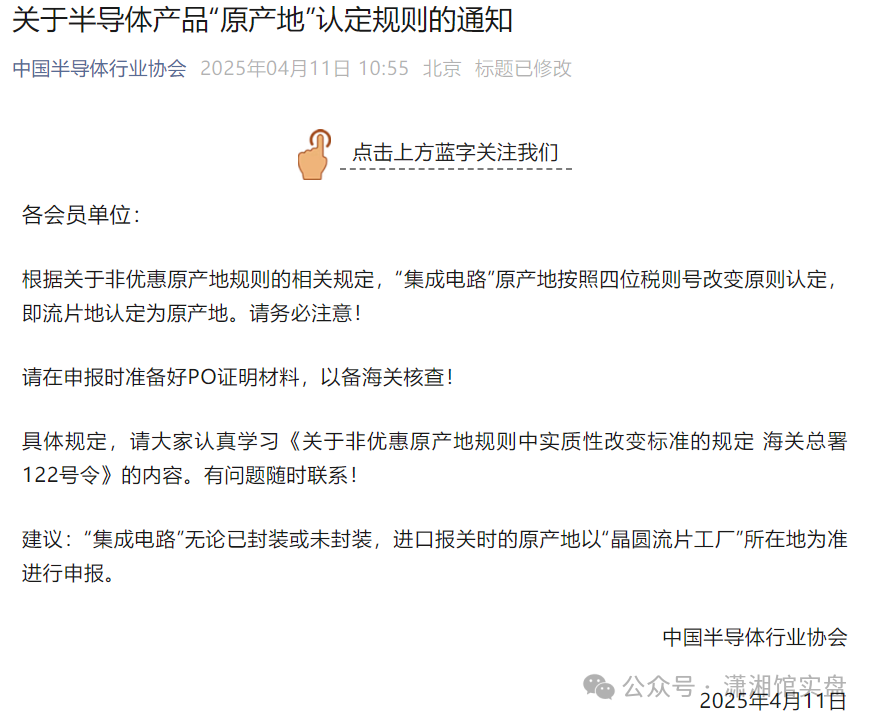

On April 11, Friday, the China Semiconductor Industry Association released the “Notice on the Rules for Determining the “Country of Origin” of Semiconductor Products,” which is as follows:

Official Account: Notice from the China Semiconductor Industry Association on the Rules for Determining the “Country of Origin” of Semiconductor Products

This article interprets the certification of the location of the “wafer tape-out factory.” First, we need to understand the concept of “wafer tape-out:

This article interprets the certification of the location of the “wafer tape-out factory.” First, we need to understand the concept of “wafer tape-out:

What is tape-out?

Tape-out refers to the process of manufacturing chips on a production line through a series of process steps, which is the final stage of integrated circuit design, that is, the submission for manufacturing.

Tape-out is essentially the “trial production” process that transforms circuit designs into ASIC chips. After a fabless manufacturer completes the circuit design and verifies that all checks are correct, the final GDSII file is submitted to the foundry to produce a small batch of sample chips (usually ranging from dozens to hundreds), to verify whether each process step is feasible and whether the circuit meets the required performance and functionality.

The term “tape” refers to “magnetic tape.” In the early days of chip design, magnetic tapes were used to store chip design data, hence the term tape-out. Although data is now mostly submitted in electronic documents, this terminology has persisted.

What stage does tape-out represent in the chip industry?The full process in the chip industry mainly includes: design, manufacturing, packaging, and testing. So at which stage does tape-out occur? Tape-out is actually the process of submitting the completed chip layout (GDSII file) to the wafer fab for the first physical chip sample production. It is both the endpoint of the design phase and the starting point of production, making it difficult to distinguish boundaries. What can be relatively certain is that many manufacturers only have design capabilities and lack tape-out capabilities due to a lack of equipment and key production technologies and processes. Tape-out, however, is a basic capability of manufacturing companies, as if they cannot even complete this trial production, how can they talk about mass production?What is the impact on trade?According to content from NetEase News:

Against the backdrop of a global chip industry market size of approximately $625 billion, China imports about 62% of the world’s chips, which undoubtedly highlights China’s important position in the global chip supply chain, while also reflecting the inadequacy of domestic chip self-sufficiency. Although the Chinese government has increased investment and policy support for the semiconductor industry in recent years, striving to enhance the level of chip localization through independent innovation, the situation of external dependence is still difficult to fundamentally change in the short term.

https://www.163.com/dy/article/JPQMGQFB0531MBRD.html

China remains a major chip importing country, and against the backdrop of trade tensions, tariffs on goods from the U.S. are also increasing.

