Shijia Photonics (SH:688313) primarily produces PLC optical splitter chips, AWG chips, VOA chips and device modules, OSW chips, WDM devices and modules, optical fiber connector jumpers, FP laser chips, DFB laser chips, EML laser chips, indoor optical cables, and polymer materials for cables.

The products applied in AI data centers include:

4CH AWG wafer chips

4x25Gb/s PSM4 optical transmitter components

4x25Gb/s PSM4 optical receiver components

4x25Gb/s CWDM4/CLR4 optical transmitter components

4x25Gb/s CWDM4/CLR4 optical receiver components

25Gbps industrial-grade LR optical transmitter components

25Gbps LR PIN optical receiver components

25Gbps electro-absorption modulated optical transmitter components

MPO-MPO jumpers

Pre-terminated jumpers

MPO pre-terminated jumpers

Pre-terminated optical fiber distribution frames

Data center optical cable Type I

Data center optical cable Type II

Data center optical cable Type III

1310 high-power laser chips

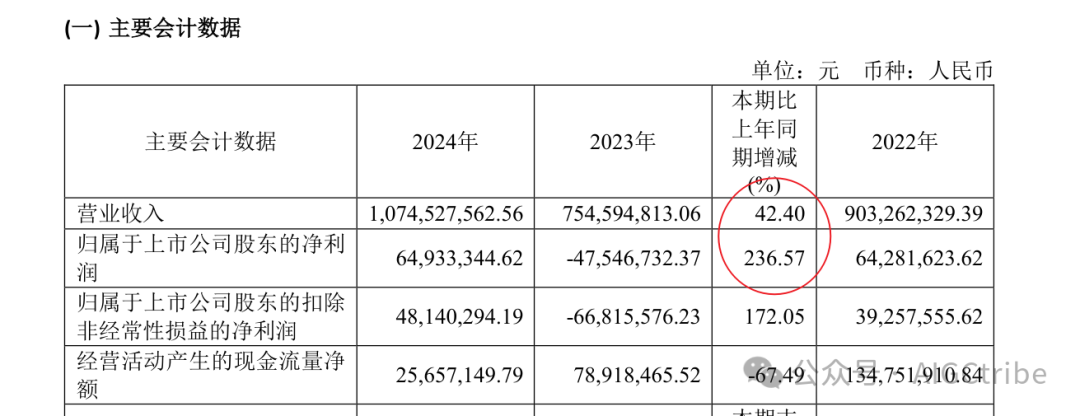

The company’s revenue and profit are expected to grow significantly in 2024.

