Recently, the Semiconductor Industry Association issued a notice stating that for imported chips, the origin determination rule is that the wafer fabrication location is considered the place of origin.

This means that regardless of which country the chip is from, only those fabricated in the United States will enjoy the appropriate tariff treatment.

After the news broke, even on social media platforms filled with Taiwanese internet armies, there wasn’t much of a reaction.

My understanding is as follows:

First, the concept of wafer fabrication is too specialized. Whether in mainland China or Taiwan, very few people have genuine access to this field.

Back when I was studying, my close friend and former roommate specialized in analog integrated circuits. At that time, the graduation requirement was to complete a chip design and successfully fabricate and test it in Wuxi before being able to submit a thesis for graduation.

This means that a graduate student in this field must have wafer fabrication experience to graduate.

I used to look down on this, thinking anyone could go for wafer fabrication. However, one day I visited my friend’s lab and casually flipped through two papers on the teacher’s desk that were submitted for review, and I was shocked because even with my poor understanding, I could tell that these theses were very superficial, merely literature reviews without any simulations or decent experimental data.

Another classmate pointed out that not everyone can go for wafer fabrication.

In fact, the vast majority of students with this major are not qualified to go for wafer fabrication during their student phase.

This is partly because it is too expensive, and also because if your teacher is not in the integrated circuit design field, most students with electronic or integrated circuit majors are likely working on semiconductor materials, to be precise, they are in materials science.

Therefore, it is common that students studying electronics or integrated circuits, which seem to have bright prospects, are generally only able to design chips and fabricate them at a few institutions, such as two in Beijing, one each in Shanghai, Nanjing, Chengdu, and Xi’an, while most others are left to chance.

This raises the threshold significantly.

Secondly, in many cases, universities emphasize papers in their assessments, so to publish a paper in integrated circuit design, one must complete wafer fabrication and verification, which raises the cost to a level that most faculty cannot accept. Without high-quality laboratories and substantial funding from various projects, they simply cannot afford it. In contrast, if one is in materials science, publishing papers can be done quite easily, and it is not uncommon for young researchers to have numerous publications. Having papers makes it easier to evaluate professional titles, so many choose to take the easier route and write superficial papers.

In Taiwan, the situation is similar. For those who are properly trained, such as those from National Taiwan University or National Tsing Hua University in Hsinchu, graduating and finding a high-paying job in Taiwan or mainland China is not an issue, so they have no need to engage in internet warfare.

In a field where internet warriors are clueless, this is naturally a foreign language to them.

For those in related fields, even if you are well-versed in Razavi’s “Design of Analog CMOS Integrated Circuits” and can solve the problems, it is futile because if you have no opportunity for wafer fabrication, you have no opportunity for wafer fabrication; solving more problems is of no use.

So my friend stayed in Wuxi for over a year just to do design and then wafer fabrication; otherwise, he wouldn’t know how to graduate. I admire him quite a bit, especially since back then, the aftermath of the Taihu Lake water pollution incident was still present, and I was worried about drinking water, so I bought bottled water.

Why is wafer fabrication being used as the basis for origin identification this time?

This move is quite ruthless. Because the production of a chip first goes through the design phase, using analog and digital methods, once you finish writing the digital design using languages like VHDL or Verilog HDL, complete the layout design, especially the esoteric analog integrated circuit design, and finally simulate it, if the results are satisfactory, the next step is to send the drawings to the factory for wafer fabrication. After spending a large sum on wafer fabrication, you receive the chip, which at this point is still unencapsulated, and then you must rigorously test various performance metrics to see if they meet standards. Meeting standards means you can go into mass production. If not, you will be in tears, scrambling to find the cause overnight.

In fact, this means that for a chip to truly come to market, it must go through design (front-end, back-end), simulation (using various EDA tools), then wafer fabrication, and after successful fabrication, testing, and only if testing is satisfactory can encapsulation proceed.

Among these, the highest technical content or the highest income (cost) is in design and wafer fabrication. As for encapsulation, the technical content is relatively lower.

In terms of design, Huawei HiSilicon was very strong in the past, but unfortunately, it was harmed by Trump. However, with the re-emergence of Huawei’s Mate 60, its status has somewhat recovered.

