Recently, at the 2025 Shanghai International Auto Show, Intel held a technology launch event, officially introducing the second-generation AI-enhanced Software Defined Vehicle (SDV) system-on-chip (SoC) — the world’s first automotive chip utilizing a multi-process node Chiplet architecture, showcasing Intel’s ambition in the smart vehicle sector.On that day, Intel also announced a strategic partnership with industry pioneers such as ModelBest and Black Sesame Technology, further expanding its automotive ecosystem and injecting strong momentum into the innovative development of AI-driven cockpits, integrated Advanced Driver Assistance Systems (ADAS) solutions, and energy-efficient vehicle computing platforms.At the launch event, Intel Fellow, Vice President, and General Manager of the Automotive Division, Jack Weast, stated: “Intel is redefining automotive computing with the second-generation SDV SoC, perfectly integrating the flexibility of chiplet technology with mature vehicle solutions. Together with our partners, we aim to tackle industry challenges from energy efficiency to AI experiences, making the revolution of software-defined vehicles accessible to everyone.”Jack Weast speaking at the launch event / Screenshot from Intel’s official websiteHow Chiplet Architecture is Redefining Automotive Chip Rules (1) Multi-Node Chiplet ArchitectureIntel’s second-generation SDV SoC is the first to apply a multi-process node Chiplet architecture in the automotive field. This design allows different functional modules (such as computing, graphics, and AI accelerators) to be manufactured using different process technologies. By integrating chiplets with different functions, each small module can utilize the most suitable process node for its function, akin to building blocks. Automotive manufacturers can flexibly choose computing, graphics, and AI functional modules for personalized customization based on their product positioning and market demands. This flexibility not only reduces development costs but also enables automakers to customize performance combinations on demand, such as tripling graphics performance compared to traditional solutions and achieving up to a tenfold increase in AI computing power.Technical Highlights:Performance Leap: Compared to the previous generation, its GPU+NPU performance in generative AI tasks has improved tenfold, meeting the demands of ADAS and immersive cockpits;Graphics processing capability has tripled, bringing revolutionary changes to automotive Human-Machine Interfaces (HMI), such as making map navigation on in-car displays more three-dimensional and vivid; supports 12-channel camera inputs, significantly enhancing camera input and image processing capabilities, allowing vehicles to obtain more comprehensive environmental information, achieve more accurate target recognition and path planning, and significantly improve driving safety and reliability.Energy Efficiency Optimization: Through dynamic power management and task scheduling technologies, overall vehicle energy consumption is reduced by 30%, while supporting the parallel operation of multiple operating systems (such as Linux, Android, AutoSAR).(2) Cross-Industry Extension of the x86 EcosystemIntel is actively extending its mature x86 architecture and Core chip technology from the PC domain to automotive scenarios. The second-generation SDV SoC is built on Intel 7 process technology, providing powerful computing capabilities that support a smooth high-performance gaming experience and stable video conferencing functions similar to PC environments. Notably, this chip can efficiently run the DeepSeek large language model with 32 billion parameters locally, achieving millisecond-level response for voice interactions, significantly enhancing human-machine interaction efficiency.This “AI PC on Wheels” strategy not only addresses the latency issues associated with cloud dependency but also reduces computing costs for automakers. According to industry research institutions, adopting Intel’s second-generation SDV SoC can reduce chip development costs for automotive manufacturers by an average of 30%-40%, allowing products to hit the market 6-9 months earlier. This enables automakers to respond more quickly to market changes and launch competitive new products, gaining an edge in the fierce market competition.