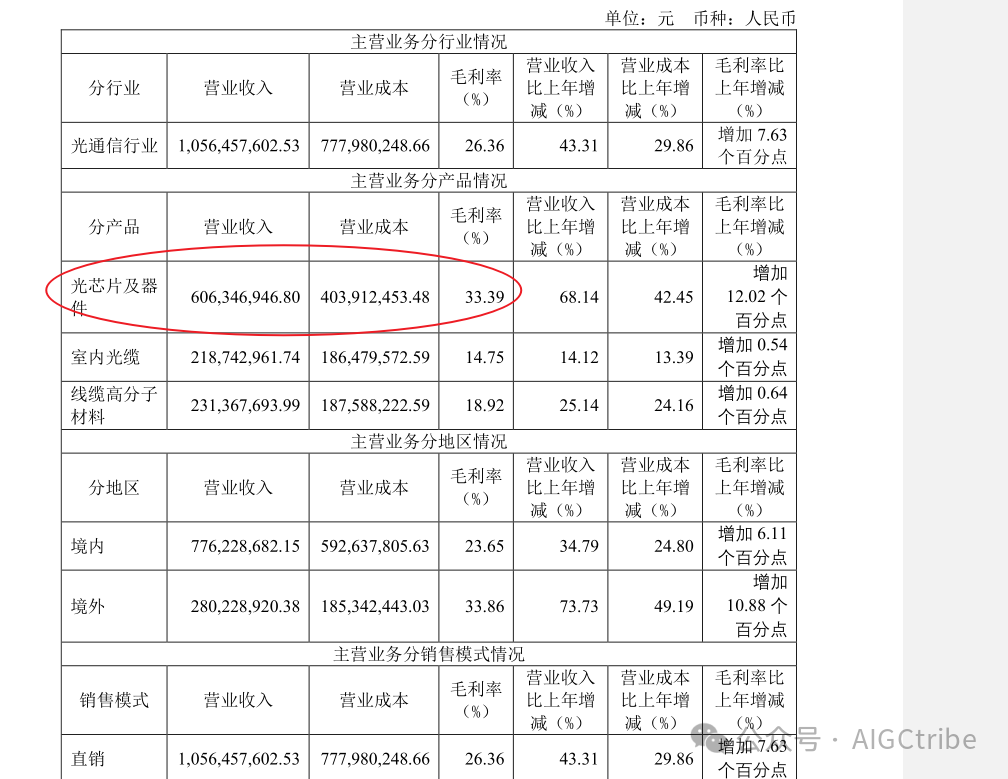

Among them, revenue from optical chips and optical devices increased by 68%, with a gross margin increase of 12%.

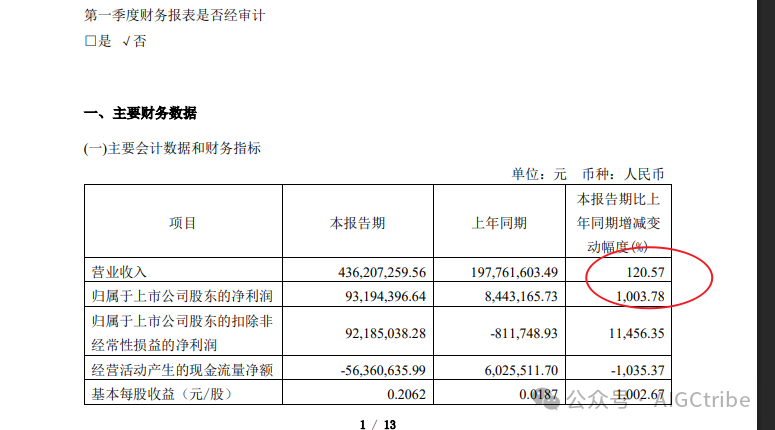

The first quarter performance growth is even more astonishing, with revenue up 120% and net profit up 1003%, indicating a rapid increase in both volume and price of its products.

