Recently, the China Semiconductor Industry Association released a notice regarding the “Rules for Determining the ‘Country of Origin’ of Semiconductor Products,” stating that according to the relevant provisions on non-preferential origin rules, the origin of “integrated circuits” is determined based on the four-digit tariff number change principle, meaning the wafer fabrication site is recognized as the country of origin.

In response, the China Semiconductor Industry Association suggested that the country of origin for “integrated circuits,” whether packaged or unpackaged, should be declared based on the location of the “wafer fabrication factory” for import customs clearance.

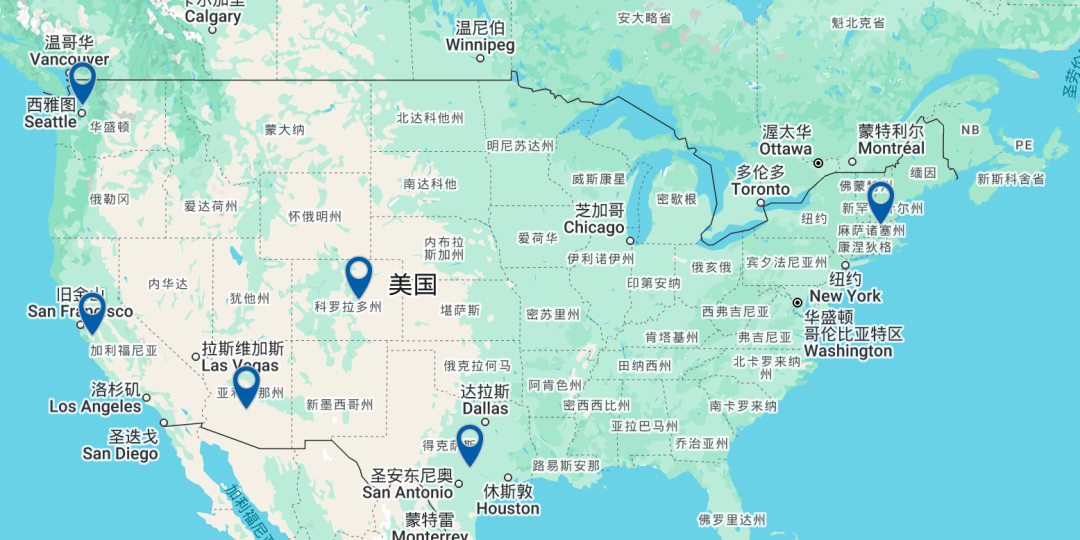

The following summarizes the profiles of 35 wafer factories in the United States:

Foundries: 4

Taiwan Semiconductor Manufacturing Company (TSMC): 2

GlobalFoundries: 3

Tower Semiconductor: 2

X-Fab: 1

IDM: 7

Intel: 4

Texas Instruments (TI): 5

Analog Devices (ADI): 3

Micron: 3

NXP: 4

Infineon: 6

Samsung: 2

1

Focus on Foundries

TSMC

TSMC is the world’s leading foundry, headquartered in Taiwan, with the largest market share in chip manufacturing, providing foundry services for well-known companies such as MediaTek, Apple, and NVIDIA.

Arizona 12-inch Factory: Mass production of 4 nm is expected in Q4 2024;

Washington 8-inch Factory: Responsible for mature processes;

The second Arizona factory (3 nm, 2 nm, A16) is expected to start production in 2028, with the third factory expected to begin construction in June 2025.

GlobalFoundries

GlobalFoundries is a semiconductor wafer foundry company headquartered in California, USA. The company originally spun off from AMD’s manufacturing division and produces not only AMD products but also collaborates with other companies.

Wafer Factories: New York (2), Vermont (1);

Processes: Focus on 14 nm, 22 nm, 90 nm;

Clients: AMD, IBM, ARM, Broadcom, NVIDIA, Qualcomm.

