In previous discussions about dual payloads, it was mentioned that payload diversity is a crucial consideration in the future development of ADCs (ADC: Payload Evolution and Dual Payload Strategy). There are two main reasons for this: first, the existing toxin payloads have relatively singular modes of action, and treatment strategies after drug resistance need to be considered, with the possibility of sequential therapy relying on the diversity of payload mechanisms; second, ADCs are no longer satisfied with the tumor market and naturally require more diverse effective payloads to expand into other indications.

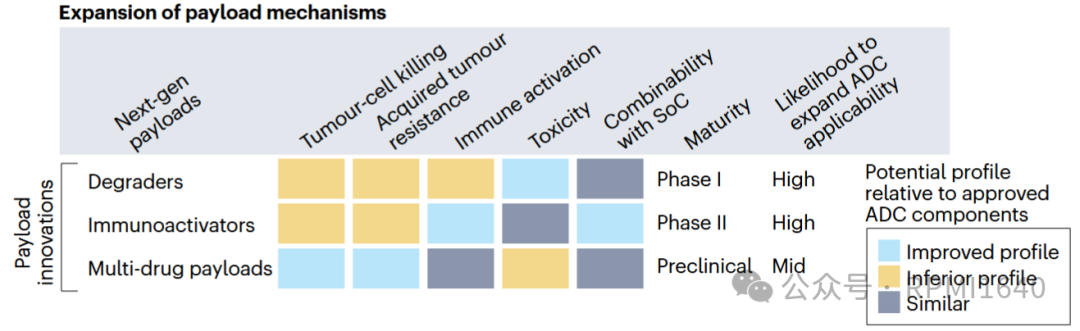

Last year, an analysis published in Nature Reviews Drug Discovery (DOI: 10.1038/d41573-024-00064-w) considered several dimensions and proposed two types of novel payloads with the potential to expand the applicability of ADCs: degraders and immune agonists. Immune agonists have been discussed in depth in previous articles, and balancing safety and activity has proven to be more challenging than expected, leading to slow clinical progress for this type of ADC (ISAC). Today, we will mainly discuss the other type, which is degrader-antibody conjugates (DAC).

As the name suggests, the biggest difference between DAC and ADC is that the effective payload is replaced with a degrader. Degraders have a more appealing name called targeted protein degradation (TPD), and their advantages are well-known, including targeting undruggable targets, targeting non-enzymatic domains, and catalyzing degradation activity, among others. For DACs, the expansion of the target protein pool undoubtedly adds value from the perspective of mechanism diversity. Additionally, theoretically, a single degrader molecule can cyclically induce the ubiquitination of multiple target proteins, achieving a “low dose, long duration” therapeutic effect, which is also beneficial for antibody conjugates that have limited delivery amounts. From the perspective of TPD, DAC also addresses the issues of systemic exposure and pharmacokinetics of degraders. So theoretically, DAC should be a case of 1+1>2, but is that really the case?