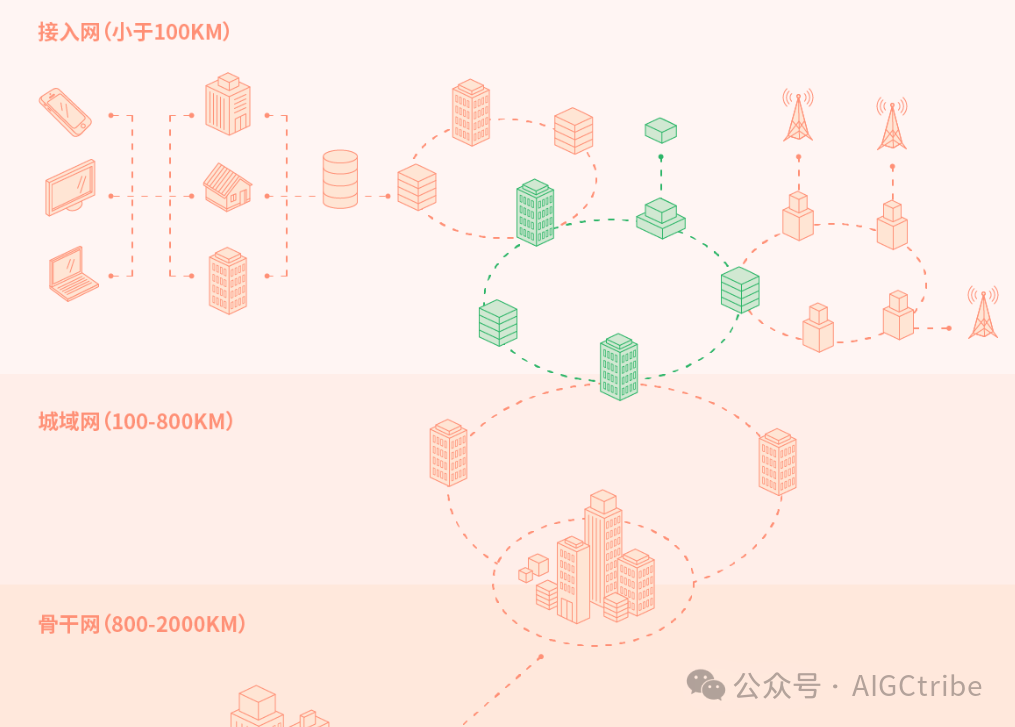

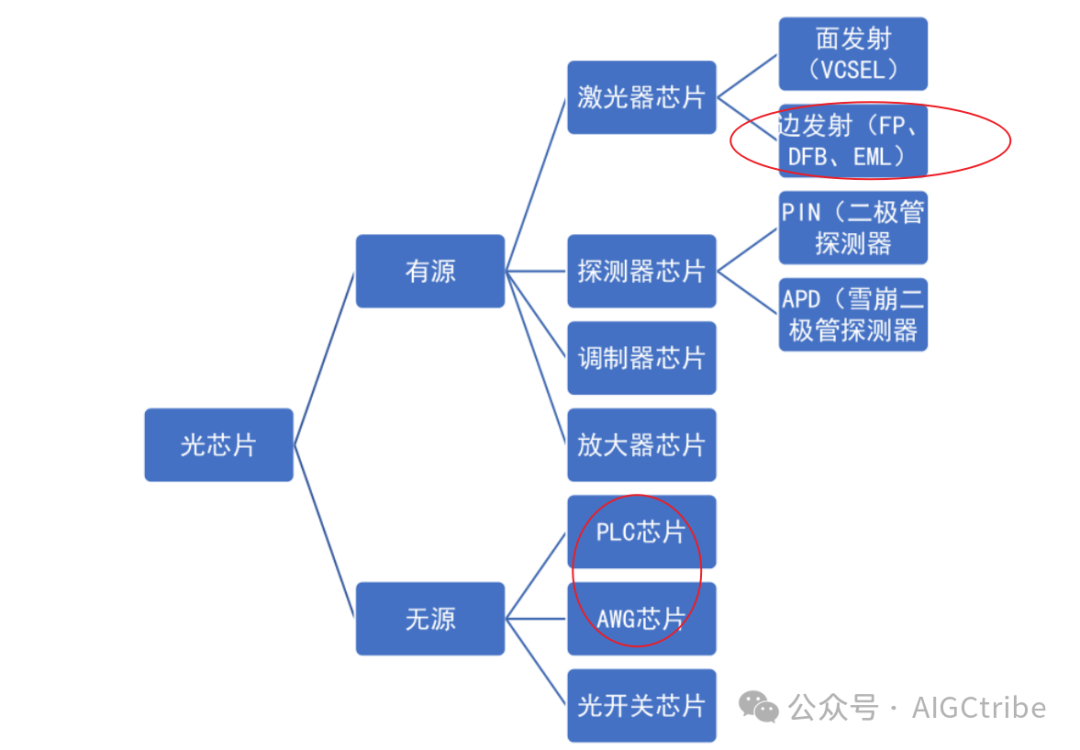

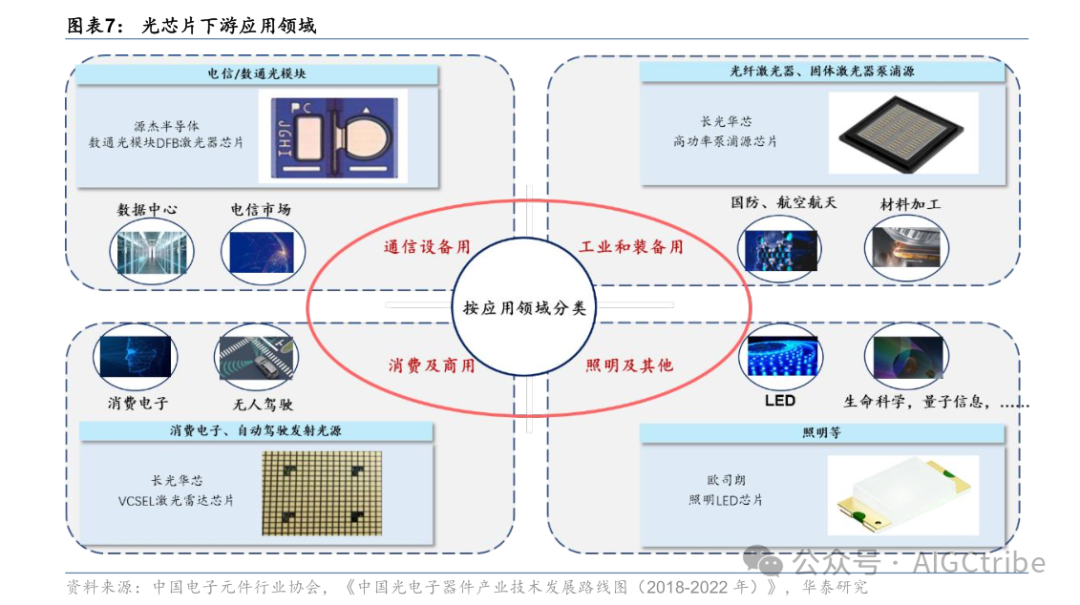

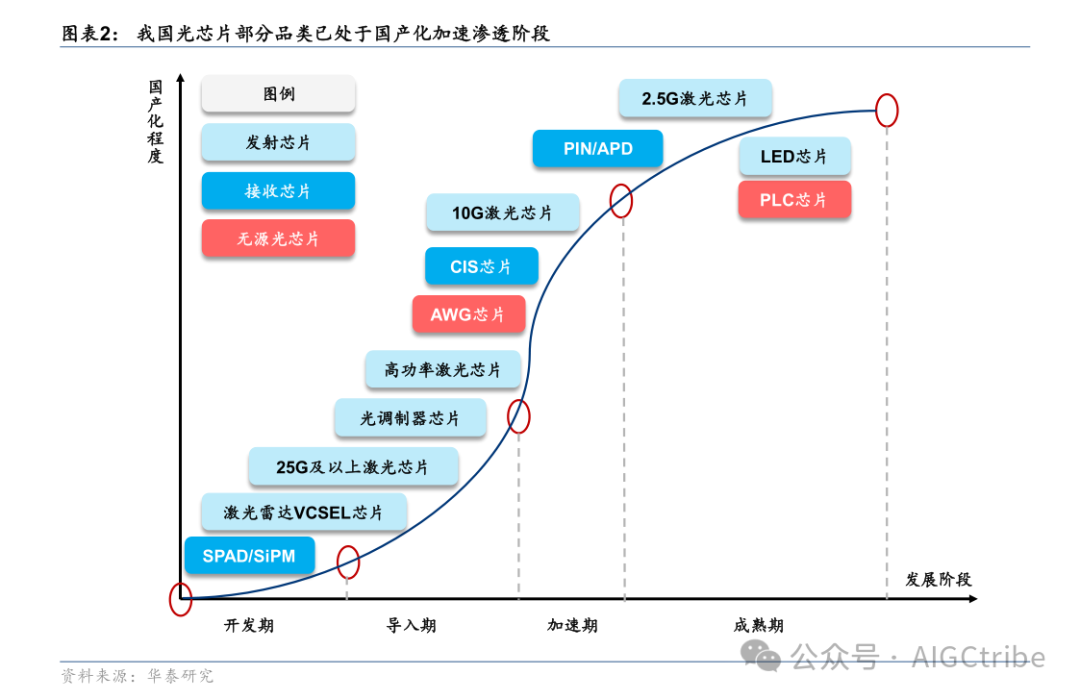

Optical chips are the core component of optical modules, with various types categorized into active chips and passive chips (PLC chips, AWG chips, VOA chips, OSW chips). Active optical chips include laser chips (edge-emitting laser chips such as FP chips, DFB chips, and EML chips; surface-emitting laser chips VCSEL) and detector chips (PIN photodiode PIN-PD chips, avalanche photodiode APD chips). High-power laser chips and electronic chip technologies above 25G are challenging, with low domestic substitution rates, representing major investment opportunities; laser chips below 10G and passive optical chips have high domestic substitution rates and intense competition. Laser chips are widely used in other industries requiring light sources, such as laser manufacturing, medical applications, lidar, and laser weapons, offering significant horizontal expansion potential.