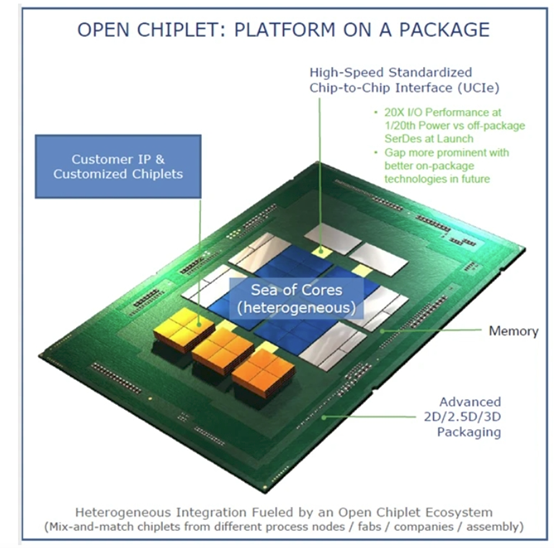

(1) Multi-Node Chiplet ArchitectureIntel’s second-generation SDV SoC is the first to apply a multi-process node Chiplet architecture in the automotive field. This design allows different functional modules (such as computing, graphics, and AI accelerators) to be manufactured using different process technologies. By integrating chiplets with different functions, each small module can utilize the most suitable process node for its function, akin to building blocks. Automotive manufacturers can flexibly choose computing, graphics, and AI functional modules for personalized customization based on their product positioning and market demands. This flexibility not only reduces development costs but also enables automakers to customize performance combinations on demand, such as tripling graphics performance compared to traditional solutions and achieving up to a tenfold increase in AI computing power.Technical Highlights:Performance Leap: Compared to the previous generation, its GPU+NPU performance in generative AI tasks has improved tenfold, meeting the demands of ADAS and immersive cockpits;Graphics processing capability has tripled, bringing revolutionary changes to automotive Human-Machine Interfaces (HMI), such as making map navigation on in-car displays more three-dimensional and vivid; supports 12-channel camera inputs, significantly enhancing camera input and image processing capabilities, allowing vehicles to obtain more comprehensive environmental information, achieve more accurate target recognition and path planning, and significantly improve driving safety and reliability.Energy Efficiency Optimization: Through dynamic power management and task scheduling technologies, overall vehicle energy consumption is reduced by 30%, while supporting the parallel operation of multiple operating systems (such as Linux, Android, AutoSAR).(2) Cross-Industry Extension of the x86 EcosystemIntel is actively extending its mature x86 architecture and Core chip technology from the PC domain to automotive scenarios. The second-generation SDV SoC is built on Intel 7 process technology, providing powerful computing capabilities that support a smooth high-performance gaming experience and stable video conferencing functions similar to PC environments. Notably, this chip can efficiently run the DeepSeek large language model with 32 billion parameters locally, achieving millisecond-level response for voice interactions, significantly enhancing human-machine interaction efficiency.This “AI PC on Wheels” strategy not only addresses the latency issues associated with cloud dependency but also reduces computing costs for automakers. According to industry research institutions, adopting Intel’s second-generation SDV SoC can reduce chip development costs for automotive manufacturers by an average of 30%-40%, allowing products to hit the market 6-9 months earlier. This enables automakers to respond more quickly to market changes and launch competitive new products, gaining an edge in the fierce market competition. Open Chiplet Architecture Platform / UCIe Alliance ImageIntel’s Collaborative Ecosystem Analysis

Open Chiplet Architecture Platform / UCIe Alliance ImageIntel’s Collaborative Ecosystem Analysis (1) ModelBest: The “Vehicle-End Revolution” of Offline Large Language ModelsThe collaboration between ModelBest and Intel marks a significant breakthrough in in-vehicle AI technology. By equipping the Intel second-generation SDV SoC and Arc graphics card, ModelBest’s GUI intelligent agent has achieved full offline support for large language models (LLM) at the vehicle end for the first time.This technological breakthrough is underpinned by powerful localized computing capabilities. The Intel SDV SoC provides over 200 TOPS of AI computing power, combined with the Arc graphics card featuring 16GB of GDDR6 memory, laying a solid foundation for the local operation of the DeepSeek large model with 32 billion parameters. Compared to the commonly used 7 billion parameter models in the industry, the parameter scale advantage of the DeepSeek large model significantly enhances the depth and breadth of semantic understanding.Even in environments without network connectivity, such as tunnels or remote mountainous areas, it can achieve millisecond-level response for voice interactions, ensuring users have a smooth and efficient interaction experience. Li Li, director of the Intelligent Driving Laboratory at Tsinghua University, commented: “Offline LLM is not only a technological breakthrough but also a qualitative change in user experience. It fills the service gap in network blind spots, providing a differentiated advantage for Chinese automakers in the high-end market.”Behind this performance enhancement is the technological migration of Intel’s AI PC acceleration program: ModelBest has optimized voice command recognition accuracy to 98%, maintaining 92% accuracy even in noisy environments (such as wind noise while driving at high speeds), while extending the context memory length to 10 rounds of dialogue, significantly better than Tesla’s FSD limit of 5 rounds.Moreover, its localized processing also addresses data privacy and compliance issues. According to China’s “Automotive Data Security Management Regulations,” sensitive data such as voice and images within the cabin must be stored and processed in the vehicle. Intel Fellow Jack Weast further emphasized: “The ‘zero-compromise’ requirement for vehicle-end AI necessitates deep collaboration between hardware and algorithms, which is the value of our partnership with ModelBest — redefining the boundaries of human-vehicle interaction.”(2) Black Sesame Technology: The “Central Brain” Paradigm of Cabin-Driving IntegrationThe collaboration between Black Sesame Technology and Intel focuses on the deep integration of ADAS and intelligent cockpits, showcasing a new height of technological integration with their jointly developed cabin-driving integration platform. This platform integrates the Intel SDV SoC and Black Sesame’s self-developed Huashan A2000 and Wudang C1200 chips, pooling computing power to elevate total computing capacity to 1000 TOPS, with the Huashan A2000 contributing 400 TOPS of autonomous driving computing power, and the Intel SDV SoC providing 600 TOPS of general computing and graphics rendering capabilities. The disruptive nature of this architecture lies in its ability to simultaneously process data from 12 camera inputs and render 4 4K screens in real-time, with an overall power consumption of only 45W, reducing power consumption by 52% compared to traditional separate solutions.Market research firm Counterpoint analyst Neil Shah pointed out: “The combination of Intel and Black Sesame is rewriting the market landscape. In the first quarter of 2025, this solution captured 17% of the share in China’s L2+ vehicle segment, surpassing Qualcomm’s Snapdragon Ride Flex at 12%. The secret to its success lies in its localization adaptation capability — Chinese automakers using NVIDIA Orin chips need to invest an additional 30% in R&D costs for algorithm migration, while the Intel + Black Sesame solution offers ‘out-of-the-box’ ecological support.”