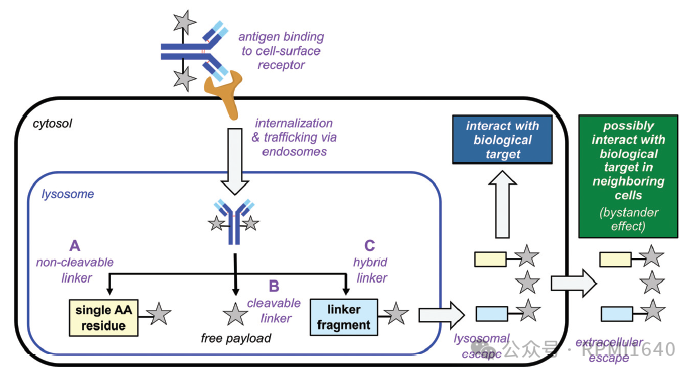

Currently, there are two main types of DACs: antibody conjugates based on PROTAC and antibody conjugates based on molecular glue (Molecular Glue-based ADCs, also known as MACs). The earliest exploration of DACs began with Genentech, and Dragovich’s research team made many attempts, ultimately reaching some conclusions: 1. PROTACs are not as direct as toxins, so selecting the right target is crucial; 2. Because they are not direct, a DAR value greater than 4 is also important; 3. PROTAC molecules are large and complex, and stability and escape issues in lysosomes must be considered. Therefore, for a long time afterward, no PROTAC-type DACs entered clinical stages. The first DAC to enter clinical stages was one with molecular glue as the effective payload. The advantage of molecular glue is its smaller molecular weight, which aligns better with small molecule drug design principles, offering superior permeability and solubility, and better compatibility with existing linkers and conjugation technologies.

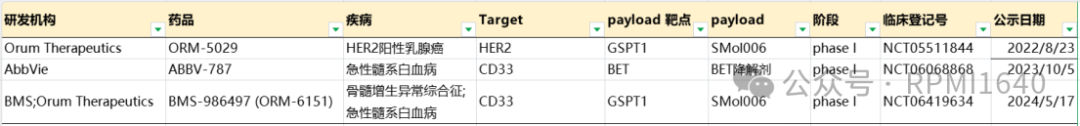

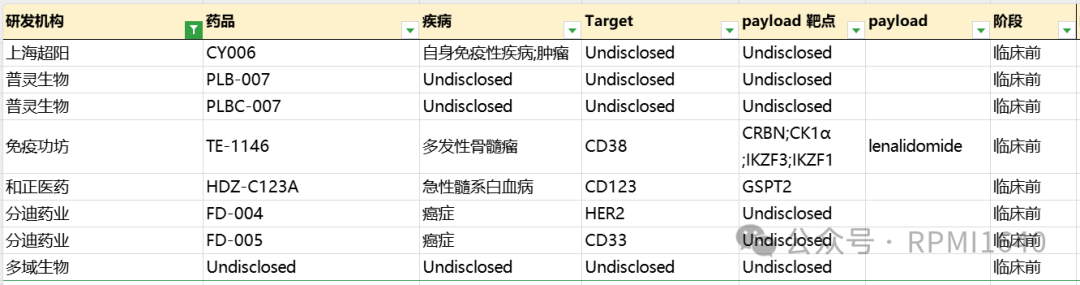

DACs are still considered an emerging drug type. According to incomplete statistics, there are about 20 publicly disclosed related pipelines. As of now, only three pipelines have entered clinical stages, all focusing on relatively mature targets in hematological malignancies and solid tumors (such as HER2, CD33), among which the fastest progress is Orum Therapeutics’ molecular glue DAC, involving the degrader payload of GSPT1 molecular glue.