In the chip design field, American companies dominate, with names like NVIDIA, Qualcomm, Broadcom, Marvell, and AMD being well-known. Even more astonishing is that the U.S. is leading in GPU, CPU, and SOC fields.

In Taiwan, companies like MediaTek and Realtek are performing well.

In mainland China, apart from Huawei HiSilicon, only Weir shares can compete.

Of course, not being able to compete with giants like NVIDIA does not mean that Chinese companies are blank in these fields.

For example, companies like Biren Technology and Moore Threads are working on GPUs, and there are many companies like GigaDevice, Unisoc, and Rockchip producing related products.

In the past, people were reluctant to use domestic products mainly because domestic chips were indeed inferior to foreign ones.

Now, people are hesitant to use American products mainly because if one day they are banned, who will take responsibility for project failures?

Trump’s harsh actions against ZTE and Huawei have instead forced the domestic industry to find ways to pursue localization, making American companies’ products less appealing.

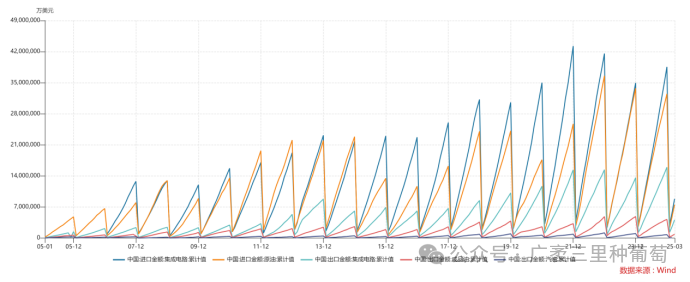

After all, China is the world’s largest buyer of integrated circuits, with peak imports exceeding those of crude oil. Just think about how significant that is.

Of course, compared to the one-sided import of crude oil (2024 year imports of 324.8 billion USD), and a small amount of gasoline exports (2024 year exports of 7.57 billion USD), the scale of integrated circuit exports is also significant,2024 year exports reached 159.5 billion USD.

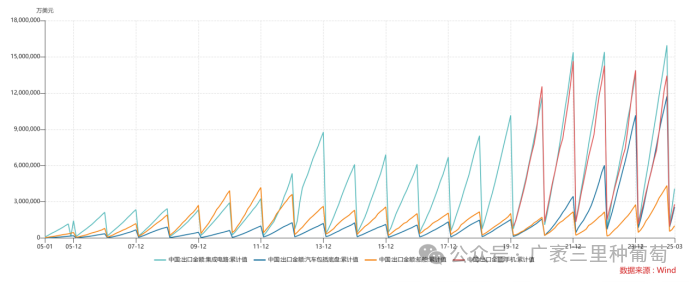

This amount exceeds the total value of China’s exports of mobile phones, ships, and automobiles. It can even be seen that in the past four years, in 2023 alone, the export value of mobile phones slightly surpassed that of integrated circuits.

Surprising, isn’t it? The export values of automobiles and ships, which have caused various countries to struggle, only amount to the same scale as integrated circuit exports.

This means that although the scale of chip imports is still large, the scale of exports is also significant.

In the chip design field, the overall situation in China has highlights but is far from comparable to similar companies in the U.S.

In the chip manufacturing field, there are wafer fabrication and encapsulation.

For wafer fabrication, high-end work is basically monopolized by TSMC and Samsung. Domestic companies currently do not have advanced process levels, but they perform well in the mid-to-low end.

Moreover, the U.S. is not doing particularly well in this area either.

As the origin of modern semiconductor science and industry, the once world-renowned “Eight Rebels” have long since disappeared, and the leading company Fairchild Semiconductor has also faded into obscurity. Today, Intel, representing high-end chip processes in the U.S., has fallen to the point of needing to partner with TSMC. After all, compared to TSMC, Intel’s high-end process products have too many issues, and the yield rates are not competitive at all.

In addition, companies like TI in the U.S. mainly conduct wafer fabrication in the U.S.

What about American companies like Qualcomm and AMD?

They know what their shortcomings are; AMD would never let its arch-rival Intel handle wafer fabrication, and they all choose TSMC for foundry services.