The company is expanding horizontally and vertically around optical chips: in horizontal expansion, the company has moved from a single PLC optical splitter chip to a series of passive chips (AWG chips, VOA chips, OSW chips) and active chips (DFB laser chips, high-power CW DFB laser chips, EML laser chips), evolving towards “passive + active” optoelectronic integration in line with industry trends; in vertical extension, the company is based on wafers and chips, gradually extending from optical chips to optical devices and optical modules through continuous improvement of packaging technology.

The company’s optical chip business has a promising development outlook, driven by three main factors:

● High growth in downstream demand

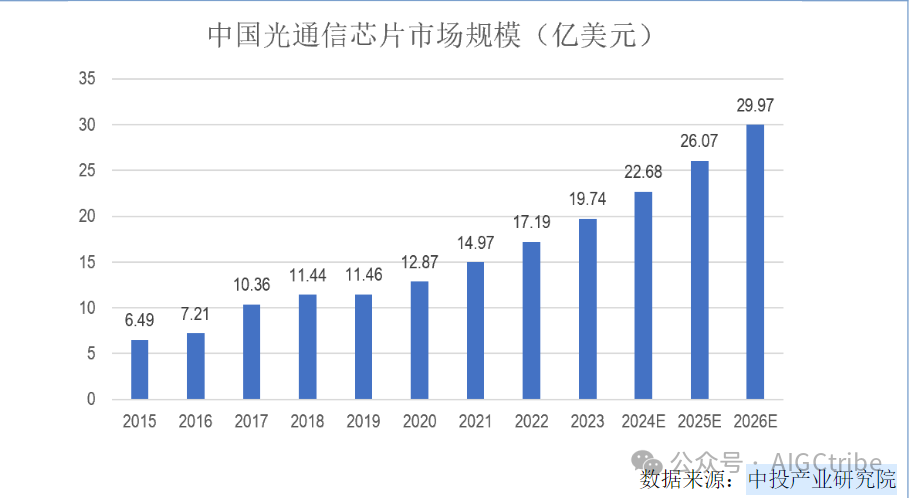

The optical communication industry market research organization LightCounting recently reported that the optical communication chip market is expected to grow at a compound annual growth rate (CAGR) of 17% between 2025 and 2030, with total sales increasing from approximately $3.5 billion in 2024 to over $11 billion by 2030. According to the China Business Industry Research Institute, the domestic optical chip market is expected to reach approximately $3 billion by 2026.

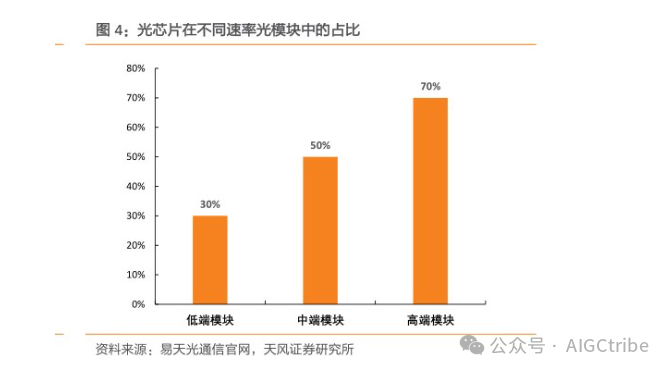

A new round of technological revolution represented by AI is sweeping the globe, and the massive growth and upgrade of computing infrastructure will become an inevitable trend. In this context, optical chips, as the core components of optical modules, have a very large market demand, especially for mid-to-high-end optical chips. According to LightCounting data, the proportion of optical chips in the optical module market is expected to rise from about 15% in 2018 to over 25% after 2025, showing an upward trend. Optoelectronic devices are an important component of optical modules, with the cost distribution of optical chips across low-end, mid-range, and high-end devices being approximately 20%, 50%, and 70%, respectively. As industries such as communications and AI rapidly increase their demand for high-performance optical modules, optical chips will exhibit a trend of simultaneous growth in both volume and price.

