and A round enterprises in the entire automotive industry chain (including the dynamic battery industry chain) to join the group (will recommend to over 800 automotive investment institutions including top institutions); there are communication groups for sci-tech innovation company leaders , automotive industry complete vehicles, automotive semiconductors, key components, new energy vehicles, smart connected vehicles, aftermarket, automotive investment, autonomous driving, Internet of Vehicles, etc., please scan the administrator’s WeChat to join the group (please indicate your company name )