Huawei also used to rely on TSMC for foundry services, and the Kirin chips became a classic. However, after extreme pressure from Trump, TSMC not only lost this major client but was also forced to relocate its factories to the U.S.

After wafer fabrication, the next step is encapsulation.

In this area, domestic companies perform relatively well. However, the technical content of encapsulation is relatively low, making it easier to be replaced in the industry chain.

Of course, the term “replacement” here should be taken with a grain of salt. After all, domestic leaders like JCET and Tongfu Microelectronics have reached their current status after decades of development and technological accumulation.

Generally speaking, European companies like STMicroelectronics prefer to conduct wafer fabrication in mainland China (because STMicroelectronics focuses on automotive applications, which do not require particularly advanced processes) and encapsulate in Southeast Asia. American companies are divided into two factions: one faction, like Intel and TI, conducts wafer fabrication in the U.S., while the other faction, like AMD, Qualcomm, NVIDIA, and Apple, conducts wafer fabrication in Taiwan.

In mainland China, due to sanctions, mid-to-low process levels do not warrant wafer fabrication in Taiwan, and the high-end process levels are still insufficient.

However, the most widely used chips are precisely those in the mid-to-low process, such as those used in various household appliances, transportation tools, and military applications.

In fact, military products do not require high processes; after all, 3nm chips consume too much power and have too significant infrared characteristics. Although their computing performance is outstanding, they have too many shortcomings. As long as they can navigate, calibrate, recognize normally, and resist interference, no one would use chips from missiles to play games.

As a result, the ones suffering are Intel and TI and a few other American companies.

In fact, AMD would be more than happy to see Intel struggle. After all, if a competitor falls, it is good news for them.

TI’s situation is special. After all, Intel has unique technology, and domestic alternatives still have a long way to go.

TI is a company I cannot avoid when learning digital signal processing and DSP technology.

However, currently, various companies that are alternatives to TI have emerged in recent years, making it difficult for TI to raise prices.

In fact, many are worried that one day Trump will ban TI, making it impossible to consider TI in product design.

In this situation, no one can afford the responsibility of changing designs halfway, so many companies proactively choose domestic alternative products, making TI’s already awkward situation even more difficult.

It is indeed a different time now; Trump’s actions have led students learning digital signal processing and DSP technology to change their textbooks and experimental equipment.

I really wonder if TI will hate him for this.

Additionally, in the chip field, China is the world’s undisputed largest importer, with last year’s imports exceeding 385.6 billion USD, making it the irreplaceable number one buyer.

Therefore, this situation creates a paradox for many internet warriors. If whoever imports more has more say, then with the U.S. imposing tariffs on China, it is certain that China will suffer. However, in the chip field, with China’s import volume being unparalleled globally, if China imposes tariffs on the U.S., it is the U.S. that will suffer.

What Trump has done has made it so that the shrimp soldiers and crab generals are like Zhu Bajie looking in the mirror—neither here nor there.

Setting aside the unreliable comments from Taiwanese internet warriors, the fact that wafer fabrication location is considered the place of origin has significant implications.

First, giants like AMD, Qualcomm, and NVIDIA can rest easy. As long as the U.S. does not act up, they can sleep soundly, because although these are American chips, they are fabricated in Taiwan, so they are not subject to tariffs.

Intel and TI are likely to be upset. Especially Intel, although it has a factory in Ireland, primarily places its wafer fabrication, especially for the most advanced processes, in Arizona, USA. The factory in Ireland is clearly not as technologically advanced as the one in the U.S. As for encapsulation and testing, Intel also has a presence in China, mainly in Chengdu. However, according to current standards, encapsulation in Chengdu is essentially no different from encapsulation not in Chengdu.

And the yield rates of domestic wafer fabrication factories in the U.S. are not competitive with TSMC.

Intel is already struggling to compete with AMD, and if it has to rely on factories in the U.S. without placing orders with TSMC in Taiwan or Samsung in Korea, it is likely to be overwhelmed by various competing manufacturers.

Intel does have alternatives, such as placing orders with manufacturers in Taiwan or Korea. Or simply moving the Arizona factory elsewhere, anywhere outside the U.S. would suffice.

