Recently, the tariff war between the US and China has been intense, with both sides exchanging blows. Many people are likely more concerned about whether their stocks are crashing than the spectacle itself. I won’t delve into the timeline of the tariff war here; instead, I will focus on last Friday’s bombshell news—“the notice regarding the ‘origin’ determination rules for semiconductor products,” which comes from the China Semiconductor Industry Association.

For more details, please see the link.

‘Tape-out’ in English refers to the process of converting a designed integrated circuit (IC) layout into an actual chip, similar to a production line where chips are manufactured through a series of process steps.

‘Tape-out’ means submitting for manufacturing, for pilot production, which is the final stage of integrated circuit design. This is when the chip design company hands over the finalized design to a wafer fab to produce a batch of sample chips (usually ranging from dozens to hundreds), to verify whether each process step is feasible and whether the circuit meets the required performance and functionality.

If such rules are implemented, then our automotive lighting industry will face significant supply risks. Take the well-known Texas Instruments TPS92662 as an example; although packaged in Southeast Asia, the wafer production is done in the US. According to the ‘tape-out location’ argument, this is considered authentic American-made and will “enjoy” high tariffs. Many may recall the struggles during the mask supply period, where we were tormented to ensure supply.

But is the reality truly like this?

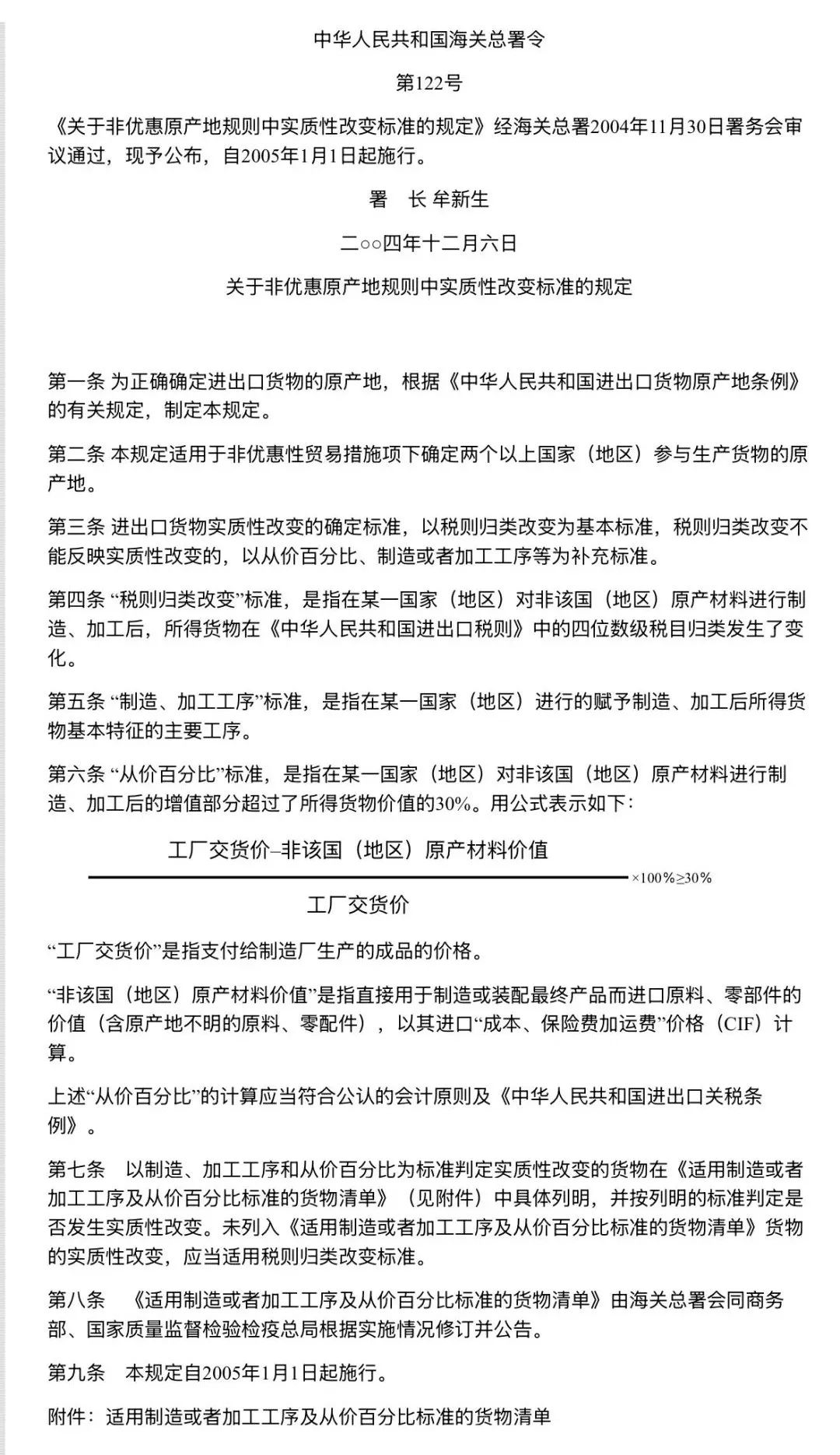

First, the original text points out that the “Regulations on Substantial Transformation Standards in Non-Preferential Origin Rules, Customs General Administration Order No. 122,” which has been in effect since 2005, is 20 years old.