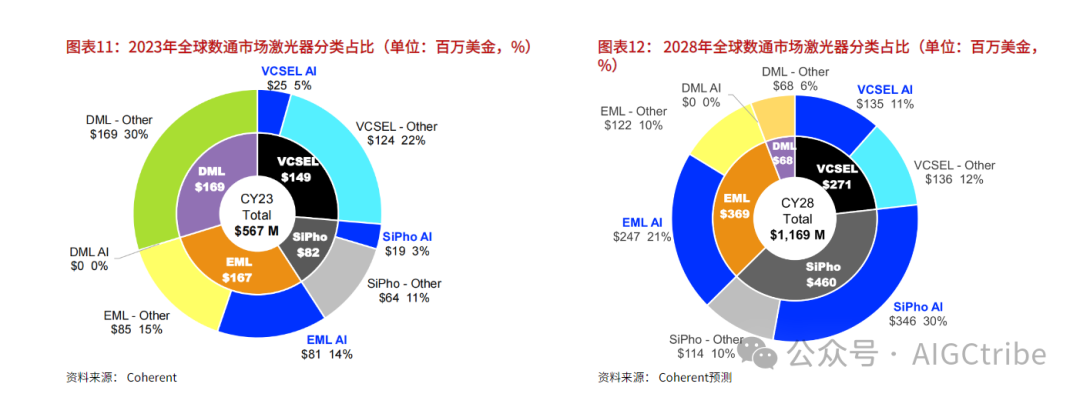

In the short term, the demand for optical chips driven by AI comes from 800G products, mainly based on 100G VCSEL and EML lasers; the medium to long-term demand comes from 1.6T products, mainly based on 200G EML, DFB, and VCSEL lasers. VCSEL lasers are used in multimode optical modules, and due to the significant increase in interconnect demand among GPUs in AI training clusters, they are expected to grow rapidly. Coherent predicts that the market size for AI VCSEL optical modules will grow from $300 million in 2023 to $1.6 billion in 2028, with the proportion increasing from 6% to 14%. EML lasers are used in single-mode optical modules, suitable for long-distance interconnects, and are mainly used for interconnecting upper-layer switches to achieve large-scale AI clusters. Coherent predicts that the market size for AI EML optical modules will grow from $600 million in 2023 to $2 billion in 2028, with the proportion increasing from 12% to 18%. Coherent forecasts that the proportion of lasers used in AI will grow from 22% in 2023 to 62% in 2028. Among them, the market size for AI VCSEL lasers will grow from $25 million in 2023 to $135 million in 2028, with the proportion increasing from 5% to 11%; the market size for AI EML lasers will grow from $81 million in 2023 to $247 million in 2028, with the proportion increasing from 14% to 21%; the market size for AI silicon photonic chips will grow from $19 million in 2023 to $346 million in 2028, with the proportion increasing from 3% to 30%.

Additionally, optical chips have numerous application scenarios including lidar, sensors, consumer electronics, aerospace, and quantum information. As the application fields of optical chips deepen and technological innovations drive new application scenarios such as lidar, the growth potential of the optical chip market remains vast. From the perspective of leading overseas manufacturers, Coherent (NYSE:COHR) and Lumentum Holdings (NASDAQ:LITE) have both exceeded 10 billion RMB in revenue.