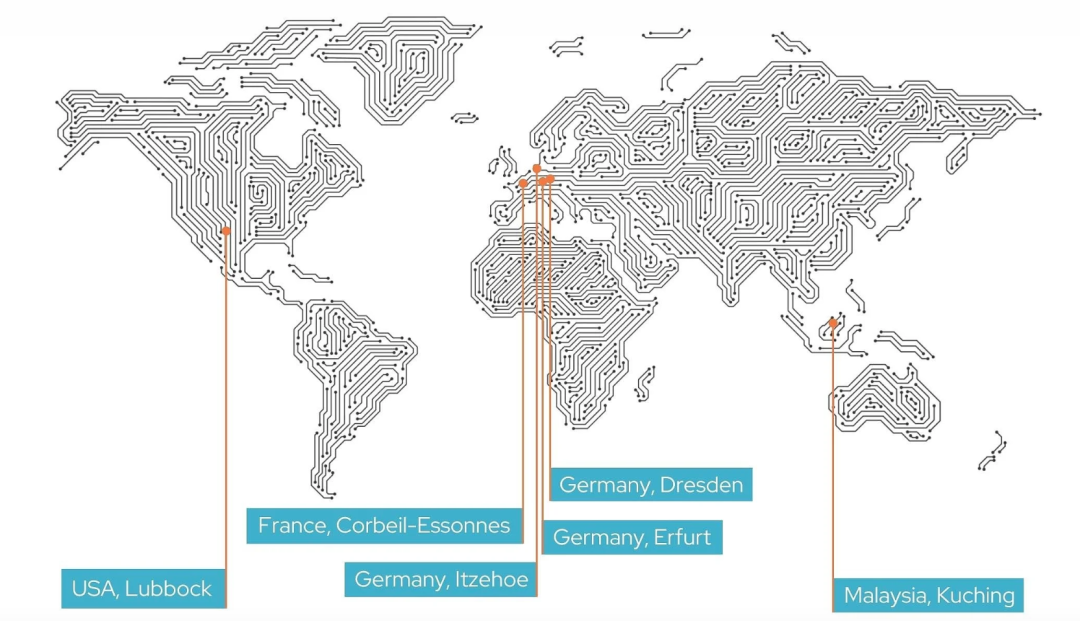

X-Fab

X-FAB is one of the world’s leading analog/mixed-signal semiconductor technology foundries, focusing on automotive, industrial, and medical applications, headquartered in Germany. The company currently has one foundry in the U.S., primarily producing CMOS mixed-signal chips and a range of SiC products.

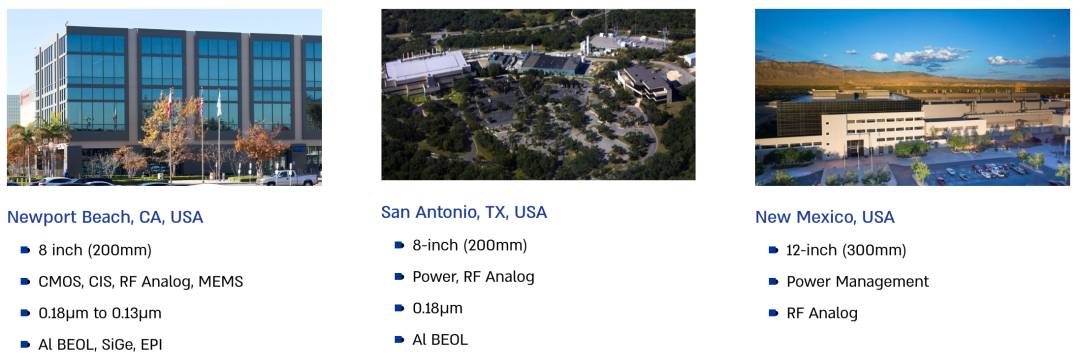

Tower Semiconductor

Tower Semiconductor is an Israeli semiconductor foundry specializing in providing customized analog solutions for differentiated products, offering cutting-edge process technologies.