China remains a major chip importing country, and against the backdrop of trade tensions, tariffs on goods from the U.S. are also increasing.

According to the “Customs Law of the People’s Republic of China,” “Customs Law of the People’s Republic of China,” “Foreign Trade Law of the People’s Republic of China,” and other laws and regulations, as well as basic principles of international law, approved by the State Council, the State Council Tariff Commission announced that starting from April 12, 2025, the adjusted tariff rate for the “Announcement on Adjusting Tariffs on Imported Goods Originating from the United States” (Tariff Commission Announcement No. 5 of 2025) will increase from 84% to 125%. Other matters will be executed according to the “Announcement on Tariffs on Imported Goods Originating from the United States” (Tariff Commission Announcement No. 4 of 2025).

https://baijiahao.baidu.com/s?id=1829130224657979445&wfr=spider&for=pc

Compared to before, the original factors of packaging, testing, and sales are no longer considered as references for the country of origin, but the focus is now on the location of tape-out. Therefore, tape-out in non-U.S. countries or regions effectively brings tariff exemptions, while for tape-out in U.S. manufacturers, tariffs are increased, which will promote the shift of import chip orders to manufacturers in non-U.S. regions.Which manufacturers benefit specifically?Here we need to mention several business models in the chip industry: IDM, Fabless, Foundry.

| Model | Covered Stages | Representative Companies |

| IDM(Integrated Device Manufacture) | Completes the entire lifecycle of chips, including the entire process from design to manufacturing, and even owns its own wafer fabs, packaging plants, and testing facilities. This model allows companies to better control product quality and technological innovation while reducing costs and improving production efficiency. However, the IDM model requires significant initial investment and maintenance costs, suitable for technology-intensive and capital-intensive industries. | Intel, Samsung,Texas Instruments |

| Fabless(Fabless) | Does not have its own wafer manufacturing plants, mainly responsible for integrated circuit design, while outsourcing wafer manufacturing, packaging, testing, and other production stages to professional foundry partners. Fabless companies focus on design technology and intellectual property creation, allowing them to concentrate on improving design capabilities and product performance while reducing equipment and fixed costs, lowering technical risks, and utilizing high-quality resources globally. However, this model also means that companies need to rely on the production capacity of foundry partners. | Qualcomm, Apple, NVIDIA, AMD, HiSilicon |

| Foundry(Foundry) | Only responsible for manufacturing, packaging, testing, etc., without being involved in chip design, focusing on process manufacturing, and can provide services to multiple design companies simultaneously. | TSMC, Samsung,SMIC |

Intel, being an IDM manufacturer with tape-out in the U.S., faces the greatest negative impact, while the beneficiaries are mainly non-U.S. tape-out manufacturers. From the previous analysis, it can be understood that non-U.S. manufacturing companies, such as SMIC, will benefit significantly.Additionally, on Friday, the market generally rose for domestic chip design and domestic chip manufacturing (foundry) sectors, which aligns with the logic of speculation. The representative stocks with significant increases are as follows:

| Direction | Stocks (Increase) |

| Digital Chip Design | Haiguang Information (4.00%)Lanqi Technology (7.27%) |

| Analog Chip Design | Shengbang Co. (20.00%)Zhuosheng Micro (13.65%)Shanghai Beiling (10.00%) |

| Integrated Circuit Manufacturing | Huahong Company (19.75%) |

Many small stocks have seen significant increases driven by capital, with many analog chip design stocks hitting their upper limits.