● Domestic substitution

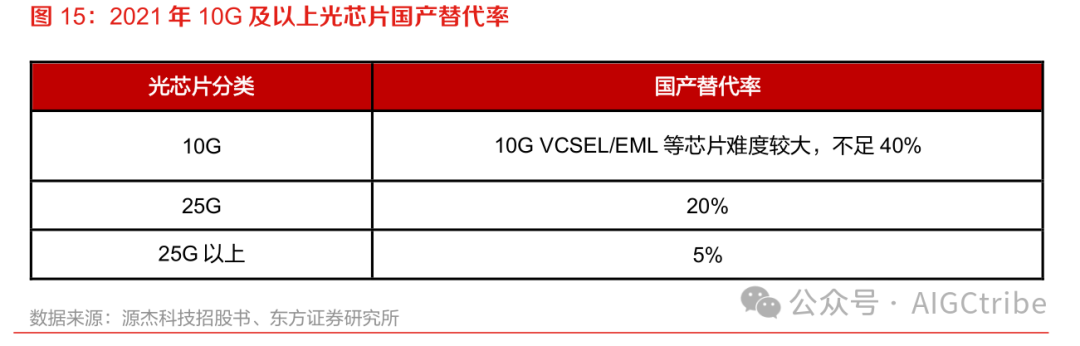

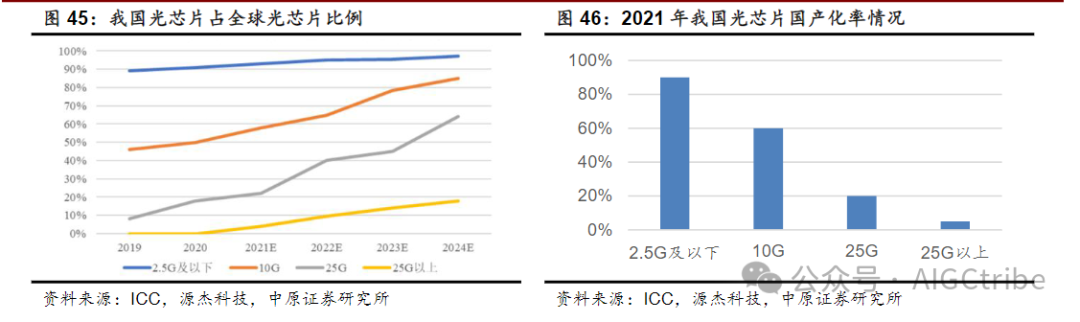

Currently, the domestic substitution rate for high-power laser chips, high-speed laser chips, VCSEL chips, and other segmented tracks is generally low, providing ample room for domestic optical chip manufacturers to increase their market share. For example, the domestic substitution rate for optical chips above 25G was only 5% in 2021.

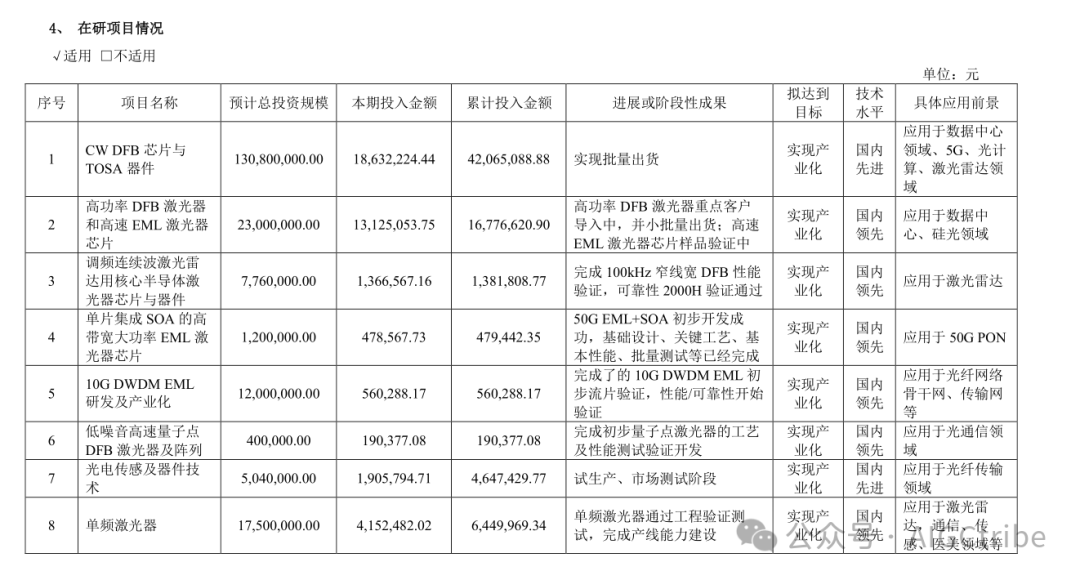

In 2024, the company is continuously making breakthroughs in mid-to-high-end optical chips:

1) Mass shipment of CWDM/LAN WDM AWG components for 400G and 800G optical modules;

2) Development of AWG chips and components suitable for 1.6T optical modules;

3) Development of MT-FA products for 800G/1.6T optical modules, achieving small batch shipments;

4) Development of multi-core high-density optical cable connectors (MMC/SNMT) for 800G/1.6T networks, achieving mass production;

5) Development of 1310nm 100G EML lasers for data centers;

6) Development of non-temperature-controlled 100mW CW DFB lasers and commercial temperature 200mW CW DFB lasers for data centers, achieving small batch shipments;

7) Development of high-power (>900mW) MOPA lasers for data centers and artificial intelligence computing power;

8) Development of 10G 1577nm EML lasers for gigabit access networks;

9) Development of 50G 1342nm EML+SOA lasers and 25G 1286nm DFB lasers for 10G access networks.