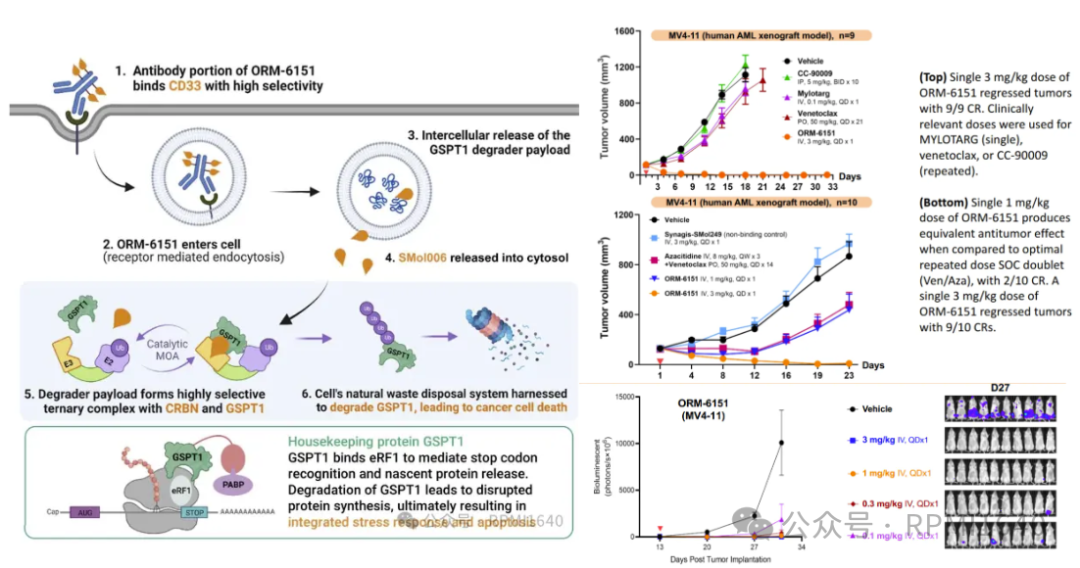

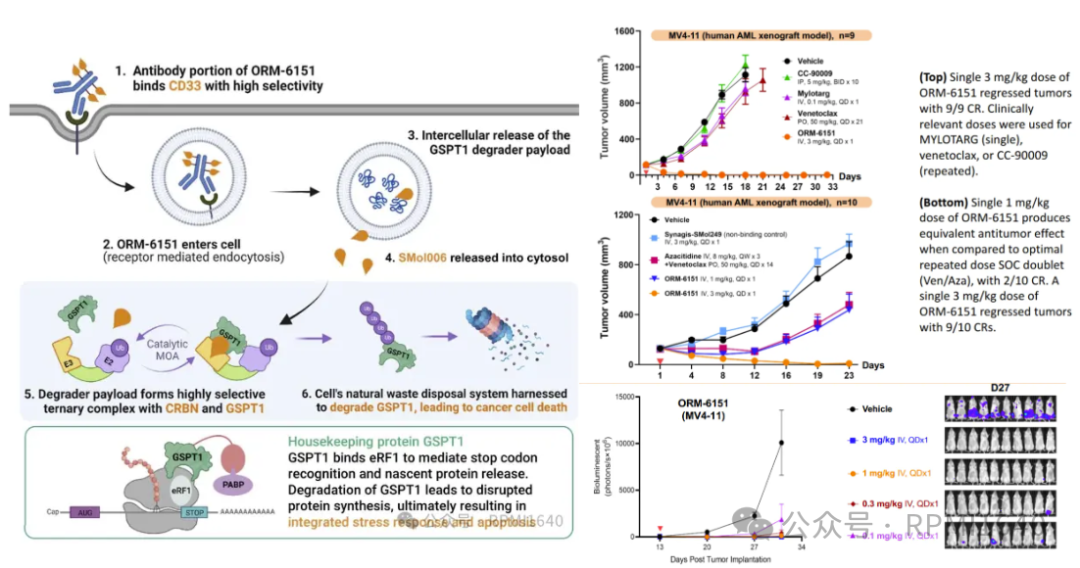

GSPT1

(G1 to S phase transition 1, also known as eRF3a) is a protein encoded by a gene that regulates cell cycle transitions. It interacts with eRF1 during translation termination and mediates the release of nascent polypeptides from the ribosome in a GTP-dependent manner. As a substrate of the CRBN E3 ubiquitin ligase, GSPT1 can be effectively degraded by immunomodulators such as thalidomide, thereby inhibiting tumor cell proliferation.

Orum Therapeutics’ ORM-5029 is the first DAC to enter clinical trials, with an effective payload of GSPT1 degrader SMol006, using the classic Mc-Val-Cit-PABC linker conjugated with Pertuzumab, with a DAR value of about 4. Preclinical data shows that in HER2-positive BT-474 cell lines, ORM-5029’s cytotoxicity is 100-1000 times higher than that of the single agent GSPT1 degrader, negative ADC, and control ADC. In BT-474 xenograft tumor models, a single dose of 10 mg/kg of ORM-5029 shows significant efficacy. Currently, ORM-5029 is undergoing Phase I clinical research in the United States, recruiting 87 HER2-positive advanced solid tumor patients (NCT05511844), expected to be completed in October 2025.