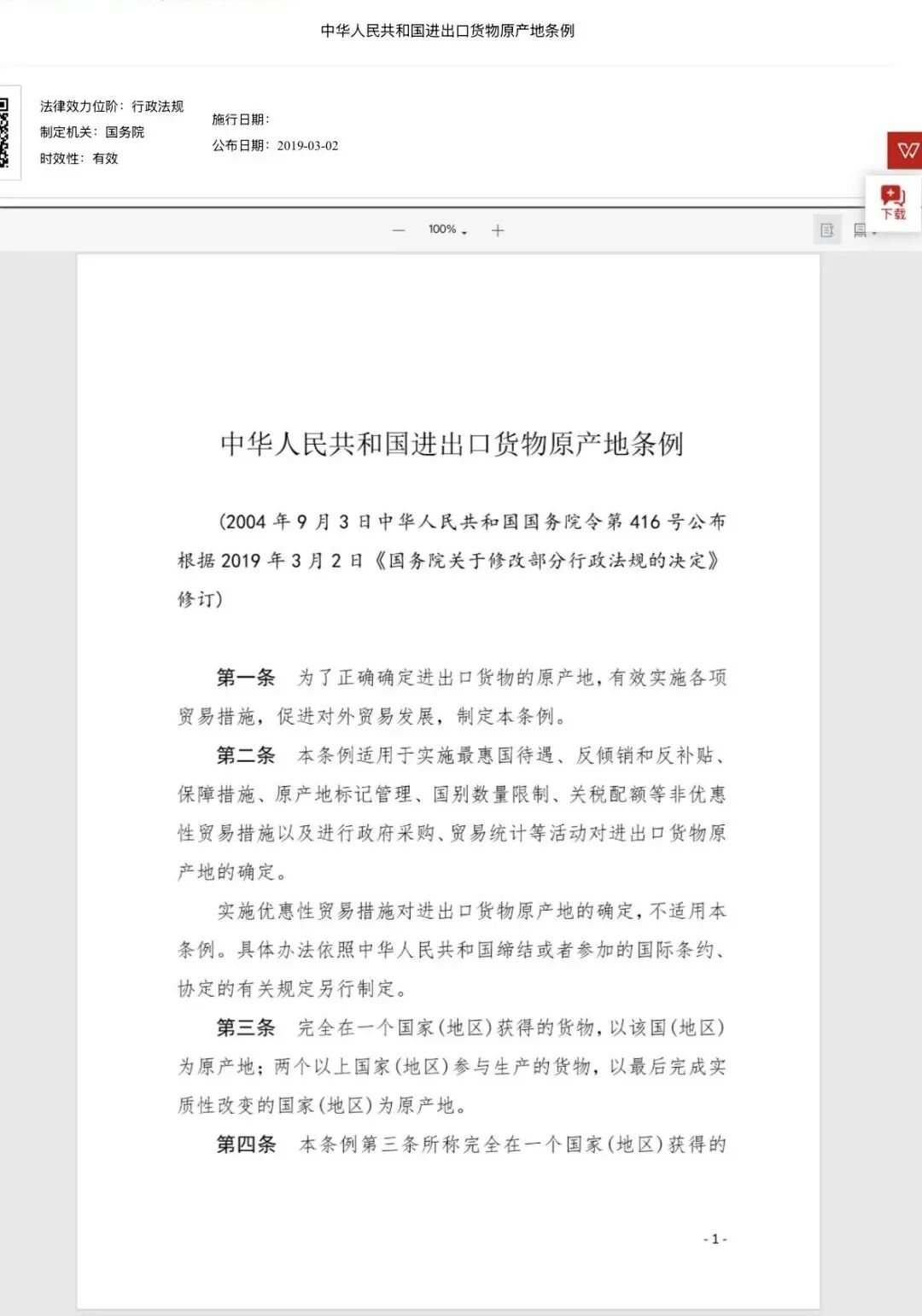

Another document, the “Regulations on the Origin of Import and Export Goods of the People’s Republic of China,” was published in 2019. Therefore, neither document indicates that the ‘tape-out location’ argument is a new rule.

Secondly, the China Semiconductor Industry Association is a non-profit, industry self-regulatory national social organization that companies and institutions voluntarily join, and thus does not have legislative or enforcement power. Therefore, its “notice” may not necessarily represent an official state action. (However, it was shared by the People’s Daily.)

What is the reaction from various sectors? I interviewed several partners to find out:

A procurement officer from a major manufacturer, who wished to remain anonymous, stated that the company has begun urgent investigations. If there is indeed a risk of supply disruption, they must immediately start researching domestic alternatives.

A representative from a chip agency, who also wished to remain anonymous, mentioned that they are closely monitoring the situation and have not yet been affected by the “notice.”

A customs officer, who preferred to remain anonymous, stated that everything is operating normally and that they have not received any so-called “new regulations.”

A tax authority staff member, who also wished to remain anonymous, declined to comment.

A chip sales representative, who was willing to disclose their company name, stated that their company, Jihai Semiconductor, sees an opportunity and welcomes inquiries from lighting manufacturers and major manufacturers.

In conclusion, regardless of whether the state will implement the ‘tape-out location’ rule, any news in the context of the tariff war will stimulate the fragile nerves of those in the automotive lighting industry. Just like this “notice” has led to a surge in semiconductor stocks, with companies like SiRuPu and Shengbang shares hitting the limit, Huahong Semiconductor soaring 16% in Hong Kong, and SMIC rising 7% in Hong Kong. At this moment, lighting manufacturers can indeed start planning to incorporate the localization of traditionally imported chips into their agenda.

Finally, I am curious, will everyone still use DLP for their new projects?