(1) ModelBest: The “Vehicle-End Revolution” of Offline Large Language ModelsThe collaboration between ModelBest and Intel marks a significant breakthrough in in-vehicle AI technology. By equipping the Intel second-generation SDV SoC and Arc graphics card, ModelBest’s GUI intelligent agent has achieved full offline support for large language models (LLM) at the vehicle end for the first time.This technological breakthrough is underpinned by powerful localized computing capabilities. The Intel SDV SoC provides over 200 TOPS of AI computing power, combined with the Arc graphics card featuring 16GB of GDDR6 memory, laying a solid foundation for the local operation of the DeepSeek large model with 32 billion parameters. Compared to the commonly used 7 billion parameter models in the industry, the parameter scale advantage of the DeepSeek large model significantly enhances the depth and breadth of semantic understanding.Even in environments without network connectivity, such as tunnels or remote mountainous areas, it can achieve millisecond-level response for voice interactions, ensuring users have a smooth and efficient interaction experience. Li Li, director of the Intelligent Driving Laboratory at Tsinghua University, commented: “Offline LLM is not only a technological breakthrough but also a qualitative change in user experience. It fills the service gap in network blind spots, providing a differentiated advantage for Chinese automakers in the high-end market.”Behind this performance enhancement is the technological migration of Intel’s AI PC acceleration program: ModelBest has optimized voice command recognition accuracy to 98%, maintaining 92% accuracy even in noisy environments (such as wind noise while driving at high speeds), while extending the context memory length to 10 rounds of dialogue, significantly better than Tesla’s FSD limit of 5 rounds.Moreover, its localized processing also addresses data privacy and compliance issues. According to China’s “Automotive Data Security Management Regulations,” sensitive data such as voice and images within the cabin must be stored and processed in the vehicle. Intel Fellow Jack Weast further emphasized: “The ‘zero-compromise’ requirement for vehicle-end AI necessitates deep collaboration between hardware and algorithms, which is the value of our partnership with ModelBest — redefining the boundaries of human-vehicle interaction.”(2) Black Sesame Technology: The “Central Brain” Paradigm of Cabin-Driving IntegrationThe collaboration between Black Sesame Technology and Intel focuses on the deep integration of ADAS and intelligent cockpits, showcasing a new height of technological integration with their jointly developed cabin-driving integration platform. This platform integrates the Intel SDV SoC and Black Sesame’s self-developed Huashan A2000 and Wudang C1200 chips, pooling computing power to elevate total computing capacity to 1000 TOPS, with the Huashan A2000 contributing 400 TOPS of autonomous driving computing power, and the Intel SDV SoC providing 600 TOPS of general computing and graphics rendering capabilities. The disruptive nature of this architecture lies in its ability to simultaneously process data from 12 camera inputs and render 4 4K screens in real-time, with an overall power consumption of only 45W, reducing power consumption by 52% compared to traditional separate solutions.Market research firm Counterpoint analyst Neil Shah pointed out: “The combination of Intel and Black Sesame is rewriting the market landscape. In the first quarter of 2025, this solution captured 17% of the share in China’s L2+ vehicle segment, surpassing Qualcomm’s Snapdragon Ride Flex at 12%. The secret to its success lies in its localization adaptation capability — Chinese automakers using NVIDIA Orin chips need to invest an additional 30% in R&D costs for algorithm migration, while the Intel + Black Sesame solution offers ‘out-of-the-box’ ecological support.” In-Vehicle AI Technology Illustration / South China Morning Post Report ImageAutomotive Chip Industry Landscape Amidst the Sino-U.S. Technology Competition