The company has two wafer factories in the U.S. (Newport Beach, California, and San Antonio, Texas) with 200 mm wafers and can utilize Intel’s 300 mm capacity corridor in New Mexico, primarily producing CMOS, CIS, RF analog, MEMS, power, etc.

2

IDM Manufacturers Overview

Intel

Intel is not only a leading IDM company globally but also provides foundry services.

Domestic Manufacturing Layout in the U.S.

• Operating Factories: 3 wafer factories in Arizona, New Mexico, and Oregon;• New Construction Plans: A new wafer factory is about to be built in Ohio to strengthen domestic manufacturing capabilities.

Global Capacity Distribution Structure

• Contribution from U.S. Owned Factories: About 20%-30% of wafer production comes from domestic factories;• External Foundry Dependence: Some capacity is outsourced to foundries like TSMC and UMC;• Overseas Owned Factories Supplement: Overseas bases such as Ireland Fab 34 and Israel Fab 28 bear the remaining capacity.

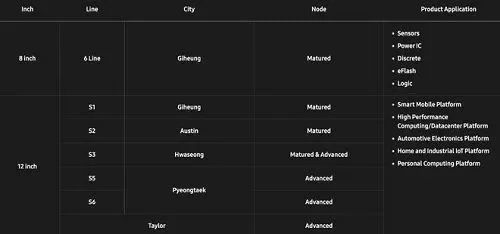

Samsung

• One factory each in Austin and Taylor, Texas, primarily 65 nm–14 nm;

• The Taylor factory is delayed until February 2027 for production.

(Samsung’s wafer factories in the U.S. and South Korea)

Texas Instruments (TI)

Texas Instruments has a long history of internal manufacturing operations, with a global presence and regional diversification, including several wafer manufacturing plants, packaging testing plants, and bump and probe factories among its 15 global manufacturing bases.

• Five wafer factories in the U.S. (Texas, Utah, Oregon), with about 90% of wafer manufacturing completed by owned factories;

• Wafer factories are mainly concentrated in the U.S., which are most susceptible to the impact of new regulations from China.

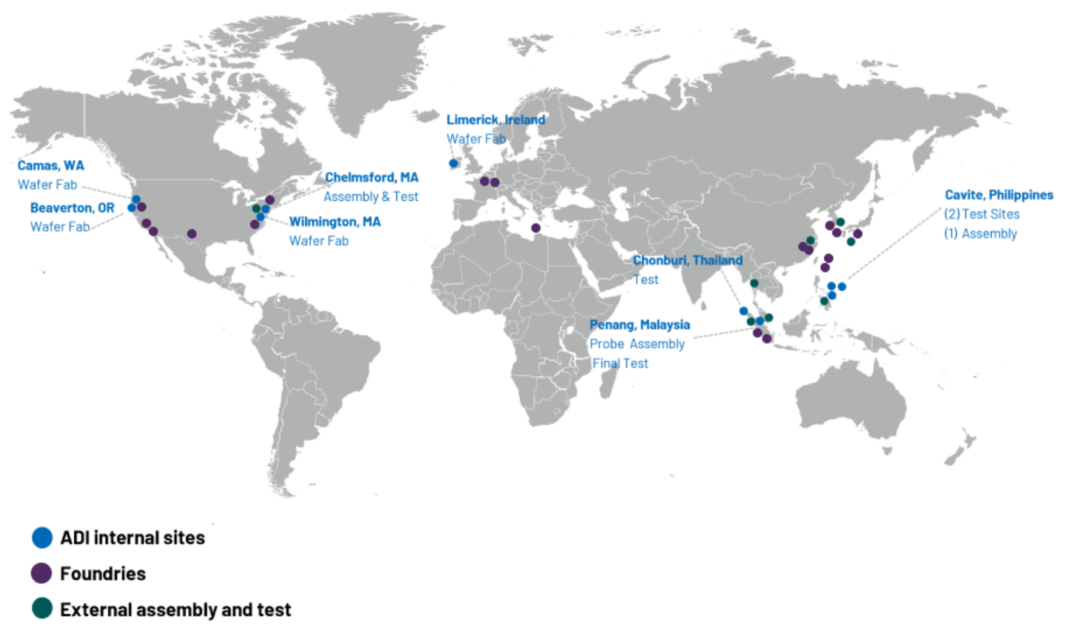

Analog Devices (ADI)

Domestic Manufacturing Network in the U.S.

