Recently, the escalating US-China tariff war has become the core battleground of the economic strategic game between the two countries.In the short term, the US-China tariff war will accelerate the decoupling of technology and industrial chains, impacting domestic manufacturers that rely on US technology and chips. In the long run, the tariff war is beneficial for technological self-reliance and the substitution of domestic chips.

Tariff War Escalation

The US-China tariff dispute began during Trump’s previous term, at that time, the US imposed $250 billion worth of Chinese goods with a 25% tariff, mainly covering machinery, electronics, chemicals, and other fields. China retaliated by imposing tariffs of 5%-25% on $110 billion worth of US goods, including agricultural products, automobiles, and energy. Subsequently, China promised to increase purchases of $200 billion worth of energy and agricultural products, and the US suspended its planned tariffs on $160 billion worth of Chinese goods, maintaining a situation of conflict without breaking.

During Biden’s administration, the Biden administration continued the tariff policies of the Trump era but initiated targeted tariff exclusion procedures, indicating that there has been some easing of the tariff issue between the US and China during Biden’s years in office.

After Trump returns to the White House, he has pushed the tariff dispute to a new peak. By April 2025, the cumulative tariffs on US goods imported from China will reach 104%.

In April 2025, China responded to the high tariff policies of the US with corresponding countermeasures, officially imposing an additional 50% tariff on all imported goods originating from the US, raising China’s overall tariff rate on the US to 84%.

Given that Trump has made “reshaping American manufacturing” and “America First” as campaign slogans, in order to cater to American populism and fulfill promises made to his supporters, the tariff dispute between the US and China will likely remain relatively severe for a long time.

The USIDM Chip Manufacturers Are Impacted

On April 4, China imposed an additional 34% tariff on all imported goods originating from the US, based on the current applicable tariff rate.

On April 11, the China Semiconductor Association released rules regarding the “origin” determination for semiconductor products:1.According to the General Administration of Customs, the origin of “integrated circuits” is determined based on the four-digit tariff number change principle, meaning the wafer fabrication site is recognized as the origin.

2.It is recommended that: the origin of “integrated circuits”, whether packaged or unpackaged, should be declared based on the location of the “wafer fabrication plant” during import customs clearance..

If the rules regarding the “origin” determination for semiconductor products released by the China Semiconductor Association receive official endorsement, then American chip manufacturers such as Intel will be impacted. In fact, due to the tariff war, Intel and Micron have already stopped quoting prices through their agents in mainland China.

According to the origin determination rules based on the wafer fabrication site, AMD, Qualcomm, Apple, NVIDIA, Xilinx, and other American IC design companies will not be affected by China’s additional tariff policies on semiconductor products manufactured at TSMC. However, Intel, Micron, TI, and other IDM manufacturers will be impacted by the tariff policies due to their wafer fabs located in the US.

In short, fabless manufacturers that fabricate at TSMC, UMC, Samsung, or SMIC will not be affected by the tariff policies, while those that fabricate at US wafer fabs will be impacted. American IDM manufacturers will be affected by the tariff policies as long as their factories are located in the US.

Practically speaking, Intel’s Xeon CPUs are manufactured, packaged, and tested in factories located in Oregon, USA, and are subject to full tariffs. Market research shows that the wholesale price of this model has increased from $4800 to $5200.

Benefits for Domestic Chip Substitution

The semiconductor industry chain is long, covering equipment, design, raw materials, manufacturing, and packaging/testing stages. Historically, American companies have dominated high-profit segments such as design and equipment, transferring some equipment and raw material industries to Japan, while moving manufacturing and packaging/testing industries to China and South Korea. Many chips are actually designed by American companies, fabricated by TSMC, and packaged/tested by mainland Chinese enterprises. If the packaging/testing site is recognized as the origin, many American chips could be recognized as originating from China.

This time, recognizing the wafer fabrication site as the origin effectively closes the loophole for using domestic packaging/testing to obscure the origin.

In fact, China’s current tariff policy has left a window open, as it does not consider the registration location of IC design companies as the origin. This means that chips from American fabless IC design companies such as AMD, Qualcomm, Apple, NVIDIA, and Xilinx will not be affected by the tariff policies. Ironically, the ones most affected are traditional IDM companies like Intel. Intel will inevitably pass the tariffs onto Chinese consumers, leading to an increase in Intel CPU prices.