In-Vehicle AI Technology Illustration / South China Morning Post Report ImageAutomotive Chip Industry Landscape Amidst the Sino-U.S. Technology Competition (1) Comparison of Automotive Chip Technology Development Status Between China and the U.S.In the field of automotive chip technology, both China and the U.S. are globally leading, but there are certain differences in technological development directions and areas of advantage. The U.S., with its strong technological strength and semiconductor industry foundation, has clear advantages in high-end chip design and AI algorithm development.The second-generation SDV SoC launched by Intel is a typical representative of U.S. innovation in automotive chip technology. Its advanced multi-node chiplet architecture, excellent AI performance, and graphics processing capabilities demonstrate the leading level of the U.S. in chip technology. Additionally, American companies like NVIDIA and Qualcomm are also performing well in the automotive chip market, with NVIDIA’s autonomous driving chips holding a significant share in the global market, while Qualcomm has strong competitiveness in automotive communication chips. Meanwhile, China has also made significant progress in the automotive chip field, particularly in mid-to-low-end chip manufacturing and application innovation.For example, some Chinese companies have achieved domestic substitution in power chips, sensor chips, and other areas, reducing automotive manufacturers’ reliance on imported chips.In terms of application innovation, Chinese automotive manufacturers and technology companies are actively exploring application scenarios such as intelligent cockpits and autonomous driving, enhancing the intelligence level of vehicles through software-defined vehicles, compensating for some shortcomings in chip design. At the same time, China’s leading position in 5G communication technology also provides strong support for the application of automotive chips in the Internet of Vehicles field.(2) Impact of Intel’s Collaboration on the U.S. Automotive Chip IndustryIntel’s collaborations with companies like ModelBest and Black Sesame Technology will have multiple impacts on the U.S. automotive chip industry. From the perspective of technological innovation, such cross-company collaborations can promote the exchange and integration of different technologies, sparking more innovative ideas. For instance, the collaboration between Intel and ModelBest in intelligent cockpit interaction technology is expected to drive broader application and deeper development of AI technology in the automotive field, providing momentum for the U.S. automotive chip industry to maintain its leading position in intelligent cockpit technology.From a market competition perspective, Intel has expanded its automotive ecosystem through collaboration, enhancing the market competitiveness of its products, which helps U.S. automotive chip companies capture a larger share in the global market. Additionally, Intel’s collaboration model also serves as a reference for other U.S. automotive chip companies, encouraging more companies to strengthen cooperation with upstream and downstream enterprises, forming a more complete industrial ecosystem and further enhancing the overall competitiveness of the U.S. automotive chip industry. However, such collaborations may also bring potential risks, such as technology leakage and dependency on partners, which U.S. companies need to pay attention to and guard against during the collaboration process.(3) Challenges and Opportunities for China’s Automotive Chip IndustryIntel’s layout and collaboration in the automotive chip field pose certain challenges to China’s automotive chip industry. In terms of technological competition, Intel’s advanced chip technology and innovative collaboration model may further widen the technological gap between China and the U.S. in the high-end automotive chip sector.Chinese companies need to increase R&D investment and accelerate technological innovation to avoid being eliminated in market competition. In terms of market share, Intel, with its brand influence and collaboration advantages, may capture some market share from Chinese automotive chip companies, especially in the high-end and international markets, where Chinese companies will face more intense competition.However, challenges and opportunities coexist. Intel’s entry also brings some opportunities for China’s automotive chip industry. On one hand, Chinese companies can learn from and adopt advanced technologies and management experiences from international companies like Intel through competition and collaboration, enhancing their own technological level and innovation capabilities. For example, the collaboration between Black Sesame Technology and Intel provides valuable learning and development opportunities for Chinese companies in the field of cabin-driving integration technology. On the other hand, Intel’s layout also encourages China to increase support for the automotive chip industry, promoting the optimization and improvement of industrial policies, creating a better policy environment for the development of Chinese automotive chip companies. Furthermore, as China’s automotive market continues to expand and the pace of intelligent development accelerates, Chinese companies have certain geographical advantages and market insights in the domestic market, likely achieving breakthroughs in mid-to-low-end markets and specific application areas, forming differentiated competitive advantages.

