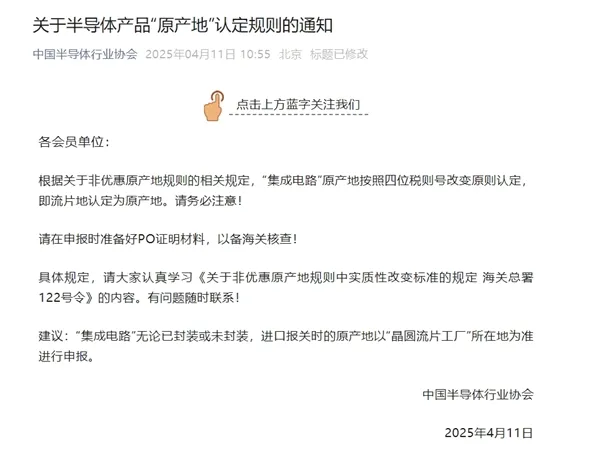

The China Semiconductor Industry Association has issued an “Emergency Notice on the Rules for the Recognition of the ‘Place of Origin’ of Semiconductor Products,” sparking widespread discussion.

The notice states that according to the relevant regulations of the General Administration of Customs, the place of origin of “integrated circuits” is determined based on the four-digit tariff code change principle, meaning that the wafer fabrication site is recognized as the place of origin.Please take note!

At the same time, the China Semiconductor Industry Association also recommends that, regardless of whether the “integrated circuits” are packaged or unpackaged, the place of origin for import customs declaration should be based on the location of the “wafer fabrication factory.”

The core content of this notice can be summarized in one sentence: “the wafer fabrication site is recognized as the place of origin.” What does this actually mean?

The semiconductor industry chain can be simply divided into four stages: design, manufacturing, packaging/testing, and end application, with wafer fabrication belonging to the manufacturing stage.

Wafer manufacturing (fabrication) is the most critical and technically demanding stage, directly determining the chip’s process technology.

Han Juke, Vice President of the China Communications Industry Association, stated that using the wafer fabrication site as the place of origin can more accurately identify the true technological source of the chips, avoiding the ambiguity of key technology attribution through the packaging site (usually labor-intensive regions).

At the same time, this move is a key step in China’s strategy for a self-controlled semiconductor industry chain, aligning with international trade rules while providing institutional support for domestic industry upgrades. In the future, as data on places of origin accumulates, China’s policy formulation and market regulation in the semiconductor field will become more targeted.

According to previous customs policies, the place of origin for semiconductors was determined based on the location of the packaging/testing factory, but it has now changed to the wafer fabrication site (the location of the wafer fab), which has several implications.

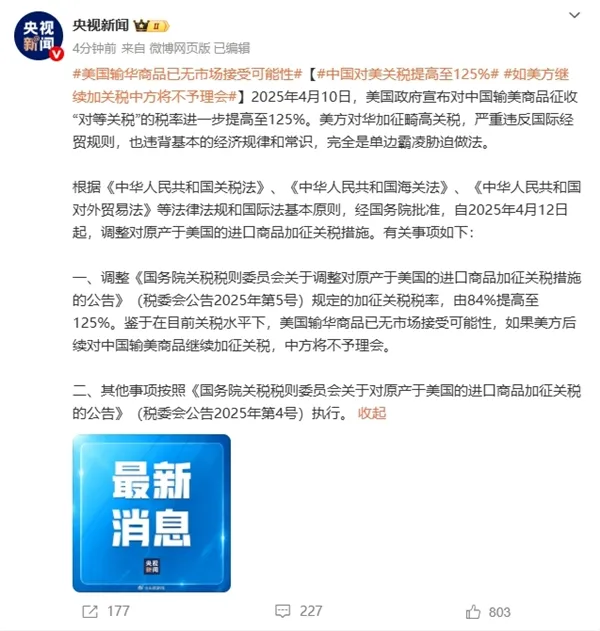

First, this new regulation can be seen as a countermeasure against U.S. tariffs. Chips produced by U.S. wafer fabs (such as TI and Intel) sold in the Chinese market may be classified as “U.S. origin,” requiring higher tariffs.

For example, if TI’s analog chips are fabricated in the U.S., their price competitiveness in the Chinese market will decline, benefiting domestic replacement enterprises.

Under the “wafer fabrication site recognized as the place of origin” rule, market participants indicate that chips from companies like Apple, AMD, and Qualcomm, which are manufactured by TSMC, will have their place of origin recognized as Taiwan (not subject to high tariffs).

In contrast, chips from IDM manufacturers like Intel, Texas Instruments, ADI, and ON Semiconductor, which have their own factories in the U.S., will be recognized as U.S. origin and may face tariffs exceeding 125%.

Secondly, this will somewhat strengthen the trend of semiconductor localization, as companies may consider relocating the wafer fabrication process to within China. Local wafer fabs like SMIC and Hua Hong Semiconductor may take on more international orders.

Thirdly, as companies gradually shift core manufacturing processes domestically, the expansion of wafer fab capacity will drive demand for semiconductor equipment. The rising costs of importing U.S. equipment (due to increased tariffs) will further promote domestic alternatives.

Overall, this adjustment of the place of origin rules is an important step for China in promoting a self-controlled semiconductor industry, with the core goal of using policy levers to shift global semiconductor manufacturing processes to China while avoiding external technology blockades.

In the short term, this policy will benefit domestic wafer fabs and equipment/material companies, accelerating the process of domestic substitution; in the long term, if it can synergize with technological breakthroughs and industry chain integration, China is expected to establish a global competitive advantage in mature process fields.

Of course, the realization of the policy’s effects also depends on the speed of domestic technological breakthroughs, the stability of international supply chains, and the trajectory of U.S.-China relations.