• Existing Factory Layout: 3 wafer factories in Camas, Washington, Beaverton, Oregon, and Wilmington, Massachusetts;

• Capacity Expansion Goals: Plans to double production capacity in the U.S. and Europe by the end of 2025 through internal investment.

Global Capacity Allocation Strategy

• Proportion of U.S. Owned Factories: About 30%-40% of production comes from domestic factories;

• External Foundry Cooperation: Relies on partners like TSMC and UMC to supplement capacity;

• Overseas Owned Bases Support: Overseas factories such as Limerick, Ireland, bear part of the self-production demand.

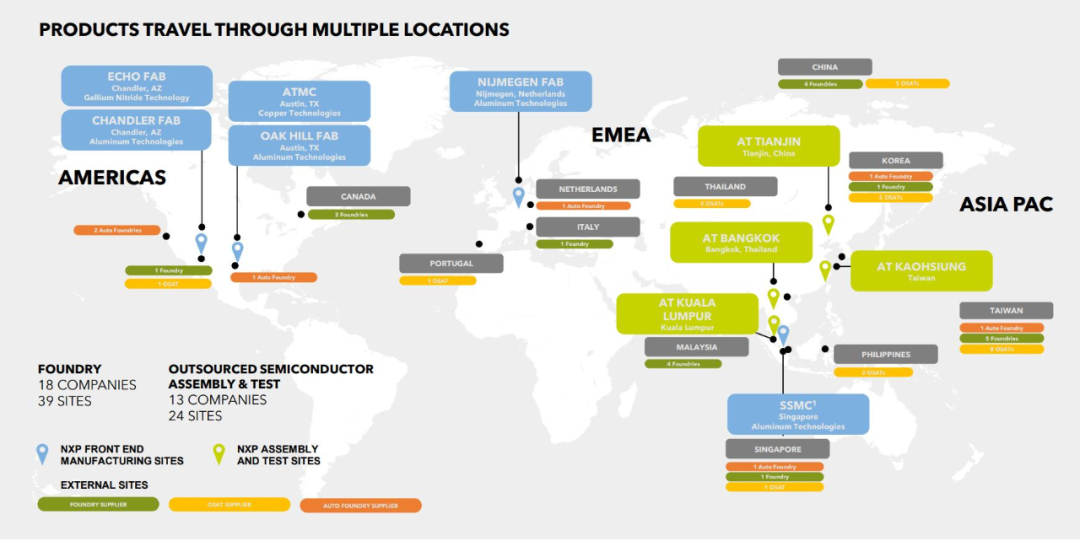

NXP

Factory Distribution: 2 in Austin, Texas, and 2 in Chandler, Arizona;

• Core Product Coverage: MCUs (Microcontrollers), MPUs (Microprocessors), power management chips, RF transceivers, amplifiers, sensors, and RF GaN devices, serving automotive and industrial intelligence needs.

• Proportion of U.S. Owned Capacity: About 30%-40% of production comes from domestic factories, focusing on automotive and industrial semiconductors.

Infineon

Six major production bases in the U.S. (Washington, California, Arizona, Colorado, Texas, and Massachusetts);

Domestic capacity accounts for 20–30%, with the remainder relying on TSMC, UMC, and overseas owned factories (such as Dresden, Germany, and Kulim, Malaysia).

In February 2025, the 200 mm wafer factory in Austin, Texas, will be sold to SkyWater for $110 million.

Disclaimer:

The above information is compiled from the internet and does not represent the views and positions of Ezkey, and is for communication and learning purposes only. If there is any infringement, please contact for deletion.