(1) Comparison of Automotive Chip Technology Development Status Between China and the U.S.In the field of automotive chip technology, both China and the U.S. are globally leading, but there are certain differences in technological development directions and areas of advantage. The U.S., with its strong technological strength and semiconductor industry foundation, has clear advantages in high-end chip design and AI algorithm development.The second-generation SDV SoC launched by Intel is a typical representative of U.S. innovation in automotive chip technology. Its advanced multi-node chiplet architecture, excellent AI performance, and graphics processing capabilities demonstrate the leading level of the U.S. in chip technology. Additionally, American companies like NVIDIA and Qualcomm are also performing well in the automotive chip market, with NVIDIA’s autonomous driving chips holding a significant share in the global market, while Qualcomm has strong competitiveness in automotive communication chips. Meanwhile, China has also made significant progress in the automotive chip field, particularly in mid-to-low-end chip manufacturing and application innovation.For example, some Chinese companies have achieved domestic substitution in power chips, sensor chips, and other areas, reducing automotive manufacturers’ reliance on imported chips.In terms of application innovation, Chinese automotive manufacturers and technology companies are actively exploring application scenarios such as intelligent cockpits and autonomous driving, enhancing the intelligence level of vehicles through software-defined vehicles, compensating for some shortcomings in chip design. At the same time, China’s leading position in 5G communication technology also provides strong support for the application of automotive chips in the Internet of Vehicles field.(2) Impact of Intel’s Collaboration on the U.S. Automotive Chip IndustryIntel’s collaborations with companies like ModelBest and Black Sesame Technology will have multiple impacts on the U.S. automotive chip industry. From the perspective of technological innovation, such cross-company collaborations can promote the exchange and integration of different technologies, sparking more innovative ideas. For instance, the collaboration between Intel and ModelBest in intelligent cockpit interaction technology is expected to drive broader application and deeper development of AI technology in the automotive field, providing momentum for the U.S. automotive chip industry to maintain its leading position in intelligent cockpit technology.From a market competition perspective, Intel has expanded its automotive ecosystem through collaboration, enhancing the market competitiveness of its products, which helps U.S. automotive chip companies capture a larger share in the global market. Additionally, Intel’s collaboration model also serves as a reference for other U.S. automotive chip companies, encouraging more companies to strengthen cooperation with upstream and downstream enterprises, forming a more complete industrial ecosystem and further enhancing the overall competitiveness of the U.S. automotive chip industry. However, such collaborations may also bring potential risks, such as technology leakage and dependency on partners, which U.S. companies need to pay attention to and guard against during the collaboration process.(3) Challenges and Opportunities for China’s Automotive Chip IndustryIntel’s layout and collaboration in the automotive chip field pose certain challenges to China’s automotive chip industry. In terms of technological competition, Intel’s advanced chip technology and innovative collaboration model may further widen the technological gap between China and the U.S. in the high-end automotive chip sector.Chinese companies need to increase R&D investment and accelerate technological innovation to avoid being eliminated in market competition. In terms of market share, Intel, with its brand influence and collaboration advantages, may capture some market share from Chinese automotive chip companies, especially in the high-end and international markets, where Chinese companies will face more intense competition.However, challenges and opportunities coexist. Intel’s entry also brings some opportunities for China’s automotive chip industry. On one hand, Chinese companies can learn from and adopt advanced technologies and management experiences from international companies like Intel through competition and collaboration, enhancing their own technological level and innovation capabilities. For example, the collaboration between Black Sesame Technology and Intel provides valuable learning and development opportunities for Chinese companies in the field of cabin-driving integration technology. On the other hand, Intel’s layout also encourages China to increase support for the automotive chip industry, promoting the optimization and improvement of industrial policies, creating a better policy environment for the development of Chinese automotive chip companies. Furthermore, as China’s automotive market continues to expand and the pace of intelligent development accelerates, Chinese companies have certain geographical advantages and market insights in the domestic market, likely achieving breakthroughs in mid-to-low-end markets and specific application areas, forming differentiated competitive advantages.

Recommended Reading

Long-Term Vision: Summary of Mushroom Cloud’s Work in 2024 and New Year Greetings

Can Musk, who escaped DOGE, save Tesla, which has plummeted by 66%?

Google Forced to Spin Off Chrome, Search Market Set for Major Shake-Up