ORM-6151 is another first-in-class anti-CD33 antibody GSPT1 degrader developed by Orum, with the same effective payload as ORM-5029, but using a novel β-glucuronide linker to conjugate with the CD33 antibody. This linker is cleaved by lysosomal glucuronidase, with hydrophilicity and stability superior to the VC linker. Additionally, the Fc region of the CD33 antibody has been modified to reduce Fc-γR binding. In vitro experiments show that ORM-6151 has pmol-level cytotoxicity in CD33-expressing cell lines. In xenograft models, ORM-6151 shows strong efficacy at doses as low as 1 mg/kg, and a correlation between tumor growth inhibition and GSPT1 degradation has been observed.

On November 6, 2023, BMS acquired Orum’s ORM-6151 (new drug code BMS-986497) for a $100 million upfront payment, with Orum expected to receive milestone payments totaling approximately $180 million. Currently, BMS has initiated a clinical study (NCT06419634) to evaluate the safety, tolerability, drug levels, and efficacy of BMS-986497 in patients with relapsed or refractory acute myeloid leukemia (AML) or myelodysplastic syndromes (MDS), aiming to recruit 35 patients.

ABBV-787 is also a first-in-class product developed by AbbVie, based on a targeted CD33 antibody and bromodomain protein 4 (BRD4) PROTAC, and is the second DAC product to enter clinical trials globally after Orum Therapeutics’ anti-GSPT1 degrader ADC product ORM-5029. AbbVie announced on October 5, 2023, that ABBV-787 is undergoing a Phase I first-in-human study (NCT06068868) to evaluate its safety, pharmacokinetics, and efficacy in adult subjects with AML.

In addition, many domestic and foreign MNCs and biotech companies have laid out in the DAC field, with companies like Zhengyi Pharmaceutical, ImmunoGen, and Yilian Biotech clearly disclosing their DAC pipeline targets and degrader targets, all employing strategies different from those already in clinical pipelines (HER2/GSTP1, CD33/BET, CD33/GSPT1).

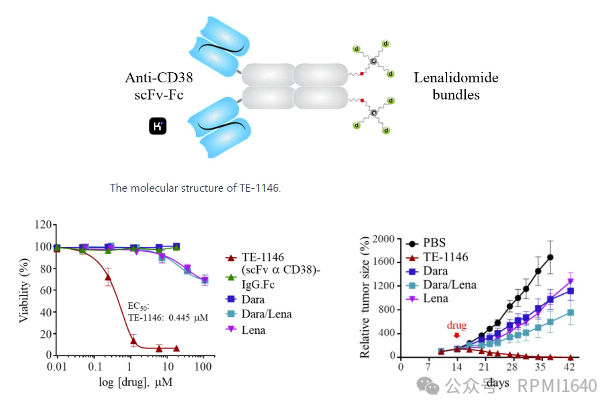

ImmunoGen’s TE-1146 uses a “multi-arm linker” to conjugate multiple lenalidomide in a drug bundle format to specific sites on the anti-CD38 fusion protein, forming a homogeneous structure with a DAR of 6. Preclinical studies show that TE-1146 can completely eliminate tumor cells in mouse models of multiple myeloma, with efficacy significantly superior to the use of lenalidomide/daratumumab alone or in combination. Pharmacokinetic studies indicate that the drug bundle conjugation of TE-1146 does not affect its clearance rate, with a half-life similar to that of daratumumab, suggesting good in vivo stability.

Zhengyi Pharmaceutical’s HDZ-C123A conjugates a humanized IgG1 targeting CD123 with the GSPT1 degrader CDG0501 through a protease-cleavable linker, with a DAR value of 8. Clinical data disclosed at ASH 2024 shows that HDZ-C123A has pM-level proliferation inhibition activity in CD123-expressing cell lines, remaining effective in Mylotarg-resistant cell lines and primary samples, with superior in vivo efficacy. Currently, no further data has been disclosed, suggesting it is still in the early stages of development.