This is beneficial for domestic CPUs, especially for completely independent CPUs like Loongson.

Conclusion

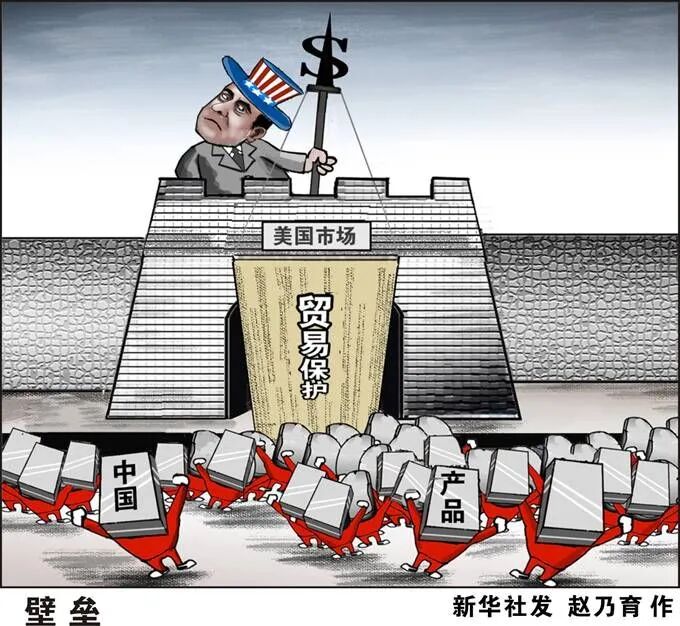

The US-China tariff war is essentially a desperate measure of an old empire facing a rising challenger, reminiscent of how Britain reacted to America’s rise by creating the pound zone to exclude the US. The US’s goal is clearly to reduce its market dependence on Chinese goods through increased tariffs, curb the transformation and upgrading of Chinese manufacturing, and prepare for further deterioration of US-China relations, such as conflicts in the Taiwan Strait or direct military confrontations, while also aiming to achieve manufacturing repatriation and revitalize the US real economy.

During the peak of imperial power, free trade was championed, but as empires decline, they inevitably resort to trade protectionism in the face of emerging powers. This was true for Britain a century ago, and it is true for the US today.

Historically, it is evident that the future decoupling of technology and industry between the US and China is an inevitable trend, and technological self-reliance is also a prevailing trend. Some people advocate abandoning independent chip research and development to integrate into the international mainstream, believing in a development path of mutual dependence, which has effectively failed.

In the future, the US and China will engage in a competition for dominance in high-tech industries.

©This article is an original content by Longke Duo (DragonLoveTech) Unauthorized reproduction is prohibited For reprints or cooperation, please contact the backend Selected articles The Chinese semiconductor industry under sanctions: less “boiling body” reporting, more rational support Longke Duo Issue 01: The “shame cloth” of foreign storage giants has been torn off Longke Duo Issue 02: Once suppressed by the US, can Japan’s semiconductor rise again? Longke Duo Issue 03: How can China’s semiconductor break through under the US-Japan joint blockade? Longke Duo Issue 04: Will DJI be choked? Longke Duo Issue 05: How did the US precisely sanction Chinese printer companies? Huawei 5G phones return? How can China break through the bottleneck of RF technology? Welcome to click on the video and follow Longke Duo’s video account, and feel free to add Longke Duo’s personal WeChat for discussions on Chinese technology.

©This article is an original content by Longke Duo (DragonLoveTech) Unauthorized reproduction is prohibited For reprints or cooperation, please contact the backend Selected articles The Chinese semiconductor industry under sanctions: less “boiling body” reporting, more rational support Longke Duo Issue 01: The “shame cloth” of foreign storage giants has been torn off Longke Duo Issue 02: Once suppressed by the US, can Japan’s semiconductor rise again? Longke Duo Issue 03: How can China’s semiconductor break through under the US-Japan joint blockade? Longke Duo Issue 04: Will DJI be choked? Longke Duo Issue 05: How did the US precisely sanction Chinese printer companies? Huawei 5G phones return? How can China break through the bottleneck of RF technology? Welcome to click on the video and follow Longke Duo’s video account, and feel free to add Longke Duo’s personal WeChat for discussions on Chinese technology.