However, both of these options would undermine the attempt to bring manufacturing back to the U.S. Not to mention whether there is enough electricity and sufficiently trained engineers, if TSMC were to relocate entirely to the U.S., the chips they fabricate would face high tariffs from the world’s largest chip importer. This means that even if TSMC were to bow down to their American overlords, they would still have to consider their livelihood; wouldn’t this just benefit Samsung?

Another method would be to uproot the entire industrial chain that uses chips, cutting it off completely and moving it out of China.

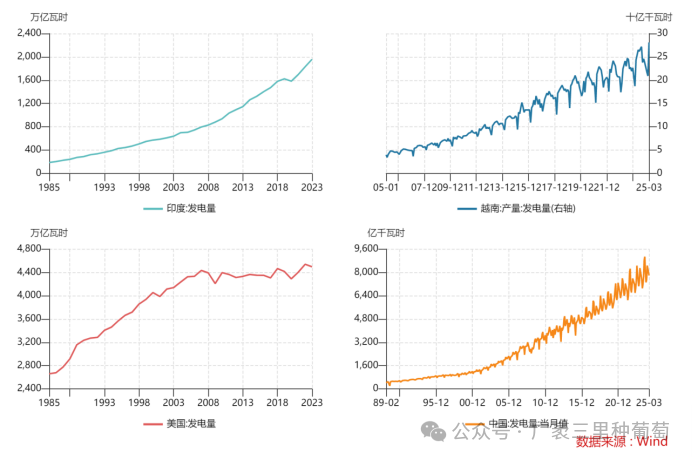

Setting aside the fact that China imports over 300 billion USD worth of chips annually, let me ask, which country has enough electricity to take on such a massive undertaking?

Don’t tell me Vietnam can do it. Vietnam still relies on the Southern Power Grid for aid when it lacks electricity.

India? Do they have enough electricity to handle such a large operation?

It can be seen that India’s power generation is less than half of that of the U.S., and Vietnam generates less than 300 billion kWh in a month, while China can easily produce over 9000 billion kWh in a month. Therefore, assisting Vietnam is not a big deal. Vietnam’s total annual power generation is less than 3500 billion kWh, while Jiangsu’s annual electricity consumption exceeds 8400 billion kWh. Vietnam’s industrial base is simply insufficient. In contrast, the U.S. generates less than 4500 trillion watt-hours annually, equivalent to 4.5 trillion kWh, while China exceeds 10 trillion kWh. Even in the U.S., how can they not have half of China’s power generation to support the return of manufacturing?

Looking at it this way, the return of American manufacturing is inherently unrealistic. Coupled with the origin policy, can TSMC still feel secure about going to the U.S.? Can Intel still feel secure about wafer fabrication in Arizona?

As for TI? Compared to Intel, which has a glaring competitor, TI, while not facing a major challenger, has a plethora of Chinese companies as competitors in almost every product line.AMD and Intel’s rivalry is like a lion vs. a tiger, while TI is sadly like a black bear vs. a pack of wolves.

It’s not easy for anyone.

TI chips, even under current circumstances, cost only a few to a dozen dollars. If a 145% tax is added, a chip could cost ten or even twenty or thirty dollars. As a Chinese manufacturer, who would still want to use you? After all, those extra few or ten dollars could very well be my profit. So why should I remain loyal to TI? Why not use domestic alternative chips instead?

Moreover, with the threat of American supply cuts looming, who can guarantee that on the first day, TI chips are used extensively, and on the second day, Trump issues a ban? Changing the design would mean overhauling everything from hardware to software, and all previous designs would be in vain. Which boss would allow the R&D department to engage in such reckless behavior?

Of course, without the efforts of the domestic industry, the current integrated circuit industry would absolutely lack the capability to compete, and without such a vast domestic market for continuous iteration and upgrades, it would often be difficult to form a positive cycle. More importantly, without Trump’s previous heavy-handed actions against Chinese companies like Huawei and ZTE, everyone would still be immersed in the dream of American chips, and localization would be impossible to discuss. Thanks to Trump, he actively educated Chinese companies to pursue self-sufficiency, handing over a massive market for product iteration and upgrades.

I wonder if Intel and TI will hate him for this.