Yilian Biotech and Shiyao both have related GSPT1 patents; if interested, please let me know, and I can write a separate article later. Notably, Yilian also has two DAC patent applications targeting Myc and Bcl2, which may be early exploratory products. Other domestic DAC-related pipeline antibody targets or payload targets have not been fully disclosed. Additionally, Shanghai Chaoyang has disclosed its layout for DAC targeting indications including autoimmune diseases, or intends to differentiate its layout in terms of indications.

Orum is a leader in this field, being the first and third new molecular entities to enter clinical trials, and in addition to reaching an acquisition agreement with BMS, Orum has also laid out at least three DAC drug type pipelines, all using GSPT1 degraders, and has partnered with Futu Pharmaceutical to potentially collaborate on up to three exclusive monoclonal antibody (mAb) targets.

Overseas MNCs often expand their DAC pipeline layouts through collaborative acquisitions. In addition to the aforementioned BMS acquisition of Orum’s pipeline and the collaboration between Futu and Orum, in September 2023, Nurix announced a collaboration agreement with Seagen to jointly develop multiple DACs, with Seagen paying a $60 million upfront payment, $3.4 billion in milestone amounts, and a certain percentage of sales sharing. In December 2023, MSD reached a collaboration agreement with C4 Therapeutics to jointly develop DACs targeting an undisclosed tumor target. According to the agreement, C4T is expected to receive approximately $600 million in milestone payments. Additionally, Merck has the option to extend the collaboration to three additional targets. If Merck exercises all options for extended collaboration, C4T will have the opportunity to receive up to approximately $2.5 billion in potential payments throughout the collaboration.

MNCs, apart from AbbVie, also include Novartis, Roche (Genentech), Eisai, and GSK, all of which have publicly disclosed related DAC publications. Since they have not been reflected in pipelines, they are considered early explorations and will not be elaborated further here. The relevant patents of Mablink have been mentioned in a previous tweet. Among other overseas biotechs, notable mentions include iLeadBMS’s IL2401, targeting Trop2, with CCNK degrader as the effective payload for treating solid tumors. AbCellera/Prelude Therapeutics’ DAC pipeline has not disclosed antibody targets, and the selection of effective payload targets is also very bold.

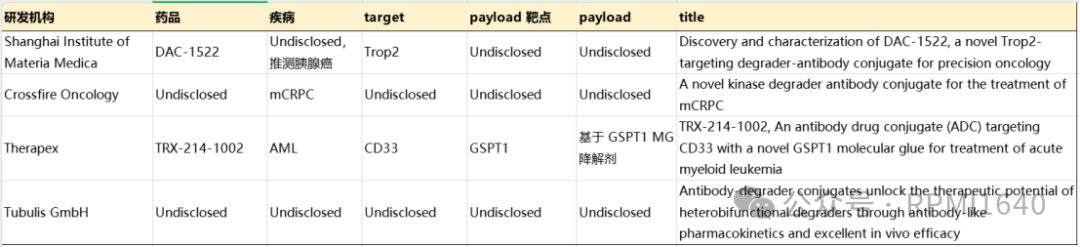

Recently disclosed abstracts from AACR indicate that there are still few studies related to DACs, with only Therapex clearly disclosing antigen and degradation targets. Therapex’s TRX-214-1002, like ORM-6151, targets CD33, with GSPT1 molecular glue as the effective payload, mentioning superior efficacy at lower doses in vivo, resembling a me-better logic. The Shanghai Institute of Materia Medica disclosed DAC-1522 targeting Trop-2, which appears to be in the early stages based on the abstract data, with the degrader target not disclosed, which is worth looking forward to. Crossfire’s DAC targets mCRPC, and the poster disclosed at ENA2024 is similar, still not specifically mentioning related targets, but from the description of cell cycle kinases, it may be a member of the CDK family. Tubulis’ publicly available information leans more towards platform technology, capable of constructing high DAR DACs based on PROTAC.

Let’s say some auspicious words, the future is promising.