As a leading domestic optical chip manufacturer, Shijia Photonics (SH:688313) is gradually breaking the foreign technology monopoly in high-speed EML and CW DFB laser chips with continuous technological breakthroughs, and will enjoy significant benefits from import substitution.

According to ICC estimates, from 2019 to 2024, the sales scale of domestic optical chip manufacturers is continuously increasing its proportion in the global optical chip market, with mid-to-high-speed optical chips growing even faster.

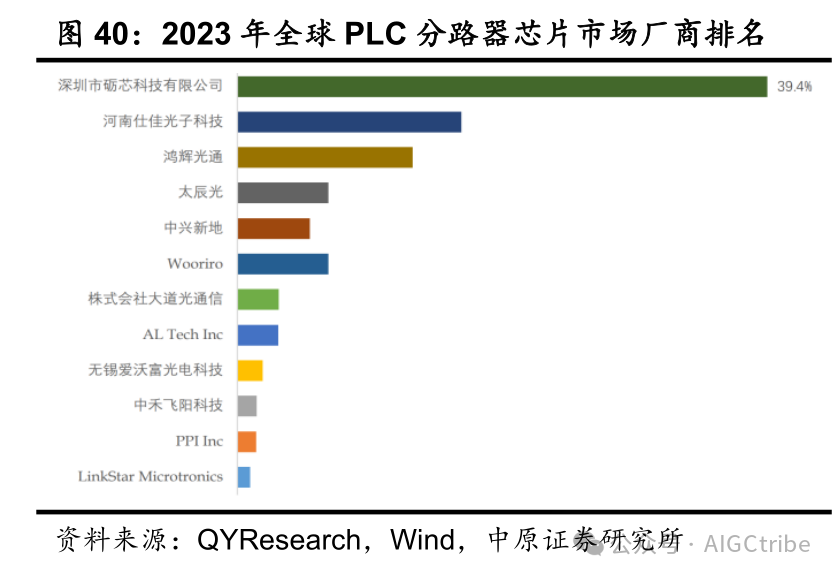

Currently, the company is the second largest in the global PLC splitter chip market. Major global manufacturers of PLC splitter chips include Shenzhen Lixin Technology Co., Ltd., Shijia Photonics, Honghui Optical Communication, Taicheng Light, ZTE, Wooriro, Daido Optical Communication Co., Ltd., AL Tech Inc, Wuxi Aifor Photonic Technology, and Zhonghe Feiyang Technology, with the top five manufacturers accounting for about 79%. It is believed that in the fields of EML and CW DFB laser chips, Shijia Photonics (SH:688313) and other domestic optical chip manufacturers will gradually capture more market share, moving from low-end to mid-to-high-end markets.

● Continuous horizontal expansion

The company’s wafer, chip, and device production model follows a vertically integrated IDM model, covering the entire process from chip design, wafer manufacturing, chip processing, to packaging and testing, allowing for full collaboration between design and manufacturing processes, which is beneficial for the company to develop and implement new technologies ahead of others. Specifically, the company adopts production reserve models, rapid response models, and sales-driven production models. IDM manufacturers of optical chips have strong horizontal product expansion capabilities. Since about 70% of the equipment and processes in the optoelectronic chip field of III-V compound semiconductors are interoperable, the company can more easily leverage its own process platform for horizontal expansion under the IDM model. The optical chip industry features many segmented categories. The company adopts a multi-product category layout, which can continuously explore new growth points through technological innovation while also mitigating the risks of cyclical fluctuations in demand in a single segmented market. The production materials, production lines, and processes for various optical chips can be reused to a certain extent, helping the company further leverage its scale advantages.